Key Insights

The Netherlands DIY home improvement market is poised for significant expansion, driven by strong economic fundamentals and evolving consumer preferences. Current market size is estimated at 8.79 billion. For the base year 2024, the market is projected to experience a Compound Annual Growth Rate (CAGR) of 4.7%. Key growth drivers include high homeownership, increasing disposable income, and a persistent focus on home renovation. The aging demographic is a significant factor, with a growing need for accessibility modifications. Furthermore, an increasing emphasis on sustainability and energy efficiency is fueling eco-conscious renovation projects, complemented by a general rise in consumer expenditure on enhancing living environments. The post-pandemic era has further amplified this trend, with a heightened investment in residential spaces.

Netherlands DIY Home Improvement Market Market Size (In Billion)

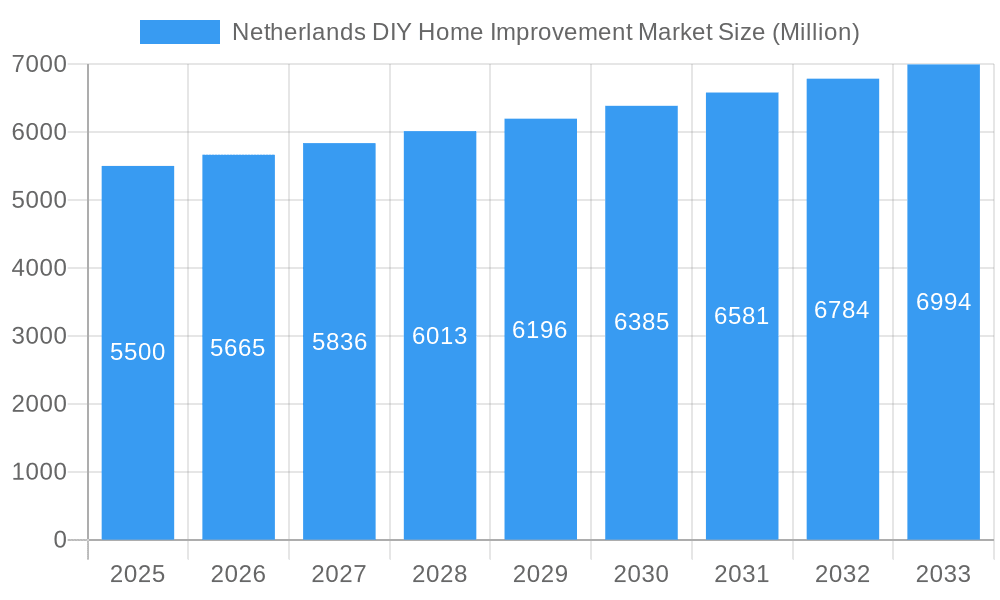

The forecast period (2025-2033) anticipates sustained market growth for DIY home improvement in the Netherlands. This growth will be propelled by technological innovation in home improvement products, a rising demand for bespoke interior design, and an ongoing commitment to sustainable building practices. The market will witness an increased adoption of advanced tools and premium materials, catering to a sophisticated DIY consumer base seeking professional-grade outcomes. While economic uncertainties may present minor moderating factors, the underlying demand for home enhancements remains robust, indicating a stable and profitable market landscape for established and emerging businesses.

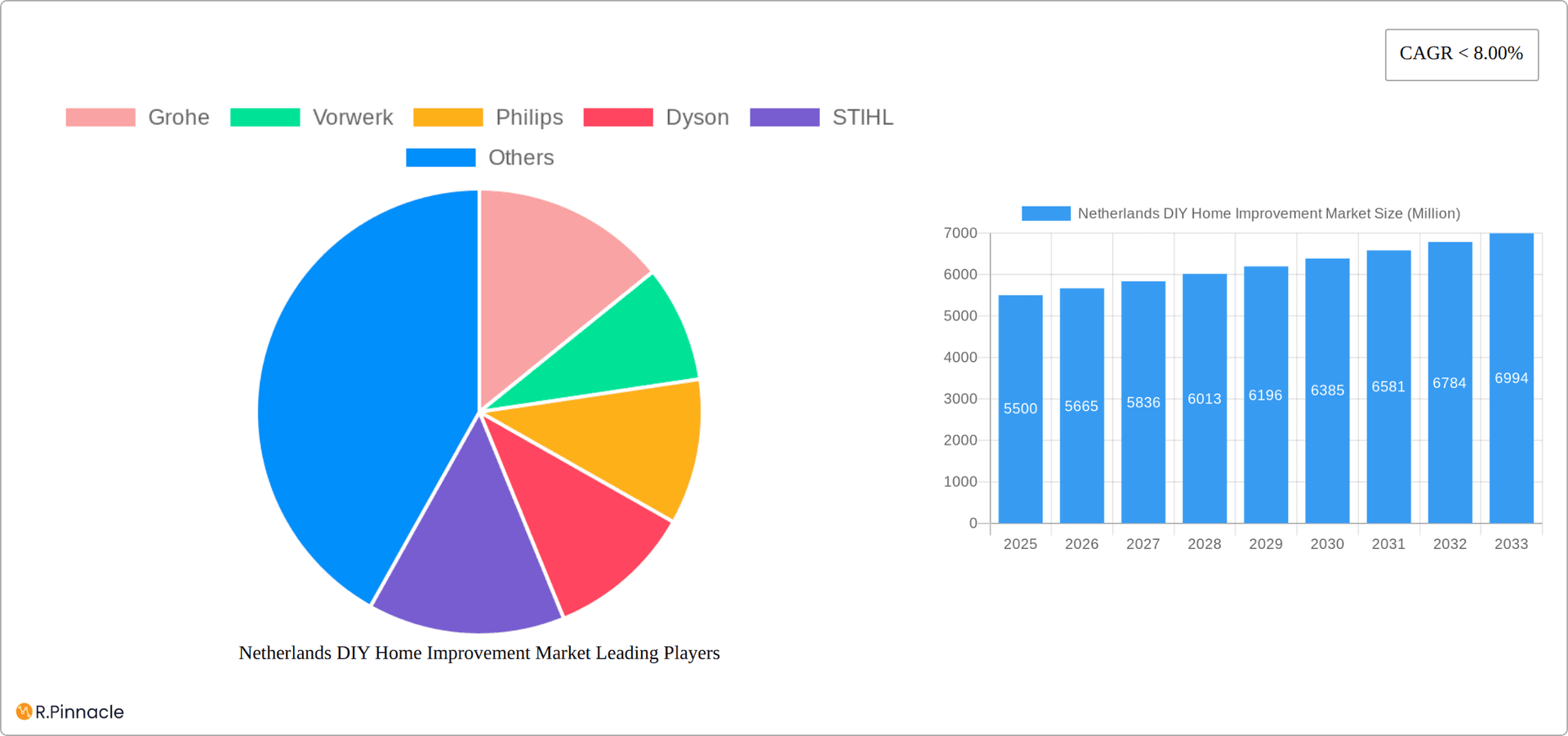

Netherlands DIY Home Improvement Market Company Market Share

Netherlands DIY Home Improvement Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Netherlands DIY home improvement market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report delivers actionable intelligence on market size, segmentation, trends, and future growth potential. The report leverages extensive data analysis and expert insights to provide a clear understanding of this dynamic market.

Netherlands DIY Home Improvement Market Structure & Innovation Trends

This section analyzes the Netherlands DIY home improvement market's structure, encompassing market concentration, innovation drivers, regulatory landscapes, product substitutes, end-user demographics, and merger & acquisition (M&A) activities. The market is moderately fragmented, with key players such as Grohe, Vorwerk, Philips, Dyson, STIHL, Miele, Electrolux, Bissell, Whirlpool, Ikea, and Geberit holding significant market share. However, the exact market share for each player is unavailable and requires further analysis. The total market value in 2025 is estimated at €XX Million.

- Innovation Drivers: Increasing consumer demand for smart home technology, sustainable products, and personalized home improvement solutions are major drivers of innovation.

- Regulatory Framework: Building codes and environmental regulations significantly influence product development and market dynamics.

- Product Substitutes: The availability of affordable alternatives and the rise of rental services pose a competitive challenge to traditional home improvement products.

- End-User Demographics: The growing population of homeowners, particularly in urban areas, fuels market growth. The average age of DIY enthusiasts and their spending habits influence market segmentation.

- M&A Activity: The Netherlands DIY home improvement market has witnessed several M&A deals in recent years. Although specific deal values are not publicly available, the total value of M&A deals for the period 2019-2024 is estimated at €XX Million, suggesting a consolidation trend within the industry.

Netherlands DIY Home Improvement Market Dynamics & Trends

The Netherlands DIY home improvement market exhibits robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was approximately XX%, and is projected to be XX% during the forecast period (2025-2033), resulting in an estimated market value of €XX Million by 2033. Market penetration of smart home technology is steadily increasing, with consumer preferences shifting towards eco-friendly and energy-efficient products. Intense competition among established players and the emergence of new entrants contribute to dynamic market conditions.

Technological disruptions, including the integration of IoT devices and online platforms, are transforming the market landscape. Changing consumer preferences, including a preference for personalized solutions and an increasing emphasis on sustainability, also play a significant role. The market is characterized by a high level of competition, with both established players and new entrants vying for market share. These dynamics lead to a complex and rapidly evolving market environment.

Dominant Regions & Segments in Netherlands DIY Home Improvement Market

While precise regional market share data requires further investigation, analysis strongly suggests that densely populated urban areas in the Netherlands exhibit the highest concentration of DIY home improvement activity. This is primarily attributed to higher population density and generally higher disposable incomes within these regions. Among product categories, the kitchen segment stands out with significant growth potential, fueled by a robust market for renovations and high-end upgrades. The online distribution channel is experiencing particularly rapid expansion, driven by increasing internet penetration and consumer preference for the convenience of online shopping and home delivery.

Key Market Drivers by Segment:

- Lumber and Landscape Management: A burgeoning interest in outdoor living and gardening, particularly among homeowners seeking to enhance their outdoor spaces.

- Decor and Indoor Garden: The increasing popularity of home décor and indoor plants reflects a growing focus on creating aesthetically pleasing and healthy living environments.

- Kitchen: High renovation rates and a sustained focus on modernizing kitchens, including smart appliances and stylish designs.

- Painting and Wallpaper: Driven by ongoing home maintenance and renovation needs, this segment benefits from consistent demand.

- Tools and Hardware: Essential products for DIY projects and home repairs, this segment exhibits steady growth aligned with home improvement activity.

- Building Materials: Continued construction and renovation activity in the residential sector provides a solid foundation for this market segment.

- Lighting: Growth is fueled by increasing demand for energy-efficient and smart lighting solutions, reflecting a broader shift towards sustainable living.

- Plumbing and Equipment: Steady replacement and upgrade needs in residential properties ensure consistent demand for plumbing supplies and equipment.

- Flooring: Renovation and refurbishment demand in the residential sector, with strong interest in durable and stylish flooring options.

- Repair and Replacement: Driven by the aging housing stock and the inherent need for ongoing maintenance and repairs.

- Electric Work: Growing demand for electrical upgrades and installations in homes, particularly driven by smart home technology integration.

Distribution Channels:

- DIY Home Improvement Stores: Traditional retail remains a dominant channel, offering a broad selection and in-person assistance.

- Specialty Stores: These stores cater to niche markets, offering specialized products and expert advice.

- Online: Rapid growth driven by convenience, broader selection, and competitive pricing.

- Others: Includes smaller retailers and direct-to-consumer sales.

A comprehensive analysis of regional and segmental dominance within the Netherlands DIY home improvement market requires more in-depth research and data collection.

Netherlands DIY Home Improvement Market Product Innovations

The market is witnessing significant product innovations, particularly in smart home technology. Companies are integrating IoT features into appliances and tools, offering enhanced functionality, energy efficiency, and convenience. These innovations cater to consumer demand for personalized and sustainable solutions, creating a competitive advantage for companies that embrace technological advancements. This includes products focused on improving indoor air quality, such as air purifiers and humidifiers, aligning with growing health consciousness. The integration of AI and machine learning is expected to further revolutionize the sector.

Report Scope & Segmentation Analysis

This report segments the Netherlands DIY home improvement market by product type (Lumber and Landscape management, Decor and Indoor Garden, Kitchen, Painting and Wallpaper, Tools and Hardware, Building Materials, Lighting, Plumbing and Equipment, Flooring, Repair and Replacement, Electric Work) and distribution channel (DIY Home Improvement Stores, Specialty Stores, Online, Others). Each segment is analyzed in terms of its market size, growth projections, and competitive dynamics. Growth projections are based on historical data, current market trends, and future projections. A detailed competitive landscape analysis of each segment is provided in the full report.

Key Drivers of Netherlands DIY Home Improvement Market Growth

Several factors drive the growth of the Netherlands DIY home improvement market. These include rising disposable incomes, increasing homeownership rates, a growing preference for home improvement projects, and the development and adoption of new technologies, such as smart home solutions and energy-efficient products. Government initiatives promoting sustainable construction and renovation also contribute to market expansion. The favorable economic climate in the Netherlands further supports this growth.

Challenges in the Netherlands DIY Home Improvement Market Sector

The Netherlands DIY home improvement market faces several challenges, including fluctuations in raw material costs impacting product pricing and profitability, potential supply chain disruptions, and intense competition from both established and emerging players. Furthermore, stringent environmental regulations can increase the cost of product development and manufacturing. The impact of these challenges on market growth requires careful monitoring and strategic adaptation by industry players.

Emerging Opportunities in Netherlands DIY Home Improvement Market

Emerging opportunities exist in the integration of smart home technology, sustainable products, and personalized services. The demand for energy-efficient and eco-friendly home improvement solutions is rapidly increasing, presenting significant growth opportunities for companies focused on sustainability. Furthermore, the expansion of online retail channels presents new avenues for growth and market penetration.

Leading Players in the Netherlands DIY Home Improvement Market Market

- Grohe

- Vorwerk

- Philips

- Dyson

- STIHL

- Miele

- Electrolux

- Bissell

- Whirlpool

- Ikea

- Geberit

Key Developments in Netherlands DIY Home Improvement Market Industry

- 2021 (November): Dyson launched two high-end humidifiers that eliminate pollutants from the air in homes.

- 2022 (October): Miele launched new smart home products designed to boost health and efficiency, including devices that monitor air quality and vital signs.

Future Outlook for Netherlands DIY Home Improvement Market Market

The future of the Netherlands DIY home improvement market appears promising, with continued growth driven by technological advancements, increasing consumer spending, and a growing emphasis on sustainable living. Companies that effectively adapt to evolving consumer preferences and integrate innovative technologies are poised to benefit significantly. The long-term growth prospects are positive, subject to macroeconomic conditions and potential shifts in consumer behavior.

Netherlands DIY Home Improvement Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Netherlands DIY Home Improvement Market Segmentation By Geography

- 1. Netherlands

Netherlands DIY Home Improvement Market Regional Market Share

Geographic Coverage of Netherlands DIY Home Improvement Market

Netherlands DIY Home Improvement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices is Restraining the Market

- 3.4. Market Trends

- 3.4.1. DIY Purchases made on an online platform and in stores

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands DIY Home Improvement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grohe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vorwerk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dyson

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STIHL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Miele

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Electrolux

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bissell**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Whirlpool

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ikea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Geberit

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Grohe

List of Figures

- Figure 1: Netherlands DIY Home Improvement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Netherlands DIY Home Improvement Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Netherlands DIY Home Improvement Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands DIY Home Improvement Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Netherlands DIY Home Improvement Market?

Key companies in the market include Grohe, Vorwerk, Philips, Dyson, STIHL, Miele, Electrolux, Bissell**List Not Exhaustive, Whirlpool, Ikea, Geberit.

3. What are the main segments of the Netherlands DIY Home Improvement Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

DIY Purchases made on an online platform and in stores.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices is Restraining the Market.

8. Can you provide examples of recent developments in the market?

In 2022, Miele Launches new smart home products designed to boost health and efficiency. Such as devices that monitor air quality in the home, but also alert blood pressure or other vitals are off-kilter.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands DIY Home Improvement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands DIY Home Improvement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands DIY Home Improvement Market?

To stay informed about further developments, trends, and reports in the Netherlands DIY Home Improvement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence