Key Insights

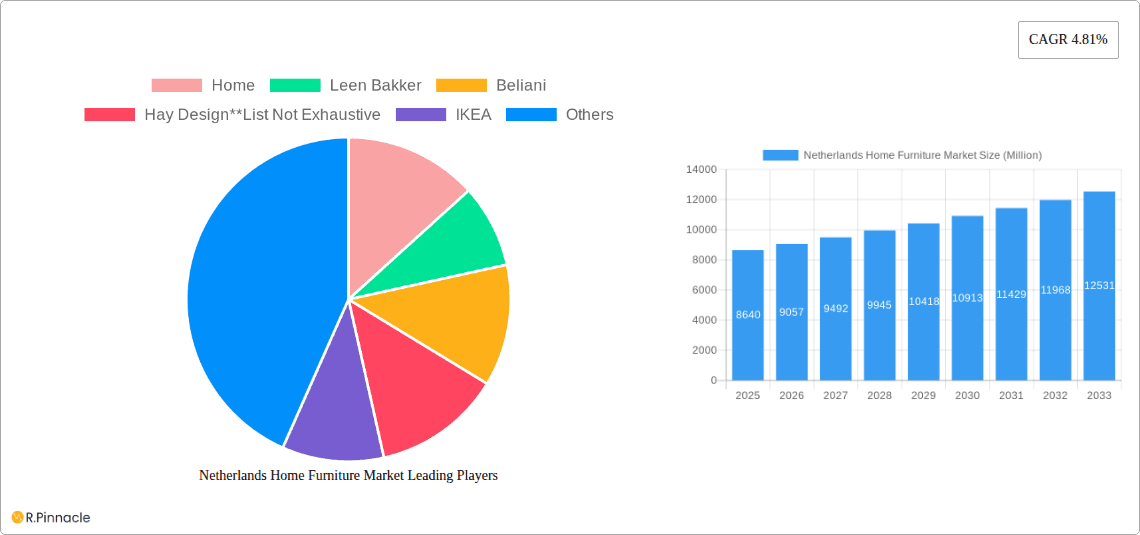

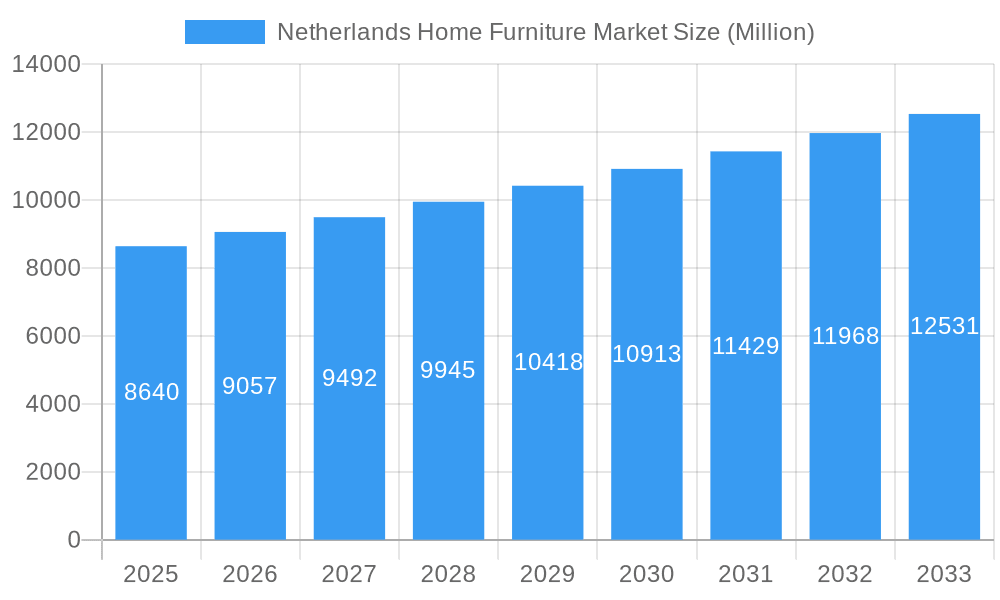

The Netherlands home furniture market, valued at €8.64 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.81% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes among Dutch households are driving increased spending on home improvement and furnishing. A growing preference for modern and aesthetically pleasing home designs, coupled with an increasing focus on creating comfortable and functional living spaces, further stimulates demand. The e-commerce boom continues to significantly impact the sector, with online retailers offering convenience and a wider selection, pressuring traditional brick-and-mortar stores to adapt their strategies and improve their online presence. The market is segmented by material (wood, metal, plastic, other), type (living room, dining room, bedroom, kitchen, other), and distribution channel (home centers, flagship stores, specialty stores, online, other). While the dominance of established players like IKEA and Leen Bakker is undeniable, the market also sees increasing competition from online-only brands like Beliani and smaller, specialized retailers catering to niche design preferences.

Netherlands Home Furniture Market Market Size (In Billion)

The market's growth is, however, subject to certain restraints. Fluctuations in raw material prices, particularly timber, can impact production costs and profitability. Economic downturns could lead to decreased consumer spending on non-essential items like furniture. Furthermore, sustainability concerns are increasingly influencing consumer purchasing decisions, pushing manufacturers to adopt more eco-friendly materials and production processes. This presents both a challenge and an opportunity for companies to innovate and meet evolving consumer demands for environmentally conscious furniture. The increasing popularity of rental furniture models also represents a potential disruption to traditional ownership-based sales. Successful companies will need to adapt to changing consumer preferences, embrace technological advancements, and focus on sustainable practices to maintain competitiveness in this dynamic market.

Netherlands Home Furniture Market Company Market Share

Netherlands Home Furniture Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Netherlands home furniture market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a base year of 2025, this report forecasts market trends and identifies key growth opportunities. The analysis encompasses market structure, dynamics, dominant segments, product innovation, and competitive landscape. Millions (M) are used for all values.

Netherlands Home Furniture Market Structure & Innovation Trends

The Netherlands home furniture market exhibits a moderately concentrated structure, with key players such as IKEA, Leen Bakker, Beliani, Hay Design, Home, Meubella, Otto, and Next Direct holding significant market share. However, the market also accommodates a large number of smaller players and independent retailers. Market share data for 2024 estimates IKEA holds approximately 25% market share, followed by Leen Bakker at 15%, and the remaining players sharing the rest. The market is driven by innovation in materials, design, and functionality, alongside a growing emphasis on sustainability.

- Market Concentration: Moderately concentrated with a few major players and numerous smaller businesses.

- Innovation Drivers: Sustainable materials, smart home integration, and personalized design.

- Regulatory Framework: Compliance with EU furniture safety regulations.

- Product Substitutes: Second-hand furniture, DIY furniture assembly kits.

- End-User Demographics: Predominantly focused on homeowners aged 25-55, with a growing segment of rental property owners.

- M&A Activities: Recent notable M&A activity includes the xxM acquisition of Zanotta by Cassina (April 2023).

Netherlands Home Furniture Market Dynamics & Trends

The Netherlands home furniture market is experiencing steady growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for aesthetically pleasing and functional home environments. The CAGR for the historical period (2019-2024) is estimated at 3%, with a projected CAGR of 4% for the forecast period (2025-2033). Technological disruptions, including the rise of e-commerce and the adoption of new manufacturing techniques, are reshaping the industry landscape. Consumer preferences are shifting towards sustainable and ethically sourced furniture. Competitive dynamics are characterized by intense competition among established players and emerging brands. Market penetration of online sales channels is constantly increasing, estimated at 35% in 2024 and expected to exceed 50% by 2033.

Dominant Regions & Segments in Netherlands Home Furniture Market

The Netherlands home furniture market displays regional variations in consumption patterns. The Randstad region, encompassing Amsterdam, Rotterdam, and The Hague, accounts for the largest market share due to high population density and economic activity.

- By Material: Wood remains the dominant material, followed by metal and plastic. Demand for sustainable and recycled materials is growing.

- By Type: Living room furniture dominates the market, driven by growing consumer expenditure on home improvement. Kitchen and bedroom furniture also hold substantial market shares.

- By Distribution Channel: Online sales are increasingly important, but flagship stores and specialty stores retain significant market presence. Home centers contribute considerably to the overall market volume.

Key drivers for dominance include strong purchasing power in urban areas, government incentives for home renovation and infrastructure improvements in specific regions, and a preference for modern styles in the Randstad area.

Netherlands Home Furniture Market Product Innovations

Recent product innovations focus on modular furniture, smart furniture incorporating technology, and sustainably sourced materials such as bamboo and recycled wood. These innovations offer consumers greater flexibility, convenience, and environmental consciousness, thereby improving market fit and enhancing the competitive advantage of adopting companies. The integration of technology in furniture is also gaining traction, with features like adjustable height desks and smart storage systems becoming increasingly popular.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Netherlands home furniture market based on material (wood, metal, plastic, other), furniture type (living room, dining room, bedroom, kitchen, other), and distribution channel (home centers, flagship stores, specialty stores, online, other). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. For example, the online channel is projected to experience the fastest growth due to increasing internet penetration and consumer preference for online shopping. Wood furniture remains the largest segment by material, while living room furniture leads in the furniture type segment.

Key Drivers of Netherlands Home Furniture Market Growth

The Netherlands home furniture market's growth is fueled by several key factors: rising disposable incomes leading to increased spending on home improvement; growing urbanization and increased housing demand; technological advancements introducing innovative products; and favorable government policies supporting the furniture industry and infrastructure investments. The growing popularity of sustainable and eco-friendly furniture is an additional key driver.

Challenges in the Netherlands Home Furniture Market Sector

The Netherlands home furniture market faces challenges such as increasing raw material costs, supply chain disruptions impacting production timelines and logistics, intense competition from both domestic and international players, and the ongoing pressure to reduce production costs while maintaining product quality and sustainability.

Emerging Opportunities in Netherlands Home Furniture Market

Emerging opportunities include the growing demand for customized and personalized furniture; increasing adoption of smart home technologies; rising interest in sustainable and ethically sourced products; and the expansion of the rental furniture market. These factors present avenues for innovation and expansion for businesses in the sector.

Leading Players in the Netherlands Home Furniture Market Market

- Home

- Leen Bakker

- Beliani

- Hay Design

- IKEA

- Meubella

- Otto

- Next Direct

Key Developments in Netherlands Home Furniture Market Industry

- April 2023: Cassina acquired the furniture brand Zanotta, expanding its portfolio and strengthening its position in the high-end market.

- January 2022: JD.com launched its Ochama store in the Netherlands, introducing a new hybrid online/offline retail model with implications for logistics and customer experience.

Future Outlook for Netherlands Home Furniture Market Market

The Netherlands home furniture market is poised for continued growth driven by increasing consumer spending, technological innovations, and the growing emphasis on sustainable living. Strategic opportunities exist for businesses that can leverage technology, embrace sustainable practices, and provide personalized experiences to cater to evolving consumer preferences. The market is expected to maintain a robust growth trajectory over the forecast period (2025-2033).

Netherlands Home Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Furniture

-

2. Type

- 2.1. Living Room Furniture

- 2.2. Dining Room Furniture

- 2.3. Bedroom Furniture

- 2.4. Kitchen Furniture

- 2.5. Other Furniture

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online

- 3.5. Other Distribution Channels

Netherlands Home Furniture Market Segmentation By Geography

- 1. Netherlands

Netherlands Home Furniture Market Regional Market Share

Geographic Coverage of Netherlands Home Furniture Market

Netherlands Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Urbanization and Housing Sector; Home Improvement and Renovation Project

- 3.3. Market Restrains

- 3.3.1. High Competitive Market; Fluctuating Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Increasing Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Home Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Living Room Furniture

- 5.2.2. Dining Room Furniture

- 5.2.3. Bedroom Furniture

- 5.2.4. Kitchen Furniture

- 5.2.5. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Home

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Leen Bakker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Beliani

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hay Design**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IKEA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Meubella

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Otto

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Next direct

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Home

List of Figures

- Figure 1: Netherlands Home Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Home Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Netherlands Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Netherlands Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Netherlands Home Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Netherlands Home Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Netherlands Home Furniture Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Netherlands Home Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Netherlands Home Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Home Furniture Market?

The projected CAGR is approximately 4.81%.

2. Which companies are prominent players in the Netherlands Home Furniture Market?

Key companies in the market include Home, Leen Bakker, Beliani, Hay Design**List Not Exhaustive, IKEA, Meubella, Otto, Next direct.

3. What are the main segments of the Netherlands Home Furniture Market?

The market segments include Material, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Urbanization and Housing Sector; Home Improvement and Renovation Project.

6. What are the notable trends driving market growth?

Increasing Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

High Competitive Market; Fluctuating Raw Material Cost.

8. Can you provide examples of recent developments in the market?

April 2023: Cassina acquired the furniture brand Zanotta, making Zanotta a part of the Haworth Lifestyle Design organization, which includes several other furniture brands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Home Furniture Market?

To stay informed about further developments, trends, and reports in the Netherlands Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence