Key Insights

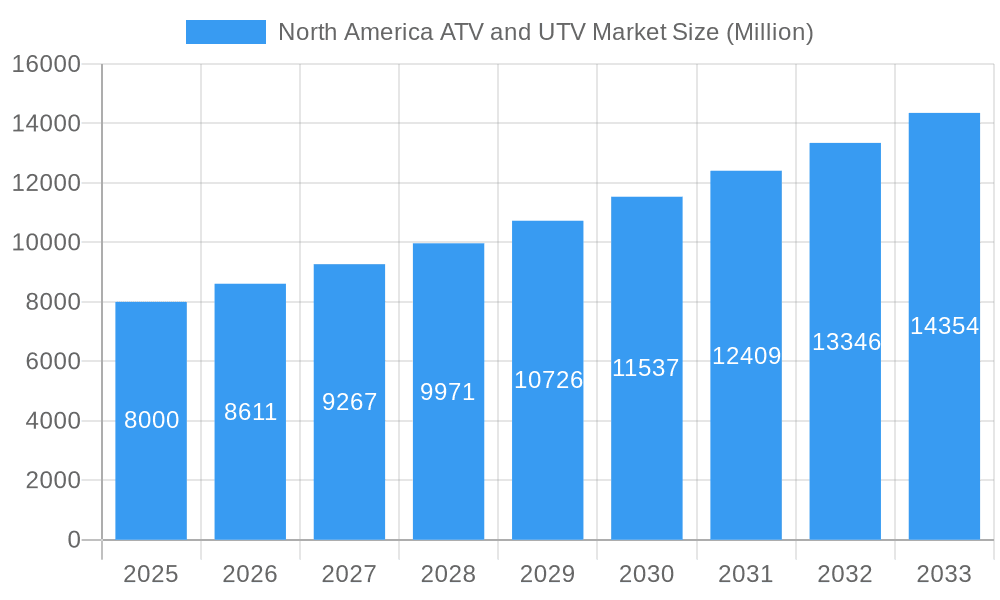

The North American All-Terrain Vehicle (ATV) and Utility Task Vehicle (UTV) market is forecast to reach $9.97 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.7% through 2033. This growth is propelled by the increasing popularity of off-road recreation, particularly among younger consumers, driving demand for sport ATVs. Concurrently, the agricultural and construction industries are adopting UTVs for enhanced efficiency in demanding environments. Technological advancements, including the development of electric-powered models that address environmental concerns and offer quieter operation, are also influencing market trends. Despite challenges such as rising raw material costs and emission regulations, the market outlook remains positive. The United States leads the North American market, followed by Canada, with Mexico and other regions presenting significant growth potential. Key segments include sports, agriculture, and commercial applications. While gasoline-powered vehicles currently dominate, electric models are rapidly gaining traction among environmentally conscious buyers. Leading manufacturers like Polaris Industries, Arctic Cat, Yamaha, and Honda are investing in R&D to improve performance, safety, and technological integration.

North America ATV and UTV Market Market Size (In Billion)

The competitive landscape features established brands and new entrants. Established players benefit from brand recognition and robust distribution networks, while newcomers focus on innovation and niche markets. The market's growth trajectory indicates a continued emphasis on product diversification, market expansion, and strategic partnerships to meet evolving consumer preferences and regulatory standards. The integration of connected technologies, advanced safety features, and enhanced user experiences are crucial for future product development. Increased disposable incomes and a growing interest in outdoor activities will further fuel market expansion. The market's diverse applications and ongoing technological innovation ensure its sustained upward trajectory.

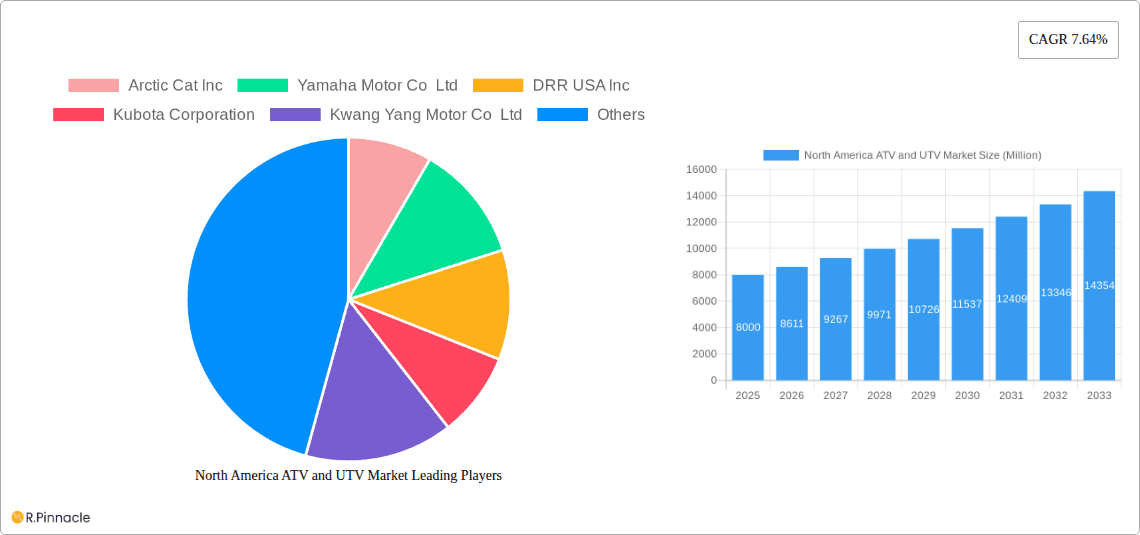

North America ATV and UTV Market Company Market Share

North America ATV and UTV Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America ATV and UTV market, offering valuable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, segmentation, key players, and future trends. The market is segmented by vehicle type (Sport ATVs, Utility Terrain Vehicles (UTVs)), application (Sports, Agriculture, Other Applications), fuel type (Gasoline Powered, Electric Powered), and country (United States, Canada, Rest of North America). Expect detailed analysis of market size (in Millions), CAGR, and competitive landscape, empowering informed decision-making.

North America ATV and UTV Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the North American ATV and UTV market. Market concentration is assessed, highlighting the market share of key players like Polaris Industries Inc, BRP Inc, and Yamaha Motor Co Ltd. The report details M&A activities, including deal values (in Millions), and their impact on market structure. Innovation drivers, such as technological advancements in engine technology and electric powertrains, are examined, alongside the influence of regulatory frameworks on emissions and safety standards. The report also considers the impact of substitute products, such as motorcycles and other recreational vehicles, on market dynamics. Finally, end-user demographics and their preferences are analyzed to understand the evolving demand for ATVs and UTVs.

- Market Concentration: Analysis of market share held by top 5 players (xx%).

- M&A Activity: Review of significant mergers and acquisitions, including deal values (xx Million).

- Innovation Drivers: Detailed examination of technological advancements and their impact.

- Regulatory Frameworks: Assessment of the influence of safety and emission standards.

- Product Substitutes: Analysis of competitive pressure from alternative recreational vehicles.

North America ATV and UTV Market Dynamics & Trends

This section delves into the market's growth trajectory, examining key drivers, technological disruptions, consumer preferences, and competitive dynamics. It includes a comprehensive analysis of the CAGR and market penetration rates for different segments. The impact of changing consumer preferences, such as a growing interest in electric vehicles and specialized applications, is explored. Competitive dynamics are assessed, including strategies adopted by major players to maintain market share.

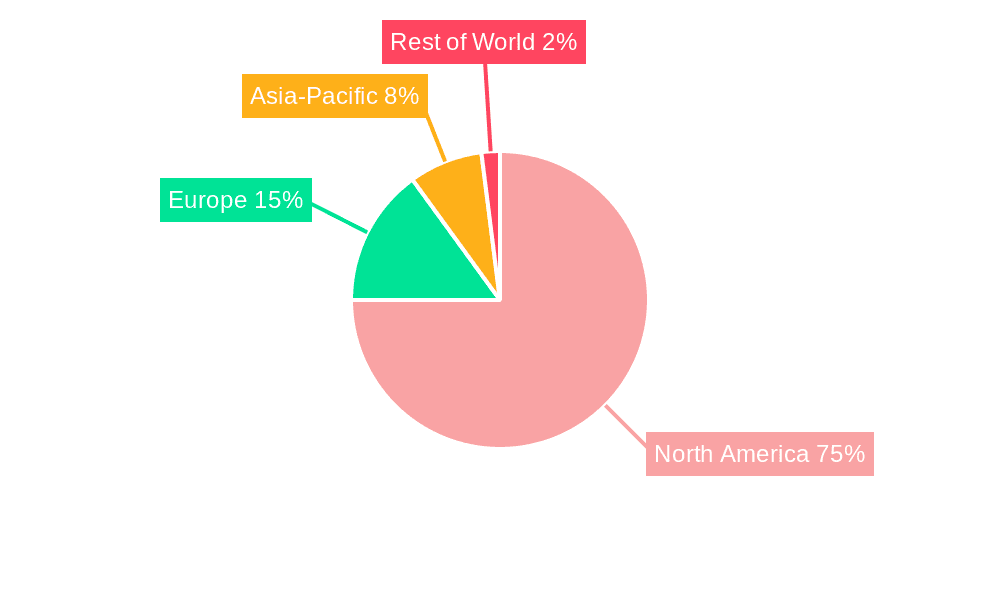

Dominant Regions & Segments in North America ATV and UTV Market

This section identifies the leading regions and segments within the North American ATV and UTV market. The analysis considers market size (in Millions), growth rates, and key drivers for each segment.

- By Vehicle: Dominance of Utility Terrain Vehicles (UTVs) driven by xx.

- By Application: The leading application segment is xx, due to xx.

- By Fuel: Gasoline-powered vehicles maintain a significant share, while electric-powered vehicles experience xx growth.

- By Country: The United States dominates the market, fueled by xx.

- Key Drivers: Economic factors (xx), infrastructure development (xx), and consumer preferences (xx) significantly influence regional and segmental dominance.

Dominance analysis for each segment, including detailed explanations for leading regions and applications.

North America ATV and UTV Market Product Innovations

This section summarizes recent product developments, highlighting technological trends and market fit. The report focuses on advancements in engine technology, electric powertrains, safety features, and design improvements. The competitive advantages offered by new products are also examined.

Report Scope & Segmentation Analysis

This section details the market segmentation by vehicle type (Sport ATVs, Utility Terrain Vehicles (UTVs)), application (Sports, Agriculture, Other Applications), fuel type (Gasoline Powered, Electric Powered), and country (United States, Canada, Rest of North America). Growth projections, market sizes (in Millions), and competitive dynamics are provided for each segment. Each segment is individually examined for its growth potential, market size projections, and competitive landscape.

Key Drivers of North America ATV and UTV Market Growth

This section outlines the key factors driving the growth of the North American ATV and UTV market, including technological advancements, economic growth, and favorable regulatory environments. Specific examples of these factors are provided. Factors such as increased disposable income, demand for recreational activities, and government initiatives promoting tourism and outdoor activities.

Challenges in the North America ATV and UTV Market Sector

This section addresses the challenges and restraints faced by the ATV and UTV market, including regulatory hurdles, supply chain disruptions, and intense competition. The quantitative impact of these challenges is assessed. This includes the effect of import tariffs and raw material price fluctuations on production costs and profit margins.

Emerging Opportunities in North America ATV and UTV Market

This section highlights emerging opportunities for growth, including the expansion into new markets, adoption of new technologies, and shifts in consumer preferences. Specific examples of such opportunities are provided. This encompasses the potential for growth in the electric ATV and UTV segment and the development of specialized models for specific applications.

Leading Players in the North America ATV and UTV Market Market

- Arctic Cat Inc

- Yamaha Motor Co Ltd (Yamaha Motor Co Ltd)

- DRR USA Inc

- Kubota Corporation (Kubota Corporation)

- Kwang Yang Motor Co Ltd

- American Honda Motor Co Inc (American Honda Motor Co Inc)

- Daymak Inc

- Suzuki Motor of America Inc (Suzuki Motor of America Inc)

- Deere and Company (Deere and Company)

- BRP Inc (BRP Inc)

- Polaris Industries Inc (Polaris Industries Inc)

- Kawasaki Heavy Industries Ltd (Kawasaki Heavy Industries Ltd)

Key Developments in North America ATV and UTV Market Industry

- July 2023: Honda North Carolina Manufacturing (NCM) begins production of Honda Four Trax and TRX series ATVs, becoming the sole North American production source for Honda ATVs.

- July 2023: Polaris Off-Road unveils enhancements to its 2024 off-road vehicle portfolio, including the Polaris XPEDITION and the Extreme Duty RANGER XD 1500.

- August 2023: Polaris Inc. launches the Polaris RANGER XD 1500, the industry's first utility side-by-side with a 1500cc 3-cylinder engine and Punch Powertrain's CVT technology.

- August 2023: BRP Inc. expands its Can-Am side-by-side lineup with the Maverick X3 MAX X rcTurbo RR, Commander MAX X mr1000R, Commander MAX DPS 700, and XT 700 four-seat versions, and introduces the Maverick X3 RS Turbo.

Future Outlook for North America ATV and UTV Market Market

The North American ATV and UTV market is poised for continued growth, driven by factors such as increasing demand for recreational vehicles, technological advancements in electric powertrains and autonomous driving features, and the expansion into new applications. Strategic partnerships and investments in research and development will further shape the market's trajectory. The market will see continued innovation in areas such as enhanced safety features, improved fuel efficiency, and the integration of advanced technologies.

North America ATV and UTV Market Segmentation

-

1. Vehicle Type

- 1.1. Sport ATVs

- 1.2. Utility Terrain Vehicle (UTVs)

-

2. Application

- 2.1. Sports

- 2.2. Agriculture

- 2.3. Other Applications

-

3. Fuel Type

- 3.1. Gasoline Powered

- 3.2. Electric Powered

North America ATV and UTV Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America ATV and UTV Market Regional Market Share

Geographic Coverage of North America ATV and UTV Market

North America ATV and UTV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Recreational and Motorsports Activities is Expected to Drive the Market; Others

- 3.3. Market Restrains

- 3.3.1. High Value and Maintenance Cost Offered to Restrain the Market Growth; Others

- 3.4. Market Trends

- 3.4.1. Rising Recreational and Motorsports Activities is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America ATV and UTV Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Sport ATVs

- 5.1.2. Utility Terrain Vehicle (UTVs)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports

- 5.2.2. Agriculture

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline Powered

- 5.3.2. Electric Powered

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arctic Cat Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yamaha Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DRR USA Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kubota Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kwang Yang Motor Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Honda Motor Co Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daymak Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Suzuki Motor of America Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Deere and Compan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BRP Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Polaris Industries Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kawasaki Heavy Industries Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Arctic Cat Inc

List of Figures

- Figure 1: North America ATV and UTV Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America ATV and UTV Market Share (%) by Company 2025

List of Tables

- Table 1: North America ATV and UTV Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America ATV and UTV Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America ATV and UTV Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 4: North America ATV and UTV Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America ATV and UTV Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America ATV and UTV Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America ATV and UTV Market Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 8: North America ATV and UTV Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America ATV and UTV Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America ATV and UTV Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America ATV and UTV Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America ATV and UTV Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the North America ATV and UTV Market?

Key companies in the market include Arctic Cat Inc, Yamaha Motor Co Ltd, DRR USA Inc, Kubota Corporation, Kwang Yang Motor Co Ltd, American Honda Motor Co Inc, Daymak Inc, Suzuki Motor of America Inc, Deere and Compan, BRP Inc, Polaris Industries Inc, Kawasaki Heavy Industries Ltd.

3. What are the main segments of the North America ATV and UTV Market?

The market segments include Vehicle Type, Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Recreational and Motorsports Activities is Expected to Drive the Market; Others.

6. What are the notable trends driving market growth?

Rising Recreational and Motorsports Activities is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

High Value and Maintenance Cost Offered to Restrain the Market Growth; Others.

8. Can you provide examples of recent developments in the market?

August 2023: Can-Am's side-by-side lineup is increased by BRP Inc. For the 2024 model year, the new Maverick X3 MAX X rcTurbo RR, Commander MAX X mr1000R, Commander MAX DPS 700, and XT 700 four-seat versions will be available. Furthermore, the new Maverick X3 RS Turbo introduces the industry's most inexpensive mid-hp 72" side-by-side to the Maverick lineup.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America ATV and UTV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America ATV and UTV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America ATV and UTV Market?

To stay informed about further developments, trends, and reports in the North America ATV and UTV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence