Key Insights

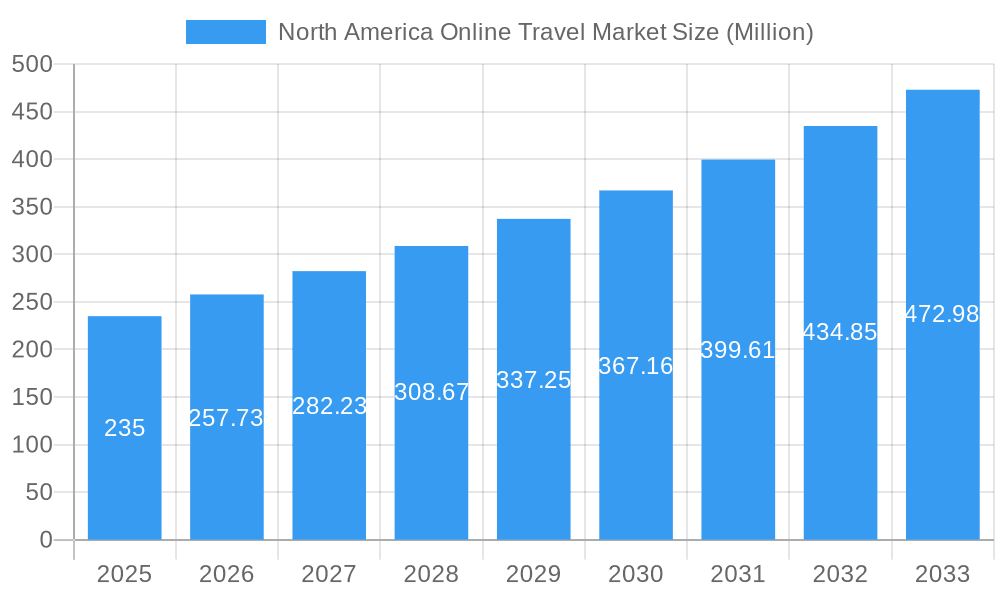

The North American online travel market, valued at $235 million in 2025, is projected to experience robust growth, driven by increasing internet and smartphone penetration, a rise in disposable incomes, and a growing preference for convenient online booking platforms. The market's Compound Annual Growth Rate (CAGR) of 9.80% from 2025 to 2033 indicates significant expansion, with substantial opportunities across various segments. Factors like the increasing popularity of mobile booking, personalized travel recommendations powered by AI, and the rise of travel influencers are further fueling this growth. While competition among established players like Expedia, Booking Holdings, and Airbnb is intense, the market remains attractive due to the continuous evolution of technology and evolving consumer preferences. The segmentation by service type (accommodation, tickets, packages, others), booking mode (direct, agents), and platform (desktop, mobile) reveals diverse market dynamics. Mobile booking is expected to dominate due to its convenience and accessibility, while the holiday package segment is anticipated to experience significant growth owing to the increasing demand for curated travel experiences. The North American market, specifically the United States, Canada, and Mexico, contributes significantly to the overall market value and growth.

North America Online Travel Market Market Size (In Million)

Growth will be further bolstered by a resurgence in post-pandemic travel demand and the continued adoption of innovative booking technologies that enhance user experience. However, potential restraints include economic downturns that may impact consumer spending, increased cybersecurity concerns regarding online transactions, and fluctuations in fuel prices affecting travel costs. The market's competitive landscape requires companies to constantly innovate, enhance their customer service, and personalize their offerings to maintain a competitive edge. Expansion into niche travel segments and strategic partnerships could provide further growth opportunities for both established players and new entrants. The forecast period (2025-2033) presents a significant opportunity for players to leverage market trends and capitalize on the increasing demand for online travel services in North America.

North America Online Travel Market Company Market Share

North America Online Travel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America online travel market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report leverages data from the historical period (2019-2024) and incorporates market sizing in Millions of USD. Key players analyzed include JTB Americas Group, TripAdvisor, Travelzoo, Travel Leaders Group, American Express Global Business Travel, Airbnb, Travel and Transport Inc, Booking Holdings, Expedia, and eDreams – but the list is not exhaustive.

North America Online Travel Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the North American online travel market. We delve into market concentration, examining the market share held by key players like Booking Holdings and Expedia, and evaluating the impact of mergers and acquisitions (M&A) activities. The report explores the influence of regulatory frameworks on market dynamics and the role of product substitutes, such as alternative accommodation platforms. Furthermore, we examine end-user demographics and their evolving travel preferences, contributing to a holistic understanding of market structure and innovation trends. The total market value in 2025 is estimated at xx Million.

- Market Concentration: Booking Holdings and Expedia hold a significant combined market share, estimated at xx%.

- M&A Activity: Analysis of recent M&A deals, including deal values, will be provided. For example, Airbnb’s acquisition of Gameplanner.AI for USD 200 Million in November 2023 signals a growing focus on AI-driven personalization.

- Innovation Drivers: Key drivers include the adoption of artificial intelligence (AI), personalization technologies, and evolving consumer preferences.

- Regulatory Frameworks: An examination of relevant regulations and their impact on market competition and growth.

North America Online Travel Market Market Dynamics & Trends

This section analyzes market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. We project the Compound Annual Growth Rate (CAGR) and market penetration rates for key segments. Factors driving market growth include increasing internet and smartphone penetration, the rise of online travel agencies (OTAs), and the growing popularity of mobile booking platforms. The impact of technological advancements such as AI-powered travel planning tools and personalized recommendations is thoroughly examined, along with an analysis of evolving consumer preferences for sustainable travel and unique experiences. The competitive landscape is explored through a lens of pricing strategies, marketing initiatives, and brand loyalty.

Dominant Regions & Segments in North America Online Travel Market

This section identifies the leading regions, countries, and segments within the North American online travel market. Analysis focuses on:

By Service Type: Accommodation Booking, Travel Tickets Booking, Holiday Package Booking, and Other Services. We will determine the dominant service type and outline the key drivers behind its success.

By Mode of Booking: Direct Booking and Travel Agents. We'll analyze the market share of each booking mode and identify the factors influencing consumer choices.

By Booking Platform: Desktop and Mobile/Tablet. We'll assess the market share held by each platform and discuss the implications of mobile's growing dominance.

Key Drivers (Examples):

- Economic Policies: Government initiatives supporting tourism and infrastructure development.

- Infrastructure: Availability of high-speed internet and mobile networks.

- Consumer Behavior: Shifting preferences towards online booking and mobile-first experiences.

North America Online Travel Market Product Innovations

This section summarizes recent product developments, applications, and competitive advantages in the online travel sector. We will highlight the role of technological trends, such as AI-powered chatbots and personalized itinerary generators, in enhancing user experience and driving market adoption. The market fit of innovative products and services will be assessed, emphasizing the competitive landscape and the strategic implications of these advancements for market leaders.

Report Scope & Segmentation Analysis

This report comprehensively segments the North American online travel market by service type (Accommodation Booking, Travel Tickets Booking, Holiday Package Booking, Other Services), mode of booking (Direct Booking, Travel Agents), and booking platform (Desktop, Mobile/Tablet). Each segment’s growth projections, market size estimates for 2025, and competitive dynamics will be analyzed.

Key Drivers of North America Online Travel Market Growth

Key growth drivers include increasing internet and smartphone penetration, rising disposable incomes, a growing preference for convenient online booking, and the adoption of innovative technologies such as AI and machine learning for personalization. Government initiatives to promote tourism also play a significant role.

Challenges in the North America Online Travel Market Sector

Challenges include increasing competition, cybersecurity threats, fluctuating fuel prices impacting airfares, and the potential for regulatory changes impacting market operations. Supply chain disruptions can also significantly impact the availability of travel services.

Emerging Opportunities in North America Online Travel Market

Emerging opportunities include the growing demand for sustainable and experiential travel, the rise of niche travel segments, and the potential for expansion into underserved markets. The integration of augmented and virtual reality technologies presents exciting possibilities for enhancing the customer experience.

Leading Players in the North America Online Travel Market Market

Key Developments in North America Online Travel Market Industry

- November 2023: Airbnb acquires Gameplanner.AI for USD 200 Million, accelerating its AI initiatives.

- July 2023: TripAdvisor partners with OpenAI to develop an AI-powered travel itinerary generator.

Future Outlook for North America Online Travel Market Market

The North American online travel market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and increasing investment in the sector. Strategic partnerships and innovative business models will play a crucial role in shaping the future of the market. The focus on personalization, sustainability, and unique travel experiences will continue to drive demand and innovation.

North America Online Travel Market Segmentation

-

1. Service Type

- 1.1. Accommodation Booking

- 1.2. Travel Tickets Booking

- 1.3. Holiday Package Booking

- 1.4. Other Services

-

2. Mode of Booking

- 2.1. Direct Booking

- 2.2. Travel Agents

-

3. Booking Platform

- 3.1. Desktop

- 3.2. Mobile/Tablet

-

4. Geography

- 4.1. United States

- 4.2. Canada

North America Online Travel Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Online Travel Market Regional Market Share

Geographic Coverage of North America Online Travel Market

North America Online Travel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Work-Life Balance; Cost Savings for Both Travelers and Employers

- 3.3. Market Restrains

- 3.3.1. Stringent Company Policies; Suitability of Business Travel Destinations

- 3.4. Market Trends

- 3.4.1. The Expanding Tourism Industry in the United States is Helping the Market in Recording More Transactions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Accommodation Booking

- 5.1.2. Travel Tickets Booking

- 5.1.3. Holiday Package Booking

- 5.1.4. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 5.2.1. Direct Booking

- 5.2.2. Travel Agents

- 5.3. Market Analysis, Insights and Forecast - by Booking Platform

- 5.3.1. Desktop

- 5.3.2. Mobile/Tablet

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Accommodation Booking

- 6.1.2. Travel Tickets Booking

- 6.1.3. Holiday Package Booking

- 6.1.4. Other Services

- 6.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 6.2.1. Direct Booking

- 6.2.2. Travel Agents

- 6.3. Market Analysis, Insights and Forecast - by Booking Platform

- 6.3.1. Desktop

- 6.3.2. Mobile/Tablet

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Online Travel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Accommodation Booking

- 7.1.2. Travel Tickets Booking

- 7.1.3. Holiday Package Booking

- 7.1.4. Other Services

- 7.2. Market Analysis, Insights and Forecast - by Mode of Booking

- 7.2.1. Direct Booking

- 7.2.2. Travel Agents

- 7.3. Market Analysis, Insights and Forecast - by Booking Platform

- 7.3.1. Desktop

- 7.3.2. Mobile/Tablet

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 JTB Americas Group

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 TripAdvisor

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Travelzoo

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Travel Leaders Group

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 American Express Global Business Travel

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Airbnb

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Travel and Transport Inc**List Not Exhaustive

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Booking Holdings

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Expedia

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 eDreams

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 JTB Americas Group

List of Figures

- Figure 1: North America Online Travel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Travel Market Share (%) by Company 2025

List of Tables

- Table 1: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 3: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 4: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Online Travel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 8: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 9: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Online Travel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: North America Online Travel Market Revenue Million Forecast, by Mode of Booking 2020 & 2033

- Table 13: North America Online Travel Market Revenue Million Forecast, by Booking Platform 2020 & 2033

- Table 14: North America Online Travel Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Online Travel Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Travel Market?

The projected CAGR is approximately 9.80%.

2. Which companies are prominent players in the North America Online Travel Market?

Key companies in the market include JTB Americas Group, TripAdvisor, Travelzoo, Travel Leaders Group, American Express Global Business Travel, Airbnb, Travel and Transport Inc**List Not Exhaustive, Booking Holdings, Expedia, eDreams.

3. What are the main segments of the North America Online Travel Market?

The market segments include Service Type, Mode of Booking, Booking Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 235 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Work-Life Balance; Cost Savings for Both Travelers and Employers.

6. What are the notable trends driving market growth?

The Expanding Tourism Industry in the United States is Helping the Market in Recording More Transactions.

7. Are there any restraints impacting market growth?

Stringent Company Policies; Suitability of Business Travel Destinations.

8. Can you provide examples of recent developments in the market?

In November 2023, Airbnb has acquired a startup called Gameplanner.AI in a deal valued at USD 200 million. Some of Airbnb's AI initiatives will be accelerated by Gameplanner.AI.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Travel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Travel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Travel Market?

To stay informed about further developments, trends, and reports in the North America Online Travel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence