Key Insights

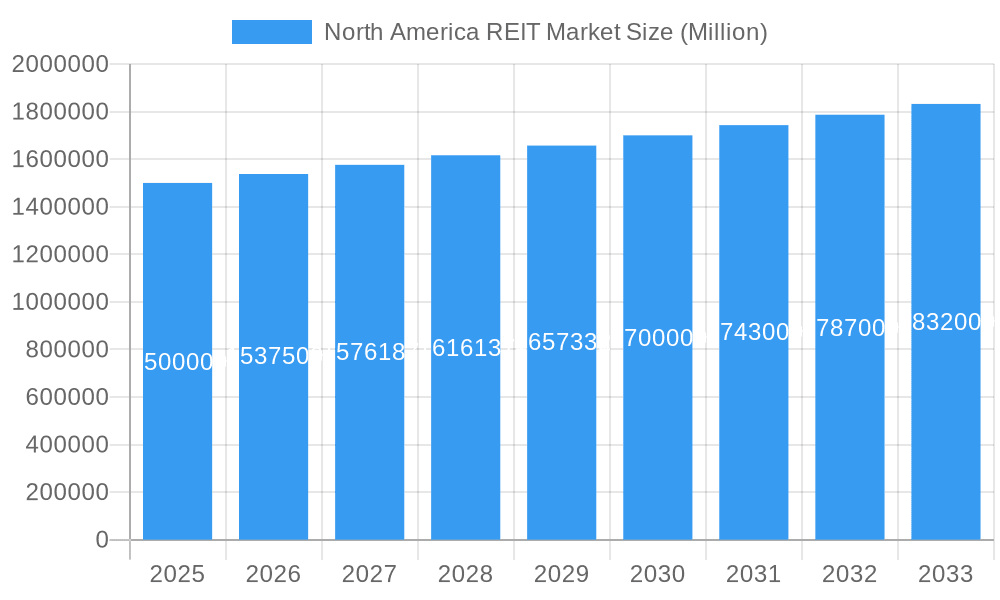

The North American Real Estate Investment Trust (REIT) market, valued at approximately $1.5 trillion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.50% from 2025 to 2033. This growth is fueled by several key drivers. Increasing urbanization and population growth, particularly in major metropolitan areas across the United States, Canada, and Mexico, consistently drive demand for commercial and residential real estate. Furthermore, the ongoing shift towards e-commerce continues to boost the demand for warehouse and logistics properties, benefiting industrial REITs. Favorable interest rates and robust investor confidence also contribute significantly to market expansion. However, economic downturns and potential interest rate hikes represent significant restraints on market growth. The market is segmented by investment holdings (Equity, Mortgage, Hybrid REITs), geographic location (United States, Canada, Mexico, and other North American countries), and property sector (Office, Retail, Residential, Industrial, and Others). The United States dominates the market, owing to its large and diversified economy. The sector's resilience is evident in the performance of major players like American Tower Corporation, Crown Castle, Prologis, Equinix, Iron Mountain, and Public Storage, showcasing the market's depth and the potential for future investment.

North America REIT Market Market Size (In Million)

The North American REIT market's future trajectory hinges on several trends. The increasing adoption of sustainable building practices and technological advancements, like smart building technologies, will influence investment decisions and reshape the market landscape. Government regulations concerning environmental, social, and governance (ESG) factors will also play a significant role, potentially influencing investor preferences towards environmentally responsible REITs. Furthermore, the evolving nature of workspaces, driven by remote work trends and the hybrid work model, will likely transform the office REIT sector, necessitating strategic adjustments by market players. Analyzing these trends and navigating potential risks is crucial for investors and stakeholders seeking to capitalize on the growth opportunities within this dynamic market.

North America REIT Market Company Market Share

North America REIT Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the North America REIT market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, dominant segments, key players, and future growth prospects. Benefit from detailed segmentation by investment holdings (Equity REITs, Mortgage REITs, Hybrid REITs), country (United States, Canada, Mexico, Costa Rica), and property sector (Office, Retail, Residential, Industrial, Others). The report leverages extensive data analysis to deliver actionable intelligence and strategic recommendations.

North America REIT Market Structure & Innovation Trends

This section analyzes the market's competitive landscape, identifying key players and their market share. It explores innovation drivers, including technological advancements and regulatory changes, impacting the REIT sector. The influence of M&A activities on market consolidation is examined, including deal values and their impact on market structure. The report also considers the role of product substitutes and end-user demographics in shaping market trends.

Market Concentration: The North American REIT market is characterized by a concentrated landscape, with a few dominant players holding significant market share. For example, Prologis and Public Storage command substantial portions of their respective segments. Estimates suggest the top five players hold approximately xx% of the total market share in 2025.

Innovation Drivers: Technological advancements such as PropTech solutions are driving innovation, improving operational efficiency, and enhancing tenant experiences. Regulatory changes, including tax policies impacting REIT structures, are also key drivers.

M&A Activity: The historical period (2019-2024) witnessed significant M&A activity, with total deal values exceeding $xx Million. The forecast period (2025-2033) is expected to see continued consolidation, driven by the pursuit of scale and diversification.

Product Substitutes: The emergence of alternative investment vehicles and changing property preferences pose some competitive pressures, though the core value proposition of REITs remains largely unaffected.

End-User Demographics: Shifting demographics, particularly urbanization and evolving preferences for housing and commercial space, are influencing sector-specific growth trajectories within the REIT market.

North America REIT Market Market Dynamics & Trends

This section delves into the key factors influencing market growth, including economic conditions, technological disruptions, evolving consumer preferences, and competitive dynamics. It presents a comprehensive overview of the market's trajectory, providing a detailed analysis of CAGR and market penetration rates.

The North American REIT market experienced a CAGR of xx% during the historical period (2019-2024). This growth was driven by several factors, including robust economic growth in key markets, increasing demand for commercial and residential real estate, and favorable investor sentiment. Technological disruptions, such as the rise of PropTech, are enhancing efficiency and transparency. Changing consumer preferences, including a shift towards experience-driven retail and flexible workspaces, are influencing investment strategies. Intense competition among REITs is leading to innovation and consolidation. The forecast period (2025-2033) is projected to see a CAGR of xx%, driven by sustained economic growth and the ongoing adoption of technology within the sector. Market penetration in specific segments, particularly in data centers and industrial properties, is expected to increase significantly.

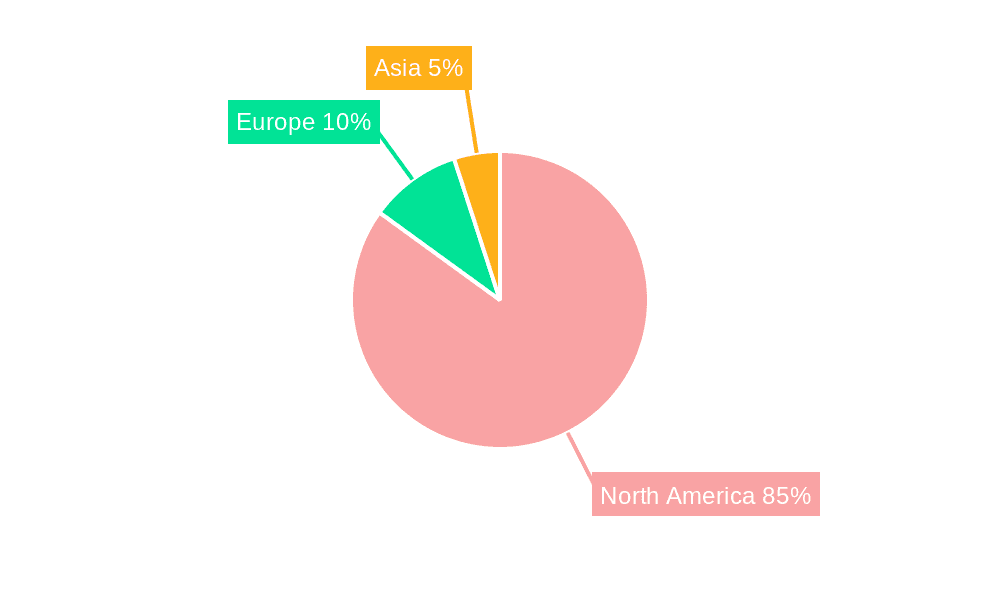

Dominant Regions & Segments in North America REIT Market

This section identifies the leading regions and segments within the North American REIT market, providing a detailed analysis of their dominance. Key drivers of growth in each segment are explored, providing insights into regional economic policies, infrastructure development, and other contributing factors.

By Investment Holdings: Equity REITs remain the dominant segment, driven by their established presence and diversified portfolios. Mortgage REITs are experiencing growth due to increased borrowing and investment activity, while Hybrid REITs are attracting investment due to their flexibility.

By Country: The United States dominates the market, driven by its large and diverse economy and well-developed real estate infrastructure. Canada and Mexico show strong growth potential, particularly in specific sectors. Costa Rica represents a smaller but growing niche within the regional market.

By Property Sector: The industrial sector is experiencing significant growth, driven by the e-commerce boom and the need for logistics facilities. The residential sector also shows strong performance, driven by urbanization and population growth. The office sector is facing challenges related to remote work, while retail is adapting to evolving consumer behavior. The 'Others' category is expected to experience growth, largely reflecting the expansion of specialized REITs catering to niche property types.

The United States' dominance stems from its large and diverse economy, robust infrastructure, and established financial markets. Favorable government policies and regulations further incentivize investment in the U.S. REIT sector.

North America REIT Market Product Innovations

This section examines recent product developments within the North America REIT market, highlighting technological trends and their impact on market competitiveness. The report analyzes the market fit of these innovations and their implications for future growth.

Recent product innovations center around technological advancements that improve operational efficiency and tenant experience. These include the adoption of smart building technologies, data analytics for optimized resource management, and the implementation of PropTech solutions for streamlined processes. These innovations are enhancing the competitive advantage of REITs, attracting investors, and driving sector growth. The market fit of these innovations is significant as they address key industry challenges and respond to evolving tenant preferences.

Report Scope & Segmentation Analysis

This section details the market segmentation utilized in the report, including projections for market size and competitive dynamics within each segment.

The report segments the North American REIT market across three key dimensions: investment holdings, country, and property sector.

Investment Holdings: Equity REITs, Mortgage REITs, and Hybrid REITs are analyzed individually, with growth projections and competitive dynamics considered for each. Market size estimates for each segment in 2025 are provided.

Country: The United States, Canada, Mexico, and Costa Rica are analyzed separately, with country-specific factors impacting market size and growth trajectories.

Property Sector: Office, Retail, Residential, Industrial, and Others are evaluated independently, providing insights into sector-specific trends, market sizes, and competitive pressures. Growth projections for each sector in the forecast period are included.

Key Drivers of North America REIT Market Growth

This section identifies the key factors driving growth in the North American REIT market, including technological advancements, economic conditions, and favorable regulatory frameworks.

Several factors contribute to the growth of the North American REIT market. Strong economic growth and low interest rates in the historical period fueled investment, while technological advancements, such as the use of data analytics and smart building technologies, enhanced efficiency and operational performance. Favorable tax policies and regulations that support REIT structures further incentivize investment.

Challenges in the North America REIT Market Sector

This section highlights the key challenges faced by the North American REIT market, including regulatory hurdles, supply chain disruptions, and competitive pressures.

The North American REIT market faces challenges including regulatory uncertainties, supply chain issues impacting construction and renovations, and intense competition for attractive properties. Increased interest rates can also dampen investor sentiment and affect borrowing costs, potentially reducing investment and development. These challenges can impact profitability and potentially slow down growth in certain segments.

Emerging Opportunities in North America REIT Market

This section explores emerging trends and opportunities within the North American REIT market, including new market segments, technological advancements, and shifting consumer preferences.

Emerging opportunities include the growth of niche sectors, such as data centers and life science properties, driven by technological advancements. The increasing demand for sustainable and environmentally friendly buildings presents a significant opportunity for REITs. Shifting consumer preferences for flexible workspace and experience-driven retail environments will require adaptive strategies, offering further market potential.

Leading Players in the North America REIT Market Market

Key Developments in North America REIT Market Industry

- 2022 Q4: Prologis announces a significant expansion of its industrial portfolio in key U.S. markets.

- 2023 Q1: American Tower Corporation completes a major acquisition, expanding its cell tower network.

- 2023 Q2: Public Storage implements a new technology to improve tenant self-service capabilities.

- 2024 Q3: Equinix invests in a new hyperscale data center, enhancing its capacity and competitive position.

Future Outlook for North America REIT Market Market

The future of the North America REIT market appears positive, with sustained growth projected across multiple segments. Further technological advancements, evolving consumer preferences, and strategic acquisitions will continue to shape the market landscape. The ongoing focus on sustainability and ESG (environmental, social, and governance) factors will influence investment decisions. The market is expected to experience growth driven by economic expansion, technological innovation, and demographic shifts. Strategic partnerships and diversification across different property sectors will be crucial for future success.

North America REIT Market Segmentation

-

1. Investment Holdings

- 1.1. Equity REITs

- 1.2. Mortagage REITs

- 1.3. Hybrid REITs

-

2. Property Sector

- 2.1. Office

- 2.2. Retail

- 2.3. Residential

- 2.4. Industrial

- 2.5. Others

North America REIT Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America REIT Market Regional Market Share

Geographic Coverage of North America REIT Market

North America REIT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fund Inflows is Driving the ETF Market

- 3.3. Market Restrains

- 3.3.1. Underlying Fluctuations and Risks are Restraining the Market

- 3.4. Market Trends

- 3.4.1. REITs prominence in Senior Housing & Care Market in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America REIT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Holdings

- 5.1.1. Equity REITs

- 5.1.2. Mortagage REITs

- 5.1.3. Hybrid REITs

- 5.2. Market Analysis, Insights and Forecast - by Property Sector

- 5.2.1. Office

- 5.2.2. Retail

- 5.2.3. Residential

- 5.2.4. Industrial

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Investment Holdings

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Tower Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Crown Castle

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Prologis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equinix

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Iron Mountain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Public Storage

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 American Tower Corporation

List of Figures

- Figure 1: North America REIT Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America REIT Market Share (%) by Company 2025

List of Tables

- Table 1: North America REIT Market Revenue Million Forecast, by Investment Holdings 2020 & 2033

- Table 2: North America REIT Market Revenue Million Forecast, by Property Sector 2020 & 2033

- Table 3: North America REIT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America REIT Market Revenue Million Forecast, by Investment Holdings 2020 & 2033

- Table 5: North America REIT Market Revenue Million Forecast, by Property Sector 2020 & 2033

- Table 6: North America REIT Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America REIT Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America REIT Market?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the North America REIT Market?

Key companies in the market include American Tower Corporation , Crown Castle, Prologis , Equinix , Iron Mountain , Public Storage.

3. What are the main segments of the North America REIT Market?

The market segments include Investment Holdings, Property Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Fund Inflows is Driving the ETF Market.

6. What are the notable trends driving market growth?

REITs prominence in Senior Housing & Care Market in United States.

7. Are there any restraints impacting market growth?

Underlying Fluctuations and Risks are Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America REIT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America REIT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America REIT Market?

To stay informed about further developments, trends, and reports in the North America REIT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence