Key Insights

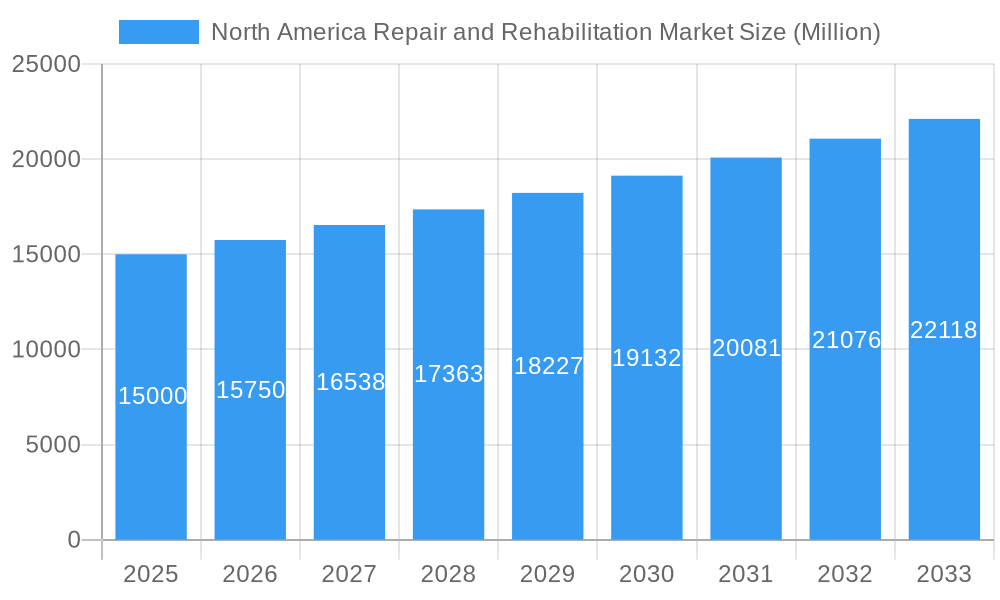

The North American repair and rehabilitation market is poised for significant expansion. Driven by aging infrastructure, increasing urbanization, and a strategic focus on extending asset lifespans, the market is projected to reach $11.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.4% through 2033. Key growth drivers include substantial infrastructure investment across the United States, Canada, and Mexico, particularly within the commercial and industrial sectors. The adoption of sustainable and innovative materials, such as resin-based modified mortars and fiber wrapping systems, further propels market growth. The residential sector also presents a considerable opportunity, with homeowners prioritizing repairs and renovations to enhance energy efficiency and property value. Competitive dynamics among established companies like FairMate, MAPEI, Pidilite, BASF, and Dow foster continuous innovation in materials and techniques.

North America Repair and Rehabilitation Market Market Size (In Billion)

Potential restraints to market growth include fluctuations in raw material prices, economic downturns impacting construction activity, and skilled labor shortages. Despite these challenges, the long-term outlook remains positive, supported by ongoing government investment in infrastructure renewal and a persistent emphasis on maintaining and upgrading existing structures across various end-user segments. Segmentation analysis reveals injection grouting materials and resin-based products as leading segments, followed by fiber wrapping systems and micro-concrete mortars, underscoring the demand for durable and efficient solutions. The North American market's substantial size and growth trajectory offer attractive opportunities for both established and emerging players, with diverse product segments catering to specific needs in commercial, industrial, residential, and infrastructure applications.

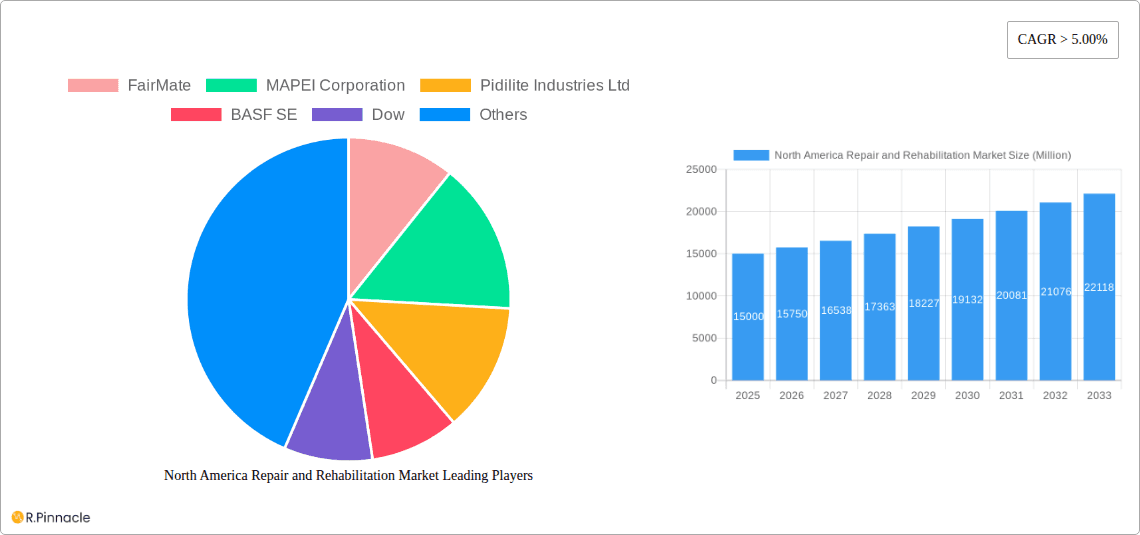

North America Repair and Rehabilitation Market Company Market Share

North America Repair and Rehabilitation Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America repair and rehabilitation market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report offers a robust understanding of market dynamics, growth drivers, and future trends. The study encompasses key segments, including end-user sectors (commercial, industrial, infrastructure, residential) and product types (Injection Grouting Materials, Resin-based Modified Mortars, Fiber Wrapping Systems, Glass Fiber Rebar Protectors, Micro-concrete Mortars, Others). Leading players like FairMate, MAPEI Corporation, Pidilite Industries Ltd, BASF SE, Dow, Simpson Strong-Tie Company Inc, STP Limited India, CHRYSO India, Fosroc Inc, SIKA AG, and CICO Group are analyzed in detail.

North America Repair and Rehabilitation Market Structure & Innovation Trends

The North America repair and rehabilitation market exhibits a moderately consolidated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized firms fosters competition and innovation. Market share analysis reveals that MAPEI Corporation and SIKA AG are among the leading companies, each holding an estimated xx% market share in 2025. Innovation is driven by the increasing demand for sustainable and high-performance materials, stricter building codes, and the need for efficient repair solutions. Regulatory frameworks, particularly those related to environmental protection and worker safety, significantly influence material selection and application methods. Product substitutes, such as advanced composite materials, are continuously emerging, posing both challenges and opportunities for established players. Mergers and acquisitions (M&A) activity is relatively high, with recent deals exceeding USD xx Million in total value, reflecting industry consolidation and expansion strategies.

- Market Concentration: Moderately Consolidated

- Key Players' Market Share (2025): MAPEI Corporation (xx%), SIKA AG (xx%), others (xx%)

- M&A Activity (2019-2024): Total deal value exceeding USD xx Million

- Innovation Drivers: Sustainability, performance requirements, stringent building codes

North America Repair and Rehabilitation Market Dynamics & Trends

The North America repair and rehabilitation market is experiencing robust growth, driven by factors such as aging infrastructure, increasing urbanization, and stringent building codes requiring regular maintenance and repair. Technological advancements, including the development of high-performance materials and innovative repair techniques, are further fueling market expansion. Consumer preferences are shifting towards sustainable and environmentally friendly solutions, creating opportunities for companies offering green repair and rehabilitation products. The competitive landscape is characterized by intense rivalry, with companies focusing on product differentiation, technological innovation, and strategic partnerships to gain market share. The market is projected to achieve a CAGR of xx% during the forecast period (2025-2033), with market penetration steadily increasing across various end-user segments.

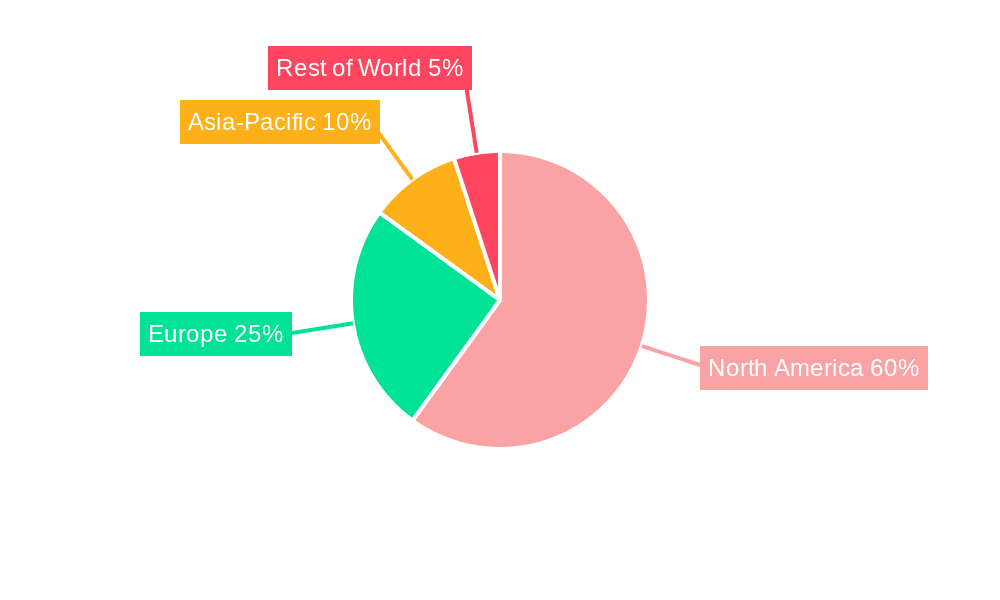

Dominant Regions & Segments in North America Repair and Rehabilitation Market

The Infrastructure segment dominates the North America repair and rehabilitation market, driven by the significant need for bridge repair, highway rehabilitation, and other large-scale infrastructure projects. The Western region of the United States is currently a leading market, owing to its robust construction activity and substantial investment in infrastructure development.

- Dominant End-User Sector: Infrastructure

- Key Drivers for Infrastructure Segment: Aging infrastructure, government investment in infrastructure projects, increased demand for highway repair and maintenance.

- Dominant Region: Western United States

- Key Drivers for Western US: High construction activity, significant infrastructure investments, favorable economic conditions.

The Injection Grouting Materials segment holds a major share within the product type category, owing to its effectiveness in repairing cracks and other structural defects. The residential segment, although smaller compared to infrastructure, is anticipated to display considerable growth due to the rising number of aging homes requiring repair and renovation.

North America Repair and Rehabilitation Market Product Innovations

Recent innovations focus on developing high-performance materials with enhanced durability, sustainability, and ease of application. These include self-healing concrete, advanced polymers, and fiber-reinforced composites. The emphasis is on creating products that reduce maintenance costs, improve structural integrity, and extend the lifespan of infrastructure and buildings. These innovative solutions are tailored to address specific market needs, ranging from quick-setting repair mortars for emergency situations to long-lasting, sustainable materials for large-scale projects.

Report Scope & Segmentation Analysis

This report segments the North America repair and rehabilitation market by end-user sector (commercial, industrial, infrastructure, residential) and product type (Injection Grouting Materials, Resin-based Modified Mortars, Fiber Wrapping Systems, Glass Fiber Rebar Protectors, Micro-concrete Mortars, Others). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. For instance, the infrastructure segment is expected to witness significant growth due to government initiatives focusing on infrastructure development, while the residential segment is poised for expansion due to an increase in home renovations and repairs. The Injection Grouting Materials segment is forecast to grow at xx% CAGR, driven by its versatility and efficacy in a variety of applications.

Key Drivers of North America Repair and Rehabilitation Market Growth

Several factors propel the growth of the North America repair and rehabilitation market. Firstly, the aging infrastructure across the region demands significant repair and maintenance. Secondly, increased urbanization and industrialization contribute to the need for enhanced building structures. Thirdly, the implementation of stricter building codes and regulations necessitates more frequent repairs and renovations. Finally, technological advancements in materials science lead to improved repair solutions and techniques.

Challenges in the North America Repair and Rehabilitation Market Sector

The market faces challenges such as fluctuating raw material prices, supply chain disruptions, and intense competition. Stringent environmental regulations also add to the complexity of the industry. These factors can impact profitability and hinder market expansion, leading to an estimated xx% decrease in profit margins for some companies in 2024.

Emerging Opportunities in North America Repair and Rehabilitation Market

Emerging opportunities arise from the increasing adoption of sustainable building practices, the growing demand for high-performance materials, and advancements in repair technologies. The market presents significant growth potential through investments in research and development of eco-friendly and innovative repair solutions, catering to the rising consumer preference for sustainability and longevity.

Leading Players in the North America Repair and Rehabilitation Market Market

- FairMate

- MAPEI Corporation

- Pidilite Industries Ltd

- BASF SE

- Dow

- Simpson Strong-Tie Company Inc

- STP Limited India

- CHRYSO India

- Fosroc Inc

- SIKA AG

- CICO Group

Key Developments in North America Repair and Rehabilitation Market Industry

- June 2022: MAPEI acquired a new 200,000-square-foot facility in Houston, Texas, to expand its production of powders and liquid admixtures. This significantly boosted its production capacity and market presence.

- July 2022: BASF SE invested USD 780 Million in the final phase of MDI expansion at its Geismar Verbund plant. This expansion enhances the availability of MDI, a key component in foam insulation used in construction, impacting the overall supply chain and potentially lowering costs for related repair and rehabilitation materials.

Future Outlook for North America Repair and Rehabilitation Market Market

The North America repair and rehabilitation market is poised for sustained growth, driven by continuous infrastructure development, technological advancements, and a focus on sustainable practices. Strategic partnerships, acquisitions, and investments in research and development will further shape the market's trajectory. Companies offering innovative, sustainable, and cost-effective solutions are expected to capture significant market share in the coming years.

North America Repair and Rehabilitation Market Segmentation

-

1. Product Type

-

1.1. Injection Grouting Materials

- 1.1.1. Cement-based

- 1.1.2. Resin-based

- 1.2. Modified Mortars

-

1.3. Fiber Wrapping Systems

- 1.3.1. Carbon Fiber

- 1.3.2. Glass Fiber

- 1.4. Rebar Protectors

- 1.5. Micro-concrete Mortars

- 1.6. Others

-

1.1. Injection Grouting Materials

-

2. End-User Sectors

- 2.1. Commercial

- 2.2. Industrial

- 2.3. Infrastructure

- 2.4. Residential

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Repair and Rehabilitation Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Repair and Rehabilitation Market Regional Market Share

Geographic Coverage of North America Repair and Rehabilitation Market

North America Repair and Rehabilitation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activities in the United States; Growing Demand for Effective and Reliable Repair and Rehabilitation Treatments for Complex Structures

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Residential Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Injection Grouting Materials

- 5.1.1.1. Cement-based

- 5.1.1.2. Resin-based

- 5.1.2. Modified Mortars

- 5.1.3. Fiber Wrapping Systems

- 5.1.3.1. Carbon Fiber

- 5.1.3.2. Glass Fiber

- 5.1.4. Rebar Protectors

- 5.1.5. Micro-concrete Mortars

- 5.1.6. Others

- 5.1.1. Injection Grouting Materials

- 5.2. Market Analysis, Insights and Forecast - by End-User Sectors

- 5.2.1. Commercial

- 5.2.2. Industrial

- 5.2.3. Infrastructure

- 5.2.4. Residential

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Injection Grouting Materials

- 6.1.1.1. Cement-based

- 6.1.1.2. Resin-based

- 6.1.2. Modified Mortars

- 6.1.3. Fiber Wrapping Systems

- 6.1.3.1. Carbon Fiber

- 6.1.3.2. Glass Fiber

- 6.1.4. Rebar Protectors

- 6.1.5. Micro-concrete Mortars

- 6.1.6. Others

- 6.1.1. Injection Grouting Materials

- 6.2. Market Analysis, Insights and Forecast - by End-User Sectors

- 6.2.1. Commercial

- 6.2.2. Industrial

- 6.2.3. Infrastructure

- 6.2.4. Residential

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Injection Grouting Materials

- 7.1.1.1. Cement-based

- 7.1.1.2. Resin-based

- 7.1.2. Modified Mortars

- 7.1.3. Fiber Wrapping Systems

- 7.1.3.1. Carbon Fiber

- 7.1.3.2. Glass Fiber

- 7.1.4. Rebar Protectors

- 7.1.5. Micro-concrete Mortars

- 7.1.6. Others

- 7.1.1. Injection Grouting Materials

- 7.2. Market Analysis, Insights and Forecast - by End-User Sectors

- 7.2.1. Commercial

- 7.2.2. Industrial

- 7.2.3. Infrastructure

- 7.2.4. Residential

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Repair and Rehabilitation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Injection Grouting Materials

- 8.1.1.1. Cement-based

- 8.1.1.2. Resin-based

- 8.1.2. Modified Mortars

- 8.1.3. Fiber Wrapping Systems

- 8.1.3.1. Carbon Fiber

- 8.1.3.2. Glass Fiber

- 8.1.4. Rebar Protectors

- 8.1.5. Micro-concrete Mortars

- 8.1.6. Others

- 8.1.1. Injection Grouting Materials

- 8.2. Market Analysis, Insights and Forecast - by End-User Sectors

- 8.2.1. Commercial

- 8.2.2. Industrial

- 8.2.3. Infrastructure

- 8.2.4. Residential

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 FairMate

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 MAPEI Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Pidilite Industries Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 BASF SE

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Dow

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Simpson Strong-Tie Company Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 STP Limited India *List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 CHRYSO India

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Fosroc Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 SIKA AG

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 CICO Group

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 FairMate

List of Figures

- Figure 1: North America Repair and Rehabilitation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Repair and Rehabilitation Market Share (%) by Company 2025

List of Tables

- Table 1: North America Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Repair and Rehabilitation Market Revenue billion Forecast, by End-User Sectors 2020 & 2033

- Table 3: North America Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Repair and Rehabilitation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America Repair and Rehabilitation Market Revenue billion Forecast, by End-User Sectors 2020 & 2033

- Table 7: North America Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Repair and Rehabilitation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Repair and Rehabilitation Market Revenue billion Forecast, by End-User Sectors 2020 & 2033

- Table 11: North America Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Repair and Rehabilitation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Repair and Rehabilitation Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America Repair and Rehabilitation Market Revenue billion Forecast, by End-User Sectors 2020 & 2033

- Table 15: North America Repair and Rehabilitation Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Repair and Rehabilitation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Repair and Rehabilitation Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the North America Repair and Rehabilitation Market?

Key companies in the market include FairMate, MAPEI Corporation, Pidilite Industries Ltd, BASF SE, Dow, Simpson Strong-Tie Company Inc, STP Limited India *List Not Exhaustive, CHRYSO India, Fosroc Inc, SIKA AG, CICO Group.

3. What are the main segments of the North America Repair and Rehabilitation Market?

The market segments include Product Type, End-User Sectors, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activities in the United States; Growing Demand for Effective and Reliable Repair and Rehabilitation Treatments for Complex Structures.

6. What are the notable trends driving market growth?

Rising Demand from the Residential Segment.

7. Are there any restraints impacting market growth?

Lack of Skilled Labors.

8. Can you provide examples of recent developments in the market?

July 2022: BASF SE confirmed the last phase of MDI expansion at the Geismar Verbund plant, with a USD 780 million investment. Methylene diphenyl diisocyanate (MDI) is used in foam insulation for appliances and construction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Repair and Rehabilitation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Repair and Rehabilitation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Repair and Rehabilitation Market?

To stay informed about further developments, trends, and reports in the North America Repair and Rehabilitation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence