Key Insights

The North American satellite bus market is projected for substantial expansion, driven by a robust Compound Annual Growth Rate (CAGR) of 7.2%. Forecasted to reach $15.45 billion by 2025, this growth is fueled by escalating demand for advanced communication, earth observation, and navigation systems across commercial and government sectors. Key expansion drivers include the proliferation of small satellites (under 100kg) and the development of satellite constellations for Internet of Things (IoT) and environmental monitoring. While Geostationary Earth Orbit (GEO) satellites remain dominant for established communication infrastructure, Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellites are gaining traction due to their lower latency and higher bandwidth capabilities. This trend is shifting the market towards smaller satellite mass segments, particularly 10-100kg and 100-500kg categories. Significant growth is supported by technological advancements and supportive government initiatives. However, potential restraints include the high costs of satellite development and launch, alongside complexities in regulatory compliance and space debris mitigation. Leading players such as Lockheed Martin, Northrop Grumman, and Airbus are at the forefront of innovation, enhancing satellite bus technologies and expanding their market presence. North America, particularly the United States, is expected to maintain a significant global market share due to its advanced space infrastructure, substantial government investment, and the presence of key industry players.

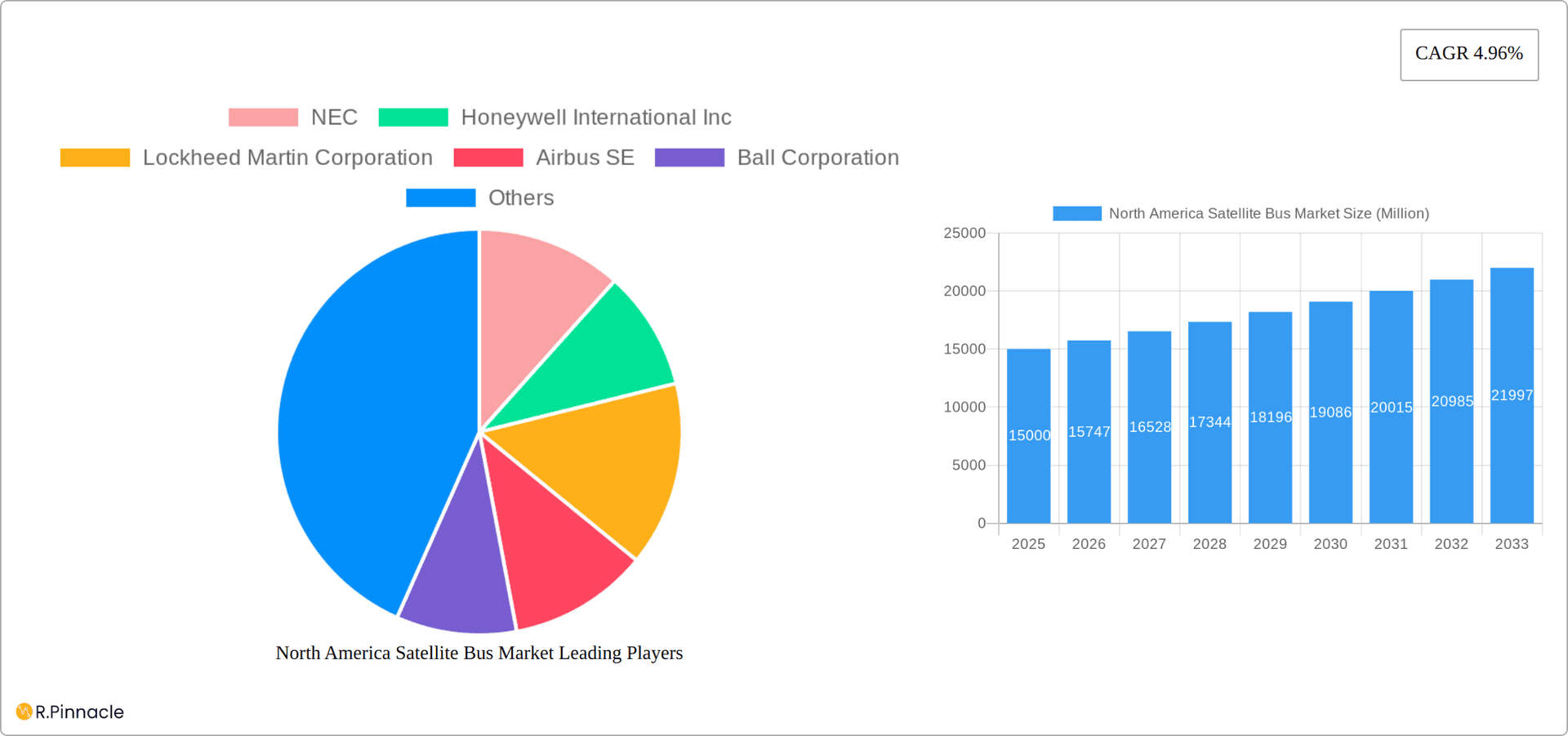

North America Satellite Bus Market Market Size (In Billion)

The North American market is segmented by orbit class (GEO, LEO, MEO), end-user (commercial, military & government, other), application (communication, earth observation, navigation, space observation, others), and satellite mass (below 10kg, 10-100kg, 100-500kg, 500-1000kg, above 1000kg). The commercial sector is a primary growth engine, with increasing investments in satellite-based communication services, IoT networks, and Earth observation for precision agriculture and environmental monitoring. Government and military applications, including national security and surveillance, also significantly contribute to market expansion, driving demand for reliable satellite buses. The market's dynamic nature necessitates continuous innovation and adaptability to meet evolving application requirements and technological advancements, including research into efficient propulsion systems, advanced materials, and miniaturized components to enhance satellite bus performance, reduce manufacturing costs, and increase payload capacity.

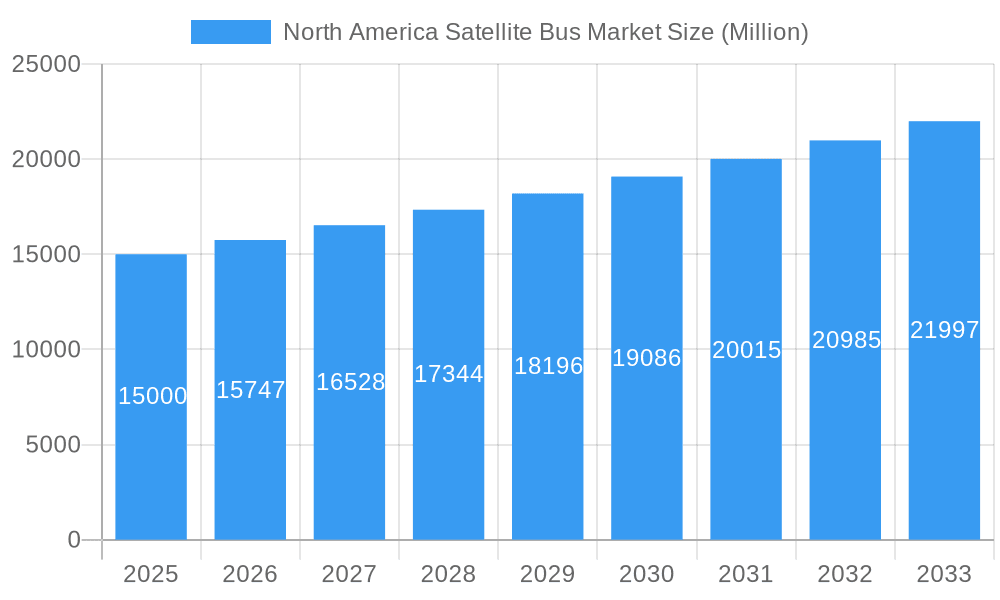

North America Satellite Bus Market Company Market Share

North America Satellite Bus Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America satellite bus market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, key players, technological advancements, and future growth prospects, enabling informed strategic decision-making for industry professionals. The report's detailed segmentation allows for a granular understanding of market trends across various parameters, including orbit class, end-user, application, and satellite mass. With a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for navigating the complexities of this dynamic market. The total market value is predicted to reach xx Million by 2033.

North America Satellite Bus Market Market Structure & Innovation Trends

The North American satellite bus market exhibits a moderately concentrated structure, with key players like NEC, Honeywell International Inc, Lockheed Martin Corporation, Airbus SE, Ball Corporation, Sierra Nevada Corporation, Nano Avionics, Thales, and Northrop Grumman Corporation holding significant market share. Precise market share data for each company is not available without further detail (xx%). However, the industry is characterized by ongoing innovation, driven by advancements in miniaturization, improved propulsion systems, and the growing demand for smaller, more affordable satellites. Regulatory frameworks, such as those governing spectrum allocation and launch licenses, significantly impact market operations. The emergence of New Space companies and increased private investment are disrupting the traditional market landscape. Substitutes for satellite buses are limited, primarily involving alternative communication technologies (e.g., terrestrial networks), but the unique capabilities of satellite communications ensure sustained demand. The market has witnessed several mergers and acquisitions (M&A) in recent years, with deal values varying significantly, ranging from xx Million to xx Million depending on the assets acquired.

- Market Concentration: Moderately Concentrated

- Innovation Drivers: Miniaturization, Advanced Propulsion, Increased Private Investment

- Regulatory Impact: Significant, impacting spectrum allocation and launch licenses.

- M&A Activity: Frequent, with deal values varying considerably.

North America Satellite Bus Market Market Dynamics & Trends

The North America satellite bus market is experiencing robust growth, driven by several factors. The increasing demand for satellite-based communication, earth observation, and navigation services is a key driver. Technological advancements, such as the development of smaller, more efficient satellites and improved launch capabilities, are further fueling market expansion. Consumer preferences are shifting towards higher bandwidth, lower latency services, and more readily available satellite constellations, leading to increased demand. Competitive dynamics are intense, with established players and new entrants vying for market share through technological innovation, strategic partnerships, and cost optimization. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated at xx%, with market penetration increasing significantly in both the commercial and government sectors.

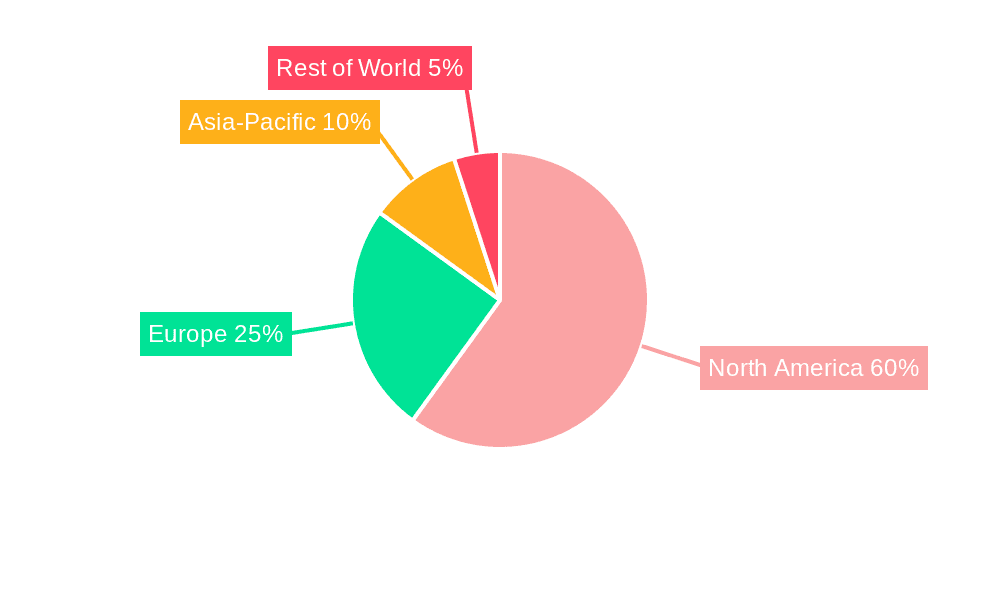

Dominant Regions & Segments in North America Satellite Bus Market

The United States dominates the North American satellite bus market, owing to its robust space infrastructure, significant government investment in space programs, and a large private sector presence. Within the market segmentation, several segments are experiencing particularly strong growth:

- Orbit Class: LEO (Low Earth Orbit) is currently the fastest-growing segment due to the increasing demand for constellation-based services.

- End User: The Commercial sector is leading in terms of growth, driven by increasing investments from private companies. The Military & Government sector maintains a substantial market share due to its strategic importance.

- Application: Communication and Earth Observation applications are experiencing high growth, propelled by the increasing need for reliable communication networks and environmental monitoring.

- Satellite Mass: The 10-100kg segment is witnessing significant growth driven by the rise of CubeSats and other small satellites.

Key drivers for regional dominance include government space policies, robust research and development, private investment, and a well-established space industry infrastructure.

North America Satellite Bus Market Product Innovations

Recent innovations focus on reducing satellite size and weight, enhancing fuel efficiency, and improving payload capacity. The integration of advanced sensors, improved communication technologies, and more robust design features are also notable trends. These innovations improve cost-effectiveness, flexibility, and mission performance, making satellite buses more adaptable to diverse applications and market demands. The emphasis is on delivering highly customized and reliable solutions to meet specific mission requirements while reducing overall costs.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America satellite bus market, segmented across key parameters:

- Orbit Class: GEO (Geosynchronous Earth Orbit), LEO (Low Earth Orbit), MEO (Medium Earth Orbit), and other emerging orbits. Each orbit class presents unique operational characteristics, influencing market dynamics and growth projections. The report analyzes the specific advantages and challenges of each orbit type, and their suitability for diverse applications.

- End User: Commercial (including telecommunications, broadcasting, and internet service providers), Military & Government (defense, intelligence, and scientific research), and Other (e.g., academic research institutions). Market size and growth trajectories vary considerably across these end-user segments, reflecting their specific needs and priorities.

- Application: Communication (broadcasting, broadband, mobile connectivity), Earth Observation (environmental monitoring, agriculture, disaster management), Navigation (GPS augmentation, precise positioning), Space Observation (astronomy, space situational awareness), and Others (e.g., scientific research, space tourism). Specific applications heavily influence the design and functionality of satellite buses, driving demand for specialized capabilities.

- Satellite Mass: Below 10 Kg (CubeSats), 10-100kg (microsatellites), 100-500kg (small satellites), 500-1000kg (medium satellites), above 1000kg (large satellites). Satellite mass is a critical parameter impacting launch costs, mission design, and overall lifecycle cost.

Detailed growth projections for each segment are derived from meticulous analysis of current market trends, technological advancements, anticipated demand, and competitive landscapes. The interplay of these factors is crucial in shaping the growth trajectory of each segment.

Key Drivers of North America Satellite Bus Market Growth

Several key factors are propelling the growth of the North America satellite bus market:

- Increased Demand for Satellite Services: The burgeoning demand for high-bandwidth, low-latency communication, precise Earth observation data, and reliable navigation services across diverse sectors (telecommunications, IoT, defense, environmental monitoring) is a fundamental driver.

- Technological Advancements: Continuous advancements in miniaturization, improved propulsion systems (e.g., electric propulsion), advanced sensor technologies, and onboard processing capabilities are enhancing satellite performance and reducing operational costs.

- Government Investments: Significant government initiatives and funding for space exploration, national security, and scientific research are actively supporting market expansion. This includes investment in both public-private partnerships and direct government-funded programs.

- Private Sector Investments: The substantial rise in private sector investments in space exploration, commercial satellite ventures (NewSpace), and constellation deployments is a major catalyst for market growth. This includes investments in both satellite manufacturing and launch services.

- NewSpace and Emerging Technologies: The emergence of NewSpace companies and innovative technologies like in-space manufacturing, servicing, and autonomous navigation is revolutionizing the industry and lowering the barrier to entry.

Challenges in the North America Satellite Bus Market Sector

Despite the significant growth potential, the North American satellite bus market faces several challenges:

- High Development Costs: The high initial investment required for satellite development, testing, and launch remains a significant barrier, especially for smaller companies and startups.

- Regulatory Hurdles: Navigating complex regulatory frameworks, obtaining necessary licenses and approvals, and adhering to international space treaties can be time-consuming and costly.

- Supply Chain Issues: Dependence on a limited number of component suppliers and potential disruptions in global supply chains pose a risk to timely project completion and overall market stability.

- Competitive Pressure: The intense competition among established and emerging players necessitates ongoing innovation and cost-effective solutions to maintain market share and profitability.

- Space Debris Mitigation: The increasing amount of space debris poses a significant threat to operational satellites and necessitates the development and implementation of mitigation strategies.

Emerging Opportunities in North America Satellite Bus Market

The North America satellite bus market presents several emerging opportunities:

- Growth of Small Satellite Constellations: The increasing adoption of smaller, more cost-effective satellites presents significant opportunities.

- Advancements in Propulsion Systems: New propulsion technologies can reduce launch costs and improve satellite maneuverability.

- Expansion into New Applications: Emerging applications like IoT (Internet of Things) and space-based surveillance create new market niches.

- Increased Focus on Sustainability: Demand for eco-friendly satellite designs and launch technologies is growing.

Leading Players in the North America Satellite Bus Market Market

- NEC

- Honeywell International Inc

- Lockheed Martin Corporation

- Airbus SE

- Ball Corporation

- Sierra Nevada Corporation

- NanoAvionics

- Thales

- Northrop Grumman Corporation

Key Developments in North America Satellite Bus Market Industry

- October 2020: NanoAvionics expands its UK presence with a new facility for satellite assembly, integration, and testing. This strengthens their position in the European market.

- August 2020: Sierra Nevada Corporation (SNC) introduces two new satellite platforms, SN-200M and SN-1000, broadening its product portfolio and targeting different orbit classes.

- July 2020: SNC secures a contract to repurpose its Shooting Star transport vehicle into an Unmanned Orbital Outpost, indicating a shift toward reusable space infrastructure.

Future Outlook for North America Satellite Bus Market Market

The North American satellite bus market is poised for continued robust growth, driven by a synergistic interplay of factors. These include the ever-increasing demand for advanced satellite-based services, continuous technological innovation, and substantial investments from both government and private sectors. Strategic partnerships, the development of more reliable and cost-effective launch technologies, and the expansion of mega-constellations are all expected to propel market expansion further. The industry's future will be shaped by a continuing focus on reducing costs, enhancing operational reliability, improving sustainability (e.g., reducing space debris), and integrating advanced technologies like AI and machine learning to optimize satellite operations and enhance service capabilities. The increasing demand for data and connectivity across various sectors, including the growing IoT market, further solidifies a positive outlook for the long-term growth of this dynamic market.

North America Satellite Bus Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

North America Satellite Bus Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Satellite Bus Market Regional Market Share

Geographic Coverage of North America Satellite Bus Market

North America Satellite Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Satellite Bus Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NEC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airbus SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ball Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sierra Nevada Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nano Avionics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Northrop Grumman Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NEC

List of Figures

- Figure 1: North America Satellite Bus Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Satellite Bus Market Share (%) by Company 2025

List of Tables

- Table 1: North America Satellite Bus Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: North America Satellite Bus Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: North America Satellite Bus Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: North America Satellite Bus Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: North America Satellite Bus Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Satellite Bus Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Satellite Bus Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 8: North America Satellite Bus Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 9: North America Satellite Bus Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: North America Satellite Bus Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Satellite Bus Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Satellite Bus Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Satellite Bus Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Satellite Bus Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Satellite Bus Market?

Key companies in the market include NEC, Honeywell International Inc, Lockheed Martin Corporation, Airbus SE, Ball Corporation, Sierra Nevada Corporation, Nano Avionics, Thale, Northrop Grumman Corporation.

3. What are the main segments of the North America Satellite Bus Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.45 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2020: NanoAvionics expanded its presence in the United Kingdom by beginning operations at its new facility in Basingstoke for satellite assembly, integration, and testing (AIT), as well as sales, technical support, and R&D activities.August 2020: SNC introduced two new satellite platforms to its spacecraft offerings, the SN-200M satellite bus, designed for medium Earth orbit (MEO), and SN-1000.July 2020: SNC was awarded a contract by the Defense Innovation Unit (DIU) for repurposing its Shooting Star transport vehicle to an Unmanned Orbital Outpost, a scalable and autonomous space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Satellite Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Satellite Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Satellite Bus Market?

To stay informed about further developments, trends, and reports in the North America Satellite Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence