Key Insights

The North American feed testing market, projected to reach $539.05 million by 2025, is poised for substantial expansion. This growth is primarily attributed to escalating consumer demand for safe, high-quality animal products and increasingly stringent government regulations on food safety. The rising incidence of foodborne illnesses further amplifies market impetus. Pathogen testing, specifically for Salmonella and E. coli, is in high demand across all feed categories, including ruminant, poultry, swine, aquaculture, and pet food. The burgeoning aquaculture sector and the adoption of advanced analytical methods like PCR and ELISA, which enhance speed and accuracy, are also significant growth drivers. Nutritional labeling analysis represents another key segment, as manufacturers prioritize compliance with labeling regulations and consumer transparency.

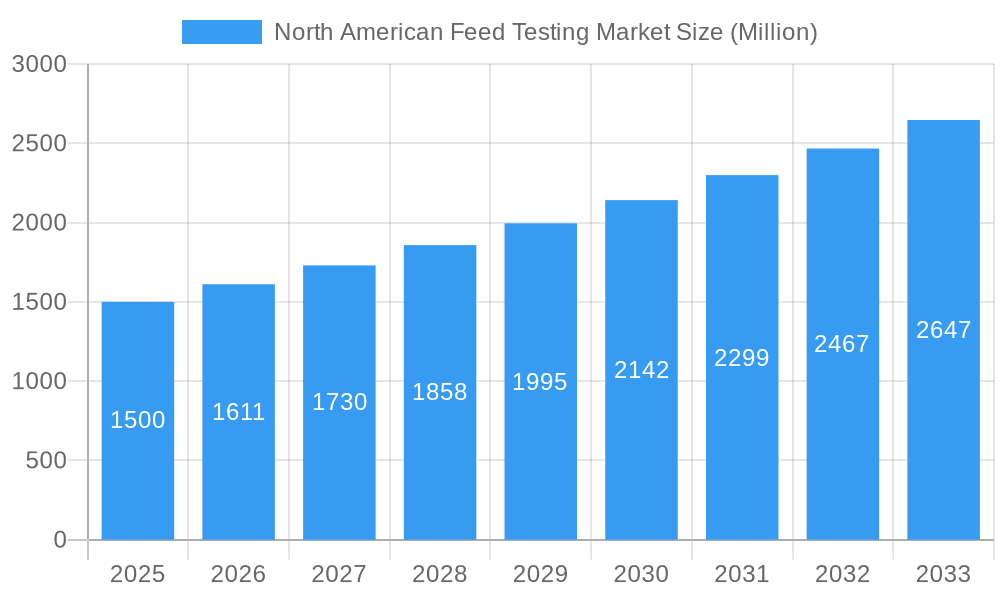

North American Feed Testing Market Market Size (In Million)

While challenges such as high testing costs and limited awareness among smaller producers exist, the market outlook remains robust. Continuous technological advancements are improving efficiency and reducing costs, thereby increasing accessibility for a broader spectrum of businesses. The market segmentation highlights considerable opportunities across diverse feed types. Poultry and swine feed testing currently hold the largest market share, owing to high production volumes and associated regulatory oversight. However, the aquaculture feed testing segment is anticipated to exhibit the highest growth rate, propelled by rapid industry expansion. Leading entities such as SGS SA, NSF International, and Eurofins Scientific are strategically investing in cutting-edge technologies and expanding their service offerings to capitalize on this burgeoning market. The growing prevalence of mycotoxins in feed, posing significant health risks to livestock and compromising feed quality, further stimulates the demand for specialized mycotoxin testing services. The competitive landscape indicates that established players leverage their extensive networks and expertise, while specialized niche providers focus on specific testing areas to secure market share. The North American market is expected to retain its leading position throughout the forecast period (2025-2033), driven by stringent regulatory frameworks and the thriving animal feed industry in the region. The compound annual growth rate (CAGR) is estimated at 7.7%.

North American Feed Testing Market Company Market Share

North American Feed Testing Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American feed testing market, offering valuable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The study meticulously segments the market by Type (Pathogen Testing, Pesticide Residue Analysis, Nutritional Labeling Analysis, Fats and Oils Analysis, Mycotoxin Testing, Other Types) and Feed Type (Ruminant Feed, Poultry Feed, Swine Feed, Aquaculture Feed, Pet Food), providing granular analysis for informed decision-making. Key players such as SGS SA, NSF International, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, and Invisible Sentinel Inc. are profiled, highlighting their market share and strategic initiatives. The total market size is projected to reach xx Million by 2033.

North American Feed Testing Market Market Structure & Innovation Trends

The North American feed testing market exhibits a moderately consolidated structure, with key players holding significant market share. SGS SA, Eurofins Scientific, and Intertek Group PLC collectively account for an estimated xx% of the market in 2025. Innovation is driven by increasing demand for accurate and rapid testing methods, stringent regulatory requirements, and the growing focus on food safety and animal health. The market witnesses continuous technological advancements, including the adoption of advanced analytical techniques like PCR, ELISA, and LC-MS/MS.

- Market Concentration: High, with top 5 players holding xx% market share in 2025.

- Innovation Drivers: Stringent regulations, demand for rapid testing, advancements in analytical techniques.

- Regulatory Framework: Stringent regulations from agencies like the FDA and USDA influence testing protocols and market dynamics.

- Product Substitutes: Limited substitutes exist due to the specialized nature of feed testing.

- M&A Activity: Significant M&A activity observed in the historical period (2019-2024), with total deal values exceeding xx Million. Consolidation is expected to continue.

North American Feed Testing Market Market Dynamics & Trends

The North American feed testing market is experiencing robust growth, driven by several factors. The rising demand for safe and high-quality animal feed, increasing consumer awareness of food safety, and stringent government regulations are key growth catalysts. Technological advancements, such as the development of faster and more accurate testing methods, are further fueling market expansion. The market exhibits a strong CAGR of xx% during the forecast period (2025-2033), with a market penetration rate of xx% in 2025, expected to increase to xx% by 2033. Competitive dynamics are characterized by intense competition among established players and emerging companies offering innovative solutions.

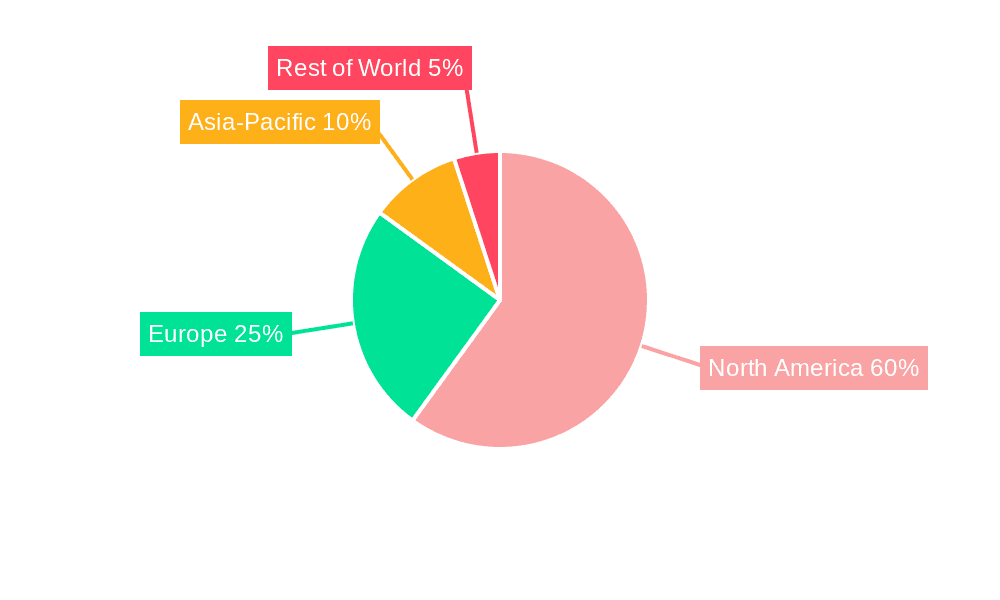

Dominant Regions & Segments in North American Feed Testing Market

The United States holds the largest market share within North America, driven by a robust livestock industry and stringent regulatory frameworks. Within the segment breakdown:

- Type: Pathogen testing constitutes the largest segment, followed by Pesticide Residue Analysis and Mycotoxin Testing. The high incidence of pathogens and the growing concern over pesticide residues are driving this segment's growth.

- Feed Type: Ruminant feed and poultry feed segments dominate the market due to the large-scale production of these feed types. However, the aquaculture feed segment is witnessing significant growth owing to rising aquaculture production.

Key Drivers (United States):

- Strong livestock industry.

- Stringent food safety regulations.

- Advanced infrastructure for testing facilities.

- High consumer awareness of food safety.

North American Feed Testing Market Product Innovations

Recent product innovations focus on developing rapid, sensitive, and cost-effective testing methods. Advancements in technologies like PCR and ELISA allow for quicker and more accurate detection of pathogens and contaminants. Miniaturization of testing equipment and development of portable testing kits enhance accessibility and efficiency. These innovations are improving the speed and accuracy of testing, leading to better food safety and reducing operational costs for feed manufacturers.

Report Scope & Segmentation Analysis

This report comprehensively segments the North American feed testing market by Type and Feed Type. Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. For instance, the Pathogen Testing segment is expected to experience robust growth due to increasing concerns regarding foodborne illnesses. Similarly, the Ruminant Feed segment is expected to dominate due to the significant size of the ruminant livestock industry. Each segment is meticulously analyzed to provide a granular understanding of the market.

Key Drivers of North American Feed Testing Market Growth

Several factors contribute to the market's growth:

- Stringent Regulations: Government regulations mandating feed testing are a major driver.

- Food Safety Concerns: Growing consumer concerns about food safety drive demand for testing.

- Technological Advancements: Rapid advancements in analytical technologies provide better testing capabilities.

- Increased Livestock Production: Higher livestock production necessitates increased feed testing.

Challenges in the North American Feed Testing Market Sector

The market faces challenges such as:

- High Testing Costs: The cost of advanced testing methods can be prohibitive for some feed producers.

- Regulatory Complexity: Navigating complex regulations adds to operational challenges.

- Competition: Intense competition among testing providers puts pressure on pricing.

Emerging Opportunities in North American Feed Testing Market

Emerging opportunities include:

- Development of Rapid Diagnostic Tests: Demand for faster testing methods is creating new opportunities.

- Expansion into Emerging Markets: Growth in aquaculture and pet food sectors provides new market access.

- Integration of IoT: IoT-enabled testing solutions offer potential for automation and data analysis.

Leading Players in the North American Feed Testing Market Market

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- Genon Laboratories Ltd

- Eurofins Scientific

- Invisible Sentinel Inc

Key Developments in North American Feed Testing Market Industry

- January 2023: Eurofins Scientific launched a new rapid mycotoxin testing kit.

- March 2022: SGS SA acquired a smaller feed testing laboratory, expanding its geographic reach.

- June 2021: NSF International introduced a new accreditation program for feed testing laboratories.

Future Outlook for North American Feed Testing Market Market

The North American feed testing market is poised for continued growth, driven by increasing demand for high-quality animal feed, stringent regulations, and technological advancements. The market is expected to witness further consolidation through mergers and acquisitions, and new players may enter the market with innovative testing solutions. The focus on rapid, accurate, and cost-effective testing methods will remain a key trend, creating opportunities for companies that can deliver these solutions.

North American Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North American Feed Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Feed Testing Market Regional Market Share

Geographic Coverage of North American Feed Testing Market

North American Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increasing Government Regulations Driving Growth of Pet Food Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bruker Biosciences Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetic ID NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genon Laboratories Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: North American Feed Testing Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North American Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North American Feed Testing Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North American Feed Testing Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Feed Testing Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the North American Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the North American Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 539.05 million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increasing Government Regulations Driving Growth of Pet Food Testing Market.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Feed Testing Market?

To stay informed about further developments, trends, and reports in the North American Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence