Key Insights

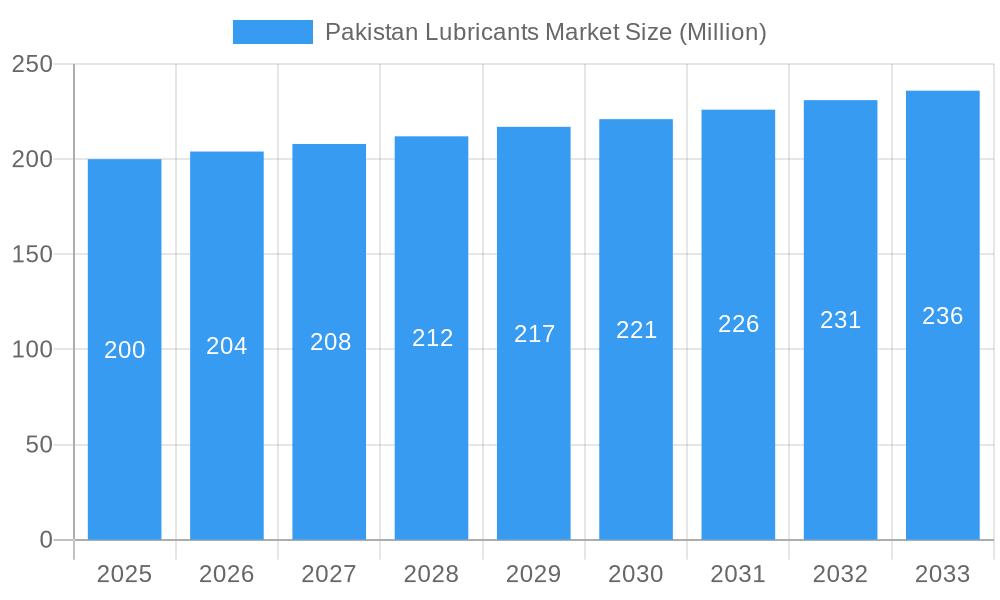

The Pakistan lubricants market, estimated at 2.28 billion in the base year 2024, is projected for robust growth with a Compound Annual Growth Rate (CAGR) of 3.2%. This expansion is propelled by a burgeoning automotive sector, notably motorcycles and light commercial vehicles, driving substantial lubricant demand. Increased industrialization and infrastructure development further augment market growth, necessitating significant quantities of industrial lubricants for machinery. Growing consumer awareness regarding engine maintenance and the advantages of high-quality lubricants also positively influence purchasing behavior. However, the market encounters hurdles such as volatile crude oil prices, impacting production costs and profitability, and economic instability, which can affect consumer spending and industrial investments. The competitive landscape is intense, featuring global leaders like Chevron, ExxonMobil, and Shell, alongside domestic entities such as Pakistan State Oil and Hascol Petroleum, fostering a price-sensitive environment. Market segmentation is anticipated across lubricant types (automotive, industrial) and product quality, with premium-grade lubricants commanding higher margins despite price sensitivity. The forecast period predicts sustained, moderate market expansion, primarily fueled by ongoing infrastructure projects and the resilient transportation sector. Further granular segmentation analysis will illuminate nuanced growth patterns within specific lubricant categories.

Pakistan Lubricants Market Market Size (In Billion)

The competitive arena comprises a blend of multinational corporations and local enterprises. International players leverage their renowned brands and advanced technologies, while domestic companies prioritize cost-efficiency and localized market needs. The market is expected to witness an increasing emphasis on environmentally friendly lubricants, aligning with global sustainability imperatives. This trend will likely spur innovation and product diversification, potentially leading to premium pricing for eco-conscious offerings. Government-led economic reforms and infrastructure investments in Pakistan will also shape market dynamics, presenting both opportunities and challenges for stakeholders. Regional variations in demand and supply are expected to further define market segmentation within Pakistan. Detailed regional data analysis is crucial for a more precise market outlook.

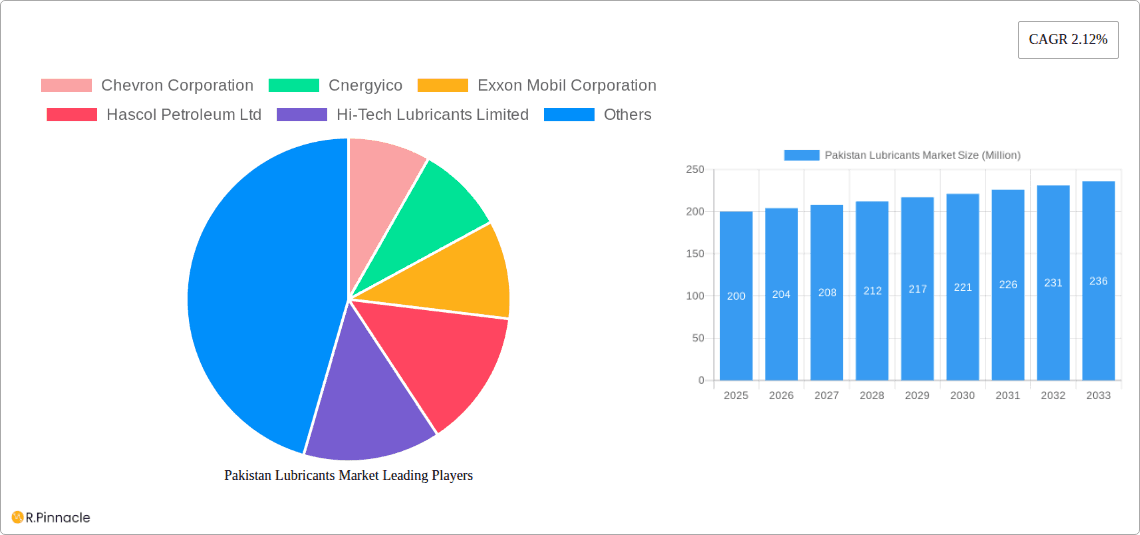

Pakistan Lubricants Market Company Market Share

This comprehensive report offers in-depth analysis of the Pakistan lubricants market, providing critical insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a detailed focus on 2024, this report elucidates market structure, dynamics, growth drivers, challenges, and future prospects. Key segments, leading players, and recent industry developments are examined to deliver actionable data for informed decision-making. The report utilizes extensive market research and data analysis to present a clear and concise overview of this dynamic sector.

Pakistan Lubricants Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Pakistan lubricants market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities.

The market exhibits a moderately concentrated structure, with several major players holding significant market share. While exact figures are proprietary to the full report, preliminary estimates suggest that the top five players collectively account for approximately xx% of the market. Innovation is driven by the increasing demand for high-performance lubricants, stringent emission regulations, and a growing focus on energy efficiency. The regulatory framework, while evolving, presents both opportunities and challenges. The presence of substitute products, such as biolubricants, is gradually increasing, but conventional lubricants continue to dominate.

- Market Share: Top 5 players hold approximately xx% (estimate).

- M&A Activity: Analysis includes xx Million (estimated) in M&A deal values over the historical period. Deals focused on expanding distribution networks and product portfolios.

- Innovation Drivers: Stringent emission norms, rising demand for energy-efficient lubricants, and technological advancements.

- Regulatory Landscape: A detailed analysis of relevant regulations and their impact on market dynamics.

Pakistan Lubricants Market Dynamics & Trends

This section explores the key dynamics and trends shaping the Pakistan lubricants market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including increasing vehicle ownership, industrialization, and rising construction activity. Technological advancements, such as the development of biolubricants and synthetic lubricants, are also playing a significant role. Consumer preferences are shifting towards higher-quality, longer-lasting lubricants. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants. Market penetration of premium lubricants is also gradually increasing.

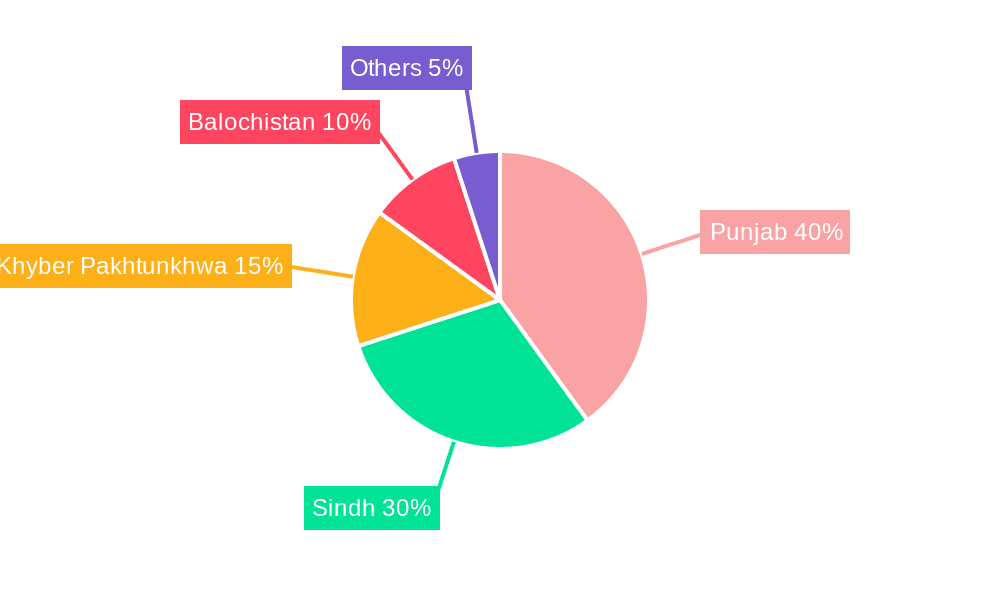

Dominant Regions & Segments in Pakistan Lubricants Market

This section identifies the leading regions and segments within the Pakistan lubricants market. Analysis reveals that the xx region holds the largest market share, driven by factors such as:

- Strong Economic Growth: High GDP growth contributes to increased demand.

- Robust Infrastructure Development: Expansion of road networks and industrial projects boosts lubricant consumption.

- Favorable Government Policies: Supportive regulatory environment fosters market expansion.

The dominance is further solidified by the high concentration of industrial and automotive activities in this region. Detailed market analysis within the full report will highlight the nuances of other regional performances.

Pakistan Lubricants Market Product Innovations

Recent product innovations focus on enhancing performance, extending lubricant life, and improving environmental compatibility. The market is witnessing a rise in the adoption of synthetic lubricants due to their superior performance characteristics. This trend is further fueled by increasing awareness of environmental concerns and the growing demand for energy-efficient products. Key players are also investing heavily in research and development to develop advanced lubricant formulations.

Report Scope & Segmentation Analysis

This report segments the Pakistan lubricants market based on product type (e.g., automotive, industrial, marine), application (e.g., passenger cars, commercial vehicles, machinery), and region. Each segment’s growth projection, market size, and competitive dynamics are analyzed in detail within the complete report. Specific values will be available in the full report.

Key Drivers of Pakistan Lubricants Market Growth

Several factors drive the growth of the Pakistan lubricants market, including:

- Economic Expansion: Pakistan's growing economy fuels demand across various sectors.

- Rising Vehicle Ownership: Increased vehicle sales drive demand for automotive lubricants.

- Industrialization: Expansion of industrial activities necessitates higher lubricant consumption.

Challenges in the Pakistan Lubricants Market Sector

Despite the growth potential, the Pakistan lubricants market faces several challenges, including:

- Supply Chain Disruptions: Logistical issues can impact the availability of raw materials and finished products.

- Price Volatility: Fluctuations in crude oil prices affect lubricant pricing and profitability.

- Counterfeit Products: The presence of counterfeit lubricants poses a significant threat.

Emerging Opportunities in Pakistan Lubricants Market

The Pakistan lubricants market presents several emerging opportunities, such as:

- Growing Demand for High-Performance Lubricants: Increased focus on efficiency and performance.

- Expansion into New Market Segments: Untapped potential in specialized lubricant applications.

- Technological Advancements: Opportunities in developing and adopting advanced lubricant technologies.

Leading Players in the Pakistan Lubricants Market Market

- Chevron Corporation

- Cnergyico

- Exxon Mobil Corporation

- Hascol Petroleum Ltd

- Hi-Tech Lubricants Limited

- Karachi Lubricants (pvt) Ltd

- Pak HY-Oils

- Pakistan Lubricants (Pvt ) Ltd

- Pakistan State Oil

- Petroliam Nasional Berhad (PETRONAS)

- Shell

- TotalEnergies

- List Not Exhaustive

Key Developments in Pakistan Lubricants Market Industry

- July 2022: Shell Pakistan appointed Burque Corporation, expanding lubricant distribution to 6,000 village outlets and 40,000 additional outlets nationwide.

- March 2022: Chevron Pakistan Lubricants collaborated with MG JW Automobile Pakistan, supplying Delo and Havoline branded synthetic lubricants for various applications.

Future Outlook for Pakistan Lubricants Market Market

The Pakistan lubricants market is poised for continued growth, driven by sustained economic expansion, infrastructure development, and rising vehicle ownership. Strategic investments in research and development, coupled with the adoption of advanced lubricant technologies, will further shape the market's trajectory. Opportunities exist for companies to capitalize on the increasing demand for high-performance and eco-friendly lubricants.

Pakistan Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Hydraulic Fluid

- 1.3. General Industrial Oil

- 1.4. Gear Oils

- 1.5. Grease

- 1.6. Other Product Types (Process Oil and Turbine Oil)

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Transportation

- 2.3. Heavy Equipment

- 2.4. Food and Beverage

- 2.5. Other En

Pakistan Lubricants Market Segmentation By Geography

- 1. Pakistan

Pakistan Lubricants Market Regional Market Share

Geographic Coverage of Pakistan Lubricants Market

Pakistan Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country

- 3.3. Market Restrains

- 3.3.1. Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country

- 3.4. Market Trends

- 3.4.1. Engine Oil to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. General Industrial Oil

- 5.1.4. Gear Oils

- 5.1.5. Grease

- 5.1.6. Other Product Types (Process Oil and Turbine Oil)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Food and Beverage

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chevron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cnergyico

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hascol Petroleum Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hi-Tech Lubricants Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karachi Lubricants (pvt) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pak HY-Oils

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pakistan Lubricants (Pvt ) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pakistan State Oil

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Petroliam Nasional Berhad (PETRONAS)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shell

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 TotalEnergies*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Chevron Corporation

List of Figures

- Figure 1: Pakistan Lubricants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Pakistan Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: Pakistan Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Pakistan Lubricants Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Pakistan Lubricants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Pakistan Lubricants Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Pakistan Lubricants Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Pakistan Lubricants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Lubricants Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Pakistan Lubricants Market?

Key companies in the market include Chevron Corporation, Cnergyico, Exxon Mobil Corporation, Hascol Petroleum Ltd, Hi-Tech Lubricants Limited, Karachi Lubricants (pvt) Ltd, Pak HY-Oils, Pakistan Lubricants (Pvt ) Ltd, Pakistan State Oil, Petroliam Nasional Berhad (PETRONAS), Shell, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Pakistan Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country.

6. What are the notable trends driving market growth?

Engine Oil to Dominate the Market.

7. Are there any restraints impacting market growth?

Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country.

8. Can you provide examples of recent developments in the market?

July 2022: Shell Pakistan appointed Burque Corporation, which has planned to expand the distribution of its lubricants in Quetta. With the collaboration, Shell Pakistan covered 6,000 outlets in villages and 40,000 additional outlets across Pakistan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Lubricants Market?

To stay informed about further developments, trends, and reports in the Pakistan Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence