Key Insights

The Polish ceramic tile market is projected to reach 8.25 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.31% from 2025 to 2033. This growth is primarily driven by a robust construction sector, increasing consumer demand for enhanced aesthetics and durability in renovations, and rising disposable incomes. Product innovation, including specialized options like porcelain and scratch-free tiles, further fuels market expansion. Segments such as porcelain tiles and residential replacement projects are anticipated to experience significant growth.

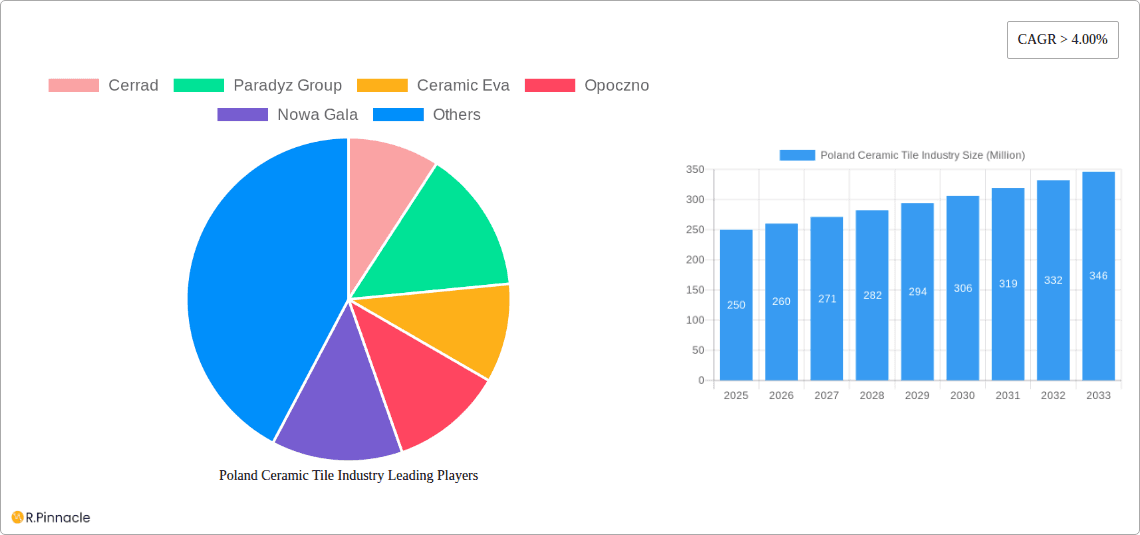

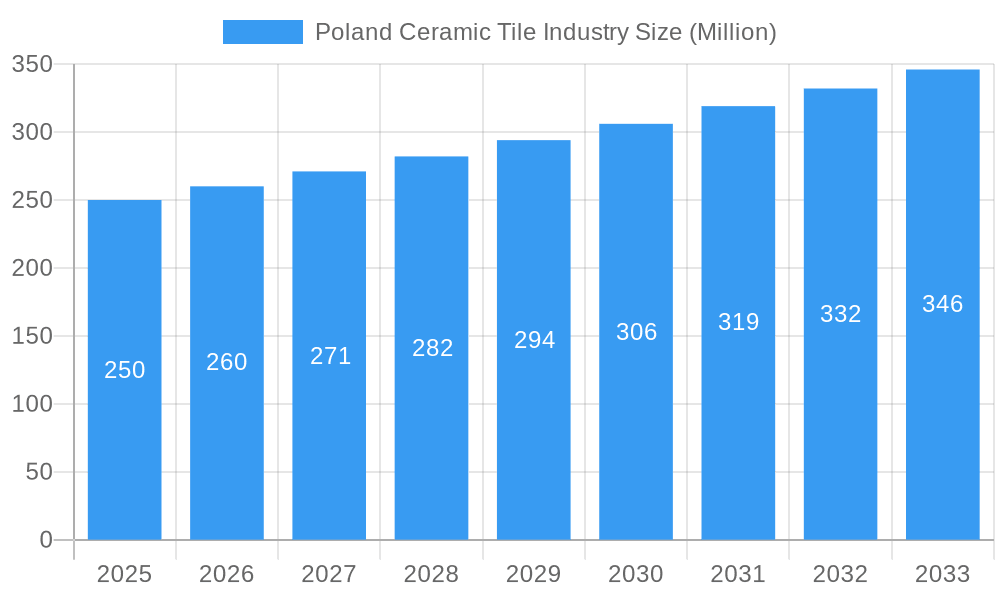

Poland Ceramic Tile Industry Market Size (In Billion)

Challenges include fluctuating raw material and energy costs, import competition, and macroeconomic influences on the construction industry. Despite these factors, the market's inherent strengths, supported by ongoing construction, consumer demand for upgrades, and product diversification, ensure sustained growth. Leading manufacturers such as Cerrad, Paradyz Group, and Cersanit are well-positioned to leverage this expansion.

Poland Ceramic Tile Industry Company Market Share

Poland Ceramic Tile Industry: Market Size, Growth, and Forecast (2019-2033)

This comprehensive report analyzes the Poland ceramic tile industry from 2019 to 2033, focusing on the 2025 market size and projections through 2033. It delivers critical insights into key trends, challenges, and opportunities, essential for industry professionals, investors, and strategic planners. Profiles of key players, including Cerrad, Paradyz Group, Ceramic Eva, Opoczno, Nowa Gala, Dagma, Ceramika Konskie Sp Zoo, Villeroy & Boch Polska, Fea Ceramics, and Cersanit, provide a detailed competitive landscape analysis.

Poland Ceramic Tile Industry Market Structure & Innovation Trends

The Polish ceramic tile market exhibits a moderately concentrated structure, with a few large players holding significant market share. Cerrad and Paradyz Group are among the leading companies, commanding a combined xx% of the market in 2024 (estimated). Smaller players account for the remaining share, creating a competitive environment. Innovation is driven by technological advancements in manufacturing processes (like Ceramika Paradyż's PLN 125 Million investment in innovative pressing technology), the development of new product types (scratch-free tiles, large format tiles), and evolving consumer preferences toward aesthetics and functionality. Regulatory frameworks concerning building codes and environmental standards influence manufacturing processes and product design. Product substitutes, such as other flooring materials (vinyl, wood), exert competitive pressure. The residential segment (especially replacement and renovation) remains the largest end-user sector. Recent M&A activities have been relatively limited, with a few notable deals having a combined value of approximately xx Million (2019-2024).

- Key Market Players: Cerrad, Paradyz Group, Ceramic Eva, Opoczno, Nowa Gala, Dagma, Ceramika Konskie Sp Zoo, Villeroy & Boch Polska, Fea Ceramics, Cersanit (List Not Exhaustive).

- Market Concentration: Moderately concentrated, with top players holding xx% market share (estimated 2024).

- Innovation Drivers: Technological advancements, new product types, consumer preferences.

- M&A Activity: Limited in recent years, with a combined estimated value of xx Million (2019-2024).

Poland Ceramic Tile Industry Market Dynamics & Trends

The Polish ceramic tile market is experiencing steady growth, driven primarily by increased construction activity, particularly in residential and commercial sectors. The rising disposable incomes and growing urbanization are fueling demand. Technological advancements, including the development of more durable and aesthetically pleasing tiles, are further stimulating market expansion. Consumer preferences are shifting toward larger format tiles and innovative designs. The competitive landscape is characterized by intense competition among domestic and international players. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration in various segments is also expected to increase with the growth in the construction sector. The introduction of sustainable and eco-friendly tiles is another key trend that is slowly gaining traction.

Dominant Regions & Segments in Poland Ceramic Tile Industry

While data on regional dominance is limited, it is predicted that the largest metropolitan areas in Poland will drive the greatest demand for ceramic tiles due to high population densities and ongoing construction projects. The residential replacement segment is significantly dominant due to the age of existing buildings and increasing home renovation activities.

- By Product Type: Porcelain tiles are gaining popularity over glazed tiles due to their superior durability and aesthetic appeal. The scratch-free segment represents a niche but rapidly growing market with high added value.

- By Application: Floor tiles represent the largest segment, followed by wall tiles.

- By Construction Type: Replacement and renovation projects comprise a larger market share compared to new constructions, driven by a growing preference for home improvements.

- By End-User Type: The residential market (both new construction and replacement) dominates, with commercial applications showing moderate growth.

Key Drivers:

- Strong domestic construction industry, especially in urban centers.

- Rising disposable incomes and improved living standards.

- Increasing preference for home improvements and renovations.

Poland Ceramic Tile Industry Product Innovations

Recent innovations include larger format tiles, improved durability (scratch-resistant, water-resistant), and aesthetically advanced designs. The focus on eco-friendly materials and production methods is becoming increasingly important. These innovations improve product appeal and offer competitive advantages by catering to evolving consumer needs. Technological advancements in pressing, dyeing, and surface treatments are key aspects of continuous product improvement in the Polish ceramic tile industry.

Report Scope & Segmentation Analysis

This report segments the Polish ceramic tile market by product type (glazed, porcelain, scratch-free), application (floor tiles, wall tiles), construction type (new construction, replacement & renovation), and end-user type (residential, commercial). Each segment’s size, growth projection (2025-2033), and competitive dynamics are analyzed. The market size will reach an estimated xx Million by 2025, exhibiting steady growth over the forecast period.

Key Drivers of Poland Ceramic Tile Industry Growth

Growth in the Polish ceramic tile industry is fueled by several factors: a robust construction industry, increasing disposable incomes, rising urbanization, technological advancements leading to enhanced product quality, and consumer preferences towards aesthetically pleasing and durable tiling solutions. Government initiatives promoting sustainable construction practices are further stimulating demand for eco-friendly tiles.

Challenges in the Poland Ceramic Tile Industry Sector

Challenges include intense competition, fluctuations in raw material costs (primarily clay and gas), potential supply chain disruptions, and environmental regulations related to manufacturing and waste disposal. These factors can impact production costs and profitability.

Emerging Opportunities in Poland Ceramic Tile Industry

Opportunities lie in the growing demand for sustainable and eco-friendly tiles, the increasing popularity of large-format tiles, and the expansion of e-commerce channels for tile sales. Exploring new product designs and applications, particularly within the commercial and industrial sectors, can provide further growth avenues.

Leading Players in the Poland Ceramic Tile Industry Market

- Cerrad

- Paradyz Group

- Ceramic Eva

- Opoczno

- Nowa Gala

- Dagma

- Ceramika Konskie Sp Zoo

- Villeroy & Boch Polska

- Fea Ceramics

- Cersanit

Key Developments in Poland Ceramic Tile Industry

- December 22, 2020: Ceramika Paradyż invests PLN 125 Million in globally innovative technology for large-format tile production.

- April 8, 2021: Ceramika Paradyż opens Ceramika Paradyz Deutschland GmbH to expand into Germany, Austria, Switzerland, and France.

- September 28, 2021: Collaboration between Cerrad and La Mania Home.

Future Outlook for Poland Ceramic Tile Industry Market

The Polish ceramic tile industry is poised for continued growth, driven by robust construction activity and increasing consumer demand for high-quality tiling solutions. Strategic investments in innovation and sustainable practices will be crucial for maintaining competitiveness. The market is expected to grow steadily throughout the forecast period, driven by both residential and commercial projects, thus creating attractive opportunities for industry stakeholders.

Poland Ceramic Tile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Poland Ceramic Tile Industry Segmentation By Geography

- 1. Poland

Poland Ceramic Tile Industry Regional Market Share

Geographic Coverage of Poland Ceramic Tile Industry

Poland Ceramic Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Level of Income and Living Standard; Rise in Demand for Vaccum cleaners in Household and Commercial space

- 3.3. Market Restrains

- 3.3.1. Rise in price of Consumer Electronics globally Post Covid; Supply Chain disruptions and Increasing Raw material prices affect the production side.

- 3.4. Market Trends

- 3.4.1. Poland Ceramic Tiles Exports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Ceramic Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cerrad

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Paradyz Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceramic Eva

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Opoczno

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nowa Gala

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dagma

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ceramika Konskie Sp Zoo

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Villeroy & Boch Polska

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fea Ceramics**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cersanit

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cerrad

List of Figures

- Figure 1: Poland Ceramic Tile Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Ceramic Tile Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Ceramic Tile Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Poland Ceramic Tile Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Poland Ceramic Tile Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Poland Ceramic Tile Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Poland Ceramic Tile Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Poland Ceramic Tile Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Poland Ceramic Tile Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Poland Ceramic Tile Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Poland Ceramic Tile Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Poland Ceramic Tile Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Poland Ceramic Tile Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Poland Ceramic Tile Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Ceramic Tile Industry?

The projected CAGR is approximately 5.31%.

2. Which companies are prominent players in the Poland Ceramic Tile Industry?

Key companies in the market include Cerrad, Paradyz Group, Ceramic Eva, Opoczno, Nowa Gala, Dagma, Ceramika Konskie Sp Zoo, Villeroy & Boch Polska, Fea Ceramics**List Not Exhaustive, Cersanit.

3. What are the main segments of the Poland Ceramic Tile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.25 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Level of Income and Living Standard; Rise in Demand for Vaccum cleaners in Household and Commercial space.

6. What are the notable trends driving market growth?

Poland Ceramic Tiles Exports.

7. Are there any restraints impacting market growth?

Rise in price of Consumer Electronics globally Post Covid; Supply Chain disruptions and Increasing Raw material prices affect the production side..

8. Can you provide examples of recent developments in the market?

April 8, 2021: Ceramika Paradyż, one of the enterprises producing ceramic tiles, opened a new company in Germany - Ceramika Paradyz Deutschland GmbH. It aims to sell dedicated products and provide comprehensive services in Germany, Austria, Switzerland, and France. On September 28, 2021, there was a collaboration between Cerrad and La Mania Home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Ceramic Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Ceramic Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Ceramic Tile Industry?

To stay informed about further developments, trends, and reports in the Poland Ceramic Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence