Key Insights

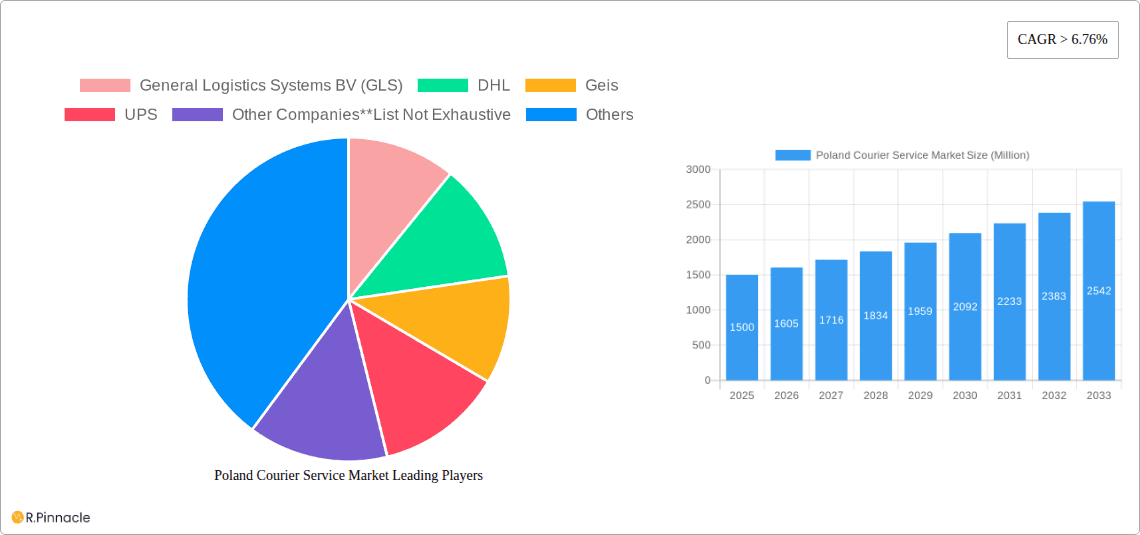

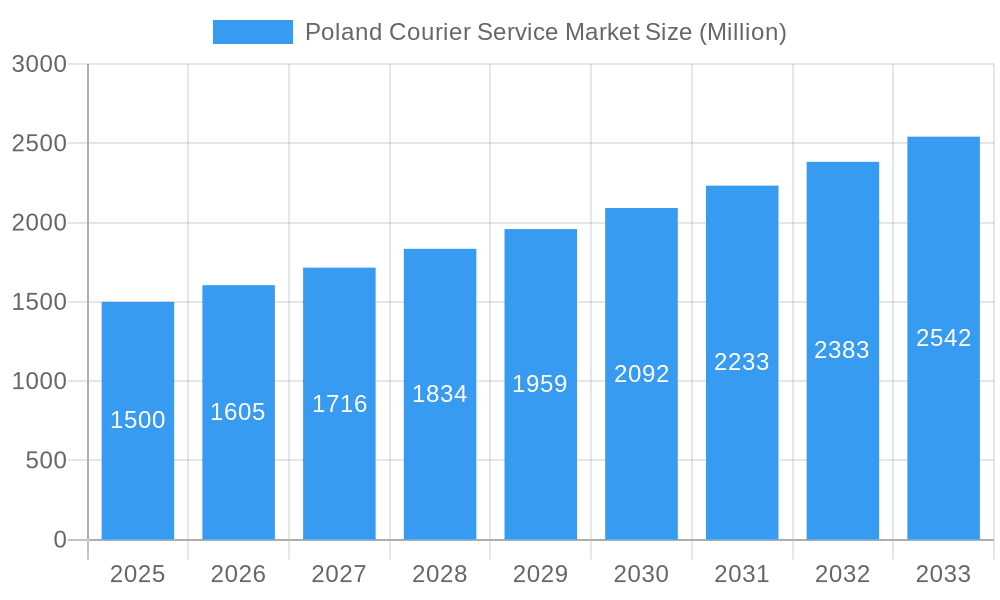

The Poland courier service market is poised for significant expansion, driven by a compelling CAGR of 5.8%. This growth is primarily attributed to the escalating e-commerce sector, heightened demand for expedited and dependable delivery solutions, and expanding cross-border trade. Key growth drivers include Business-to-Consumer (B2C) deliveries, propelled by the surge in online retail, and services catering to the BFSI sector, which necessitates secure and efficient courier operations. While domestic deliveries currently lead, international shipments are projected to gain substantial momentum due to increasing globalization and augmented trade partnerships. Major industry players such as GLS, DHL, FedEx, UPS, and DPD Group leverage their extensive networks and technological innovations to maintain market leadership. Concurrently, specialized courier firms are emerging to address niche markets and offer competitive pricing. The market may encounter short-term growth moderation due to escalating fuel costs and regulatory stringency. Nevertheless, the long-term forecast remains optimistic, with the market size projected to reach 453.56 billion by the base year 2024.

Poland Courier Service Market Market Size (In Billion)

The competitive arena features a mix of international conglomerates and domestic Polish enterprises. A notable trend is the consolidation of smaller courier firms, aiming for enhanced operational efficiency and broader service portfolios. Technological advancements, including sophisticated tracking systems, automated sorting, and AI integration, are revolutionizing operations, optimizing delivery times, and boosting overall efficiency. Growing emphasis on sustainability within logistics is also influencing the market, with companies adopting environmentally conscious practices. Future expansion will be contingent upon infrastructure development, supportive government policies for e-commerce and logistics, and the sustained integration of innovative technologies. The continued proliferation of e-commerce in Poland and the escalating demand for rapid delivery services across diverse industries will sustain the market's robust growth trajectory.

Poland Courier Service Market Company Market Share

Poland Courier Service Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland courier service market, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, segmentation, key players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Poland Courier Service Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Poland courier service market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of international giants and domestic players, leading to varying levels of market share.

- Market Concentration: The market exhibits moderate concentration, with key players like DHL, FedEx, and UPS holding significant shares, while local players like InPost and Polish Post (Poczta Polska) maintain a substantial presence. The exact market share for each player is detailed in the full report.

- Innovation Drivers: Technological advancements, such as automated sorting systems and delivery drones, are driving innovation. The increasing adoption of e-commerce is also a major factor.

- Regulatory Framework: The Polish government's regulations concerning logistics and transportation significantly influence market operations. The full report details the current regulatory landscape and potential future changes.

- Product Substitutes: Alternative delivery methods, including same-day delivery services and crowd-sourced delivery platforms, are emerging as substitutes.

- End-User Demographics: The report analyzes end-user demographics across various sectors, including B2B and B2C segments.

- M&A Activities: Significant M&A activities have shaped the market landscape. For example, the value of M&A deals in the past five years is estimated at xx Million. Specific deal details, including participating companies and deal values, are included in the full report.

Poland Courier Service Market Market Dynamics & Trends

This section delves into the key market dynamics and trends influencing the growth of the Poland courier service market. Factors driving market expansion include the burgeoning e-commerce sector, the rise of omnichannel retailing, and increasing demand for faster and more reliable delivery services. Technological advancements like AI-powered route optimization and autonomous delivery systems are disrupting traditional operations. Consumer preferences are shifting towards greater convenience and transparency in the delivery process. Competitive dynamics are shaped by pricing strategies, service offerings, and technological capabilities. The market is expected to witness substantial growth, with a significant market penetration rate projected in the coming years.

Dominant Regions & Segments in Poland Courier Service Market

This section identifies the dominant regions and segments within the Poland courier service market. The report provides a detailed analysis of each segment, outlining key drivers for growth and competitive dynamics.

- By Business: Both B2B and B2C segments contribute significantly to market growth, with B2C experiencing faster expansion driven by the booming e-commerce sector.

- By Destination: The domestic segment dominates the market due to the high volume of intra-country shipments, although international shipping is experiencing robust growth, boosted by increased cross-border e-commerce.

- By End User: Wholesale and retail trade (particularly e-commerce) is currently the leading end-user segment, followed by the services sector (BFSI). Growth in other segments, such as manufacturing and construction, is also anticipated.

Major cities in Poland, particularly Warsaw, are expected to experience higher growth rates due to increased economic activity and higher population density. Factors driving this growth include robust infrastructure, favorable government policies, and the concentration of key industries.

Poland Courier Service Market Product Innovations

The Poland courier service market is witnessing significant product innovations, driven by technological advancements and evolving customer demands. New services include same-day delivery, enhanced tracking capabilities, and specialized handling for fragile or temperature-sensitive goods. Companies are focusing on improving delivery efficiency and incorporating sustainable practices. These innovations are aimed at improving customer satisfaction and achieving a competitive advantage.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Poland courier service market across various parameters. The market is segmented by business type (B2B and B2C), destination (domestic and international), and end-user industries (services, wholesale and retail trade, manufacturing, construction, primary industries). Each segment’s growth projections, market size, and competitive landscape are meticulously analyzed, offering a granular understanding of the market's structure.

Key Drivers of Poland Courier Service Market Growth

The robust expansion of the Poland courier service market is significantly influenced by a confluence of dynamic factors. The meteoric rise of e-commerce continues to be a primary catalyst, driven by evolving consumer habits and an insatiable demand for swift, reliable, and increasingly convenient delivery solutions. Complementing this, strategic government investments aimed at modernizing and enhancing Poland's logistics infrastructure are playing a pivotal role in facilitating smoother and more efficient operations. Furthermore, the relentless march of technological innovation, particularly in areas such as AI-powered route optimization, predictive analytics for demand forecasting, and advanced automated sorting systems, is dramatically boosting operational efficiency, reducing delivery times, and ultimately leading to cost savings for both providers and consumers.

Challenges in the Poland Courier Service Market Sector

Notwithstanding its impressive growth trajectory, the Poland courier service market is not without its hurdles. Volatile fluctuations in global fuel prices represent a persistent challenge, directly impacting operational costs. The upward trend in labor costs, coupled with a competitive job market, also presents significant staffing considerations. The market is characterized by intense competition, necessitating continuous innovation and service differentiation to maintain market share. Ensuring optimal supply chain resilience and agility, especially during high-demand periods like holiday seasons, demands sophisticated planning and execution. Additionally, navigating the complex and ever-evolving landscape of regulatory requirements, including environmental standards and data protection laws, poses ongoing compliance challenges for all operators in the sector.

Emerging Opportunities in Poland Courier Service Market

The Poland courier service market presents several lucrative opportunities. The growth of e-commerce continues to present significant prospects, especially for specialized services like same-day delivery and refrigerated transport. The adoption of new technologies, such as drone delivery and autonomous vehicles, offers further opportunities for expansion and increased efficiency.

Leading Players in the Poland Courier Service Market Market

The Poland courier service market is a vibrant ecosystem populated by a diverse array of established international conglomerates and agile domestic enterprises. These key players are instrumental in shaping the market's competitive dynamics and service standards. Prominent among them are:

- General Logistics Systems BV (GLS)

- DHL

- Geis

- UPS

- FedEx

- Polish Post (Poczta Polska)

- DPD Group

- Inpost

- Other Companies (List Not Exhaustive)

Key Developments in Poland Courier Service Market Industry

- July 2022: Worldline's strategic partnership with Happy Pack marked a significant advancement in payment convenience, integrating SoftPos payment terminals directly into parcel pickup and delivery points, thereby streamlining transactions for customers.

- February 2022: The acquisition of Zenkraft by Bringg represented a substantial enhancement of its delivery and fulfillment platform capabilities, bolstering its service offerings and strengthening its competitive position within the market.

Future Outlook for Poland Courier Service Market Market

The future trajectory for the Poland courier service market is decidedly optimistic, underpinned by sustained growth drivers and emerging opportunities. The continued exponential growth of e-commerce, both domestically and cross-border, will undoubtedly remain a primary engine of expansion. Simultaneously, ongoing technological advancements, from AI-driven logistics to the expansion of autonomous delivery solutions, promise to further revolutionize efficiency and customer experience. Strategic collaborations, mergers, and acquisitions are expected to play a crucial role in consolidating the market and fostering innovation. Investments in green logistics and sustainable delivery practices are also anticipated to gain prominence, aligning with broader environmental concerns and regulatory trends. Consequently, the Poland courier service market is poised for significant, sustained growth, driven by a potent combination of evolving consumer demands, technological innovation, and strategic market development.

Poland Courier Service Market Segmentation

-

1. Business

- 1.1. B2B (Business-to-Business)

- 1.2. B2C (Business-to-Consumer)

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade (E-commerce)

- 3.3. Manufacturing, Construction, and Utilities

- 3.4. Primary

Poland Courier Service Market Segmentation By Geography

- 1. Poland

Poland Courier Service Market Regional Market Share

Geographic Coverage of Poland Courier Service Market

Poland Courier Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. Growing Express Delivery Segment is Driving the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Courier Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. B2B (Business-to-Business)

- 5.1.2. B2C (Business-to-Consumer)

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade (E-commerce)

- 5.3.3. Manufacturing, Construction, and Utilities

- 5.3.4. Primary

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 General Logistics Systems BV (GLS)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Geis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UPS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Other Companies**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Polish Post (Poczta Polska)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DPD Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Inpost

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 General Logistics Systems BV (GLS)

List of Figures

- Figure 1: Poland Courier Service Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Courier Service Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Courier Service Market Revenue billion Forecast, by Business 2020 & 2033

- Table 2: Poland Courier Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 3: Poland Courier Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Poland Courier Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Poland Courier Service Market Revenue billion Forecast, by Business 2020 & 2033

- Table 6: Poland Courier Service Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 7: Poland Courier Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Poland Courier Service Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Courier Service Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Poland Courier Service Market?

Key companies in the market include General Logistics Systems BV (GLS), DHL, Geis, UPS, Other Companies**List Not Exhaustive, FedEx, Polish Post (Poczta Polska), DPD Group, Inpost.

3. What are the main segments of the Poland Courier Service Market?

The market segments include Business, Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 453.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

Growing Express Delivery Segment is Driving the Market's Growth.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

July 2022: Worldline, the industry's top supplier of electronic payment solutions, partnered with Happy Pack, a company that develops and produces software for the autonomous delivery and pickup of courier packages. As part of the collaboration, Worldline will provide its cutting-edge SoftPos payment terminals to parcel pickup and delivery locations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Courier Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Courier Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Courier Service Market?

To stay informed about further developments, trends, and reports in the Poland Courier Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence