Key Insights

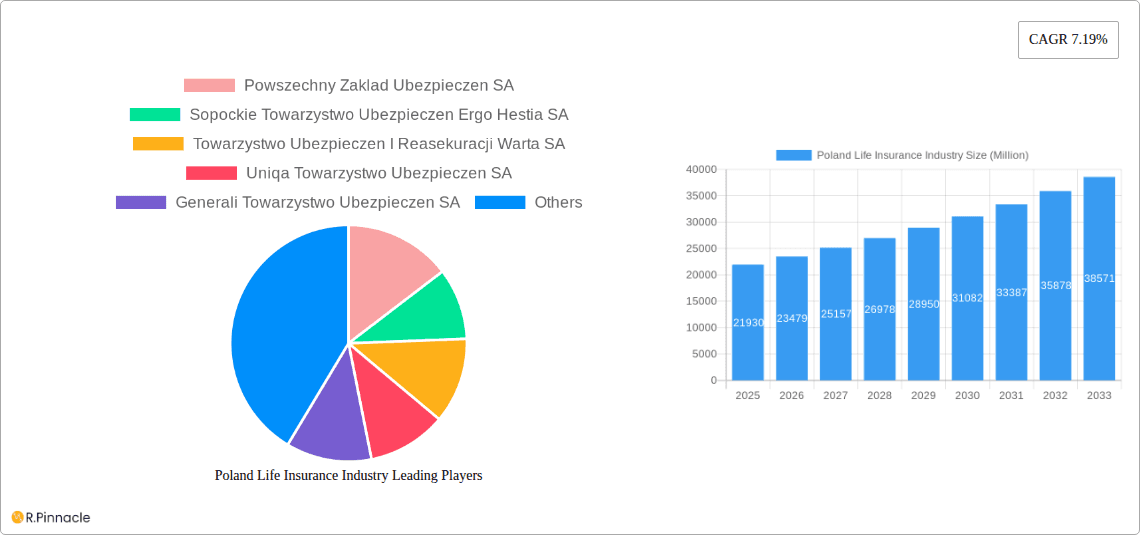

The Polish insurance market is poised for robust expansion, with the life insurance sector projected to reach a substantial 21.93 million by 2025. This growth is fueled by a 7.19% CAGR, indicating a dynamic and evolving landscape. Key drivers for this surge include increasing disposable incomes, a growing awareness of financial planning, and a rising demand for comprehensive protection against life's uncertainties. The market is segmented into Life Insurance, encompassing individual and group policies, and Non-life Insurance, covering home, motor, and other related products. Distribution channels are diverse, with direct sales, agency networks, banking partnerships, and other innovative approaches all playing crucial roles in reaching a broad customer base. Emerging trends such as the digitalization of insurance services, the development of tailored product offerings, and a greater focus on customer experience are shaping the future of the Polish insurance industry.

Poland Life Insurance Industry Market Size (In Billion)

Despite the optimistic outlook, certain restraints may influence the pace of growth. These could include evolving regulatory frameworks, economic volatility, and a degree of price sensitivity among consumers. However, the underlying strengths of the Polish economy, coupled with an expanding middle class and a proactive approach by insurers to adapt to changing consumer needs, are expected to outweigh these challenges. The competitive landscape features prominent players such as Powszechny Zaklad Ubezpieczen SA, Sopockie Towarzystwo Ubezpieczen Ergo Hestia SA, and Towarzystwo Ubezpieczen I Reasekuracji Warta SA, all vying for market share by offering innovative products and superior customer service. The overall trajectory points towards a sustained period of growth and innovation within the Polish insurance market.

Poland Life Insurance Industry Company Market Share

Poland Life Insurance Industry Market Structure & Innovation Trends

This comprehensive report delves into the intricate market structure of the Poland life insurance industry, meticulously analyzing its concentration levels, key innovation drivers, and the overarching regulatory frameworks shaping its trajectory. We explore the influence of product substitutes and evolving end-user demographics, alongside a detailed examination of Mergers & Acquisitions (M&A) activities. The market, while competitive, is characterized by strategic consolidation and a growing focus on innovative product development. Market share analyses reveal key players and their strategic positioning. M&A deal values provide insights into the financial landscape and consolidation trends.

- Market Concentration: The industry exhibits a moderate to high concentration, with a few dominant players holding significant market share.

- Innovation Drivers: Technological advancements, evolving consumer needs for tailored protection, and regulatory impetus are key drivers.

- Regulatory Frameworks: The Polish Financial Supervision Authority (KNF) plays a crucial role in overseeing insurer conduct and consumer protection.

- Product Substitutes: Savings products, investment funds, and government social security schemes act as indirect substitutes.

- End-User Demographics: An aging population, rising disposable incomes, and increased awareness of financial planning are influencing demand.

- M&A Activities: Strategic acquisitions and mergers are observed, aimed at expanding market reach, enhancing product portfolios, and achieving operational synergies.

Poland Life Insurance Industry Market Dynamics & Trends

The Poland life insurance industry is experiencing robust growth, driven by a confluence of economic recovery, increasing financial literacy, and a demand for comprehensive protection solutions. The market penetration is on an upward trajectory, fueled by rising disposable incomes and a growing awareness of the importance of life insurance for long-term financial security. Technological advancements are playing a pivotal role in reshaping market dynamics, enabling insurers to offer more personalized products and streamline distribution channels. Insurtech innovations are facilitating digital onboarding, automated claims processing, and the development of data-driven underwriting, leading to improved customer experiences and operational efficiencies.

Consumer preferences are evolving, with a marked shift towards flexible, customizable policies that cater to individual needs and life stages. Demand for unit-linked products, offering both protection and investment growth, is steadily increasing. The competitive landscape is intense, with established domestic and international players vying for market share. This competition, coupled with regulatory oversight, is pushing insurers to focus on customer-centric strategies, innovative product design, and enhanced service delivery. Strategic partnerships, particularly with banks and other financial institutions, are crucial for expanding reach and accessing new customer segments.

The industry's CAGR is indicative of its healthy expansion, reflecting increased consumer confidence and a proactive approach by insurers in meeting evolving demands. Factors such as a young workforce entering the insurance market and a growing middle class with higher disposable incomes are significant growth accelerators. Furthermore, the government's initiatives promoting financial inclusion and long-term savings are contributing to a more favorable environment for the life insurance sector. The market's resilience is evident in its ability to adapt to economic fluctuations and regulatory changes, demonstrating a strong foundation for sustained growth.

Dominant Regions & Segments in Poland Life Insurance Industry

The Poland life insurance industry's dominance is intrinsically linked to its segmentation across various product lines and distribution channels. The Individual Life Insurance segment stands out as a key driver of market growth. This dominance is underpinned by increasing consumer awareness regarding financial planning for personal protection, retirement, and legacy purposes. Economic policies encouraging individual savings and investment, coupled with a growing middle class with higher disposable incomes, directly fuel demand for individual life policies.

The Agency distribution channel continues to hold significant sway, largely due to the personalized advice and trust it offers, particularly for complex life insurance products. The human touch remains invaluable in explaining policy benefits, risk assessment, and addressing individual concerns, making agencies a preferred choice for many consumers seeking tailored solutions.

However, the landscape is dynamic. The Direct distribution channel, encompassing online sales and digital platforms, is rapidly gaining traction. This surge is attributed to advancements in technology, making it easier for consumers to research, compare, and purchase policies online. Convenience, speed, and potentially lower premiums make direct channels increasingly attractive, especially for younger demographics.

Within Non-life Insurance, while not the primary focus of this report, the broader insurance ecosystem influences life insurance uptake. Products like Home Insurance and Motor Insurance, while distinct, contribute to an overall insurance-conscious populace, potentially making them more receptive to life insurance products.

The country's economic stability and favorable demographic trends, including a growing workforce and an increasing life expectancy, create a fertile ground for life insurance penetration across all segments. Strategic initiatives by insurers to offer bundled products, combining life and non-life coverage, also play a role in segment dominance.

- Key Drivers for Individual Life Insurance Dominance:

- Rising disposable incomes and economic stability.

- Increased financial literacy and awareness of long-term financial planning needs.

- Aging population seeking retirement and legacy planning solutions.

- Government incentives for savings and investment.

- Key Drivers for Agency Distribution Dominance:

- Need for personalized advice and trust in complex financial products.

- Relationship building and client hand-holding.

- Effective for explaining policy nuances and addressing concerns.

- Key Drivers for Direct Channel Growth:

- Convenience and speed of online purchasing.

- Technological advancements in digital platforms and customer interfaces.

- Attractiveness for digitally-savvy younger demographics.

- Potential for cost savings passed on to consumers.

Poland Life Insurance Industry Product Innovations

The Poland life insurance industry is witnessing a surge in product innovations, driven by technological advancements and a heightened focus on customer-centricity. Insurers are actively developing flexible, modular policies that allow policyholders to customize coverage based on their evolving life stages and financial goals. Unit-linked products that combine insurance protection with investment opportunities are gaining prominence, catering to a growing demand for wealth creation alongside security. The integration of digital tools for policy management, claims processing, and personalized recommendations is enhancing customer experience and operational efficiency. These innovations aim to provide greater value, transparency, and accessibility, thereby strengthening the competitive advantage of proactive insurers.

Report Scope & Segmentation Analysis

This report meticulously examines the Poland life insurance industry, covering a comprehensive range of segments. The Life Insurance market is dissected into Individual and Group policies, analyzing their respective growth drivers and market dynamics. The Non-life Insurance sector is addressed through Home, Motor, and Other Non-Life Insurance Types, providing a holistic view of the broader insurance landscape influencing life insurance penetration. Distribution channels are thoroughly analyzed, including Direct sales, Agency networks, Banks as intermediaries, and Other Distribution Channels, to understand how insurance products reach consumers. Growth projections, market sizes, and competitive dynamics are detailed for each segment, offering actionable insights for industry stakeholders.

Key Drivers of Poland Life Insurance Industry Growth

Several intertwined factors are propelling the growth of the Poland life insurance industry. A burgeoning economy, marked by rising disposable incomes and improved living standards, is a primary catalyst, increasing the affordability and demand for life insurance products. Enhanced financial literacy among the population, coupled with a growing awareness of the need for long-term financial security and retirement planning, further fuels market expansion. Regulatory reforms aimed at consumer protection and market transparency are building trust and confidence in the insurance sector. Technological innovation, including the adoption of insurtech solutions, is revolutionizing product development, distribution, and customer service, making insurance more accessible and tailored to individual needs.

Challenges in the Poland Life Insurance Industry Sector

The Poland life insurance industry faces several hurdles that could impede its growth trajectory. Stringent regulatory requirements, while beneficial for consumer protection, can increase compliance costs and operational complexities for insurers. Intense competition from both established players and emerging insurtech companies puts pressure on pricing and profitability. Fluctuations in economic conditions, such as inflation or interest rate changes, can impact investment returns and the overall attractiveness of certain life insurance products. Supply chain issues, particularly concerning the availability of skilled personnel for sales and underwriting, can also pose challenges. Furthermore, a segment of the population remains underserved or uninsured due to a lack of awareness or perceived affordability, presenting a continuous challenge for market penetration.

Emerging Opportunities in Poland Life Insurance Industry

The Poland life insurance industry is ripe with emerging opportunities. The growing demand for personalized and flexible insurance solutions presents a significant avenue for product innovation, such as tailored life and health insurance packages. The increasing adoption of digital technologies offers opportunities for insurers to expand their reach through online platforms and mobile applications, catering to a digitally-native customer base. The untapped potential in rural areas and among younger demographics represents a significant market expansion opportunity. Strategic partnerships with fintech companies and employers can unlock new distribution channels and customer segments. Furthermore, an increasing focus on financial wellness and preventative healthcare among consumers creates opportunities for insurers to offer integrated solutions that go beyond traditional life coverage.

Leading Players in the Poland Life Insurance Industry Market

- Powszechny Zaklad Ubezpieczen SA

- Sopockie Towarzystwo Ubezpieczen Ergo Hestia SA

- Towarzystwo Ubezpieczen I Reasekuracji Warta SA

- Uniqa Towarzystwo Ubezpieczen SA

- Generali Towarzystwo Ubezpieczen SA

- Link4 Towarzystwo Ubezpieczen SA

- Compensa Towarzystwo Ubezpieczen SA Vienna Insurance Group

- Interrisk Towarzystwo Ubezpieczen SA Vienna Insurance Group

- Aviva Towarzystwo Ubezpieczen Na Zycie SA

- Wiener Towarzystwo Ubezpieczen SA Vienna Insurance Group

Key Developments in Poland Life Insurance Industry Industry

- March 2024: UNIQA Towarzystwo Ubezpieczeń SA secured a contract from Park Śląski Spółka Akcyjna for a range of insurance services, including damage or loss insurance, weather-related insurance, and liability insurance services, valued at approximately USD 11.9 Million.

- February 2024: Significant legislative updates, effective from late 2022 through 2023, were implemented. These include new KNF Recommendations on bancassurance (June 2023) and life insurance (September 2023), an Act enhancing financial market operations (August 2023), amendments to the Commercial Companies Code (October 2022), and a Criminal Code revision (October 2023). These changes are designed to bolster transparency, consumer protection, and insurer accountability, necessitating strategic adjustments by insurance providers.

Future Outlook for Poland Life Insurance Industry Market

The future outlook for the Poland life insurance industry is exceptionally promising, driven by a confluence of favorable demographic, economic, and technological trends. Continued economic growth and rising disposable incomes will further enhance the affordability and demand for life insurance products. The aging population and increasing life expectancy will drive demand for retirement planning and long-term care solutions. Advancements in digital technologies and insurtech will continue to reshape distribution channels and product offerings, leading to more personalized, accessible, and efficient insurance services. Regulatory frameworks are expected to evolve further, focusing on enhanced consumer protection and market stability, which will foster greater trust. Strategic opportunities lie in leveraging data analytics for risk assessment and product customization, expanding into underserved markets, and forging partnerships to offer comprehensive financial wellness solutions. The industry is poised for sustained growth, presenting significant opportunities for both established players and innovative newcomers.

Poland Life Insurance Industry Segmentation

-

1. Life Insurance

- 1.1. Individual

- 1.2. Group

-

2. Non-life Insurance

- 2.1. Home

- 2.2. Motor

- 2.3. Other Non-Life Insurance Types

-

3. Distribution Channel

- 3.1. Direct

- 3.2. Agency

- 3.3. Banks

- 3.4. Other Distribution Channels

Poland Life Insurance Industry Segmentation By Geography

- 1. Poland

Poland Life Insurance Industry Regional Market Share

Geographic Coverage of Poland Life Insurance Industry

Poland Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Economic Stability and Growth Increase Disposable Incomes

- 3.2.2 Leading to Higher Investments in Life Insurance Products; Government Policies and Regulations

- 3.2.3 such as Mandatory Insurance Coverage or Tax Benefits

- 3.2.4 can Drive the Uptake of Life Insurance

- 3.3. Market Restrains

- 3.3.1 Economic Stability and Growth Increase Disposable Incomes

- 3.3.2 Leading to Higher Investments in Life Insurance Products; Government Policies and Regulations

- 3.3.3 such as Mandatory Insurance Coverage or Tax Benefits

- 3.3.4 can Drive the Uptake of Life Insurance

- 3.4. Market Trends

- 3.4.1. Digital Transformation is Reshaping the Insurance Landscape of Poland

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Life Insurance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Life Insurance

- 5.1.1. Individual

- 5.1.2. Group

- 5.2. Market Analysis, Insights and Forecast - by Non-life Insurance

- 5.2.1. Home

- 5.2.2. Motor

- 5.2.3. Other Non-Life Insurance Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct

- 5.3.2. Agency

- 5.3.3. Banks

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Life Insurance

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Powszechny Zaklad Ubezpieczen SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sopockie Towarzystwo Ubezpieczen Ergo Hestia SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Towarzystwo Ubezpieczen I Reasekuracji Warta SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uniqa Towarzystwo Ubezpieczen SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Generali Towarzystwo Ubezpieczen SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Link4 Towarzystwo Ubezpieczen SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Compensa Towarzystwo Ubezpieczen SA Vienna Insurance Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Interrisk Towarzystwo Ubezpieczen SA Vienna Insurance Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Aviva Towarzystwo Ubezpieczen Na Zycie SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wiener Towarzystwo Ubezpieczen SA Vienna Insurance Group**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Powszechny Zaklad Ubezpieczen SA

List of Figures

- Figure 1: Poland Life Insurance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Life Insurance Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Life Insurance Industry Revenue Million Forecast, by Life Insurance 2020 & 2033

- Table 2: Poland Life Insurance Industry Volume Billion Forecast, by Life Insurance 2020 & 2033

- Table 3: Poland Life Insurance Industry Revenue Million Forecast, by Non-life Insurance 2020 & 2033

- Table 4: Poland Life Insurance Industry Volume Billion Forecast, by Non-life Insurance 2020 & 2033

- Table 5: Poland Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Poland Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Poland Life Insurance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Poland Life Insurance Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Poland Life Insurance Industry Revenue Million Forecast, by Life Insurance 2020 & 2033

- Table 10: Poland Life Insurance Industry Volume Billion Forecast, by Life Insurance 2020 & 2033

- Table 11: Poland Life Insurance Industry Revenue Million Forecast, by Non-life Insurance 2020 & 2033

- Table 12: Poland Life Insurance Industry Volume Billion Forecast, by Non-life Insurance 2020 & 2033

- Table 13: Poland Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Poland Life Insurance Industry Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Poland Life Insurance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Poland Life Insurance Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Life Insurance Industry?

The projected CAGR is approximately 7.19%.

2. Which companies are prominent players in the Poland Life Insurance Industry?

Key companies in the market include Powszechny Zaklad Ubezpieczen SA, Sopockie Towarzystwo Ubezpieczen Ergo Hestia SA, Towarzystwo Ubezpieczen I Reasekuracji Warta SA, Uniqa Towarzystwo Ubezpieczen SA, Generali Towarzystwo Ubezpieczen SA, Link4 Towarzystwo Ubezpieczen SA, Compensa Towarzystwo Ubezpieczen SA Vienna Insurance Group, Interrisk Towarzystwo Ubezpieczen SA Vienna Insurance Group, Aviva Towarzystwo Ubezpieczen Na Zycie SA, Wiener Towarzystwo Ubezpieczen SA Vienna Insurance Group**List Not Exhaustive.

3. What are the main segments of the Poland Life Insurance Industry?

The market segments include Life Insurance, Non-life Insurance, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Stability and Growth Increase Disposable Incomes. Leading to Higher Investments in Life Insurance Products; Government Policies and Regulations. such as Mandatory Insurance Coverage or Tax Benefits. can Drive the Uptake of Life Insurance.

6. What are the notable trends driving market growth?

Digital Transformation is Reshaping the Insurance Landscape of Poland.

7. Are there any restraints impacting market growth?

Economic Stability and Growth Increase Disposable Incomes. Leading to Higher Investments in Life Insurance Products; Government Policies and Regulations. such as Mandatory Insurance Coverage or Tax Benefits. can Drive the Uptake of Life Insurance.

8. Can you provide examples of recent developments in the market?

March 2024: UNIQA Towarzystwo Ubezpieczeń SA, a Poland-based company, secured a contract from Park Śląski Spółka Akcyjna for a range of insurance services. The contract, valued at USD 11,910,396, includes damage or loss insurance, weather-related insurance, and liability insurance services.February 2024: Recent legislative updates in Poland, effective from late 2022 and throughout 2023, include new KNF Recommendations on bancassurance (June 2023) and life insurance (September 2023), an Act enhancing financial market operations (August 2023), amendments to the Commercial Companies Code (October 2022), and a Criminal Code revision (October 2023). These changes aim to boost transparency, consumer protection, and insurer accountability, requiring insurers to adjust their strategies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Poland Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence