Key Insights

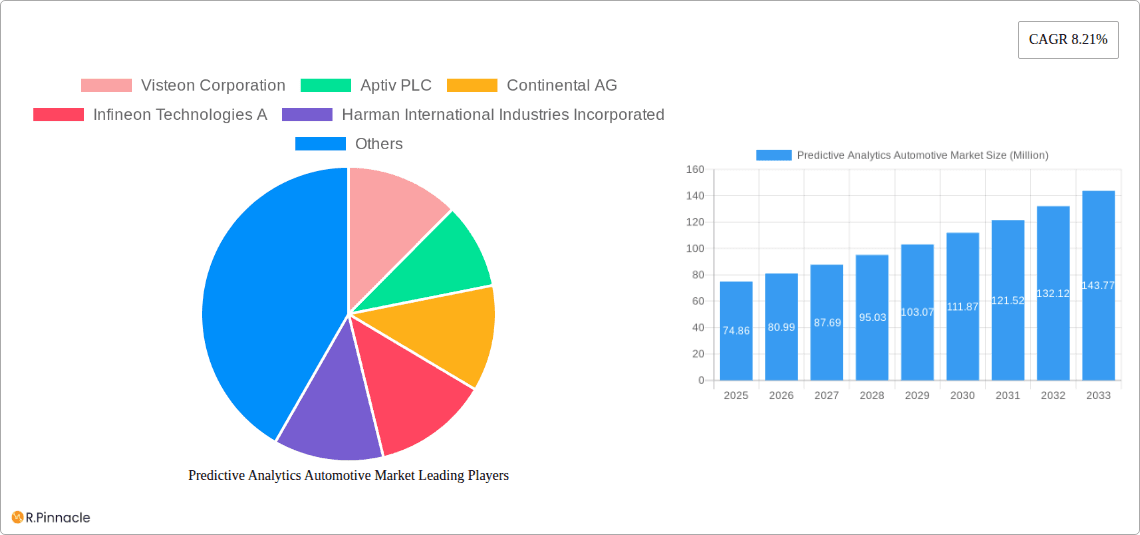

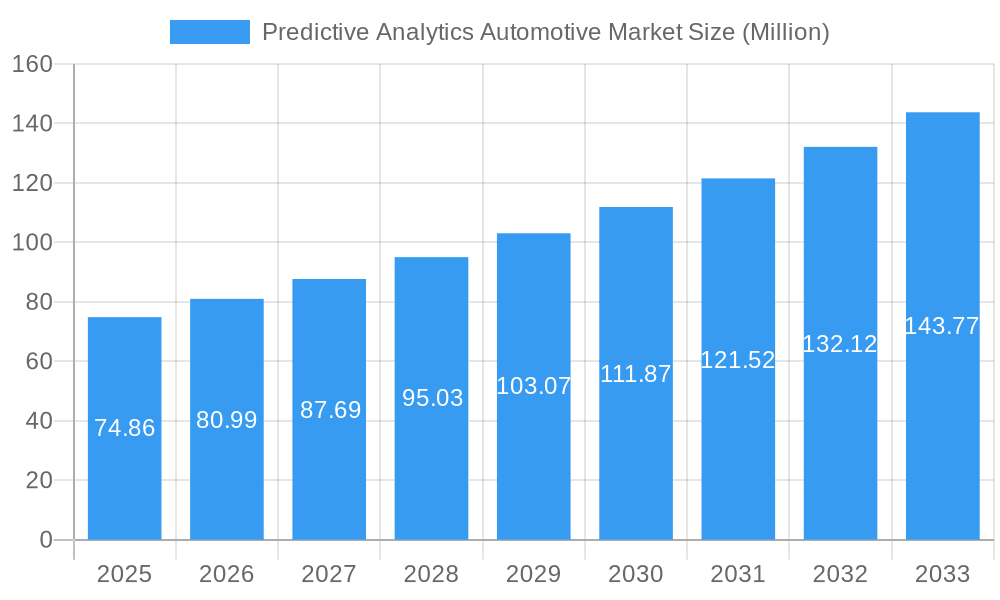

The global Predictive Analytics Automotive Market is poised for significant expansion, projected to reach $74.86 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.21% from 2025 to 2033. This robust growth is fueled by an increasing adoption of advanced automotive technologies, including Advanced Driver-Assistance Systems (ADAS) and sophisticated on-board diagnostic (OBD) hardware. The surge in connected vehicles and the growing demand for enhanced vehicle safety, performance optimization, and proactive maintenance are primary market drivers. Fleet owners are increasingly leveraging predictive analytics to reduce operational costs, improve fuel efficiency, and minimize downtime by anticipating potential component failures and optimizing maintenance schedules. Similarly, insurance companies are integrating predictive analytics for more accurate risk assessment, personalized premium pricing, and faster claims processing by analyzing driver behavior and vehicle health data.

Predictive Analytics Automotive Market Market Size (In Million)

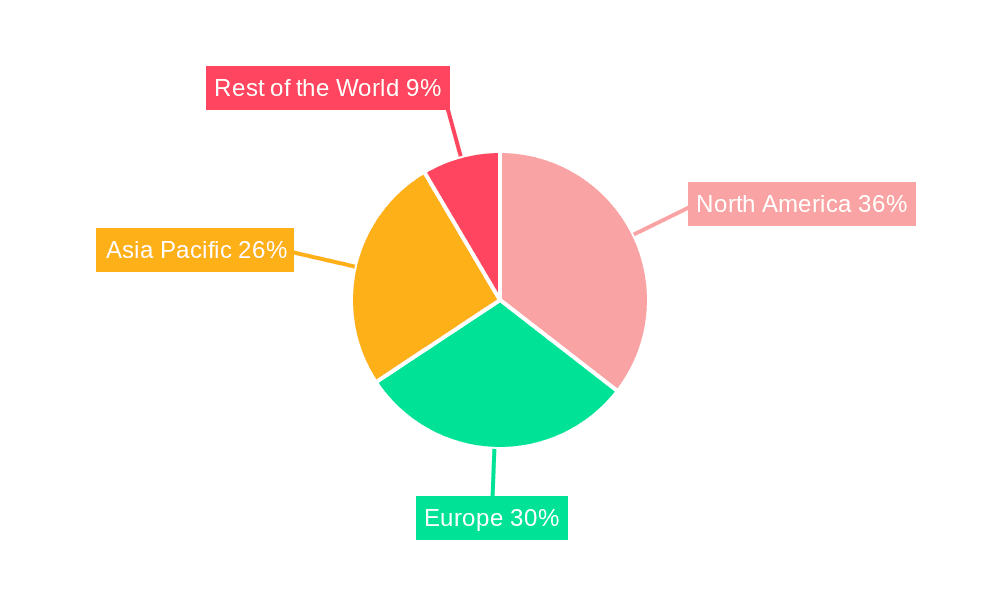

The market is segmented across various vehicle types, with passenger vehicles expected to lead the adoption due to their higher volume and rapid integration of smart features. Commercial vehicles also represent a substantial segment, driven by the economic benefits of predictive maintenance and operational efficiency for logistics and transportation companies. The growing complexity of automotive electronics and software necessitates advanced diagnostic and analytical tools, further propelling the demand for predictive analytics solutions. Geographically, North America and Europe are anticipated to be leading markets, owing to early adoption of advanced automotive technologies and stringent safety regulations. However, the Asia Pacific region, particularly China and India, is expected to witness the fastest growth, driven by a burgeoning automotive industry, increasing disposable incomes, and a rapid influx of smart mobility solutions. Emerging markets in the Rest of the World are also presenting significant opportunities as adoption of connected car technologies gains momentum.

Predictive Analytics Automotive Market Company Market Share

Predictive Analytics Automotive Market: Data-Driven Insights for the Future of Mobility (2025-2033)

Unlock the power of data to navigate the rapidly evolving automotive landscape. This comprehensive report delivers in-depth analysis and actionable insights into the global Predictive Analytics Automotive Market. With a study period spanning 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report is your essential guide to understanding market dynamics, identifying growth opportunities, and staying ahead of the competition. Gain a competitive edge with granular segmentation across vehicle types, end-users, and hardware, and detailed analysis of key players and industry developments.

Predictive Analytics Automotive Market Market Structure & Innovation Trends

The global Predictive Analytics Automotive Market exhibits a moderately concentrated structure, with key players like Robert Bosch GmbH, Continental AG, and Aptiv PLC holding significant market share. Innovation is primarily driven by advancements in Artificial Intelligence (AI), machine learning algorithms, and the increasing adoption of connected vehicle technologies. Regulatory frameworks, particularly those related to data privacy and autonomous driving safety, play a crucial role in shaping market dynamics. While product substitutes exist in the form of traditional diagnostic tools, the unique ability of predictive analytics to forecast potential failures and optimize operational efficiency offers a distinct competitive advantage. End-user demographics are broadening, encompassing fleet owners demanding enhanced operational efficiency, insurers seeking to mitigate risks, and automotive manufacturers striving for improved vehicle performance and safety. Mergers and acquisition (M&A) activities are expected to continue as companies aim to consolidate their market position and acquire specialized technological capabilities. For instance, M&A deals in the automotive AI and data analytics space have seen valuations in the hundreds of millions to billions of dollars, reflecting the strategic importance of these capabilities. The market share of leading companies is estimated to be between 8% and 15% each.

Predictive Analytics Automotive Market Market Dynamics & Trends

The Predictive Analytics Automotive Market is experiencing robust growth, fueled by a confluence of technological advancements, evolving consumer demands, and stringent safety regulations. The projected Compound Annual Growth Rate (CAGR) for this market is robust, estimated to be around 18-22% over the forecast period. This surge is intrinsically linked to the escalating adoption of Advanced Driver-Assistance Systems (ADAS) and the ongoing transition towards autonomous driving. Vehicles are becoming increasingly sophisticated, generating vast amounts of data from sensors, ECUs, and telematics units. Predictive analytics leverages this data to anticipate component failures, optimize maintenance schedules, improve fuel efficiency, and enhance driver safety.

Technological disruptions are a primary growth catalyst. The integration of AI and machine learning algorithms is enabling more accurate and timely predictions, moving beyond reactive diagnostics to proactive maintenance and risk mitigation. Companies are investing heavily in developing proprietary algorithms and data processing platforms. Consumer preferences are also shifting towards safer, more connected, and personalized driving experiences. Predictive analytics contributes to this by enabling features such as predictive maintenance alerts, personalized driving insights, and optimized route planning based on real-time traffic and vehicle performance data.

The competitive landscape is characterized by intense innovation and strategic collaborations. Major automotive suppliers, technology giants, and specialized AI firms are vying for market leadership. This includes companies like Visteon Corporation, Harman International Industries Incorporated, and Infineon Technologies A, all actively developing and deploying predictive analytics solutions. The increasing market penetration of connected cars, estimated to exceed 85% by 2030, creates a fertile ground for predictive analytics adoption. Furthermore, the growing emphasis on reducing operational costs for commercial fleets and the potential for insurers to offer usage-based insurance (UBI) policies are significant drivers. The economic implications of preventing costly breakdowns and accidents are substantial, pushing stakeholders to embrace these data-driven solutions. The demand for real-time diagnostics and prognostics is reshaping the aftermarket service sector, driving innovation in remote diagnostics and predictive maintenance services.

Dominant Regions & Segments in Predictive Analytics Automotive Market

The North America region is currently the dominant force in the global Predictive Analytics Automotive Market, driven by its early adoption of advanced automotive technologies, significant investments in R&D, and a strong presence of leading automotive manufacturers and technology providers. Within North America, countries like the United States lead due to substantial government initiatives supporting autonomous vehicle development and robust infrastructure for connected car services.

Vehicle Type Dominance: Passenger Vehicles constitute the largest segment within the Predictive Analytics Automotive Market. This is attributed to the sheer volume of passenger cars on the road globally and the increasing consumer demand for enhanced safety, convenience, and personalized features offered by predictive analytics solutions. The integration of ADAS in passenger vehicles, which relies heavily on predictive algorithms for functions like emergency braking and lane keeping, further amplifies this segment's dominance.

End-User Dominance: Fleet Owners represent a significant and rapidly growing end-user segment. The economic imperative to minimize downtime, optimize fuel consumption, and reduce maintenance costs makes predictive analytics an indispensable tool for managing large fleets of commercial vehicles. Real-time monitoring and predictive maintenance capabilities directly translate into substantial cost savings and improved operational efficiency for these users.

Hardware Type Dominance: The ADAS (Advanced Driver-Assistance Systems) hardware segment holds a commanding position. ADAS relies intrinsically on predictive analytics for its core functionalities, such as object detection, collision avoidance, and adaptive cruise control. As the sophistication and ubiquity of ADAS increase, so does the demand for the predictive analytics solutions that power them. This includes sensors like cameras, radar, and lidar, which generate data analyzed by predictive algorithms.

The dominance in these segments is further reinforced by supportive economic policies, investments in smart city infrastructure that facilitates connected vehicle data flow, and consumer preferences for safety and technologically advanced vehicles. The regulatory landscape, particularly concerning vehicle safety standards and data privacy, also plays a pivotal role in shaping the adoption patterns of predictive analytics across different regions and segments.

Predictive Analytics Automotive Market Product Innovations

Product innovations in the Predictive Analytics Automotive Market are revolutionizing vehicle maintenance and safety. Companies are developing sophisticated AI-powered platforms that analyze real-time vehicle data to predict component failures before they occur, enabling proactive maintenance and reducing unexpected breakdowns. Applications include predicting tire wear, battery health, and engine performance degradation. These innovations offer significant competitive advantages by enhancing vehicle reliability, reducing operational costs for fleet owners, and improving safety for all road users. Key trends include the integration of edge computing for faster, on-board analysis and the development of digital twin technologies for more accurate performance modeling.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the Predictive Analytics Automotive Market, segmented across key dimensions.

Vehicle Type: The market is divided into Passenger Vehicles and Commercial Vehicles. Passenger vehicles, due to their high production volumes and increasing integration of advanced features, are expected to dominate the market, with a projected market size of over $15 Billion by 2033. Commercial vehicles, driven by fleet operational efficiency needs, will also see substantial growth, estimated at a CAGR of 19%.

End-User: Key end-users include Fleet Owners, Insurers, and Other End-Users. Fleet owners, seeking to optimize operations and reduce costs, represent a significant market share, projected to exceed $12 Billion by 2033. Insurers are increasingly adopting predictive analytics for risk assessment and usage-based insurance, contributing to a projected market size of over $5 Billion.

Hardware Type: The analysis focuses on ADAS, On-board Diagnosis, and Other Hardware Types. The ADAS segment is expected to be the largest, with a projected market size exceeding $18 Billion by 2033, owing to the critical role of predictive analytics in autonomous and semi-autonomous driving functions. On-board diagnosis and other hardware types will also witness steady growth.

Key Drivers of Predictive Analytics Automotive Market Growth

The growth of the Predictive Analytics Automotive Market is propelled by several key factors. The rapid advancement in AI and machine learning technologies is enabling more sophisticated and accurate predictive models. The increasing adoption of connected car technologies generates a wealth of data crucial for predictive analytics. Stringent government regulations mandating enhanced vehicle safety and emission standards are also a significant driver. Furthermore, the economic benefits of reduced maintenance costs, improved fuel efficiency, and minimized downtime for commercial fleets are pushing widespread adoption.

Challenges in the Predictive Analytics Automotive Market Sector

Despite its promising growth, the Predictive Analytics Automotive Market faces several challenges. Data privacy and security concerns are paramount, requiring robust frameworks to protect sensitive vehicle and user information. The complexity of integrating diverse data sources from various vehicle systems and manufacturers presents a significant technical hurdle. Furthermore, the high initial investment costs for implementing predictive analytics solutions can be a barrier for smaller players. The lack of skilled professionals proficient in data science and automotive engineering also poses a constraint on market expansion.

Emerging Opportunities in Predictive Analytics Automotive Market

Emerging opportunities in the Predictive Analytics Automotive Market lie in the burgeoning field of autonomous driving, where predictive capabilities are essential for safe and efficient operation. The expansion of electric vehicles (EVs) presents a new frontier for predictive maintenance, focusing on battery health and charging optimization. The integration of predictive analytics with smart city infrastructure, enabling vehicle-to-infrastructure (V2I) communication, offers potential for enhanced traffic management and safety. Furthermore, the development of personalized in-car experiences and predictive infotainment systems opens new avenues for market growth.

Leading Players in the Predictive Analytics Automotive Market Market

- Visteon Corporation

- Aptiv PLC

- Continental AG

- Infineon Technologies A

- Harman International Industries Incorporated

- Robert Bosch GmbH

- Valeo SA

- Verizon

- Garrett Motion Inc

- ZF Friedrichshafen AG

Key Developments in Predictive Analytics Automotive Market Industry

- January 2023: ZF, a leading automotive supplier, launched Smart Camera 6, its next-generation camera system designed to advance urban and highway automated driving and safety systems. This development enhances environmental monitoring capabilities through image processing, offering 3D surround view and interior monitoring systems.

- January 2023: Continental and Ambarella, Inc. announced a strategic partnership to jointly develop scalable, end-to-end hardware and software solutions powered by artificial intelligence (AI) for assisted and automated driving (AD).

Future Outlook for Predictive Analytics Automotive Market Market

The future outlook for the Predictive Analytics Automotive Market is exceptionally bright, poised for sustained and accelerated growth. The increasing sophistication of autonomous driving technology will demand more advanced predictive algorithms for decision-making and safety. The expansion of the electric vehicle ecosystem will create new opportunities for predictive analytics in areas like battery management and charging infrastructure optimization. Continued advancements in AI, edge computing, and 5G connectivity will further enhance the capabilities and adoption of predictive solutions. Strategic partnerships and collaborations among automotive manufacturers, technology providers, and data analytics firms will be crucial in driving innovation and market penetration. The growing emphasis on data-driven decision-making across the automotive value chain, from manufacturing to after-sales service, will solidify predictive analytics as an indispensable component of future mobility.

Predictive Analytics Automotive Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. End-User

- 2.1. Fleet Owners

- 2.2. Insurers

- 2.3. Other End-Users

-

3. Hardware Type

- 3.1. ADAS

- 3.2. On-board Diagnosis

- 3.3. Other Hardware Types

Predictive Analytics Automotive Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. United Arab Emirates

- 4.4. Other Countries

Predictive Analytics Automotive Market Regional Market Share

Geographic Coverage of Predictive Analytics Automotive Market

Predictive Analytics Automotive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Connected Cars; Advancements In Data Analytics And Machine Learning

- 3.3. Market Restrains

- 3.3.1. High Implementation And Maintenance Costs

- 3.4. Market Trends

- 3.4.1. ADAS Segment Likley to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Predictive Analytics Automotive Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Fleet Owners

- 5.2.2. Insurers

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Hardware Type

- 5.3.1. ADAS

- 5.3.2. On-board Diagnosis

- 5.3.3. Other Hardware Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Predictive Analytics Automotive Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Vehicles

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Fleet Owners

- 6.2.2. Insurers

- 6.2.3. Other End-Users

- 6.3. Market Analysis, Insights and Forecast - by Hardware Type

- 6.3.1. ADAS

- 6.3.2. On-board Diagnosis

- 6.3.3. Other Hardware Types

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Predictive Analytics Automotive Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Vehicles

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Fleet Owners

- 7.2.2. Insurers

- 7.2.3. Other End-Users

- 7.3. Market Analysis, Insights and Forecast - by Hardware Type

- 7.3.1. ADAS

- 7.3.2. On-board Diagnosis

- 7.3.3. Other Hardware Types

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Predictive Analytics Automotive Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Vehicles

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Fleet Owners

- 8.2.2. Insurers

- 8.2.3. Other End-Users

- 8.3. Market Analysis, Insights and Forecast - by Hardware Type

- 8.3.1. ADAS

- 8.3.2. On-board Diagnosis

- 8.3.3. Other Hardware Types

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Predictive Analytics Automotive Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Vehicles

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Fleet Owners

- 9.2.2. Insurers

- 9.2.3. Other End-Users

- 9.3. Market Analysis, Insights and Forecast - by Hardware Type

- 9.3.1. ADAS

- 9.3.2. On-board Diagnosis

- 9.3.3. Other Hardware Types

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Visteon Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Aptiv PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Continental AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Infineon Technologies A

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Harman International Industries Incorporated

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Robert Bosch GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Valeo SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Verizon

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Garrett Motion Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZF Friedrichshafen AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Visteon Corporation

List of Figures

- Figure 1: Global Predictive Analytics Automotive Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Predictive Analytics Automotive Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Predictive Analytics Automotive Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Predictive Analytics Automotive Market Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Predictive Analytics Automotive Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Predictive Analytics Automotive Market Revenue (Million), by Hardware Type 2025 & 2033

- Figure 7: North America Predictive Analytics Automotive Market Revenue Share (%), by Hardware Type 2025 & 2033

- Figure 8: North America Predictive Analytics Automotive Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Predictive Analytics Automotive Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Predictive Analytics Automotive Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Predictive Analytics Automotive Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Predictive Analytics Automotive Market Revenue (Million), by End-User 2025 & 2033

- Figure 13: Europe Predictive Analytics Automotive Market Revenue Share (%), by End-User 2025 & 2033

- Figure 14: Europe Predictive Analytics Automotive Market Revenue (Million), by Hardware Type 2025 & 2033

- Figure 15: Europe Predictive Analytics Automotive Market Revenue Share (%), by Hardware Type 2025 & 2033

- Figure 16: Europe Predictive Analytics Automotive Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Predictive Analytics Automotive Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Predictive Analytics Automotive Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Predictive Analytics Automotive Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Predictive Analytics Automotive Market Revenue (Million), by End-User 2025 & 2033

- Figure 21: Asia Pacific Predictive Analytics Automotive Market Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Asia Pacific Predictive Analytics Automotive Market Revenue (Million), by Hardware Type 2025 & 2033

- Figure 23: Asia Pacific Predictive Analytics Automotive Market Revenue Share (%), by Hardware Type 2025 & 2033

- Figure 24: Asia Pacific Predictive Analytics Automotive Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Predictive Analytics Automotive Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Predictive Analytics Automotive Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Predictive Analytics Automotive Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Predictive Analytics Automotive Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: Rest of the World Predictive Analytics Automotive Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Rest of the World Predictive Analytics Automotive Market Revenue (Million), by Hardware Type 2025 & 2033

- Figure 31: Rest of the World Predictive Analytics Automotive Market Revenue Share (%), by Hardware Type 2025 & 2033

- Figure 32: Rest of the World Predictive Analytics Automotive Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Predictive Analytics Automotive Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Predictive Analytics Automotive Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Hardware Type 2020 & 2033

- Table 4: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Predictive Analytics Automotive Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 7: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Hardware Type 2020 & 2033

- Table 8: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Predictive Analytics Automotive Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Hardware Type 2020 & 2033

- Table 15: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Predictive Analytics Automotive Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 22: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Hardware Type 2020 & 2033

- Table 23: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 30: Global Predictive Analytics Automotive Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 31: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Hardware Type 2020 & 2033

- Table 32: Global Predictive Analytics Automotive Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Other Countries Predictive Analytics Automotive Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Predictive Analytics Automotive Market?

The projected CAGR is approximately 8.21%.

2. Which companies are prominent players in the Predictive Analytics Automotive Market?

Key companies in the market include Visteon Corporation, Aptiv PLC, Continental AG, Infineon Technologies A, Harman International Industries Incorporated, Robert Bosch GmbH, Valeo SA, Verizon, Garrett Motion Inc, ZF Friedrichshafen AG.

3. What are the main segments of the Predictive Analytics Automotive Market?

The market segments include Vehicle Type, End-User, Hardware Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 74.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Connected Cars; Advancements In Data Analytics And Machine Learning.

6. What are the notable trends driving market growth?

ADAS Segment Likley to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

High Implementation And Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2023: ZF, the world's leading supplier of automotive cameras, developed Smart Camera 6, its next generation of cameras for the advanced development of urban and highway automated driving and safety systems. ZF also offers multi-sensor environmental monitoring through image processing module systems to offer 3D surround view, interior monitoring systems, and more.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Predictive Analytics Automotive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Predictive Analytics Automotive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Predictive Analytics Automotive Market?

To stay informed about further developments, trends, and reports in the Predictive Analytics Automotive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence