Key Insights

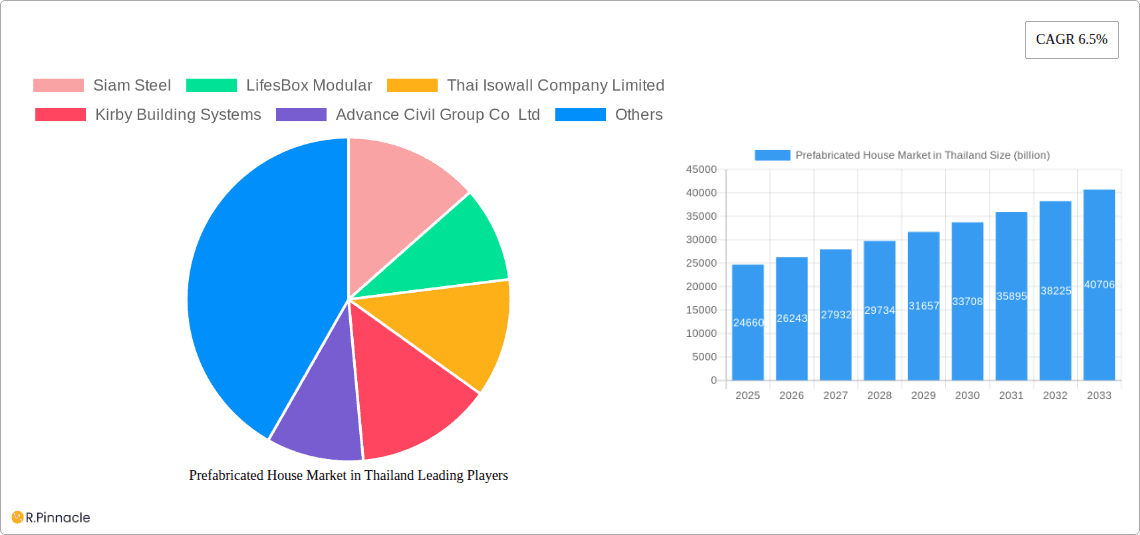

The Thai prefabricated housing market is poised for significant expansion, projected to reach a USD 24.66 billion valuation in 2025. Driven by robust economic growth, increasing urbanization, and a growing demand for cost-effective and sustainable construction solutions, the market is expected to witness a CAGR of 6.5% from 2025 to 2033. Key growth drivers include government initiatives promoting affordable housing, the need for rapid infrastructure development, and the rising adoption of modular construction techniques in both residential and commercial sectors. The convenience of faster build times, reduced waste, and controlled quality inherent in prefabricated systems aligns perfectly with Thailand's development objectives. Furthermore, the growing awareness of environmental sustainability and the desire for energy-efficient homes are contributing to the market's upward trajectory. The residential segment, in particular, is anticipated to dominate, fueled by a rising middle class and the demand for modern, readily available housing options.

Prefabricated House Market in Thailand Market Size (In Billion)

Emerging trends such as the integration of smart home technology into prefabricated units and the increasing use of advanced, eco-friendly materials are shaping the future of this market. The demand for prefabricated solutions extends beyond individual homes, encompassing commercial spaces like retail outlets, offices, and even temporary structures for events and disaster relief. While the market benefits from strong demand, potential restraints may include initial capital investment for manufacturing facilities, evolving building codes and regulations, and the need for skilled labor in specialized construction methods. However, the overall outlook remains highly positive, with companies like Siam Steel, LifesBox Modular, and Thai Isowall Company Limited actively contributing to market innovation and expansion across various applications and regions. The market's dynamism is further evidenced by the significant presence of key players and the broad geographical reach of its impact.

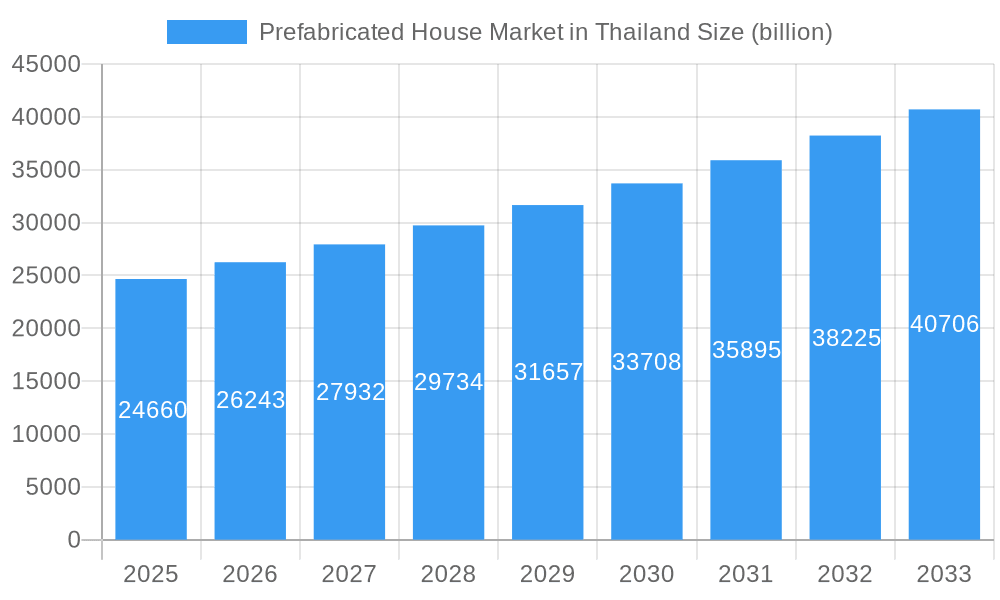

Prefabricated House Market in Thailand Company Market Share

Gain unparalleled insights into Thailand's burgeoning prefabricated house market with this in-depth report. Covering the study period of 2019–2033, with a base year of 2025, this analysis delves into critical market dynamics, innovation trends, and future projections. Discover market size valued in the billions of USD, CAGR estimations, and key growth drivers shaping the residential construction, commercial building, and infrastructure development sectors. Whether you're a manufacturer, investor, developer, or industry professional, this report provides actionable intelligence on market concentration, dominant regions, product innovations, and the competitive landscape featuring leading players like Siam Steel, LifesBox Modular, and Thai Isowall Company Limited.

Prefabricated House Market in Thailand Market Structure & Innovation Trends

The Thai prefabricated house market exhibits a moderately concentrated structure, with a few key players holding significant market share, while a growing number of regional and specialized manufacturers cater to niche demands. Innovation is primarily driven by the pursuit of enhanced construction speed, cost-effectiveness, and sustainability. Regulatory frameworks are evolving to support modular construction, with an increasing emphasis on building codes and standardization to ensure quality and safety. Product substitutes, such as traditional on-site construction methods, still represent a significant competitive force, but the advantages of prefabrication in terms of reduced labor costs and waste are increasingly recognized. End-user demographics are shifting, with growing demand from urban dwellers seeking faster housing solutions and commercial entities requiring quick deployment of facilities. Mergers and acquisitions (M&A) activities are on the rise as established companies seek to expand their capabilities and market reach. While specific M&A deal values are still developing in this dynamic sector, the overall trend indicates consolidation and strategic partnerships aimed at capturing greater market share. The market share of prefabricated solutions is projected to witness significant growth from an estimated xx% in 2025 to xx% by 2033, driven by technological advancements and increasing adoption rates across various applications.

Prefabricated House Market in Thailand Market Dynamics & Trends

The Thai prefabricated house market is experiencing robust growth, propelled by a confluence of compelling market drivers. The escalating demand for affordable and rapid housing solutions, particularly in urban centers and for workforce accommodation, is a primary catalyst. This is closely followed by government initiatives promoting infrastructure development and housing affordability, which directly translate into increased demand for efficient construction methods. Technological advancements in manufacturing processes, including automated fabrication and the use of advanced materials like lightweight steel and sustainable composites, are further accelerating market penetration and improving the quality and design flexibility of prefabricated homes. Consumer preferences are increasingly leaning towards prefabricated options due to their perceived cost predictability, reduced construction timelines, and lower environmental impact compared to traditional building. This shift is supported by growing awareness of the benefits of modular construction, including enhanced energy efficiency and superior structural integrity. The competitive landscape is characterized by intense competition among both local and international players, fostering innovation and driving down costs. Emerging trends include the integration of smart home technologies into prefabricated units and the growing application of prefabricated structures in diverse sectors beyond residential, such as commercial retail spaces and industrial facilities. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period, indicating substantial expansion and increasing market penetration from an estimated xx% in 2025 to xx% by 2033. The increasing adoption of modular building techniques is a significant disruption in the traditional construction industry, offering a more streamlined and efficient alternative.

Dominant Regions & Segments in Prefabricated House Market in Thailand

The Residential segment is currently the dominant force within Thailand's prefabricated house market, driven by a substantial and growing demand for affordable and quickly deployable housing solutions. This dominance is fueled by rapid urbanization, an expanding middle class with increasing disposable incomes, and government policies aimed at addressing housing shortages. Key drivers include government housing schemes, the need for second homes and vacation properties in popular tourist destinations, and the growing preference for modern, efficient living spaces.

- Residential:

- Key Drivers: Urbanization, demand for affordable housing, government housing initiatives, second home market, lifestyle upgrades.

- Dominance Analysis: This segment commands the largest market share due to the sheer volume of housing units required. The ease and speed of construction offered by prefabricated solutions are particularly attractive for individual homeowners and mass housing projects alike. Developers are increasingly opting for prefabricated modules to reduce construction timelines and costs, thereby increasing project profitability and delivery speed. The economic policies supporting homeownership and construction also play a crucial role in bolstering this segment.

The Commercial segment is experiencing significant growth, driven by the need for flexible and rapidly deployable business spaces. This includes retail outlets, offices, modular clinics, and educational facilities. The ability to customize and expand these structures easily makes them ideal for businesses seeking agility in their operations.

- Commercial:

- Key Drivers: Business expansion, demand for flexible retail and office spaces, temporary and pop-up structures, modular healthcare and education facilities.

- Dominance Analysis: While currently smaller than the residential segment, the commercial sector presents substantial growth opportunities. The inherent adaptability of prefabricated buildings allows businesses to quickly establish or reconfigure their premises, responding effectively to market demands. Government investments in economic development and the growth of the tourism sector further stimulate demand for commercial prefabricated structures.

The Other Applications (Infrastructure and Industrial) segment, though nascent, holds immense future potential. This includes modular facilities for infrastructure projects, temporary worker accommodations at construction sites, industrial storage solutions, and specialized facilities for sectors like mining and energy.

- Other Applications (Infrastructure and Industrial):

- Key Drivers: Large-scale infrastructure projects, industrial expansion, remote workforce housing needs, rapid deployment for disaster relief.

- Dominance Analysis: This segment is poised for exponential growth as Thailand continues to invest in its infrastructure and industrial capabilities. The need for robust, quickly deployable solutions in remote or challenging locations makes prefabrication an attractive option. The development of specific industrial applications, such as modular factories and warehousing, will further propel its expansion.

Prefabricated House Market in Thailand Product Innovations

Product innovations in the Thai prefabricated house market are centered on enhancing durability, sustainability, and customization. Manufacturers are increasingly incorporating advanced materials like high-performance insulation, fire-resistant panels, and recycled components. Technological advancements are enabling greater design flexibility, allowing for a wider range of architectural styles and interior finishes. The integration of smart home technologies and energy-efficient systems is a growing trend, offering enhanced comfort and reduced operational costs for end-users. These innovations aim to bridge the gap between prefabricated and traditional construction in terms of aesthetics and functionality, while leveraging the inherent advantages of speed and cost-efficiency.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the prefabricated house market in Thailand, segmented by application.

- Residential: This segment focuses on the construction of dwelling units for individuals and families, encompassing single-family homes, multi-story apartments, and affordable housing projects. Growth projections indicate substantial expansion driven by population increase and urbanization.

- Commercial: This segment covers prefabricated structures used for business purposes, including retail spaces, offices, hotels, and educational institutions. The demand for flexibility and rapid deployment fuels its growth.

- Other Applications (Infrastructure and Industrial): This segment includes prefabricated buildings for infrastructure projects, industrial facilities, temporary housing for labor, and specialized structures for sectors like healthcare and disaster relief. Its growth is linked to national development and industrial expansion.

Key Drivers of Prefabricated House Market in Thailand Growth

The growth of the prefabricated house market in Thailand is propelled by several key factors. Government initiatives promoting affordable housing and infrastructure development play a crucial role. The increasing demand for faster construction timelines and cost-effective building solutions is a significant driver, particularly in urban areas facing housing shortages. Technological advancements in manufacturing efficiency and the use of sustainable materials further enhance the appeal of prefabricated homes. The growing awareness among consumers and developers regarding the benefits of modular construction, such as reduced waste and predictable quality, is also a critical growth accelerator.

Challenges in the Prefabricated House Market in Thailand Sector

Despite its promising growth, the Thai prefabricated house market faces several challenges. Regulatory hurdles and evolving building codes can sometimes slow down adoption and require significant adaptation for manufacturers. Supply chain disruptions and the availability of skilled labor for specialized fabrication and installation can pose logistical challenges. Perceptions and cultural biases favoring traditional construction methods still exist among some consumer segments. Furthermore, initial investment costs for setting up advanced manufacturing facilities can be a barrier for smaller players, leading to price competition and impacting profit margins for some.

Emerging Opportunities in Prefabricated House Market in Thailand

Emerging opportunities in the Thai prefabricated house market are abundant. The growing demand for sustainable and eco-friendly building solutions presents a significant avenue for innovation and market penetration. The expansion of tourism infrastructure requires rapid development of hotels, resorts, and service facilities, which prefabricated solutions are well-suited for. Increased government focus on disaster resilience and rapid rebuilding offers a substantial opportunity for modular housing in emergency situations. Furthermore, the integration of smart home technologies and AI into prefabricated units is creating new value propositions and catering to a tech-savvy demographic.

Leading Players in the Prefabricated House Market in Thailand Market

- Siam Steel

- LifesBox Modular

- Thai Isowall Company Limited

- Kirby Building Systems

- Advance Civil Group Co Ltd

- Unibuild

- Modern Modular Co Ltd

- Container Kings

- Karmod Prefabricated Technologies

- Maxxi Factory

Key Developments in Prefabricated House Market in Thailand Industry

- June 2022: Naval Facilities Engineering Systems Command (NAVFAC) Pacific Resident Officer in Charge of Construction (ROICC) Thailand completed construction of an Unmanned Aerial System (UAS) Operations Support Facility on June 9 at U-Tapao Royal Thai Navy Airfield. ROICC Thailand awarded a 100-day construction contract to a local Thai company to provide a 1,600 square feet two-story facility with a control room, maintenance room, and storage for launch and retrieval equipment. The prefabricated facility was assembled on-site in record time. This highlights the efficiency and speed of prefabricated solutions for critical infrastructure.

- March 2021: Panasonic chose Thailand as the first country in the region to offer modular construction housing by partnering with Siam Steel International, Thailand's leading manufacturer of steel products and building materials. The company is providing two types of houses, producing and selling six models measuring 200 square meters, 250 sq m, and 370 sq m, while the price is set at THB 35,000 (USD 1068) per sq m. Panasonic aims to develop mid-priced housing projects at THB 5-10 (USD 0.15-0.31) million per unit. This signifies a major push towards mainstream adoption of prefabricated housing by a global brand.

Future Outlook for Prefabricated House Market in Thailand Market

The future outlook for the prefabricated house market in Thailand is exceptionally bright, characterized by sustained growth and increasing market penetration. The continued emphasis on affordable housing solutions, coupled with government support for infrastructure development, will remain core growth accelerators. Advancements in material science and manufacturing technologies will further enhance the quality, affordability, and sustainability of prefabricated homes, making them increasingly competitive against traditional construction methods. The market is poised to benefit from growing environmental consciousness among consumers and developers, leading to higher demand for green building solutions. Strategic partnerships and increasing foreign investment are expected to further bolster innovation and market expansion, solidifying prefabricated construction as a mainstream and preferred building method in Thailand.

Prefabricated House Market in Thailand Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Applications (Infrastructure and Industrial)

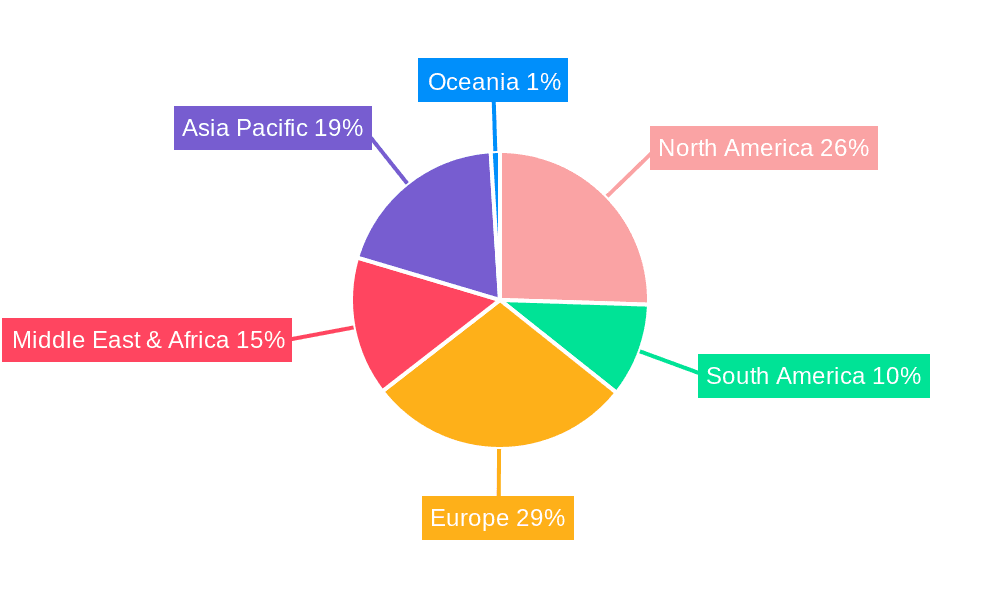

Prefabricated House Market in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Prefabricated House Market in Thailand Regional Market Share

Geographic Coverage of Prefabricated House Market in Thailand

Prefabricated House Market in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing number of startups

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Construction Investment to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Applications (Infrastructure and Industrial)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Applications (Infrastructure and Industrial)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Applications (Infrastructure and Industrial)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Applications (Infrastructure and Industrial)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Applications (Infrastructure and Industrial)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Prefabricated House Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Applications (Infrastructure and Industrial)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Siam Steel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LifesBox Modular

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thai Isowall Company Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kirby Building Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advance Civil Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unibuild

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Modern Modular Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Container Kings

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Karmod Prefabricated Technologies**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Maxxi Factory

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Siam Steel

List of Figures

- Figure 1: Global Prefabricated House Market in Thailand Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 7: South America Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 8: South America Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 15: Middle East & Africa Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 16: Middle East & Africa Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Prefabricated House Market in Thailand Revenue (billion), by Application 2025 & 2033

- Figure 19: Asia Pacific Prefabricated House Market in Thailand Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Prefabricated House Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Prefabricated House Market in Thailand Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Global Prefabricated House Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Prefabricated House Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Prefabricated House Market in Thailand?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Prefabricated House Market in Thailand?

Key companies in the market include Siam Steel, LifesBox Modular, Thai Isowall Company Limited, Kirby Building Systems, Advance Civil Group Co Ltd, Unibuild, Modern Modular Co Ltd, Container Kings, Karmod Prefabricated Technologies**List Not Exhaustive, Maxxi Factory.

3. What are the main segments of the Prefabricated House Market in Thailand?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing number of startups.

6. What are the notable trends driving market growth?

Construction Investment to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Low Awareness and Privacy Issues.

8. Can you provide examples of recent developments in the market?

June 2022: Naval Facilities Engineering Systems Command (NAVFAC) Pacific Resident Officer in Charge of Construction (ROICC) Thailand completed construction of an Unmanned Aerial System (UAS) Operations Support Facility on June 9 at U-Tapao Royal Thai Navy Airfield in Thailand. ROICC Thailand awarded a 100-day construction contract to a local Thai company to provide a 1,600 square feet two-story facility with a control room, maintenance room, and storage for the launch and retrieval equipment. The prefabricated facility was assembled on-site in record time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Prefabricated House Market in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Prefabricated House Market in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Prefabricated House Market in Thailand?

To stay informed about further developments, trends, and reports in the Prefabricated House Market in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence