Key Insights

The Russia automotive composites market is projected to reach $11.1 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 14.5% through 2033. Key growth drivers include the escalating demand for lightweight vehicles to improve fuel efficiency and reduce emissions, alongside stringent government regulations promoting eco-friendly automotive technologies. The industry's increasing adoption of advanced composite materials, such as carbon fiber and glass fiber, offers superior strength-to-weight ratios and enhanced design flexibility. Furthermore, efficient manufacturing techniques like resin transfer molding (RTM) and vacuum infusion processing are contributing to market expansion. Automotive composites are widely applied in powertrain, exterior, interior, and structural assemblies within the Russian automotive sector. The market is segmented by material type (thermoset, thermoplastic, carbon fiber, glass fiber, others), production type (hand layup, RTM, vacuum infusion, injection molding, compression molding), and application (powertrain, exterior, interior, structural assembly, others). Key industry players include Cytec Industries, BASF, and Gurit, who are driving innovation and strategic collaborations.

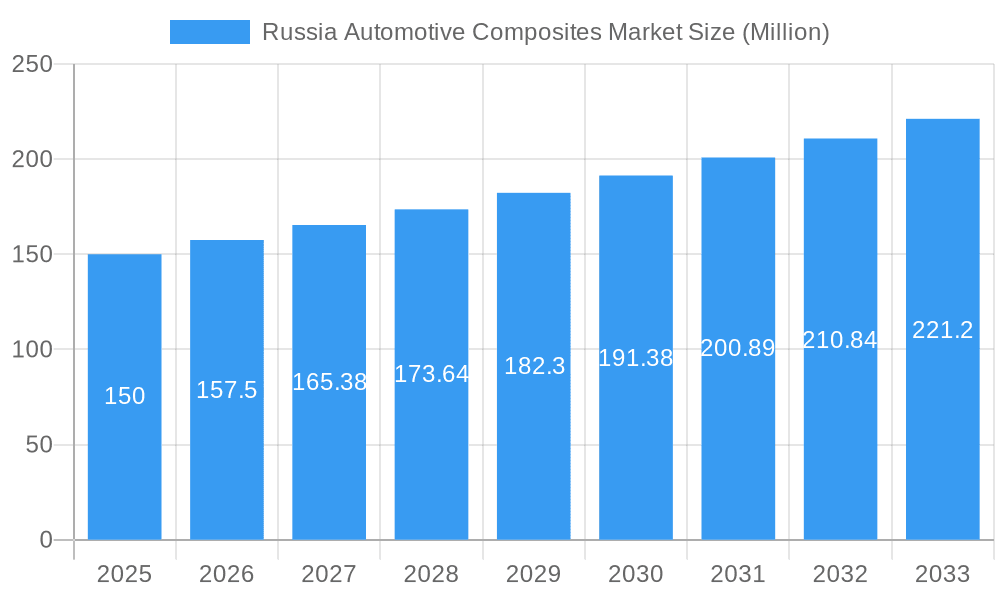

Russia Automotive Composites Market Market Size (In Billion)

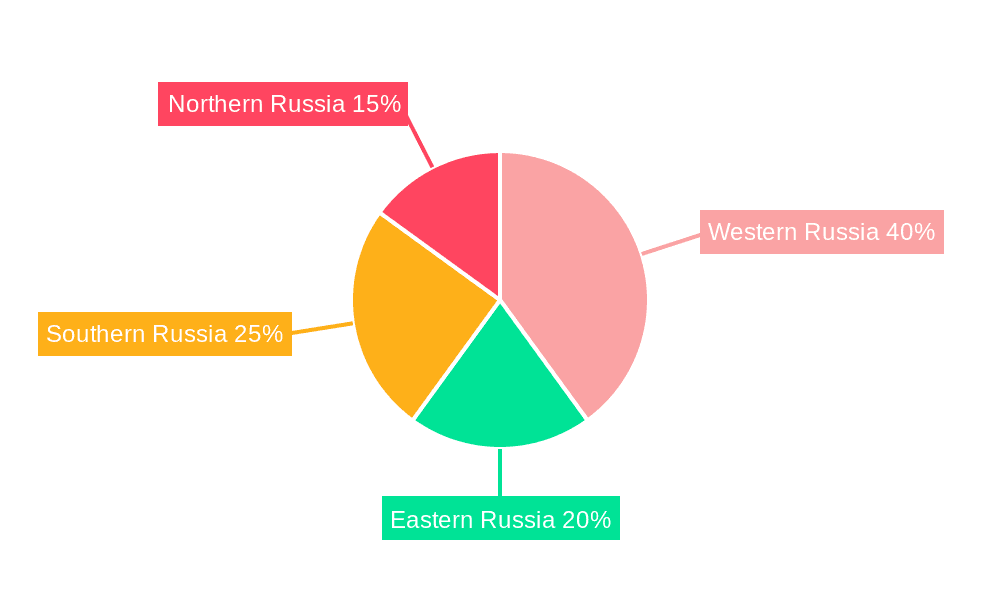

Despite positive growth prospects, challenges such as economic volatility, potential supply chain disruptions, and the comparatively higher cost of advanced composites compared to traditional materials may act as restraints. The development and implementation of sustainable recycling and disposal methods for composite materials are critical for long-term market sustainability. Nonetheless, the strong industry emphasis on vehicle lightweighting, coupled with the growing availability of advanced composite materials and manufacturing technologies, positions the Russian automotive composites market for significant expansion. Regional market dynamics are expected to vary due to differing levels of automotive industry development across Western, Eastern, Southern, and Northern Russia. Tailored market entry and expansion strategies will be essential for each region.

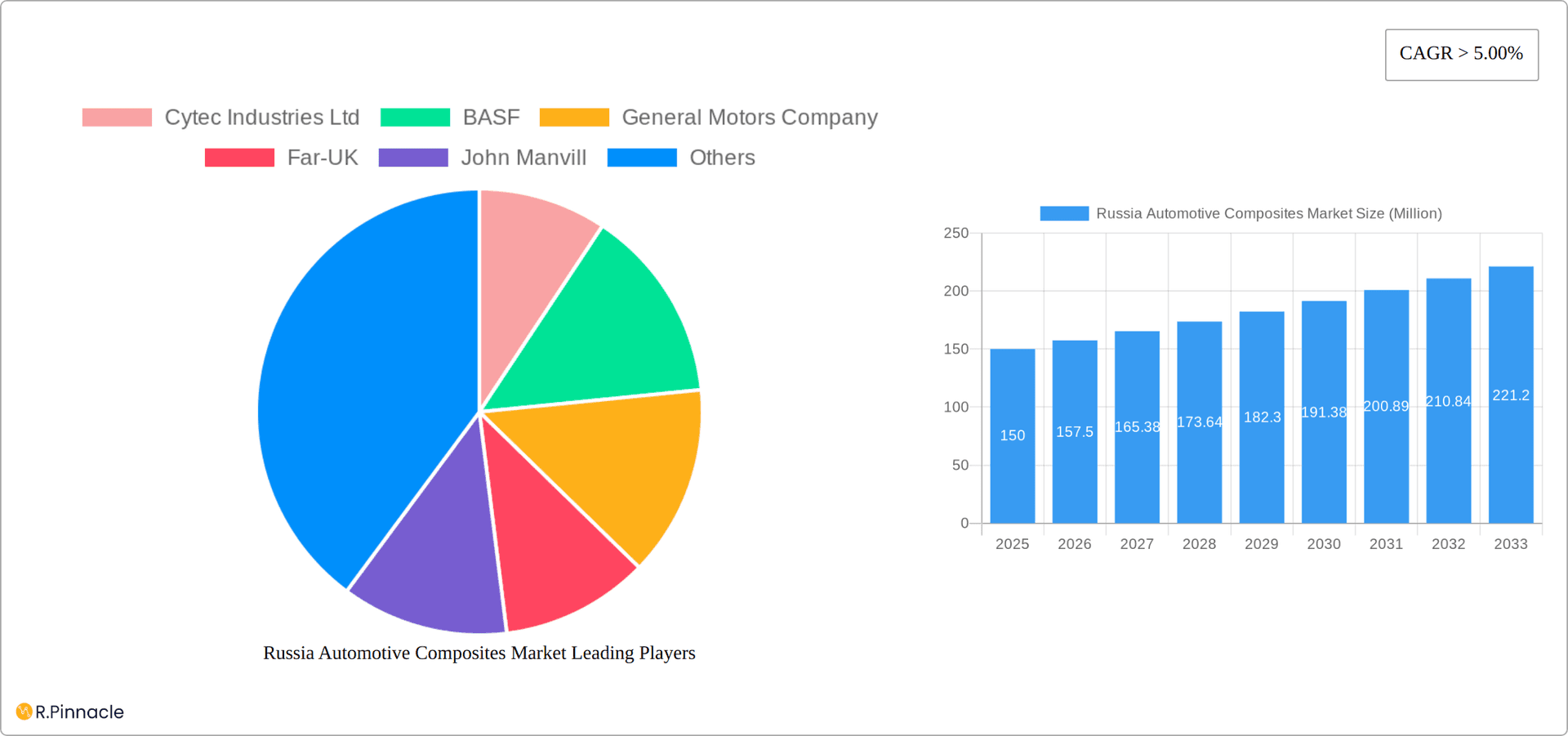

Russia Automotive Composites Market Company Market Share

Russia Automotive Composites Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia Automotive Composites Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers a detailed understanding of market dynamics, growth drivers, challenges, and future opportunities. The market size is projected to reach xx Million by 2033.

Russia Automotive Composites Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Russia Automotive Composites Market, focusing on market concentration, innovation drivers, regulatory frameworks, and M&A activities. We examine the market share of key players such as Cytec Industries Ltd, BASF, General Motors Company, Far-UK, John Manvill, Delphi Technologies, Gurit, 3B-Fiberglass, Base Group, and BMW. The report also details the impact of regulatory changes and the role of technological advancements in shaping the market's trajectory. M&A activities are analyzed, including deal values (xx Million in total for the period 2019-2024, with an estimated xx Million in 2025) and their influence on market consolidation. The analysis includes:

- Market Concentration: A detailed analysis of market share held by major players, revealing the level of competition and dominance.

- Innovation Drivers: Identification of key technological advancements driving innovation and product development within the sector.

- Regulatory Landscape: A comprehensive assessment of relevant regulations and their impact on market growth and competitiveness.

- Product Substitutes: Exploration of potential substitute materials and their impact on market dynamics.

- End-User Demographics: Analysis of the key end-users driving demand within the market.

- M&A Activity: Detailed overview of mergers and acquisitions, including deal sizes and their strategic implications.

Russia Automotive Composites Market Dynamics & Trends

This section delves into the key factors shaping the Russia Automotive Composites Market's growth trajectory. We explore market growth drivers (e.g., increasing demand for lightweight vehicles, government initiatives promoting fuel efficiency), technological disruptions (e.g., advancements in material science, automation in manufacturing processes), consumer preferences (e.g., demand for enhanced vehicle safety and aesthetics), and competitive dynamics. The report projects a CAGR of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Specific trends and market shifts are analyzed in detail, providing a comprehensive understanding of the market’s evolution.

Dominant Regions & Segments in Russia Automotive Composites Market

This section identifies the leading regions and segments within the Russia Automotive Composites Market. The analysis focuses on Material Type (Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, Glass Fiber, Others), Production Type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, Compression Molding), and Application (Powertrain Components, Exterior, Interior, Structural Assembly, Others). Key drivers for each dominant segment are highlighted, offering a comprehensive overview of market leadership:

- Leading Region: [Insert Dominant Region] – This dominance is attributed to robust automotive manufacturing hubs, significant government investment in regional industrial development, and favorable logistical networks that support efficient supply chains for composite materials. Factors like established automotive clusters and regional economic growth further bolster its leading position.

- Leading Material Type: [Insert Dominant Material Type] – The preference for [Insert Dominant Material Type] is driven by its optimal balance of cost-effectiveness and performance characteristics for a wide array of automotive applications. Its ready availability within the Russian market and the established manufacturing expertise further solidify its leading status, meeting the diverse needs of the automotive sector.

- Leading Production Type: [Insert Dominant Production Type] – [Insert Dominant Production Type] stands out due to its inherent production efficiency, excellent scalability to meet high-volume demands, and its versatility in producing complex composite parts. This method is particularly well-suited for high-volume automotive component manufacturing, contributing to cost optimization and rapid market response.

- Leading Application: [Insert Dominant Application] – The strong demand in the [Insert Dominant Application] segment is fueled by the automotive industry's continuous drive for weight reduction, enhanced safety features, and improved fuel efficiency. Innovations in composite material design and manufacturing specifically tailored for [Insert Dominant Application] are key contributors to its market prominence.

Russia Automotive Composites Market Product Innovations

This section summarizes recent product developments, highlighting key technological advancements and their market fit within the Russian automotive landscape. Focus is placed on innovations that enhance material properties, such as improved strength-to-weight ratios and increased durability, as well as advancements in manufacturing processes that lead to higher production rates and reduced costs. Furthermore, we examine innovations tailored for specific application-driven performance improvements in areas like noise, vibration, and harshness (NVH) reduction and crashworthiness. The analysis investigates how these innovations contribute to competitive advantages, foster market differentiation, and enable manufacturers to meet evolving industry standards and consumer expectations.

Report Scope & Segmentation Analysis

This report comprehensively segments the Russia Automotive Composites Market across Material Type, Production Type, and Application. Each segment's market size, growth projections, and competitive dynamics are detailed. Detailed breakdowns for each segment are presented, projecting growth trajectories and assessing competitive forces within each area.

Key Drivers of Russia Automotive Composites Market Growth

The growth of the Russia Automotive Composites Market is driven by several factors, including: increasing demand for lightweight vehicles to improve fuel efficiency, government regulations promoting the use of sustainable materials, technological advancements leading to improved material performance and processing, and rising investments in automotive research and development.

Challenges in the Russia Automotive Composites Market Sector

The Russia Automotive Composites Market navigates several significant challenges. Fluctuating raw material prices, particularly for specialized fibers and resins, introduce cost volatility and impact profitability. Geopolitical uncertainties continue to pose risks to supply chain stability, potentially leading to disruptions and delays in material procurement. Stringent environmental regulations are increasingly demanding sustainable manufacturing practices, necessitating investments in eco-friendly processes and materials. Furthermore, intense competition from both established domestic manufacturers and international players vying for market share requires continuous innovation and cost-efficiency to maintain a competitive edge. Addressing these complexities requires adaptive strategies and robust risk management.

Emerging Opportunities in Russia Automotive Composites Market

Emerging opportunities within the Russia Automotive Composites Market are primarily driven by the burgeoning demand for electric and hybrid vehicles, which necessitates lighter weight materials to enhance battery range and overall efficiency. Technological advancements are continuously offering higher-performance composite materials with superior mechanical properties and tailored functionalities. Growing investments in infrastructure development, including the expansion and modernization of automotive manufacturing facilities, are fostering increased demand for advanced automotive components made from composites. These converging trends present significant potential for market growth and the introduction of novel composite solutions.

Leading Players in the Russia Automotive Composites Market Market

- Cytec Industries Ltd

- BASF

- General Motors Company

- Far-UK

- John Manvill

- Delphi Technologies

- Gurit

- 3B-Fiberglass

- Base Group

- BMW

Key Developments in Russia Automotive Composites Market Industry

- [Insert key development with date, e.g., "January 2023: Launch of new carbon fiber composite by Company X"]

- [Insert key development with date]

- [Insert key development with date]

Future Outlook for Russia Automotive Composites Market Market

The future of the Russia Automotive Composites Market appears promising, driven by continued technological advancements, supportive government policies, and strong demand from the automotive industry. The market is poised for considerable growth, presenting significant opportunities for companies to capitalize on emerging trends and expand their market share. Strategic partnerships and investments in research and development will be crucial for success in this dynamic market.

Russia Automotive Composites Market Segmentation

-

1. Material Type

- 1.1. Thermoset Polymer

- 1.2. Thermoplastic Polymer

- 1.3. Carbon Fiber

- 1.4. Glass Fiber

- 1.5. Others

-

2. Production Type

- 2.1. Hand Layup

- 2.2. Resin Transfer Molding

- 2.3. Vacuum Infusion Processing

- 2.4. Injection Molding

- 2.5. Compression Molding

-

3. Application

- 3.1. Powertrain Components

- 3.2. Exterior

- 3.3. Interior

- 3.4. Structural Assembly

- 3.5. Others

Russia Automotive Composites Market Segmentation By Geography

- 1. Russia

Russia Automotive Composites Market Regional Market Share

Geographic Coverage of Russia Automotive Composites Market

Russia Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Trend to Decrease weight Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Thermoset Polymer

- 5.1.2. Thermoplastic Polymer

- 5.1.3. Carbon Fiber

- 5.1.4. Glass Fiber

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Production Type

- 5.2.1. Hand Layup

- 5.2.2. Resin Transfer Molding

- 5.2.3. Vacuum Infusion Processing

- 5.2.4. Injection Molding

- 5.2.5. Compression Molding

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Powertrain Components

- 5.3.2. Exterior

- 5.3.3. Interior

- 5.3.4. Structural Assembly

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cytec Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Motors Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Far-UK

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 John Manvill

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Delphi Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gurit

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3B-Fiberglass

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Base Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BMW

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cytec Industries Ltd

List of Figures

- Figure 1: Russia Automotive Composites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Automotive Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Automotive Composites Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Russia Automotive Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 3: Russia Automotive Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Russia Automotive Composites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russia Automotive Composites Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Russia Automotive Composites Market Revenue billion Forecast, by Production Type 2020 & 2033

- Table 7: Russia Automotive Composites Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Russia Automotive Composites Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Automotive Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Russia Automotive Composites Market?

Key companies in the market include Cytec Industries Ltd, BASF, General Motors Company, Far-UK, John Manvill, Delphi Technologies, Gurit, 3B-Fiberglass, Base Group, BMW.

3. What are the main segments of the Russia Automotive Composites Market?

The market segments include Material Type, Production Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Trend to Decrease weight Driving Growth.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Russia Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence