Key Insights

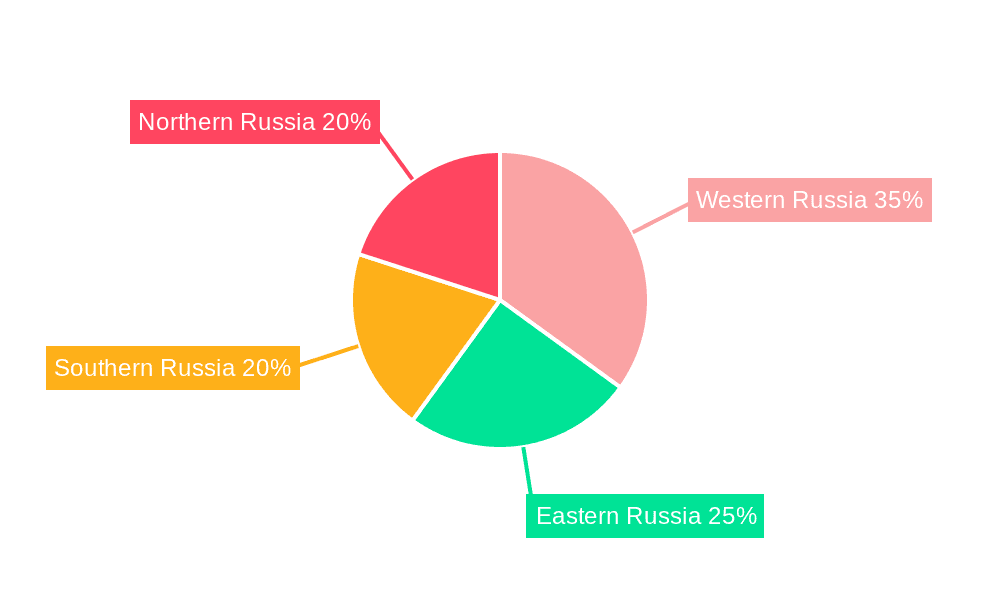

The Russian mining machine industry, valued at approximately $160.19 billion in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 8% throughout the forecast period (2025-2033). This expansion is driven by escalating demand for minerals and metals, government initiatives supporting mining modernization, and a focus on enhancing sector efficiency. The market is segmented by mining type (surface and underground), equipment type (mineral processing, among others), application (metal, mineral, coal mining), and powertrain (internal combustion engines and electric). The electric powertrain segment is anticipated to grow significantly due to increasing environmental consciousness and government mandates promoting sustainable mining. However, market expansion may be constrained by economic volatility, fluctuating commodity prices, and potential sanctions impacting technology imports. Regional analysis indicates varying growth potential across Western, Eastern, Southern, and Northern Russia, with certain regions expected to benefit more from infrastructure and resource development investments. Key competitors, including Hitachi Construction Machinery, Kopeysk Machine Building Plant, and Uralmash, are actively pursuing market share through innovation and strategic alliances. The industry is set for substantial transformation, necessitating adaptation to technological advancements and evolving regulatory frameworks.

Russian Mining Machine Industry Market Size (In Billion)

The prevalence of specific mining types, such as metal mining, within the application segment will shape demand for particular equipment. The growing trend towards automation and digitalization in mining operations presents significant opportunities for companies offering advanced technologies. The competitive landscape is likely to witness an increase in mergers and acquisitions as firms seek economies of scale and technological leadership. Furthermore, the emphasis on sustainable mining practices will expedite the adoption of eco-friendly technologies, potentially creating new market niches and specialized equipment providers. A comprehensive understanding of the interplay between technological innovation, regulatory changes, and economic conditions is vital for success in the Russian mining machine industry.

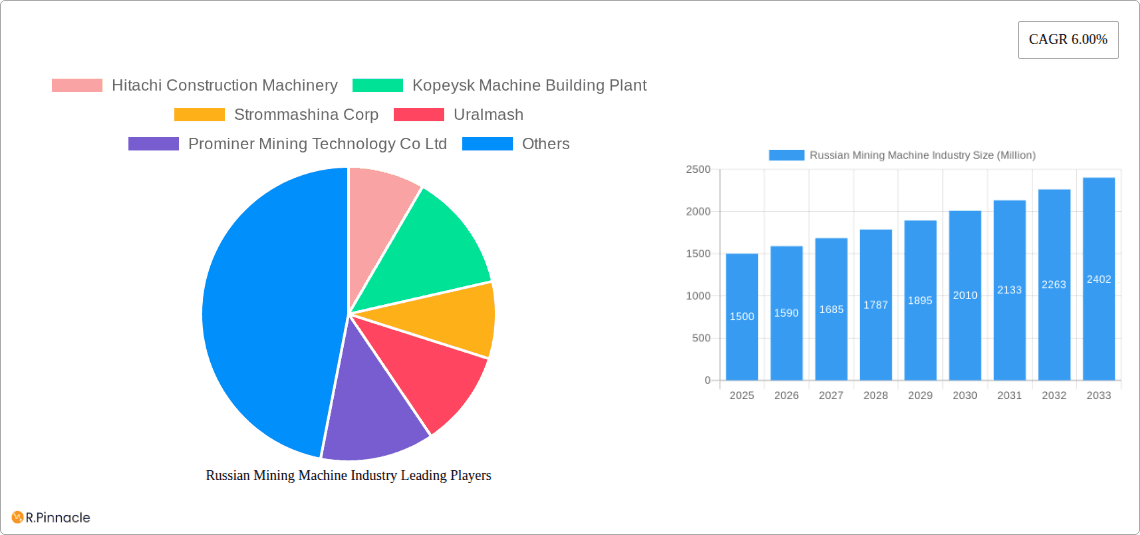

Russian Mining Machine Industry Company Market Share

Russian Mining Machine Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Russian mining machine industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on market dynamics, innovation trends, and future growth potential, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The total market size in 2025 is estimated at $XX Million.

Russian Mining Machine Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the Russian mining machine market. Market concentration is moderate, with Uralmash and Kopeysk Machine Building Plant holding significant market share (combined xx%). Innovation is driven by increasing automation, the adoption of electric powertrains, and the need for enhanced efficiency in resource extraction. Regulatory frameworks, including environmental regulations and safety standards, significantly impact market dynamics. Product substitutes, primarily focused on improving efficiency and reducing environmental impact, are gaining traction. Recent M&A activity, although relatively limited, indicates a potential consolidation trend, with a total deal value of approximately $XX Million in the past five years. End-user demographics show a continued focus on large-scale mining operations, particularly in coal and metal mining.

- Market Share: Uralmash (xx%), Kopeysk Machine Building Plant (xx%), Others (xx%)

- M&A Activity: Total Deal Value (2019-2024): ~$XX Million

- Key Innovation Drivers: Automation, Electric Powertrains, Environmental Regulations

Russian Mining Machine Industry Market Dynamics & Trends

The Russian mining machine market demonstrates robust growth, driven by increasing demand for minerals and metals, coupled with government initiatives to modernize the mining sector. The CAGR from 2025 to 2033 is projected at xx%. This growth is fueled by technological advancements, such as the integration of IoT and AI in mining equipment, leading to enhanced productivity and operational efficiency. Consumer preference leans toward advanced, environmentally friendly equipment that minimizes operational costs. Competitive dynamics are characterized by both domestic and international players vying for market share. Market penetration of electric powertrains is expected to increase significantly by 2033, driven by government incentives and the desire for reduced operational costs and environmental footprint. Specific growth drivers include increasing investment in mining projects and rising metal prices.

Dominant Regions & Segments in Russian Mining Machine Industry

The Siberian Federal District is currently the dominant region for mining machine sales, driven by its extensive mineral reserves and ongoing mining expansion. Within market segments, the underground mining equipment segment holds the largest market share, due to the prevalence of underground mining operations within the country. The metal mining application segment is the most significant in terms of revenue, followed by coal mining. The market for mineral processing equipment is expanding, reflecting the growing need for efficient mineral processing facilities. The IC Engine powertrain type currently dominates, but electric powertrains are experiencing rapid growth, driven by increasing environmental awareness and government regulations.

- Key Drivers for Siberian Federal District Dominance: Abundant Mineral Resources, Government Investment in Mining Infrastructure

- Key Drivers for Underground Mining Segment Dominance: Prevalent Underground Mining Operations, High Demand for Specialized Equipment

- Key Drivers for Metal Mining Application Dominance: High Demand for Metals, Large Scale Mining Operations

Russian Mining Machine Industry Product Innovations

Recent product developments focus on increased automation, improved safety features, and enhanced fuel efficiency. The integration of advanced technologies like AI and IoT improves productivity and reduces operational costs. These innovations cater to the growing need for efficient, safe, and environmentally conscious mining operations. Electric powertrains offer significant competitive advantages in terms of reduced emissions and operational costs, aligning with global sustainability initiatives.

Report Scope & Segmentation Analysis

This report comprehensively segments the Russian mining machine market based on type (surface mining, underground mining, mineral processing equipment), application (metal mining, mineral mining, coal mining), and powertrain type (IC Engines, Electric). Each segment's growth projections, market size, and competitive dynamics are meticulously analyzed. The underground mining segment is projected to witness the highest growth rate, while the electric powertrain segment shows considerable expansion potential. Competitive dynamics vary across segments, reflecting the presence of both domestic and international players.

Key Drivers of Russian Mining Machine Industry Growth

The growth of the Russian mining machine industry is driven by a number of factors, including: (1) increasing demand for minerals and metals globally; (2) government initiatives promoting modernization and investment in the mining sector; (3) technological advancements leading to higher efficiency and productivity; and (4) rising metal prices boosting profitability.

Challenges in the Russian Mining Machine Industry Sector

Key challenges include: (1) the volatility of raw material prices, which directly impacts investment; (2) stringent environmental regulations that increase compliance costs; (3) import restrictions that limit access to certain components; and (4) intense competition from both domestic and international companies. The combined impact of these challenges is an estimated annual revenue loss of approximately $XX Million.

Emerging Opportunities in Russian Mining Machine Industry

Growing opportunities include: (1) the increasing adoption of automation and digital technologies within the mining industry; (2) the development of environmentally friendly mining equipment; (3) expansion into new mining regions; and (4) exploration of potential mining partnerships with international companies. The potential revenue generated from these opportunities is estimated at $XX Million annually by 2033.

Leading Players in the Russian Mining Machine Industry Market

- Hitachi Construction Machinery

- Kopeysk Machine Building Plant

- Strommashina Corp

- Uralmash

- Prominer Mining Technology Co Ltd

- Xinhai Mineral Processing EP

- UZTM Kartex Gazprombank Group

- DXN

- Mitsubishi Corporation (Russia) LLC

Key Developments in Russian Mining Machine Industry Industry

- 2022 Q4: Uralmash launched a new line of automated drilling rigs.

- 2023 Q1: A joint venture between Strommashina Corp and a foreign partner was announced.

- 2024 Q2: New environmental regulations impacted the market for IC Engine-powered equipment. (Specific details on impact are required for accurate reporting.)

Future Outlook for Russian Mining Machine Industry Market

The Russian mining machine industry is poised for continued growth, driven by technological innovation and increased investment in the mining sector. The growing adoption of automation, electric powertrains, and environmentally friendly technologies will shape the industry's future. Strategic partnerships and collaborations are anticipated to drive further expansion and diversification. The market is expected to surpass $XX Million by 2033.

Russian Mining Machine Industry Segmentation

-

1. Type

- 1.1. Surface Mining

- 1.2. Underground Mining

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engines

- 3.2. Electric

Russian Mining Machine Industry Segmentation By Geography

- 1. Russia

Russian Mining Machine Industry Regional Market Share

Geographic Coverage of Russian Mining Machine Industry

Russian Mining Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Segment Grows with High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Mining Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining

- 5.1.2. Underground Mining

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engines

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kopeysk Machine Building Plant

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Strommashina Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uralmash

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prominer Mining Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhai Mineral Processing EP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UZTM Kartex Gazprombank Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXN

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Corporation (Russia) LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi Construction Machinery

List of Figures

- Figure 1: Russian Mining Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Mining Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 4: Russian Mining Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 8: Russian Mining Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Mining Machine Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Russian Mining Machine Industry?

Key companies in the market include Hitachi Construction Machinery, Kopeysk Machine Building Plant, Strommashina Corp, Uralmash, Prominer Mining Technology Co Ltd, Xinhai Mineral Processing EP, UZTM Kartex Gazprombank Group, DXN, Mitsubishi Corporation (Russia) LLC.

3. What are the main segments of the Russian Mining Machine Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.19 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Electric Vehicles Segment Grows with High CAGR.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Mining Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Mining Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Mining Machine Industry?

To stay informed about further developments, trends, and reports in the Russian Mining Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence