Key Insights

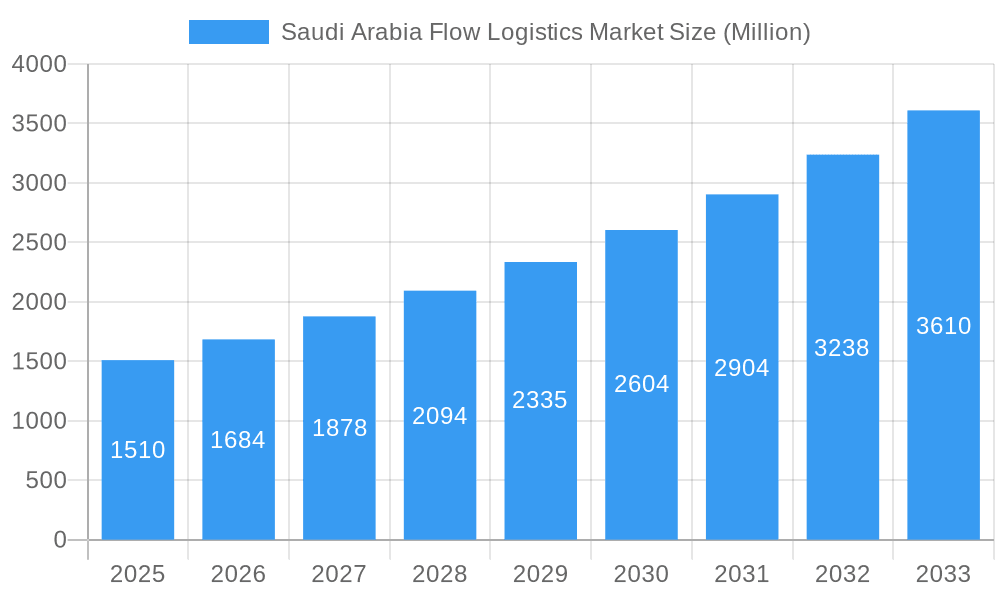

The Saudi Arabian cold chain logistics market, valued at $1.51 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.39% from 2025 to 2033. This surge is driven by several key factors. The burgeoning food and beverage sector, particularly the increasing demand for fresh produce, dairy, and processed foods, necessitates efficient cold chain solutions. Furthermore, the Saudi government's investment in infrastructure development, including improved warehousing and transportation networks, significantly contributes to market expansion. The rising adoption of advanced technologies like temperature monitoring systems and improved logistics management software further enhances efficiency and reduces spoilage, fueling market growth. Growth is also spurred by the increasing focus on food safety and quality regulations, pushing businesses to adopt robust cold chain practices. The diverse end-user segments, encompassing horticulture, dairy, meat, fish, poultry, processed foods, and pharmaceuticals, contribute to the market's breadth and potential.

Saudi Arabia Flow Logistics Market Market Size (In Billion)

Segmentation reveals significant opportunities within specific areas. The value-added services segment, including blast freezing, labeling, and inventory management, is poised for considerable growth, reflecting the industry's move towards comprehensive logistics solutions. Frozen products are likely to dominate the temperature segment due to their longer shelf life and the increasing demand for imported frozen food items. While challenges exist, such as maintaining consistent temperature control across the extensive geographical regions of Saudi Arabia and managing potential fluctuations in energy costs, the overall growth outlook remains overwhelmingly positive, presenting lucrative investment opportunities for logistics providers. The presence of established players like Al-Theyab Logistics, IFFCO Logistics, and Naqel Express, alongside emerging local companies, indicates a dynamic and competitive market landscape.

Saudi Arabia Flow Logistics Market Company Market Share

Saudi Arabia Flow Logistics Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia flow logistics market, offering valuable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market size, growth drivers, challenges, and emerging opportunities. The report leverages extensive primary and secondary research to provide a granular understanding of the market dynamics, including detailed segmentation by service, temperature, and end-user. The report also highlights key players such as Al-Theyab Logistics Co, IFFCO Logistics, NAQEL Express, Agility Logistics, Wared Logistics, Coldstores Group of Saudi Arabia, United Warehouse Company, Takhzeen Logistics, 3 Camels Party Logistics, Almajdouie Logistics, and Mosanada Logistics Services (list not exhaustive).

Saudi Arabia Flow Logistics Market Structure & Innovation Trends

The Saudi Arabian flow logistics market exhibits a moderately concentrated structure, with a few major players holding significant market share. Market share data for 2024 suggests that the top five players collectively account for approximately xx% of the market. Innovation is driven by the increasing adoption of technology, government initiatives to improve infrastructure, and the growing e-commerce sector. The regulatory framework, while evolving, generally supports market growth. Product substitutes are limited, primarily focusing on alternative transportation modes. End-user demographics are shifting towards greater demand from the food and beverage, pharmaceutical, and e-commerce sectors. M&A activity has been moderate in recent years, with several deals valued at over USD xx Million driving consolidation within the market.

- Market Concentration: Moderately concentrated, top 5 players holding xx% market share (2024).

- Innovation Drivers: Technological advancements, government infrastructure projects, e-commerce growth.

- Regulatory Framework: Supportive, undergoing continuous evolution.

- Product Substitutes: Limited, mostly alternative transport options.

- End-User Demographics: Growth driven by food & beverage, pharma, and e-commerce.

- M&A Activity: Moderate activity, deals exceeding USD xx Million.

Saudi Arabia Flow Logistics Market Dynamics & Trends

The Saudi Arabia flow logistics market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, expanding e-commerce penetration, and significant investments in infrastructure development. Technological disruptions, particularly in areas such as automation, IoT, and AI, are transforming logistics operations. Consumer preferences are shifting towards faster, more reliable, and more transparent delivery services. The competitive landscape is characterized by both intense rivalry among established players and the emergence of new entrants. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration increasing from xx% in 2024 to xx% by 2033.

Dominant Regions & Segments in Saudi Arabia Flow Logistics Market

The Jeddah and Riyadh regions dominate the Saudi Arabian flow logistics market, driven by factors such as their strategic locations, well-developed infrastructure, and high population density. Within the market segments, the cold chain logistics segment, encompassing both chilled and frozen storage and transportation, is experiencing particularly strong growth, fueled by rising demand for perishable goods. The food and beverage sector, particularly the dairy and processed food segments, are major end-users of these services.

Key Drivers (Jeddah & Riyadh): Strategic location, advanced infrastructure, high population density.

Cold Chain Logistics Dominance: Driven by perishable goods demand, particularly in food and beverage.

Major End-Users: Dairy products, processed foods, pharmaceuticals.

By Service: Storage currently holds the largest market share, followed by Transportation and Value-Added Services. Value-added services are experiencing the fastest growth.

By Temperature: Frozen segment is larger than chilled, driven by the increasing demand for frozen food products.

By End User: The Food & Beverage sector dominates, followed by Pharma and Life Sciences. E-commerce is a rapidly growing segment.

Saudi Arabia Flow Logistics Market Product Innovations

Recent product innovations focus on enhancing efficiency and traceability through the implementation of technology like blockchain, RFID tracking, and advanced warehouse management systems (WMS). These innovations aim to improve supply chain visibility, reduce waste, and enhance customer satisfaction. The market is witnessing the integration of automation and robotics to optimize warehousing and transportation processes. These technological advancements are creating significant competitive advantages for companies that adopt them rapidly.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Saudi Arabia flow logistics market across various parameters.

- By Service: Storage, Transportation, Value-added Services (Blast Freezing, Labeling, Inventory Management, etc.) Each service segment exhibits different growth projections and competitive dynamics. Storage has the largest market size currently, while value-added services show the highest growth potential.

- By Temperature: Chilled and Frozen. Frozen products constitute a significantly large portion of the cold chain logistics market, driven by increased demand for frozen foods.

- By End User: Horticulture (Fresh Fruits and Vegetables), Dairy Products (Milk, Ice-cream, Butter, etc.), Meats, Fish, and Poultry, Processed Food Products, Pharma and Life Sciences, Other End Users. The Food & Beverage sector is the largest end-user, with high growth potential in the Pharma and Life Sciences segments.

Key Drivers of Saudi Arabia Flow Logistics Market Growth

The Saudi Arabian flow logistics market is propelled by significant government investments in infrastructure development, including new ports and logistics parks. The booming e-commerce sector necessitates efficient logistics solutions. Additionally, the government's focus on Vision 2030, aimed at diversifying the economy and improving logistics infrastructure, fuels significant growth. These factors, along with the rising demand for imported goods, contribute to the market's expansion.

Challenges in the Saudi Arabia Flow Logistics Market Sector

Challenges include the high cost of labor, a shortage of skilled personnel, and the need for further improvements in infrastructure, particularly in certain regions. Regulatory complexities and the dependence on imported equipment and technology also pose obstacles. The intense competition among existing players requires companies to constantly adapt and innovate to stay competitive. These factors can affect overall market efficiency and expansion.

Emerging Opportunities in Saudi Arabia Flow Logistics Market

Significant opportunities exist in leveraging technology for greater automation and efficiency, especially in the cold chain logistics segment. The growth of e-commerce creates demand for specialized fulfillment services. Expansion into niche markets, such as the fast-growing healthcare and perishables sectors, presents further opportunities. Lastly, focusing on sustainability and implementing eco-friendly logistics solutions are gaining traction and presenting new areas for growth.

Leading Players in the Saudi Arabia Flow Logistics Market Market

- Al-Theyab Logistics Co

- IFFCO Logistics

- NAQEL Express

- Agility Logistics

- Wared Logistics

- Coldstores Group of Saudi Arabia

- United Warehouse Company

- Takhzeen Logistics

- 3 Camels Party Logistics

- Almajdouie Logistics

- Mosanada Logistics Services

Key Developments in Saudi Arabia Flow Logistics Market Industry

- February 2023: A. P. Moller - Maersk and Saudi Ports Authority 'Mawani' launched Saudi Arabia's largest Integrated Logistics Park at Jeddah Islamic Port, significantly boosting warehousing and distribution capacity. This development will significantly impact market dynamics by increasing capacity and efficiency.

- November 2022: Agility invested USD 163 Million in a large logistics park near Jeddah, enhancing storage and distribution capabilities and increasing competition. This investment demonstrates confidence in the market’s future growth and potential.

Future Outlook for Saudi Arabia Flow Logistics Market Market

The Saudi Arabia flow logistics market is poised for continued strong growth, driven by ongoing infrastructure investments, technological advancements, and the expanding e-commerce sector. The government's commitment to Vision 2030 will continue to create a favorable environment for market expansion. Strategic partnerships and investments in technology will be critical for companies to capitalize on emerging opportunities and maintain a competitive edge in this dynamic market.

Saudi Arabia Flow Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

-

3. End User

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, and Poultry

- 3.4. Processed Food Products

- 3.5. Pharma and Life Sciences

- 3.6. Other End Users

Saudi Arabia Flow Logistics Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Flow Logistics Market Regional Market Share

Geographic Coverage of Saudi Arabia Flow Logistics Market

Saudi Arabia Flow Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. Growth of Pharmaceuticals Supporting Cold Chain Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Flow Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, and Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma and Life Sciences

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Al-Theyab Logistics Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IFFCO Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NAQEL Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Agility Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wared Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coldstores Group of Saudi Arabia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Warehouse Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takhzeen Logistics**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 3 Camels Party Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Almajdouie Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mosanada Logistics Services

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Al-Theyab Logistics Co

List of Figures

- Figure 1: Saudi Arabia Flow Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Flow Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Saudi Arabia Flow Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Flow Logistics Market?

The projected CAGR is approximately 11.39%.

2. Which companies are prominent players in the Saudi Arabia Flow Logistics Market?

Key companies in the market include Al-Theyab Logistics Co, IFFCO Logistics, NAQEL Express, Agility Logistics, Wared Logistics, Coldstores Group of Saudi Arabia, United Warehouse Company, Takhzeen Logistics**List Not Exhaustive, 3 Camels Party Logistics, Almajdouie Logistics, Mosanada Logistics Services.

3. What are the main segments of the Saudi Arabia Flow Logistics Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

Growth of Pharmaceuticals Supporting Cold Chain Logistics.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

February 2023 - A. P. Moller - Maersk and Saudi Ports Authority 'Mawani' broke ground for Saudi Arabia's largest Integrated Logistics Park at Jeddah Islamic Port. The bonded and non-bonded warehousing & distribution (W&D) facility will cover more than 70% of the total area of the Integrated Logistics Park while the remaining part will act as a hub for transhipment, air freight and LCL cargo. The W&D part will have several different sections to accommodate general warehousing and cold chain storage (fruits & vegetables, protein and confectionary & consumables). To cater to the rapid penetration of eCommerce in Saudi Arabia, the facility will also have a dedicated eCommerce fulfilment centre. The Integrated Logistics Park will be able to handle annual volumes of close to 200,000 TEUs across different products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Flow Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Flow Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Flow Logistics Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Flow Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence