Key Insights

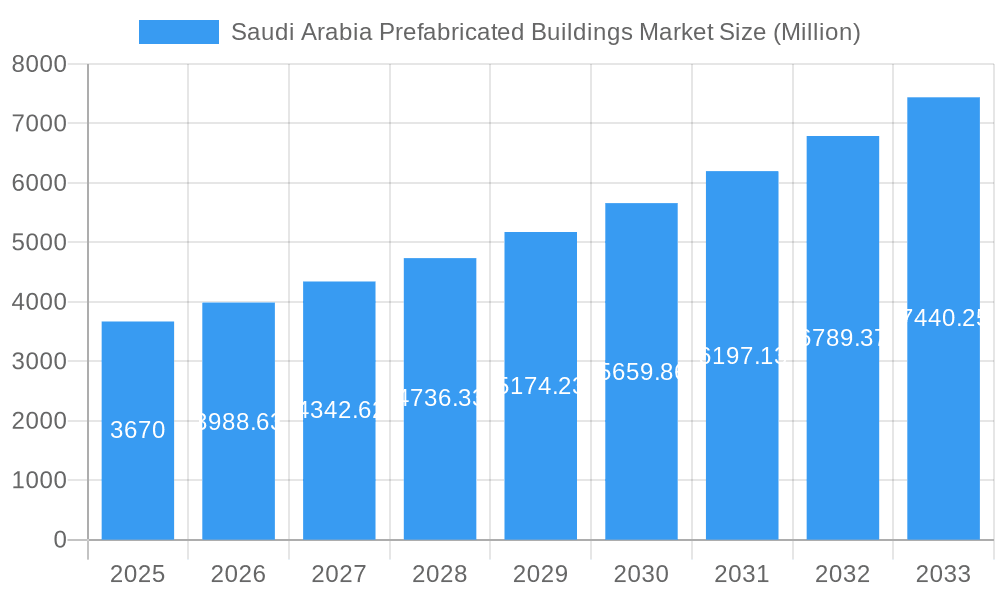

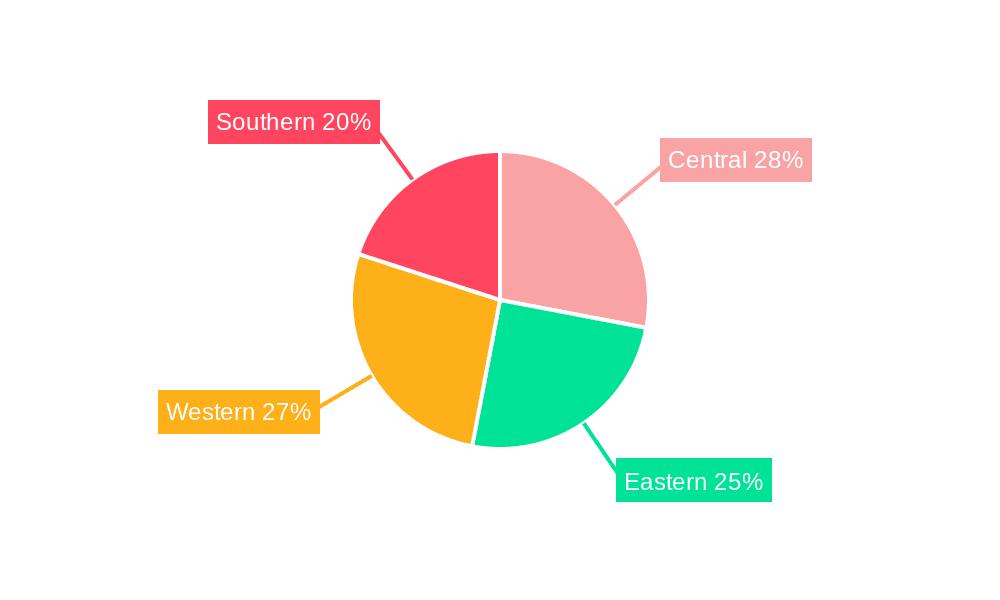

The Saudi Arabia prefabricated buildings market is experiencing robust growth, projected to reach a market size of $3.67 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) exceeding 8.59% from 2025 to 2033. This expansion is fueled by several key drivers. The Kingdom's ambitious Vision 2030 initiative, focused on infrastructure development and diversification of the economy, significantly boosts demand for rapid and cost-effective construction solutions offered by prefabricated buildings. Furthermore, the rising population and urbanization in Saudi Arabia create a surge in housing and commercial construction needs, further fueling market growth. The government's emphasis on sustainable construction practices also plays a role, as prefabricated buildings often contribute to reduced construction waste and improved energy efficiency. Segment-wise, the concrete material type and residential application sectors currently dominate, reflecting the prevalence of traditional construction methods and the substantial need for affordable housing. However, the market is witnessing a growing adoption of other materials like steel and timber, driven by innovative designs and a rising focus on sustainability. The regional distribution showcases strong demand across all regions (Central, Eastern, Western, and Southern), reflecting the nationwide development efforts.

Saudi Arabia Prefabricated Buildings Market Market Size (In Billion)

Major players like Saudi Building Systems Mfg Co, Red Sea Housing Services, and Zamil Industrial Investment Co are actively contributing to market growth through technological advancements and expansion of their product portfolios. The market's future growth trajectory will likely be influenced by government policies supporting sustainable construction, fluctuations in raw material prices, and the continuing implementation of Vision 2030 projects. Competition is expected to intensify as new entrants emerge and existing companies strive to differentiate their offerings through innovative designs, efficient manufacturing processes, and enhanced customer service. The market's resilience stems from its ability to deliver cost-effective solutions addressing various building needs, positioning it for sustained growth in the coming years. Further market segmentation by specific building types (schools, hospitals, etc.) and a deeper analysis of technological innovations within the industry could provide more granular insights into future growth potentials.

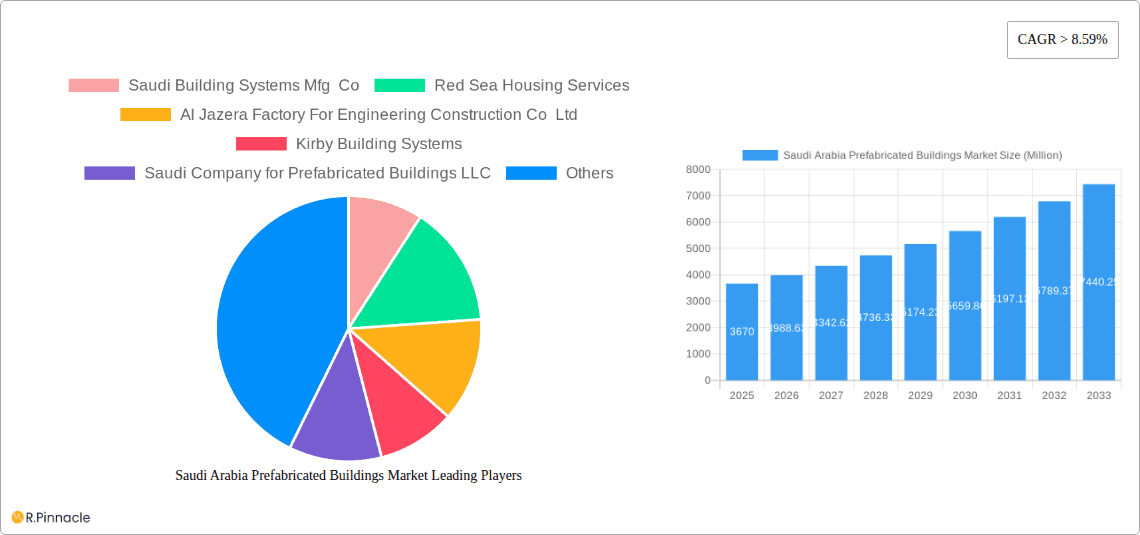

Saudi Arabia Prefabricated Buildings Market Company Market Share

Saudi Arabia Prefabricated Buildings Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia prefabricated buildings market, offering valuable insights for industry professionals, investors, and stakeholders. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report forecasts market trends from 2025 to 2033, leveraging data from the historical period of 2019-2024. The market is segmented by material type (Concrete, Glass, Metal, Timber, Other Material Types) and application (Residential, Commercial, Other Applications - Industrial, Institutional, and Infrastructure). Key players analyzed include Saudi Building Systems Mfg Co, Red Sea Housing Services, Al Jazera Factory For Engineering Construction Co Ltd, Kirby Building Systems, Saudi Company for Prefabricated Buildings LLC, Al-Shahin Metal Industries, United Company for Caravans and Prefab Houses, Zamil Industrial Investment Co, Eastern Precast Concrete, Alabniah, and others. The market is projected to reach xx Million by 2033.

Saudi Arabia Prefabricated Buildings Market Structure & Innovation Trends

This section analyzes the market structure, highlighting concentration levels, innovation drivers, regulatory influence, and competitive dynamics within the Saudi Arabian prefabricated buildings sector. We examine the impact of product substitutes, end-user demographics, and mergers and acquisitions (M&A) activities.

Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025. This is influenced by the presence of both large established players and smaller, specialized firms.

Innovation Drivers: Government initiatives promoting sustainable construction practices and the Vision 2030 plan are key innovation drivers. Technological advancements in modular construction, 3D printing, and smart building technologies are also fueling innovation.

Regulatory Framework: Building codes and regulations significantly influence material choices and construction methods. The government's focus on sustainable construction impacts the adoption of eco-friendly prefabricated building materials.

Product Substitutes: Traditional construction methods represent the primary substitute. However, the increasing preference for speed, cost-effectiveness, and efficiency is driving the shift towards prefabrication.

End-User Demographics: The growing urban population and increased demand for affordable housing are significant market drivers. Commercial construction projects, particularly in the infrastructure and industrial sectors, also contribute to market growth.

M&A Activities: The past five years have witnessed a moderate level of M&A activity, with deal values averaging approximately xx Million per transaction. These activities are primarily driven by strategies for expansion and technological integration.

Saudi Arabia Prefabricated Buildings Market Dynamics & Trends

This section explores the key market dynamics shaping the Saudi Arabian prefabricated buildings market, including growth drivers, technological disruptions, evolving consumer preferences, and competitive landscapes.

The Saudi Arabian prefabricated buildings market is experiencing robust growth, driven by factors such as the government's ambitious Vision 2030 program, rapid urbanization, and the rising demand for affordable and efficient housing solutions. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. This growth is fueled by increasing investments in infrastructure projects, a surge in tourism sector development (Red Sea Project, NEOM), and a rising preference for sustainable building practices. Technological advancements, such as the adoption of Building Information Modeling (BIM) and modular construction techniques, are further enhancing efficiency and productivity. Market penetration of prefabricated buildings is expected to increase from xx% in 2025 to xx% by 2033. Competitive dynamics are characterized by both intense competition among established players and the emergence of innovative startups. The market is also witnessing increasing adoption of sustainable and eco-friendly materials.

Dominant Regions & Segments in Saudi Arabia Prefabricated Buildings Market

This section identifies the leading regions and segments within the Saudi Arabia prefabricated buildings market.

Leading Region: The Eastern Province and Riyadh are currently the dominant regions, driven by significant infrastructure projects and a high concentration of residential and commercial developments.

Material Type: Concrete remains the most dominant material type due to its cost-effectiveness and widespread availability. However, the demand for metal and other sustainable materials is increasing due to their superior performance characteristics.

Application: Residential construction accounts for the largest share, fueled by the burgeoning population and government initiatives to provide affordable housing. However, the commercial and industrial sectors are experiencing strong growth.

Key Drivers: Several factors drive the dominance of specific segments and regions. These include government policies promoting affordable housing and infrastructure development, economic growth, and the availability of skilled labor and materials. Infrastructure development, particularly related to Vision 2030 projects, is significantly impacting the market's growth in specific regions.

Dominance Analysis: The dominance of concrete in the material type segment is primarily due to its established position, cost-effectiveness, and wide acceptance. Residential applications dominate due to the large-scale housing projects undertaken as part of the Vision 2030 plan. The Eastern Province's dominance is attributable to its industrial concentration and ongoing large-scale developments.

Saudi Arabia Prefabricated Buildings Market Product Innovations

Recent product innovations focus on incorporating sustainable materials, enhancing design flexibility, and improving construction speed. Manufacturers are emphasizing lightweight, high-strength materials and prefabricated systems that integrate renewable energy solutions. The increased adoption of BIM and modular construction methodologies facilitates streamlined design and construction processes. These innovations aim to enhance the overall value proposition of prefabricated buildings, addressing issues such as cost, efficiency, and sustainability.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia prefabricated buildings market by material type (Concrete, Glass, Metal, Timber, Other) and application (Residential, Commercial, Other). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing a comprehensive overview. Growth projections are based on current market trends, government policies, and technological advancements. The competitive landscape within each segment varies depending on factors such as technology, cost, and sustainability considerations.

Concrete: This segment is currently the largest, with steady growth projected due to its cost-effectiveness.

Metal: This segment is gaining traction due to its strength and durability, particularly in industrial and commercial projects.

Glass: This segment is experiencing moderate growth, mainly driven by high-end residential and commercial constructions.

Timber: This segment holds a smaller market share but is growing due to the rising demand for sustainable building options.

Other Materials: This segment comprises composite materials and other specialized materials with niche applications and moderate growth.

Residential: This segment accounts for the largest share due to the government's focus on affordable housing.

Commercial: This segment shows significant growth, driven by increased commercial and office space demands.

Other Applications: This segment encompasses industrial, institutional, and infrastructure projects and is experiencing steady growth.

Key Drivers of Saudi Arabia Prefabricated Buildings Market Growth

Several key factors are driving the growth of the Saudi Arabian prefabricated buildings market. These include the government's ambitious Vision 2030 initiative, promoting large-scale infrastructure development, and its focus on sustainable construction practices. The rapid urbanization and increasing population density are creating a high demand for affordable and quickly constructed housing. Furthermore, technological advancements, like the adoption of 3D printing and modular construction, are significantly improving construction efficiency and cost-effectiveness.

Challenges in the Saudi Arabia Prefabricated Buildings Market Sector

Despite the significant growth potential, the Saudi Arabia prefabricated buildings market faces several challenges. These include the high upfront capital costs associated with setting up prefabrication facilities and the need for skilled labor. The reliance on imports for certain materials can lead to supply chain disruptions and price volatility. Moreover, stringent building codes and regulations can add complexity and increase construction timelines. Competition from traditional construction methods also presents a challenge. These factors combined can potentially impact the market’s growth trajectory and need to be carefully managed.

Emerging Opportunities in Saudi Arabia Prefabricated Buildings Market

The Saudi Arabian prefabricated buildings market presents several promising opportunities. These include the growing demand for sustainable and eco-friendly building materials, the increasing adoption of advanced technologies like 3D printing and modular construction, and the potential for expansion into niche markets such as affordable housing and disaster relief. The development of smart building technologies, which integrate energy efficiency and automation, also presents a significant opportunity. Additionally, focusing on value-added services such as design and installation can enhance market penetration.

Leading Players in the Saudi Arabia Prefabricated Buildings Market

- Saudi Building Systems Mfg Co

- Red Sea Housing Services

- Al Jazera Factory For Engineering Construction Co Ltd

- Kirby Building Systems

- Saudi Company for Prefabricated Buildings LLC

- Al-Shahin Metal Industries

- United Company for Caravans and Prefab Houses

- Zamil Industrial Investment Co

- Eastern Precast Concrete

- Alabniah

- (List Not Exhaustive)

Key Developments in Saudi Arabia Prefabricated Buildings Market Industry

- January 2023: Launch of a new sustainable prefabricated housing project by Saudi Company for Prefabricated Buildings LLC.

- June 2022: Merger between two regional prefabricated building companies resulting in increased market share.

- October 2021: Government announcement of incentives to promote the use of sustainable building materials.

- (Further key developments will be included in the full report)

Future Outlook for Saudi Arabia Prefabricated Buildings Market

The future of the Saudi Arabia prefabricated buildings market is exceptionally promising, driven by sustained government support and a robust demand for efficient, cost-effective, and sustainable housing and infrastructure solutions. The continuing adoption of innovative technologies, along with the government's ongoing investments in infrastructure projects under Vision 2030, will accelerate market expansion. The focus on sustainable construction methods will further propel the growth of eco-friendly building materials and technologies. These factors indicate considerable potential for market players to capitalize on emerging opportunities and contribute significantly to Saudi Arabia's economic diversification goals.

Saudi Arabia Prefabricated Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Saudi Arabia Prefabricated Buildings Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Prefabricated Buildings Market Regional Market Share

Geographic Coverage of Saudi Arabia Prefabricated Buildings Market

Saudi Arabia Prefabricated Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices

- 3.3. Market Restrains

- 3.3.1. Uneven Topography; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Metal Holds the Major Share in Prefab Buildings Industry in Saudi Arabia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Prefabricated Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Saudi Building Systems Mfg Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Red Sea Housing Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Jazera Factory For Engineering Construction Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kirby Building Systems

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saudi Company for Prefabricated Buildings LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Shahin Metal Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 United Company for Caravans and Prefab Houses

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zamil Industrial investment Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eastern Precast Concrete**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Alabniah

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Saudi Building Systems Mfg Co

List of Figures

- Figure 1: Saudi Arabia Prefabricated Buildings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Prefabricated Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Saudi Arabia Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Saudi Arabia Prefabricated Buildings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Saudi Arabia Prefabricated Buildings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Saudi Arabia Prefabricated Buildings Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Prefabricated Buildings Market?

The projected CAGR is approximately > 8.59%.

2. Which companies are prominent players in the Saudi Arabia Prefabricated Buildings Market?

Key companies in the market include Saudi Building Systems Mfg Co, Red Sea Housing Services, Al Jazera Factory For Engineering Construction Co Ltd, Kirby Building Systems, Saudi Company for Prefabricated Buildings LLC, Al-Shahin Metal Industries, United Company for Caravans and Prefab Houses, Zamil Industrial investment Co, Eastern Precast Concrete**List Not Exhaustive, Alabniah.

3. What are the main segments of the Saudi Arabia Prefabricated Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices.

6. What are the notable trends driving market growth?

Metal Holds the Major Share in Prefab Buildings Industry in Saudi Arabia.

7. Are there any restraints impacting market growth?

Uneven Topography; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Prefabricated Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Prefabricated Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Prefabricated Buildings Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Prefabricated Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence