Key Insights

The Singapore luxury goods market, though a niche segment globally, presents substantial growth prospects fueled by its affluent demographic, demand for premium quality, and robust tourism. Projections indicate a continued upward trend, with an estimated Compound Annual Growth Rate (CAGR) of 6.42%. Key growth catalysts include increasing disposable incomes among high-net-worth individuals, enhanced brand visibility via targeted marketing and digital strategies, and the rising appeal of experiential luxury. The market is categorized by distribution channels (boutiques, multi-brand retailers, e-commerce) and product segments (apparel, footwear, accessories, jewelry, watches). While e-commerce is expanding, the enduring preference for in-store experiences, particularly for high-value items, will persist. Intense competition among leading luxury conglomerates will drive innovation and product evolution.

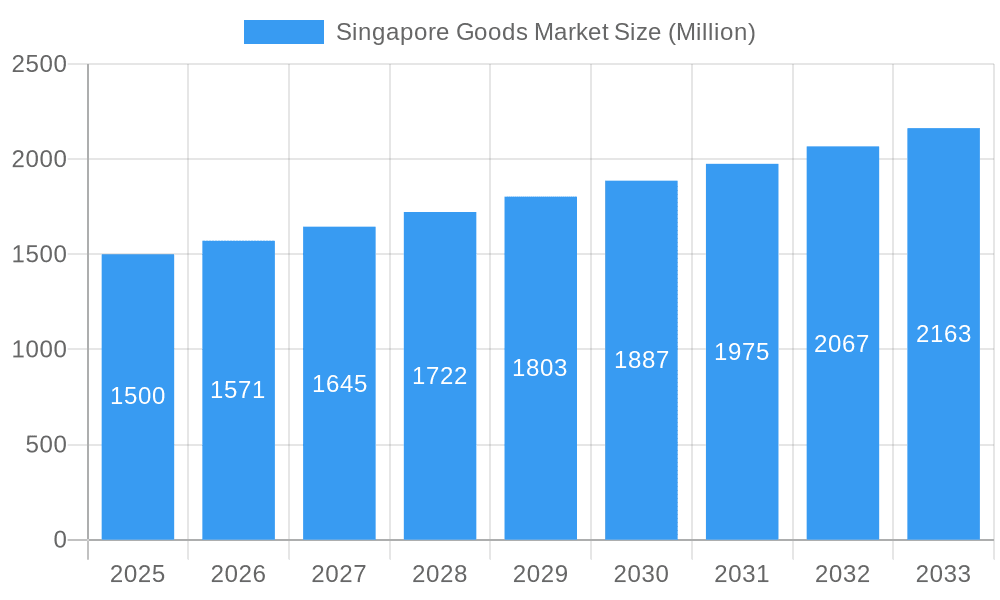

Singapore Goods Market Market Size (In Billion)

Market limitations include susceptibility to economic fluctuations and the persistent threat of counterfeiting. Evolving consumer expectations for sustainable and ethical luxury practices necessitate adaptive supply chain management and transparent marketing. Singapore's strategic position and discerning consumer base make it a pivotal market in the Asia-Pacific region. Sustained growth, tempered by market dynamics, offers a promising landscape for both established and emerging luxury brands, provided they address challenges such as potential market saturation and competitive pricing.

Singapore Goods Market Company Market Share

The market size is projected to reach 10.45 billion by the base year 2025.

Singapore Goods Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Singapore goods market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033, and historical period 2019-2024), this report unravels the market's dynamics, trends, and future potential, focusing on key segments like clothing, footwear, jewelry, and watches across various distribution channels. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Singapore Goods Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Singapore goods market, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. Leading players include LVMH Moet Hennessy Louis Vuitton, Kering SA, The Estee Lauder Companies, The Swatch Group Ltd, Richemont SA, Chanel SA, Rolex SA, PVH Corp, Ralph Lauren Corporation, and Prada SpA (list not exhaustive).

The market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. For example, LVMH and Kering collectively hold an estimated xx% market share in the luxury segment. Innovation is driven by factors such as evolving consumer preferences (demand for sustainable and ethically sourced products), technological advancements (e.g., personalized shopping experiences, AR/VR applications), and government initiatives promoting innovation in the retail sector. Regulatory frameworks, including those related to product safety and consumer protection, significantly influence market operations. M&A activities have played a role in shaping market dynamics, with deal values exceeding xx Million in recent years. Key M&A trends include expansion into new segments, geographical reach, and technology integration.

- Market Concentration: High in luxury segments, moderate in others.

- Innovation Drivers: Consumer preferences, technological advancements, government initiatives.

- Regulatory Framework: Focus on product safety and consumer protection.

- M&A Activity: xx Million in recent years, driven by expansion and technology integration.

Singapore Goods Market Market Dynamics & Trends

This section explores the key dynamics and trends shaping the Singapore goods market, focusing on factors influencing market growth, technological disruptions, consumer preferences, and competitive dynamics.

The Singapore goods market exhibits robust growth, fueled by a strong economy, rising disposable incomes, and a growing preference for luxury and branded goods. Technological disruptions, such as the rise of e-commerce and the increasing adoption of digital marketing strategies, are transforming the retail landscape. Consumer preferences are evolving towards sustainable and ethically sourced products, influencing brand strategies and product development. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants.

The market is witnessing a significant shift towards online retail, with increasing market penetration by e-commerce platforms. The CAGR for the online retail segment is projected at xx% during the forecast period.

Dominant Regions & Segments in Singapore Goods Market

This section identifies the leading regions and segments within the Singapore goods market.

By Distribution Channel:

- Single-branded Stores: Dominated by luxury brands, leveraging brand image and exclusive experiences. Key drivers include strong brand loyalty and willingness to pay a premium.

- Multi-brand Stores: Offer diverse product portfolios, attracting a wider customer base. Key drivers include convenience and price competitiveness.

- Online Retail Stores: Rapid growth driven by convenience, wider selection, and competitive pricing. Key drivers include increasing internet penetration and mobile commerce adoption.

- Other Distribution Channels: Include department stores, duty-free shops, and direct-to-consumer channels.

By Type:

- Watches & Jewelry: High growth potential due to strong demand for luxury timepieces and fine jewelry. Key drivers include strong brand appeal and investment value.

- Clothing & Apparel: A large segment influenced by fashion trends and brand recognition. Key drivers include the adoption of sustainable practices and collaborations with fashion influencers.

- Footwear & Bags: Growing segment with strong potential for growth. Key drivers include consumer preferences and fashion trends.

The Orchard Road shopping district remains the dominant region, benefiting from high foot traffic and luxury brand concentration. Government policies promoting tourism and retail development further contribute to its dominance.

Singapore Goods Market Product Innovations

Recent product innovations include the launch of Gucci's online store in Singapore (December 2021), Buccellati's first boutique opening (May 2022), and GRAY's CYBER WATCH collection (May 2020). These innovations highlight a trend towards enhanced online experiences, the expansion of luxury brands into new markets, and the fusion of technology with luxury goods. Such innovations cater to evolving consumer preferences for convenience, exclusivity, and technologically advanced products.

Report Scope & Segmentation Analysis

The report provides a comprehensive segmentation analysis of the Singapore goods market by distribution channel (single-branded stores, multi-brand stores, online retail stores, other distribution channels) and by product type (clothing and apparel, footwear, bags, jewelry, watches, other types). Each segment's market size, growth projections, and competitive dynamics are analyzed, providing insights into market opportunities and challenges. Growth projections vary across segments, with online retail and luxury goods demonstrating higher growth potential. Competitive dynamics are influenced by factors such as brand recognition, pricing strategies, and product innovation.

Key Drivers of Singapore Goods Market Growth

Growth in the Singapore goods market is driven by several key factors:

- Strong economic performance and rising disposable incomes among consumers.

- Increasing tourism and the influx of affluent visitors.

- Government support for the retail sector and investments in infrastructure.

- Technological advancements that enhance retail experiences and customer engagement.

Challenges in the Singapore Goods Market Sector

Challenges include:

- High operating costs and competition in the retail sector.

- Supply chain disruptions and global economic uncertainty.

- Evolving consumer preferences requiring brands to adapt their offerings.

- Regulatory compliance and stringent product safety standards.

These factors can impact profitability and market expansion, requiring businesses to adopt effective strategies to mitigate risks.

Emerging Opportunities in Singapore Goods Market

Emerging opportunities include:

- Growth of e-commerce and the adoption of omnichannel strategies.

- Rising demand for sustainable and ethical products.

- Focus on personalized shopping experiences and customer loyalty programs.

- Expansion into new markets and untapped consumer segments.

Leading Players in the Singapore Goods Market Market

- LVMH Moet Hennessy Louis Vuitton

- Kering SA

- The Estee Lauder Companies

- The Swatch Group Ltd

- Richemont SA

- Chanel SA

- Rolex SA

- PVH Corp

- Ralph Lauren Corporation

- Prada SpA

Key Developments in Singapore Goods Market Industry

- May 2022: Buccellati opens its first boutique in Singapore, showcasing high-end Italian jewelry and watches.

- December 2021: Gucci launches its online store in Singapore, expanding its reach to digital consumers.

- May 2020: Singapore-based luxury brand GRAY launches the CYBER WATCH collection, combining technology and luxury design.

Future Outlook for Singapore Goods Market Market

The Singapore goods market is poised for continued growth, driven by a favorable economic environment, evolving consumer preferences, and ongoing technological advancements. Strategic opportunities exist for brands focusing on sustainability, personalization, and seamless omnichannel experiences. The market's future success will hinge on adaptability, innovation, and a deep understanding of evolving consumer needs.

Singapore Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other types

-

2. Distibution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Singapore Goods Market Segmentation By Geography

- 1. Singapore

Singapore Goods Market Regional Market Share

Geographic Coverage of Singapore Goods Market

Singapore Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Tourism and Growing Cultural Iinfluence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LVMH Moet Hennessy Louis Vuitton

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kering SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Estee Lauder Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Swatch Group Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Richemont SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chanel SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rolex SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PVH Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ralph Lauren Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prada SpA*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LVMH Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: Singapore Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Goods Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Singapore Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Singapore Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Singapore Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Singapore Goods Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Goods Market?

The projected CAGR is approximately 6.42%.

2. Which companies are prominent players in the Singapore Goods Market?

Key companies in the market include LVMH Moet Hennessy Louis Vuitton, Kering SA, The Estee Lauder Company, The Swatch Group Ltd, Richemont SA, Chanel SA, Rolex SA, PVH Corp, Ralph Lauren Corporation, Prada SpA*List Not Exhaustive.

3. What are the main segments of the Singapore Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.45 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle and Athleisure.

6. What are the notable trends driving market growth?

Increasing Tourism and Growing Cultural Iinfluence.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In May 2022, the high-jewellery brand Buccellati opened its first boutique in Singapore at the shops at Marina Bay Sands, that is designed in line with Buccellati's other architectural concepts, the maison has brought over the best of Italian savoir-faire with its iconic High Jewellery pieces. The iconic Bluebell Watch, for one, is distinguished by its slight flower-shaped white gold case, encrusted with diamonds, and finished with a blue enamel and diamond dial.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Goods Market?

To stay informed about further developments, trends, and reports in the Singapore Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence