Key Insights

The Singapore retail market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.7%. The market size is estimated at $144.42 billion in the base year of 2025. This expansion is driven by a rising middle class with increasing disposable income, substantial government investment in infrastructure and tourism, and the rapid adoption of e-commerce and omnichannel shopping experiences. Traditional retailers face heightened competition from agile domestic players and international brands, underscoring the need for strategic customer experience enhancement, innovative marketing, and efficient supply chain management. Leading retailers are leveraging data analytics to personalize offerings and adapt to evolving consumer demands.

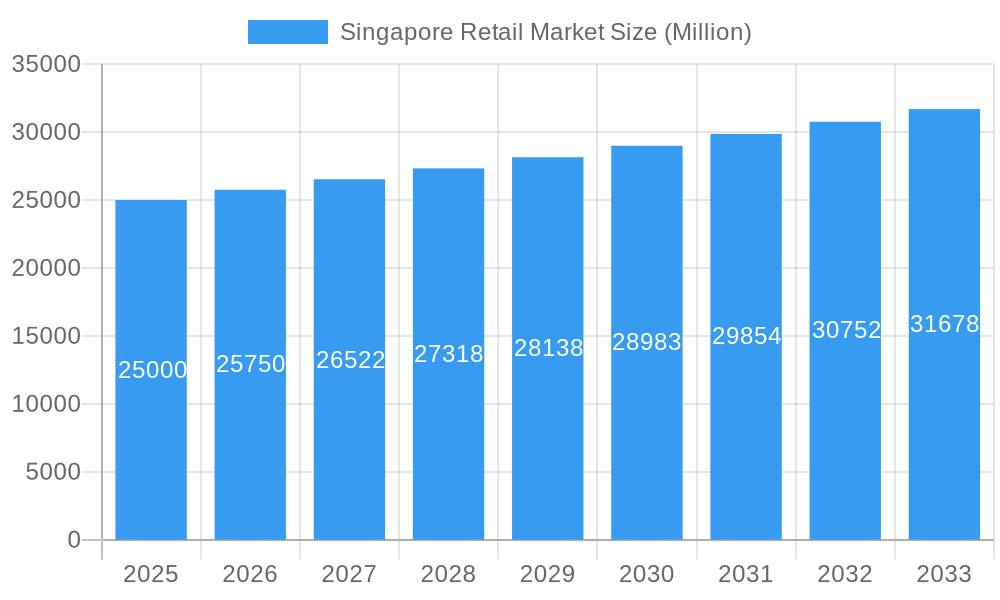

Singapore Retail Market Market Size (In Billion)

The market is segmented by product categories, retail formats, and geographic locations. Key growth inhibitors include escalating operational costs, fierce competition, and dynamic consumer behavior requiring constant adaptation. Despite these challenges, the long-term outlook remains optimistic, with continued expansion anticipated through the forecast period of 2025-2033. Companies such as Sheng Siong Group and Japan Foods Holding are strategically positioned to capitalize on their sector-specific expertise. Future growth will be largely contingent on retailers' agility in navigating the digital landscape and meeting the sophisticated needs of Singaporean consumers.

Singapore Retail Market Company Market Share

This report offers a comprehensive analysis of the Singapore retail market, providing actionable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a specific focus on 2025, the report details the market's structure, dynamics, and future trajectory, including in-depth segmentation analysis, competitive landscape assessments, and growth projections to support informed business decisions.

Singapore Retail Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Singapore retail market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The historical period (2019-2024) and the forecast period (2025-2033) are examined to provide a holistic view.

The Singapore retail market exhibits a moderately concentrated structure, with key players like Dairy Farm International Holdings (DFI) and NTUC holding significant market share. However, the emergence of e-commerce players and smaller, specialized retailers is increasing competition. The estimated market size in 2025 is xx Million, projected to reach xx Million by 2033.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2025.

- Innovation Drivers: E-commerce adoption, omnichannel strategies, personalized customer experiences, and sustainability initiatives are key drivers of innovation.

- Regulatory Framework: Singapore's relatively open and business-friendly regulatory environment fosters competition and innovation.

- Product Substitutes: The rise of online marketplaces and direct-to-consumer brands presents significant substitution challenges for traditional retailers.

- End-User Demographics: The Singaporean population is characterized by a high level of disposable income and tech-savviness, influencing consumer preferences and purchasing behavior.

- M&A Activities: While specific M&A deal values for the period are not publicly available, significant activity has been observed, with deals focusing on expansion into new segments and technologies (xx Million estimated total value for 2019-2024).

Singapore Retail Market Market Dynamics & Trends

This section explores the key dynamics shaping the Singapore retail market. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, driven by factors such as rising disposable incomes, increasing urbanization, and the growing adoption of e-commerce. Market penetration of online retail is projected to reach xx% by 2033.

Technological disruptions, including the rise of mobile commerce, social commerce, and artificial intelligence (AI)-powered personalization, are fundamentally altering the retail landscape. Changing consumer preferences, such as a preference for convenience, sustainability, and personalized experiences, are also significantly impacting the market. Intense competition, both from established players and new entrants, further shapes market dynamics. The impact of the COVID-19 pandemic accelerated the adoption of digital channels and highlighted the importance of supply chain resilience.

Dominant Regions & Segments in Singapore Retail Market

This section identifies the dominant regions and segments within the Singapore retail market. Given Singapore's small geographical size, regional variations are less pronounced than segmental differences.

The dominance of specific segments is largely driven by consumer preferences and economic conditions. The food and beverage sector, particularly supermarkets and convenience stores, represents a significant segment. Apparel and fashion, electronics, and cosmetics also hold substantial market share.

- Key Drivers of Segment Dominance:

- Food & Beverage: High population density, strong demand for imported and local produce, and a preference for convenient food options.

- Apparel & Fashion: High disposable incomes and a fashion-conscious population.

- Electronics: High tech adoption and a preference for latest technology products.

Singapore Retail Market Product Innovations

Recent product innovations within the Singapore retail market are characterized by a strong focus on technological integration and enhanced customer experiences. Omnichannel strategies, personalized recommendations, and advanced analytics are being utilized to improve efficiency and customer engagement. The integration of mobile payment systems and loyalty programs has also gained significant traction. Sustainability initiatives, such as reducing packaging waste and promoting eco-friendly products, are gaining prominence in response to growing consumer awareness.

Report Scope & Segmentation Analysis

This report segments the Singapore retail market based on product type (e.g., food and beverage, apparel, electronics), distribution channel (e.g., online, offline), and consumer demographic (e.g., age, income). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed. For example, the online retail segment is projected to experience significant growth due to rising internet penetration and increased consumer preference for online shopping, while the traditional brick-and-mortar segment faces challenges from the rising popularity of e-commerce.

Key Drivers of Singapore Retail Market Growth

Key drivers of growth in the Singapore retail market include:

- Rising Disposable Incomes: Singapore's strong economy and high disposable incomes fuel consumer spending.

- Technological Advancements: E-commerce, mobile payments, and data analytics are transforming the retail experience.

- Government Initiatives: Supportive government policies and infrastructure development further stimulate growth.

Challenges in the Singapore Retail Market Sector

Challenges facing the Singapore retail market include:

- High Rental Costs: Operating costs, especially rental expenses, can significantly impact profitability.

- Intense Competition: The market is highly competitive, both domestically and internationally.

- Evolving Consumer Preferences: Keeping up with changing consumer demands and preferences is a constant challenge.

Emerging Opportunities in Singapore Retail Market

Emerging opportunities include:

- Growth of E-commerce: Expanding e-commerce capabilities and reaching new online customer segments.

- Personalization and Data Analytics: Utilizing data to offer personalized shopping experiences.

- Sustainable Retail Practices: Adopting environmentally friendly practices to appeal to conscious consumers.

Leading Players in the Singapore Retail Market Market

- Japan Foods Holding Ltd

- Sheng Siong Group Ltd

- Watsons

- RedMart Ltd

- ABR Holdings Ltd

- NTUC

- QAF Limited

- U Stars

- Dairy Farm International Holdings (DFI)

- Font Creative Pte Ltd

Key Developments in Singapore Retail Market Industry

- April 2021: Closure of Naiise, highlighting the challenges faced by smaller retailers during the pandemic.

Future Outlook for Singapore Retail Market Market

The future of the Singapore retail market is bright, driven by continued economic growth, technological innovation, and evolving consumer preferences. Strategic investments in e-commerce, omnichannel strategies, and data-driven personalization will be crucial for success. The market is poised for continued growth, with opportunities for both established players and new entrants to thrive.

Singapore Retail Market Segmentation

-

1. Product

- 1.1. Food and Beverage

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 2.2. Specialty Stores

- 2.3. Department Stores

- 2.4. E-commerce

- 2.5. Other Distribution Channels

Singapore Retail Market Segmentation By Geography

- 1. Singapore

Singapore Retail Market Regional Market Share

Geographic Coverage of Singapore Retail Market

Singapore Retail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Upgrading Technology is Helping the Market to Record More Revenues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Retail Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets, Supermarkets, and Convenience Stores

- 5.2.2. Specialty Stores

- 5.2.3. Department Stores

- 5.2.4. E-commerce

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Foods Holding Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sheng Siong Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Watsons

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RedMart Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABR Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NTUC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 QAF Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 U Stars

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dairy Farm International Holdings (DFI)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Font Creative Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Japan Foods Holding Ltd

List of Figures

- Figure 1: Singapore Retail Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Retail Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Singapore Retail Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Singapore Retail Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Singapore Retail Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Singapore Retail Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Retail Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Singapore Retail Market?

Key companies in the market include Japan Foods Holding Ltd, Sheng Siong Group Ltd, Watsons, RedMart Ltd, ABR Holdings Ltd, NTUC, QAF Limited, U Stars, Dairy Farm International Holdings (DFI), Font Creative Pte Ltd.

3. What are the main segments of the Singapore Retail Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 144.42 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Upgrading Technology is Helping the Market to Record More Revenues.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2021, Singapore homegrown retailer Naiise has shut down after struggling to survive through the pandemic, with its owner Dennis Tay filing for personal bankruptcy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Retail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Retail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Retail Market?

To stay informed about further developments, trends, and reports in the Singapore Retail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence