Key Insights

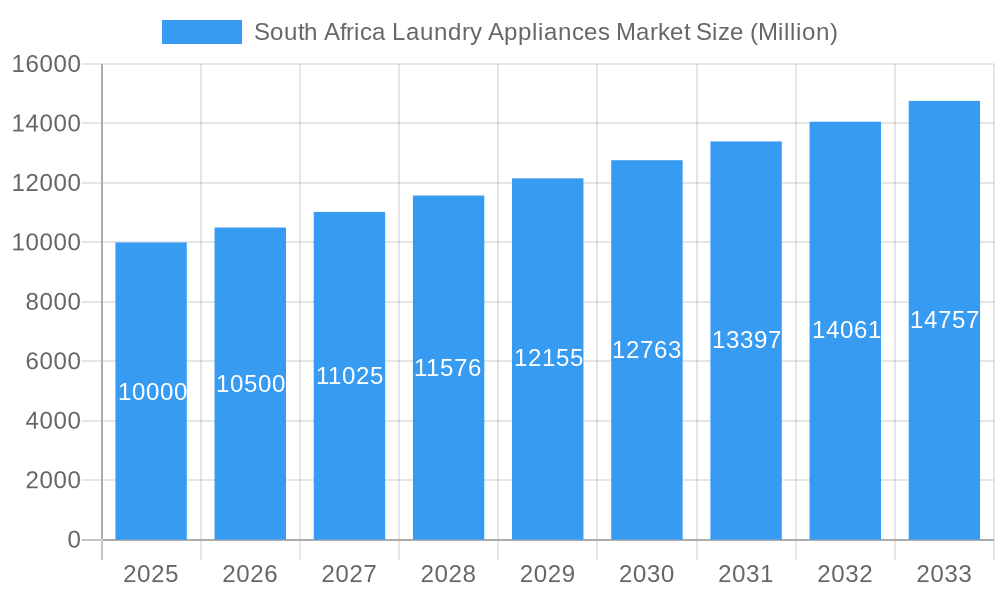

The South African laundry appliances market, estimated at 4.92 billion in 2024, is projected to achieve a compound annual growth rate (CAGR) of 5.6% through 2033. This growth is propelled by increasing urbanization and a rising middle class, driving demand for efficient laundry solutions, particularly in major urban hubs. Growing disposable incomes are facilitating consumer investment in premium appliances like automatic washing machines and dryers, displacing traditional methods. The expanding hospitality and commercial laundry sectors also significantly contribute to market expansion. E-commerce proliferation further enhances consumer accessibility and choice. Potential restraints include economic volatility and inconsistent power supply. The market is segmented by distribution channel (offline, online), end-use (residential, commercial), product type (washing machines, dryers, pressing machines, others), and technology (automatic, semi-automatic, others). Key market participants, including LG, Samsung, Bosch, and Electrolux, compete on product features, pricing, and brand equity. Within the African region analyzed, South Africa commands the largest market share. Future expansion is anticipated to be influenced by the adoption of energy-efficient and smart home integrated appliances, alongside the continued growth of e-commerce platforms.

South Africa Laundry Appliances Market Market Size (In Billion)

The competitive arena features a blend of global and local manufacturers. International brands leverage established brand recognition and technological leadership, while domestic players offer competitive pricing and address localized demands. Product innovation, emphasizing larger capacities, enhanced energy efficiency, and smart connectivity, will be pivotal for sustained growth. Growing consumer consciousness regarding water conservation and sustainability will also shape preferences towards eco-friendly appliances. Supportive government initiatives focused on energy and water efficiency may further catalyze market development.

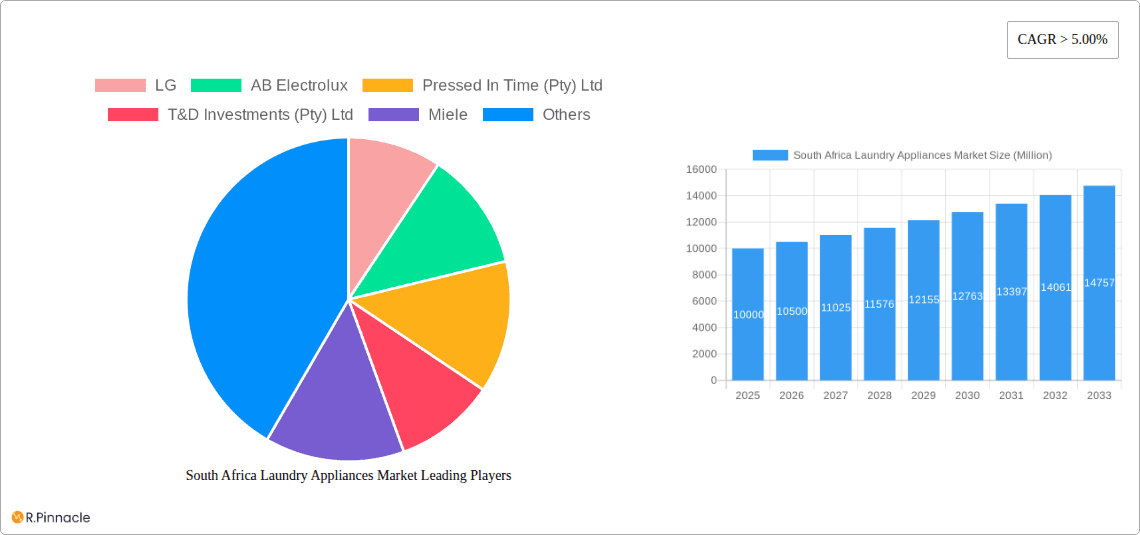

South Africa Laundry Appliances Market Company Market Share

South Africa Laundry Appliances Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the South Africa laundry appliances market, covering the period 2019-2033. It offers actionable insights into market dynamics, growth drivers, challenges, and opportunities, providing a crucial resource for industry professionals, investors, and stakeholders. The report leverages extensive data and analysis to forecast market trends and identify key players shaping the landscape.

South Africa Laundry Appliances Market Structure & Innovation Trends

The South Africa laundry appliances market exhibits a moderately consolidated structure, with key players like LG, Samsung, Bosch, and Electrolux holding significant market share. However, several smaller regional players like Pressed In Time (Pty) Ltd and T&D Investments (Pty) Ltd also contribute to the market's diversity. Market share data for 2024 indicates LG holds approximately xx%, Samsung xx%, Bosch xx%, and Electrolux xx%, with the remaining share distributed among other players. Innovation is driven by increasing consumer demand for energy-efficient, technologically advanced appliances, alongside a growing preference for convenience and ease of use. Regulatory frameworks focused on energy efficiency standards and waste management are also influencing product development. The market witnesses limited M&A activity, with deal values in the xx Million range in recent years. Key innovation drivers include:

- Energy efficiency standards: Government regulations pushing for higher energy efficiency ratings.

- Smart home integration: Growing demand for appliances with connectivity features and smart controls.

- Sustainable materials: Increased use of eco-friendly materials in manufacturing.

- Water conservation technologies: Focus on developing appliances with reduced water consumption.

South Africa Laundry Appliances Market Market Dynamics & Trends

The South Africa laundry appliances market demonstrates a robust growth trajectory, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising disposable incomes, increasing urbanization, and a shift towards nuclear families. Consumer preferences are moving towards technologically advanced appliances, specifically automatic washing machines and dryers with features like smart controls, energy-efficient motors, and advanced wash cycles. Market penetration of automatic washing machines remains relatively low compared to global standards, presenting a significant opportunity for growth. Intense competition among established and emerging players necessitates constant innovation and aggressive marketing strategies. Technological disruptions are evident in the increasing adoption of IoT-enabled appliances and the integration of AI-powered features.

Dominant Regions & Segments in South Africa Laundry Appliances Market

The Gauteng province consistently dominates the South Africa laundry appliances market, driven by higher population density, higher disposable incomes, and greater infrastructural development. The Offline distribution channel holds the lion's share of the market due to the prevalence of traditional retail outlets and consumer preference for in-person product evaluation. However, the online channel is witnessing significant growth, driven by increasing internet penetration and e-commerce adoption. In terms of end use, the residential sector represents the largest segment, while the commercial sector, particularly hotels and laundromats, demonstrates significant growth potential. Within product types, washing machines occupy the largest market share followed by dryers. Automatic washing machines represent the dominant technology segment due to their convenience and efficiency. Key drivers for the dominant segments:

- Gauteng Province: High population density, robust infrastructure, and high disposable incomes.

- Offline Distribution: Established retail networks, consumer preference for in-person experience.

- Residential End Use: Rising disposable incomes, growing nuclear families, and increased appliance ownership.

- Washing Machines: Essential household appliance with high demand across various income groups.

- Automatic Technology: Preference for convenience and efficiency.

South Africa Laundry Appliances Market Product Innovations

Recent product developments highlight a strong emphasis on energy efficiency, smart features, and improved cleaning performance. Companies are incorporating AI-powered features, such as intelligent washing cycles that adapt to the type and quantity of laundry. The integration of smart connectivity allows users to monitor and control appliances remotely. These innovations enhance convenience and improve overall user experience, driving market acceptance. Focus on sustainability features like reduced water consumption and eco-friendly materials further strengthens market positioning.

Report Scope & Segmentation Analysis

This report segments the South Africa laundry appliances market based on Distribution Channel (Offline, Online), End Use (Residential, Commercial), Type (Built-in, Free Standing), Product (Washing Machines, Dryers, Electric Pressing Machines, Others), and Technology (Automatic, Semi-Automatic, Others). Each segment's growth projection, market size (in Million), and competitive dynamics are extensively analyzed for the study period (2019-2033).

- Distribution Channel: The Offline channel is expected to maintain its dominance, but the Online segment will experience robust growth.

- End-Use: Residential segment to remain the largest, with commercial experiencing faster growth.

- Type: Free-standing appliances hold a larger market share compared to built-in appliances.

- Product: Washing machines and dryers comprise the majority of the market.

- Technology: Automatic technology is expected to increase its market penetration.

Key Drivers of South Africa Laundry Appliances Market Growth

Several factors contribute to the market's growth. Rising disposable incomes across various socioeconomic groups fuel increased demand for household appliances. Urbanization drives a shift toward nuclear families, increasing the need for individual washing machines and dryers. Technological advancements, such as energy-efficient motors and smart features, enhance appliance appeal. Government policies promoting energy efficiency and sustainable consumption patterns also contribute positively.

Challenges in the South Africa Laundry Appliances Market Sector

The market faces challenges such as inconsistent electricity supply, impacting appliance usage and consumer preference. High import duties on certain components increase production costs, affecting pricing competitiveness. Furthermore, the informal economy's presence offers low-cost alternatives, creating pressure on formal market players.

Emerging Opportunities in South Africa Laundry Appliances Market

The growing middle class presents a significant opportunity for increased appliance penetration. The rising demand for energy-efficient and sustainable products opens avenues for innovation and market differentiation. Expanding e-commerce platforms provide new avenues for market access and consumer reach. Focus on rural markets and tapping into underserved communities presents untapped potential.

Leading Players in the South Africa Laundry Appliances Market Market

- LG

- AB Electrolux

- Pressed In Time (Pty) Ltd

- T&D Investments (Pty) Ltd

- Miele

- Desert Charm Trading 40 (Pty) Ltd

- Nannucci Dry Cleaners (Pty) Ltd

- Levingers Franchising (Pty) Ltd

- Bidvest Group Ltd (The)

- Hisense SA

- Bosch

- Combined Cleaners (Pty) Ltd

- Tullis Laundry Solutions Africa (Pty) Ltd

- Atlantic Cleaners

- Servworx Integrated Service Solutions (Pty) Ltd

- Unilever South Africa

- Samsung

- Midea

Key Developments in South Africa Laundry Appliances Market Industry

- August 2022: Samsung and OMO detergent partnered to offer a combined laundry solution, focusing on efficiency and sustainability.

- July 2022: Samsung Electronics launched the Bespoke AI Washer and Dryer, emphasizing sustainability and smart features.

Future Outlook for South Africa Laundry Appliances Market Market

The South Africa laundry appliances market is poised for continued growth, driven by increasing urbanization, rising disposable incomes, and the adoption of technologically advanced appliances. Strategic focus on energy efficiency, smart features, and affordability will be crucial for sustained market success. Expanding reach into underserved markets and leveraging e-commerce channels will be key to maximizing growth potential. The market is expected to witness a steady rise in demand for higher-end appliances with advanced features and improved energy efficiency.

South Africa Laundry Appliances Market Segmentation

-

1. Type

- 1.1. Built-in

- 1.2. Free Standing

-

2. Product

- 2.1. Washing Machines

- 2.2. Dryers

- 2.3. Electric Pressing Machines

- 2.4. Others

-

3. Technology

- 3.1. Automatic

- 3.2. Semi-Automatic

- 3.3. Others

-

4. Distribution Channel

- 4.1. Offline

- 4.2. Online

-

5. End Use

- 5.1. Residential

- 5.2. Commercial

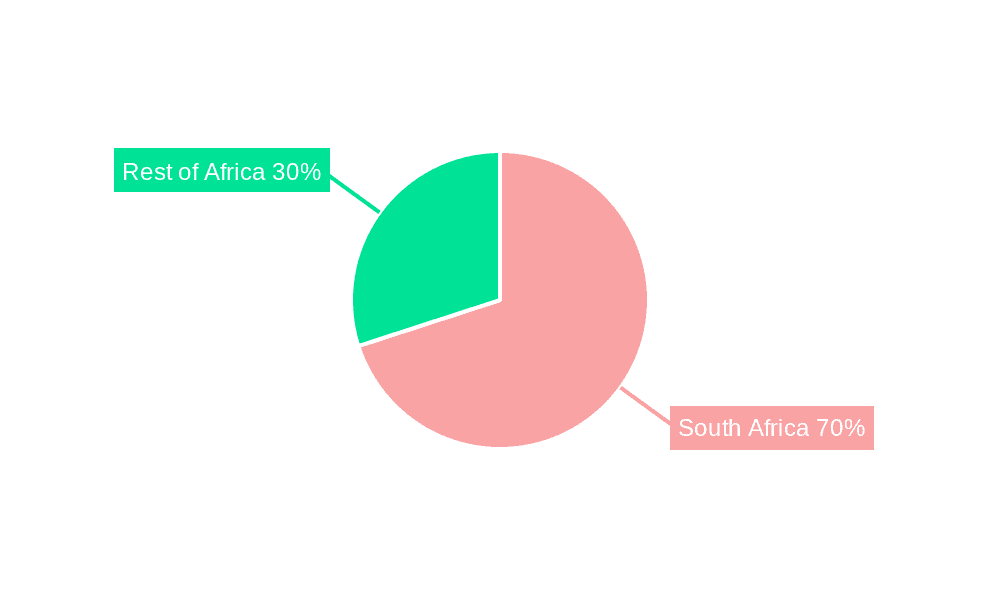

South Africa Laundry Appliances Market Segmentation By Geography

- 1. South Africa

South Africa Laundry Appliances Market Regional Market Share

Geographic Coverage of South Africa Laundry Appliances Market

South Africa Laundry Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in spending on washing machines in South Africa.; Rising share of Online Sales in Laundry Appliance products.

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Per Capita Income of South Africa Post Covid; Increasing market penetration by Global players affecting local manufacturers.

- 3.4. Market Trends

- 3.4.1. Automatic Washing Machines Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Laundry Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Built-in

- 5.1.2. Free Standing

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Washing Machines

- 5.2.2. Dryers

- 5.2.3. Electric Pressing Machines

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Automatic

- 5.3.2. Semi-Automatic

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Offline

- 5.4.2. Online

- 5.5. Market Analysis, Insights and Forecast - by End Use

- 5.5.1. Residential

- 5.5.2. Commercial

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AB Electrolux

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pressed In Time (Pty) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 T&D Investments (Pty) Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Miele

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Desert Charm Trading 40 (Pty) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nannucci Dry Cleaners (Pty) Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Levingers Franchising (Pty) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bidvest Group Ltd (The)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hisense SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bosch

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Combined Cleaners (Pty) Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Tullis Laundry Solutions Africa (Pty) Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Atlantic Cleaners

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Servworx Integrated Service Solutions (Pty) Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Unilever South Africa

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Samsung

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Midea

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: South Africa Laundry Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Laundry Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Africa Laundry Appliances Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South Africa Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 4: South Africa Laundry Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 5: South Africa Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: South Africa Laundry Appliances Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 7: South Africa Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: South Africa Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 9: South Africa Laundry Appliances Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 10: South Africa Laundry Appliances Market Volume K Unit Forecast, by End Use 2020 & 2033

- Table 11: South Africa Laundry Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 12: South Africa Laundry Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: South Africa Laundry Appliances Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South Africa Laundry Appliances Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: South Africa Laundry Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 16: South Africa Laundry Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 17: South Africa Laundry Appliances Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: South Africa Laundry Appliances Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 19: South Africa Laundry Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: South Africa Laundry Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 21: South Africa Laundry Appliances Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 22: South Africa Laundry Appliances Market Volume K Unit Forecast, by End Use 2020 & 2033

- Table 23: South Africa Laundry Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South Africa Laundry Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Laundry Appliances Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the South Africa Laundry Appliances Market?

Key companies in the market include LG, AB Electrolux, Pressed In Time (Pty) Ltd, T&D Investments (Pty) Ltd, Miele, Desert Charm Trading 40 (Pty) Ltd, Nannucci Dry Cleaners (Pty) Ltd, Levingers Franchising (Pty) Ltd, Bidvest Group Ltd (The), Hisense SA, Bosch, Combined Cleaners (Pty) Ltd, Tullis Laundry Solutions Africa (Pty) Ltd, Atlantic Cleaners, Servworx Integrated Service Solutions (Pty) Ltd, Unilever South Africa, Samsung, Midea.

3. What are the main segments of the South Africa Laundry Appliances Market?

The market segments include Type, Product, Technology, Distribution Channel, End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in spending on washing machines in South Africa.; Rising share of Online Sales in Laundry Appliance products..

6. What are the notable trends driving market growth?

Automatic Washing Machines Driving The Market.

7. Are there any restraints impacting market growth?

Fluctuation in Per Capita Income of South Africa Post Covid; Increasing market penetration by Global players affecting local manufacturers..

8. Can you provide examples of recent developments in the market?

On August 2022, Samsung and OMO detergent partnered to offer a combination of Samsung's state-of-the-art washing machines and OMO Auto's incredible cleaning power, creating a seamless, stress-free, and sustainable laundry experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Laundry Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Laundry Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Laundry Appliances Market?

To stay informed about further developments, trends, and reports in the South Africa Laundry Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence