Key Insights

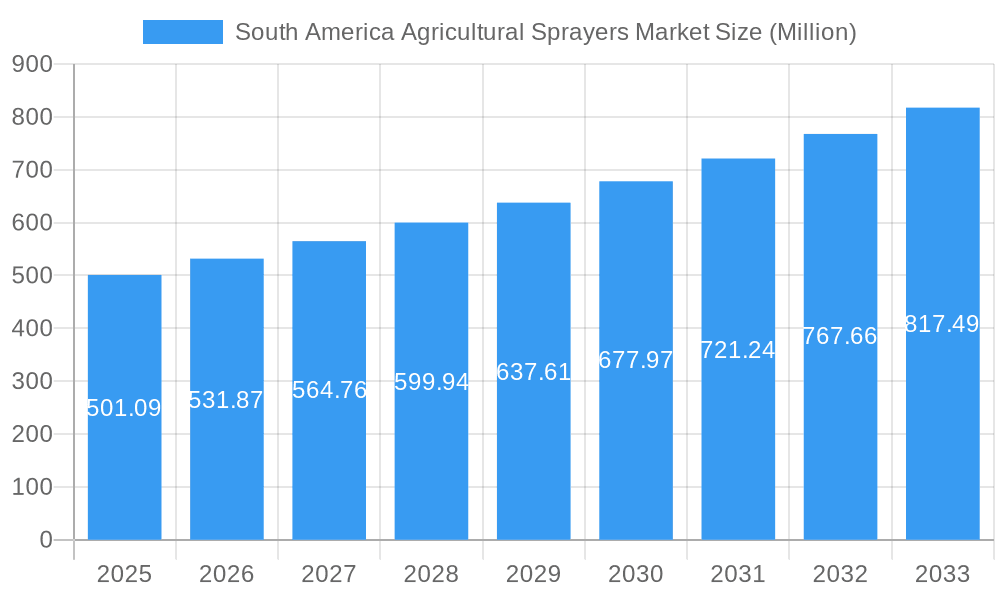

The South America Agricultural Sprayers Market is experiencing robust growth, projected to reach $501.09 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.89% from 2025 to 2033. This expansion is fueled by several key factors. Increased adoption of precision agriculture techniques, aimed at optimizing pesticide and fertilizer application, is driving demand for advanced sprayers. The rising focus on improving crop yields and combating crop diseases and pests further contributes to market growth. Furthermore, government initiatives promoting sustainable agricultural practices and the growing awareness of the environmental impact of traditional spraying methods are encouraging farmers to adopt more efficient and environmentally friendly sprayers. The market segmentation reveals significant opportunities across various sprayer types. Battery-operated and solar sprayers are gaining traction due to their reduced environmental impact and lower operational costs compared to fuel-operated counterparts. The high volume segment dominates the market capacity, catering to large-scale agricultural operations in countries like Brazil and Argentina. Key players like Deere & Company (PLA Group), Jacto Inc, and Stara SA are driving innovation and competition within the market, leading to continuous improvements in sprayer technology and efficiency.

South America Agricultural Sprayers Market Market Size (In Million)

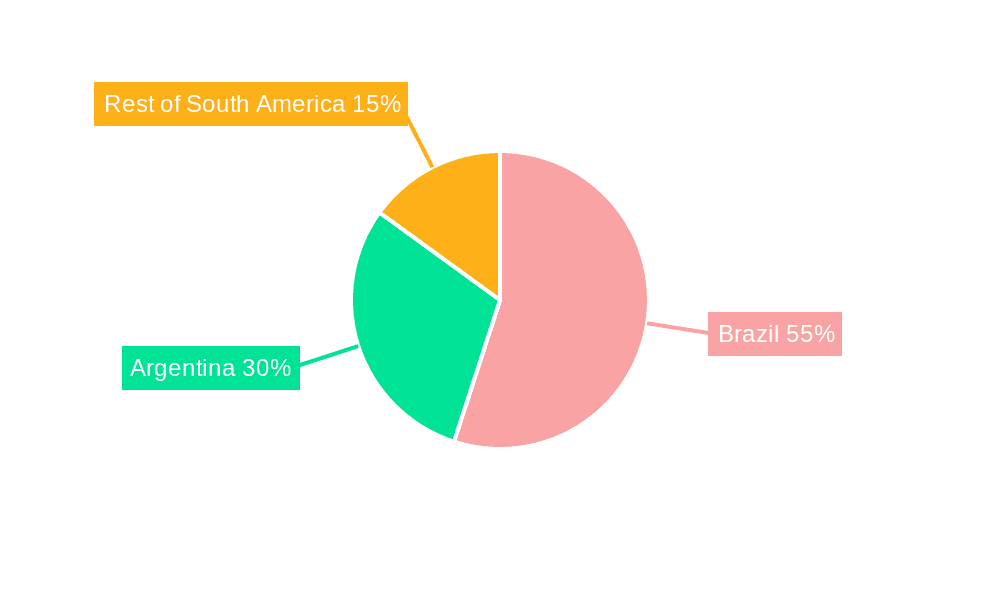

Brazil and Argentina constitute the largest market share within South America, reflecting their significant agricultural output and substantial acreage under cultivation. The "Rest of South America" segment, although smaller, presents growth potential as agricultural practices modernize and farmer awareness increases. However, factors such as high initial investment costs for advanced sprayers and the uneven distribution of agricultural technology across the region present challenges to market penetration. Nevertheless, the long-term outlook remains positive, driven by continuous technological advancements, government support, and a growing focus on sustainable agricultural practices throughout South America. The market is expected to continue its trajectory of growth, making it an attractive investment opportunity for stakeholders in the agricultural technology sector.

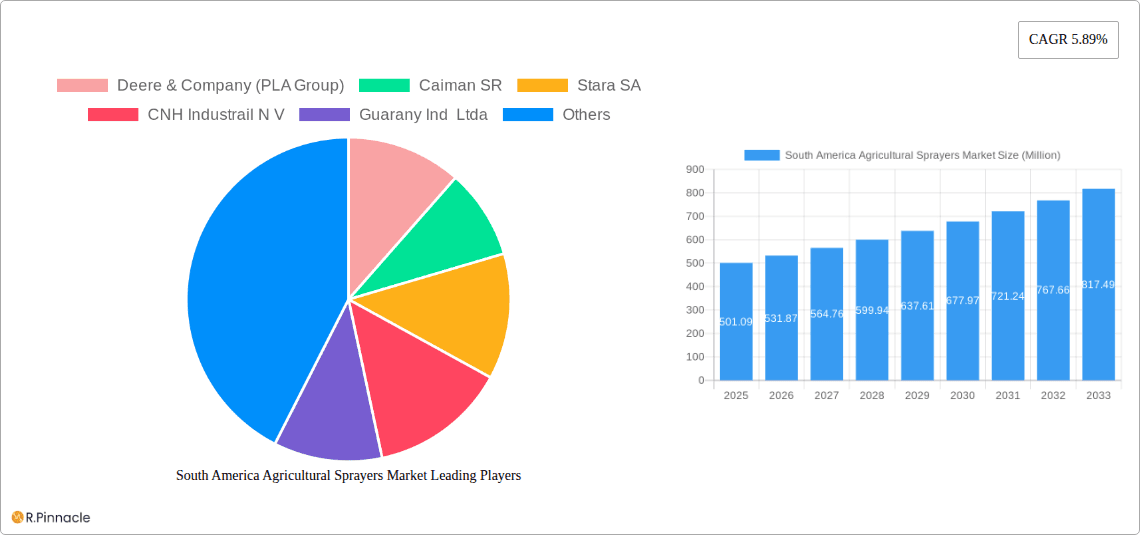

South America Agricultural Sprayers Market Company Market Share

South America Agricultural Sprayers Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America Agricultural Sprayers Market, covering the period 2019-2033. It offers valuable insights into market dynamics, growth drivers, competitive landscape, and future opportunities for industry professionals, investors, and stakeholders. The report leverages extensive market research and data analysis to deliver actionable intelligence for strategic decision-making. With a focus on Brazil and Argentina, alongside the rest of South America, this report provides a granular view of this burgeoning market. The Base Year is 2025 and the Estimated Year is 2025. The Forecast Period is 2025-2033 and the Historical Period is 2019-2024.

South America Agricultural Sprayers Market Structure & Innovation Trends

This section analyzes the market structure, focusing on concentration, innovation, regulations, and competitive activity. The South American agricultural sprayer market exhibits a moderately concentrated structure, with key players holding significant market share. Deere & Company (PLA Group), CNH Industrial N.V., AGCO Corporation, Jacto Inc., Stara SA, Guarany Ind Ltda, and Caiman SR are prominent players, each possessing varying degrees of market influence. Market share data for 2024 shows Deere & Company holding approximately xx% market share, followed by CNH Industrial N.V. at xx%, and AGCO Corporation at xx%. The remaining market share is distributed among other players.

Innovation is a key driver, fueled by the increasing demand for precision agriculture and sustainable farming practices. Regulatory frameworks, while varying across countries, generally focus on environmental protection and worker safety. Product substitutes are limited, primarily encompassing older, less efficient sprayer models. M&A activities have been moderate, with deal values ranging from xx Million to xx Million in the last five years, reflecting a consolidating market. The market is seeing a shift towards advanced technologies, leading to increased M&A activity focusing on technology integration and expansion.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Innovation Drivers: Precision agriculture, sustainability, technological advancements.

- Regulatory Frameworks: Environmental protection, worker safety.

- Product Substitutes: Limited, mainly older models.

- M&A Activity: Moderate, with deal values between xx Million and xx Million (2019-2024).

South America Agricultural Sprayers Market Dynamics & Trends

The South America Agricultural Sprayers market is experiencing robust growth, driven by factors such as rising agricultural output, increasing adoption of modern farming techniques, and government initiatives promoting agricultural modernization. Technological advancements, particularly in precision spraying technologies, are further accelerating market expansion. Consumer preferences are shifting towards high-efficiency, low-impact sprayers that minimize environmental damage and improve crop yields. The market is witnessing a rising trend towards automation and data-driven decision-making in agricultural practices. Competitive dynamics are intense, with leading players investing heavily in R&D, strategic partnerships, and expansion into new markets. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%. Market penetration of advanced sprayers is expected to reach approximately xx% by 2033.

Dominant Regions & Segments in South America Agricultural Sprayers Market

Brazil dominates the South America Agricultural Sprayers Market, driven by its vast agricultural sector, favorable government policies supporting agricultural modernization, and extensive infrastructure. Argentina holds the second largest share, followed by the "Rest of South America".

Brazil's Dominance:

- Key Drivers: Large agricultural sector, strong government support, developed infrastructure.

- Market Size (2024): xx Million USD

- Growth Projections (2025-2033): xx% CAGR

Argentina's Market:

- Key Drivers: Expanding agricultural production, growing adoption of advanced technologies.

- Market Size (2024): xx Million USD

- Growth Projections (2025-2033): xx% CAGR

Segment Dominance:

- Source of Power: Fuel-operated sprayers hold the largest market share due to their power and versatility. However, battery-operated and solar sprayers are witnessing significant growth due to environmental concerns and cost-effectiveness.

- Usage: Field sprayers constitute the largest segment, followed by orchard sprayers. Gardening sprayers represent a smaller but growing niche.

- Mode of Capacity: High-volume sprayers dominate the market; however, the demand for ultra-low volume (ULV) sprayers is increasing due to their efficiency and reduced chemical usage.

South America Agricultural Sprayers Market Product Innovations

Recent innovations focus on precision spraying technologies, such as GPS-guided sprayers and variable-rate application systems. These advancements enhance efficiency, reduce chemical usage, and minimize environmental impact. The integration of smart sensors and data analytics enables real-time monitoring and optimization of spraying operations. These innovative sprayers provide competitive advantages through improved accuracy, reduced operational costs, and increased yields. Furthermore, the market is witnessing the introduction of eco-friendly sprayers designed to minimize environmental impact, further enhancing their market appeal.

Report Scope & Segmentation Analysis

This report segments the South America Agricultural Sprayers Market by source of power (manual, battery-operated, solar, fuel-operated), usage (field, orchard, gardening), mode of capacity (ultra-low volume, low volume, high volume), and country (Brazil, Argentina, Rest of South America). Each segment’s growth projections, market sizes, and competitive dynamics are analyzed in detail, providing comprehensive insights into market opportunities and challenges.

By Source of Power: The fuel-operated segment is expected to hold a significant share but will see growth in battery-operated segments. By Usage: The field sprayer segment dominates. By Mode of Capacity: The high-volume segment is largest, but the ultra-low volume segment is growing. By Country: Brazil and Argentina are the key markets.

Key Drivers of South America Agricultural Sprayers Market Growth

The market's growth is driven by factors such as expanding agricultural land under cultivation, increasing demand for high-yield crops, growing adoption of advanced agricultural technologies, and supportive government policies promoting agricultural modernization. The rising adoption of precision agriculture techniques, increasing awareness of sustainable farming practices, and investments in agricultural infrastructure are also contributing to the market's expansion.

Challenges in the South America Agricultural Sprayers Market Sector

Challenges include high initial investment costs for advanced sprayers, limited access to credit for smallholder farmers, fluctuating prices of raw materials and components, and varying levels of technological expertise among farmers. Infrastructure limitations in certain regions and stringent environmental regulations also pose challenges. The dependence on imports for some components leads to supply chain vulnerabilities.

Emerging Opportunities in South America Agricultural Sprayers Market

Emerging opportunities lie in the growing demand for precision sprayers, particularly in the developing regions of South America. The market for battery-operated and solar sprayers is expected to grow rapidly. The increasing adoption of data-driven decision making in agriculture presents opportunities for companies offering integrated solutions that combine hardware and software. Expansion into new agricultural segments, such as the horticulture sector, also offers significant potential.

Leading Players in the South America Agricultural Sprayers Market Market

- Deere & Company (PLA Group)

- Caiman SR

- Stara SA

- CNH Industrial N.V.

- Guarany Ind Ltda

- Jacto Inc

- AGCO Corporation

Key Developments in South America Agricultural Sprayers Market Industry

- September 2022: John Deere launched its 'see and spray' technology, a green-on-green targeted spraying system, enhancing precision agriculture.

- June 2022: Bosch BASF Smart Farming GmbH collaborated with Stara to launch a smart spraying solution for the Imperador 4000 Eco Sprayer in Latin America.

Future Outlook for South America Agricultural Sprayers Market Market

The South America Agricultural Sprayers Market is poised for continued strong growth, driven by technological advancements, rising agricultural productivity, and increasing farmer adoption of modern farming techniques. The market will likely see increased consolidation as major players seek to expand their market share through strategic acquisitions and partnerships. Furthermore, the growing focus on sustainable agriculture practices is likely to drive demand for eco-friendly and efficient spraying solutions. The market is projected to reach xx Million USD by 2033.

South America Agricultural Sprayers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Agricultural Sprayers Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Agricultural Sprayers Market Regional Market Share

Geographic Coverage of South America Agricultural Sprayers Market

South America Agricultural Sprayers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment and Price Sensitivity; Data Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Increase in Average Farm Size Leading To Adoption of Agricultural Sprayers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Agricultural Sprayers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deere & Company (PLA Group)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caiman SR

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stara SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CNH Industrail N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Guarany Ind Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jacto Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGCO Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Deere & Company (PLA Group)

List of Figures

- Figure 1: South America Agricultural Sprayers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Agricultural Sprayers Market Share (%) by Company 2025

List of Tables

- Table 1: South America Agricultural Sprayers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Agricultural Sprayers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Agricultural Sprayers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Agricultural Sprayers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Agricultural Sprayers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Agricultural Sprayers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South America Agricultural Sprayers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Agricultural Sprayers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Agricultural Sprayers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Agricultural Sprayers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Agricultural Sprayers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Agricultural Sprayers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Agricultural Sprayers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Agricultural Sprayers Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the South America Agricultural Sprayers Market?

Key companies in the market include Deere & Company (PLA Group), Caiman SR, Stara SA, CNH Industrail N V, Guarany Ind Ltda, Jacto Inc, AGCO Corporation.

3. What are the main segments of the South America Agricultural Sprayers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 501.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements.

6. What are the notable trends driving market growth?

Increase in Average Farm Size Leading To Adoption of Agricultural Sprayers.

7. Are there any restraints impacting market growth?

High Cost of Equipment and Price Sensitivity; Data Privacy Concerns.

8. Can you provide examples of recent developments in the market?

September 2022: John Deere has launched its 'see and spray' technology on one of the new sprayers released at the Farm Progress Show. The machine combines targeted spray technology with a conventional broadcast system to offer growers options throughout the season and it is the first green-on-green targeted spray technology to be commercialized by the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Agricultural Sprayers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Agricultural Sprayers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Agricultural Sprayers Market?

To stay informed about further developments, trends, and reports in the South America Agricultural Sprayers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence