Key Insights

The South Korean luxury goods market, valued at 2.02 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 1.31% from 2025 to 2033. This growth is propelled by an expanding affluent demographic with rising disposable incomes, a strong preference for premium brands, and an increasing aspirational consumer base. The proliferation of online luxury retail and strategic brand collaborations tailored to the South Korean consumer further bolster market expansion. The market is segmented by product type (apparel, footwear, accessories, watches, jewelry) and distribution channels (brand boutiques, multi-brand retailers, e-commerce, and other outlets). Key players include global luxury conglomerates such as LVMH and Kering, alongside prominent international and emerging domestic brands. While economic volatility and geopolitical factors present potential challenges, the market's outlook remains robust, underpinned by the enduring allure of luxury and South Korea's economic strength.

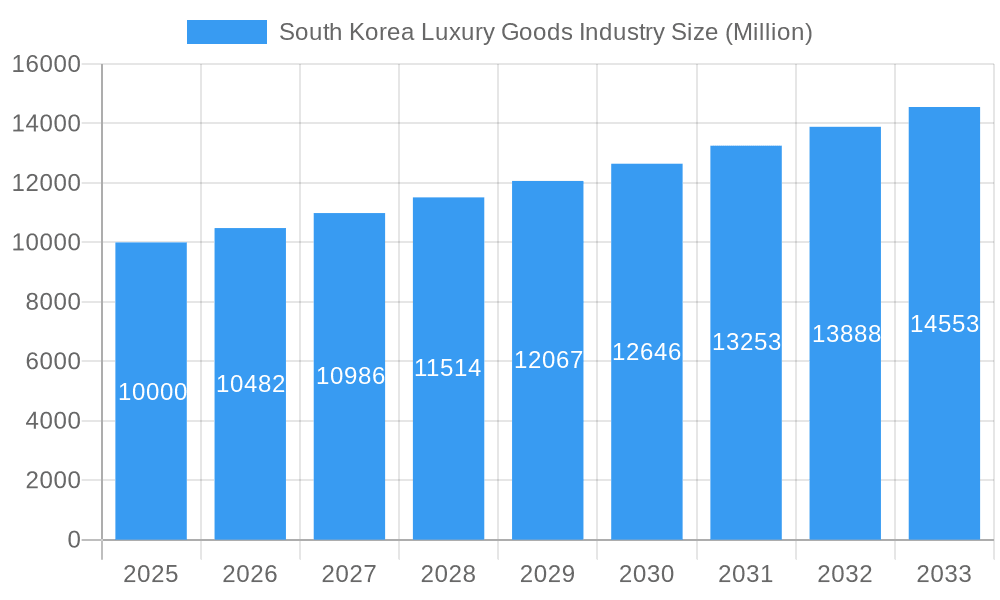

South Korea Luxury Goods Industry Market Size (In Billion)

The competitive landscape is characterized by a significant presence of international luxury brands and a growing cohort of successful local players. The robust performance of online channels highlights successful adaptation to evolving consumer behaviors. Future success will likely depend on continued investment in digital marketing, personalized consumer experiences, and a growing emphasis on sustainability and ethical sourcing, which are increasingly influencing consumer choices and brand positioning. Understanding these trends is crucial for capitalizing on the significant growth opportunities within the South Korean luxury goods market.

South Korea Luxury Goods Industry Company Market Share

South Korea Luxury Goods Market Analysis: 2019-2033

This report offers a comprehensive analysis of the South Korean luxury goods market, providing essential insights for industry stakeholders, investors, and strategists. Spanning 2019 to 2033, with a specific focus on 2025, the report utilizes rigorous data analysis and expert commentary to identify key trends and opportunities in this dynamic sector. The South Korean luxury goods market, valued at 2.02 billion in 2025, is forecast to reach substantial growth by 2033, demonstrating a compelling CAGR of 1.31%.

South Korea Luxury Goods Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory aspects of the South Korean luxury goods market. We examine market concentration, highlighting the significant players like LVMH Moet Hennessy Louis Vuitton, Kering Group (Gucci), and Chanel, alongside prominent domestic brands such as We11Done and Gentle Monster. The report also assesses the impact of M&A activities, including the January 2022 Sequoia Capital investment in We11Done (xx Million deal value estimated), on market share dynamics. Furthermore, we delve into the regulatory frameworks governing the industry, exploring their influence on innovation and market access. The analysis includes an assessment of product substitutes and the evolving demographics of luxury goods consumers in South Korea.

South Korea Luxury Goods Industry Market Dynamics & Trends

The South Korean luxury goods market is experiencing dynamic growth, fueled by a confluence of factors shaping its future trajectory. This analysis delves into evolving consumer preferences across key product categories – Clothing and Apparel, Footwear, Bags, Watches, Jewelry, and Other Accessories – and distribution channels encompassing Single-Brand Stores, Multi-Brand Stores, Online Stores, and Other Distribution Channels. We examine the significant impact of technological disruptions, including the explosive growth of e-commerce and the implementation of sophisticated personalized marketing strategies, on market penetration and overall expansion. A detailed competitive landscape analysis considers pricing strategies, branding effectiveness, and the crucial role of product differentiation. Furthermore, this report provides quantifiable data on Compound Annual Growth Rate (CAGR) and market penetration rates for key segments, offering a robust understanding of market growth drivers.

Dominant Regions & Segments in South Korea Luxury Goods Industry

This section pinpoints the leading regions and segments within the vibrant South Korean luxury goods market. We present a comprehensive analysis of geographically dominant areas within South Korea and meticulously examine the performance of each product category (Clothing and Apparel, Footwear, Bags, Watches, Jewelry, Other Accessories) and distribution channel (Single-Brand Stores, Multi-Brand Stores, Online Stores, Other Distribution Channels). The analysis incorporates economic policies, infrastructure advancements, and evolving consumer behavior to explain the observed market dominance.

- Key Drivers (by Segment):

- Clothing & Apparel: A strong foundation of domestic design talent coupled with escalating disposable incomes fuels significant growth.

- Footwear: The demand for high-end sneakers and designer footwear continues to surge, driving market expansion.

- Bags: The enduring popularity of luxury handbags, further amplified by increasing brand awareness, contributes to robust market performance.

- Watches & Jewelry: A growing appreciation for luxury timepieces and fine jewelry reflects a shift towards aspirational purchases.

- Other Accessories: The rising popularity of luxury eyewear and other accessories underscores the expanding scope of the luxury market.

- Single-Brand Stores: Strategic flagship store openings and targeted brand-building initiatives contribute to market share gains.

- Multi-Brand Stores: The diverse product offerings of multi-brand stores cater to a broader spectrum of customer preferences.

- Online Stores: The unparalleled convenience and extended reach provided by e-commerce platforms are reshaping the retail landscape.

South Korea Luxury Goods Industry Product Innovations

The South Korean luxury goods market is defined by a relentless pursuit of product innovation, reflecting prevailing trends towards personalization, sustainability, and seamless technological integration. Brands are leveraging technology to create elevated customer experiences, utilizing tools such as virtual try-on applications and sophisticated personalized recommendation engines. The adoption of smart materials and sustainable manufacturing practices is also gaining momentum, aligning with the evolving values of conscious consumers and addressing critical environmental concerns. This focus on innovation is a key driver of competitive advantage, securing market share, and ensuring lasting brand relevance.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the South Korean luxury goods market by product type (Clothing and Apparel, Footwear, Bags, Watches, Jewelry, Other Accessories) and distribution channel (Single-Brand Stores, Multi-Brand Stores, Online Stores, Other Distribution Channels). Each segment’s growth projections, market size, and competitive dynamics are thoroughly analyzed. For example, the online retail segment is expected to exhibit significant growth due to increasing internet penetration and consumer preference for online shopping experiences.

Key Drivers of South Korea Luxury Goods Industry Growth

The remarkable growth of the South Korean luxury goods industry is driven by a combination of key factors. Significantly, rising disposable incomes and the expansion of a burgeoning middle class fuel the demand for premium products. Government support, manifested through favorable policies and strategic infrastructure development within the fashion and luxury sectors, further enhances market growth. Crucially, the global surge in popularity of Korean culture ("Korean Wave") significantly boosts the international appeal of South Korean luxury brands.

Challenges in the South Korea Luxury Goods Industry Sector

The South Korean luxury goods industry faces challenges including intense competition from both established international brands and emerging domestic players. Supply chain disruptions and increasing raw material costs pose a significant threat to profitability. Furthermore, the economic climate and consumer sentiment can heavily influence market demand, creating uncertainty for businesses.

Emerging Opportunities in South Korea Luxury Goods Industry

Significant opportunities exist in the South Korean luxury goods sector. The growing demand for personalized luxury experiences presents opportunities for brands to cater to individual customer needs. The expansion of e-commerce creates new avenues for market penetration and increased sales. Furthermore, the rising interest in sustainable and ethically produced luxury goods offers opportunities for brands to differentiate themselves and appeal to an environmentally conscious consumer base.

Leading Players in the South Korea Luxury Goods Industry Market

Key Developments in South Korea Luxury Goods Industry Industry

- May 2022: Dior opens a large pop-up store in Seoul, showcasing its women's ready-to-wear line. This significantly increases Dior's brand visibility and market reach in South Korea.

- January 2022: Sequoia Capital China invests in We11Done, signaling confidence in the brand's growth potential and boosting its market standing.

- February 2021: Kampos, an Italian luxury brand, enters the South Korean market through a partnership with a local distributor, expanding its global presence.

Future Outlook for South Korea Luxury Goods Industry Market

The South Korean luxury goods market is poised for sustained growth, propelled by increasing affluence, evolving consumer preferences, and continuous technological advancements. Strategic partnerships, strategic brand expansion, and continuous innovation in both product offerings and retail experiences will be paramount for success in this fiercely competitive market. The growing emphasis on sustainability and ethical sourcing will increasingly shape the market's future trajectory, creating lucrative opportunities for brands that prioritize these values and resonate with the values of conscious consumers.

South Korea Luxury Goods Industry Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Watches

- 1.5. Jewelry

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-Brand Stores

- 2.2. Multi-Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

South Korea Luxury Goods Industry Segmentation By Geography

- 1. South Korea

South Korea Luxury Goods Industry Regional Market Share

Geographic Coverage of South Korea Luxury Goods Industry

South Korea Luxury Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sunglasses As A Fashion Statement; Advertisement and Promotional Activities

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Celebrities Endorsements Driving the Demand for Luxury Goods in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Watches

- 5.1.5. Jewelry

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-Brand Stores

- 5.2.2. Multi-Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Giorgio Armani S p A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 We11Done

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermes International SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Estee Lauder Companies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gentle Monster

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chanel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering Group (Gucci)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rolex SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 H & M Hennes & Mauritz AB (H&M)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Prada Holding S p A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: South Korea Luxury Goods Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Korea Luxury Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Luxury Goods Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South Korea Luxury Goods Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: South Korea Luxury Goods Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Korea Luxury Goods Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: South Korea Luxury Goods Industry Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: South Korea Luxury Goods Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Luxury Goods Industry?

The projected CAGR is approximately 1.31%.

2. Which companies are prominent players in the South Korea Luxury Goods Industry?

Key companies in the market include Giorgio Armani S p A, We11Done, Hermes International SA, The Estee Lauder Companies Inc, LVMH Moet Hennessy Louis Vuitton*List Not Exhaustive, Gentle Monster, Chanel, Kering Group (Gucci), Rolex SA, H & M Hennes & Mauritz AB (H&M), Prada Holding S p A.

3. What are the main segments of the South Korea Luxury Goods Industry?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Sunglasses As A Fashion Statement; Advertisement and Promotional Activities.

6. What are the notable trends driving market growth?

Celebrities Endorsements Driving the Demand for Luxury Goods in South Korea.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In May 2022, Dior, the French fashion brand opened a large pop-up store in Seoul, South Korea. The store features several rooms inside, each dedicated to a definite segment of the women's ready-to-wear line.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Luxury Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Luxury Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Luxury Goods Industry?

To stay informed about further developments, trends, and reports in the South Korea Luxury Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence