Key Insights

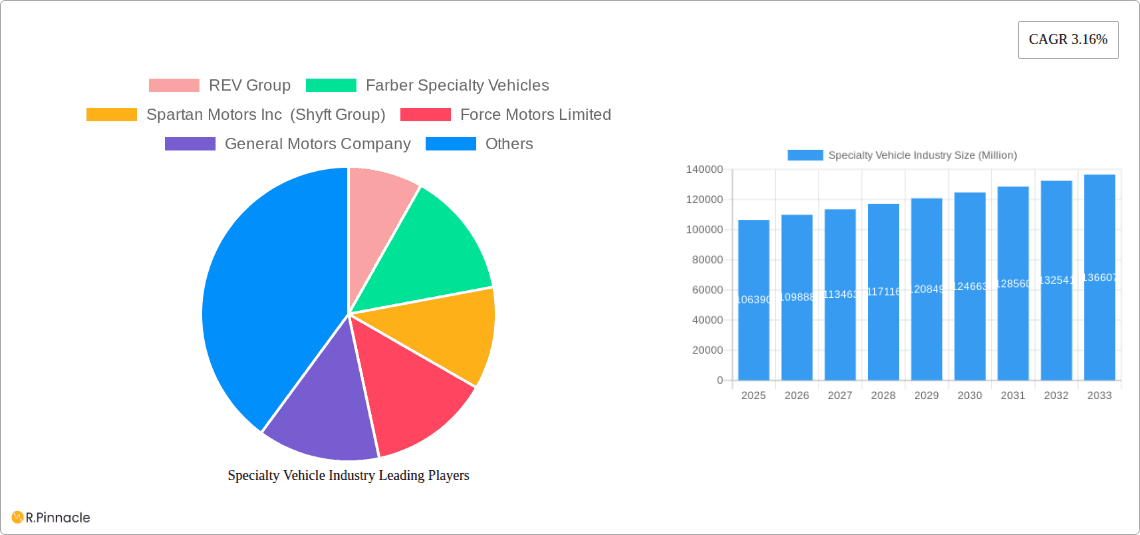

The specialty vehicle market, valued at $106.39 billion in 2025, is projected to experience steady growth, driven by increasing demand for specialized transportation solutions across diverse sectors. The Compound Annual Growth Rate (CAGR) of 3.16% from 2025 to 2033 reflects a consistent expansion, influenced by factors such as rising government spending on public safety and infrastructure development, particularly in North America and Europe. Growth is further fueled by the burgeoning need for efficient and reliable transportation in the medical and healthcare sectors, coupled with the rising popularity of recreational vehicles. Technological advancements leading to improved vehicle safety, fuel efficiency, and advanced functionalities are also contributing significantly to market growth. However, fluctuating raw material prices and stringent emission regulations present challenges that may slightly temper growth in certain segments. The market segmentation reveals a strong reliance on ambulances and fire extinguishing trucks, indicating the substantial influence of public safety needs. Further growth potential is present within the medical and healthcare applications due to the increased demand for efficient emergency and patient transport solutions, while the recreational vehicles segment is likely to see moderate expansion, driven by changing consumer preferences and discretionary spending.

Specialty Vehicle Industry Market Size (In Billion)

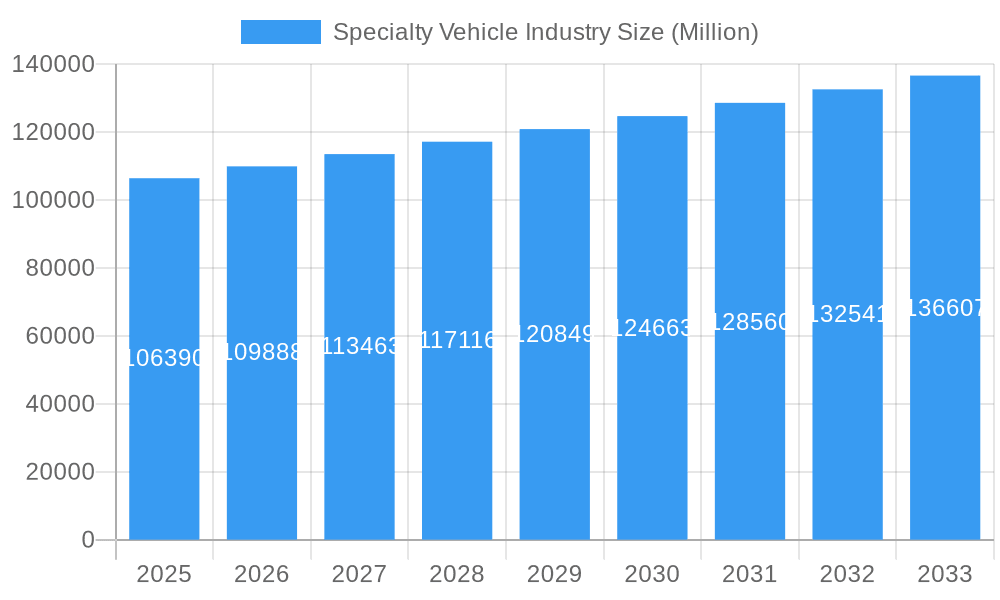

The competitive landscape is characterized by a mix of established players like REV Group, Oshkosh Corporation, and Daimler AG, and smaller specialized manufacturers. These companies leverage their expertise in vehicle design and manufacturing, coupled with strategic partnerships, to maintain market share. The Asia-Pacific region, particularly China and India, is expected to present substantial opportunities, fueled by urbanization and economic growth. However, regulatory hurdles and infrastructural limitations could potentially pose challenges in some emerging markets. Overall, the outlook for the specialty vehicle market remains positive, with continued expansion driven by the factors outlined above, even considering potential economic fluctuations. The forecast period of 2025-2033 suggests a promising trajectory for this crucial sector.

Specialty Vehicle Industry Company Market Share

Specialty Vehicle Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global specialty vehicle industry, projecting a market valuation exceeding $XX Million by 2033. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategic planners seeking actionable insights into this dynamic sector. The report leverages extensive data analysis and expert insights to forecast market trends, identify key players, and unveil emerging opportunities.

Specialty Vehicle Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape, highlighting market concentration, innovation drivers, regulatory impacts, and M&A activities within the specialty vehicle sector. The global market is moderately fragmented, with key players such as REV Group, Daimler AG, and Oshkosh Corporation holding significant but not dominant market share. Market share is expected to see a shift during the forecast period due to new entrants and evolving technologies.

Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at XX, indicating a moderately concentrated market. This allows for strategic analysis of competitive dynamics.

Innovation Drivers: Technological advancements in electric and autonomous vehicle technologies are primary drivers of innovation, especially in ambulances and law enforcement vehicles. Furthermore, increasing demand for customized vehicles tailored to specific applications pushes manufacturers towards further innovation.

Regulatory Frameworks: Stringent safety and emission regulations influence vehicle design and production, creating both challenges and opportunities for manufacturers to invest in compliance-driven technologies.

Product Substitutes: The emergence of alternative transportation solutions, such as ride-sharing services, presents limited substitutive pressure to the specialty vehicle market. However, within the segments, specialized applications maintain unique and irreplaceable functions.

M&A Activities: Significant M&A activity, totaling an estimated $XX Million in deal value during 2019-2024, points to industry consolidation and expansion. These transactions aim to diversify product portfolios and bolster geographic reach. The average deal value is estimated at $XX Million.

Specialty Vehicle Industry Market Dynamics & Trends

The global specialty vehicle market is characterized by robust growth, driven by increasing government spending on public safety and healthcare infrastructure, along with rising demand for recreational vehicles. The market exhibits a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration of electric specialty vehicles is projected to increase from XX% in 2025 to XX% by 2033.

Key growth drivers include:

- Infrastructure Development: Investment in public infrastructure is directly correlated with demand for specialty vehicles, creating sustained growth.

- Technological Advancements: The integration of advanced technologies, such as telematics, enhances vehicle performance and safety, boosting market demand.

- Government Regulations: Stringent safety standards and environmental regulations fuel the need for advanced, compliant vehicles, impacting market growth.

- Rising Disposable Incomes: Increases in disposable income fuel the demand for recreational vehicles, a significant market segment.

- Growing Urbanization: The expansion of urban areas results in an increased need for specialized vehicles to cater to specific urban challenges.

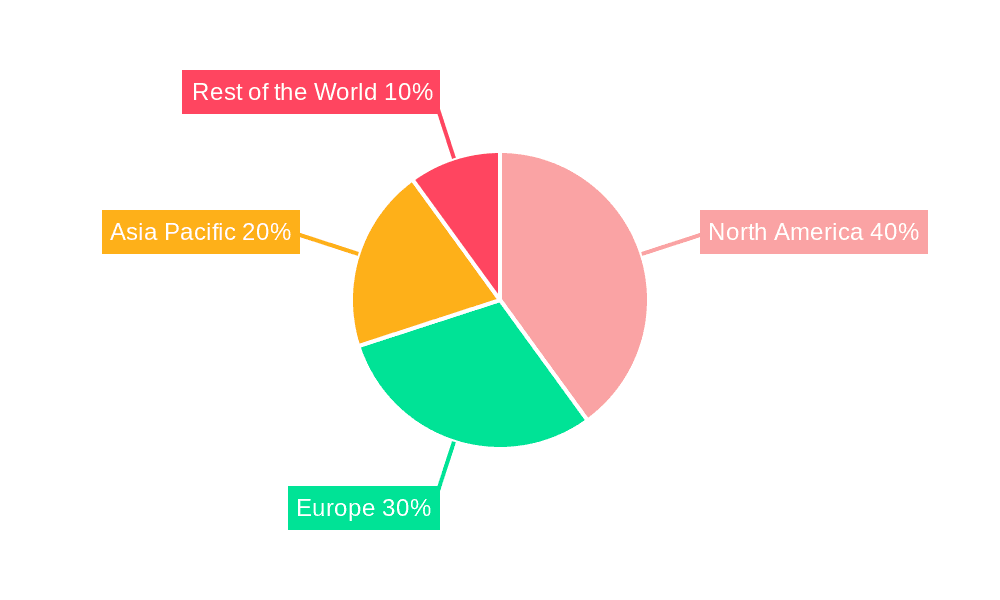

Dominant Regions & Segments in Specialty Vehicle Industry

The North American region currently dominates the specialty vehicle market, driven by high public safety spending and a mature recreational vehicle sector. Europe is a significant market, followed by Asia Pacific.

By Type:

- Ambulances: This segment is a significant portion of the overall market and is expanding due to the increasing demand for improved healthcare infrastructure and emergency services.

- Fire Extinguishing Trucks: This segment exhibits moderate growth driven by infrastructure and safety requirements.

- Mobile Fuel Carrying Tankers: This segment displays consistent demand, influenced by energy requirements across various sectors.

- Other Types: This segment comprises various specialized vehicles.

By Application Type:

- Law Enforcement and Public Safety: This segment shows substantial growth due to increasing government spending.

- Medical and Healthcare: This is one of the most significant segments and shows healthy growth because of rising healthcare spending.

- Recreational Vehicles: This segment is experiencing growth from an increase in personal disposable income.

- Other Services: This includes other specialized vehicles not explicitly included in the above categories.

Specialty Vehicle Industry Product Innovations

Recent innovations highlight the integration of electric powertrains in ambulances (Mercedes-Benz eSprinter) and the introduction of new minibus lines by MAZ. These demonstrate a push toward sustainable and efficient specialty vehicles, catering to evolving consumer needs and environmental regulations. Emphasis is on enhancing safety features, improving fuel efficiency, and incorporating advanced technologies. The market is seeing increased customization to meet specific application needs.

Report Scope & Segmentation Analysis

This report segments the specialty vehicle market by vehicle type (ambulances, fire trucks, fuel tankers, others) and application (law enforcement, medical, recreational, others). Each segment's growth projections, market size, and competitive dynamics are analyzed, providing a granular understanding of the industry. Growth rates vary depending on the segment, with the medical and healthcare segment expected to maintain the fastest growth.

Key Drivers of Specialty Vehicle Industry Growth

Government investments in infrastructure projects (particularly in developing economies) are driving considerable growth. The rising demand for improved healthcare and public safety services also contributes significantly. Technological advancements like autonomous driving capabilities and alternative fuel options are further stimulating market expansion.

Challenges in the Specialty Vehicle Industry Sector

The specialty vehicle sector faces challenges like fluctuating raw material prices, supply chain disruptions and intense competition. These factors impact production costs and profitability. Meeting stringent safety and emission regulations also presents significant challenges.

Emerging Opportunities in Specialty Vehicle Industry

The increasing adoption of electric and autonomous technologies presents significant opportunities. Emerging markets in developing economies offer untapped potential. The development of specialized vehicles for niche applications (e.g., disaster relief) also creates growth opportunities.

Leading Players in the Specialty Vehicle Industry Market

- REV Group

- Farber Specialty Vehicles

- Spartan Motors Inc (Shyft Group)

- Force Motors Limited

- General Motors Company

- Specialty Vehicles Inc

- Daimler AG

- Volvo Group

- Emergency One Group

- Matthews Specialty Vehicles Inc

- LDV Inc

- Oshkosh Corporation

Key Developments in Specialty Vehicle Industry

- June 2022: Minsk Automobile Plant (MAZ) launched the MAZ minibus line, including the MAZ-365022, a light-duty vehicle adaptable for ambulance use.

- March 2021: Mercedes-Benz Vans launched an electric ambulance based on the eSprinter, showcasing technological advancements in the sector.

- March 2021: Falck signed a master agreement with MAN Truck & Bus for ambulance and patient transport applications, indicating strategic partnerships.

Future Outlook for Specialty Vehicle Industry Market

The specialty vehicle industry is poised for continued growth, driven by technological innovation, rising demand in key segments, and substantial investment in infrastructure development globally. Strategic partnerships and product diversification will play a key role in shaping the future market landscape. The market shows strong potential for expansion, particularly in emerging economies and specialized segments.

Specialty Vehicle Industry Segmentation

-

1. Type

- 1.1. Ambulances

- 1.2. Fire Extinguishing Trucks

- 1.3. Mobile Fuel Carrying Tankers

- 1.4. Other Types

-

2. Application Type

- 2.1. Law Enforcement And Public Safety

- 2.2. Medical And Healthcare

- 2.3. Recreational Vehicles

- 2.4. Other Services

Specialty Vehicle Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Specialty Vehicle Industry Regional Market Share

Geographic Coverage of Specialty Vehicle Industry

Specialty Vehicle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Advanced Comfort Systems In Vehicles

- 3.3. Market Restrains

- 3.3.1. High Cost Assoicated with Advanced Features

- 3.4. Market Trends

- 3.4.1. Increase in Spending on Law Enforcement and Healthcare Facilities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Specialty Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ambulances

- 5.1.2. Fire Extinguishing Trucks

- 5.1.3. Mobile Fuel Carrying Tankers

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Law Enforcement And Public Safety

- 5.2.2. Medical And Healthcare

- 5.2.3. Recreational Vehicles

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Specialty Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ambulances

- 6.1.2. Fire Extinguishing Trucks

- 6.1.3. Mobile Fuel Carrying Tankers

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Law Enforcement And Public Safety

- 6.2.2. Medical And Healthcare

- 6.2.3. Recreational Vehicles

- 6.2.4. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Specialty Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ambulances

- 7.1.2. Fire Extinguishing Trucks

- 7.1.3. Mobile Fuel Carrying Tankers

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Law Enforcement And Public Safety

- 7.2.2. Medical And Healthcare

- 7.2.3. Recreational Vehicles

- 7.2.4. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Specialty Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ambulances

- 8.1.2. Fire Extinguishing Trucks

- 8.1.3. Mobile Fuel Carrying Tankers

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Law Enforcement And Public Safety

- 8.2.2. Medical And Healthcare

- 8.2.3. Recreational Vehicles

- 8.2.4. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Specialty Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ambulances

- 9.1.2. Fire Extinguishing Trucks

- 9.1.3. Mobile Fuel Carrying Tankers

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Law Enforcement And Public Safety

- 9.2.2. Medical And Healthcare

- 9.2.3. Recreational Vehicles

- 9.2.4. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 REV Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Farber Specialty Vehicles

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Spartan Motors Inc (Shyft Group)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Force Motors Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Motors Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Specialty Vehicles Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Daimler AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Volvo Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Emergency One Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Matthews Specialty Vehicles Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 LDV Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Oshkosh Corporatio

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 REV Group

List of Figures

- Figure 1: Global Specialty Vehicle Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Specialty Vehicle Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Specialty Vehicle Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Specialty Vehicle Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Specialty Vehicle Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Specialty Vehicle Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Specialty Vehicle Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Specialty Vehicle Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Specialty Vehicle Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Specialty Vehicle Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 11: Europe Specialty Vehicle Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 12: Europe Specialty Vehicle Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Specialty Vehicle Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Specialty Vehicle Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Specialty Vehicle Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Specialty Vehicle Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 17: Asia Pacific Specialty Vehicle Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 18: Asia Pacific Specialty Vehicle Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Specialty Vehicle Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Specialty Vehicle Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Specialty Vehicle Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Specialty Vehicle Industry Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Rest of the World Specialty Vehicle Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Rest of the World Specialty Vehicle Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Specialty Vehicle Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Specialty Vehicle Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Specialty Vehicle Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Specialty Vehicle Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Specialty Vehicle Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Specialty Vehicle Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 6: Global Specialty Vehicle Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Specialty Vehicle Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Specialty Vehicle Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 12: Global Specialty Vehicle Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Specialty Vehicle Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Specialty Vehicle Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 19: Global Specialty Vehicle Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Specialty Vehicle Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Specialty Vehicle Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 27: Global Specialty Vehicle Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: South America Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Middle East and Africa Specialty Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Specialty Vehicle Industry?

The projected CAGR is approximately 3.16%.

2. Which companies are prominent players in the Specialty Vehicle Industry?

Key companies in the market include REV Group, Farber Specialty Vehicles, Spartan Motors Inc (Shyft Group), Force Motors Limited, General Motors Company, Specialty Vehicles Inc, Daimler AG, Volvo Group, Emergency One Group, Matthews Specialty Vehicles Inc, LDV Inc, Oshkosh Corporatio.

3. What are the main segments of the Specialty Vehicle Industry?

The market segments include Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 106.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Advanced Comfort Systems In Vehicles.

6. What are the notable trends driving market growth?

Increase in Spending on Law Enforcement and Healthcare Facilities.

7. Are there any restraints impacting market growth?

High Cost Assoicated with Advanced Features.

8. Can you provide examples of recent developments in the market?

Jun 2022: Minsk Automobile Plant (MAZ) announced the launch of the MAZ minibus line. New products MAZ-281040 and MAZ-365022 were introduced at the event. MAZ-365022 is a light-duty commercial vehicle. This vehicle can be used to transport anything from a manufactured goods van to an ambulance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Specialty Vehicle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Specialty Vehicle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Specialty Vehicle Industry?

To stay informed about further developments, trends, and reports in the Specialty Vehicle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence