Key Insights

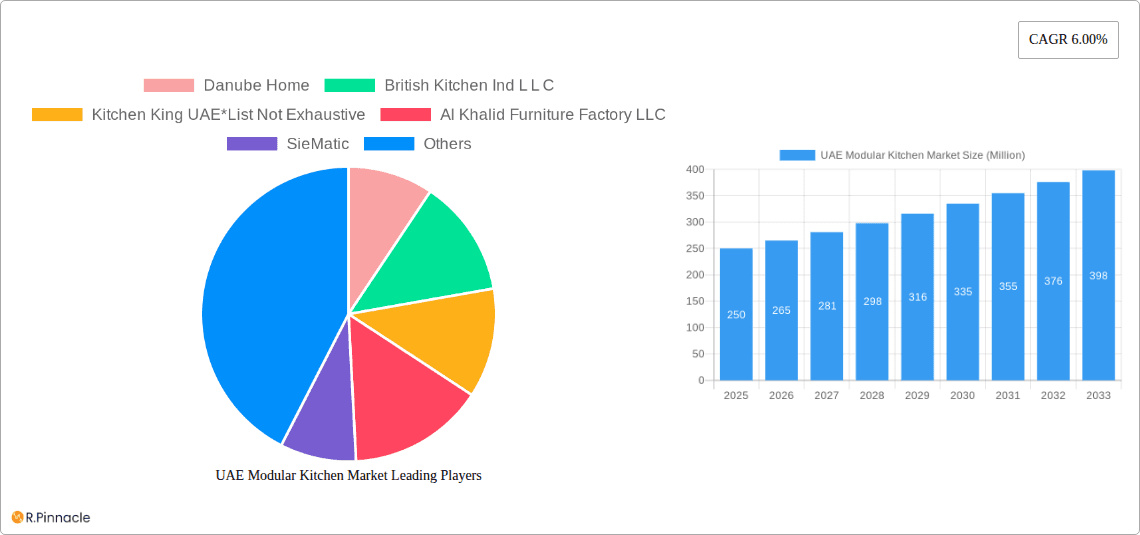

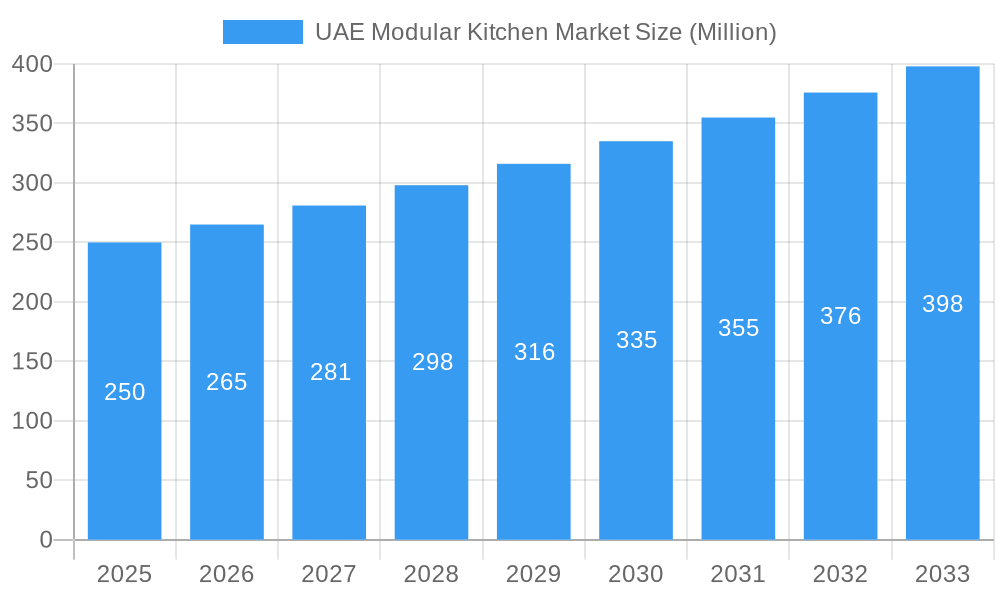

The UAE modular kitchen market, valued at $1676 million in 2024, is projected for substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of 2.7% from 2024 to 2033. This growth is propelled by increasing urbanization and a rising middle class, driving demand for contemporary, space-efficient, and aesthetically pleasing kitchen solutions. The burgeoning popularity of modern home designs and a preference for customized kitchens significantly contribute to market dynamism. Modular kitchens offer enhanced convenience and efficiency over traditional installations, further accelerating adoption. The market is segmented by product type (cabinetry, storage units, accessories), distribution channels (offline via contractors and builders, and online retail), and end-users (residential and commercial). Offline channels, dominated by contractors and builders involved in new construction and renovations, are currently the primary market drivers. However, the increasing online presence of key manufacturers suggests a growing share for the online retail segment. Key market participants include established brands and numerous local manufacturers, all competing for market share. Sustained economic development, infrastructure investment, and evolving lifestyle trends in the UAE are crucial for future market growth.

UAE Modular Kitchen Market Market Size (In Billion)

The competitive arena features a blend of international brands, known for their recognition and advanced technology, and local manufacturers, who offer market insight and cost advantages. Future growth is intricately linked to real estate development, consumer preference shifts, and the UAE's economic climate. Emerging trends, such as smart home technology integration and the use of sustainable materials, are poised to redefine modular kitchen designs. Challenges including raw material price volatility and intense competition necessitate strategic management for sustained growth. Government initiatives supporting sustainable construction can boost demand for eco-friendly modular kitchen solutions.

UAE Modular Kitchen Market Company Market Share

UAE Modular Kitchen Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UAE modular kitchen market, offering actionable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report leverages extensive market research to deliver a precise understanding of current market dynamics and future growth trajectories. The report covers key players such as Danube Home, British Kitchen Ind L L C, Kitchen King UAE, Al Khalid Furniture Factory LLC, SieMatic, Space 3 LLC, Scavolini, Arabian Falcon Metal Kitchens LLC, Al Marri Metal Kitchen Factory LLC, Hacker, and Inter IKEA Group, but the list is not exhaustive.

UAE Modular Kitchen Market Structure & Innovation Trends

This section analyzes the competitive landscape, encompassing market concentration, innovation drivers, and regulatory influences within the UAE modular kitchen market. We examine the market share of key players and delve into M&A activities, including deal values (where available). The report also considers the impact of product substitutes and evolving end-user demographics on market structure.

- Market Concentration: The UAE modular kitchen market exhibits a [xx]% level of concentration, with [xx] major players controlling [xx]% of the market share. This is expected to [increase/decrease] by [xx]% by 2033.

- Innovation Drivers: Technological advancements in materials, design software, and manufacturing processes are driving innovation, particularly in areas such as smart kitchen technology and sustainable materials.

- Regulatory Framework: UAE building codes and regulations regarding kitchen safety and design influence market trends. [Further detail on specific regulations and their impact needed].

- Product Substitutes: [Discussion of existing or emerging substitutes for modular kitchens and their market impact].

- End-User Demographics: The increasing number of [explain the demographic that contributes to the growth] is fueling growth in the residential segment.

- M&A Activities: [Include details of any mergers and acquisitions, including deal values if available. If not available, state "Data unavailable"].

UAE Modular Kitchen Market Dynamics & Trends

This section explores the key factors driving the growth of the UAE modular kitchen market, including technological disruptions, evolving consumer preferences, and competitive dynamics. We present a detailed analysis of market growth drivers, projecting a Compound Annual Growth Rate (CAGR) of [xx]% during the forecast period (2025-2033). Market penetration rates for different product segments will also be examined.

[Insert 600 words of detailed analysis on market growth drivers, technological disruptions, consumer preferences, competitive dynamics, CAGR, and market penetration for UAE Modular Kitchen Market. Include quantifiable data wherever possible].

Dominant Regions & Segments in UAE Modular Kitchen Market

This section identifies the leading regions and segments within the UAE modular kitchen market, categorized by product type (Floor Cabinet & Wall Cabinets, Tall Storage Cabinets, Other Products), distribution channel (Offline, Online), and end-user (Residential, Commercial). Key drivers for dominance in each segment are highlighted.

Dominant Segments:

- By Product: Floor Cabinet & Wall Cabinets remains the dominant segment, driven by [explain reasons].

- By Distribution Channel: Offline channels (contractors, builders) currently hold a larger market share than online channels. This is attributed to [explain reasons]. However, online channels are experiencing significant growth due to [explain reasons].

- By End-User: The residential segment dominates the market due to [explain reasons]. The commercial segment shows promising growth potential driven by [explain reasons].

Key Drivers (Bullet points for each dominant segment):

- Economic Policies: [e.g., government initiatives supporting real estate development].

- Infrastructure Development: [e.g., new residential and commercial projects].

- Consumer Preferences: [e.g., increasing preference for modern and customized kitchens].

[Insert detailed dominance analysis for each segment (approx. 200 words per segment)].

UAE Modular Kitchen Market Product Innovations

The UAE modular kitchen market is witnessing significant product innovations, particularly in materials, designs, and smart kitchen technologies. Manufacturers are increasingly focusing on sustainable materials and energy-efficient appliances to cater to environmentally conscious consumers. The integration of smart home technology, such as voice-activated controls and integrated appliances, is also gaining traction. This innovation is driving higher prices but also increased customer satisfaction. The market fit for these new products is generally excellent due to [explain reasons].

Report Scope & Segmentation Analysis

This report segments the UAE modular kitchen market by product, distribution channel, and end-user.

By Product: The report analyzes the market size and growth projections for Floor Cabinet & Wall Cabinets, Tall Storage Cabinets, and Other Products. Competitive dynamics within each product segment are also discussed.

By Distribution Channel: The report examines the market size and growth of offline (contractors, builders) and online channels, highlighting the competitive landscape and growth prospects of each.

By End-User: The report segments the market by residential and commercial end-users, analyzing their individual market sizes, growth rates, and specific needs.

Key Drivers of UAE Modular Kitchen Market Growth

The growth of the UAE modular kitchen market is driven by several factors, including:

- Rising Disposable Incomes: Increased purchasing power among UAE residents fuels demand for high-quality modular kitchens.

- Real Estate Boom: Significant investments in residential and commercial real estate projects drive demand for modular kitchens.

- Government Initiatives: [Examples of supportive government policies].

Challenges in the UAE Modular Kitchen Market Sector

The UAE modular kitchen market faces several challenges:

- High Import Costs: Dependence on imported materials and components impacts pricing and profitability.

- Intense Competition: A competitive market requires manufacturers to differentiate themselves through innovation and branding.

- Supply Chain Disruptions: Global supply chain issues can impact production and delivery timelines.

Emerging Opportunities in UAE Modular Kitchen Market

The UAE modular kitchen market presents numerous emerging opportunities:

- Smart Kitchen Technology: Growing demand for smart home features creates opportunities for integrated appliances and automation.

- Sustainable Materials: Eco-conscious consumers drive demand for sustainable and eco-friendly kitchen solutions.

- Customization: The growing demand for customized kitchens and designs provides a niche for businesses offering such services.

Leading Players in the UAE Modular Kitchen Market Market

- Danube Home

- British Kitchen Ind L L C

- Kitchen King UAE

- Al Khalid Furniture Factory LLC

- SieMatic

- Space 3 LLC

- Scavolini

- Arabian Falcon Metal Kitchens LLC

- Al Marri Metal Kitchen Factory LLC

- Hacker

- Inter IKEA Group

Key Developments in UAE Modular Kitchen Market Industry

- December 2022: OC Home announced a 100,000 sq ft retail space expansion, including three new stores in the UAE, signaling increased market competition and consumer demand.

- February 2022: Dubai retailer Casa Milano's collaboration with Arredo3 broadened the range of high-end modular kitchen designs available, raising the bar for market offerings.

Future Outlook for UAE Modular Kitchen Market Market

The UAE modular kitchen market is poised for sustained growth, driven by increasing urbanization, rising disposable incomes, and a preference for modern, customized kitchens. Strategic opportunities exist for manufacturers who can innovate in sustainable materials, smart home integration, and cater to the unique needs of the UAE market. The market is expected to reach [xx] Million by 2033.

UAE Modular Kitchen Market Segmentation

-

1. Product

- 1.1. Floor Cabinet & Wall Cabinets

- 1.2. Tall Storage Cabinets

- 1.3. Other Products

-

2. Distribution Channel

- 2.1. Offline (Contractors, Builders, etc.)

- 2.2. Online

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

UAE Modular Kitchen Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Modular Kitchen Market Regional Market Share

Geographic Coverage of UAE Modular Kitchen Market

UAE Modular Kitchen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Offline Distribution Channel is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Reduced Consumer Spending is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Development in the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Floor Cabinet & Wall Cabinets

- 5.1.2. Tall Storage Cabinets

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline (Contractors, Builders, etc.)

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Floor Cabinet & Wall Cabinets

- 6.1.2. Tall Storage Cabinets

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline (Contractors, Builders, etc.)

- 6.2.2. Online

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Floor Cabinet & Wall Cabinets

- 7.1.2. Tall Storage Cabinets

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline (Contractors, Builders, etc.)

- 7.2.2. Online

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Floor Cabinet & Wall Cabinets

- 8.1.2. Tall Storage Cabinets

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline (Contractors, Builders, etc.)

- 8.2.2. Online

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Floor Cabinet & Wall Cabinets

- 9.1.2. Tall Storage Cabinets

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline (Contractors, Builders, etc.)

- 9.2.2. Online

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Floor Cabinet & Wall Cabinets

- 10.1.2. Tall Storage Cabinets

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline (Contractors, Builders, etc.)

- 10.2.2. Online

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Danube Home

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 British Kitchen Ind L L C

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kitchen King UAE*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Khalid Furniture Factory LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SieMatic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Space 3 LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Scavolini

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arabian Falcon Metal Kitchens LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Marri Metal Kitchen Factory LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hacker

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inter IKEA Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Danube Home

List of Figures

- Figure 1: Global UAE Modular Kitchen Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 3: North America UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 7: North America UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 11: South America UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 13: South America UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 15: South America UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 19: Europe UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Europe UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 21: Europe UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 23: Europe UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Europe UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 27: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 31: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 35: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: Asia Pacific UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 39: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Asia Pacific UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Global UAE Modular Kitchen Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 13: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 15: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 20: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 22: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 33: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 35: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 43: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 45: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 46: China UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Modular Kitchen Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the UAE Modular Kitchen Market?

Key companies in the market include Danube Home, British Kitchen Ind L L C, Kitchen King UAE*List Not Exhaustive, Al Khalid Furniture Factory LLC, SieMatic, Space 3 LLC, Scavolini, Arabian Falcon Metal Kitchens LLC, Al Marri Metal Kitchen Factory LLC, Hacker, Inter IKEA Group.

3. What are the main segments of the UAE Modular Kitchen Market?

The market segments include Product, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1676 million as of 2022.

5. What are some drivers contributing to market growth?

Offline Distribution Channel is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Development in the Construction Sector.

7. Are there any restraints impacting market growth?

Reduced Consumer Spending is Restraining the Market.

8. Can you provide examples of recent developments in the market?

December 2022: OC Home, a provider of modern home improvement needs, announced 100,000 sq ft of retail space expansion plans with a new store launch in Muscat and three new stores in the UAE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Modular Kitchen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Modular Kitchen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Modular Kitchen Market?

To stay informed about further developments, trends, and reports in the UAE Modular Kitchen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence