Key Insights

The UK Anti-Money Laundering (AML) market is poised for substantial expansion, driven by the escalating sophistication of financial crime and increasingly stringent regulatory mandates. This dynamic sector is projected to reach £4.13 billion by 2025, with a compound annual growth rate (CAGR) of 17.8% through 2033. Several key drivers underpin this robust growth. The pervasive threat of money laundering and terrorist financing necessitates advanced AML solutions. Regulatory bodies, including the Financial Conduct Authority (FCA), are intensifying enforcement and imposing severe penalties for non-compliance, compelling organizations to significantly invest in AML technologies and services. Furthermore, the proliferation of fintech and digital transactions introduces new avenues for illicit activities, demanding sophisticated real-time fraud detection and prevention capabilities. The market landscape is diverse, encompassing solutions such as transaction monitoring, identity verification, sanctions screening, and compliance consulting. Leading entities like NICE Actimize, Trulioo, and LexisNexis Risk Solutions are actively engaged in fierce competition, fostering innovation and promoting the adoption of advanced technologies, including AI and machine learning, to enhance AML efficacy.

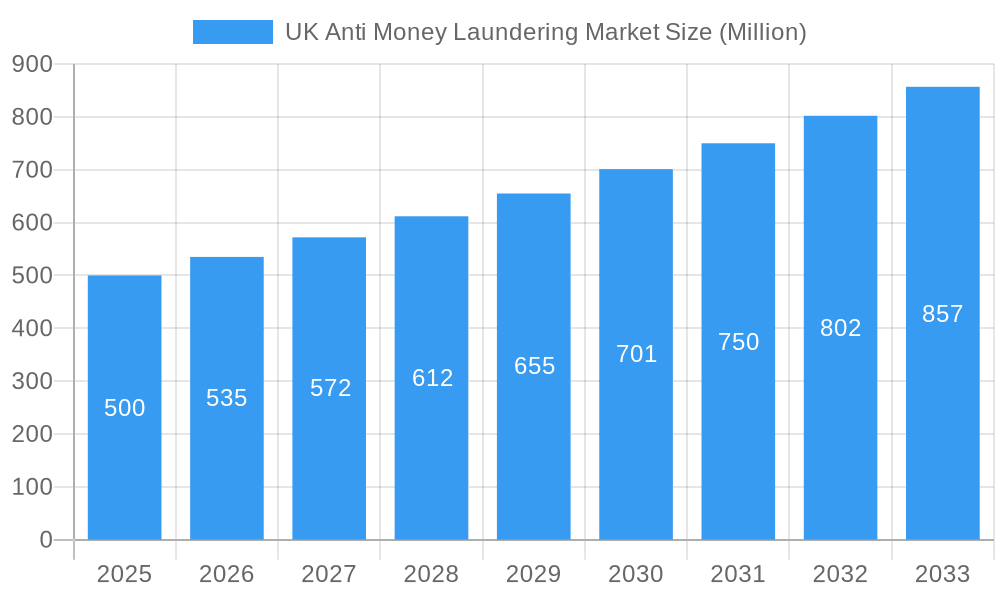

UK Anti Money Laundering Market Market Size (In Billion)

The perpetual evolution of money laundering tactics requires a proactive and adaptive approach to AML strategies. Future market expansion will be influenced by the increasing adoption of cloud-based solutions, the integration of open banking data for enhanced risk assessment, and a growing emphasis on behavioral analytics for identifying suspicious patterns. Despite existing challenges, such as the cost of AML system implementation and maintenance and the potential for regulatory shifts, the UK AML market outlook remains exceptionally positive. The consistent demand for advanced AML solutions, coupled with ongoing regulatory pressures and the evolving threat landscape, ensures sustained market growth and lucrative opportunities for both established market participants and emerging technology providers. The projected CAGR of 17.8% signifies consistent and predictable expansion, presenting a compelling investment prospect for public and private sectors.

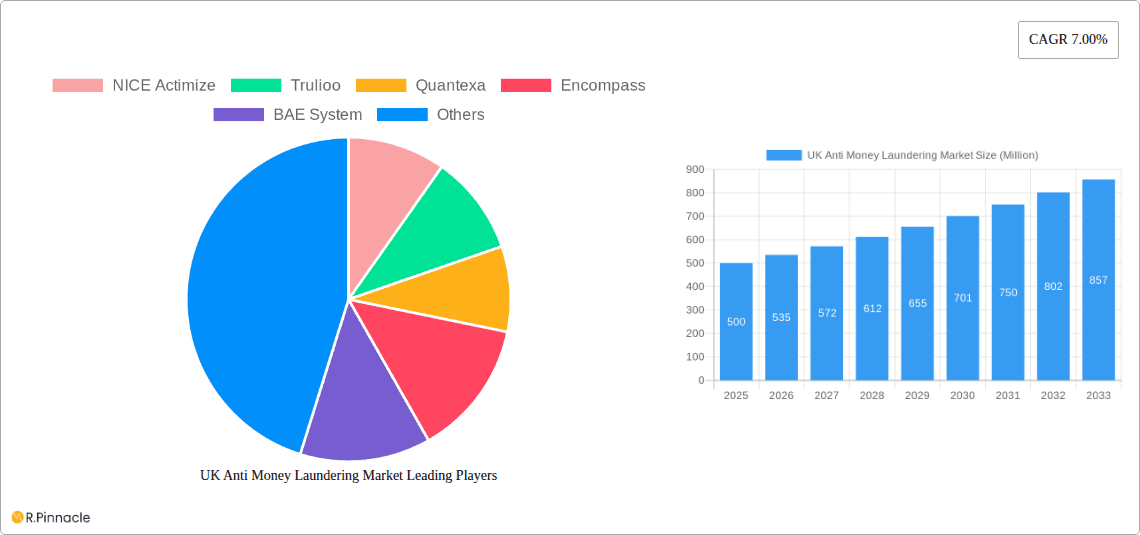

UK Anti Money Laundering Market Company Market Share

UK Anti-Money Laundering (AML) Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK Anti-Money Laundering market, offering invaluable insights for industry professionals, investors, and regulatory bodies. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant players, and future outlook. The market is projected to reach £XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

UK Anti-Money Laundering Market Market Structure & Innovation Trends

This section analyzes the UK AML market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is moderately concentrated, with key players like NICE Actimize, Trulioo, Quantexa, Encompass, BAE Systems, LexisNexis Risk Solutions, Passfort, Refinitive, Sanctionscanner, and FullCircl holding significant market share (exact figures are detailed in the full report). Innovation is driven by evolving regulatory requirements, advancements in AI and machine learning, and the increasing sophistication of money laundering techniques.

- Market Concentration: Moderate, with top 5 players holding approximately XX% market share in 2025.

- Innovation Drivers: AI/ML, blockchain technology, enhanced KYC/KYB solutions.

- Regulatory Frameworks: FCA, HMRC, and other relevant UK AML regulations heavily influence market dynamics.

- M&A Activity: The report details significant M&A transactions within the period, with a total deal value exceeding £XX Million during the historical period (2019-2024). Specific deals and their financial impacts are analyzed in detail.

- Product Substitutes: The emergence of alternative compliance solutions presents both opportunities and challenges for established players.

- End-User Demographics: The report segments end-users by industry, including finance, gaming, and real estate, analyzing their specific AML needs and technology adoption rates.

UK Anti-Money Laundering Market Market Dynamics & Trends

This section delves into the factors shaping the UK AML market's growth trajectory, including technological advancements, evolving regulatory landscapes, and shifting consumer preferences. The market's growth is driven by increasing cross-border financial transactions, the rising prevalence of cybercrime, and stricter regulatory enforcement. The integration of AI and machine learning is significantly transforming AML solutions, leading to improved detection rates and reduced false positives. The market penetration of advanced AML technologies remains relatively low, indicating substantial growth potential.

The report provides a detailed analysis of market growth drivers, technological disruptions, consumer preferences (e.g., demand for cloud-based solutions), and competitive dynamics. Key metrics like CAGR and market penetration rates for various segments are comprehensively presented within the full report.

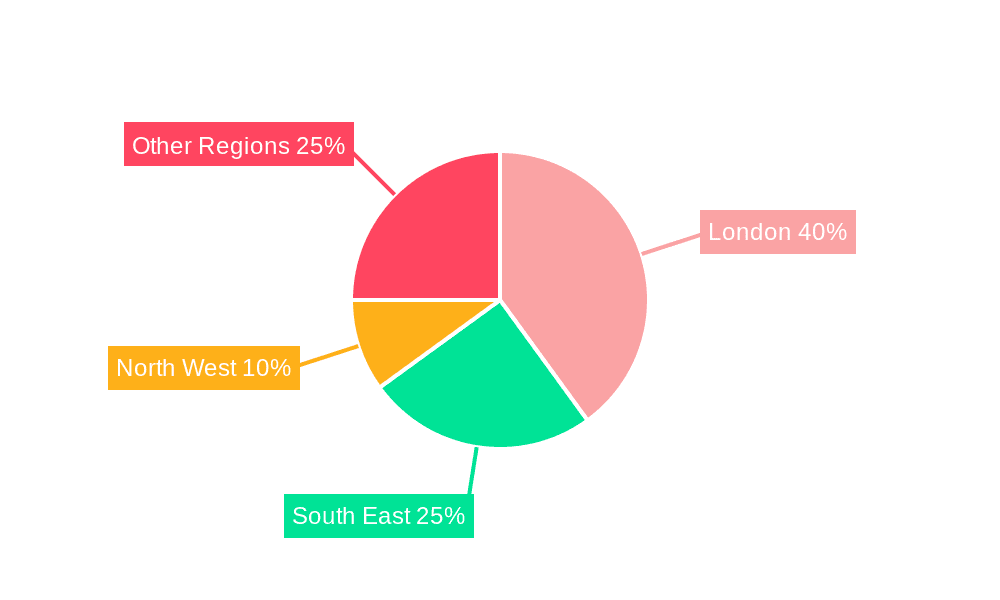

Dominant Regions & Segments in UK Anti-Money Laundering Market

The UK AML market exhibits geographic variations in growth and adoption rates, with London and other major financial hubs demonstrating higher demand for advanced solutions. The report analyzes these regional disparities, providing detailed explanations for the dominance of specific regions/segments.

- Key Drivers for Dominant Regions:

- London: High concentration of financial institutions, robust regulatory framework, and significant investment in fintech.

- Other Major Cities: Presence of key industry players, supportive regulatory environment, and increasing adoption of technology.

- Dominant Segments: Financial services, gaming, and real estate sectors exhibit high growth due to stringent regulations and higher risk profiles.

UK Anti-Money Laundering Market Product Innovations

Recent years have witnessed significant innovation in AML technology, including the rise of AI-powered solutions, cloud-based platforms, and integrated KYC/KYB systems. These innovations offer enhanced accuracy, efficiency, and scalability compared to traditional methods. The market is witnessing a shift towards proactive and predictive AML solutions, leveraging big data analytics and machine learning to identify and mitigate risks before they materialize. This aligns with the growing demand for automated and streamlined compliance processes.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the UK AML market, analyzing various aspects such as deployment type (cloud-based vs. on-premise), solution type (KYC/KYB, transaction monitoring, fraud detection), end-user industry, and company size. Each segment's growth projections, market sizes, and competitive dynamics are discussed in detail within the full report.

Key Drivers of UK Anti-Money Laundering Market Growth

The growth of the UK AML market is fueled by several key factors: increasing regulatory scrutiny, the rising sophistication of money laundering techniques, the growing adoption of digital financial services, and the increasing awareness of AML risks among businesses. The government's commitment to combating financial crime and the continuous evolution of AML regulations are crucial drivers of this market's expansion. Technological advancements, like AI and machine learning, enable more effective AML solutions.

Challenges in the UK Anti Money Laundering Market Sector

The UK AML market faces various challenges, including the high cost of implementing and maintaining AML systems, the complexity of regulatory compliance, and the constant need to adapt to evolving money laundering techniques. The scarcity of skilled professionals specializing in AML compliance further exacerbates these difficulties. These challenges significantly impact the market’s growth trajectory. The report quantifies these impacts with detailed analysis.

Emerging Opportunities in UK Anti Money Laundering Market

Emerging opportunities include the growing demand for cloud-based solutions, the increasing adoption of AI and machine learning, and the expansion into new sectors such as cryptocurrency and fintech. The development of innovative solutions that address specific industry challenges presents significant growth potential for market participants.

Leading Players in the UK Anti-Money Laundering Market Market

- NICE Actimize

- Trulioo

- Quantexa

- Encompass

- BAE Systems

- LexisNexis Risk Solutions

- Passfort

- Refinitive

- Sanctionscanner

- FullCircl

- (List Not Exhaustive)

Key Developments in UK Anti-Money Laundering Market Industry

- April 2022: NICE Actimize partnered with Deutsche Telekom Global Business to deliver CXone solutions across Europe. This expansion significantly broadens NICE Actimize’s reach and strengthens its position in the European market.

- January 2022: PassFort partnered with Trulioo to streamline KYC/KYB processes for regulated enterprises. This collaboration enhances the efficiency and effectiveness of AML compliance for businesses using both platforms.

Future Outlook for UK Anti-Money Laundering Market Market

The UK AML market is poised for significant growth in the coming years, driven by ongoing regulatory changes, technological advancements, and the increasing sophistication of financial crimes. The adoption of advanced analytics, AI, and machine learning will continue to transform the landscape, creating new opportunities for innovative solutions and market expansion. The market's future potential is substantial, presenting lucrative prospects for businesses that can adapt to the evolving regulatory environment and technological advancements.

UK Anti Money Laundering Market Segmentation

-

1. Solutions

- 1.1. Know Your Customer (KYC) Systems

- 1.2. Compliance Reporting

- 1.3. Transactions Monitoring

- 1.4. Auditing

-

2. Type

- 2.1. Softwares

- 2.2. Solutions

-

3. Deployment Model

- 3.1. On-Cloud

- 3.2. On-Premise

-

4. End-User

- 4.1. BFSI's

- 4.2. Government

- 4.3. IT & Telecom

- 4.4. Others

UK Anti Money Laundering Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Anti Money Laundering Market Regional Market Share

Geographic Coverage of UK Anti Money Laundering Market

UK Anti Money Laundering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. UK Ranks in Top for Global Money Laundering

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 5.1.1. Know Your Customer (KYC) Systems

- 5.1.2. Compliance Reporting

- 5.1.3. Transactions Monitoring

- 5.1.4. Auditing

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Softwares

- 5.2.2. Solutions

- 5.3. Market Analysis, Insights and Forecast - by Deployment Model

- 5.3.1. On-Cloud

- 5.3.2. On-Premise

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI's

- 5.4.2. Government

- 5.4.3. IT & Telecom

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 6. North America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 6.1.1. Know Your Customer (KYC) Systems

- 6.1.2. Compliance Reporting

- 6.1.3. Transactions Monitoring

- 6.1.4. Auditing

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Softwares

- 6.2.2. Solutions

- 6.3. Market Analysis, Insights and Forecast - by Deployment Model

- 6.3.1. On-Cloud

- 6.3.2. On-Premise

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. BFSI's

- 6.4.2. Government

- 6.4.3. IT & Telecom

- 6.4.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Solutions

- 7. South America UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 7.1.1. Know Your Customer (KYC) Systems

- 7.1.2. Compliance Reporting

- 7.1.3. Transactions Monitoring

- 7.1.4. Auditing

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Softwares

- 7.2.2. Solutions

- 7.3. Market Analysis, Insights and Forecast - by Deployment Model

- 7.3.1. On-Cloud

- 7.3.2. On-Premise

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. BFSI's

- 7.4.2. Government

- 7.4.3. IT & Telecom

- 7.4.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Solutions

- 8. Europe UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 8.1.1. Know Your Customer (KYC) Systems

- 8.1.2. Compliance Reporting

- 8.1.3. Transactions Monitoring

- 8.1.4. Auditing

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Softwares

- 8.2.2. Solutions

- 8.3. Market Analysis, Insights and Forecast - by Deployment Model

- 8.3.1. On-Cloud

- 8.3.2. On-Premise

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. BFSI's

- 8.4.2. Government

- 8.4.3. IT & Telecom

- 8.4.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Solutions

- 9. Middle East & Africa UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 9.1.1. Know Your Customer (KYC) Systems

- 9.1.2. Compliance Reporting

- 9.1.3. Transactions Monitoring

- 9.1.4. Auditing

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Softwares

- 9.2.2. Solutions

- 9.3. Market Analysis, Insights and Forecast - by Deployment Model

- 9.3.1. On-Cloud

- 9.3.2. On-Premise

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. BFSI's

- 9.4.2. Government

- 9.4.3. IT & Telecom

- 9.4.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Solutions

- 10. Asia Pacific UK Anti Money Laundering Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 10.1.1. Know Your Customer (KYC) Systems

- 10.1.2. Compliance Reporting

- 10.1.3. Transactions Monitoring

- 10.1.4. Auditing

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Softwares

- 10.2.2. Solutions

- 10.3. Market Analysis, Insights and Forecast - by Deployment Model

- 10.3.1. On-Cloud

- 10.3.2. On-Premise

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. BFSI's

- 10.4.2. Government

- 10.4.3. IT & Telecom

- 10.4.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Solutions

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 NICE Actimize

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Trulioo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quantexa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Encompass

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BAE System

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LexisNexis Risk Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Passfort

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Refinitive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sanctionscanner

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 FullCircl**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 NICE Actimize

List of Figures

- Figure 1: Global UK Anti Money Laundering Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 3: North America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 4: North America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 5: North America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 7: North America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 8: North America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 9: North America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 13: South America UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 14: South America UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 15: South America UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: South America UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 17: South America UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 18: South America UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: South America UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: South America UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 23: Europe UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 24: Europe UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 25: Europe UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Europe UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 27: Europe UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 28: Europe UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Europe UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Europe UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 33: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 34: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 37: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 38: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East & Africa UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Solutions 2025 & 2033

- Figure 43: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Solutions 2025 & 2033

- Figure 44: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Type 2025 & 2033

- Figure 45: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 47: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 48: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by End-User 2025 & 2033

- Figure 49: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by End-User 2025 & 2033

- Figure 50: Asia Pacific UK Anti Money Laundering Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific UK Anti Money Laundering Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 2: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 4: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Global UK Anti Money Laundering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 7: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 9: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 10: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 15: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 16: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 17: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 23: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 25: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 26: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 37: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 39: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 40: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global UK Anti Money Laundering Market Revenue billion Forecast, by Solutions 2020 & 2033

- Table 48: Global UK Anti Money Laundering Market Revenue billion Forecast, by Type 2020 & 2033

- Table 49: Global UK Anti Money Laundering Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 50: Global UK Anti Money Laundering Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 51: Global UK Anti Money Laundering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UK Anti Money Laundering Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Anti Money Laundering Market?

The projected CAGR is approximately 17.8%.

2. Which companies are prominent players in the UK Anti Money Laundering Market?

Key companies in the market include NICE Actimize, Trulioo, Quantexa, Encompass, BAE System, LexisNexis Risk Solutions, Passfort, Refinitive, Sanctionscanner, FullCircl**List Not Exhaustive.

3. What are the main segments of the UK Anti Money Laundering Market?

The market segments include Solutions, Type, Deployment Model, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

UK Ranks in Top for Global Money Laundering.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, NICE established cooperation with Deutsche Telekom Global Business, a subsidiary of Deutsche Telekom that provides telecommunications and connectivity services to businesses of all kinds, including the government. Deutsche Telekom Global Business is now delivering the CXone portfolio of industry-leading digital and agent-assisted CX solutions across Europe as part of the partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Anti Money Laundering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Anti Money Laundering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Anti Money Laundering Market?

To stay informed about further developments, trends, and reports in the UK Anti Money Laundering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence