Key Insights

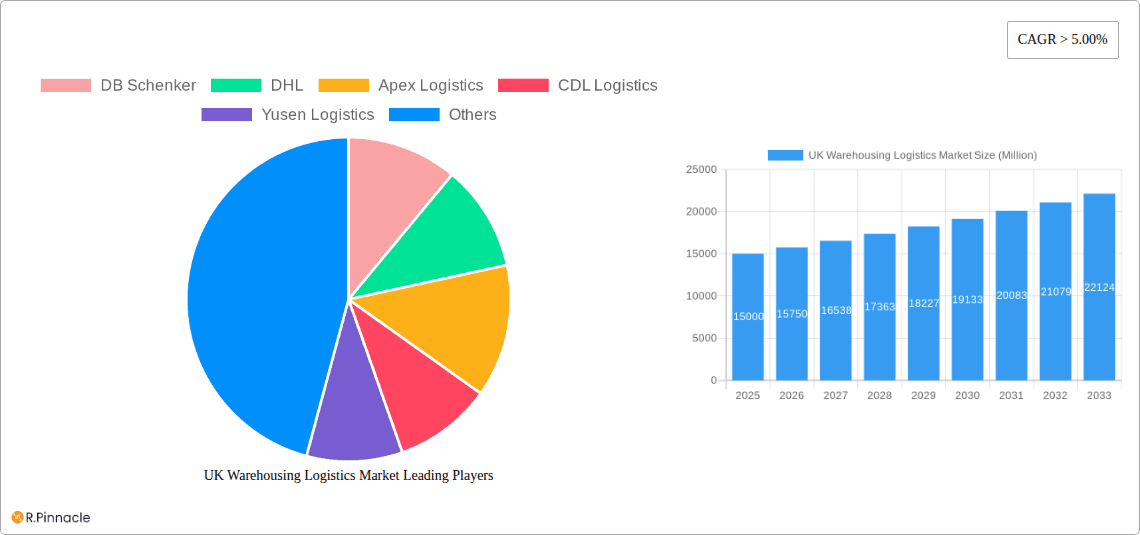

The UK warehousing and logistics market is experiencing significant expansion, propelled by the sustained growth of e-commerce, escalating consumer demand, and the imperative for optimized supply chain management. Projections indicate a Compound Annual Growth Rate (CAGR) of 5.7% from 2025 to 2033, signaling a robust upward trend. Key drivers include the evolution of online retail, necessitating advanced warehousing and distribution infrastructures to manage increased order volumes and ensure prompt deliveries. Technological innovations, such as automation and robotics, are enhancing operational efficiency and productivity, thereby reducing costs for logistics providers. The market's breadth is further supported by diverse end-user sectors, including manufacturing, consumer goods, food and beverage, retail, and healthcare. Regional growth dynamics within the UK are influenced by factors like proximity to key transportation networks and the concentration of specific industries.

UK Warehousing Logistics Market Market Size (In Billion)

Despite growth, challenges such as labor shortages, rising transportation expenditures, and navigating post-Brexit regulatory complexities require strategic attention from industry participants. The competitive landscape features established global providers alongside agile, specialized firms offering tailored solutions. Future market development will be shaped by the integration of advanced technologies like artificial intelligence and the Internet of Things (IoT) for superior tracking and inventory management. Sustainability is also a growing focus, with companies prioritizing carbon footprint reduction and eco-friendly operations. The UK warehousing and logistics market is positioned for sustained growth through 2033, driven by ongoing e-commerce expansion and the demand for efficient supply chains, though subject to macroeconomic influences. The estimated market size in 2025 is projected at £38.2 billion.

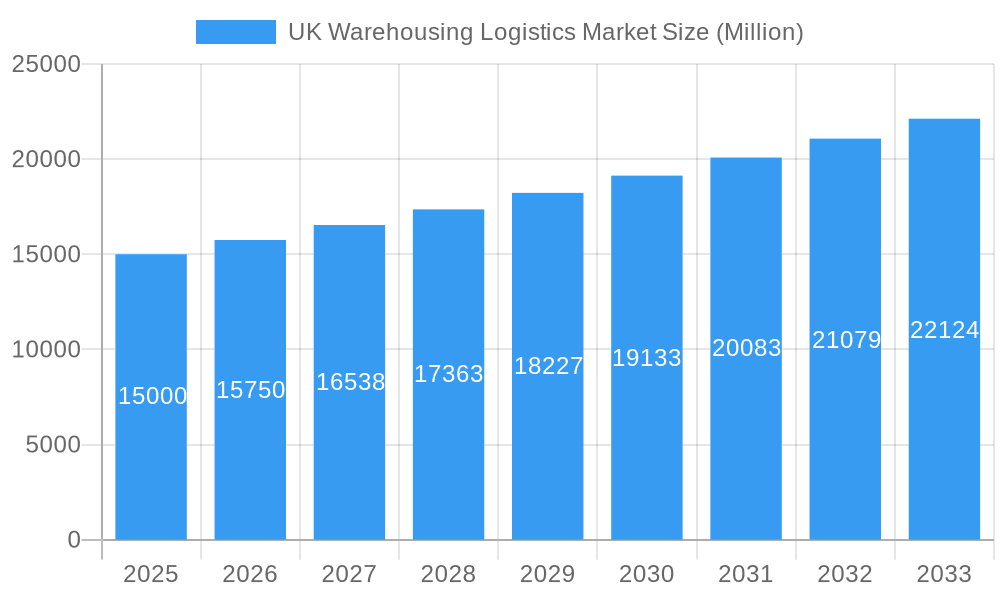

UK Warehousing Logistics Market Company Market Share

UK Warehousing Logistics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK warehousing logistics market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period 2019-2033, with a base year of 2025, this report unveils market dynamics, key players, and future growth potential. The study meticulously examines market segmentation by end-user (Manufacturing, Consumer Goods, Food and Beverage, Retail, Healthcare, and Other End-Users), revealing dominant segments and regional variations. With a focus on actionable intelligence, this report is essential for navigating the complexities of this dynamic market.

UK Warehousing Logistics Market Market Structure & Innovation Trends

The UK warehousing logistics market exhibits a moderately concentrated structure, with key players like DB Schenker, DHL, Apex Logistics, CDL Logistics, Yusen Logistics, CEVA Logistics, Whistl, Fullers Logistics, Kuehne + Nagel, Expeditors, Wincanton PLC, and Rhenus Logistics holding significant market share. However, the presence of numerous smaller operators ensures a competitive landscape. Market share distribution is currently estimated at xx% for the top 5 players, and xx% for the remaining participants (2025). Innovation is driven by advancements in automation (robotics, AI), sustainable practices (green logistics), and data analytics for enhanced efficiency. Regulatory frameworks, particularly concerning environmental regulations and data privacy (GDPR), significantly impact market operations. Product substitutes, such as improved transportation networks, influence market dynamics. M&A activity has been moderate, with deal values totaling approximately £xx Million in the past five years (2019-2024). End-user demographics are diverse, with the manufacturing and e-commerce sectors driving significant demand.

UK Warehousing Logistics Market Market Dynamics & Trends

The UK warehousing logistics market is experiencing robust growth, driven by the expansion of e-commerce, increasing consumer demand, and the growing adoption of advanced technologies. The market’s CAGR from 2025 to 2033 is projected to be xx%, significantly influenced by factors such as supply chain optimization strategies and the rise of omnichannel fulfillment. Technological disruptions, notably the integration of automation and AI into warehouse operations, are significantly improving efficiency and reducing costs. Consumer preferences for faster delivery times and increased transparency are putting pressure on logistics providers to adopt innovative solutions. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants offering specialized services. Market penetration of automated systems is currently at xx% (2025) and is projected to increase to xx% by 2033. The shift towards sustainable logistics practices is also shaping the market, with companies increasingly adopting eco-friendly solutions to meet environmental regulations and consumer expectations.

Dominant Regions & Segments in UK Warehousing Logistics Market

The South East region of the UK dominates the warehousing logistics market, benefiting from its proximity to major ports, excellent infrastructure, and a large concentration of businesses. This dominance is further solidified by significant government investment in infrastructure development and favorable economic policies in the region.

- Key Drivers for South East Dominance:

- Superior infrastructure (road, rail, and air connectivity)

- Proximity to major ports (London Gateway, Southampton)

- High concentration of businesses and distribution hubs

- Supportive government policies and investments

- Skilled workforce

Other regions exhibit varying degrees of market participation, influenced by factors such as infrastructure development, economic activity, and the presence of key industrial sectors.

By end-user segment, the retail sector currently dominates, followed by manufacturing and consumer goods. This is attributed to the booming e-commerce sector, the requirement for efficient supply chains, and the increasing demand for fast and reliable delivery services. However, growth in the healthcare sector is projected to surpass others in the coming years.

UK Warehousing Logistics Market Product Innovations

Recent product innovations focus on automation, improved tracking systems, and optimized warehouse management software. The use of robotics and AI is boosting warehouse efficiency, while blockchain technology is enhancing supply chain transparency and security. These innovations are aimed at reducing costs, improving speed and accuracy, and enhancing customer satisfaction. Market fit is excellent, as these advancements directly address the key challenges faced by logistics providers and their clients.

Report Scope & Segmentation Analysis

This report segments the UK warehousing logistics market by end-user:

- Manufacturing: This segment is characterized by a need for efficient inventory management and timely delivery of raw materials and finished goods. Market size is estimated at £xx Million in 2025, with a projected growth rate of xx% during the forecast period.

- Consumer Goods: This segment exhibits high demand for flexible warehousing and fast-paced order fulfillment. Market size is estimated at £xx Million in 2025, with a projected growth rate of xx% during the forecast period.

- Food and Beverage: This segment necessitates specialized cold storage facilities and stringent hygiene standards. Market size is estimated at £xx Million in 2025, with a projected growth rate of xx% during the forecast period.

- Retail: This segment is experiencing the highest growth due to e-commerce expansion, with a strong emphasis on omnichannel capabilities. Market size is estimated at £xx Million in 2025, with a projected growth rate of xx% during the forecast period.

- Healthcare: This segment requires stringent regulatory compliance and temperature-controlled storage for pharmaceuticals. Market size is estimated at £xx Million in 2025, with a projected growth rate of xx% during the forecast period.

- Other End-Users: This segment encompasses diverse industries with varying logistics needs. Market size is estimated at £xx Million in 2025, with a projected growth rate of xx% during the forecast period.

Competitive dynamics vary across segments, reflecting differing technological requirements and service expectations.

Key Drivers of UK Warehousing Logistics Market Growth

The UK warehousing logistics market is propelled by several key drivers:

- E-commerce boom: The rapid growth of online shopping fuels demand for efficient warehousing and delivery services.

- Technological advancements: Automation, AI, and data analytics enhance warehouse efficiency and reduce costs.

- Government initiatives: Investments in infrastructure and supportive policies promote market growth.

- Supply chain optimization: Businesses increasingly focus on improving their supply chain to enhance competitiveness.

Challenges in the UK Warehousing Logistics Market Sector

The UK warehousing logistics market faces challenges such as:

- Driver shortages: A persistent shortage of qualified drivers impacts delivery efficiency and increases costs.

- Rising fuel costs: Increased fuel prices directly impact transportation costs and profitability.

- Brexit impact: Changes in trade regulations and customs procedures have created complexities for cross-border logistics.

- Warehouse space scarcity: Limited availability of suitable warehouse space, particularly in prime locations, drives up rental costs.

Emerging Opportunities in UK Warehousing Logistics Market

Emerging opportunities include:

- Growth of automation and robotics: Increased adoption of automated solutions promises higher efficiency and cost savings.

- Last-mile delivery optimization: Innovations in last-mile delivery, such as drone delivery, offer improved speed and efficiency.

- Sustainable logistics practices: Demand for eco-friendly solutions is driving growth in green logistics.

- Expansion into niche markets: Specialization in sectors like healthcare or temperature-sensitive goods offers lucrative opportunities.

Leading Players in the UK Warehousing Logistics Market Market

- DB Schenker

- DHL

- Apex Logistics

- CDL Logistics

- Yusen Logistics

- CEVA Logistics

- Whistl

- Fullers Logistics

- Kuehne + Nagel

- Expeditors

- Wincanton PLC

- Rhenus Logistics

Key Developments in UK Warehousing Logistics Market Industry

- August 2022: DHL Supply Chain expands its partnership with Nespresso, handling six million orders annually from a new omnichannel facility in Coventry.

- November 2022: PGS Global Logistics invests £10 Million (USD 11.2 Million) in a new solar-powered warehouse in West Bromwich.

Future Outlook for UK Warehousing Logistics Market Market

The UK warehousing logistics market is poised for continued growth, driven by the ongoing expansion of e-commerce, increasing demand for efficient supply chains, and the adoption of innovative technologies. Strategic opportunities lie in investing in automation, optimizing last-mile delivery, and embracing sustainable logistics practices. The market's future success will hinge on adapting to evolving consumer preferences and maintaining resilience in the face of global economic uncertainties.

UK Warehousing Logistics Market Segmentation

-

1. End-User

- 1.1. Manufacturing

- 1.2. Consumer Goods

- 1.3. Food and Beverage

- 1.4. Retail

- 1.5. Healthcare

- 1.6. Other End-Users

UK Warehousing Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

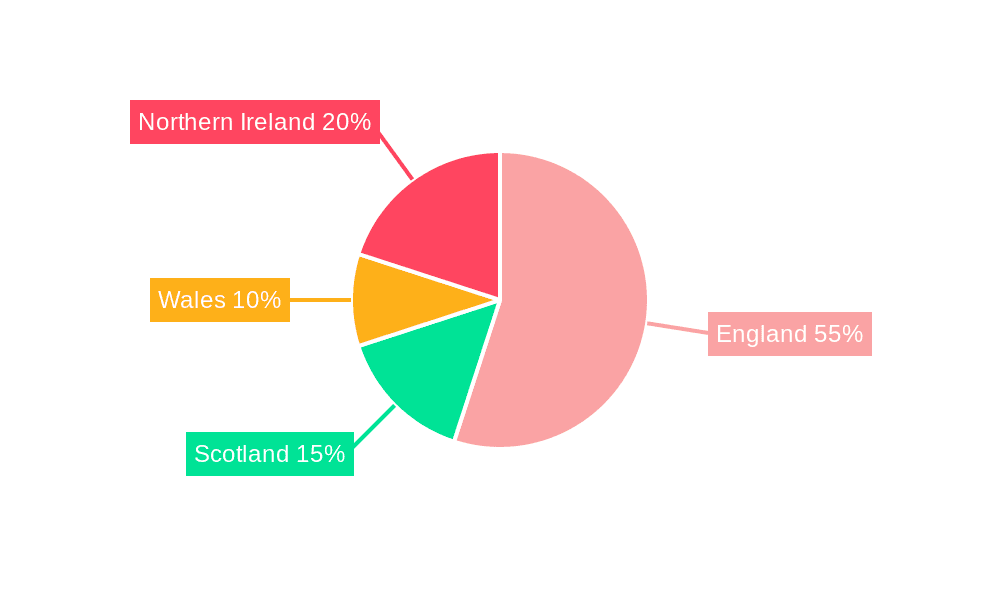

UK Warehousing Logistics Market Regional Market Share

Geographic Coverage of UK Warehousing Logistics Market

UK Warehousing Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. E-commerce Growth Driving the Warehouse Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Manufacturing

- 5.1.2. Consumer Goods

- 5.1.3. Food and Beverage

- 5.1.4. Retail

- 5.1.5. Healthcare

- 5.1.6. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Manufacturing

- 6.1.2. Consumer Goods

- 6.1.3. Food and Beverage

- 6.1.4. Retail

- 6.1.5. Healthcare

- 6.1.6. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. South America UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Manufacturing

- 7.1.2. Consumer Goods

- 7.1.3. Food and Beverage

- 7.1.4. Retail

- 7.1.5. Healthcare

- 7.1.6. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Europe UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Manufacturing

- 8.1.2. Consumer Goods

- 8.1.3. Food and Beverage

- 8.1.4. Retail

- 8.1.5. Healthcare

- 8.1.6. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Middle East & Africa UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Manufacturing

- 9.1.2. Consumer Goods

- 9.1.3. Food and Beverage

- 9.1.4. Retail

- 9.1.5. Healthcare

- 9.1.6. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Asia Pacific UK Warehousing Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Manufacturing

- 10.1.2. Consumer Goods

- 10.1.3. Food and Beverage

- 10.1.4. Retail

- 10.1.5. Healthcare

- 10.1.6. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DHL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Apex Logistics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CDL Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yusen Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CEVA Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Whistl**List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fullers Logistics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kuehne + Nagel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Expeditors

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wincanton PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rhenus Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global UK Warehousing Logistics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 3: North America UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 7: South America UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: South America UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 11: Europe UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 15: Middle East & Africa UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Middle East & Africa UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Warehousing Logistics Market Revenue (billion), by End-User 2025 & 2033

- Figure 19: Asia Pacific UK Warehousing Logistics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Asia Pacific UK Warehousing Logistics Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Warehousing Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 2: Global UK Warehousing Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 25: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Warehousing Logistics Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 33: Global UK Warehousing Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Warehousing Logistics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Warehousing Logistics Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the UK Warehousing Logistics Market?

Key companies in the market include DB Schenker, DHL, Apex Logistics, CDL Logistics, Yusen Logistics, CEVA Logistics, Whistl**List Not Exhaustive, Fullers Logistics, Kuehne + Nagel, Expeditors, Wincanton PLC, Rhenus Logistics.

3. What are the main segments of the UK Warehousing Logistics Market?

The market segments include End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.2 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

E-commerce Growth Driving the Warehouse Development.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

August 2022: DHL Supply Chain, the world's leading contract logistics provider, is extending its strategic partnership with Nestlé Nespresso S.A., the company announced today. Building on a relationship dating back to 2014, DHL will now also provide logistics and fulfillment services in the UK and the Republic of Ireland (ROI). The existing partnerships between DHL and Nespresso in Italy, Brazil, Malaysia, and Taiwan will continue. From Q1 2023, DHL will handle all warehousing across Nespresso's e-commerce and network of retail boutiques in the UK and ROI. Projected to handle six million orders in year one alone, the UK operation will be based in a dedicated omnichannel facility in Coventry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Warehousing Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Warehousing Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Warehousing Logistics Market?

To stay informed about further developments, trends, and reports in the UK Warehousing Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence