Key Insights

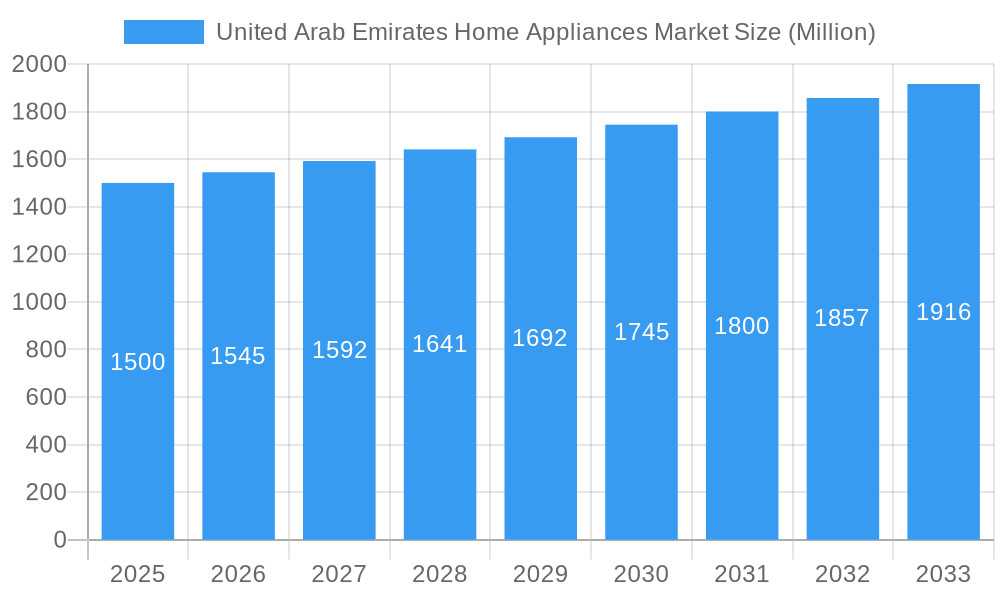

The United Arab Emirates (UAE) home appliances market is experiencing significant expansion, fueled by population growth, rising disposable incomes, and a strong consumer preference for modern, technologically advanced products. The market's Compound Annual Growth Rate (CAGR) is projected at 4.13%. This growth is underpinned by household modernization, a shift towards convenient, energy-efficient appliances, and the UAE's thriving tourism and expatriate sectors, driving demand in both residential and commercial segments. The market is segmented by product type, with major appliances like refrigerators and washing machines holding a substantial share. Key distribution channels include hypermarkets, specialty stores, and a rapidly growing online segment. Leading international brands like Electrolux, Haier, BSH, Samsung, and LG compete on innovation, pricing, and brand recognition. Despite potential economic fluctuations, the long-term outlook remains positive, supported by sustained economic development and evolving consumer preferences. The forecast period (2025-2033) anticipates continued robust growth, particularly with increasing adoption of smart home technologies and eco-friendly appliances, aligning with the UAE's focus on sustainable development. The estimated market size for 2025 is $3.48 billion.

United Arab Emirates Home Appliances Market Market Size (In Billion)

The competitive landscape is dynamic, with global and regional players focusing on localized product features, superior after-sales service, and marketing that highlights quality and innovation. The burgeoning online sales trend necessitates adaptive distribution strategies and enhanced e-commerce capabilities. Differentiation through innovative features, energy efficiency certifications, and attractive financing options are critical for market share growth. Evolving market segmentation emphasizes niche categories and personalized appliance solutions. Continued infrastructure development and a commitment to quality of life in the UAE are fundamental drivers of this positive market outlook.

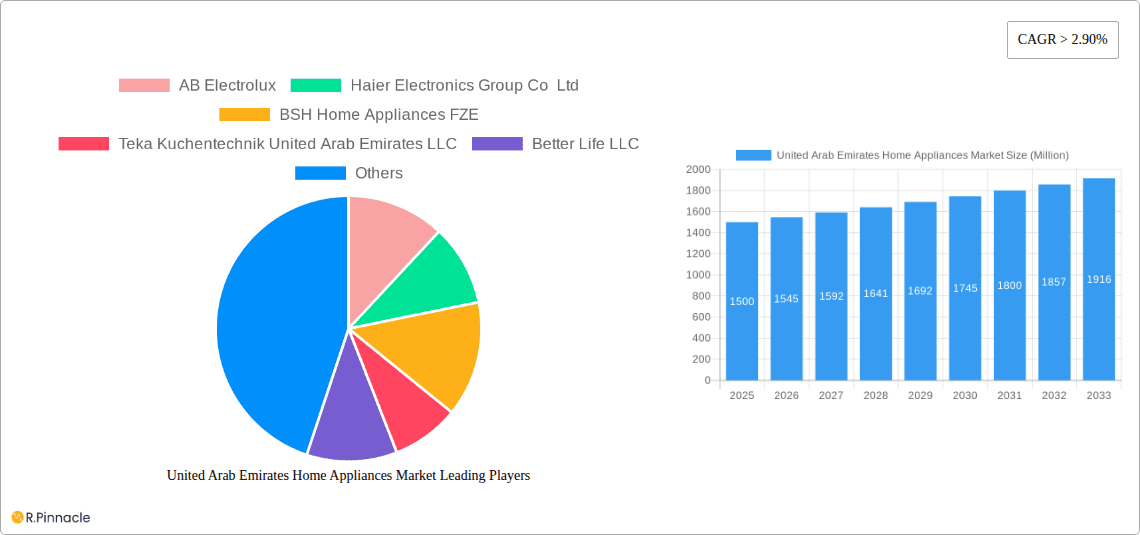

United Arab Emirates Home Appliances Market Company Market Share

United Arab Emirates Home Appliances Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United Arab Emirates (UAE) home appliances market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, growth drivers, competitive landscapes, and future opportunities within this dynamic sector. The UAE home appliances market is projected to reach xx Million by 2033.

United Arab Emirates Home Appliances Market Structure & Innovation Trends

This section analyzes the UAE home appliances market's structure, highlighting key players, their market share, and the influence of innovation. The report examines the market concentration, identifying dominant players and assessing their competitive strategies. It also explores the role of innovation drivers, such as technological advancements and consumer preferences, in shaping market trends. Regulatory frameworks and their impact on market growth are assessed, along with an analysis of product substitutes and their market penetration. Finally, the report delves into end-user demographics and their purchasing patterns, while providing an overview of M&A activities, including deal values and their implications for market consolidation.

- Market Concentration: The market is characterized by a mix of international and local players, with [insert estimated market share data for top 3-5 players, e.g., Samsung holding xx% market share, followed by LG with xx%].

- Innovation Drivers: Increasing demand for smart home appliances and energy-efficient models is driving innovation.

- Regulatory Framework: UAE government initiatives promoting energy efficiency and sustainability are influencing product development.

- M&A Activities: The report includes an analysis of recent mergers and acquisitions, detailing deal values and their impact on market consolidation. (e.g., A recent xx Million acquisition of [Company A] by [Company B] reshaped the market dynamics in [Specific Segment]).

United Arab Emirates Home Appliances Market Dynamics & Trends

This section delves into the dynamic forces shaping the UAE home appliances market. It explores market growth drivers, such as rising disposable incomes, urbanization, and changing lifestyles. The report also examines the impact of technological disruptions, including the emergence of smart home appliances and the Internet of Things (IoT), on market trends. Consumer preferences, evolving purchasing habits, and brand loyalty are analyzed to understand the consumer landscape. Competitive dynamics, including pricing strategies, product differentiation, and marketing campaigns, are also examined. Key metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates are provided for key segments. The report projects a CAGR of xx% for the forecast period (2025-2033).

Dominant Regions & Segments in United Arab Emirates Home Appliances Market

This section identifies the leading regions and segments within the UAE home appliances market. A detailed analysis of the performance of various segments—Major Appliances, Small Appliances, and distribution channels (Supermarkets and Hypermarkets, Specialty Stores, Online, Other Distribution Channels)—is provided.

- Key Drivers for Dominant Segments:

- Major Appliances: High disposable incomes and increasing demand for modern kitchens are driving growth in this segment.

- Small Appliances: Convenience and time-saving features are boosting demand for small kitchen appliances.

- Supermarkets & Hypermarkets: These channels dominate due to their wide reach and established customer base.

- Online: E-commerce growth is driving sales through online channels, especially amongst younger demographics.

The report provides a comprehensive analysis of the factors influencing the dominance of these segments. Geographic factors, economic conditions, infrastructure, and consumer preferences are among the key aspects considered.

United Arab Emirates Home Appliances Market Product Innovations

This section summarizes recent product developments, focusing on technological trends and their market fit. The integration of smart features, energy-efficient technologies, and improved designs are key areas of innovation. The competitive advantages offered by these innovations are also discussed. Recent launches such as LG's new built-in appliance line exemplify this trend.

Report Scope & Segmentation Analysis

This report segments the UAE home appliances market by product type (Major Appliances and Small Appliances) and distribution channel (Supermarkets and Hypermarkets, Specialty Stores, Online, Other Distribution Channels). Each segment’s growth projections, market size, and competitive dynamics are analyzed.

Key Drivers of United Arab Emirates Home Appliances Market Growth

The UAE home appliances market is driven by several factors including rising disposable incomes, increasing urbanization leading to nuclear family setups and smaller living spaces (boosting demand for space saving appliances), a growing preference for modern and convenient kitchen appliances, and government initiatives promoting energy-efficient appliances. Technological advancements, such as smart home integration and energy-efficient designs, further fuel market growth.

Challenges in the United Arab Emirates Home Appliances Market Sector

Challenges include intense competition, fluctuating energy prices affecting manufacturing costs, supply chain disruptions, and the potential impact of economic downturns on consumer spending. Regulatory changes related to energy efficiency standards and import tariffs can also create hurdles.

Emerging Opportunities in United Arab Emirates Home Appliances Market

Emerging opportunities lie in the growing adoption of smart home technologies, increased demand for energy-efficient appliances, and the expansion of e-commerce platforms. Furthermore, catering to the increasing preference for premium and customized appliances presents lucrative opportunities.

Leading Players in the United Arab Emirates Home Appliances Market Market

- AB Electrolux

- Haier Electronics Group Co Ltd

- BSH Home Appliances FZE

- Teka Kuchentechnik United Arab Emirates LLC

- Better Life LLC

- Samsung Electronics Ltd

- LG Electronics Gulf FZE

- Dyson Limited

- Hisense Middle East

- Karcher

Key Developments in United Arab Emirates Home Appliances Market Industry

- June 2023: LG Electronics launched a new line-up of built-in home appliances in the UAE, featuring premium ovens, hoods, and cooktops. This launch is expected to significantly impact the premium segment of the market.

- March 2023: BSH Home Appliances announced a €50 million (USD 53,362,500) investment in a state-of-the-art stove factory in Cairo, potentially impacting its supply chain and competitiveness in the UAE market.

Future Outlook for United Arab Emirates Home Appliances Market Market

The UAE home appliances market is poised for continued growth, driven by sustained economic development, increasing urbanization, and rising consumer spending. The adoption of smart home technology and the focus on energy efficiency will shape future market trends. Companies focusing on innovation, customization, and sustainable practices are well-positioned to capitalize on emerging opportunities.

United Arab Emirates Home Appliances Market Segmentation

-

1. Product

-

1.1. Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Ovens

- 1.1.6. Air Conditioners

- 1.1.7. Other Major Appliances

-

1.2. Small Appliances

- 1.2.1. Coffee/Tea Makers

- 1.2.2. Food Processors

- 1.2.3. Grills & Roasters

- 1.2.4. Vacuum Cleaners

- 1.2.5. Other Small Appliances

-

1.1. Major Appliances

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

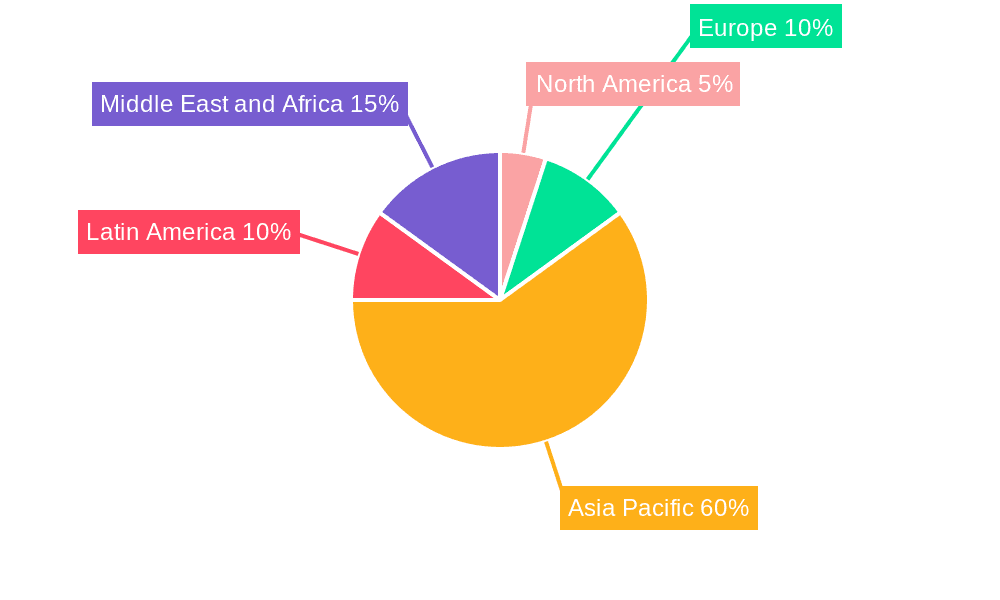

United Arab Emirates Home Appliances Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Home Appliances Market Regional Market Share

Geographic Coverage of United Arab Emirates Home Appliances Market

United Arab Emirates Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income; Growing population and urbanization

- 3.3. Market Restrains

- 3.3.1. Price sensitivity; Seasonal demand fluctuations

- 3.4. Market Trends

- 3.4.1. Growing Expatriate Population is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Ovens

- 5.1.1.6. Air Conditioners

- 5.1.1.7. Other Major Appliances

- 5.1.2. Small Appliances

- 5.1.2.1. Coffee/Tea Makers

- 5.1.2.2. Food Processors

- 5.1.2.3. Grills & Roasters

- 5.1.2.4. Vacuum Cleaners

- 5.1.2.5. Other Small Appliances

- 5.1.1. Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AB Electrolux

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haier Electronics Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSH Home Appliances FZE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Teka Kuchentechnik United Arab Emirates LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Better Life LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsung Electronics Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Gulf FZE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dyson Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hisense Middle East

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Karcher**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AB Electrolux

List of Figures

- Figure 1: United Arab Emirates Home Appliances Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Product 2020 & 2033

- Table 8: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: United Arab Emirates Home Appliances Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Arab Emirates Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Home Appliances Market?

The projected CAGR is approximately 4.13%.

2. Which companies are prominent players in the United Arab Emirates Home Appliances Market?

Key companies in the market include AB Electrolux, Haier Electronics Group Co Ltd, BSH Home Appliances FZE, Teka Kuchentechnik United Arab Emirates LLC, Better Life LLC, Samsung Electronics Ltd, LG Electronics Gulf FZE, Dyson Limited, Hisense Middle East, Karcher**List Not Exhaustive.

3. What are the main segments of the United Arab Emirates Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income; Growing population and urbanization.

6. What are the notable trends driving market growth?

Growing Expatriate Population is Driving the Market.

7. Are there any restraints impacting market growth?

Price sensitivity; Seasonal demand fluctuations.

8. Can you provide examples of recent developments in the market?

June 2023: LG Electronics (LG) announced the launch of its new line-up of built-in home appliances in the UAE. It includes premium ovens, hoods, electric and gas cooktops with versatile, elegant designs and easy controls, all built to revolutionize the way people cook and provide them with a seamless and modern cooking experience. The new appliances are designed to blend seamlessly into any kitchen interior, creating a sleek and modern look while delivering the latest technology and meeting the highest requirements for ergonomics and equipment in the modern kitchen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Home Appliances Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence