Key Insights

The United Kingdom luxury goods market, estimated at £18.08 billion in the 2025 base year, is poised for significant expansion. This growth is attributed to increasing disposable incomes among high-net-worth individuals and a burgeoning aspirational middle class. The UK's status as a global fashion and luxury retail center, coupled with a strong tourism industry, further bolsters market dynamics. Key trends include rising online penetration, particularly among younger consumers, and a growing demand for personalized and sustainable luxury experiences. While economic uncertainties present challenges, the market's resilience is expected, supported by established brands and emerging innovators. Clothing and apparel lead market segmentation, followed by accessories such as jewelry, watches, and bags. Distribution channels are dominated by single-brand stores, with online sales experiencing rapid growth.

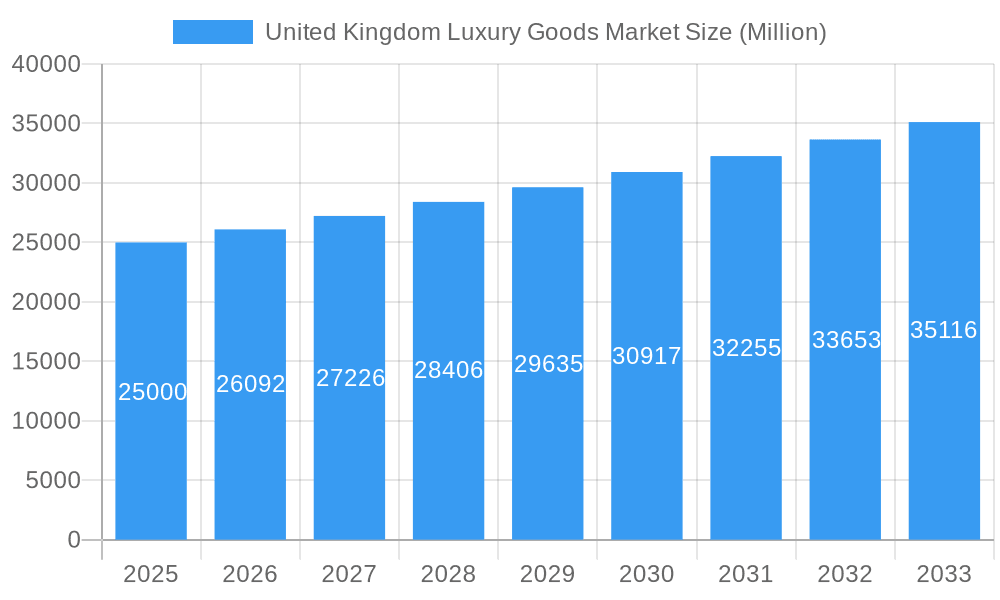

United Kingdom Luxury Goods Market Market Size (In Billion)

The competitive landscape features major international players including LVMH, Kering, Richemont, and Estee Lauder, alongside prominent British brands. These entities capitalize on brand heritage, global presence, and innovative marketing to meet discerning UK consumer demands. The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 2.29%, projecting a market value exceeding £25 billion by 2033. This growth trajectory is maintained despite potential global economic fluctuations and evolving consumer preferences. The UK luxury goods market demonstrates enduring appeal, driven by economic prosperity, brand loyalty, and a continually evolving retail experience. Strategic segmentation facilitates targeted marketing and a deeper understanding of customer needs across product categories and distribution channels.

United Kingdom Luxury Goods Market Company Market Share

United Kingdom Luxury Goods Market Analysis & Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the United Kingdom luxury goods market, providing critical insights for industry stakeholders, investors, and strategists. Covering the period 2025-2033, with a focus on the 2025 base year, this report details market structure, dynamics, and future outlook, enabling informed strategic planning. The analysis integrates extensive data and expert insights for a clear and actionable understanding of this dynamic sector.

United Kingdom Luxury Goods Market Market Structure & Innovation Trends

This section analyzes the UK luxury goods market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and mergers & acquisitions (M&A) activity. We examine the market share held by key players like The Estee Lauder Companies Inc, Compagnie Financière Richemont SA, KERING, TFG LONDON LIMITED, PVH Corp, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton, MAX MARA SRL, and CHANEL, among others. The report also details M&A activities, providing insights into deal values and their impact on market structure. Expected market concentration will be xx% by 2033, driven by factors such as [Specific factor 1, e.g., brand consolidation], [Specific factor 2, e.g., increasing demand for sustainable products] and [Specific factor 3, e.g., evolving consumer preferences].

- Market Share Analysis: Detailed breakdown of market share for leading companies.

- Innovation Drivers: Analysis of technological advancements, design innovation, and sustainable practices driving market growth.

- Regulatory Landscape: Assessment of relevant regulations impacting the sector.

- Product Substitutes: Evaluation of potential substitute products and their impact on market competition.

- End-User Demographics: Profiling of key consumer segments and their buying behavior.

- M&A Activity: Review of significant M&A transactions, including deal values and their strategic implications.

United Kingdom Luxury Goods Market Market Dynamics & Trends

This section delves into the market's growth trajectory, exploring key drivers such as evolving consumer preferences, technological disruptions, and competitive dynamics. We will project a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), driven by factors like [Specific factor 1, e.g., rising disposable incomes], [Specific factor 2, e.g., increasing online luxury retail penetration] and [Specific factor 3, e.g., growing demand for personalized luxury experiences]. Market penetration is expected to reach xx% by 2033. The report also examines technological disruptions, such as the rise of e-commerce and personalized marketing, and their impact on market dynamics and consumer behavior. We further analyze the competitive dynamics, highlighting strategies employed by leading companies to gain market share. The analysis will cover both established and emerging players, offering a holistic view of the competitive landscape.

Dominant Regions & Segments in United Kingdom Luxury Goods Market

This section identifies the leading regions, countries, and segments within the UK luxury goods market. We analyze performance across segments including By Type (Clothing and Apparel, Footwear, Bags, Jewelry, Watches, Other Accessories) and By Distribution Channel (Single-brand Stores, Multi-brand Stores, Online Stores, Other Distribution Channels). The leading segment will be identified with its key drivers examined in detail.

- By Type: Detailed analysis of the fastest-growing segments, driven by [Specific factor 1], [Specific factor 2], and [Specific factor 3].

- By Distribution Channel: Evaluation of the dominance of different distribution channels, based on factors such as convenience, brand experience and omnichannel strategy.

- Regional Analysis: Assessment of regional variations in market performance, considering factors like economic conditions and consumer preferences. London is expected to remain a dominant region, driven by factors such as high concentration of luxury retailers and high spending power.

United Kingdom Luxury Goods Market Product Innovations

This section summarizes recent product developments, their applications, and competitive advantages. The report will highlight technological trends, such as the incorporation of sustainable materials and the use of augmented reality in retail experiences, driving product innovation. The emphasis will be on products meeting evolving consumer demands and preferences in the luxury sector.

Report Scope & Segmentation Analysis

This report covers the UK luxury goods market, segmented by product type (Clothing and Apparel, Footwear, Bags, Jewelry, Watches, Other Accessories) and distribution channel (Single-brand Stores, Multi-brand Stores, Online Stores, Other Distribution Channels). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail, providing a comprehensive understanding of market opportunities and challenges within each segment.

Key Drivers of United Kingdom Luxury Goods Market Growth

The growth of the UK luxury goods market is driven by several key factors, including the increasing disposable income of affluent consumers, the rising popularity of online luxury retail, and the growing demand for experiences and personalized luxury goods. Government policies supporting the luxury sector also contribute to market growth.

Challenges in the United Kingdom Luxury Goods Market Sector

The UK luxury goods market faces several challenges, including economic uncertainty, increasing competition from both established and emerging brands, rising raw material costs, and supply chain disruptions. These factors can lead to decreased profit margins and growth stagnation.

Emerging Opportunities in United Kingdom Luxury Goods Market

The UK luxury goods market presents several emerging opportunities, including the growth of the online luxury retail market, the increasing demand for sustainable and ethical luxury goods, and the growing popularity of personalized luxury experiences. These offer significant potential for market expansion and innovation.

Leading Players in the United Kingdom Luxury Goods Market Market

- The Estee Lauder Companies Inc

- Compagnie Financière Richemont SA

- KERING

- TFG LONDON LIMITED

- PVH Corp

- Ralph Lauren Corporation

- L'OREAL

- LVMH Moët Hennessy Louis Vuitton

- MAX MARA SRL

- CHANEL

Key Developments in United Kingdom Luxury Goods Market Industry

- September 2021: Estée Lauder launched a new collection of luxury perfumes, featuring ScentCapture Fragrance Extender technology.

- April 2020: Burberry released a sustainable collection, showcasing its commitment to environmental responsibility.

- January 2020: Versace opened a new flagship store in London, expanding its retail presence.

Future Outlook for United Kingdom Luxury Goods Market Market

The UK luxury goods market is poised for continued growth, driven by factors such as rising disposable incomes, increasing demand for luxury experiences, and the expanding online luxury retail sector. The market is expected to witness further innovation and diversification, with new brands and technologies entering the market. Strategic partnerships and investments will play a crucial role in shaping the future of the industry.

United Kingdom Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

United Kingdom Luxury Goods Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Luxury Goods Market Regional Market Share

Geographic Coverage of United Kingdom Luxury Goods Market

United Kingdom Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Natural and Organic Formulations

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Beauty and Personal Care Products

- 3.4. Market Trends

- 3.4.1. Rising Affinity for Vegan Leather Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KERING

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TFG LONDON LIMITED

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PVH Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ralph Lauren Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'OREAL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LVMH Moët Hennessy Louis Vuitton

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAX MARA SRL*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CHANEL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: United Kingdom Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: United Kingdom Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: United Kingdom Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Luxury Goods Market?

The projected CAGR is approximately 2.29%.

2. Which companies are prominent players in the United Kingdom Luxury Goods Market?

Key companies in the market include The Estee Lauder Companies Inc, Compagnie Financière Richemont SA, KERING, TFG LONDON LIMITED, PVH Corp, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton, MAX MARA SRL*List Not Exhaustive, CHANEL.

3. What are the main segments of the United Kingdom Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Natural and Organic Formulations.

6. What are the notable trends driving market growth?

Rising Affinity for Vegan Leather Goods.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Beauty and Personal Care Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Estée Lauder launched a new collection of luxury perfumes, featuring the brand's exclusive technology - ScentCapture Fragrance Extender which allows the fragrance to last for aroundnd 12 hours after a single application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Luxury Goods Market?

To stay informed about further developments, trends, and reports in the United Kingdom Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence