Key Insights

The United States Bath Fitting Market, encompassing faucets, showerheads, bathtubs, and accessories, is poised for robust expansion. Projected to reach $22.53 billion by 2025, the market's growth is fueled by rising homeownership, increased disposable income, and a strong demand for home renovation. The historical period (2019-2024) demonstrated consistent growth, driven by water-saving technologies and smart home integration. This upward trend is expected to continue through the forecast period (2025-2033), with an anticipated Compound Annual Growth Rate (CAGR) of 4.7%. The increasing adoption of luxury bath fittings, emphasizing enhanced functionality and aesthetics, will further propel market growth. The market is segmented by product type (faucets, shower systems, bathtubs), material (brass, ceramic, stainless steel), and price point (budget, mid-range, luxury). The luxury segment is expected to be a key growth driver, catering to consumers prioritizing comfort and personalized bathroom design.

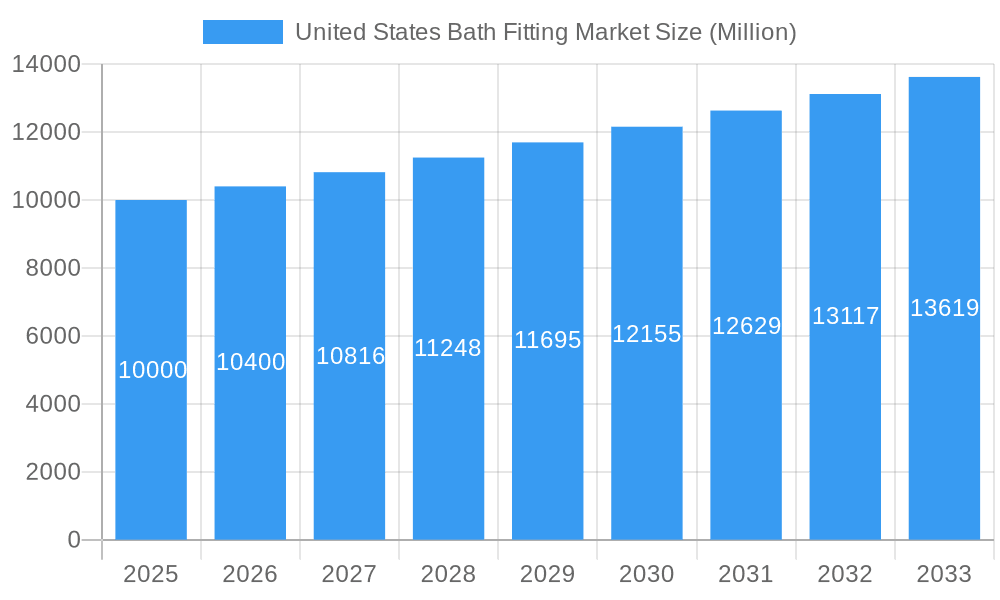

United States Bath Fitting Market Market Size (In Billion)

The projected CAGR of 4.7% signifies sustained market expansion. Key growth drivers include the increasing demand for water-efficient products aligned with environmental regulations, the introduction of innovative designs with smart features, and the growing consumer preference for stylish bathroom upgrades. The expanding influence of e-commerce and home improvement influencers is enhancing consumer awareness and purchasing decisions. Intense competition among established and emerging brands will drive innovation and competitive pricing. The consistent growth and positive outlook present a compelling investment opportunity within the US Bath Fitting Market.

United States Bath Fitting Market Company Market Share

United States Bath Fitting Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States bath fitting market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report dissects market dynamics, growth drivers, challenges, and opportunities. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

United States Bath Fitting Market Structure & Innovation Trends

This section analyzes the competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities within the US bath fitting market.

The market exhibits a moderately consolidated structure, with key players like American Standard, Grohe, Delta Faucet, TOTO, Kohler, Kraus, Pfister, and Peerless holding significant market shares. Their combined market share is estimated at xx%.

- Market Share: American Standard (xx%), Kohler (xx%), Delta Faucet (xx%), Grohe (xx%), Others (xx%).

- Innovation Drivers: Growing demand for smart bathroom technology, increasing focus on water conservation, and rising preference for aesthetically pleasing designs.

- Regulatory Landscape: Compliance with water efficiency standards (e.g., WaterSense) and safety regulations significantly impacts market dynamics.

- Product Substitutes: Limited direct substitutes exist; however, competition arises from alternative bathroom fixtures and designs.

- End-User Demographics: The residential sector dominates, followed by the commercial and hospitality sectors. The growing millennial and Gen Z population, with their focus on modern aesthetics and sustainable products, is a key driver.

- M&A Activities: The past five years have witnessed xx M&A deals, with a total value of approximately xx Million, primarily focused on expanding product portfolios and market reach.

United States Bath Fitting Market Market Dynamics & Trends

This section delves into the driving forces shaping the US bath fitting market. Market growth is propelled by several factors, including increasing disposable incomes, rising demand for home renovations and new constructions, and a shift towards luxury bathroom designs. Technological advancements, such as smart faucets and shower systems, are transforming consumer preferences. The market is witnessing increased adoption of water-saving technologies and sustainable materials due to growing environmental consciousness. Competitive pressures are intensifying with new entrants and established players constantly innovating to capture market share. The market's CAGR during the forecast period (2025-2033) is projected to be xx%, driven by factors like increasing urbanization and rising demand for smart home technology. Market penetration of smart bathroom fittings is currently at xx% and is projected to reach xx% by 2033.

Dominant Regions & Segments in United States Bath Fitting Market

The analysis reveals that the dominant region for bath fittings is the Northeast and West Coast, due to higher disposable incomes and a higher concentration of new constructions and renovations. By product segment, faucets hold the largest market share, followed by showers, bathtubs, shower enclosures, and other product types. Multi-brand stores dominate the distribution channel, but online stores are witnessing rapid growth. The residential segment comprises the majority of the end-user market.

By Product:

- Faucets: Driven by diverse designs, technological advancements (smart faucets), and ease of installation.

- Showers: High demand for water-efficient showerheads and luxurious shower systems.

- Bathtubs: Driven by increasing preference for freestanding and modern bathtubs, especially in new constructions.

- Shower Enclosures: Expanding product diversity to cater to varying bathroom sizes and preferences.

- Other Product Types: Includes accessories like bathroom sinks, taps, and other related products, witnessing steady growth.

By Distribution Channel:

- Multi-brand Stores: Benefit from wide reach and established customer base.

- Exclusive Stores: Offer specialized selection and personalized service but have limited geographical reach.

- Online Stores: Growing rapidly, driven by convenience and wider selection.

- Other Distribution Channels: Include direct sales and wholesale distributors.

By End Users:

- Residential: Majority of market share, fueled by increasing home renovations and new housing projects.

- Commercial: Growing demand from hotels, hospitals and other commercial establishments.

United States Bath Fitting Market Product Innovations

Recent product innovations include smart faucets with touchless operation and water temperature control, water-efficient showerheads, and aesthetically appealing shower enclosures. These innovations cater to consumer preferences for convenience, sustainability, and style. The focus on smart home integration is also driving innovation. The adoption of durable, low-maintenance materials like ceramic, stainless steel, and composite materials provides competitive advantages.

Report Scope & Segmentation Analysis

This report segments the US bath fitting market by product (faucets, showers, bathtubs, shower enclosures, other product types), distribution channel (multi-brand stores, exclusive stores, online stores, other channels), and end-user (residential, commercial). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed, providing a holistic understanding of the market's structure and potential. The report projects significant growth in smart bath fittings across all segments, particularly in the residential sector.

Key Drivers of United States Bath Fitting Market Growth

The key drivers are rising disposable incomes, increased focus on home improvement and renovations, growing preference for smart home technology and sustainable products, and favorable government policies promoting water conservation. The increasing construction of new residential and commercial buildings further fuels market growth. Technological advancements in water-saving and energy-efficient fixtures also contribute significantly.

Challenges in the United States Bath Fitting Market Sector

Challenges include fluctuating raw material prices, supply chain disruptions, intense competition, and the need to comply with stringent water conservation regulations. These challenges impact profitability and market expansion strategies.

Emerging Opportunities in United States Bath Fitting Market

Emerging opportunities lie in smart home integration, the growing demand for sustainable and eco-friendly products, and the expansion into niche markets like luxury and high-end bathroom fixtures. The rising popularity of minimalist and modern bathroom designs creates opportunities for innovative product development.

Leading Players in the United States Bath Fitting Market Market

- American Standard

- Grohe

- Peerless

- Delta Faucet

- TOTO

- Kohler

- Kraus

- Pfister

Key Developments in United States Bath Fitting Market Industry

- 2022 Q4: Delta Faucet launched a new line of smart faucets with voice control capabilities.

- 2023 Q1: Kohler acquired a smaller competitor specializing in luxury bath fittings, expanding its product portfolio.

- 2023 Q3: American Standard introduced a new range of water-efficient showerheads. (Further developments will be added in the full report)

Future Outlook for United States Bath Fitting Market Market

The US bath fitting market is poised for continued growth, driven by ongoing technological advancements, increasing consumer preference for modern and sustainable products, and robust construction activities. Strategic investments in R&D and expansion into new market segments will be crucial for companies seeking to maintain a competitive edge. The increasing adoption of smart technology in bathrooms presents a significant growth opportunity for manufacturers.

United States Bath Fitting Market Segmentation

-

1. Product

- 1.1. Faucets

- 1.2. Showers

- 1.3. Bathtubs

- 1.4. Showers Enclosures

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Multi- brand Stores

- 2.2. Exclusive Store

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. End Users

- 3.1. Residential

- 3.2. Commercial

United States Bath Fitting Market Segmentation By Geography

- 1. United States

United States Bath Fitting Market Regional Market Share

Geographic Coverage of United States Bath Fitting Market

United States Bath Fitting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising Urbanization And Construction Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Bath Fitting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Faucets

- 5.1.2. Showers

- 5.1.3. Bathtubs

- 5.1.4. Showers Enclosures

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi- brand Stores

- 5.2.2. Exclusive Store

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Standard

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grohe

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Peerless*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Faucet

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TOTO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kohler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kraus

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pfister

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 American Standard

List of Figures

- Figure 1: United States Bath Fitting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Bath Fitting Market Share (%) by Company 2025

List of Tables

- Table 1: United States Bath Fitting Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Bath Fitting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: United States Bath Fitting Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: United States Bath Fitting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Bath Fitting Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Bath Fitting Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Bath Fitting Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: United States Bath Fitting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Bath Fitting Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the United States Bath Fitting Market?

Key companies in the market include American Standard, Grohe, Peerless*List Not Exhaustive, Delta Faucet, TOTO, Kohler, Kraus, Pfister.

3. What are the main segments of the United States Bath Fitting Market?

The market segments include Product, Distribution Channel, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.53 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising Urbanization And Construction Activities.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Bath Fitting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Bath Fitting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Bath Fitting Market?

To stay informed about further developments, trends, and reports in the United States Bath Fitting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence