Key Insights

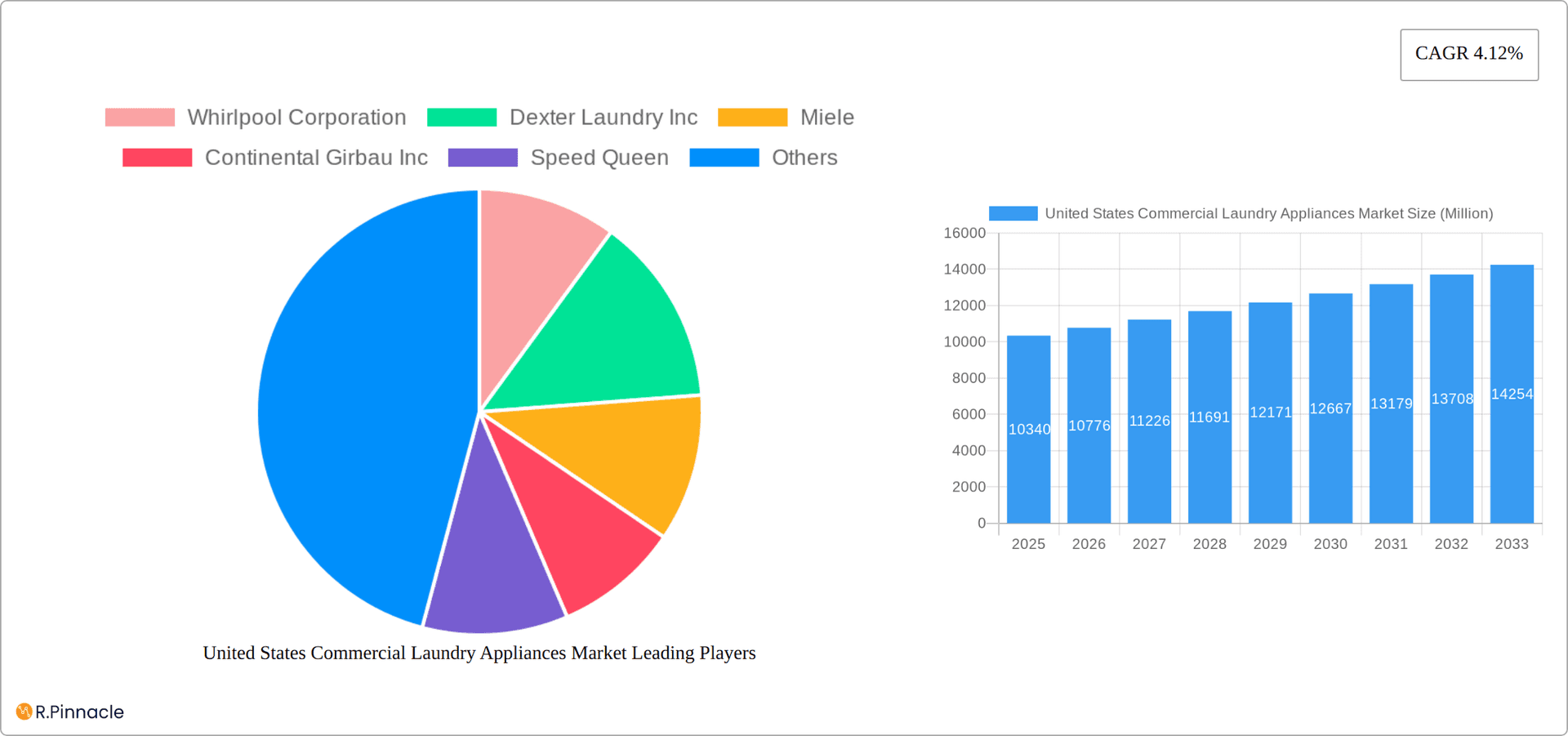

The United States commercial laundry appliances market, valued at approximately $10.34 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.12% from 2025 to 2033. This expansion is driven by several key factors. The hospitality sector, including hotels and restaurants, is a significant driver, fueled by increasing tourism and the need for efficient, high-capacity laundry solutions. The healthcare industry also contributes substantially, demanding reliable and hygienic laundry equipment for hospitals and medical facilities. Furthermore, the ongoing trend toward automation in commercial settings is pushing demand for fully automatic washing machines and dryers, leading to increased efficiency and reduced labor costs. Growth in the online retail segment is also facilitating easier purchasing of commercial laundry solutions for small businesses and entrepreneurs. While increasing raw material costs and potential supply chain disruptions pose challenges, the overall market outlook remains positive due to consistent demand from key industry verticals.

United States Commercial Laundry Appliances Market Market Size (In Billion)

Growth within specific segments is expected to vary. Fully automatic systems are anticipated to lead in market share, reflecting the increasing preference for advanced technology. The hospitality sector will likely continue to be the largest end-user segment, followed by healthcare, with other end-users showing steady, albeit slower growth. Direct sales are expected to maintain a significant share of the distribution channel, but online retailers are poised to demonstrate notable expansion, offering convenience and competitive pricing. The consistent demand for reliable, high-capacity equipment and the ongoing shift towards technologically advanced solutions are expected to further drive growth over the next decade. Market players are focusing on innovation, such as energy-efficient models and advanced controls, further stimulating demand.

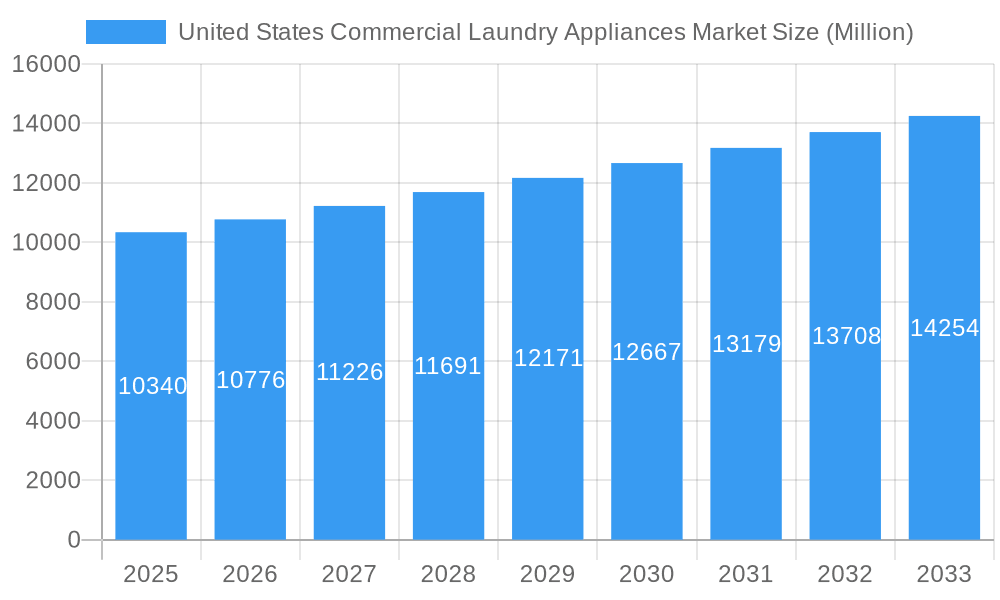

United States Commercial Laundry Appliances Market Company Market Share

This in-depth report provides a comprehensive analysis of the United States commercial laundry appliances market, offering invaluable insights for industry professionals, investors, and strategists. The study covers the period from 2019 to 2033, with a focus on the current market landscape (base year 2025) and future projections. The report uses rigorous data analysis to forecast market growth, identify key trends, and highlight significant opportunities and challenges. The market size is projected to reach xx Million by 2033.

United States Commercial Laundry Appliances Market Market Structure & Innovation Trends

The US commercial laundry appliances market exhibits a moderately concentrated structure, with key players like Whirlpool Corporation, Dexter Laundry Inc, Miele, Continental Girbau Inc, Speed Queen, Alliance Laundry Systems LLC, Bosch, Electrolux AB, Maytag, and LG Electronics holding significant market share. Market concentration is estimated at xx% in 2025. Innovation is driven by increasing demand for energy-efficient, water-saving, and technologically advanced appliances. Stringent environmental regulations and a focus on sustainability are also key drivers. The market witnesses frequent mergers and acquisitions (M&A) activities, reflecting the competitive landscape. For example, in 2023, Alliance Laundry Systems made significant acquisitions, impacting the market structure. The total M&A deal value in the last 5 years (2019-2024) is estimated at xx Million.

- Market Share (2025): Whirlpool Corporation (xx%), Alliance Laundry Systems LLC (xx%), Dexter Laundry Inc (xx%), Others (xx%)

- Key Innovation Drivers: Energy efficiency, water conservation, smart technology integration, improved durability.

- Regulatory Framework: EPA regulations on water and energy consumption.

- Product Substitutes: Limited direct substitutes; focus is on efficiency improvements within the category.

- End-User Demographics: Significant presence across hospitality, healthcare, and other commercial sectors.

United States Commercial Laundry Appliances Market Market Dynamics & Trends

The United States commercial laundry appliances market is experiencing a period of significant transformation and robust expansion. This growth is underpinned by a confluence of powerful drivers, including the escalating needs of the dynamic hospitality and healthcare sectors, the continuous effects of increasing urbanization, and a pronounced consumer and business preference for highly automated and technologically sophisticated equipment. The market is witnessing a pronounced and accelerating shift towards fully automatic appliances, a trend directly attributable to the imperative for enhanced operational efficiency and the crucial need to mitigate rising labor expenditures. Technological disruptions are not merely incremental; they are fundamentally reshaping the industry landscape. The integration of cutting-edge smart technology and the pervasive adoption of IoT capabilities are revolutionizing how commercial laundry operations are managed and executed. The competitive arena is characterized by its dynamism and intensity, with major industry participants actively engaging in strategic alliances, targeted acquisitions, and relentless product innovation to solidify and expand their market leadership positions. For the projected forecast period spanning 2025-2033, the Compound Annual Growth Rate (CAGR) is anticipated to reach an impressive xx%. The market penetration of fully automatic washing machines is estimated to be approximately xx% as of 2025. Furthermore, a distinct and growing consumer preference is evident, increasingly favoring energy-efficient and exceptionally durable appliance models, which directly translate to reduced long-term operational costs for businesses.

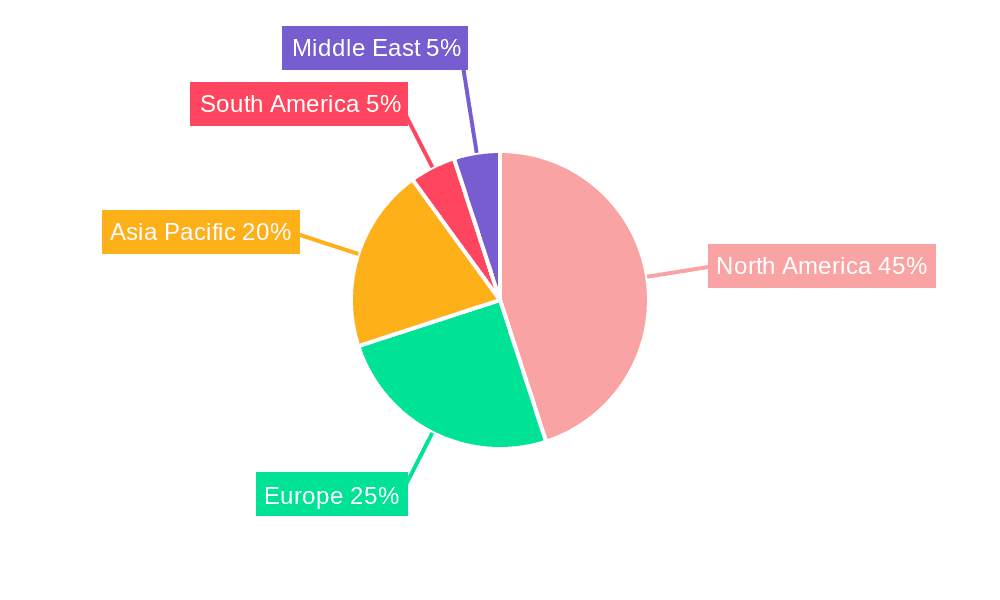

Dominant Regions & Segments in United States Commercial Laundry Appliances Market

The market is geographically diverse, with significant presence across various regions. However, specific data on regional dominance needs further investigation.

- By End User: The hospitality sector currently dominates the market, driven by the high volume of laundry needs in hotels, restaurants, and other hospitality establishments. Healthcare is a fast-growing segment due to the stringent hygiene requirements in hospitals and clinics.

- By Distribution Channel: Distributors and dealers constitute the largest distribution channel, owing to their established network and reach. Direct sales and online retailers are also gaining traction.

- By Product Type: Washing machines hold the largest market share, followed by dryers and ironers.

- By Technology: Fully automatic appliances are witnessing a significant increase in adoption, surpassing semi-automatic counterparts.

Key Drivers:

- Strong growth in the hospitality and healthcare sectors

- Increasing preference for efficient and automated systems.

- Government initiatives promoting energy efficiency and sustainability.

United States Commercial Laundry Appliances Market Product Innovations

Recent product innovations focus on improved energy efficiency, water conservation, enhanced durability, and the integration of smart technology. These innovations aim to address consumer demand for cost-effective and environmentally friendly solutions. Manufacturers are incorporating advanced features such as connected appliances and remote monitoring capabilities. The market is witnessing a growing trend towards compact, space-saving designs that cater to the needs of businesses with limited space.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the US commercial laundry appliances market across various segments:

- By End User: Hospitality, Healthcare, Other End Users (Growth projections: xx%, xx%, xx% respectively from 2025 to 2033; Market size 2025: xx Million, xx Million, xx Million respectively).

- By Distribution Channel: Direct Sales, Distributors and Dealers, Online Retailers (Growth projections: xx%, xx%, xx% respectively from 2025 to 2033; Market size 2025: xx Million, xx Million, xx Million respectively).

- By Product Type: Washing Machines, Dryers, Ironers (Growth projections: xx%, xx%, xx% respectively from 2025 to 2033; Market size 2025: xx Million, xx Million, xx Million respectively).

- By Technology: Fully Automatic, Semi-automatic (Growth projections: xx%, xx% respectively from 2025 to 2033; Market size 2025: xx Million, xx Million respectively).

Key Drivers of United States Commercial Laundry Appliances Market Growth

A multifaceted array of factors is actively propelling the sustained growth of the United States commercial laundry appliances market:

- The continuously expanding and evolving hospitality and healthcare sectors are significant contributors, generating substantial and ongoing demand for state-of-the-art and highly efficient laundry solutions.

- Pioneering technological advancements, most notably the seamless integration of smart technology and the widespread implementation of IoT capabilities, are demonstrably enhancing appliance performance, operational efficiency, and overall user experience.

- Increasingly stringent environmental regulations and a growing societal emphasis on sustainability are compelling businesses to proactively adopt energy-efficient and water-saving appliances, thereby minimizing their ecological footprint.

- The persistent rise in labor costs across various industries is a powerful incentive for businesses to invest in and adopt automated laundry systems, a strategic move aimed at substantially reducing overall operational expenses and improving productivity.

Challenges in the United States Commercial Laundry Appliances Market Sector

The market faces certain challenges:

- High initial investment costs for advanced equipment can hinder adoption by smaller businesses.

- Supply chain disruptions and rising raw material costs can impact production and pricing.

- Intense competition among established players and new entrants necessitates continuous innovation and strategic adjustments.

Emerging Opportunities in United States Commercial Laundry Appliances Market

The United States commercial laundry appliances market is ripe with promising opportunities for innovation and expansion:

- The escalating demand for environmentally conscious and sustainable laundry solutions presents a significant opportunity for manufacturers to develop and market innovative energy-efficient and water-saving products.

- Strategic expansion into nascent or underserved market segments, such as the burgeoning self-service laundromat industry and specialized industrial laundry facilities, holds considerable potential for driving market growth.

- The development and seamless integration of advanced, intelligent features, including sophisticated AI-powered laundry management systems, can unlock new revenue streams and enhance service offerings.

Leading Players in the United States Commercial Laundry Appliances Market Market

- Whirlpool Corporation

- Dexter Laundry Inc

- Miele

- Continental Girbau Inc

- Speed Queen

- Alliance Laundry Systems LLC

- Bosch

- Electrolux AB

- Maytag

- LG Electronics

Key Developments in United States Commercial Laundry Appliances Market Industry

- June 2023: Alliance Laundry Systems acquired the distribution assets of Kirkland, Washington-based Dynamic Sales and Service.

- November 2023: Alliance Laundry Systems acquired Taylor Houseman's distribution assets. This significantly expands Alliance Laundry's reach in the Northern California commercial laundry market.

Future Outlook for United States Commercial Laundry Appliances Market Market

The future trajectory of the United States commercial laundry appliances market is exceptionally promising, indicating a period of sustained and dynamic growth. This optimistic outlook is propelled by a combination of ongoing, rapid technological advancements, an increasingly pronounced global emphasis on sustainability and eco-friendly practices, and the perpetual expansion of the vital hospitality and healthcare sectors. To not only maintain but also enhance their competitive standing, market players will find it imperative to engage in strategic partnerships, pursue targeted acquisitions, and actively pursue product diversification strategies. The market is projected to witness a continuous and accelerating adoption of smart technology and innovative IoT-enabled appliances, which will inevitably lead to substantial improvements in operational efficiency and a significant reduction in overall operational expenditures. The unwavering demand for energy-efficient and water-saving solutions will undoubtedly remain a cornerstone and a primary driver of future market growth.

United States Commercial Laundry Appliances Market Segmentation

-

1. Product Type

- 1.1. Washing Machines

- 1.2. Dryers

- 1.3. Ironers

-

2. Technology

- 2.1. Fully Automatic

- 2.2. Semi-automatic

-

3. End User

- 3.1. Hospitality

- 3.2. Healthcare

- 3.3. Other End Users

-

4. Distribution Channel

- 4.1. Direct Sales

- 4.2. Distributors and Dealers

- 4.3. Online Retailers

United States Commercial Laundry Appliances Market Segmentation By Geography

- 1. United States

United States Commercial Laundry Appliances Market Regional Market Share

Geographic Coverage of United States Commercial Laundry Appliances Market

United States Commercial Laundry Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of the Hospitality Sector

- 3.3. Market Restrains

- 3.3.1. High Initial Investment; High Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Washing Machines Dominating the Commercial Laundry Appliances Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Commercial Laundry Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Washing Machines

- 5.1.2. Dryers

- 5.1.3. Ironers

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fully Automatic

- 5.2.2. Semi-automatic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitality

- 5.3.2. Healthcare

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Direct Sales

- 5.4.2. Distributors and Dealers

- 5.4.3. Online Retailers

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dexter Laundry Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Miele

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Continental Girbau Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Speed Queen

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alliance Laundry Systems LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Electrolux AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Maytag**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: United States Commercial Laundry Appliances Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Commercial Laundry Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: United States Commercial Laundry Appliances Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: United States Commercial Laundry Appliances Market Revenue Million Forecast, by End User 2020 & 2033

- Table 9: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: United States Commercial Laundry Appliances Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Commercial Laundry Appliances Market?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the United States Commercial Laundry Appliances Market?

Key companies in the market include Whirlpool Corporation, Dexter Laundry Inc, Miele, Continental Girbau Inc, Speed Queen, Alliance Laundry Systems LLC, Bosch, Electrolux AB, Maytag**List Not Exhaustive, LG Electronics.

3. What are the main segments of the United States Commercial Laundry Appliances Market?

The market segments include Product Type, Technology, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of the Hospitality Sector.

6. What are the notable trends driving market growth?

Washing Machines Dominating the Commercial Laundry Appliances Market.

7. Are there any restraints impacting market growth?

High Initial Investment; High Maintenance Costs.

8. Can you provide examples of recent developments in the market?

November 2023: Alliance Laundry Systems acquired Taylor Houseman's distribution assets. Taylor Houseman provides commercial laundry products, services, and support for on-premises laundry, dry cleaning, laundromat, and industrial laundry to customers in Northern California.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Commercial Laundry Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Commercial Laundry Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Commercial Laundry Appliances Market?

To stay informed about further developments, trends, and reports in the United States Commercial Laundry Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence