Key Insights

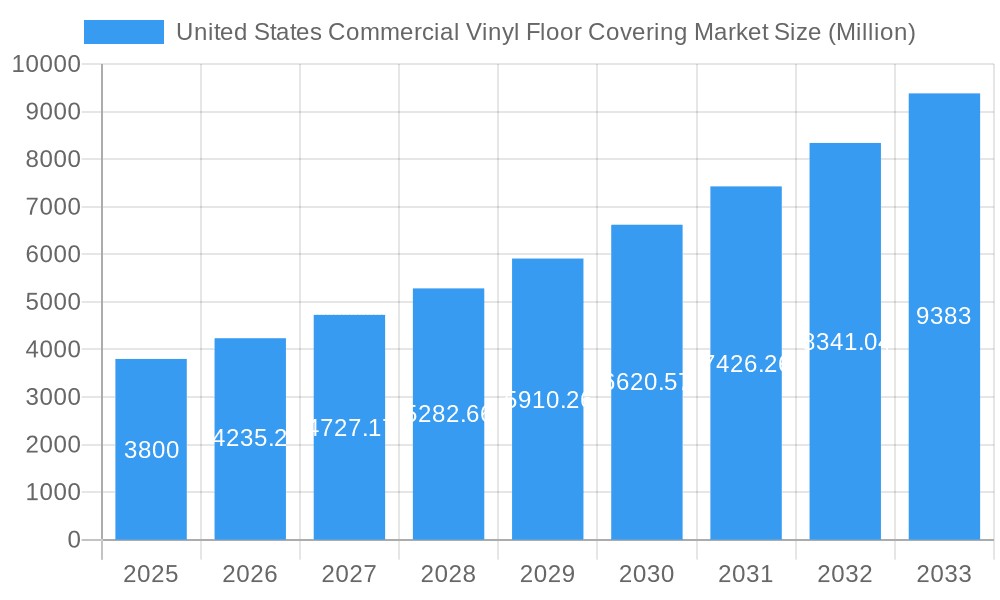

The United States commercial vinyl floor covering market is experiencing robust growth, projected to reach \$3.80 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 11.20% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing preference for durable, low-maintenance, and cost-effective flooring solutions in commercial spaces like offices, retail stores, and healthcare facilities is a significant factor. Furthermore, advancements in vinyl flooring technology, leading to improved aesthetics, enhanced durability, and a wider range of design options, are boosting market demand. The rising construction activity across the US, particularly in commercial real estate, further contributes to the market's growth trajectory. While potential restraints like fluctuating raw material prices and environmental concerns surrounding vinyl production exist, the market's inherent advantages and ongoing innovation are expected to mitigate these challenges. The segmentation of the market likely includes variations based on product type (e.g., sheet vinyl, tile, planks), end-use application (e.g., healthcare, education, retail), and price point, each exhibiting unique growth patterns. Major players like Shaw Industries, Tarkett, and Mohawk Industries are driving innovation and competition, shaping the market landscape.

United States Commercial Vinyl Floor Covering Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth, driven by continued construction activity and the increasing adoption of vinyl flooring in various commercial segments. While economic fluctuations could influence growth rates, the long-term outlook remains positive, supported by the inherent advantages of vinyl flooring – affordability, versatility, and ease of maintenance – making it a favored choice for commercial spaces. The competitive landscape will remain dynamic, with existing players focused on product innovation and expansion, and potential new entrants seeking to capitalize on the market's growth opportunities. Understanding specific segment performances and regional variations will be crucial for strategic planning and investment decisions within this thriving market.

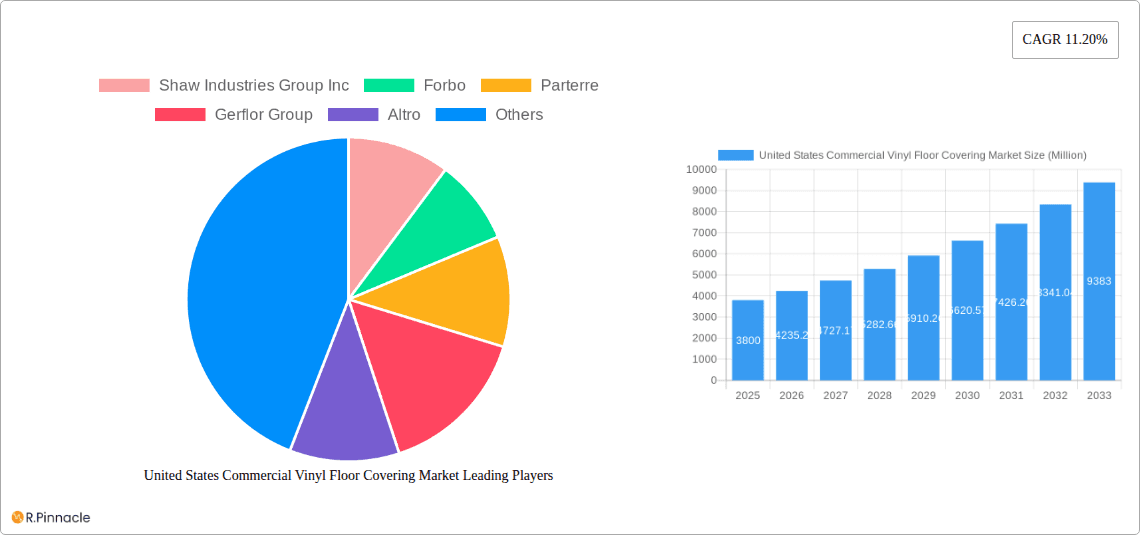

United States Commercial Vinyl Floor Covering Market Company Market Share

United States Commercial Vinyl Floor Covering Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the United States commercial vinyl floor covering market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, trends, and future growth potential. The report features detailed segmentation analysis, competitive landscapes, and key player profiles, including Shaw Industries Group Inc, Forbo, Parterre, Gerflor Group, Altro, Karndean Designflooring, Tarkett SA, Mohawk Industries Inc, Armstrong Flooring, Mannington Commercial, Flexco Floors, Interface Inc, and Milliken.

United States Commercial Vinyl Floor Covering Market Structure & Innovation Trends

This section analyzes the market structure, highlighting key trends and drivers shaping the US commercial vinyl floor covering market from 2019-2024. We examine market concentration, identifying leading players and their respective market shares. The report delves into innovation drivers, including technological advancements in materials and manufacturing, and explores the impact of regulatory frameworks on market growth. Furthermore, we analyze the competitive landscape, focusing on M&A activities and their influence on market dynamics. Examples of substitute products and their competitive impact are explored, alongside an analysis of end-user demographics and their preferences. The analysis also includes an assessment of predicted M&A deal values for the forecast period. Market share data for key players is included, offering a complete view of market concentration.

United States Commercial Vinyl Floor Covering Market Market Dynamics & Trends

This in-depth analysis explores the key dynamics driving the growth of the US commercial vinyl floor covering market. We examine market growth drivers, such as increasing construction activities and renovations across various commercial sectors. Technological disruptions, such as the introduction of innovative materials and sustainable manufacturing processes, are assessed for their impact. Furthermore, the report analyzes evolving consumer preferences, including the demand for durable, aesthetically pleasing, and cost-effective flooring solutions. We also explore competitive dynamics, including pricing strategies, product differentiation, and marketing approaches employed by leading players. The report provides a comprehensive analysis of the Compound Annual Growth Rate (CAGR) and market penetration rates, presenting a detailed picture of market evolution.

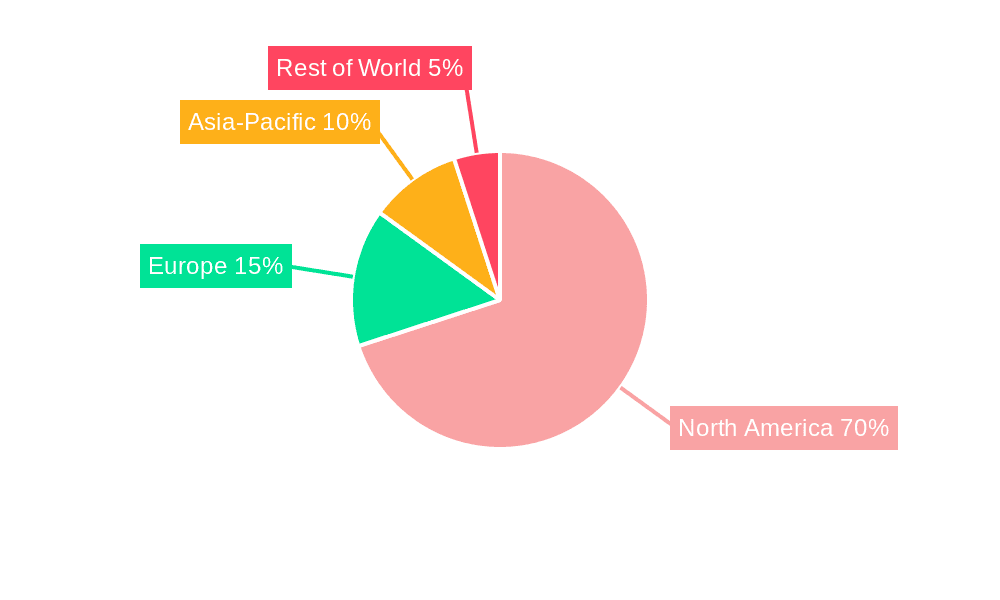

Dominant Regions & Segments in United States Commercial Vinyl Floor Covering Market

This section identifies the leading regions and segments within the US commercial vinyl floor covering market. A detailed dominance analysis is provided, exploring the factors contributing to the leading region's success.

- Key Drivers for Dominant Region: This section will outline the factors responsible for the dominance, such as:

- Favorable economic policies promoting construction and infrastructure development.

- High levels of commercial construction activity and renovation projects.

- Strong government support for sustainable building practices.

- Presence of major manufacturers and distributors within the region.

- Robust consumer demand for high-quality commercial flooring solutions.

Further analysis explores regional variations in market trends, highlighting specific growth opportunities and challenges faced by each region.

United States Commercial Vinyl Floor Covering Market Product Innovations

This section details recent product innovations and technological trends within the US commercial vinyl floor covering market. We highlight new product applications and their competitive advantages, focusing on improved durability, aesthetics, and sustainability. The analysis underscores the impact of these innovations on market growth and customer adoption rates.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the United States Commercial Vinyl Floor Covering Market. The segmentation is explored in detail, considering projected market sizes and competitive dynamics for each segment. Growth projections are provided based on our analysis and current industry trends.

(Specific segments and their analysis would be detailed here. Due to the lack of specific segment information in your prompt, this section will remain generalized.)

Key Drivers of United States Commercial Vinyl Floor Covering Market Growth

The growth of the US commercial vinyl floor covering market is driven by a confluence of factors. Technological advancements leading to improved product performance, durability, and aesthetics play a key role. Furthermore, robust economic growth coupled with increased investment in commercial construction and renovation projects is a significant driver. Government regulations promoting sustainable building practices and energy efficiency also contribute to market expansion.

Challenges in the United States Commercial Vinyl Floor Covering Market Sector

The US commercial vinyl floor covering market faces several challenges. Supply chain disruptions and raw material price fluctuations impact production costs and profitability. Intense competition among established players and the emergence of new entrants create pricing pressures. Furthermore, regulatory hurdles related to environmental standards and health concerns can impact market growth. The quantifiable impact of these challenges will be detailed within the report.

Emerging Opportunities in United States Commercial Vinyl Floor Covering Market

Despite existing challenges, the US commercial vinyl floor covering market presents considerable opportunities. The rising demand for sustainable and eco-friendly flooring solutions creates a niche for innovative products with reduced environmental impact. Furthermore, technological advancements like improved digital printing capabilities and the introduction of new materials open doors for product diversification and market expansion. These opportunities are thoroughly examined in the report.

Leading Players in the United States Commercial Vinyl Floor Covering Market Market

- Shaw Industries Group Inc

- Forbo

- Parterre

- Gerflor Group

- Altro

- Karndean Designflooring

- Tarkett SA

- Mohawk Industries Inc

- Armstrong Flooring

- Mannington Commercial

- Flexco Floors

- Interface Inc

- Milliken

Key Developments in United States Commercial Vinyl Floor Covering Market Industry

- March 2024: AHF Products launched Unfazed Luxury Vinyl Flooring under its Parterre brand, highlighting US manufacturing and simplified installation.

- February 2024: MSI expanded its Everlife collection with two new luxury vinyl plank lines: Laurel and Laurel Reserve.

- September 2023: AHF Products partnered with Spartan Surfaces for exclusive distribution of Parterre luxury vinyl flooring.

Future Outlook for United States Commercial Vinyl Floor Covering Market Market

The future of the US commercial vinyl floor covering market appears promising, driven by continuous innovation, increasing demand from diverse commercial sectors, and a focus on sustainability. Strategic opportunities exist for companies focusing on high-performance, eco-friendly products and expanding into emerging market segments. The market's positive outlook is supported by projected growth rates and strong demand forecasts. Further details and predictions for the 2025-2033 forecast period are included within the full report.

United States Commercial Vinyl Floor Covering Market Segmentation

-

1. Product Type

- 1.1. Luxury Vinyl Tiles and Planks

- 1.2. Vinyl Sheets

- 1.3. Vinyl Composite Tiles

-

2. Application

-

2.1. Transport

- 2.1.1. Automotive Flooring

- 2.1.2. Aviation Flooring

- 2.1.3. Marine Flooring

- 2.1.4. Other Transport

- 2.2. Hospitality

- 2.3. Gym and Fitness

- 2.4. Hospitals

- 2.5. Retail

- 2.6. Corporate

- 2.7. Education

- 2.8. Other Commercial Applications

-

2.1. Transport

-

3. Distribution Channel

- 3.1. Directly From the Manufacturers

- 3.2. Dealers/Retailers

United States Commercial Vinyl Floor Covering Market Segmentation By Geography

- 1. United States

United States Commercial Vinyl Floor Covering Market Regional Market Share

Geographic Coverage of United States Commercial Vinyl Floor Covering Market

United States Commercial Vinyl Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities

- 3.3. Market Restrains

- 3.3.1. Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities

- 3.4. Market Trends

- 3.4.1. Resilient Flooring

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Commercial Vinyl Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Luxury Vinyl Tiles and Planks

- 5.1.2. Vinyl Sheets

- 5.1.3. Vinyl Composite Tiles

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Transport

- 5.2.1.1. Automotive Flooring

- 5.2.1.2. Aviation Flooring

- 5.2.1.3. Marine Flooring

- 5.2.1.4. Other Transport

- 5.2.2. Hospitality

- 5.2.3. Gym and Fitness

- 5.2.4. Hospitals

- 5.2.5. Retail

- 5.2.6. Corporate

- 5.2.7. Education

- 5.2.8. Other Commercial Applications

- 5.2.1. Transport

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Directly From the Manufacturers

- 5.3.2. Dealers/Retailers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shaw Industries Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Forbo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Parterre

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gerflor Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Altro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karndean Designflooring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tarkett SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawk Industries Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Armstrong Flooring

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mannington Commercial

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Flexco Floors

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Interface Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Milliken

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Shaw Industries Group Inc

List of Figures

- Figure 1: United States Commercial Vinyl Floor Covering Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Commercial Vinyl Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: United States Commercial Vinyl Floor Covering Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Commercial Vinyl Floor Covering Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Commercial Vinyl Floor Covering Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the United States Commercial Vinyl Floor Covering Market?

Key companies in the market include Shaw Industries Group Inc, Forbo, Parterre, Gerflor Group, Altro, Karndean Designflooring, Tarkett SA, Mohawk Industries Inc, Armstrong Flooring, Mannington Commercial, Flexco Floors, Interface Inc, Milliken.

3. What are the main segments of the United States Commercial Vinyl Floor Covering Market?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities.

6. What are the notable trends driving market growth?

Resilient Flooring.

7. Are there any restraints impacting market growth?

Growth in Commercial Construction Projects; Increasing Demand from Fitness Facilities.

8. Can you provide examples of recent developments in the market?

March 2024- AHF Products, a leading manufacturer known for its hard surface flooring tailored for commercial settings, introduced its newest offering under the Parterre brand: Unfazed Luxury Vinyl Flooring. Manufactured in Lancaster, Pennsylvania, this addition underscores AHF's dedication to quality, featuring a resilient, low-maintenance design. Notably, being crafted in the US, Unfazed Luxury Vinyl stands out by eliminating the acclimation requirement and streamlining the installation process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Commercial Vinyl Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Commercial Vinyl Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Commercial Vinyl Floor Covering Market?

To stay informed about further developments, trends, and reports in the United States Commercial Vinyl Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence