Key Insights

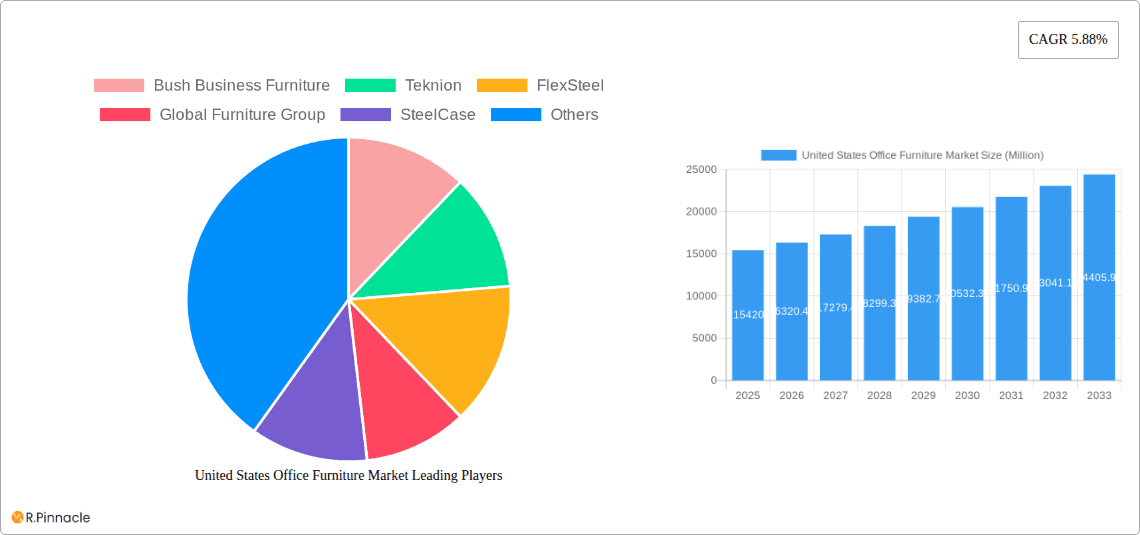

The United States Office Furniture Market is projected to reach \$15.42 billion in value, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.88% over the forecast period from 2025 to 2033. This steady expansion is primarily fueled by the evolving needs of modern workplaces, including the increasing adoption of hybrid work models, the demand for ergonomic and aesthetically pleasing furniture, and the ongoing office space redesigns aimed at enhancing collaboration and employee well-being. Key drivers include the growing emphasis on creating flexible and adaptable workspaces that can accommodate diverse work styles, alongside a sustained need for replacements and upgrades in corporate environments. Furthermore, the burgeoning technology sector and the expansion of startups continue to contribute to the demand for new office setups and furnishing.

United States Office Furniture Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. In terms of materials, a significant portion of the market is occupied by wood and metal, favored for their durability and aesthetic appeal in traditional and modern office designs. However, plastics are gaining traction due to their versatility, cost-effectiveness, and the development of sustainable, eco-friendly options. Products like seating, particularly ergonomic chairs, and storage units (including bins, shelves, and cabinets) represent major segments, reflecting the ongoing focus on comfort, organization, and space optimization. The distribution channel is predominantly indirect, with retailers and e-commerce platforms playing a crucial role in reaching a broad customer base. Leading companies such as SteelCase, Herman Miller, and HNI Corporation are at the forefront, driving innovation and shaping market trends with their diverse product portfolios and strategic initiatives. The United States, being a major economic hub, is expected to represent the entirety of the regional data provided, indicating its significant dominance in this market.

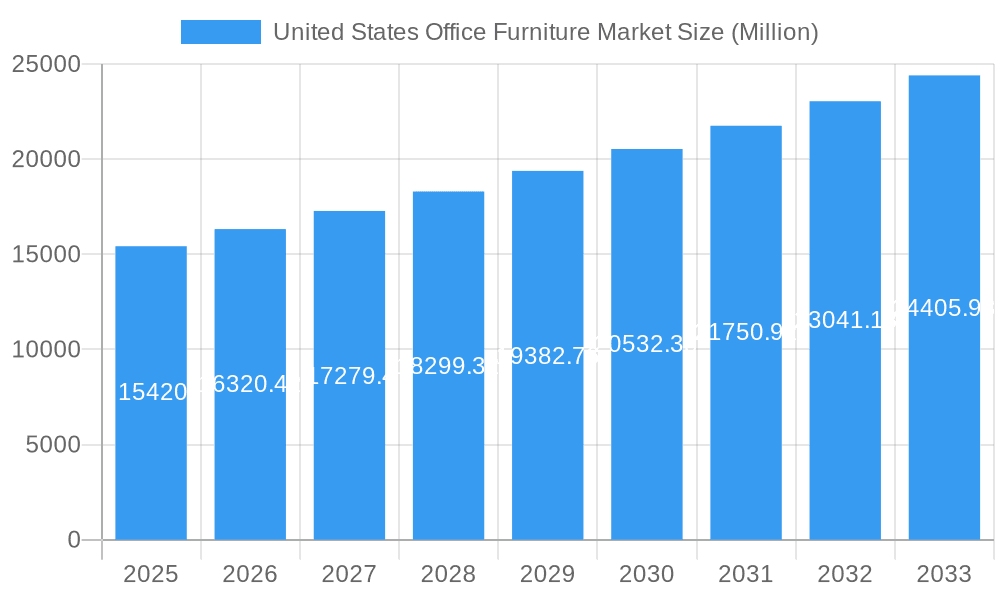

United States Office Furniture Market Company Market Share

This in-depth report provides a definitive analysis of the United States Office Furniture Market, meticulously examining market structure, dynamics, dominant regions, product innovations, and future growth trajectories. Covering the historical period from 2019 to 2024, with a base year of 2025 and a comprehensive forecast period extending to 2033, this report offers actionable insights for industry stakeholders. Leveraging high-ranking keywords and detailed segmentation, this analysis is designed to enhance search visibility and equip industry professionals with the critical data needed for strategic decision-making. The market is projected to reach xx Million USD by 2033, exhibiting a robust CAGR of xx% during the forecast period.

United States Office Furniture Market Market Structure & Innovation Trends

The United States Office Furniture Market exhibits a moderately concentrated structure, with a few key players holding significant market share. Steelcase, Herman Miller, and HNI Corporation are among the dominant entities, influencing market trends through strategic acquisitions and product development. Innovation is primarily driven by evolving workplace needs, including a growing emphasis on ergonomic design, sustainability, and smart furniture solutions that integrate technology. Regulatory frameworks, such as those related to environmental standards and workplace safety, play a crucial role in shaping product development and manufacturing processes. Product substitutes, while present in the form of makeshift home office setups or repurposed furniture, are unlikely to significantly disrupt the professional office furniture market due to specialized requirements for durability, functionality, and aesthetic integration. End-user demographics are shifting, with a rising demand for flexible and adaptable furniture to accommodate hybrid work models and diverse employee needs. Mergers and acquisitions (M&A) activities continue to be a significant aspect of market consolidation, with deal values often reflecting strategic alignment and market expansion goals. For instance, a hypothetical recent M&A deal might have been valued at xx Million USD, further solidifying the position of larger entities. The market is characterized by a continuous pursuit of enhanced user experience and operational efficiency through innovative designs and material utilization.

United States Office Furniture Market Market Dynamics & Trends

The United States Office Furniture Market is experiencing significant evolution, propelled by a confluence of dynamic market growth drivers, technological disruptions, shifting consumer preferences, and intense competitive dynamics. The sustained demand for modern office spaces, coupled with the ongoing trend of hybrid and remote work models, necessitates the adoption of flexible, ergonomic, and aesthetically pleasing furniture solutions. This has significantly influenced market penetration, encouraging businesses to invest in reconfigurable workstations and collaborative furniture. Technological advancements are at the forefront of this transformation, with the integration of smart features such as embedded charging ports, adjustable lighting, and connectivity solutions becoming increasingly prevalent. This technological integration not only enhances user convenience but also contributes to a more productive and engaging work environment.

Consumer preferences are rapidly evolving. There is a discernible shift towards furniture that prioritizes employee well-being, incorporating ergonomic designs that promote better posture and reduce physical strain. Sustainability is no longer a niche concern; it is a core purchasing criterion, with clients actively seeking furniture made from recycled, renewable, and eco-friendly materials. This growing environmental consciousness is driving innovation in material science and manufacturing processes within the industry.

Competitive dynamics are intensifying, with established players like Steelcase, Herman Miller, and HNI Corporation facing increased competition from both domestic and international manufacturers. The rise of direct-to-consumer (DTC) brands specializing in home office furniture also presents a growing challenge, forcing traditional players to adapt their distribution strategies and product offerings. The market is also influenced by economic indicators, such as corporate spending patterns and office real estate trends. A healthy economic environment generally translates to increased investment in office infrastructure and furniture. The estimated CAGR for the United States Office Furniture Market stands at xx%, reflecting its robust growth potential driven by these multifaceted factors. The penetration of advanced ergonomic and smart furniture solutions is expected to continue its upward trajectory, further shaping the future landscape of office environments.

Dominant Regions & Segments in United States Office Furniture Market

The United States Office Furniture Market is characterized by a strong concentration of demand and production within specific regions and segments, driven by a complex interplay of economic policies, infrastructure development, and evolving business needs.

Leading Region: The Northeastern United States and the Western United States, particularly states with major economic hubs like California, New York, and Texas, emerge as dominant regions. These areas benefit from a high concentration of corporate headquarters, technology companies, and financial institutions, all of which are significant purchasers of office furniture. Robust economic policies that foster business growth and substantial investment in commercial real estate development contribute to the sustained demand in these regions. Advanced infrastructure, including efficient logistics networks, further supports the distribution and accessibility of office furniture products.

Dominant Segments:

Products:

- Seating: This segment consistently commands the largest market share due to the fundamental requirement for seating in any office environment. The increasing emphasis on ergonomic chairs and collaborative seating solutions for open-plan offices fuels its dominance.

- Tables: With the proliferation of collaborative workspaces and the need for versatile meeting solutions, tables, including height-adjustable and modular designs, represent a significant and growing segment.

- Storage Units (Bins & Shelves, Cabinets, Others): While essential, this segment's growth is influenced by the move towards more streamlined and integrated storage solutions, often embedded within workstations or offered as modular systems.

- Other Accessories: This category, encompassing items like desk organizers and privacy screens, is experiencing growth as users seek to personalize and optimize their individual workspaces.

Material:

- Wood: Traditional and widely used, wood continues to be a popular material, especially for executive furniture and aesthetic appeal. Its versatility in terms of finishes and styles contributes to its sustained demand.

- Metal: Valued for its durability and modern aesthetic, metal is extensively used in desk frames, chair bases, and storage units, particularly in contemporary office designs.

- Plastics: Lightweight and cost-effective, plastics are integral to the manufacturing of various components, including chair shells, armrests, and desk accessories, offering both functional and design flexibility.

- Other Materials: This category, including textiles, composites, and recycled materials, is experiencing significant growth driven by sustainability initiatives and the demand for innovative, eco-friendly furniture solutions.

Distribution Channel:

- Indirect: This channel, encompassing office supply retailers, furniture dealerships, and e-commerce platforms, remains dominant due to its broad reach and ability to cater to a wide spectrum of businesses, from small enterprises to large corporations. The convenience and product variety offered through indirect channels are key drivers of their market leadership.

- Direct: While smaller, the direct channel, involving manufacturers selling directly to end-users, is gaining traction, particularly for large-scale corporate projects and for brands focusing on custom solutions or premium offerings.

United States Office Furniture Market Product Innovations

Product innovations in the United States Office Furniture Market are heavily skewed towards enhancing user well-being, promoting flexibility, and integrating technology. The development of advanced ergonomic seating with personalized adjustability and intelligent posture support is a key trend. Modular and reconfigurable furniture systems are gaining traction, enabling businesses to adapt their workspaces quickly to evolving team sizes and work methodologies. Furthermore, the integration of smart features, such as wireless charging capabilities, ambient lighting controls, and built-in connectivity hubs, is transforming traditional furniture into interactive workspaces. These innovations provide a competitive advantage by addressing the growing demand for adaptable, health-conscious, and technologically empowered work environments, aligning market fit with emerging user expectations.

Report Scope & Segmentation Analysis

This report meticulously segments the United States Office Furniture Market across key parameters to provide granular insights.

Material Segmentation: The market is analyzed by Wood, Metal, Plastics, and Other Materials. Wood is anticipated to maintain a stable market share, while Metal will see steady growth due to its durability. Plastics are expected to grow moderately due to cost-effectiveness. The Other Materials segment, encompassing sustainable and advanced composites, is projected for the highest growth rate, driven by environmental consciousness.

Product Segmentation: Analysis includes Seating, Storage Units (Bins & Shelves, Cabinets, Others), Tables, and Other Accessories. Seating remains the largest segment, with strong growth in ergonomic and collaborative options. Tables are expected to witness significant expansion, particularly modular and height-adjustable types. Storage units will see moderate growth, with a trend towards integrated solutions. Other Accessories will grow as individuals customize personal workspaces.

Distribution Channel Segmentation: The market is evaluated based on Direct and Indirect channels. The Indirect channel is projected to maintain its dominance due to extensive reach and diverse offerings. The Direct channel, however, is expected to exhibit a higher growth rate, driven by manufacturers seeking direct customer relationships and catering to large-scale projects.

Key Drivers of United States Office Furniture Market Growth

The United States Office Furniture Market is propelled by several key drivers. The ongoing trend of hybrid and remote work necessitates the creation of flexible, ergonomic, and technology-integrated office spaces, boosting demand for adaptable furniture. Technological advancements, such as smart furniture with embedded connectivity and ergonomic sensors, are creating new product categories and enhancing user experience. Economic recovery and corporate investment in modernizing workplaces are directly fueling market expansion. Furthermore, increasing awareness and demand for sustainable and eco-friendly furniture options are driving innovation and influencing purchasing decisions. Government initiatives promoting green building standards and healthy work environments also contribute to market growth.

Challenges in the United States Office Furniture Market Sector

Despite robust growth, the United States Office Furniture Market faces several challenges. Supply chain disruptions and rising raw material costs, particularly for wood and metals, can impact production timelines and profitability, leading to price volatility. Intense competition from both established global brands and emerging domestic players exerts pressure on profit margins. Stringent regulatory frameworks, while promoting safety and sustainability, can increase compliance costs for manufacturers. Furthermore, the evolving nature of work, with increasing remote work adoption, poses a challenge in predicting long-term demand for traditional office furniture. The need for significant capital investment in advanced manufacturing technologies and sustainable material sourcing also presents a barrier for smaller players.

Emerging Opportunities in United States Office Furniture Market

Emerging opportunities in the United States Office Furniture Market lie in catering to the growing demand for hybrid work solutions, focusing on sustainable and circular economy principles, and leveraging technological integration. The expansion of the home office furniture segment presents a significant avenue for growth, with consumers seeking ergonomic and aesthetically pleasing solutions. The development of smart furniture with integrated technology for enhanced productivity and well-being offers substantial market potential. Furthermore, the increasing emphasis on biophilic design and the use of natural materials in furniture manufacturing presents an opportunity to create healthier and more inspiring work environments. Exploring new markets, such as co-working spaces and educational institutions, also offers avenues for expansion.

Leading Players in the United States Office Furniture Market Market

- Steelcase

- Herman Miller

- HNI Corporation

- Teknion

- Global Furniture Group

- Bush Business Furniture

- FlexSteel

- La-Z-Boy Inc

- AIS

- Virco

- KI

- Knoll

- Kimball International

- Haworth

- Ashley Furniture Industries

Key Developments in United States Office Furniture Market Industry

- January 2023: Steelcase and the Frank Lloyd Wright Foundation released their first collection of home office furniture as part of a collaboration announced last year.

- January 2023: Kokuyo Co Ltd and Allsteel partnered to provide support for Kokuyo with office furniture for global clients in the Asia-Pacific region and Allsteel in North America.

Future Outlook for United States Office Furniture Market Market

The future outlook for the United States Office Furniture Market remains highly promising, driven by continuous innovation and evolving workplace paradigms. The sustained adoption of hybrid work models will fuel demand for flexible, modular, and ergonomic furniture solutions designed to optimize both in-office and remote work experiences. Technological integration, including smart furniture and connectivity features, will become increasingly mainstream, enhancing productivity and user comfort. A significant growth accelerator will be the increasing consumer and corporate demand for sustainable and eco-friendly products, pushing manufacturers towards circular economy principles and the use of recycled materials. Strategic partnerships and acquisitions will continue to shape market consolidation, allowing for expanded product portfolios and broader market reach. Investment in research and development focused on user well-being, advanced ergonomics, and smart office solutions will be crucial for sustained competitive advantage.

United States Office Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastics

- 1.4. Other Materials

-

2. Products

- 2.1. Seating

- 2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 2.3. Tables (

- 2.4. Other Accessories

-

3. Distribution Channel

- 3.1. Direct

- 3.2. Indirect

United States Office Furniture Market Segmentation By Geography

- 1. United States

United States Office Furniture Market Regional Market Share

Geographic Coverage of United States Office Furniture Market

United States Office Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The integration of technology into office furniture is becoming more common

- 3.2.2 with smart furniture that can enhance productivity and wellness. This includes desks with programmable height settings

- 3.2.3 chairs with posture monitoring features

- 3.2.4 and furniture equipped with wireless charging stations and connectivity options.

- 3.3. Market Restrains

- 3.3.1 The U.S. office furniture market is highly competitive

- 3.3.2 with numerous domestic and international players. This competition

- 3.3.3 combined with price sensitivity in certain market segments

- 3.3.4 can pressure manufacturers to lower prices

- 3.3.5 potentially impacting profitability.

- 3.4. Market Trends

- 3.4.1. The trend towards flexible and adaptable workspaces is driving demand for modular office furniture that can be easily reconfigured. This is particularly important in open-plan offices and coworking spaces where flexibility is key to accommodating different team sizes and work styles.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Office Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastics

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Products

- 5.2.1. Seating

- 5.2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 5.2.3. Tables (

- 5.2.4. Other Accessories

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct

- 5.3.2. Indirect

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bush Business Furniture

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teknion

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FlexSteel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Global Furniture Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SteelCase

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Herman Miller

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HNI Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 La-Z-Boy Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AIS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virco

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KI

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Knoll

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Kimball International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Haworth

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Ashley Furniture Industries

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Bush Business Furniture

List of Figures

- Figure 1: United States Office Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Office Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: United States Office Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: United States Office Furniture Market Revenue Million Forecast, by Products 2020 & 2033

- Table 3: United States Office Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States Office Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Office Furniture Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: United States Office Furniture Market Revenue Million Forecast, by Products 2020 & 2033

- Table 7: United States Office Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States Office Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Office Furniture Market?

The projected CAGR is approximately 5.88%.

2. Which companies are prominent players in the United States Office Furniture Market?

Key companies in the market include Bush Business Furniture, Teknion, FlexSteel, Global Furniture Group, SteelCase, Herman Miller, HNI Corporation, La-Z-Boy Inc, AIS, Virco, KI, Knoll, Kimball International, Haworth, Ashley Furniture Industries.

3. What are the main segments of the United States Office Furniture Market?

The market segments include Material, Products, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.42 Million as of 2022.

5. What are some drivers contributing to market growth?

The integration of technology into office furniture is becoming more common. with smart furniture that can enhance productivity and wellness. This includes desks with programmable height settings. chairs with posture monitoring features. and furniture equipped with wireless charging stations and connectivity options..

6. What are the notable trends driving market growth?

The trend towards flexible and adaptable workspaces is driving demand for modular office furniture that can be easily reconfigured. This is particularly important in open-plan offices and coworking spaces where flexibility is key to accommodating different team sizes and work styles..

7. Are there any restraints impacting market growth?

The U.S. office furniture market is highly competitive. with numerous domestic and international players. This competition. combined with price sensitivity in certain market segments. can pressure manufacturers to lower prices. potentially impacting profitability..

8. Can you provide examples of recent developments in the market?

January 2023: Steelcase and the Frank Lloyd Wright Foundation released their first collection of home office furniture as part of a collaboration announced last year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Office Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Office Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Office Furniture Market?

To stay informed about further developments, trends, and reports in the United States Office Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence