Key Insights

The United States used car market is experiencing significant expansion, driven by increasing consumer demand for affordable pre-owned vehicles amidst rising new car prices and inflationary pressures. Enhanced transparency and consumer confidence are being fostered by technological advancements in online sales platforms and vehicle history reporting. The growing adoption of electric vehicles (EVs) is also creating new dynamics within the used car segment. While the organized sector, including dealerships and online platforms, is growing, the unorganized sector remains vital, particularly in local markets. The market caters to diverse consumer needs with a wide range of body types, from hatchbacks to SUVs. Petrol and diesel vehicles continue to dominate, with EVs gradually gaining market share.

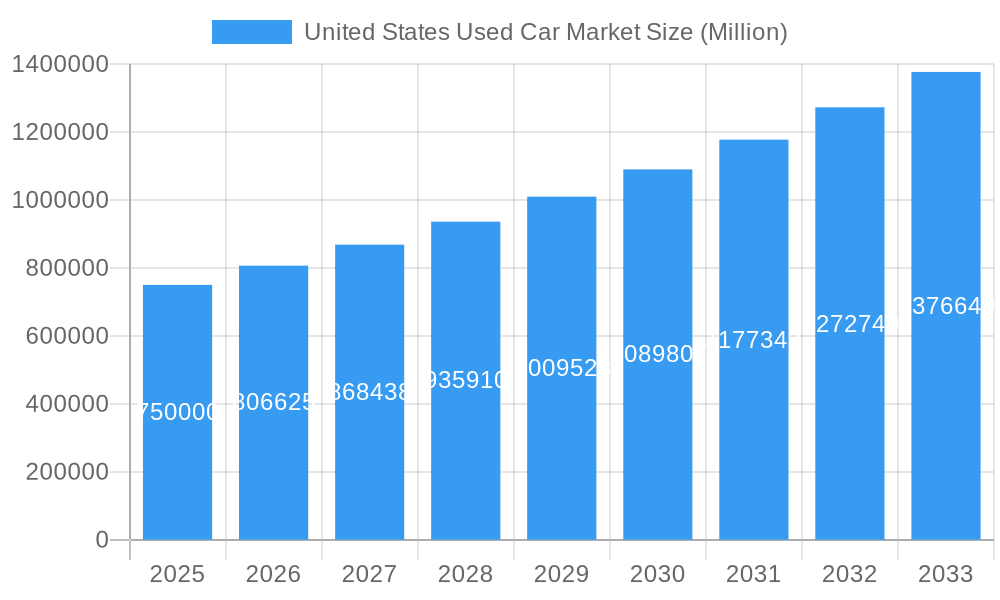

United States Used Car Market Market Size (In Billion)

Key challenges impacting the market include supply chain disruptions affecting vehicle availability and price volatility influenced by economic conditions. Government regulations on emissions and safety standards also shape market dynamics. Intense competition and innovative business models are further transforming the landscape. The United States used car market is projected for robust growth, with a Compound Annual Growth Rate (CAGR) of 5%. With a base year of 2024, the market size is estimated at $654,574 million. This forecast considers inflation and sustained vehicle demand.

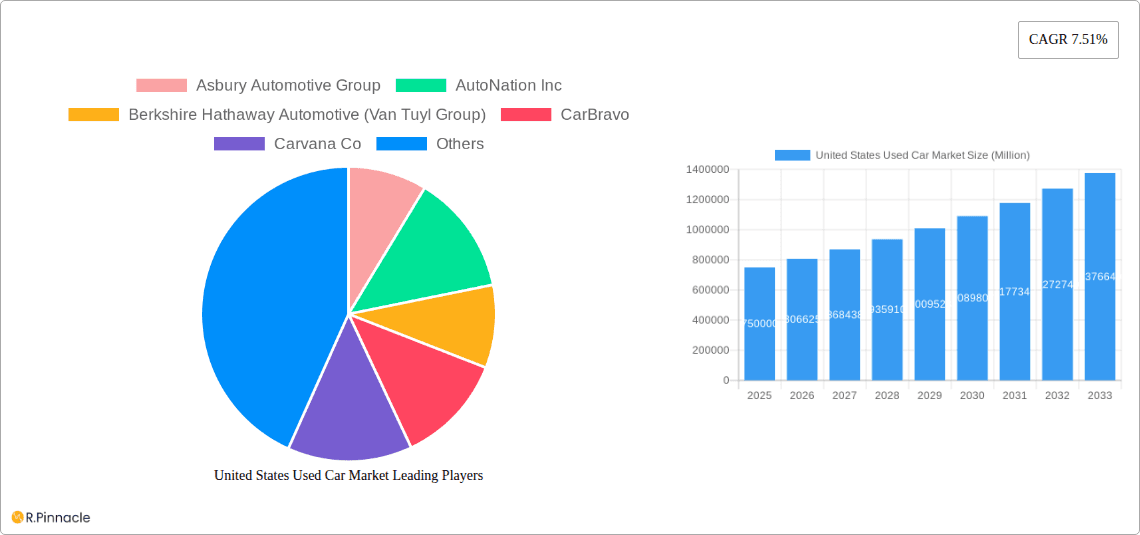

United States Used Car Market Company Market Share

United States Used Car Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the United States used car market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive dynamics, and future growth potential. The report leverages extensive data analysis and expert insights to provide actionable intelligence across key segments. The total market size in 2025 is estimated at $XX Million.

United States Used Car Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities within the US used car market. We explore the influence of technological advancements, evolving consumer preferences, and regulatory changes on market structure. The market is segmented by vendor type (organized and unorganized), fuel type (petrol, diesel, electric, others), body type (hatchback, sedan, SUV, MPV), and sales channel (online and offline).

- Market Concentration: The market exhibits a moderately concentrated structure, with key players like CarMax Inc., AutoNation Inc., and Asbury Automotive Group holding significant market share. The combined market share of the top five players is estimated at XX%.

- Innovation Drivers: Technological advancements such as online marketplaces, automated valuation tools, and digital retailing platforms are driving innovation.

- Regulatory Framework: Federal and state regulations concerning emissions, safety, and consumer protection significantly influence market dynamics.

- Product Substitutes: The rise of ride-sharing services and public transportation presents a mild substitute to used car ownership.

- End-User Demographics: The primary end-users are individuals and families seeking affordable transportation options.

- M&A Activities: The used car market has witnessed significant M&A activity in recent years, with deal values totaling $XX Million in 2024. Examples include [specific examples if available, otherwise replace with "various acquisitions and mergers within the industry"].

United States Used Car Market Market Dynamics & Trends

This section delves into the market's growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a comprehensive understanding of the market's evolution. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected at XX%, driven by factors such as increasing demand, technological advancements, and evolving consumer preferences. Market penetration of online sales channels is expected to reach XX% by 2033.

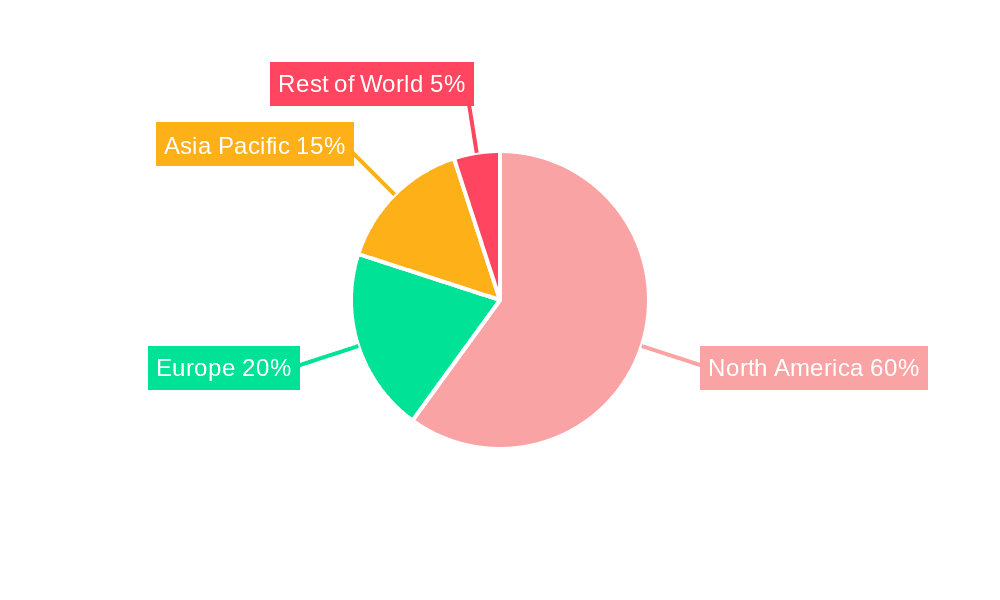

Dominant Regions & Segments in United States Used Car Market

This section identifies the leading regions and segments within the US used car market. The analysis considers factors such as economic conditions, infrastructure development, and consumer behavior.

- Leading Region: [Identify the leading region, e.g., the South East] shows the highest market growth due to [explain the reasons].

- Dominant Vendor Type: The organized sector dominates the market due to [explain reasons, e.g., greater efficiency and brand recognition].

- Leading Fuel Type: Petrol remains the dominant fuel type, though electric vehicle sales are steadily increasing.

- Preferred Body Type: SUVs and MPVs are the most popular body types.

- Sales Channel: Online sales are witnessing substantial growth, although offline channels continue to hold a significant share.

Detailed analysis supporting these findings is provided within the full report.

United States Used Car Market Product Innovations

Recent product innovations focus on enhancing the online car-buying experience through features like virtual inspections, online financing, and home delivery. The integration of AI and machine learning is improving vehicle valuation and fraud detection. These innovations are enhancing transparency, convenience, and trust in the used car market, leading to increased customer satisfaction and market expansion.

Report Scope & Segmentation Analysis

This report segments the US used car market by vendor type (organized, unorganized), fuel type (petrol, diesel, electric, others), body type (hatchback, sedan, SUV, MPV), and sales channel (online, offline). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail within the full report. The market is projected to reach $XX Million by 2033.

Key Drivers of United States Used Car Market Growth

Growth is fueled by several factors, including rising disposable incomes, the increasing preference for used vehicles due to affordability, technological advancements enhancing the buying experience, and favorable government policies encouraging the automotive sector. The growing demand for electric vehicles further fuels market growth within specific segments.

Challenges in the United States Used Car Market Sector

Challenges include fluctuating used car prices due to supply chain disruptions, increasing competition, and stringent environmental regulations that impact vehicle standards. The used car market also experiences concerns regarding vehicle history verification and fraud. These factors influence market stability and profitability.

Emerging Opportunities in United States Used Car Market

Emerging opportunities lie in the growth of the online used car market, the increasing demand for electric and hybrid vehicles, the expansion of subscription services for used cars, and the development of innovative financing options. These trends open new avenues for market growth and expansion.

Leading Players in the United States Used Car Market Market

- Asbury Automotive Group

- AutoNation Inc

- Berkshire Hathaway Automotive (Van Tuyl Group)

- CarBravo

- Carvana Co

- Sonic Automotive

- CarMax Inc

- Lithia Motors Inc

- Hendrick Automotive Group

- Group 1 Automotive Inc

Key Developments in United States Used Car Market Industry

- May 2022: Topmarq launches its online platform for automated bidding and seller appointment scheduling in the Texas market, aiming to expand to other major metropolitan areas. This development enhances the efficiency of used car inventory acquisition for dealers.

Future Outlook for United States Used Car Market Market

The US used car market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and increasing demand. Strategic opportunities lie in expanding online sales channels, embracing innovative financing solutions, and catering to the growing demand for electric and hybrid vehicles. The market is expected to witness significant expansion and transformation over the forecast period.

United States Used Car Market Segmentation

-

1. Vendor Type

- 1.1. Organized

- 1.2. Unorganized

-

2. Fuel Type

- 2.1. Petrol

- 2.2. Diesel

- 2.3. Electric

- 2.4. Others

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Sports Utility Vehicle and Multi-Purpose Vehicle

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

United States Used Car Market Segmentation By Geography

- 1. United States

United States Used Car Market Regional Market Share

Geographic Coverage of United States Used Car Market

United States Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diverse Selection Among Car Models is Anticipated to Drive the Market Growth

- 3.3. Market Restrains

- 3.3.1. Counterfeit and Illegally Imported Vehicles are Restraining the Market Growth

- 3.4. Market Trends

- 3.4.1. TECHNOLOGICAL ADVANCEMENT IN THE ONLINE MODE SEGEMENT IS EXPECTED TO FOSTER THE DEMAND OF TARGET MARKET

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 5.1.1. Organized

- 5.1.2. Unorganized

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Petrol

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Sports Utility Vehicle and Multi-Purpose Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Vendor Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Asbury Automotive Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AutoNation Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berkshire Hathaway Automotive (Van Tuyl Group)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CarBravo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carvana Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sonic Automotive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CarMax Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lithia Motors Inc *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hendrick Automotive Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Group 1 Automotive Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Asbury Automotive Group

List of Figures

- Figure 1: United States Used Car Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: United States Used Car Market Revenue million Forecast, by Vendor Type 2020 & 2033

- Table 2: United States Used Car Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 3: United States Used Car Market Revenue million Forecast, by Body Type 2020 & 2033

- Table 4: United States Used Car Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 5: United States Used Car Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: United States Used Car Market Revenue million Forecast, by Vendor Type 2020 & 2033

- Table 7: United States Used Car Market Revenue million Forecast, by Fuel Type 2020 & 2033

- Table 8: United States Used Car Market Revenue million Forecast, by Body Type 2020 & 2033

- Table 9: United States Used Car Market Revenue million Forecast, by Sales Channel 2020 & 2033

- Table 10: United States Used Car Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Used Car Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the United States Used Car Market?

Key companies in the market include Asbury Automotive Group, AutoNation Inc, Berkshire Hathaway Automotive (Van Tuyl Group), CarBravo, Carvana Co, Sonic Automotive, CarMax Inc, Lithia Motors Inc *List Not Exhaustive, Hendrick Automotive Group, Group 1 Automotive Inc.

3. What are the main segments of the United States Used Car Market?

The market segments include Vendor Type, Fuel Type, Body Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 654574 million as of 2022.

5. What are some drivers contributing to market growth?

Diverse Selection Among Car Models is Anticipated to Drive the Market Growth.

6. What are the notable trends driving market growth?

TECHNOLOGICAL ADVANCEMENT IN THE ONLINE MODE SEGEMENT IS EXPECTED TO FOSTER THE DEMAND OF TARGET MARKET.

7. Are there any restraints impacting market growth?

Counterfeit and Illegally Imported Vehicles are Restraining the Market Growth.

8. Can you provide examples of recent developments in the market?

In May 2022, Topmarq debuted its solution, which is intended to be an online service with automatic bidding and seller appointment arranging. The platform is being introduced as a limited public beta, according to a press release. Topmarq stated that it is now focusing on the Texas market, with intentions to expand to other large metros in the near future. This technology tool was released to assist dealers in acquiring used inventory from vehicles sold by individual owners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Used Car Market?

To stay informed about further developments, trends, and reports in the United States Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence