Key Insights

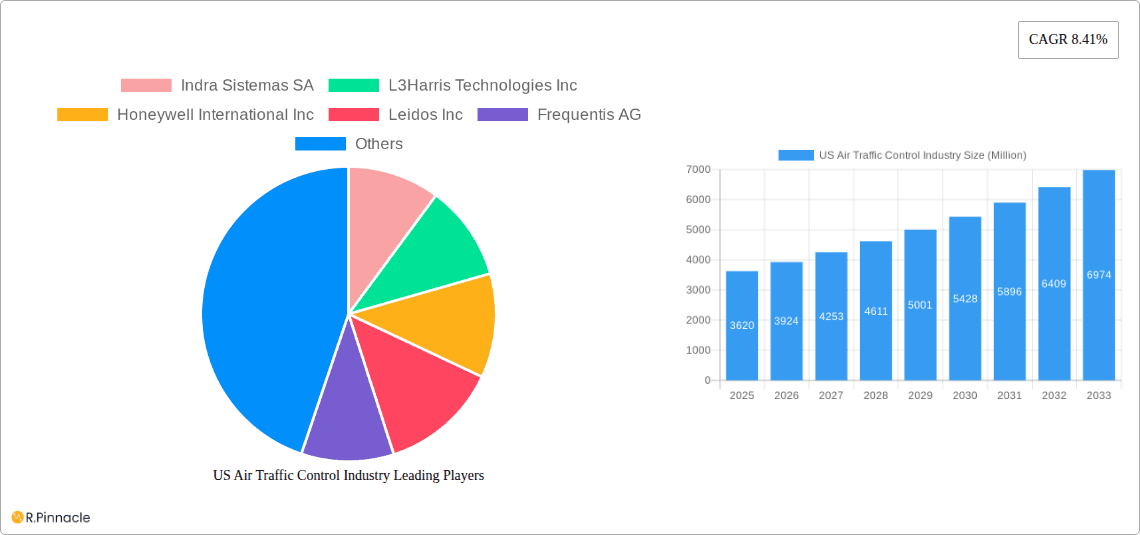

The US Air Traffic Control (ATC) industry is poised for robust expansion, driven by escalating air travel demand and the critical need for advanced, secure, and efficient air traffic management systems. With a substantial market size of approximately $3.62 billion in 2025, the sector is projected to grow at a compound annual growth rate (CAGR) of 8.41% through 2033. This growth is fueled by significant investments in modernizing aging infrastructure, implementing next-generation surveillance and communication technologies, and enhancing automation to manage increasingly congested airspace. The imperative to improve safety, reduce delays, and optimize flight paths in the face of rising passenger volumes and cargo operations presents a powerful catalyst for market expansion. Key drivers include the adoption of technologies like AI, machine learning, and advanced radar systems to predict and mitigate potential conflicts, alongside the push for greater interoperability and data-sharing capabilities across different ATC systems. The continuous need for upgrades to meet evolving security standards and environmental regulations further propels market development.

US Air Traffic Control Industry Market Size (In Billion)

The US ATC market is characterized by a dynamic interplay of technological innovation, strategic partnerships, and stringent regulatory oversight. Key trends include the shift towards cloud-based solutions for enhanced scalability and data processing, the integration of drones and unmanned aerial vehicles (UAVs) into managed airspace, and the increasing focus on cybersecurity to protect critical air traffic infrastructure from sophisticated threats. While the market benefits from strong governmental support and a clear vision for future air mobility, it also faces certain restraints. These include the high initial capital investment required for system upgrades, potential workforce challenges in recruiting and training skilled personnel to operate and maintain advanced technologies, and the complexities associated with integrating new systems into legacy infrastructure. Nevertheless, the overarching demand for safer, more efficient, and environmentally responsible air travel ensures a promising trajectory for the US ATC industry, with significant opportunities for market leaders and innovators.

US Air Traffic Control Industry Company Market Share

This comprehensive report provides an in-depth analysis of the US Air Traffic Control (ATC) industry, a critical sector for national security, economic prosperity, and passenger safety. Leveraging extensive data and expert insights, this study forecasts the market's trajectory from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. We dissect market dynamics, technological advancements, regulatory landscapes, and competitive strategies to offer actionable intelligence for stakeholders. Explore current market trends, production and consumption analyses, import/export dynamics, price trends, and pivotal industry developments. Discover the key players, dominant regions, and emerging opportunities that will shape the future of US ATC.

US Air Traffic Control Industry Market Structure & Innovation Trends

The US Air Traffic Control industry is characterized by a moderately concentrated market structure. Leading entities like Honeywell International Inc., L3Harris Technologies Inc., and RTX Corporation command significant market shares, driven by their robust portfolios of advanced air traffic management systems, radar technologies, and communication solutions. Innovation is primarily fueled by the FAA's continuous investment in NextGen Air Transportation System modernization, pushing for greater efficiency, capacity, and safety. Key innovation drivers include the integration of artificial intelligence for predictive analytics, the deployment of advanced surveillance technologies like ADS-B, and the development of resilient communication networks. Regulatory frameworks, primarily governed by the Federal Aviation Administration (FAA), play a pivotal role, dictating standards for system certification, operational procedures, and cybersecurity. While direct product substitutes are limited due to the specialized nature of ATC systems, advancements in data analytics and automation within existing infrastructure represent indirect competitive pressures. End-user demographics are dominated by government agencies (FAA), commercial airlines, and private aviation operators. Mergers and acquisitions (M&A) activities, while not at an extremely high volume, are strategic, often involving consolidation of specialized capabilities or expansion into new technological domains. For instance, a hypothetical M&A deal in the past few years might have involved a tech company acquiring a niche cybersecurity firm specializing in aviation networks for an estimated $500 Million. Understanding these structural elements and innovation trends is crucial for navigating this complex and vital market.

US Air Traffic Control Industry Market Dynamics & Trends

The US Air Traffic Control industry is experiencing robust growth, driven by an escalating demand for air travel, coupled with the imperative for enhanced airspace efficiency and safety. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8% during the forecast period. Technological disruptions are at the forefront, with the ongoing implementation of the FAA's NextGen initiative revolutionizing air traffic management. This includes the widespread adoption of Performance-Based Navigation (PBN), Automatic Dependent Surveillance-Broadcast (ADS-B) for improved surveillance, and advanced data communication systems. Consumer preferences, while indirectly influencing ATC through the demand for more direct routes and reduced flight delays, are indirectly addressed by these technological advancements aimed at optimizing flight paths and improving airspace flow. Competitive dynamics are shaped by a blend of established defense and aerospace giants and specialized technology providers, all vying for lucrative government contracts and private sector investments. The penetration of advanced digital technologies and AI-powered solutions within ATC operations is steadily increasing, promising significant improvements in capacity management, conflict detection, and overall system resilience. The market is also witnessing a strong emphasis on cybersecurity solutions to protect critical air traffic infrastructure from evolving threats. Furthermore, the integration of drones and uncrewed aerial vehicles (UAVs) into the national airspace presents both a challenge and an opportunity, necessitating the development of new traffic management protocols and technologies. The continuous need for upgrading aging infrastructure and the increasing complexity of air traffic operations are primary growth accelerators. The estimated market size for the US Air Traffic Control industry in 2025 is projected to be around $15 Billion, with continued expansion anticipated.

Dominant Regions & Segments in US Air Traffic Control Industry

Within the US Air Traffic Control industry, the United States itself stands as the dominant region, accounting for a substantial portion of both production and consumption. This dominance is attributed to the vast domestic air travel market, significant military aviation needs, and the proactive approach of the Federal Aviation Administration (FAA) in investing in and modernizing its air traffic control infrastructure.

Production Analysis: The production of ATC systems and technologies is largely concentrated within the US, with key players like Honeywell International Inc., L3Harris Technologies Inc., and RTX Corporation having substantial manufacturing and R&D facilities.

- Key Drivers: Strong government funding, established aerospace manufacturing base, and a highly skilled workforce.

- Dominance Analysis: The US government's commitment to NextGen has spurred domestic production of advanced radar systems, communication equipment, and software solutions.

Consumption Analysis: The US exhibits the highest consumption of ATC products and services globally, driven by the sheer volume of air traffic.

- Key Drivers: High passenger and cargo volumes, extensive airport network, and the continuous need for operational upgrades.

- Dominance Analysis: The FAA's ambitious modernization programs, coupled with the operational demands of major airlines, create a perpetual demand for cutting-edge ATC technology.

Import Market Analysis (Value & Volume): While the US is a major producer, it also imports specialized components and technologies that may be more efficiently manufactured or innovated elsewhere.

- Key Drivers: Sourcing of niche technological components, specialized software modules, and contributions from international collaborators in R&D.

- Dominance Analysis: Import volumes are significantly lower compared to domestic production and consumption, indicating a strong self-sufficiency. Expected import value in 2025: $1.2 Billion.

Export Market Analysis (Value & Volume): US companies are significant exporters of ATC technology to allied nations and developing markets seeking to modernize their air traffic management capabilities.

- Key Drivers: Reputation for advanced technology, stringent quality standards, and international partnerships.

- Dominance Analysis: The US export market for ATC solutions is robust, driven by global demand for safety and efficiency. Expected export value in 2025: $2.5 Billion.

Price Trend Analysis: Prices for ATC equipment and services are generally stable to increasing, influenced by technological complexity, R&D costs, and demand.

- Key Drivers: High R&D investments, advanced material costs, stringent certification processes, and long-term service contracts.

- Dominance Analysis: Premium pricing for highly sophisticated and certified systems is the norm, reflecting their critical role.

US Air Traffic Control Industry Product Innovations

Product innovations in the US Air Traffic Control industry are largely driven by the pursuit of enhanced safety, efficiency, and capacity within the national airspace. Key advancements include the development of AI-powered decision support tools for air traffic controllers, providing real-time predictive analytics for conflict detection and resolution. The integration of cloud-based platforms for data management and collaborative operations is another significant trend, enabling seamless information exchange between various stakeholders. ADS-B surveillance technology continues to be refined, offering more precise tracking of aircraft. Furthermore, advancements in radar processing and communication systems are improving situational awareness and reducing latency. These innovations provide competitive advantages by offering greater reliability, lower operational costs, and improved airspace utilization, directly addressing the evolving needs of modern aviation.

Report Scope & Segmentation Analysis

This report meticulously segments the US Air Traffic Control industry across several key areas. Production Analysis focuses on the manufacturing capabilities and output of ATC systems. Consumption Analysis examines the demand for these systems by various end-users. The Import Market Analysis (Value & Volume) scrutinizes the inflow of ATC-related products and technologies into the US, while the Export Market Analysis (Value & Volume) assesses the outflow of US-made ATC solutions to global markets. Lastly, Price Trend Analysis provides insights into the cost dynamics of ATC equipment and services. Each segment is analyzed with an eye towards growth projections, current market sizes, and the competitive landscape within its specific domain, offering a granular view of the industry's components and their future trajectories.

Key Drivers of US Air Traffic Control Industry Growth

The growth of the US Air Traffic Control industry is propelled by several interconnected factors. Foremost is the technological imperative to modernize aging infrastructure and embrace digital solutions, epitomized by the FAA's NextGen initiative. This includes the adoption of satellite-based navigation, advanced surveillance, and enhanced communication systems. Economic growth and increasing air travel demand are critical drivers, necessitating greater airspace capacity and efficiency. Regulatory mandates and a steadfast commitment to enhancing aviation safety also play a significant role, pushing for the implementation of more robust and reliable ATC systems. Furthermore, the burgeoning integration of drones and advanced air mobility vehicles into the national airspace presents a substantial growth opportunity, requiring new management solutions.

Challenges in the US Air Traffic Control Industry Sector

Despite its growth trajectory, the US Air Traffic Control industry faces several formidable challenges. Significant upfront investment and long procurement cycles for complex, high-assurance systems can be a barrier. Regulatory hurdles and the stringent certification processes required for ATC technologies necessitate extensive testing and validation, slowing down the adoption of new innovations. Supply chain complexities and potential disruptions, particularly for specialized electronic components, can impact production timelines and costs. Furthermore, managing the integration of legacy systems with new technologies presents technical and operational complexities. Competitive pressures, while driving innovation, also mean that securing and maintaining contracts is a continuous challenge for all players.

Emerging Opportunities in US Air Traffic Control Industry

The US Air Traffic Control industry is ripe with emerging opportunities. The widespread deployment of AI and machine learning for predictive maintenance, traffic flow optimization, and enhanced decision support presents a significant avenue for innovation and efficiency gains. The ongoing integration of Unmanned Aerial Systems (UAS) and Advanced Air Mobility (AAM) vehicles into the national airspace necessitates the development of new traffic management solutions, creating a substantial new market. Opportunities also lie in strengthening cybersecurity defenses for critical ATC infrastructure, a growing concern for aviation authorities. Furthermore, the demand for sustainable aviation solutions, including optimized flight paths to reduce fuel consumption, is creating a niche for technologies that support eco-friendly air travel.

Leading Players in the US Air Traffic Control Industry Market

- Indra Sistemas SA

- L3Harris Technologies Inc.

- Honeywell International Inc.

- Leidos Inc.

- Frequentis AG

- Thales

- RTX Corporation

- Advanced Navigation and Positioning Corporation

- Saab AB

- SITA

- Northrop Grumman Corporation

Key Developments in US Air Traffic Control Industry Industry

- 2023/08: FAA awards major contract for next-generation radar systems to enhance surveillance capabilities.

- 2023/06: Honeywell announces advancements in AI-driven air traffic management software, improving controller workload.

- 2023/04: L3Harris Technologies secures a contract for critical communication system upgrades for major airports.

- 2022/12: Thales collaborates with industry partners on developing solutions for integrating drones into controlled airspace.

- 2022/09: RTX Corporation showcases its latest ADS-B transponder technology, improving aircraft tracking accuracy.

- 2022/05: Leidos Inc. expands its portfolio of cybersecurity solutions tailored for aviation infrastructure.

Future Outlook for US Air Traffic Control Industry Market

The future outlook for the US Air Traffic Control industry is exceptionally positive, driven by sustained investment in modernization, the ever-increasing demand for air travel, and the transformative impact of emerging technologies. The full implementation of NextGen, coupled with advancements in AI, automation, and data analytics, will lead to a more efficient, resilient, and safer air traffic management system. The burgeoning drone delivery and advanced air mobility sectors will create entirely new markets for ATC solutions. Strategic partnerships, continued government support, and the relentless pursuit of innovation will ensure robust growth and the successful navigation of future airspace complexities. The industry is poised for significant expansion, with an estimated market size projected to reach approximately $25 Billion by 2033.

US Air Traffic Control Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

US Air Traffic Control Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Air Traffic Control Industry Regional Market Share

Geographic Coverage of US Air Traffic Control Industry

US Air Traffic Control Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Air Traffic Control Segment to Dominate Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Air Traffic Control Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America US Air Traffic Control Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America US Air Traffic Control Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe US Air Traffic Control Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa US Air Traffic Control Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific US Air Traffic Control Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Indra Sistemas SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 L3Harris Technologies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leidos Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Frequentis AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thales

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Advanced Navigation and Positioning Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Saab A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SITA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Indra Sistemas SA

List of Figures

- Figure 1: Global US Air Traffic Control Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Air Traffic Control Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America US Air Traffic Control Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America US Air Traffic Control Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America US Air Traffic Control Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America US Air Traffic Control Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America US Air Traffic Control Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America US Air Traffic Control Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America US Air Traffic Control Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America US Air Traffic Control Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America US Air Traffic Control Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America US Air Traffic Control Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America US Air Traffic Control Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America US Air Traffic Control Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America US Air Traffic Control Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America US Air Traffic Control Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America US Air Traffic Control Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America US Air Traffic Control Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America US Air Traffic Control Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America US Air Traffic Control Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America US Air Traffic Control Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America US Air Traffic Control Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America US Air Traffic Control Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America US Air Traffic Control Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America US Air Traffic Control Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Air Traffic Control Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe US Air Traffic Control Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe US Air Traffic Control Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe US Air Traffic Control Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe US Air Traffic Control Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe US Air Traffic Control Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe US Air Traffic Control Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe US Air Traffic Control Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe US Air Traffic Control Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe US Air Traffic Control Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe US Air Traffic Control Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe US Air Traffic Control Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa US Air Traffic Control Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa US Air Traffic Control Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa US Air Traffic Control Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa US Air Traffic Control Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa US Air Traffic Control Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa US Air Traffic Control Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa US Air Traffic Control Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa US Air Traffic Control Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa US Air Traffic Control Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa US Air Traffic Control Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa US Air Traffic Control Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Air Traffic Control Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific US Air Traffic Control Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific US Air Traffic Control Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific US Air Traffic Control Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific US Air Traffic Control Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific US Air Traffic Control Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific US Air Traffic Control Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific US Air Traffic Control Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific US Air Traffic Control Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific US Air Traffic Control Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific US Air Traffic Control Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific US Air Traffic Control Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific US Air Traffic Control Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Air Traffic Control Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global US Air Traffic Control Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global US Air Traffic Control Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global US Air Traffic Control Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global US Air Traffic Control Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global US Air Traffic Control Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global US Air Traffic Control Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global US Air Traffic Control Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global US Air Traffic Control Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global US Air Traffic Control Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global US Air Traffic Control Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global US Air Traffic Control Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Air Traffic Control Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global US Air Traffic Control Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global US Air Traffic Control Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global US Air Traffic Control Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global US Air Traffic Control Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global US Air Traffic Control Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global US Air Traffic Control Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global US Air Traffic Control Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global US Air Traffic Control Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global US Air Traffic Control Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global US Air Traffic Control Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global US Air Traffic Control Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global US Air Traffic Control Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global US Air Traffic Control Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global US Air Traffic Control Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global US Air Traffic Control Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global US Air Traffic Control Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global US Air Traffic Control Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global US Air Traffic Control Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global US Air Traffic Control Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global US Air Traffic Control Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global US Air Traffic Control Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global US Air Traffic Control Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global US Air Traffic Control Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific US Air Traffic Control Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Air Traffic Control Industry?

The projected CAGR is approximately 8.41%.

2. Which companies are prominent players in the US Air Traffic Control Industry?

Key companies in the market include Indra Sistemas SA, L3Harris Technologies Inc, Honeywell International Inc, Leidos Inc, Frequentis AG, Thales, RTX Corporation, Advanced Navigation and Positioning Corporation, Saab A, SITA, Northrop Grumman Corporation.

3. What are the main segments of the US Air Traffic Control Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.62 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Air Traffic Control Segment to Dominate Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Air Traffic Control Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Air Traffic Control Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Air Traffic Control Industry?

To stay informed about further developments, trends, and reports in the US Air Traffic Control Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence