Key Insights

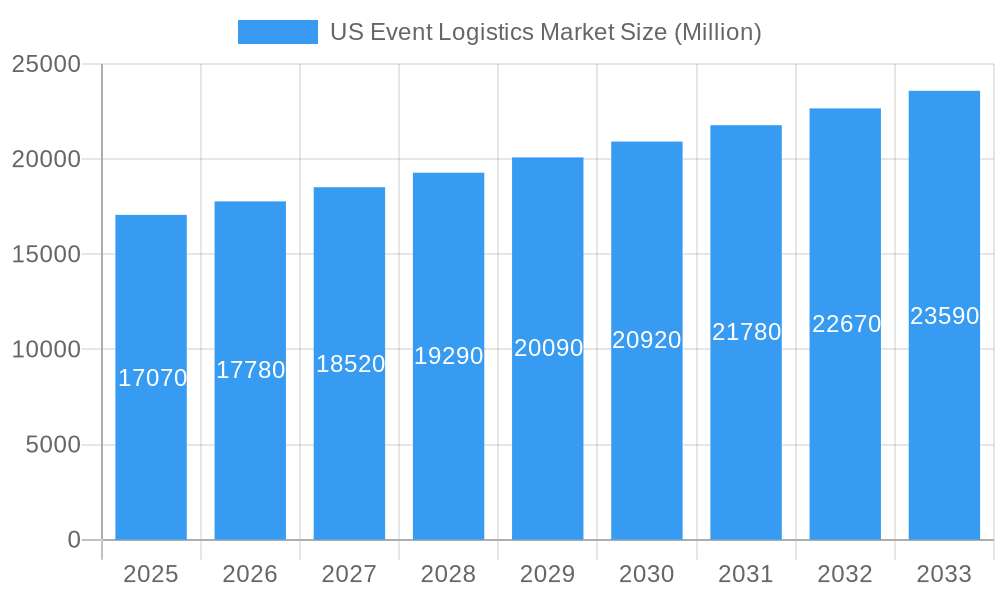

The US event logistics market, valued at $17.07 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.23% from 2025 to 2033. This expansion is fueled by several key factors. The resurgence of in-person events following the pandemic, coupled with the increasing popularity of large-scale concerts, sporting events, and trade shows, is significantly boosting demand for efficient and reliable logistics solutions. Furthermore, technological advancements, such as improved inventory management systems and sophisticated route optimization software, are streamlining operations and enhancing overall efficiency within the sector. The market is segmented by type (inventory control, distribution systems, logistics solutions) and application (entertainment, sports, trade fairs, other applications), offering diverse opportunities for specialized service providers. Major players like DB Schenker, DHL, FedEx, and UPS are fiercely competitive, constantly innovating to meet the evolving needs of event organizers. Regional variations exist, with higher concentrations of activity expected in densely populated areas like the Northeast and West Coast.

US Event Logistics Market Market Size (In Billion)

The sustained growth trajectory of the US event logistics market is anticipated to continue throughout the forecast period. However, challenges such as fluctuating fuel prices, potential labor shortages, and the increasing complexity of managing global supply chains could present headwinds. Nevertheless, the market’s inherent resilience, coupled with the ongoing trend of event diversification and technological innovation, suggests a positive outlook. The strategic partnerships between logistics providers and event organizers, focused on customized solutions and enhanced transparency, will be crucial for maximizing efficiency and minimizing disruptions. This collaborative approach underscores the ongoing evolution of the event logistics market, ensuring its ability to adapt to future challenges and capitalize on new growth opportunities.

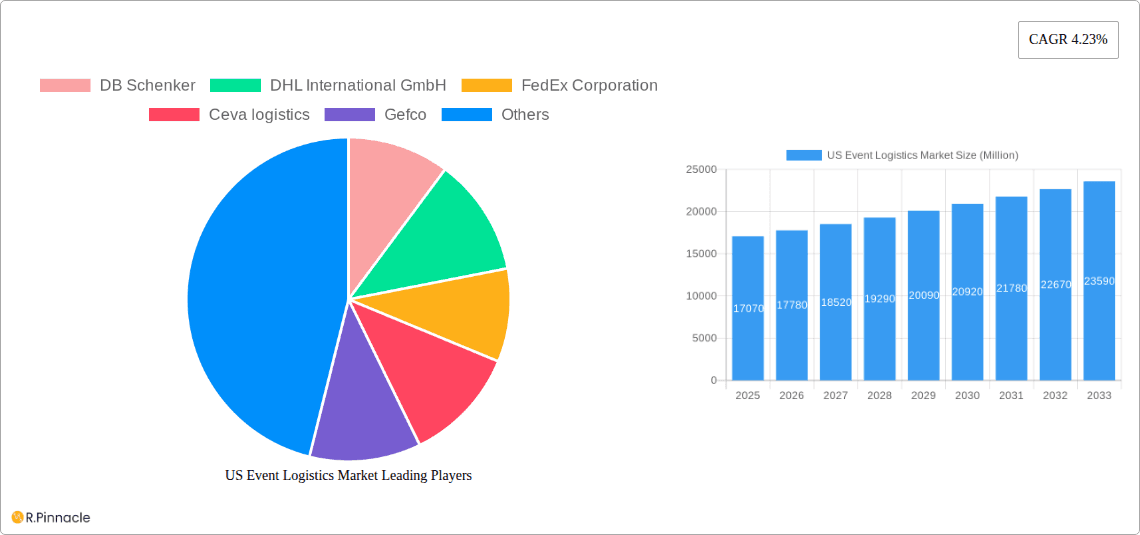

US Event Logistics Market Company Market Share

US Event Logistics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the US Event Logistics Market, offering invaluable insights for industry professionals, investors, and strategists. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The report leverages extensive data and expert analysis to provide a clear understanding of this dynamic sector.

US Event Logistics Market Market Structure & Innovation Trends

The US Event Logistics market is characterized by a moderately concentrated structure, with several prominent global players holding substantial market share. Key industry leaders, including DB Schenker, DHL International GmbH, FedEx Corporation, Ceva Logistics, Gefco, Kuehne + Nagel International AG, Rhenus SE & Co KG, XPO Logistics Inc, Geodis, and United Parcel Service of America Inc., are instrumental in shaping the landscape. Alongside these major entities, a dynamic ecosystem of numerous smaller, specialized providers caters to niche requirements and specific event types. The combined market share of the top 5 players is projected to be approximately 45% in 2025, underscoring the influence of established giants.

Innovation in the US Event Logistics market is primarily propelled by rapid technological advancements. The adoption of automation is streamlining operational efficiencies, while AI-powered route optimization is enhancing delivery speed and cost-effectiveness. Real-time tracking capabilities provide unparalleled visibility, and predictive analytics are enabling proactive problem-solving and resource allocation. Furthermore, stringent regulatory frameworks governing safety, security, and environmental sustainability are not only influencing operational practices but also driving the development of more compliant and responsible logistics solutions. While substitute services from independent contractors and smaller local operators exist, they often lack the comprehensive scale, technological sophistication, and robust infrastructure offered by the major players. The end-user demographic is exceptionally diverse, encompassing event organizers, corporations, and individual clients across a broad spectrum of sectors, including entertainment, sports, trade fairs, conferences, and various corporate events. Merger and acquisition (M&A) activity remains a prevalent strategy for consolidation and expansion. For instance, the acquisition of Maine Pointe by SGS in September 2023 exemplifies a strategic move to bolster supply chain expertise, which is directly transferable and beneficial to the event logistics sector. The number of M&A deals in the last five years is estimated at approximately 15-20, indicating a robust period of strategic realignment within the industry.

US Event Logistics Market Market Dynamics & Trends

The US Event Logistics market is currently experiencing a period of robust growth, fueled significantly by the strong resurgence of in-person events following the global pandemic and the continuous increasing sophistication of event management practices. The Compound Annual Growth Rate (CAGR) for the period from 2025-2033 is projected to be around 7.5% to 8.5%, reflecting strong underlying demand. Technological disruptions are actively reshaping market dynamics, with the adoption of emerging technologies like blockchain gaining traction for its potential to enhance security, transparency, and traceability of high-value or sensitive event materials. Consumer preferences are increasingly leaning towards seamless, highly efficient, and environmentally sustainable event experiences, directly influencing service offerings and pushing providers to innovate. Intense competition among both established players and agile emerging entrants is a key driver in shaping pricing strategies and spurring service innovation. The market penetration of advanced logistics technologies is steadily increasing, with an estimated 60-70% of event logistics providers currently utilizing AI-powered solutions for various aspects of their operations, from planning to execution.

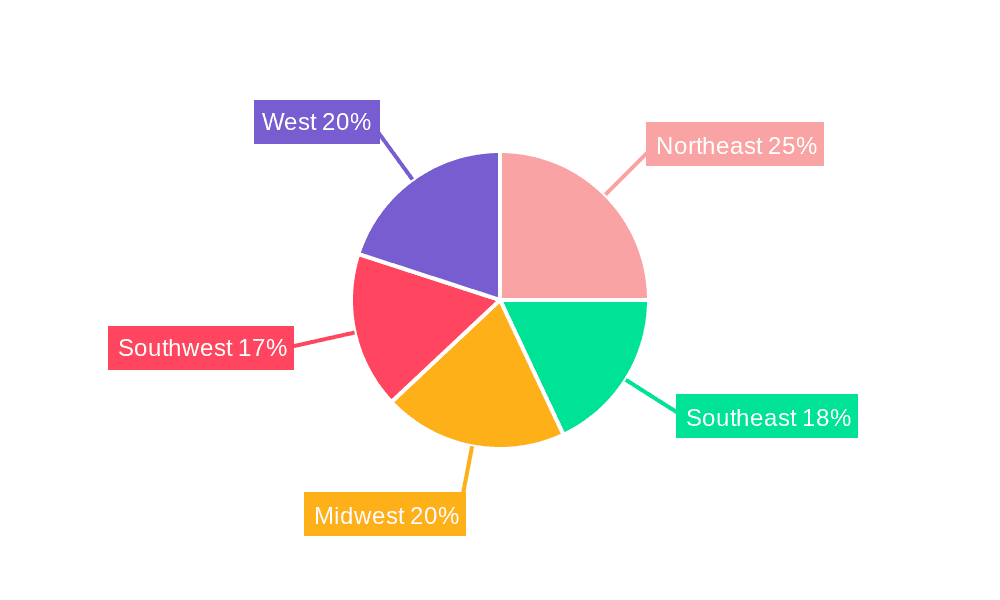

Dominant Regions & Segments in US Event Logistics Market

The largest segment by application is Entertainment, contributing approximately xx% of the total market revenue in 2025. The leading region is the Northeast, driven by the high concentration of major event venues and a robust entertainment industry.

Key Drivers for Entertainment Segment Dominance:

- High volume of concerts, festivals, and other entertainment events.

- Strong presence of major event organizers and production companies.

- Developed infrastructure supporting large-scale event logistics.

Key Drivers for Northeast Region Dominance:

- High population density and concentration of major cities.

- Well-established infrastructure, including transportation networks and warehousing facilities.

- Supportive economic policies and government initiatives.

By Type, Logistics Solutions holds the largest market share due to the increasing demand for comprehensive, end-to-end event logistics management. The dominance is further consolidated by the strong market penetration of major players offering full-service solutions. Further analysis reveals the consistent growth of Inventory Control and Distribution Systems, driven by the increasing need for efficient supply chain management.

US Event Logistics Market Product Innovations

Recent innovations focus on improving efficiency, visibility, and sustainability. This includes the development of advanced tracking systems, optimized routing software, and eco-friendly transportation solutions. These innovations cater to the growing demand for real-time visibility, reduced costs, and environmentally conscious event planning. The integration of AI and Machine Learning is allowing for predictive maintenance of logistics equipment and improved route optimization reducing overall costs and enhancing efficiency.

Report Scope & Segmentation Analysis

This report meticulously segments the US Event Logistics market to provide a granular understanding of its various facets. The primary segmentation includes Type (such as Inventory Control, Distribution Systems, and comprehensive Logistics Solutions) and Application (including Entertainment, Sports, Trade Fairs, Conferences, and Other Applications). Each segment is thoroughly analyzed to provide insights into its current market size, future growth projections, and prevailing competitive dynamics. For instance, the Inventory Control segment is anticipated to grow at a robust CAGR of approximately 8% to 9% during the forecast period, largely driven by the increasing demand for precise and efficient inventory management solutions among event organizers. The Distribution Systems segment is expected to exhibit similar strong growth, propelled by the critical need for timely and secure delivery of event materials and equipment. The Logistics Solutions segment currently represents the largest segment by market value, with a projected market size of $15 billion to $18 billion in 2025, reflecting the escalating demand for end-to-end, integrated event logistics services that encompass planning, execution, and post-event management.

Key Drivers of US Event Logistics Market Growth

Growth is fueled by several factors. The revival of in-person events following the pandemic is a major driver. Technological advancements, particularly in real-time tracking and route optimization, also boost efficiency and reduce costs. Furthermore, increasing demand for sustainable and environmentally friendly logistics solutions is shaping market growth.

Challenges in the US Event Logistics Market Sector

Challenges include fluctuating fuel prices impacting transportation costs, potential supply chain disruptions, and intense competition among established players and new entrants. Regulatory compliance and labor shortages also add to the complexities of the sector. These factors contribute to increased operational expenses and can impact profitability.

Emerging Opportunities in US Event Logistics Market

The US Event Logistics market presents a fertile ground for emerging opportunities. The integration of blockchain technology is poised to revolutionize security and transparency in the handling of high-value assets and sensitive data associated with events. The growing demand for on-demand logistics services, catering specifically to the flexible and often last-minute needs of smaller events and pop-up experiences, represents a significant growth avenue. Furthermore, the expansion into niche event segments, such as the burgeoning field of virtual and hybrid events, offers new avenues for specialized logistics and technical support. The increasing emphasis on personalized event experiences is creating a substantial opportunity for logistics providers to develop highly tailored and bespoke solutions that cater to the unique requirements of individual clients and brands.

Leading Players in the US Event Logistics Market Market

- DB Schenker

- DHL International GmbH

- FedEx Corporation

- Ceva Logistics

- Gefco

- Kuehne + Nagel International AG

- Rhenus SE & Co KG

- XPO Logistics Inc

- Geodis

- United Parcel Service of America Inc

Key Developments in US Event Logistics Market Industry

- September 2023: SGS, a global leader in inspection, verification, and certification services, successfully completed the acquisition of Maine Pointe, a prominent global supply chain and operations consulting firm. This strategic acquisition significantly strengthens SGS's capabilities within the broader supply chain management sector, positioning it to offer enhanced and more comprehensive services directly applicable to the complexities of event logistics, including specialized warehousing, transportation optimization, and operational efficiency consulting.

- February 2023: XPDEL, a significant player in the 3PL (Third-Party Logistics) space, announced substantial expansion plans, including the establishment of a new, state-of-the-art fulfillment center in Delhi, India. While this specific development is outside the US, it underscores a broader global trend of considerable investment in advanced logistics technologies, capacity expansion, and the strategic development of sophisticated fulfillment networks within the 3PL sector, which directly impacts the global logistics ecosystem and can influence service availability and innovation within the US market.

Future Outlook for US Event Logistics Market Market

The US Event Logistics market is poised for continued growth, driven by the sustained demand for in-person events and ongoing technological advancements. Strategic partnerships, investments in innovation, and the adoption of sustainable practices will be key factors influencing future market leadership and success. The increasing adoption of digital technologies and the rise of specialized logistics solutions present significant opportunities for growth and innovation within the event logistics sector.

US Event Logistics Market Segmentation

-

1. Type

- 1.1. Inventory Control

- 1.2. Distribution Systems

- 1.3. Logistics Solutions

-

2. Application

- 2.1. Entertainment

- 2.2. Sports

- 2.3. Trade fair

- 2.4. Other Applications

US Event Logistics Market Segmentation By Geography

- 1. Germany

- 2. UK

- 3. Spain

- 4. Italy

- 5. France

- 6. Rest of Europe

US Event Logistics Market Regional Market Share

Geographic Coverage of US Event Logistics Market

US Event Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services

- 3.3. Market Restrains

- 3.3.1. High Labour Cost; High Pricing

- 3.4. Market Trends

- 3.4.1. Increasing demand from media and entertainment segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inventory Control

- 5.1.2. Distribution Systems

- 5.1.3. Logistics Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Entertainment

- 5.2.2. Sports

- 5.2.3. Trade fair

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. UK

- 5.3.3. Spain

- 5.3.4. Italy

- 5.3.5. France

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Inventory Control

- 6.1.2. Distribution Systems

- 6.1.3. Logistics Solutions

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Entertainment

- 6.2.2. Sports

- 6.2.3. Trade fair

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. UK US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Inventory Control

- 7.1.2. Distribution Systems

- 7.1.3. Logistics Solutions

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Entertainment

- 7.2.2. Sports

- 7.2.3. Trade fair

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Inventory Control

- 8.1.2. Distribution Systems

- 8.1.3. Logistics Solutions

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Entertainment

- 8.2.2. Sports

- 8.2.3. Trade fair

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Inventory Control

- 9.1.2. Distribution Systems

- 9.1.3. Logistics Solutions

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Entertainment

- 9.2.2. Sports

- 9.2.3. Trade fair

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. France US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Inventory Control

- 10.1.2. Distribution Systems

- 10.1.3. Logistics Solutions

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Entertainment

- 10.2.2. Sports

- 10.2.3. Trade fair

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe US Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Inventory Control

- 11.1.2. Distribution Systems

- 11.1.3. Logistics Solutions

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Entertainment

- 11.2.2. Sports

- 11.2.3. Trade fair

- 11.2.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 DB Schenker

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DHL International GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 FedEx Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ceva logistics

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Gefco

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kuehne + Nagel International AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 *List Not Exhaustive*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rhenus SE & Co KG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 XPO Logistics Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Geodis

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 United Parcel Service of America Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 DB Schenker

List of Figures

- Figure 1: US Event Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: US Event Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: US Event Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: US Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: US Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: US Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Event Logistics Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the US Event Logistics Market?

Key companies in the market include DB Schenker, DHL International GmbH, FedEx Corporation, Ceva logistics, Gefco, Kuehne + Nagel International AG, *List Not Exhaustive*List Not Exhaustive, Rhenus SE & Co KG, XPO Logistics Inc, Geodis, United Parcel Service of America Inc.

3. What are the main segments of the US Event Logistics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Events in E-commerce Sector; Increasing Demand for Qualified Event Logistics Services.

6. What are the notable trends driving market growth?

Increasing demand from media and entertainment segment.

7. Are there any restraints impacting market growth?

High Labour Cost; High Pricing.

8. Can you provide examples of recent developments in the market?

September 2023: SGS completed acquisition of global supply chain and operations consulting firm Maine Pointe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Event Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Event Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Event Logistics Market?

To stay informed about further developments, trends, and reports in the US Event Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence