Key Insights

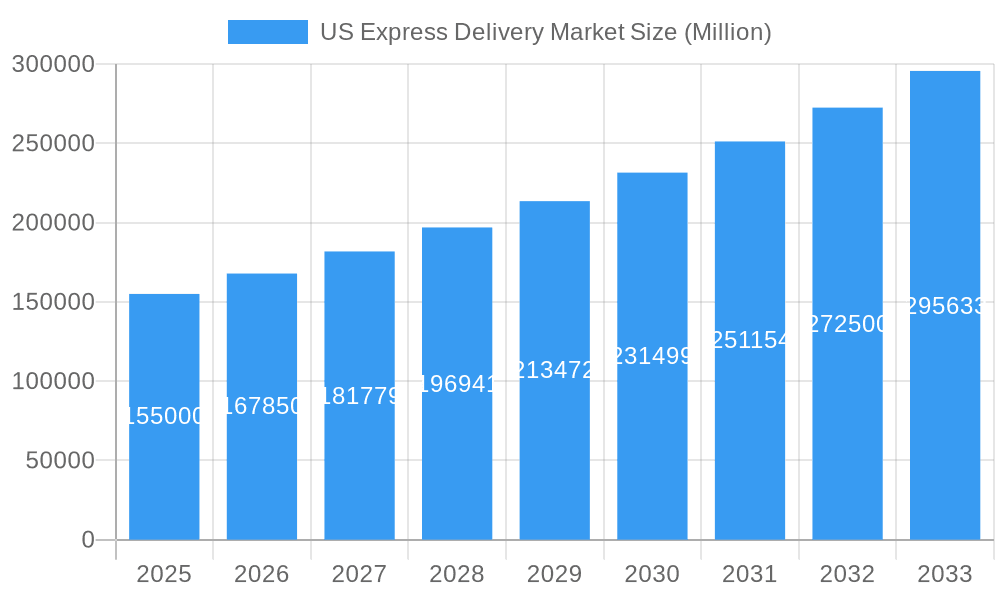

The US Express Delivery Market is poised for significant expansion, projected to surpass a market size of approximately $150 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 8.00% through 2033. This dynamic growth is primarily fueled by the insatiable demand for e-commerce, which continues to reshape consumer purchasing habits and necessitates faster, more reliable shipping solutions. The surge in Business-to-Business (B2B) transactions, particularly within wholesale and retail trade, and the increasing adoption of digital platforms by manufacturers and construction companies for their supply chain logistics, are also key drivers. Furthermore, evolving consumer expectations for same-day and next-day delivery, coupled with advancements in logistics technology and infrastructure, are creating a fertile ground for market players to innovate and capture market share. The US, as a dominant economic power, naturally commands a substantial portion of this global market.

US Express Delivery Market Market Size (In Billion)

The market's trajectory is further shaped by several key trends, including the growing emphasis on sustainable delivery practices, the integration of AI and automation in sorting and route optimization, and the rise of on-demand delivery services catering to niche markets. While these trends present significant opportunities, certain restraints could temper growth. These include increasing operational costs due to fuel price volatility, labor shortages, and the complexities of last-mile delivery in densely populated urban areas. Regulatory changes impacting transportation and environmental standards could also pose challenges. Despite these hurdles, the inherent resilience of the express delivery sector, driven by its critical role in modern commerce and supply chains, suggests continued strong performance and innovation across its diverse segments and regions.

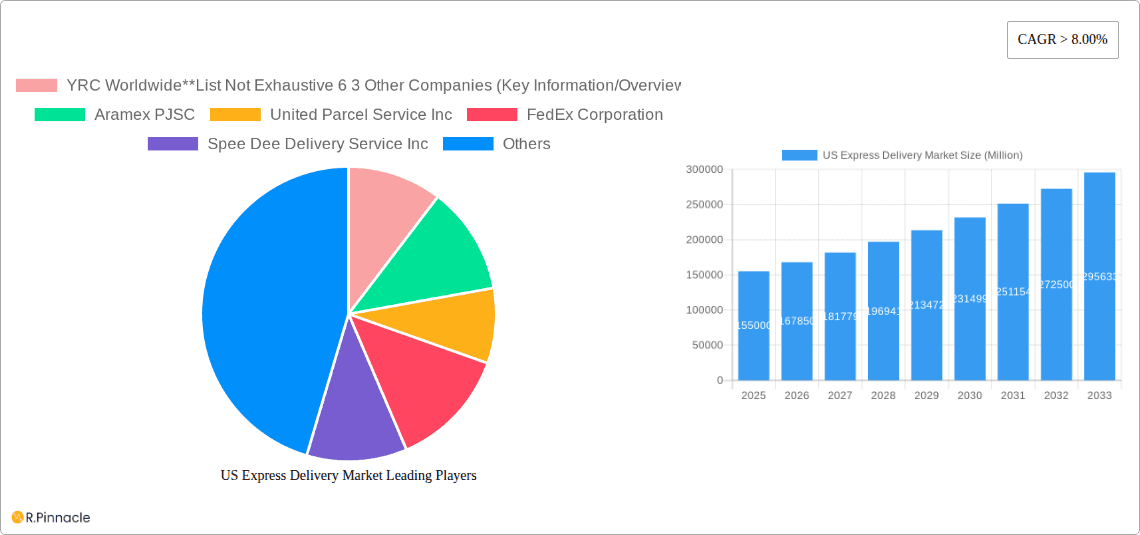

US Express Delivery Market Company Market Share

Gain unparalleled insights into the dynamic US Express Delivery Market with this in-depth report. Covering the historical period of 2019-2024 and projecting growth through 2033, this analysis provides strategic intelligence for industry professionals, logistics providers, and investors. Dive deep into market structure, growth drivers, dominant regions, and emerging opportunities, equipping you with the knowledge to navigate this rapidly evolving sector. This report leverages high-ranking keywords such as "US express delivery," "expedited shipping," "e-commerce logistics," "last-mile delivery," and "freight transportation" to maximize visibility and deliver actionable data.

US Express Delivery Market Market Structure & Innovation Trends

The US Express Delivery Market is characterized by a moderate to high level of concentration, with a few dominant players like United Parcel Service Inc, FedEx Corporation, and Deutsche Post DHL Group holding significant market share. However, the landscape is also punctuated by a vibrant ecosystem of specialized carriers and innovative startups. Innovation is primarily driven by the relentless demand for faster delivery times, enhanced tracking capabilities, and cost-efficiency. Regulatory frameworks, including those pertaining to transportation safety, labor laws, and environmental standards, play a crucial role in shaping operational strategies and investment decisions. Product substitutes, such as slower but more economical freight options and the rise of in-house logistics by large e-commerce entities, present ongoing competitive pressures. End-user demographics are increasingly diverse, with a strong influence from digitally native consumers and businesses seeking agile supply chain solutions. Mergers and acquisitions (M&A) are a significant trend, with strategic consolidation aimed at expanding service offerings, geographical reach, and technological capabilities. For instance, the acquisition of Land Air Express by Forward Air Corporation for USD 56.5 million exemplifies this trend, aiming to bolster expedited LTL services and national terminal footprint. Market share shifts are closely watched, particularly as new technologies and business models emerge.

US Express Delivery Market Market Dynamics & Trends

The US Express Delivery Market is experiencing robust growth, fueled by several converging trends. The exponential expansion of e-commerce remains the primary growth driver, creating an insatiable demand for rapid, reliable, and affordable delivery services. Consumers' increasing expectation for same-day or next-day delivery is pushing logistics providers to optimize their last-mile operations and invest heavily in automation and advanced routing technologies. Technological disruptions are transforming the industry at an unprecedented pace. The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing route optimization, predictive analytics for delivery times, and warehouse management, leading to greater efficiency and reduced operational costs. The exploration of autonomous delivery vehicles, as demonstrated by the collaboration between Uber Technologies and Nuro for food deliveries, signals a potential paradigm shift in the future of urban logistics, promising lower labor costs and increased delivery capacity, though regulatory hurdles and public acceptance remain key considerations. Consumer preferences are evolving beyond speed, with a growing emphasis on sustainability and transparent delivery processes. Customers are increasingly seeking eco-friendly delivery options and real-time updates on their package's journey. Competitive dynamics are intense, with established giants constantly innovating and agile startups challenging the status quo with specialized services and disruptive business models. The market penetration of express delivery services continues to rise, driven by both business-to-consumer (B2C) and business-to-business (B2B) sectors. The projected Compound Annual Growth Rate (CAGR) for the express delivery market is estimated to be in the range of 8-10% over the forecast period, driven by these powerful market forces.

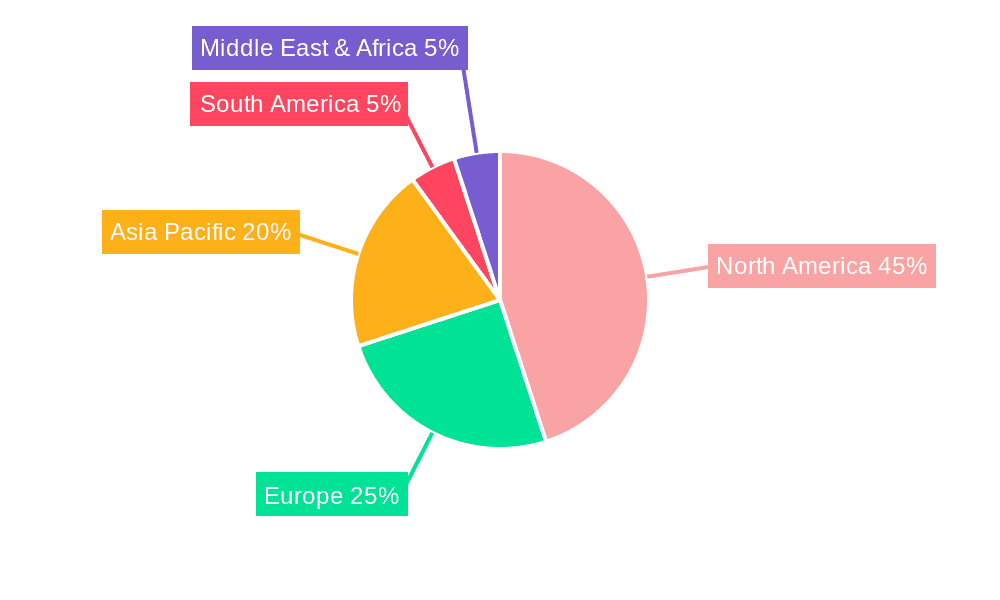

Dominant Regions & Segments in US Express Delivery Market

The Domestic segment within the US Express Delivery Market holds significant dominance, driven by the sheer volume of internal trade and the ubiquitous nature of e-commerce within the United States. This dominance is underpinned by strong economic policies that support domestic commerce and an expansive, well-developed infrastructure of roads, airports, and logistics hubs. Key drivers for this segment include:

- Robust E-commerce Ecosystem: The overwhelming majority of online retail transactions occur domestically, necessitating swift and reliable delivery solutions.

- Consumer Expectations: American consumers have grown accustomed to rapid delivery, making domestic express services a near necessity for online retailers.

- Technological Adoption: Advanced tracking, routing software, and warehouse automation are more readily implemented and integrated within a single national regulatory framework.

Within the End User segmentation, the Wholesale and Retail Trade (E-commerce) segment is the leading force. The explosive growth of online retail has fundamentally reshaped the demand for express delivery services. Retailers rely heavily on these services to meet customer expectations for fast shipping, which directly impacts customer satisfaction and sales conversion rates. The ability to offer expedited shipping options is often a key differentiator in the competitive e-commerce landscape. Furthermore, the Services end-user segment also contributes significantly, encompassing the delivery of time-sensitive documents, medical supplies, and other critical items. The Manufacturing, Construction, and Utilities sectors, while not as voluminous as e-commerce, represent critical demand for expedited delivery of parts, equipment, and critical components, often with significant financial implications if delays occur.

The Business: B2C (Business-to-Consumer) segment is currently the largest and fastest-growing in terms of shipment volume, directly linked to the e-commerce boom. However, the Business: B2B (Business-to-Business) segment is equally crucial, encompassing the movement of goods between businesses, from manufacturers to distributors, and from wholesalers to retailers. The efficiency and speed of B2B express delivery have a cascading effect on the entire supply chain, influencing production schedules and inventory management.

US Express Delivery Market Product Innovations

Product innovations in the US Express Delivery Market are centered around enhancing speed, efficiency, and customer experience. Advancements in route optimization software utilizing AI and predictive analytics are enabling faster and more precise deliveries. The development of specialized packaging for temperature-sensitive goods and fragile items is crucial for specific industries. Furthermore, the integration of IoT devices for real-time package tracking and condition monitoring provides unprecedented transparency and security. Drone and autonomous vehicle delivery are emerging as key areas of innovation, promising to revolutionize last-mile logistics by offering faster, potentially lower-cost delivery options in specific scenarios. These innovations offer significant competitive advantages by reducing transit times, minimizing errors, and improving overall customer satisfaction.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the US Express Delivery Market, segmented by Business type, Destination, and End User.

- Business Segmentation: The B2B (Business-to-Business) segment is a cornerstone of the market, facilitating critical supply chain operations for businesses of all sizes. Growth is projected to be steady, driven by the need for efficient movement of goods between commercial entities. The B2C (Business-to-Consumer) segment is experiencing explosive growth, directly correlated with e-commerce expansion. Projected growth rates are exceptionally high, driven by evolving consumer expectations for rapid delivery.

- Destination Segmentation: The Domestic segment is the largest and most dominant, fueled by internal commerce and e-commerce. Its growth trajectory remains strong due to sustained domestic economic activity. The International segment, while smaller, offers significant growth potential, driven by globalized trade and cross-border e-commerce. Market penetration is increasing as more businesses engage in international trade.

- End User Segmentation: The Services segment, encompassing time-sensitive document and item delivery, shows consistent demand. Growth is projected to be stable. The Wholesale and Retail Trade (E-commerce) segment is the primary growth engine, with high projected growth rates driven by online retail expansion. The Manufacturing, Construction, and Utilities segments represent crucial demand for expedited parts and equipment, with moderate to strong growth projections tied to industrial activity. The Primary segment encompasses various other industries requiring express delivery solutions, contributing to the overall market growth.

Key Drivers of US Express Delivery Market Growth

The growth of the US Express Delivery Market is propelled by a confluence of powerful factors. The continued digital transformation and e-commerce boom is the most significant driver, creating an insatiable demand for fast and reliable shipping. Technological advancements in areas like AI-powered route optimization, automation, and real-time tracking enhance efficiency and customer satisfaction. Shifting consumer preferences towards same-day or next-day delivery further accelerate the need for express services. Furthermore, economic policies that promote trade and commerce, coupled with investments in infrastructure development, provide a fertile ground for the expansion of logistics networks. The increasing adoption of sustainable logistics practices also presents an opportunity for growth as consumers and businesses prioritize eco-friendly options.

Challenges in the US Express Delivery Market Sector

Despite its robust growth, the US Express Delivery Market faces several significant challenges. Intensifying competition from both established players and agile startups puts pressure on pricing and margins. Rising operational costs, including fuel prices, labor expenses, and vehicle maintenance, can impact profitability. Regulatory hurdles, particularly concerning labor laws for drivers and environmental regulations, require constant adaptation and investment. Infrastructure limitations, especially in densely populated urban areas, can lead to traffic congestion and delivery delays, impacting last-mile efficiency. Supply chain disruptions, whether due to natural disasters, geopolitical events, or economic downturns, can create significant bottlenecks and affect delivery timelines. The increasing demand for sustainability also presents a challenge, requiring significant investment in greener fleets and operational practices.

Emerging Opportunities in US Express Delivery Market

The US Express Delivery Market is ripe with emerging opportunities. The continued expansion of e-commerce into new product categories and demographics will fuel sustained demand. The growth of specialized delivery services, such as temperature-controlled logistics for pharmaceuticals and perishables, presents significant niche market potential. Advancements in autonomous delivery vehicles and drone technology are poised to revolutionize last-mile logistics, offering greater efficiency and speed in certain environments. The increasing focus on sustainability creates opportunities for companies offering eco-friendly delivery solutions, attracting environmentally conscious consumers and businesses. Furthermore, the globalization of trade and the rise of cross-border e-commerce present significant opportunities for international express delivery services.

Leading Players in the US Express Delivery Market Market

- United Parcel Service Inc

- FedEx Corporation

- Deutsche Post DHL Group

- Aramex PJSC

- SF Express (Group) Co Ltd

- OnTrac Inc

- Spee Dee Delivery Service Inc

- YRC Worldwide

- Courier Express

- A-1 Express Delivery Service Inc

- Amazon Atlantic International Express

- A-1 Express Logistics

- USA Couriers

- Postmates

- Deliv

- Routific

- Roadie

- American Expediting

- Koch Cos Inc

Key Developments in US Express Delivery Market Industry

- January 2023: Forward Air Corporation has agreed to pay USD 56.5 million for full-service expedited LTL carrier Land Air Express. This acquisition is expected to hasten the expansion of Forward Air's national terminal footprint, particularly in the Midwest, strategically positioning them to better fulfill customers' present and future demands.

- September 2022: Uber Technologies and Nuro, a leading autonomous vehicle company, announced a multi-year collaboration to use Nuro's self-driving electric vehicles for food deliveries in the United States. This agreement allows Uber Eats customers to order meals and goods for delivery by Nuro's zero-occupant autonomous delivery vehicles operating on public roads.

Future Outlook for US Express Delivery Market Market

The future outlook for the US Express Delivery Market is exceptionally bright, driven by sustained e-commerce growth, continuous technological innovation, and evolving consumer expectations. The market is projected to witness accelerated growth as investments in automation, AI, and autonomous delivery technologies mature. The increasing demand for faster, more personalized, and sustainable delivery options will compel companies to further optimize their operations and explore novel solutions. Strategic partnerships and M&A activities will likely continue as companies seek to consolidate their market position, expand service portfolios, and gain a competitive edge. The ability to adapt to evolving regulatory landscapes and embrace environmentally responsible practices will be critical for long-term success. The market will continue to be shaped by the dynamic interplay between technological advancements, shifting consumer behaviors, and the ongoing pursuit of logistical excellence.

US Express Delivery Market Segmentation

-

1. Business

- 1.1. B2B (Business-to-Business)

- 1.2. B2C (Business-to-Consumer)

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade (E-commerce)

- 3.3. Manufacturing, Construction, and Utilities

- 3.4. Primary

US Express Delivery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Express Delivery Market Regional Market Share

Geographic Coverage of US Express Delivery Market

US Express Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace

- 3.2.2 automotive

- 3.2.3 and pharmaceuticals.

- 3.3. Market Restrains

- 3.3.1 4.; The geopolitical situation in the Middle East can create security concerns for logistics operations

- 3.3.2 4.; Regulations and customs procedures can be complex and subject to change.

- 3.4. Market Trends

- 3.4.1. Increased E-commerce Sales Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Express Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. B2B (Business-to-Business)

- 5.1.2. B2C (Business-to-Consumer)

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade (E-commerce)

- 5.3.3. Manufacturing, Construction, and Utilities

- 5.3.4. Primary

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. North America US Express Delivery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Business

- 6.1.1. B2B (Business-to-Business)

- 6.1.2. B2C (Business-to-Consumer)

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Services

- 6.3.2. Wholesale and Retail Trade (E-commerce)

- 6.3.3. Manufacturing, Construction, and Utilities

- 6.3.4. Primary

- 6.1. Market Analysis, Insights and Forecast - by Business

- 7. South America US Express Delivery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Business

- 7.1.1. B2B (Business-to-Business)

- 7.1.2. B2C (Business-to-Consumer)

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Services

- 7.3.2. Wholesale and Retail Trade (E-commerce)

- 7.3.3. Manufacturing, Construction, and Utilities

- 7.3.4. Primary

- 7.1. Market Analysis, Insights and Forecast - by Business

- 8. Europe US Express Delivery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Business

- 8.1.1. B2B (Business-to-Business)

- 8.1.2. B2C (Business-to-Consumer)

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Services

- 8.3.2. Wholesale and Retail Trade (E-commerce)

- 8.3.3. Manufacturing, Construction, and Utilities

- 8.3.4. Primary

- 8.1. Market Analysis, Insights and Forecast - by Business

- 9. Middle East & Africa US Express Delivery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Business

- 9.1.1. B2B (Business-to-Business)

- 9.1.2. B2C (Business-to-Consumer)

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Services

- 9.3.2. Wholesale and Retail Trade (E-commerce)

- 9.3.3. Manufacturing, Construction, and Utilities

- 9.3.4. Primary

- 9.1. Market Analysis, Insights and Forecast - by Business

- 10. Asia Pacific US Express Delivery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Business

- 10.1.1. B2B (Business-to-Business)

- 10.1.2. B2C (Business-to-Consumer)

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Services

- 10.3.2. Wholesale and Retail Trade (E-commerce)

- 10.3.3. Manufacturing, Construction, and Utilities

- 10.3.4. Primary

- 10.1. Market Analysis, Insights and Forecast - by Business

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 YRC Worldwide**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aramex PJSC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 United Parcel Service Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FedEx Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Spee Dee Delivery Service Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SF Express (Group) Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OnTrac Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Deutsche Post DHL Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Courier Express

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 A-1 Express Delivery Service Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 (Amazon Atlantic International Express A-1 Express Logistics USA Couriers Postmates Deliv Routific Roadie American Expediting Koch Cos Inc )

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 YRC Worldwide**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)

List of Figures

- Figure 1: Global US Express Delivery Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Express Delivery Market Revenue (undefined), by Business 2025 & 2033

- Figure 3: North America US Express Delivery Market Revenue Share (%), by Business 2025 & 2033

- Figure 4: North America US Express Delivery Market Revenue (undefined), by Destination 2025 & 2033

- Figure 5: North America US Express Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 6: North America US Express Delivery Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America US Express Delivery Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America US Express Delivery Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America US Express Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Express Delivery Market Revenue (undefined), by Business 2025 & 2033

- Figure 11: South America US Express Delivery Market Revenue Share (%), by Business 2025 & 2033

- Figure 12: South America US Express Delivery Market Revenue (undefined), by Destination 2025 & 2033

- Figure 13: South America US Express Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 14: South America US Express Delivery Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: South America US Express Delivery Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America US Express Delivery Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America US Express Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Express Delivery Market Revenue (undefined), by Business 2025 & 2033

- Figure 19: Europe US Express Delivery Market Revenue Share (%), by Business 2025 & 2033

- Figure 20: Europe US Express Delivery Market Revenue (undefined), by Destination 2025 & 2033

- Figure 21: Europe US Express Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 22: Europe US Express Delivery Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Europe US Express Delivery Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe US Express Delivery Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe US Express Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Express Delivery Market Revenue (undefined), by Business 2025 & 2033

- Figure 27: Middle East & Africa US Express Delivery Market Revenue Share (%), by Business 2025 & 2033

- Figure 28: Middle East & Africa US Express Delivery Market Revenue (undefined), by Destination 2025 & 2033

- Figure 29: Middle East & Africa US Express Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 30: Middle East & Africa US Express Delivery Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Middle East & Africa US Express Delivery Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa US Express Delivery Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Express Delivery Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Express Delivery Market Revenue (undefined), by Business 2025 & 2033

- Figure 35: Asia Pacific US Express Delivery Market Revenue Share (%), by Business 2025 & 2033

- Figure 36: Asia Pacific US Express Delivery Market Revenue (undefined), by Destination 2025 & 2033

- Figure 37: Asia Pacific US Express Delivery Market Revenue Share (%), by Destination 2025 & 2033

- Figure 38: Asia Pacific US Express Delivery Market Revenue (undefined), by End User 2025 & 2033

- Figure 39: Asia Pacific US Express Delivery Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific US Express Delivery Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific US Express Delivery Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Express Delivery Market Revenue undefined Forecast, by Business 2020 & 2033

- Table 2: Global US Express Delivery Market Revenue undefined Forecast, by Destination 2020 & 2033

- Table 3: Global US Express Delivery Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global US Express Delivery Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global US Express Delivery Market Revenue undefined Forecast, by Business 2020 & 2033

- Table 6: Global US Express Delivery Market Revenue undefined Forecast, by Destination 2020 & 2033

- Table 7: Global US Express Delivery Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global US Express Delivery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global US Express Delivery Market Revenue undefined Forecast, by Business 2020 & 2033

- Table 13: Global US Express Delivery Market Revenue undefined Forecast, by Destination 2020 & 2033

- Table 14: Global US Express Delivery Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global US Express Delivery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global US Express Delivery Market Revenue undefined Forecast, by Business 2020 & 2033

- Table 20: Global US Express Delivery Market Revenue undefined Forecast, by Destination 2020 & 2033

- Table 21: Global US Express Delivery Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Global US Express Delivery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global US Express Delivery Market Revenue undefined Forecast, by Business 2020 & 2033

- Table 33: Global US Express Delivery Market Revenue undefined Forecast, by Destination 2020 & 2033

- Table 34: Global US Express Delivery Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global US Express Delivery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global US Express Delivery Market Revenue undefined Forecast, by Business 2020 & 2033

- Table 43: Global US Express Delivery Market Revenue undefined Forecast, by Destination 2020 & 2033

- Table 44: Global US Express Delivery Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 45: Global US Express Delivery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Express Delivery Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Express Delivery Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the US Express Delivery Market?

Key companies in the market include YRC Worldwide**List Not Exhaustive 6 3 Other Companies (Key Information/Overview), Aramex PJSC, United Parcel Service Inc, FedEx Corporation, Spee Dee Delivery Service Inc, SF Express (Group) Co Ltd, OnTrac Inc, Deutsche Post DHL Group, Courier Express, A-1 Express Delivery Service Inc, (Amazon Atlantic International Express A-1 Express Logistics USA Couriers Postmates Deliv Routific Roadie American Expediting Koch Cos Inc ).

3. What are the main segments of the US Express Delivery Market?

The market segments include Business, Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace. automotive. and pharmaceuticals..

6. What are the notable trends driving market growth?

Increased E-commerce Sales Driving the Market.

7. Are there any restraints impacting market growth?

4.; The geopolitical situation in the Middle East can create security concerns for logistics operations. 4.; Regulations and customs procedures can be complex and subject to change..

8. Can you provide examples of recent developments in the market?

January 2023: Forward Air Corporation, an asset-light provider of transportation services in the United States, Canada, and Mexico, has agreed to pay USD 56.5 million for full-service expedited LTL carrier Land Air Express. Forward Air currently offers expedited LTL services such as local pick-up and delivery, shipment consolidation/deconsolidation, warehousing, and customs brokerage. This acquisition will hasten the expansion of our national terminal footprint, particularly in the Midwest, and we think it will strategically position us to better fulfil customers' present and future demands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Express Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Express Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Express Delivery Market?

To stay informed about further developments, trends, and reports in the US Express Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence