Key Insights

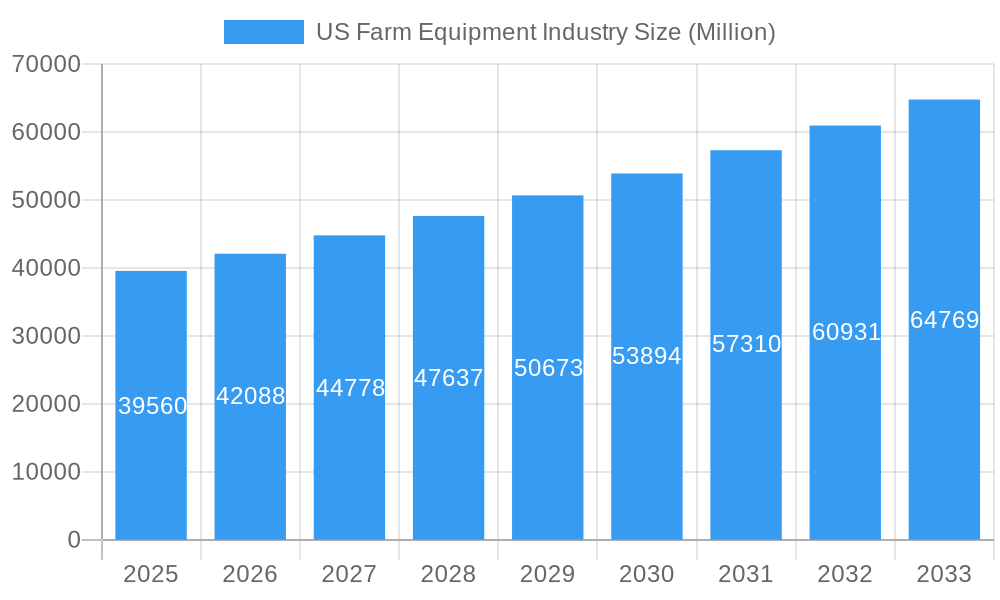

The US farm equipment market, valued at $39.56 billion in 2025, is projected to experience robust growth, driven by several key factors. Increased adoption of precision agriculture technologies, including GPS-guided machinery, automated systems, and data analytics, is significantly boosting efficiency and yields, leading to higher demand for advanced farm equipment. Government initiatives promoting sustainable farming practices and investments in agricultural infrastructure further fuel market expansion. The rising global population and the consequent need for increased food production are also major contributors to this growth. Furthermore, favorable government policies supporting technological advancements in agriculture and encouraging the adoption of modern farming techniques contribute significantly to market expansion.

US Farm Equipment Industry Market Size (In Billion)

Segment-wise, the harvesting machinery segment, encompassing combine harvesters and forage harvesters, commands a significant market share due to their crucial role in post-harvest operations. The planting machinery segment, including seed drills and planters, also exhibits substantial growth, driven by the increasing adoption of precision planting techniques for optimized seed distribution and germination. However, the market faces certain restraints, including fluctuating commodity prices and the high initial investment costs associated with advanced farm equipment. Nevertheless, the long-term prospects for the US farm equipment market remain positive, with consistent growth expected throughout the forecast period (2025-2033) fueled by technological innovation and the ever-growing demand for efficient and sustainable agricultural practices. Key players like Deere & Company, John Deere, AGCO, and Kubota are actively innovating and expanding their product portfolios to cater to evolving farmer needs, further shaping the market landscape.

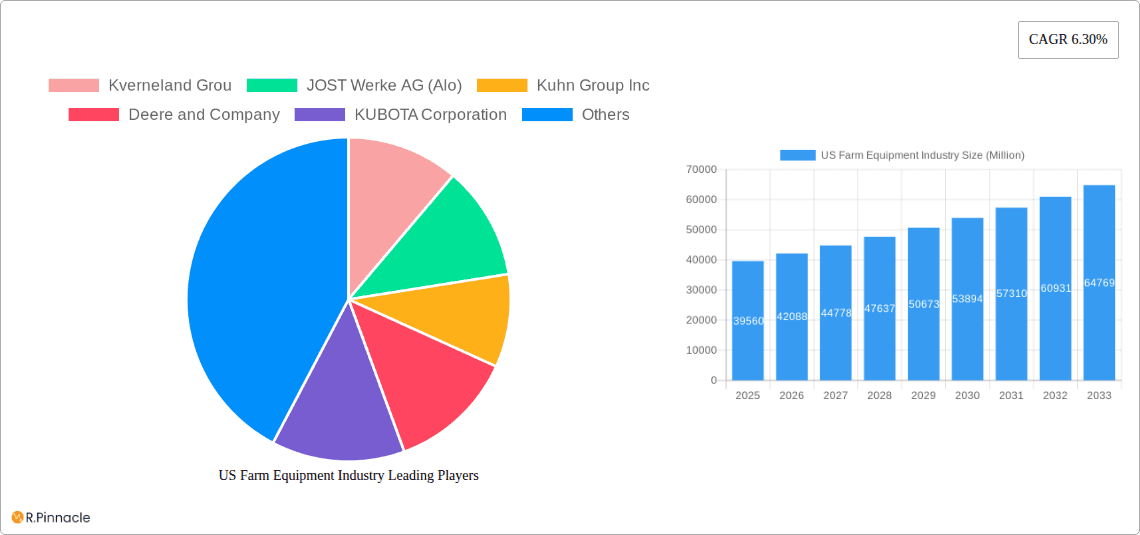

US Farm Equipment Industry Company Market Share

US Farm Equipment Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the US farm equipment industry, offering valuable insights for industry professionals, investors, and stakeholders. We analyze market trends, key players, and future growth prospects, covering the period from 2019 to 2033, with a focus on 2025. This report is crucial for understanding the dynamic landscape of US agriculture and making informed strategic decisions.

US Farm Equipment Industry Market Structure & Innovation Trends

The US farm equipment market is characterized by a moderately concentrated structure, with several major players holding significant market share. Deere & Company, AGCO Corporation, and CNH Industrial are dominant forces, collectively accounting for an estimated xx% of the market in 2025. However, smaller players like Kubota Corporation and Mahindra Agriculture North America are increasingly competitive, particularly in specialized segments. Innovation is driven by the need for increased efficiency, precision agriculture, and sustainable farming practices. Stringent environmental regulations and the growing adoption of automation and autonomy are key drivers. The market is also witnessing significant M&A activity, as evidenced by recent deals with estimated values totaling $xx Million. For instance, AGCO’s acquisition of JCA Industries in May 2022 demonstrates the industry’s focus on enhancing technological capabilities.

- Market Concentration: High (xx% market share held by top 3 players in 2025).

- Key Innovation Drivers: Precision agriculture, automation, sustainability, environmental regulations.

- M&A Activity: Significant, with deals totaling $xx Million in recent years.

- Product Substitutes: Limited, but alternative farming practices and technologies are emerging.

- End-User Demographics: Shifting towards larger, more technologically advanced farms.

US Farm Equipment Industry Market Dynamics & Trends

The US farm equipment market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include increasing demand for high-yield crops, technological advancements in precision farming, rising labor costs, and government support for agricultural modernization. However, factors such as economic downturns, commodity price fluctuations, and supply chain disruptions could pose challenges. Market penetration of advanced technologies, such as autonomous tractors and precision planting systems, is expected to increase significantly. The growing adoption of data-driven decision-making and the integration of IoT (Internet of Things) devices are also transforming the industry. Competitive dynamics are characterized by intense rivalry among major players, leading to continuous product innovation and strategic partnerships.

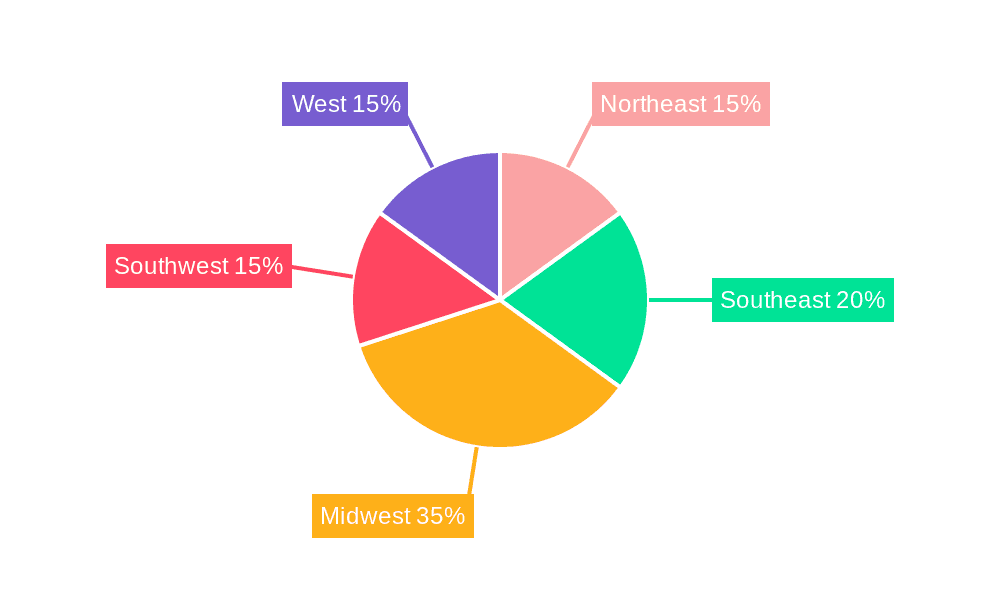

Dominant Regions & Segments in US Farm Equipment Industry

The Midwest region of the US remains the dominant market for farm equipment, driven by its vast agricultural lands and high crop yields. Within segments, planting machinery (seed drills, planters, spreaders) and harvesting machinery (combine harvesters, forage harvesters) represent the largest market shares.

Key Drivers for Midwest Dominance:

- Extensive arable land.

- High crop production.

- Established agricultural infrastructure.

- Favorable government policies.

Dominant Segments:

- Planting Machinery: Strong demand for advanced precision planting technologies.

- Harvesting Machinery: High adoption of efficient and automated harvesting equipment.

Detailed Dominance Analysis: The Midwest's dominance is due to its historical significance in agriculture, coupled with favorable climate and soil conditions for high-yield crops. This translates into greater demand for advanced machinery compared to other regions.

US Farm Equipment Industry Product Innovations

Recent innovations focus on automation, precision, and data-driven insights. Autonomous tractors, driver-assist harvesting systems, and smart irrigation technologies are gaining traction. These advancements aim to increase efficiency, reduce operational costs, and enhance yields while minimizing environmental impact. The market is witnessing a shift towards modular and interconnected systems that allow for customized solutions based on specific farm needs.

Report Scope & Segmentation Analysis

This report segments the US farm equipment market based on equipment type:

- Plowing and Cultivating Machinery: Includes ploughs, harrows, cultivators, and tillers. The market size is projected to reach $xx Million by 2033, driven by demand for efficient land preparation techniques.

- Planting Machinery: Encompasses seed drills, planters, and spreaders. This segment is expected to exhibit strong growth due to precision planting technologies. Projected market size: $xx Million by 2033.

- Harvesting Machinery: Includes combine harvesters, forage harvesters, and other harvesters. Technological advancements are driving growth in this segment. Projected market size: $xx Million by 2033.

- Haying and Forage Machinery: Includes mowers and balers. This segment’s growth is tied to livestock farming and the demand for efficient forage harvesting. Projected market size: $xx Million by 2033.

- Irrigation Machinery: Includes sprinkler and drip irrigation systems. The market is expected to grow due to increasing water scarcity and the need for efficient irrigation techniques. Projected market size: $xx Million by 2033.

Key Drivers of US Farm Equipment Industry Growth

Technological advancements, particularly in precision agriculture and automation, are driving significant growth. Government incentives and subsidies for adopting modern farming technologies also contribute. Furthermore, increasing demand for food production due to population growth and changing dietary preferences bolster market expansion. Finally, the rising cost of labor is compelling farmers to invest in automated equipment.

Challenges in the US Farm Equipment Industry Sector

The industry faces challenges including supply chain disruptions, leading to increased input costs and delays in equipment delivery. Economic downturns impact farmer spending, affecting demand. Furthermore, intense competition among major players creates price pressures. The impact of these challenges is estimated to reduce the overall market growth by xx% in 2025.

Emerging Opportunities in US Farm Equipment Industry

The adoption of data analytics, AI, and IoT technologies presents significant opportunities for growth. Sustainable farming practices are gaining importance, creating demand for eco-friendly equipment. The expansion of precision agriculture techniques presents a large potential market. Finally, the development of autonomous systems offers substantial opportunities for efficiency improvements.

Leading Players in the US Farm Equipment Industry Market

- Kverneland Group

- JOST Werke AG (Alo)

- Kuhn Group Inc

- Deere and Company

- KUBOTA Corporation

- CNH Industrial

- Farmtrac Tractor Europe

- AGCO Corporation

- Deutz-Fahr

- Mahindra Agriculture North America

- Claas KGaA mbH

Key Developments in US Farm Equipment Industry Industry

- December 2022: CNH Industrial launched new automation and autonomy solutions, boosting productivity.

- May 2022: AGCO acquired JCA Industries to accelerate automation technology development.

- April 2022: Deere & Company and GUSS Automation formed a joint venture for semi-autonomous sprayers.

Future Outlook for US Farm Equipment Industry Market

The US farm equipment market is poised for continued growth, driven by technological advancements, increasing demand for food, and the growing adoption of sustainable agricultural practices. The focus on precision agriculture, automation, and data-driven decision-making will shape the industry's future. Strategic partnerships and mergers & acquisitions will continue to play a significant role in shaping the competitive landscape.

US Farm Equipment Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

US Farm Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Farm Equipment Industry Regional Market Share

Geographic Coverage of US Farm Equipment Industry

US Farm Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Availability of Skilled Labor; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery

- 3.4. Market Trends

- 3.4.1. Increasing Average Farm Size

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America US Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America US Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe US Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa US Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific US Farm Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kverneland Grou

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JOST Werke AG (Alo)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kuhn Group Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Deere and Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KUBOTA Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CNH Industrial

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Farmtrac Tractor Europe

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGCO Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Deutz-Fahr

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mahindra Agriculture North America

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Claas KGaA mbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Kverneland Grou

List of Figures

- Figure 1: Global US Farm Equipment Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Farm Equipment Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America US Farm Equipment Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America US Farm Equipment Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America US Farm Equipment Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America US Farm Equipment Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America US Farm Equipment Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America US Farm Equipment Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America US Farm Equipment Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America US Farm Equipment Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America US Farm Equipment Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America US Farm Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America US Farm Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America US Farm Equipment Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America US Farm Equipment Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America US Farm Equipment Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America US Farm Equipment Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America US Farm Equipment Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America US Farm Equipment Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America US Farm Equipment Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America US Farm Equipment Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America US Farm Equipment Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America US Farm Equipment Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America US Farm Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America US Farm Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Farm Equipment Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe US Farm Equipment Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe US Farm Equipment Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe US Farm Equipment Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe US Farm Equipment Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe US Farm Equipment Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe US Farm Equipment Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe US Farm Equipment Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe US Farm Equipment Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe US Farm Equipment Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe US Farm Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe US Farm Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa US Farm Equipment Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa US Farm Equipment Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa US Farm Equipment Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa US Farm Equipment Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa US Farm Equipment Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa US Farm Equipment Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa US Farm Equipment Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa US Farm Equipment Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa US Farm Equipment Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa US Farm Equipment Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa US Farm Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Farm Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific US Farm Equipment Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific US Farm Equipment Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific US Farm Equipment Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific US Farm Equipment Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific US Farm Equipment Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific US Farm Equipment Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific US Farm Equipment Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific US Farm Equipment Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific US Farm Equipment Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific US Farm Equipment Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific US Farm Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific US Farm Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global US Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global US Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global US Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global US Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global US Farm Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global US Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global US Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global US Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global US Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global US Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global US Farm Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global US Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global US Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global US Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global US Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global US Farm Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global US Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global US Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global US Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global US Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global US Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global US Farm Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global US Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global US Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global US Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global US Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global US Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global US Farm Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global US Farm Equipment Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global US Farm Equipment Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global US Farm Equipment Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global US Farm Equipment Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global US Farm Equipment Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global US Farm Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific US Farm Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Farm Equipment Industry?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the US Farm Equipment Industry?

Key companies in the market include Kverneland Grou, JOST Werke AG (Alo), Kuhn Group Inc, Deere and Company, KUBOTA Corporation, CNH Industrial, Farmtrac Tractor Europe, AGCO Corporation, Deutz-Fahr, Mahindra Agriculture North America, Claas KGaA mbH.

3. What are the main segments of the US Farm Equipment Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Low Availability of Skilled Labor; Technological Advancements.

6. What are the notable trends driving market growth?

Increasing Average Farm Size.

7. Are there any restraints impacting market growth?

Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery.

8. Can you provide examples of recent developments in the market?

December 2022: CNH Industrial added new Automation and Autonomy Solutions to the Ag Tech portfolio in Phoenix, Arizona, and the USA. These New Driverless Tillage and Driver Assist Harvest solutions from Raven, and Baler Automation from Case IH and New Holland, can deliver automation and autonomous equipment enhancements and help solve farmers' most significant challenges to increasing productivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Farm Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Farm Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Farm Equipment Industry?

To stay informed about further developments, trends, and reports in the US Farm Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence