Key Insights

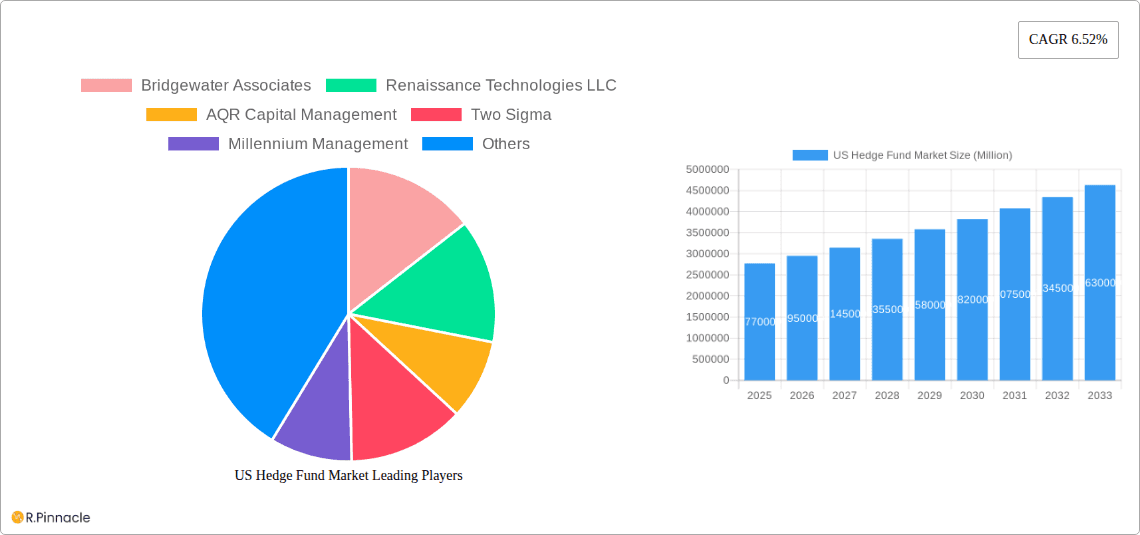

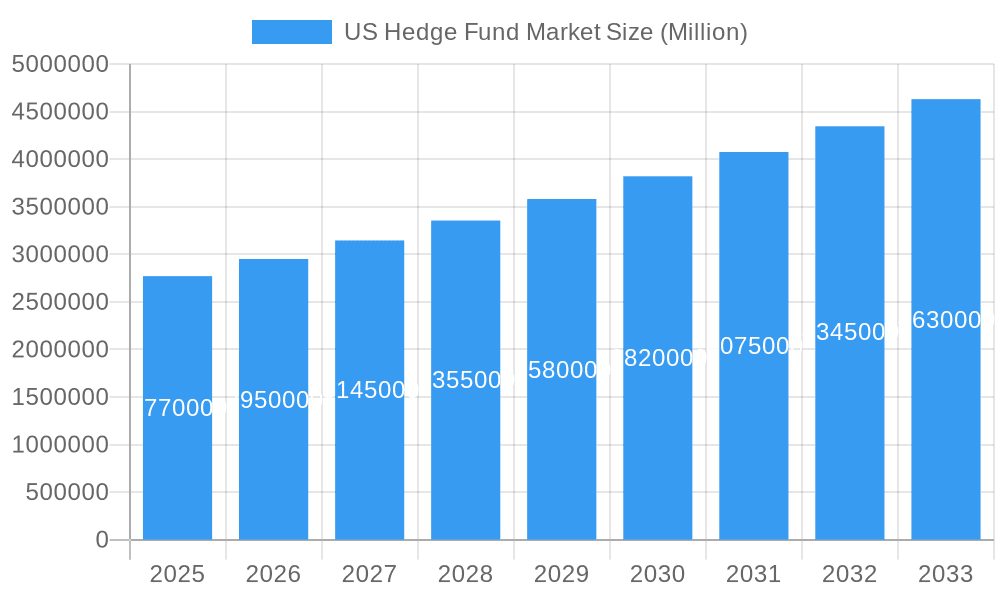

The US hedge fund market, a cornerstone of alternative investments, is a dynamic and high-stakes arena. With a 2025 market size estimated at $2.77 trillion, the sector demonstrates consistent growth, projected at a Compound Annual Growth Rate (CAGR) of 6.52% from 2025 to 2033. This robust expansion is driven by several key factors. Firstly, persistent investor demand for higher returns in a low-interest-rate environment fuels capital inflows into hedge funds. Secondly, sophisticated investment strategies, including quantitative and long/short equity approaches, coupled with advanced data analytics and artificial intelligence, continue to attract investors seeking alpha generation. Finally, the increasing complexity of global markets and the need for active management contribute to the sector's sustained appeal. Competition remains fierce among leading players like Bridgewater Associates, Renaissance Technologies, and BlackRock, pushing innovation and specialization within the industry.

US Hedge Fund Market Market Size (In Million)

However, the market also faces challenges. Regulatory scrutiny, particularly around transparency and fee structures, presents an ongoing concern. Furthermore, performance fluctuations in specific market segments and increasing competition from other alternative investment strategies like private equity and venture capital could put pressure on margins. Nevertheless, the long-term outlook remains positive, fueled by the enduring need for sophisticated risk management and alpha generation within a globalized financial system. The sector’s segmentation is evolving, with a greater focus on niche strategies, potentially leading to diversification and increased resilience against market volatility. As the market expands, we expect to see continued consolidation and innovation within the industry, with established players broadening their capabilities and smaller firms focusing on specialized market niches.

US Hedge Fund Market Company Market Share

US Hedge Fund Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the US Hedge Fund Market, covering historical performance (2019-2024), the current state (2025), and future projections (2025-2033). It delves into market structure, key players, emerging trends, and challenges, offering actionable insights for industry professionals. The report uses 2025 as the base year and includes a robust forecast until 2033. The total market size in 2025 is estimated at $xx Million.

US Hedge Fund Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovative strategies, regulatory environment, and M&A activity within the US hedge fund market. The market is characterized by a high degree of concentration, with a few dominant players holding significant market share. Bridgewater Associates, Renaissance Technologies LLC, AQR Capital Management, and Two Sigma consistently rank among the largest firms. However, a large number of smaller firms contribute significantly to the overall market dynamism.

- Market Concentration: The top 10 firms account for approximately xx% of the total assets under management (AUM), indicating a consolidated market structure.

- Innovation Drivers: Technological advancements (AI, machine learning), evolving investor preferences (ESG investing), and regulatory changes are key drivers of innovation.

- Regulatory Frameworks: Stringent regulations, such as the Dodd-Frank Act, continue to shape the market landscape, impacting operational costs and investment strategies. Compliance remains a significant factor influencing operational decisions.

- Product Substitutes: Alternative investment vehicles, including private equity and venture capital, compete for investor capital.

- End-User Demographics: High-net-worth individuals, institutional investors (pension funds, endowments), and family offices constitute the primary end-user base.

- M&A Activities: The market has witnessed significant M&A activity in recent years, with deal values reaching $xx Million annually. This consolidation trend is projected to continue. Smaller firms might face pressure to merge or be acquired by larger players to remain competitive.

US Hedge Fund Market Market Dynamics & Trends

The US hedge fund market is characterized by a dynamic environment of growth, disruption, and evolving investor preferences. Market growth is fueled by strong investor demand, although overall returns in recent years have varied depending on the investment strategy employed. The CAGR for the period 2025-2033 is projected to be xx%. Market penetration varies among different segments and is influenced by economic conditions and investor sentiment. Technological disruption, including the increased use of AI and machine learning for investment analysis and portfolio management, is transforming the industry. Consumer preferences are shifting towards more sustainable and responsible investing strategies, influencing investment choices. Competitive dynamics are intense, with firms continually striving for alpha generation.

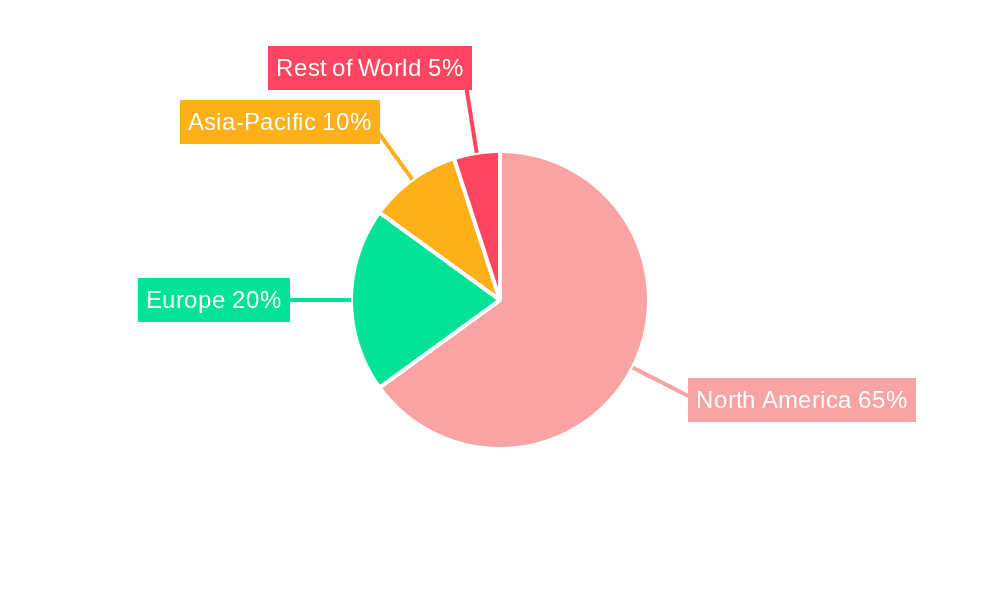

Dominant Regions & Segments in US Hedge Fund Market

The New York City metropolitan area remains the dominant hub for the US hedge fund industry, driven by a dense concentration of talent, financial infrastructure, and access to capital. This dominance is supported by several factors:

- Economic Policies: Favorable tax policies and a business-friendly regulatory environment attract investors and hedge funds.

- Infrastructure: A robust financial infrastructure, including exchanges, clearing houses, and legal professionals, supports market operations.

- Talent Pool: A large and skilled workforce with expertise in finance, technology, and investment management contributes to the region's competitiveness.

Other regions like Connecticut, California, and Florida also play significant roles, but their combined market share remains lower than New York. Segment-wise, Equity Hedge funds retain a substantial share, followed by Macro Hedge funds, and Relative Value funds.

US Hedge Fund Market Product Innovations

Recent innovations involve increased use of alternative data sources, advanced quantitative modeling, and AI-powered investment strategies. These technological advancements aim to improve risk management, enhance portfolio diversification, and achieve superior returns. The focus on ESG investing has also led to the development of new products specifically targeting environmentally and socially responsible investments. Firms are actively seeking to integrate technology and sustainable investing practices into their core offerings.

Report Scope & Segmentation Analysis

This report segments the US hedge fund market by strategy (e.g., long-short equity, macro, relative value), investment style (e.g., value, growth, quantitative), and investor type (e.g., high-net-worth individuals, institutional investors). Each segment's growth is projected based on historical data and future market trends. Competitive dynamics vary across segments, reflecting the specific investment strategies and investor profiles. The market size of each segment is expected to show significant growth during the forecast period, driven by diverse factors, including increased investor demand and technological advancements.

Key Drivers of US Hedge Fund Market Growth

Several factors fuel the growth of the US hedge fund market:

- Technological advancements: AI, machine learning, and big data analytics enhance investment strategies and risk management.

- Economic growth: A strong US economy attracts significant investment, increasing demand for hedge fund services.

- Favorable regulatory environment: Although regulations are stringent, a stable regulatory framework fosters market confidence.

- Increasing institutional investor participation: Pension funds and endowments are increasingly allocating assets to hedge funds.

Challenges in the US Hedge Fund Market Sector

The US hedge fund market faces challenges:

- Regulatory scrutiny: Increased regulatory oversight adds to operational costs and compliance burdens.

- Competitive pressures: Intense competition among firms necessitates continuous innovation and efficient resource management.

- Market volatility: Economic downturns and geopolitical events can significantly impact investor sentiment and fund performance.

- Talent acquisition: Attracting and retaining skilled professionals is crucial for success.

Emerging Opportunities in US Hedge Fund Market

Several opportunities exist for growth:

- Expansion into new markets: Exploring emerging markets and alternative asset classes can unlock new growth potential.

- Adoption of innovative technologies: AI, blockchain, and other technologies can improve efficiency and profitability.

- Focus on ESG investing: Growing investor interest in sustainable investing creates lucrative opportunities.

- Strategic partnerships and acquisitions: Collaboration and consolidation can enhance competitiveness and expand reach.

Leading Players in the US Hedge Fund Market Market

Key Developments in US Hedge Fund Market Industry

- January 2024: The Palm Beach Hedge Fund Association (PBHFA) and Entoro partnered to enhance deal distribution for hedge funds, facilitating greater market access.

- October 2022: Divya Nettimi launched a hedge fund with over $1 Billion in commitments, marking a significant milestone for women in the industry.

Future Outlook for US Hedge Fund Market Market

The US hedge fund market is poised for continued growth, driven by technological advancements, evolving investor preferences, and the increasing importance of alternative investments. Strategic partnerships, focus on ESG investing, and the adoption of innovative technologies will be critical for success. The market is expected to experience moderate growth, with a continued emphasis on efficiency, transparency, and risk management.

US Hedge Fund Market Segmentation

-

1. Core Investment Strategies

- 1.1. Equity Strategies

- 1.2. Macro Strategies

- 1.3. Event Driven Strategies

- 1.4. Credit Strategies

- 1.5. Relative Value Strategies

- 1.6. Niche Strategies

- 1.7. Multi-Strategy

- 1.8. Managed Futures/CTA Strategies

US Hedge Fund Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Hedge Fund Market Regional Market Share

Geographic Coverage of US Hedge Fund Market

US Hedge Fund Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Positive Trends in Equity Market is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Positive Trends in Equity Market is Driving the Market

- 3.4. Market Trends

- 3.4.1. Rise of the Crypto Hedge Funds in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 5.1.1. Equity Strategies

- 5.1.2. Macro Strategies

- 5.1.3. Event Driven Strategies

- 5.1.4. Credit Strategies

- 5.1.5. Relative Value Strategies

- 5.1.6. Niche Strategies

- 5.1.7. Multi-Strategy

- 5.1.8. Managed Futures/CTA Strategies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6. North America US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6.1.1. Equity Strategies

- 6.1.2. Macro Strategies

- 6.1.3. Event Driven Strategies

- 6.1.4. Credit Strategies

- 6.1.5. Relative Value Strategies

- 6.1.6. Niche Strategies

- 6.1.7. Multi-Strategy

- 6.1.8. Managed Futures/CTA Strategies

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7. South America US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7.1.1. Equity Strategies

- 7.1.2. Macro Strategies

- 7.1.3. Event Driven Strategies

- 7.1.4. Credit Strategies

- 7.1.5. Relative Value Strategies

- 7.1.6. Niche Strategies

- 7.1.7. Multi-Strategy

- 7.1.8. Managed Futures/CTA Strategies

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8. Europe US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8.1.1. Equity Strategies

- 8.1.2. Macro Strategies

- 8.1.3. Event Driven Strategies

- 8.1.4. Credit Strategies

- 8.1.5. Relative Value Strategies

- 8.1.6. Niche Strategies

- 8.1.7. Multi-Strategy

- 8.1.8. Managed Futures/CTA Strategies

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9. Middle East & Africa US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9.1.1. Equity Strategies

- 9.1.2. Macro Strategies

- 9.1.3. Event Driven Strategies

- 9.1.4. Credit Strategies

- 9.1.5. Relative Value Strategies

- 9.1.6. Niche Strategies

- 9.1.7. Multi-Strategy

- 9.1.8. Managed Futures/CTA Strategies

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10. Asia Pacific US Hedge Fund Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10.1.1. Equity Strategies

- 10.1.2. Macro Strategies

- 10.1.3. Event Driven Strategies

- 10.1.4. Credit Strategies

- 10.1.5. Relative Value Strategies

- 10.1.6. Niche Strategies

- 10.1.7. Multi-Strategy

- 10.1.8. Managed Futures/CTA Strategies

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bridgewater Associates

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renaissance Technologies LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AQR Capital Management

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Two Sigma

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Millennium Management

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elliott Investment Management

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BlackRock Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Citadel

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Davidson Kempner Capital Management

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 D E Shaw & Co **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bridgewater Associates

List of Figures

- Figure 1: Global US Hedge Fund Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Hedge Fund Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 4: North America US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 5: North America US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 6: North America US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 7: North America US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 9: North America US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 12: South America US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 13: South America US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 14: South America US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 15: South America US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South America US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: South America US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 20: Europe US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 21: Europe US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 22: Europe US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 23: Europe US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 28: Middle East & Africa US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 29: Middle East & Africa US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 30: Middle East & Africa US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 31: Middle East & Africa US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific US Hedge Fund Market Revenue (Million), by Core Investment Strategies 2025 & 2033

- Figure 36: Asia Pacific US Hedge Fund Market Volume (Trillion), by Core Investment Strategies 2025 & 2033

- Figure 37: Asia Pacific US Hedge Fund Market Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 38: Asia Pacific US Hedge Fund Market Volume Share (%), by Core Investment Strategies 2025 & 2033

- Figure 39: Asia Pacific US Hedge Fund Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific US Hedge Fund Market Volume (Trillion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Hedge Fund Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Hedge Fund Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 2: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 3: Global US Hedge Fund Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Hedge Fund Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 5: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 6: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 7: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 9: United States US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 11: Canada US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 16: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 17: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Brazil US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: Argentina US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 26: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 27: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Germany US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: France US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Italy US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Spain US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Russia US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: Benelux US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Nordics US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 48: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 49: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 51: Turkey US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Israel US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: GCC US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: North Africa US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: South Africa US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Global US Hedge Fund Market Revenue Million Forecast, by Core Investment Strategies 2020 & 2033

- Table 64: Global US Hedge Fund Market Volume Trillion Forecast, by Core Investment Strategies 2020 & 2033

- Table 65: Global US Hedge Fund Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global US Hedge Fund Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 67: China US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: India US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Japan US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: South Korea US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: ASEAN US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 77: Oceania US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific US Hedge Fund Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific US Hedge Fund Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Hedge Fund Market?

The projected CAGR is approximately 6.52%.

2. Which companies are prominent players in the US Hedge Fund Market?

Key companies in the market include Bridgewater Associates, Renaissance Technologies LLC, AQR Capital Management, Two Sigma, Millennium Management, Elliott Investment Management, BlackRock Inc, Citadel, Davidson Kempner Capital Management, D E Shaw & Co **List Not Exhaustive.

3. What are the main segments of the US Hedge Fund Market?

The market segments include Core Investment Strategies.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Positive Trends in Equity Market is Driving the Market.

6. What are the notable trends driving market growth?

Rise of the Crypto Hedge Funds in United States.

7. Are there any restraints impacting market growth?

Positive Trends in Equity Market is Driving the Market.

8. Can you provide examples of recent developments in the market?

January 2024: The Palm Beach Hedge Fund Association (PBHFA), the premier trade association for investors and financial professionals in South Florida, and Entoro, a leading boutique finance and investment banking group, announced a strategic partnership to improve deal distribution for hedge funds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Hedge Fund Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Hedge Fund Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Hedge Fund Market?

To stay informed about further developments, trends, and reports in the US Hedge Fund Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence