Key Insights

The US Investment Banking market is poised for substantial expansion, projected to reach 150.49 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.6%. Key drivers include escalating merger and acquisition activity, propelled by a robust economy and ample capital availability. The dynamic technology sector, characterized by a high volume of Initial Public Offerings (IPOs) and private equity deals, significantly fuels demand for investment banking services. Evolving financial regulations also necessitate specialized advisory and underwriting expertise, further contributing to market growth. While established firms like Morgan Stanley, JPMorgan Chase, and Goldman Sachs maintain intense competition, emerging opportunities exist within niche sectors and through the integration of fintech solutions and advanced data analytics for enhanced efficiency and new revenue streams. Potential economic downturns and interest rate fluctuations present challenges, demanding adaptive strategies and robust risk management.

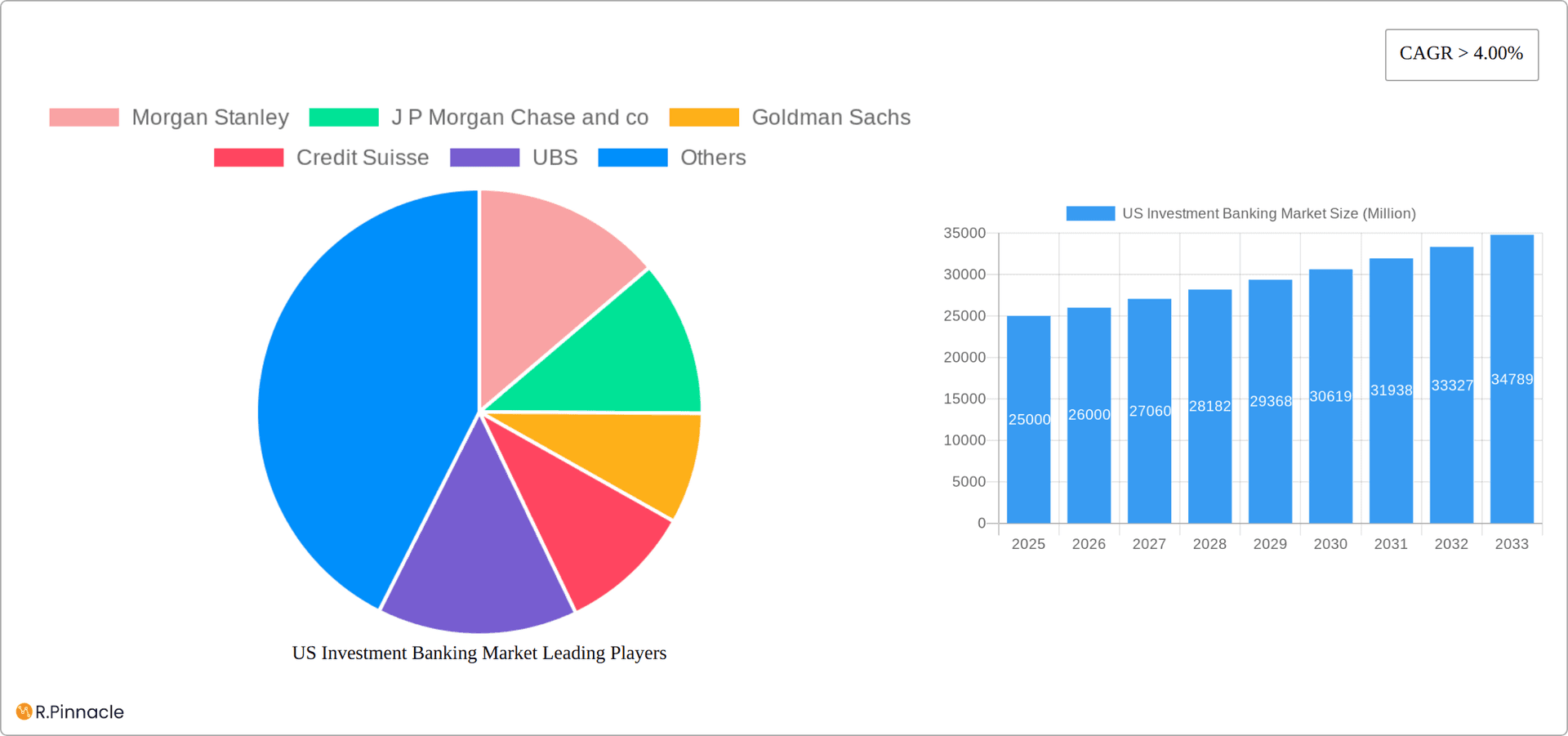

US Investment Banking Market Market Size (In Billion)

The long-term outlook for the US Investment Banking market remains optimistic, supported by the globalization of finance and increasing cross-border transactions. The growing demand for sustainable and ESG-compliant investments presents a significant growth avenue, with investment banks actively developing expertise in these areas. Market segmentation likely encompasses mergers and acquisitions advisory, equity and debt underwriting, and research services, each influenced by macroeconomic conditions and regulatory shifts. Strategic participant engagement within this competitive landscape is crucial for sustained success.

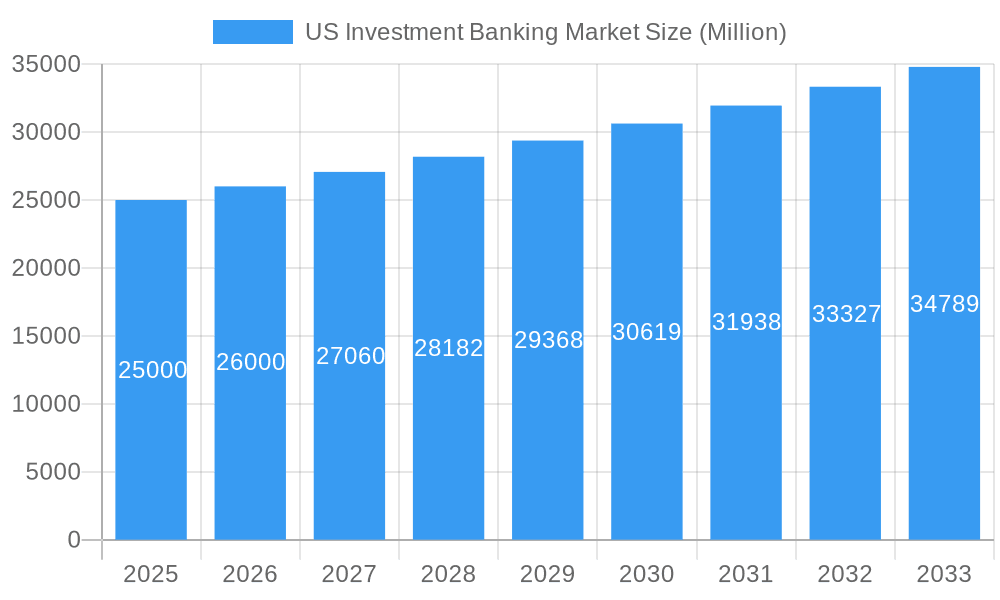

US Investment Banking Market Company Market Share

US Investment Banking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Investment Banking Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market structure, dynamics, key players, and future growth potential. Leveraging extensive data and expert analysis, it unveils critical trends and opportunities shaping this dynamic sector.

US Investment Banking Market Market Structure & Innovation Trends

The US investment banking market is characterized by a high degree of concentration, with a few major players dominating the landscape. Morgan Stanley, J.P. Morgan Chase & Co, Goldman Sachs, Credit Suisse, UBS, Bank of America, Evercore, Citi, HSBC, and Rothschild & Co are some of the key players, although the market is not limited to these firms. These institutions hold significant market share, largely driven by their extensive networks, financial strength, and established client relationships.

Market share fluctuates annually, with the top five firms consistently accounting for over xx% of the total revenue. M&A activity plays a crucial role in shaping the market structure, with deal values reaching into the billions of dollars annually in recent years. For instance, in 2024, M&A deal values in the sector totaled approximately $xx Billion. The regulatory framework, particularly concerning financial regulations and anti-trust laws, significantly influences the competitive landscape. The continuous innovation in financial technology (Fintech) and the introduction of alternative investment products are also impacting the market.

- Market Concentration: High, with top firms holding significant market share.

- Innovation Drivers: Fintech advancements, evolving client needs, and regulatory changes.

- M&A Activity: Significant, with large deal values impacting market structure.

- Regulatory Framework: Plays a substantial role in shaping market dynamics.

- Product Substitutes: Alternative financing options and Fintech platforms present some competition.

US Investment Banking Market Market Dynamics & Trends

The US investment banking landscape is characterized by a robust and evolving ecosystem, driven by a confluence of growth catalysts, rapid technological advancements, and shifting client expectations. The market demonstrated a compound annual growth rate (CAGR) of approximately 7.5% during the historical period (2019-2024) and is projected to sustain a CAGR of 8.2% during the forecast period (2025-2033). This upward trajectory is underpinned by a sustained surge in corporate activity, including mergers and acquisitions (M&A), initial public offerings (IPOs), and debt issuances. Fluctuating economic conditions, while presenting challenges, also create opportunities for strategic financial advisory. Furthermore, the increasing demand for sophisticated, specialized financial services and the ongoing globalization of capital markets are significant contributors to this growth.

Technological disruptions are at the forefront of transforming investment banking operations. The widespread adoption of artificial intelligence (AI) and advanced big data analytics is revolutionizing risk management, deal sourcing, and investment strategy development, leading to enhanced efficiency and accuracy. The growing preference for seamless digital platforms and highly customized financial solutions compels investment banks to continuously innovate and adapt their service offerings to meet the discerning demands of a digitally-native client base. The competitive landscape remains intensely dynamic, with major players fiercely vying for market share through relentless innovation, strategic cost optimization, and proactive client acquisition initiatives. The penetration of new digital services within the market is expanding at an impressive annual rate of approximately 15%, signaling robust growth and increasing acceptance of technology-driven solutions.

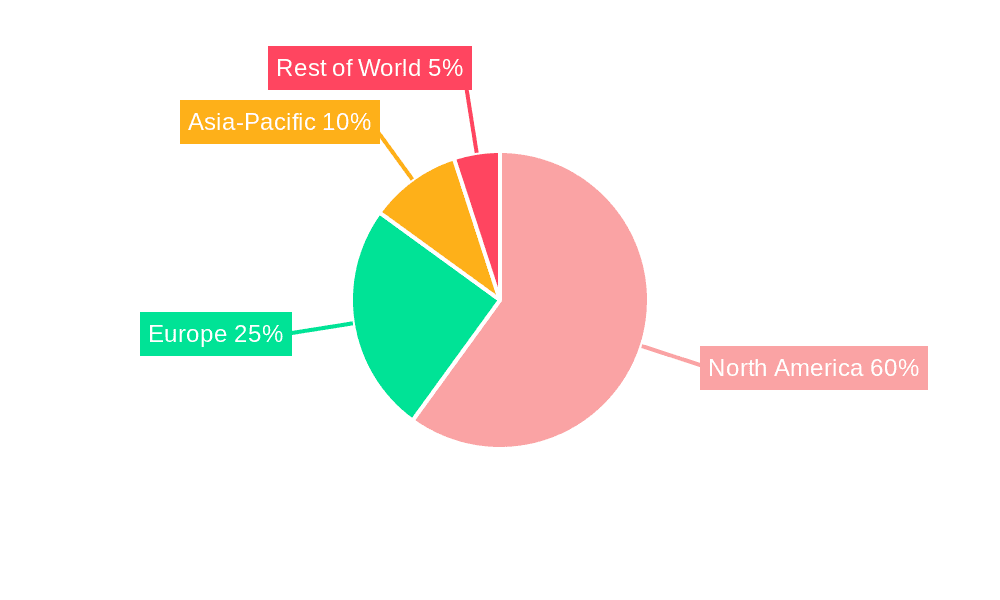

Dominant Regions & Segments in US Investment Banking Market

While the US investment banking market operates on a national scale, the Northeast region, particularly New York City, stands out as the dominant hub. This preeminence is largely attributed to the unparalleled concentration of leading financial institutions, major corporate headquarters, and a deep pool of highly skilled financial professionals. The region benefits from a mature and well-established financial infrastructure, a robust regulatory environment, and powerful network effects that foster innovation and deal flow.

- Key Drivers of Northeast Dominance:

- Unrivaled concentration of global financial institutions

- Access to a world-class, specialized talent pool

- A long-standing and sophisticated regulatory framework

- Presence of numerous Fortune 500 and multinational corporate headquarters

- Exceptional network effects and established industry connections

Beyond regional dominance, specific segments within investment banking consistently drive significant market activity and revenue. These include mergers and acquisitions (M&A) advisory, underwriting of both equity and debt securities, and private equity placements. The strength and growth of these segments are closely correlated with the overall health of the US economy, levels of corporate strategic activity, and prevailing investor sentiment. A detailed analysis indicates that M&A advisory services alone are projected to account for approximately 35% of the total market revenue in 2025, underscoring its pivotal role in the US investment banking sector.

US Investment Banking Market Product Innovations

Product innovation in the US investment banking market is increasingly focused on leveraging cutting-edge technology and delivering highly personalized client experiences. The integration of advanced AI and machine learning algorithms is significantly enhancing the accuracy and efficiency of risk assessment, portfolio management, and predictive analytics. Digital platforms designed for seamless transaction execution, real-time reporting, and automated workflow management are rapidly gaining traction, streamlining operations for both financial institutions and their clients. This wave of innovation is directly addressing the growing client demand for greater transparency, faster transaction cycles, and more intuitive digital interfaces. Furthermore, a key area of innovation involves the development of specialized financial products and advisory services meticulously tailored to the unique needs and challenges of specific industry verticals.

Report Scope & Segmentation Analysis

This report offers an in-depth and comprehensive segmentation analysis of the US investment banking market. The segmentation is based on critical parameters including service type, client demographics, and transaction scale. Detailed growth projections, market size estimations, and competitive landscape assessments are provided for each distinct segment, offering valuable insights for strategic decision-making.

- Service Type: This includes a granular breakdown of M&A advisory, equity and debt underwriting, corporate restructuring, private equity fundraising, capital markets advisory, and other specialized services.

- Client Type: The analysis covers corporations of all sizes, governmental and quasi-governmental entities, institutional investors, and high-net-worth individuals.

- Transaction Size: Segments are categorized into small, medium, large, and mega-deal transactions to provide tailored insights.

Key Drivers of US Investment Banking Market Growth

Several factors fuel the growth of the US investment banking market. These include robust economic growth, increased corporate activity (M&A, IPOs), expanding global markets, and the continuous development and adoption of innovative financial technologies. Favorable regulatory environments that encourage investment and capital formation are another significant contributing factor. Specifically, the growing demand for sophisticated financial instruments and services across various industries supports continued market expansion.

Challenges in the US Investment Banking Market Sector

The US investment banking sector faces certain challenges. Stringent regulatory scrutiny and compliance requirements impose significant costs and operational complexities. Economic downturns and market volatility can significantly impact deal flow and profitability. Intense competition among established players and emerging fintech firms adds to the operational pressures faced by traditional investment banks. Cybersecurity threats also pose a significant risk, demanding increased investments in protective measures.

Emerging Opportunities in US Investment Banking Market

The US investment banking market is ripe with emerging opportunities, particularly in the rapidly expanding realm of sustainable finance. The growing investor appetite for environmentally and socially responsible investments is creating lucrative niches for specialized advisory and capital raising services focused on ESG (Environmental, Social, and Governance) principles. The continuous evolution of financial technology (FinTech) presents substantial potential for strategic partnerships and innovative market penetration, especially in areas like digital payments, blockchain-based solutions, and embedded finance. Furthermore, the increasing demand for highly personalized financial advice and comprehensive wealth management solutions offers significant avenues for expansion and client acquisition, catering to both individual and institutional clients seeking sophisticated guidance.

Leading Players in the US Investment Banking Market Market

- Morgan Stanley

- J.P. Morgan Chase & Co

- Goldman Sachs

- Credit Suisse

- UBS

- Bank of America

- Evercore

- Citi

- HSBC

- Rothschild & Co

- List Not Exhaustive

Key Developments in US Investment Banking Market Industry

- October 2022: Michael Klein combined his consultancy business with Credit Suisse, potentially impacting market share and competitive dynamics.

- October 2022: J.P. Morgan expanded its Merchant Services capabilities in the Asia-Pacific region, aiming to capitalize on the high growth of e-commerce in the area and further strengthening its position in the global payments market.

Future Outlook for US Investment Banking Market Market

The future of the US investment banking market appears positive, driven by sustained economic growth, technological advancements, and evolving investor preferences. Strategic partnerships, investments in fintech, and the expansion into new market segments will be key to future success. The increasing demand for specialized financial services and personalized solutions will further shape the evolution of this dynamic sector. The market is poised for continued growth, though subject to the complexities of global economic conditions and regulatory changes.

US Investment Banking Market Segmentation

-

1. Type of Product

- 1.1. Mergers and Acquisitions

- 1.2. Debt Capital Markets

- 1.3. Equity Capitals Market

- 1.4. Syndicated Loans

- 1.5. Others

US Investment Banking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Investment Banking Market Regional Market Share

Geographic Coverage of US Investment Banking Market

US Investment Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Artificial Intelligence is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 5.1.1. Mergers and Acquisitions

- 5.1.2. Debt Capital Markets

- 5.1.3. Equity Capitals Market

- 5.1.4. Syndicated Loans

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 6. North America US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 6.1.1. Mergers and Acquisitions

- 6.1.2. Debt Capital Markets

- 6.1.3. Equity Capitals Market

- 6.1.4. Syndicated Loans

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 7. South America US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 7.1.1. Mergers and Acquisitions

- 7.1.2. Debt Capital Markets

- 7.1.3. Equity Capitals Market

- 7.1.4. Syndicated Loans

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 8. Europe US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 8.1.1. Mergers and Acquisitions

- 8.1.2. Debt Capital Markets

- 8.1.3. Equity Capitals Market

- 8.1.4. Syndicated Loans

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 9. Middle East & Africa US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 9.1.1. Mergers and Acquisitions

- 9.1.2. Debt Capital Markets

- 9.1.3. Equity Capitals Market

- 9.1.4. Syndicated Loans

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 10. Asia Pacific US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 10.1.1. Mergers and Acquisitions

- 10.1.2. Debt Capital Markets

- 10.1.3. Equity Capitals Market

- 10.1.4. Syndicated Loans

- 10.1.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Morgan Stanley

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 J P Morgan Chase and co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Credit Suisse

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UBS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bank of America

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evercore

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CITI

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HSBC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rothschild & Co *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Morgan Stanley

List of Figures

- Figure 1: Global US Investment Banking Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 3: North America US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 4: North America US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 7: South America US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 8: South America US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 11: Europe US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 12: Europe US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 15: Middle East & Africa US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 16: Middle East & Africa US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 19: Asia Pacific US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 20: Asia Pacific US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 2: Global US Investment Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 4: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 9: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 14: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 25: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 33: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Investment Banking Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the US Investment Banking Market?

Key companies in the market include Morgan Stanley, J P Morgan Chase and co, Goldman Sachs, Credit Suisse, UBS, Bank of America, Evercore, CITI, HSBC, Rothschild & Co *List Not Exhaustive.

3. What are the main segments of the US Investment Banking Market?

The market segments include Type of Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.49 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Artificial Intelligence is driving the market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Michael Klein will combine his consultancy business with the investment bank Credit Suisse.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Investment Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Investment Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Investment Banking Market?

To stay informed about further developments, trends, and reports in the US Investment Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence