Key Insights

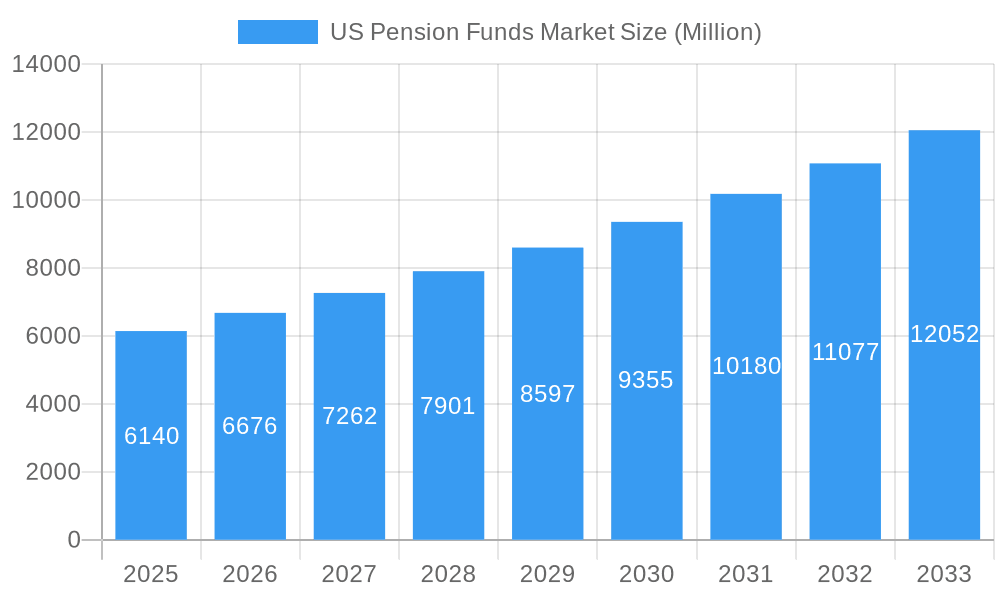

The US Pension Funds market, valued at $6.14 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.90% from 2025 to 2033. This expansion is driven by several key factors. The aging population necessitates increased retirement savings and pension plan contributions, fueling demand for secure investment vehicles. Furthermore, favorable regulatory environments and increasing government initiatives to promote retirement security are bolstering market growth. The rise of defined contribution plans, offering employees more control over their retirement investments, contributes to market expansion. However, challenges remain, including persistent low interest rates impacting investment returns, increased longevity placing pressure on existing pension funds, and volatility in global financial markets. These factors create a complex landscape for pension fund managers, demanding strategic allocation and risk management capabilities.

US Pension Funds Market Market Size (In Billion)

Major players such as Social Security Administration, Franklin Templeton, and Vanguard dominate the market, leveraging their extensive experience and established network. However, the market is also witnessing the emergence of new entrants and innovative investment strategies, particularly within the defined contribution sector. Competition is fierce, pushing providers to develop sophisticated technology platforms and personalized investment solutions to attract and retain clients. Geographic concentration is likely skewed towards states with large populations and established financial centers, with regional variations in market size reflecting differences in population demographics and economic conditions. The continued success of the US Pension Funds market hinges on the ability of industry stakeholders to adapt to shifting demographics, market volatility, and evolving regulatory landscapes while offering sustainable and attractive retirement investment solutions.

US Pension Funds Market Company Market Share

US Pension Funds Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the US Pension Funds Market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study unravels market dynamics, growth drivers, and future opportunities. The report leverages extensive data analysis and expert insights to provide actionable strategies for navigating this dynamic landscape. The market size is estimated at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

US Pension Funds Market Market Structure & Innovation Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory influences shaping the US Pension Funds Market. We examine market concentration, identifying key players and their market share. The analysis includes a deep dive into M&A activities, evaluating deal values and their impact on market structure. The influence of regulatory frameworks, the presence of product substitutes, and evolving end-user demographics are also thoroughly examined.

- Market Concentration: The US pension fund market is characterized by a mix of large, established players and smaller, specialized firms. The top five players account for approximately XX% of the market share in 2025.

- M&A Activity: Significant M&A activity has been observed, with deal values exceeding $XX Million in the past five years. For example, Franklin Templeton's acquisition of Lexington Partners in April 2022 significantly altered the competitive landscape.

- Innovation Drivers: Technological advancements, particularly in data analytics and algorithmic trading, are driving innovation in investment strategies and risk management. Regulatory changes also influence innovation, pushing for greater transparency and accountability.

- Regulatory Frameworks: ERISA (Employee Retirement Income Security Act of 1974) and other regulations significantly impact the market, shaping investment strategies and operational practices.

US Pension Funds Market Market Dynamics & Trends

This section delves into the key factors influencing market growth, including technological disruptions, evolving consumer preferences, and intense competitive dynamics. We explore market growth drivers, providing a comprehensive overview of the factors propelling market expansion. The analysis incorporates a thorough assessment of technological disruptions and their impact on market trends. This section also examines the changing preferences of pension fund beneficiaries and the competitive landscape.

The market is experiencing robust growth, driven by factors such as increasing retirement savings needs and the rise of defined contribution plans. Technological advancements in portfolio management and risk assessment are also transforming the industry. The increasing adoption of ESG (Environmental, Social, and Governance) investing is another key trend, reshaping investment strategies and portfolio composition. The market is highly competitive, with established players facing challenges from new entrants and disruptive technologies.

Dominant Regions & Segments in US Pension Funds Market

This section identifies the leading regions and segments within the US Pension Funds Market. We analyze the factors contributing to the dominance of specific regions or segments, including economic policies, infrastructure development, and regulatory frameworks. A detailed analysis of market share, growth rates, and future potential is provided for each dominant segment.

- Key Drivers of Dominance:

- California: The presence of large pension funds like CalPERS (California Public Employees' Retirement System) and favorable economic conditions contribute to California's leading position.

- Northeast: High concentration of financial institutions and a strong regulatory framework support the Northeast's significant market share.

- Dominance Analysis: The Northeast and West Coast regions currently dominate the market, driven by the concentration of large pension funds and sophisticated investment management capabilities. However, other regions are experiencing growth, driven by evolving economic conditions and increased retirement savings needs.

US Pension Funds Market Product Innovations

This section provides a summary of recent product developments, emphasizing technological trends and market fit. We examine the competitive advantages of new products and services, highlighting their impact on market dynamics. Innovation in areas such as algorithmic trading, risk management solutions, and personalized retirement planning is transforming the industry.

Report Scope & Segmentation Analysis

This report segments the US Pension Funds Market based on fund type (defined benefit, defined contribution), investment strategy (active, passive), asset class (equities, fixed income, alternatives), and fund size. Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed.

- Defined Benefit Funds: This segment is characterized by slower growth due to declining employer sponsorship, but still represents a substantial portion of the market.

- Defined Contribution Funds: This segment is experiencing rapid growth, driven by the increasing prevalence of 401(k) plans.

- Asset Class Segmentation: Each asset class exhibits unique growth patterns and competitive dynamics, influenced by market conditions and investor preferences.

Key Drivers of US Pension Funds Market Growth

Several factors drive the growth of the US Pension Funds Market, including:

- Increasing Retirement Savings Needs: The aging population and rising life expectancy necessitate increased retirement savings.

- Technological Advancements: Innovations in portfolio management and risk assessment enhance efficiency and investment returns.

- Regulatory Changes: New regulations promote transparency and accountability, encouraging growth and investment.

Challenges in the US Pension Funds Market Sector

The US Pension Funds Market faces several challenges:

- Funding Shortfalls: Many pension plans face significant funding shortfalls, impacting their ability to meet future obligations.

- Market Volatility: Fluctuations in the financial markets pose significant risks to pension fund investments.

- Regulatory Complexity: Compliance with complex regulations adds to the operational costs and complexities of managing pension funds.

Emerging Opportunities in US Pension Funds Market

This sector presents several opportunities:

- Growth in Defined Contribution Plans: The increasing popularity of defined contribution plans creates opportunities for innovative investment solutions and financial advice.

- ESG Investing: Growing demand for sustainable and responsible investments creates new avenues for growth.

- Technological Advancements: Innovative technologies can improve operational efficiency, reduce costs, and enhance investment returns.

Leading Players in the US Pension Funds Market Market

- Social Security Administration

- Franklin Templeton

- California Public Employees Retirement System

- TD Ameritrade

- 1199 Seiu National Benefit Fund

- Vanguard

- National Railroad Retirement Investment Trust

- Ohio Public Employees Retirement System

- List Not Exhaustive

Key Developments in US Pension Funds Market Industry

- April 2022: Franklin Templeton acquires Lexington Partners L.P., expanding its presence in the secondary private equity market.

- January 2023: CalPERS invests USD 1 Billion in smaller private equity firms, seeking enhanced returns.

Future Outlook for US Pension Funds Market Market

The US Pension Funds Market is poised for continued growth, driven by technological innovation, evolving investment strategies, and the increasing focus on retirement security. Strategic partnerships, expansion into new markets, and the adoption of innovative technologies will play a pivotal role in shaping the future of the industry.

US Pension Funds Market Segmentation

-

1. Type of Pension Plan

-

1.1. Distributed Contribution

- 1.1.1. Distributed Benefit

- 1.1.2. Reserved Fund

- 1.1.3. Hybrid

-

1.1. Distributed Contribution

US Pension Funds Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Pension Funds Market Regional Market Share

Geographic Coverage of US Pension Funds Market

US Pension Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Asset Allocations in Pension Funds is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Pension Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 5.1.1. Distributed Contribution

- 5.1.1.1. Distributed Benefit

- 5.1.1.2. Reserved Fund

- 5.1.1.3. Hybrid

- 5.1.1. Distributed Contribution

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 6. North America US Pension Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 6.1.1. Distributed Contribution

- 6.1.1.1. Distributed Benefit

- 6.1.1.2. Reserved Fund

- 6.1.1.3. Hybrid

- 6.1.1. Distributed Contribution

- 6.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 7. South America US Pension Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 7.1.1. Distributed Contribution

- 7.1.1.1. Distributed Benefit

- 7.1.1.2. Reserved Fund

- 7.1.1.3. Hybrid

- 7.1.1. Distributed Contribution

- 7.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 8. Europe US Pension Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 8.1.1. Distributed Contribution

- 8.1.1.1. Distributed Benefit

- 8.1.1.2. Reserved Fund

- 8.1.1.3. Hybrid

- 8.1.1. Distributed Contribution

- 8.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 9. Middle East & Africa US Pension Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 9.1.1. Distributed Contribution

- 9.1.1.1. Distributed Benefit

- 9.1.1.2. Reserved Fund

- 9.1.1.3. Hybrid

- 9.1.1. Distributed Contribution

- 9.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 10. Asia Pacific US Pension Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 10.1.1. Distributed Contribution

- 10.1.1.1. Distributed Benefit

- 10.1.1.2. Reserved Fund

- 10.1.1.3. Hybrid

- 10.1.1. Distributed Contribution

- 10.1. Market Analysis, Insights and Forecast - by Type of Pension Plan

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Social Security Administration

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Franklin Templeton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 California Public Employees Retirement System

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TD Ameritrade

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 1199 Seiu National Benefit Fund

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vangaurd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National RailRoad Retirement Investment Trust

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ohio Public Employees Retirement System*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Social Security Administration

List of Figures

- Figure 1: Global US Pension Funds Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global US Pension Funds Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America US Pension Funds Market Revenue (Million), by Type of Pension Plan 2025 & 2033

- Figure 4: North America US Pension Funds Market Volume (Trillion), by Type of Pension Plan 2025 & 2033

- Figure 5: North America US Pension Funds Market Revenue Share (%), by Type of Pension Plan 2025 & 2033

- Figure 6: North America US Pension Funds Market Volume Share (%), by Type of Pension Plan 2025 & 2033

- Figure 7: North America US Pension Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America US Pension Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 9: North America US Pension Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America US Pension Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 11: South America US Pension Funds Market Revenue (Million), by Type of Pension Plan 2025 & 2033

- Figure 12: South America US Pension Funds Market Volume (Trillion), by Type of Pension Plan 2025 & 2033

- Figure 13: South America US Pension Funds Market Revenue Share (%), by Type of Pension Plan 2025 & 2033

- Figure 14: South America US Pension Funds Market Volume Share (%), by Type of Pension Plan 2025 & 2033

- Figure 15: South America US Pension Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 16: South America US Pension Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: South America US Pension Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America US Pension Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe US Pension Funds Market Revenue (Million), by Type of Pension Plan 2025 & 2033

- Figure 20: Europe US Pension Funds Market Volume (Trillion), by Type of Pension Plan 2025 & 2033

- Figure 21: Europe US Pension Funds Market Revenue Share (%), by Type of Pension Plan 2025 & 2033

- Figure 22: Europe US Pension Funds Market Volume Share (%), by Type of Pension Plan 2025 & 2033

- Figure 23: Europe US Pension Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe US Pension Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe US Pension Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Pension Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East & Africa US Pension Funds Market Revenue (Million), by Type of Pension Plan 2025 & 2033

- Figure 28: Middle East & Africa US Pension Funds Market Volume (Trillion), by Type of Pension Plan 2025 & 2033

- Figure 29: Middle East & Africa US Pension Funds Market Revenue Share (%), by Type of Pension Plan 2025 & 2033

- Figure 30: Middle East & Africa US Pension Funds Market Volume Share (%), by Type of Pension Plan 2025 & 2033

- Figure 31: Middle East & Africa US Pension Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Middle East & Africa US Pension Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Pension Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East & Africa US Pension Funds Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific US Pension Funds Market Revenue (Million), by Type of Pension Plan 2025 & 2033

- Figure 36: Asia Pacific US Pension Funds Market Volume (Trillion), by Type of Pension Plan 2025 & 2033

- Figure 37: Asia Pacific US Pension Funds Market Revenue Share (%), by Type of Pension Plan 2025 & 2033

- Figure 38: Asia Pacific US Pension Funds Market Volume Share (%), by Type of Pension Plan 2025 & 2033

- Figure 39: Asia Pacific US Pension Funds Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Asia Pacific US Pension Funds Market Volume (Trillion), by Country 2025 & 2033

- Figure 41: Asia Pacific US Pension Funds Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific US Pension Funds Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Pension Funds Market Revenue Million Forecast, by Type of Pension Plan 2020 & 2033

- Table 2: Global US Pension Funds Market Volume Trillion Forecast, by Type of Pension Plan 2020 & 2033

- Table 3: Global US Pension Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Pension Funds Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 5: Global US Pension Funds Market Revenue Million Forecast, by Type of Pension Plan 2020 & 2033

- Table 6: Global US Pension Funds Market Volume Trillion Forecast, by Type of Pension Plan 2020 & 2033

- Table 7: Global US Pension Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global US Pension Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 9: United States US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 11: Canada US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 13: Mexico US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Global US Pension Funds Market Revenue Million Forecast, by Type of Pension Plan 2020 & 2033

- Table 16: Global US Pension Funds Market Volume Trillion Forecast, by Type of Pension Plan 2020 & 2033

- Table 17: Global US Pension Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global US Pension Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 19: Brazil US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Brazil US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: Argentina US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Argentina US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Global US Pension Funds Market Revenue Million Forecast, by Type of Pension Plan 2020 & 2033

- Table 26: Global US Pension Funds Market Volume Trillion Forecast, by Type of Pension Plan 2020 & 2033

- Table 27: Global US Pension Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global US Pension Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 29: United Kingdom US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Germany US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: France US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Italy US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Spain US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Russia US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: Benelux US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Benelux US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Nordics US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Nordics US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Global US Pension Funds Market Revenue Million Forecast, by Type of Pension Plan 2020 & 2033

- Table 48: Global US Pension Funds Market Volume Trillion Forecast, by Type of Pension Plan 2020 & 2033

- Table 49: Global US Pension Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global US Pension Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 51: Turkey US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Turkey US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Israel US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Israel US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: GCC US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: GCC US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 57: North Africa US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 59: South Africa US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Global US Pension Funds Market Revenue Million Forecast, by Type of Pension Plan 2020 & 2033

- Table 64: Global US Pension Funds Market Volume Trillion Forecast, by Type of Pension Plan 2020 & 2033

- Table 65: Global US Pension Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global US Pension Funds Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 67: China US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: India US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Japan US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: South Korea US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Korea US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: ASEAN US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: ASEAN US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 77: Oceania US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Oceania US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific US Pension Funds Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific US Pension Funds Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Pension Funds Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the US Pension Funds Market?

Key companies in the market include Social Security Administration, Franklin Templeton, California Public Employees Retirement System, TD Ameritrade, 1199 Seiu National Benefit Fund, Vangaurd, National RailRoad Retirement Investment Trust, Ohio Public Employees Retirement System*List Not Exhaustive.

3. What are the main segments of the US Pension Funds Market?

The market segments include Type of Pension Plan.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.14 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Asset Allocations in Pension Funds is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: The California Public Employees' Retirement System is making a USD 1 billion wager that small private equity firms without the heft of the biggest buyout institutions can boost the pension giant's returns and clout.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Pension Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Pension Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Pension Funds Market?

To stay informed about further developments, trends, and reports in the US Pension Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence