Key Insights

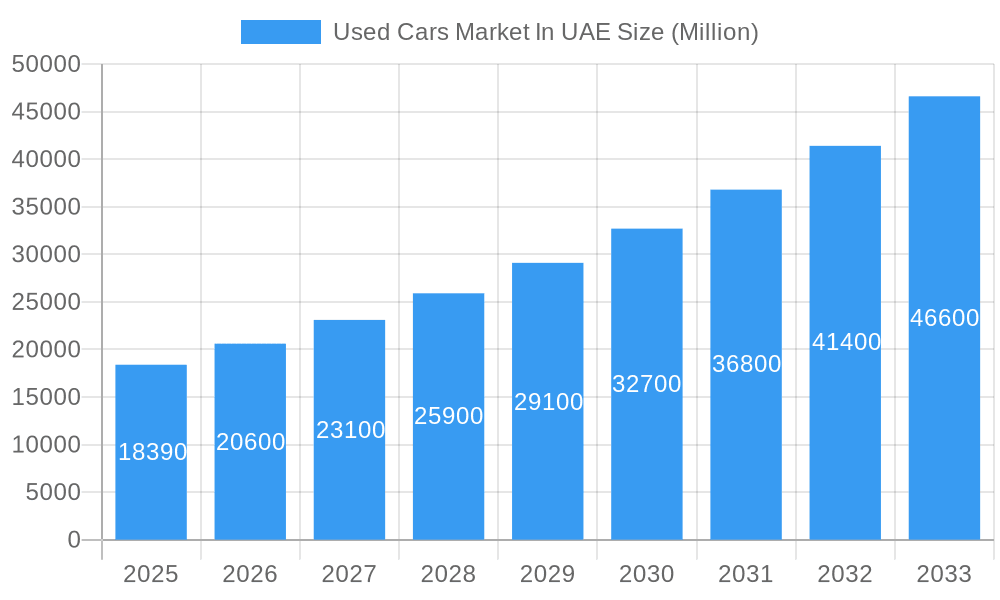

The UAE used car market, valued at $18.39 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.73% from 2025 to 2033. This surge is driven by several factors. Firstly, the increasing affordability of used vehicles compared to new cars attracts budget-conscious buyers. Secondly, a growing population and expanding middle class fuel demand for personal transportation. Thirdly, the development of online platforms like Carswitch, OpenSooq, and Yalla Motors has significantly improved market accessibility and transparency, enhancing consumer confidence and driving sales. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, MPVs), vendor type (organized and unorganized dealerships), booking type (online and offline), and fuel type (petrol, diesel, and others). SUVs and MPVs are likely to dominate the market due to their practicality and suitability to the UAE's lifestyle. The organized sector is expected to show greater growth due to its professional approach and reliability. Online booking is anticipated to continue its upward trajectory reflecting broader global e-commerce trends. However, challenges remain, including concerns about vehicle quality and maintenance costs, potentially impacting growth. Competition among established players like Al-Futtaim Group, Arabian Automobiles, and Al Tayer Motors, alongside emerging online marketplaces, intensifies market dynamism.

Used Cars Market In UAE Market Size (In Billion)

The forecast for the UAE used car market beyond 2025 is optimistic. Continued economic growth and government initiatives promoting sustainable transportation could further stimulate demand. However, potential restraints include fluctuations in fuel prices, import regulations, and the introduction of stricter emission standards. The market's success hinges on addressing consumer concerns regarding vehicle history and condition, and leveraging technological advancements to provide enhanced transparency and buyer protection. The strategic use of online platforms will be crucial for both established and emerging players aiming to capture market share in this competitive landscape. A focus on certified pre-owned vehicles, along with innovative financing options, will be key for driving further growth in the coming years.

Used Cars Market In UAE Company Market Share

Used Cars Market in UAE: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning used car market in the UAE, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages robust data and market intelligence to illuminate current market dynamics and future growth trajectories. The market size is projected to reach xx Million by 2033, representing a significant CAGR of xx% during the forecast period.

Used Cars Market In UAE Market Structure & Innovation Trends

This section analyzes the UAE's used car market structure, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user demographics, and M&A activities. The market is characterized by a mix of organized and unorganized players, with organized players such as CARS, OpenSooq.com, and CarSwitch holding significant market share. However, the unorganized sector remains substantial, contributing significantly to the overall market volume.

- Market Concentration: The market exhibits moderate concentration, with the top 5 players accounting for approximately xx% of the market share in 2024. The remaining share is distributed across numerous smaller dealerships and individual sellers.

- Innovation Drivers: Technological advancements such as online marketplaces and digital inspection tools are driving innovation, enhancing transparency, and improving customer experience.

- Regulatory Framework: Government regulations concerning vehicle inspections, emissions standards, and licensing contribute to market structure and competition.

- M&A Activities: The past five years have witnessed several M&A activities, with deal values totaling approximately xx Million. These mergers and acquisitions are mainly driven by consolidation efforts and expansion strategies. For example, CarSwitch's recent expansion plans signify a strategic move to consolidate market share.

- Product Substitutes: Public transportation and ride-hailing services pose some level of competitive pressure, but the demand for personal vehicles remains robust.

- End-User Demographics: The market caters to a diverse population, with significant demand across various age groups and income levels.

Used Cars Market In UAE Market Dynamics & Trends

The UAE's used car market is experiencing dynamic growth, fueled by several key factors. Rising disposable incomes, a growing population, and favorable government policies contribute to this expansion. Technological disruptions, such as online marketplaces, are transforming the buying and selling process, increasing transparency and convenience. Consumer preferences are shifting towards pre-owned vehicles due to their cost-effectiveness compared to new cars. Competitive dynamics are shaped by the presence of both established players and new entrants, leading to intense competition and innovation. The market witnessed a CAGR of xx% from 2019 to 2024, with a projected market penetration rate of xx% by 2033.

Dominant Regions & Segments in Used Cars Market In UAE

The UAE's used car market shows robust growth across various segments and regions. Dubai and Abu Dhabi remain the dominant regions, owing to their higher population density, economic activity, and well-developed infrastructure.

By Vehicle Type: SUVs and Sedans constitute the largest segments, driven by consumer preference and practicality.

By Vendor Type: The organized sector is witnessing faster growth compared to the unorganized sector due to increased trust and transparency.

By Booking Type: Online booking is gaining traction, but offline channels still play a vital role in the sales process.

By Fuel Type: Petrol-powered vehicles dominate, but the adoption of diesel and other fuel types is gradually increasing.

Key Drivers:

- Favorable economic conditions and robust infrastructure.

- Increased consumer preference for pre-owned vehicles.

- Growth of online marketplaces improving accessibility.

Used Cars Market In UAE Product Innovations

The used car market is witnessing continuous product innovation, with a focus on enhancing customer experience and transparency. Online platforms integrate features such as virtual inspections, detailed vehicle history reports, and secure payment gateways. These innovations aim to build trust and streamline the buying process, attracting more customers to online marketplaces. Technological advancements in vehicle inspection and certification are also improving the quality and reliability of used cars, enhancing consumer confidence.

Report Scope & Segmentation Analysis

This report segments the UAE used car market based on various parameters:

- Vehicle Type: Hatchbacks, Sedans, SUVs, and MPVs. Each segment demonstrates unique growth patterns influenced by consumer demand and vehicle availability.

- Vendor Type: Organized (dealerships, online marketplaces) and Unorganized (individual sellers). The organized sector is experiencing faster growth, driven by increased consumer trust and transparency.

- Booking Type: Online and Offline. Online bookings are growing, but offline channels remain prominent.

- Fuel Type: Petrol, Diesel, and Others. Petrol-fueled vehicles dominate due to wider availability and lower costs, though diesel and alternative fuels are gaining gradual traction.

Key Drivers of Used Cars Market In UAE Growth

The growth of the UAE used car market is primarily driven by a strong economy, rising disposable incomes, and a growing population. The increasing popularity of online marketplaces further boosts market growth by providing enhanced convenience and transparency. Government initiatives to improve infrastructure and streamline regulations also contribute positively.

Challenges in the Used Cars Market In UAE Sector

Challenges faced by the UAE used car market include the prevalence of unorganized sellers, potentially leading to issues with vehicle quality and authenticity. Competition among various players in both online and offline channels is intense, putting pressure on profit margins. Maintaining consistent vehicle quality across all vendors is another persistent challenge. Regulatory complexities related to vehicle registration and licensing can pose a barrier to entry for new players.

Emerging Opportunities in Used Cars Market In UAE

Several promising opportunities exist for growth in the UAE used car market. The expansion of online marketplaces offering financing and subscription models creates new revenue streams and customer acquisition opportunities. The adoption of innovative technologies, such as AI-powered vehicle valuation tools and blockchain-based vehicle history verification, can further improve transparency and trust. Growing consumer demand for eco-friendly vehicles presents an opportunity for growth in the used electric and hybrid vehicle segments.

Leading Players in the Used Cars Market In UAE Market

- CARS

- OpenSooq.com

- CarSwitch

- Al Nabooda Automobiles LLC

- Al-Futtaim group

- ARABIAN AUTOMOBILES CO LLC

- Yalla Motors.com

- ALBA TRADING FZC

- Al Tayer Motors

- SellAnyCar.com

Key Developments in Used Cars Market In UAE Industry

- October 2023: CarSwitch's expansion plans across the UAE, including new services like car financing and subscription models, and new physical showrooms, signify a major market disruption and expansion of services.

- January 2023: Linda Cars' new showroom expansion in Dubai demonstrates increased investment in the physical used car market and focus on luxury brands.

Future Outlook for Used Cars Market In UAE Market

The UAE's used car market is poised for continued growth, driven by sustained economic growth, favorable demographic trends, and technological advancements. The increasing adoption of online platforms, the expansion of financing options, and the growing popularity of subscription models will drive future market expansion. The market’s potential is significant, with ongoing expansion and innovation expected to shape its trajectory in the coming years.

Used Cars Market In UAE Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Booking Type

- 3.1. Online

- 3.2. Offline

-

4. Fuel Type

- 4.1. Petrol

- 4.2. Diesel

- 4.3. Others

Used Cars Market In UAE Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Used Cars Market In UAE Regional Market Share

Geographic Coverage of Used Cars Market In UAE

Used Cars Market In UAE REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Luxury Cars is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Comparatively Limited Market Transparency May Hinder the Market

- 3.4. Market Trends

- 3.4.1. The Sports Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs) Segment is Expected to Hold Higher Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Used Cars Market In UAE Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Booking Type

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Fuel Type

- 5.4.1. Petrol

- 5.4.2. Diesel

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Used Cars Market In UAE Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Hatchbacks

- 6.1.2. Sedans

- 6.1.3. Sports U

- 6.2. Market Analysis, Insights and Forecast - by Vendor Type

- 6.2.1. Organized

- 6.2.2. Unorganized

- 6.3. Market Analysis, Insights and Forecast - by Booking Type

- 6.3.1. Online

- 6.3.2. Offline

- 6.4. Market Analysis, Insights and Forecast - by Fuel Type

- 6.4.1. Petrol

- 6.4.2. Diesel

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. South America Used Cars Market In UAE Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Hatchbacks

- 7.1.2. Sedans

- 7.1.3. Sports U

- 7.2. Market Analysis, Insights and Forecast - by Vendor Type

- 7.2.1. Organized

- 7.2.2. Unorganized

- 7.3. Market Analysis, Insights and Forecast - by Booking Type

- 7.3.1. Online

- 7.3.2. Offline

- 7.4. Market Analysis, Insights and Forecast - by Fuel Type

- 7.4.1. Petrol

- 7.4.2. Diesel

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Europe Used Cars Market In UAE Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Hatchbacks

- 8.1.2. Sedans

- 8.1.3. Sports U

- 8.2. Market Analysis, Insights and Forecast - by Vendor Type

- 8.2.1. Organized

- 8.2.2. Unorganized

- 8.3. Market Analysis, Insights and Forecast - by Booking Type

- 8.3.1. Online

- 8.3.2. Offline

- 8.4. Market Analysis, Insights and Forecast - by Fuel Type

- 8.4.1. Petrol

- 8.4.2. Diesel

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Middle East & Africa Used Cars Market In UAE Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Hatchbacks

- 9.1.2. Sedans

- 9.1.3. Sports U

- 9.2. Market Analysis, Insights and Forecast - by Vendor Type

- 9.2.1. Organized

- 9.2.2. Unorganized

- 9.3. Market Analysis, Insights and Forecast - by Booking Type

- 9.3.1. Online

- 9.3.2. Offline

- 9.4. Market Analysis, Insights and Forecast - by Fuel Type

- 9.4.1. Petrol

- 9.4.2. Diesel

- 9.4.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Asia Pacific Used Cars Market In UAE Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Hatchbacks

- 10.1.2. Sedans

- 10.1.3. Sports U

- 10.2. Market Analysis, Insights and Forecast - by Vendor Type

- 10.2.1. Organized

- 10.2.2. Unorganized

- 10.3. Market Analysis, Insights and Forecast - by Booking Type

- 10.3.1. Online

- 10.3.2. Offline

- 10.4. Market Analysis, Insights and Forecast - by Fuel Type

- 10.4.1. Petrol

- 10.4.2. Diesel

- 10.4.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CARS

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 OpenSooq com

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Carswitc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Nabooda Automobiles LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Al-Futtaim group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ARABIAN AUTOMOBILES CO LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yalla Motors com

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ALBA TRADING FZC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Tayer Motors

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SellAnyCar Com

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CARS

List of Figures

- Figure 1: Global Used Cars Market In UAE Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Used Cars Market In UAE Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Used Cars Market In UAE Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Used Cars Market In UAE Revenue (Million), by Vendor Type 2025 & 2033

- Figure 5: North America Used Cars Market In UAE Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 6: North America Used Cars Market In UAE Revenue (Million), by Booking Type 2025 & 2033

- Figure 7: North America Used Cars Market In UAE Revenue Share (%), by Booking Type 2025 & 2033

- Figure 8: North America Used Cars Market In UAE Revenue (Million), by Fuel Type 2025 & 2033

- Figure 9: North America Used Cars Market In UAE Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 10: North America Used Cars Market In UAE Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Used Cars Market In UAE Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Used Cars Market In UAE Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: South America Used Cars Market In UAE Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: South America Used Cars Market In UAE Revenue (Million), by Vendor Type 2025 & 2033

- Figure 15: South America Used Cars Market In UAE Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 16: South America Used Cars Market In UAE Revenue (Million), by Booking Type 2025 & 2033

- Figure 17: South America Used Cars Market In UAE Revenue Share (%), by Booking Type 2025 & 2033

- Figure 18: South America Used Cars Market In UAE Revenue (Million), by Fuel Type 2025 & 2033

- Figure 19: South America Used Cars Market In UAE Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 20: South America Used Cars Market In UAE Revenue (Million), by Country 2025 & 2033

- Figure 21: South America Used Cars Market In UAE Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Used Cars Market In UAE Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Europe Used Cars Market In UAE Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Europe Used Cars Market In UAE Revenue (Million), by Vendor Type 2025 & 2033

- Figure 25: Europe Used Cars Market In UAE Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 26: Europe Used Cars Market In UAE Revenue (Million), by Booking Type 2025 & 2033

- Figure 27: Europe Used Cars Market In UAE Revenue Share (%), by Booking Type 2025 & 2033

- Figure 28: Europe Used Cars Market In UAE Revenue (Million), by Fuel Type 2025 & 2033

- Figure 29: Europe Used Cars Market In UAE Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 30: Europe Used Cars Market In UAE Revenue (Million), by Country 2025 & 2033

- Figure 31: Europe Used Cars Market In UAE Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Used Cars Market In UAE Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 33: Middle East & Africa Used Cars Market In UAE Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 34: Middle East & Africa Used Cars Market In UAE Revenue (Million), by Vendor Type 2025 & 2033

- Figure 35: Middle East & Africa Used Cars Market In UAE Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 36: Middle East & Africa Used Cars Market In UAE Revenue (Million), by Booking Type 2025 & 2033

- Figure 37: Middle East & Africa Used Cars Market In UAE Revenue Share (%), by Booking Type 2025 & 2033

- Figure 38: Middle East & Africa Used Cars Market In UAE Revenue (Million), by Fuel Type 2025 & 2033

- Figure 39: Middle East & Africa Used Cars Market In UAE Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 40: Middle East & Africa Used Cars Market In UAE Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East & Africa Used Cars Market In UAE Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Used Cars Market In UAE Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 43: Asia Pacific Used Cars Market In UAE Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 44: Asia Pacific Used Cars Market In UAE Revenue (Million), by Vendor Type 2025 & 2033

- Figure 45: Asia Pacific Used Cars Market In UAE Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 46: Asia Pacific Used Cars Market In UAE Revenue (Million), by Booking Type 2025 & 2033

- Figure 47: Asia Pacific Used Cars Market In UAE Revenue Share (%), by Booking Type 2025 & 2033

- Figure 48: Asia Pacific Used Cars Market In UAE Revenue (Million), by Fuel Type 2025 & 2033

- Figure 49: Asia Pacific Used Cars Market In UAE Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 50: Asia Pacific Used Cars Market In UAE Revenue (Million), by Country 2025 & 2033

- Figure 51: Asia Pacific Used Cars Market In UAE Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Used Cars Market In UAE Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Used Cars Market In UAE Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Global Used Cars Market In UAE Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 4: Global Used Cars Market In UAE Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 5: Global Used Cars Market In UAE Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Used Cars Market In UAE Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Used Cars Market In UAE Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 8: Global Used Cars Market In UAE Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 9: Global Used Cars Market In UAE Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 10: Global Used Cars Market In UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Used Cars Market In UAE Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Used Cars Market In UAE Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 16: Global Used Cars Market In UAE Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 17: Global Used Cars Market In UAE Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 18: Global Used Cars Market In UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Brazil Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Used Cars Market In UAE Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Used Cars Market In UAE Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 24: Global Used Cars Market In UAE Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 25: Global Used Cars Market In UAE Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 26: Global Used Cars Market In UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: France Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Spain Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Benelux Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Used Cars Market In UAE Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 37: Global Used Cars Market In UAE Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 38: Global Used Cars Market In UAE Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 39: Global Used Cars Market In UAE Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 40: Global Used Cars Market In UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Turkey Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Israel Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: GCC Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: North Africa Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: South Africa Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Global Used Cars Market In UAE Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 48: Global Used Cars Market In UAE Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 49: Global Used Cars Market In UAE Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 50: Global Used Cars Market In UAE Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 51: Global Used Cars Market In UAE Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Oceania Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Used Cars Market In UAE Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Used Cars Market In UAE?

The projected CAGR is approximately 11.73%.

2. Which companies are prominent players in the Used Cars Market In UAE?

Key companies in the market include CARS, OpenSooq com, Carswitc, Al Nabooda Automobiles LLC, Al-Futtaim group, ARABIAN AUTOMOBILES CO LLC, Yalla Motors com, ALBA TRADING FZC, Al Tayer Motors, SellAnyCar Com.

3. What are the main segments of the Used Cars Market In UAE?

The market segments include Vehicle Type, Vendor Type, Booking Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.39 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Luxury Cars is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

The Sports Utility Vehicles (SUVs) and Multi-Purpose Vehicles (MPVs) Segment is Expected to Hold Higher Share in the Market.

7. Are there any restraints impacting market growth?

Comparatively Limited Market Transparency May Hinder the Market.

8. Can you provide examples of recent developments in the market?

October 2023: CarSwitch, a Dubai-based online used car marketplace, announced its plans to expand its operations across the United Arab Emirates and launch new services, such as car financing and subscription services. The company is also planning to open new physical showrooms in major cities across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Used Cars Market In UAE," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Used Cars Market In UAE report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Used Cars Market In UAE?

To stay informed about further developments, trends, and reports in the Used Cars Market In UAE, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence