Key Insights

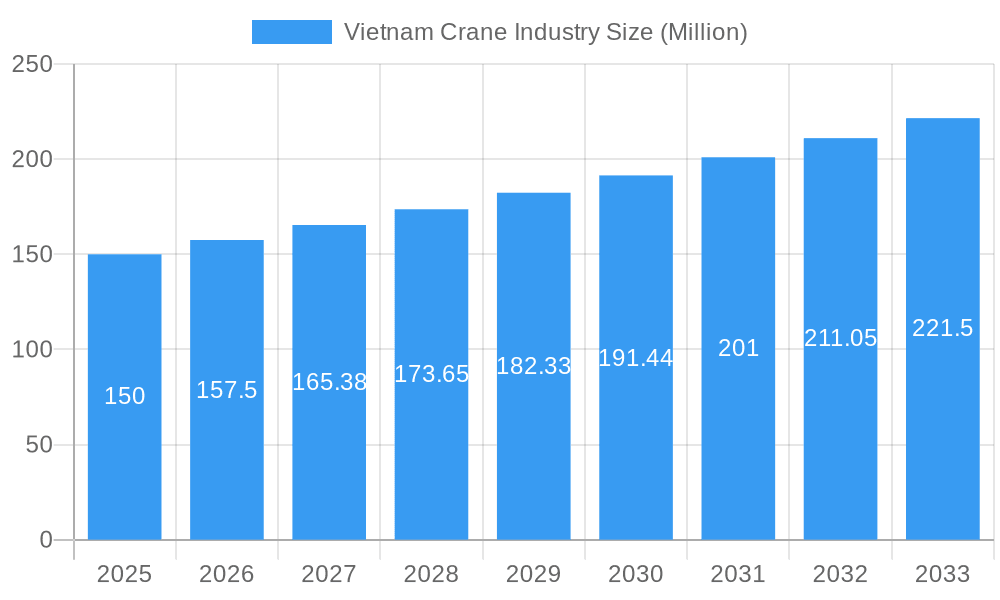

The Vietnam crane market, valued at approximately $223.9 million in the base year 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.23%. This robust growth is primarily driven by significant infrastructure development, including port expansions, industrial zone establishment, and urban area enhancement. The burgeoning construction and mining sectors, alongside substantial investments in renewable energy projects like wind and solar farms, are creating a sustained demand for various crane types. The market is segmented by crane type (mobile, fixed, marine/offshore) and application (construction, mining, marine, industrial), with mobile cranes leading due to their inherent versatility. Supportive government policies for infrastructure development are advantageous, though potential challenges include commodity price volatility impacting mining and global supply chain disruptions affecting imports and component availability. The competitive landscape features both global leaders such as Liebherr and Konecranes, and prominent local entities like Vietnam Steel Structures and Lifting Equipment JSC. The sector anticipates increased adoption of technologically advanced cranes with enhanced safety features and automation capabilities.

Vietnam Crane Industry Market Size (In Million)

The outlook for the Vietnam crane market is highly positive, with substantial growth anticipated over the coming decade. Continued modernization and expansion of Vietnam's infrastructure will remain a key demand driver. The integration of advanced crane technologies will improve operational efficiency and safety, contributing to overall market expansion. Intense competition from both international and domestic manufacturers is expected to foster innovation and price optimization. Strategic management of supply chain complexities and adaptability to fluctuating commodity prices will be critical for sustained company success in this dynamic sector. Furthermore, an increasing emphasis on sustainability and environmentally conscious crane operations may emerge as a significant future trend.

Vietnam Crane Industry Company Market Share

Vietnam Crane Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Vietnam crane industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Expect detailed market sizing (in Millions USD), segmentation, competitive landscape analysis, and future growth projections.

Vietnam Crane Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of Vietnam's crane market, examining market concentration, innovation drivers, regulatory frameworks, and key industry activities. The analysis considers the impact of mergers & acquisitions (M&A) and explores the dynamics of product substitution within the sector.

Market Concentration: The Vietnam crane market exhibits a moderately concentrated structure, with a few major players holding significant market share. The top 5 players account for approximately XX% of the total market revenue in 2025.

Innovation Drivers: Technological advancements, such as the adoption of automation and digitalization, are key innovation drivers in this industry. Stringent safety regulations also push innovation towards safer and more efficient crane technologies.

Regulatory Framework: Government regulations regarding safety standards and environmental protection significantly influence market operations. Compliance costs and the complexity of regulations can impact market growth.

Product Substitutes: The crane market faces competition from alternative lifting and material handling solutions. These include specialized vehicles and customized lifting systems. However, the versatility and heavy-duty capabilities of cranes sustain their demand.

End-User Demographics: The industry caters to various end-users, including construction companies, infrastructure projects, mining operations, and ports. The construction and infrastructure sector, driven by significant government spending, comprises the largest end-user segment.

M&A Activities: The forecast period (2025-2033) will likely witness increased M&A activities, with estimated deal values exceeding $XX Million by 2033. This is driven by consolidation trends and a desire to expand market share.

Vietnam Crane Industry Market Dynamics & Trends

The Vietnam crane industry is experiencing a period of robust growth, driven by a confluence of factors shaping its market dynamics and future trajectory. This section analyzes the key elements influencing this expansion, including growth drivers, technological advancements, evolving consumer preferences, and the competitive landscape.

Market projections indicate a strong Compound Annual Growth Rate (CAGR) of XX% for the Vietnam crane market between 2025 and 2033. This significant expansion is fueled by several key factors:

- Rapid Infrastructure Development: Large-scale infrastructure projects, spurred by government initiatives, create substantial demand for cranes across various applications.

- Booming Industrialization: Vietnam's burgeoning industrial sector necessitates efficient material handling solutions, significantly boosting the need for cranes in manufacturing and logistics.

- Construction Sector Boom: The construction sector, fueled by both residential and commercial development, is a major driver of crane demand, particularly for mobile and tower cranes.

- Marine and Offshore Activities: Investments in port expansion and offshore energy projects are creating significant opportunities for specialized marine and offshore cranes.

- Technological Innovation: Advancements in crane technology, such as remote operation, improved safety features, and automation, are enhancing efficiency and attracting increased investment.

- Growing Focus on Sustainability: The increasing emphasis on environmentally friendly practices is driving demand for energy-efficient and sustainable crane solutions.

- Increased Competition: The competitive landscape is intensifying, necessitating continuous innovation, strategic partnerships, and a focus on delivering customized solutions to meet specific industry needs.

The market is also witnessing a notable shift towards specialized cranes and customized solutions tailored to the unique requirements of diverse industries. The integration of Internet of Things (IoT) technology is further enhancing operational efficiency and data-driven decision-making.

Dominant Regions & Segments in Vietnam Crane Industry

This section provides a detailed analysis of the leading regions and segments within the dynamic Vietnam crane market, highlighting their current dominance and future growth potential.

By Crane Type:

Mobile Cranes: This segment maintains its leading position due to its versatility and applicability across diverse sectors, particularly construction and infrastructure projects. The demand for mobile cranes is expected to remain strong, driven by ongoing infrastructure development.

Fixed Cranes: The fixed crane segment is experiencing steady growth, primarily driven by the requirements of port operations, heavy industrial applications, and large-scale manufacturing facilities.

Marine and Offshore Cranes: This specialized segment is poised for significant growth, fueled by continuous investment in port expansion and the development of offshore energy resources.

Tower Cranes: The increasing number of high-rise construction projects is fueling the demand for tower cranes, contributing significantly to this segment's growth.

By Application Type:

Construction and Infrastructure: This segment remains the largest market share, driven by robust government investment in infrastructure development and the expansion of urban areas. The ongoing demand for housing and commercial spaces further propels the growth of this sector.

Mining and Excavation: This segment exhibits consistent growth, reflecting Vietnam's expanding mining sector. However, compared to the construction sector, its growth may be comparatively more moderate.

Marine and Offshore: This segment is projected to show substantial growth driven by significant investments in port infrastructure upgrades and the exploration of offshore resources.

Industrial Applications: The industrial applications segment is characterized by moderate but steady growth, reflecting the increasing industrial activity and manufacturing output in Vietnam.

Other Applications: This segment encompasses a variety of niche applications and demonstrates growth consistent with the overall economic expansion of the country.

Vietnam Crane Industry Product Innovations

Recent innovations focus on enhancing safety, efficiency, and precision. The incorporation of advanced technologies like remote control and automated systems is boosting productivity while reducing safety risks. These innovations are improving the overall efficiency of operations and satisfying the demand for specialized applications. The trend toward energy-efficient designs and environmentally friendly components is gaining momentum.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Vietnam crane industry, segmented by type (Mobile, Fixed, Marine & Offshore) and application (Construction & Infrastructure, Mining & Excavation, Marine & Offshore, Industrial, Other). Each segment's market size, growth projections, and competitive dynamics are analyzed. The report considers various market factors, including regulatory changes, technological developments, and economic conditions.

Key Drivers of Vietnam Crane Industry Growth

The remarkable growth of the Vietnam crane industry is fueled by several key drivers:

Government Infrastructure Initiatives: Ambitious government programs focused on infrastructure development are significantly boosting demand for cranes.

Rapid Industrialization and Economic Growth: Vietnam's rapid economic growth and industrial expansion are creating a strong need for efficient material handling solutions.

Favorable Government Policies: Supportive government policies, including tax incentives and investment promotion strategies, create a conducive environment for industry growth.

Foreign Direct Investment (FDI): Significant FDI inflows are contributing to the expansion of various sectors, leading to increased demand for cranes.

Challenges in the Vietnam Crane Industry Sector

Challenges include:

Stringent safety regulations: Compliance with strict safety standards involves substantial investment and operational complexities.

Supply chain disruptions: Global supply chain volatility may affect the availability of components and impact production timelines.

Intense competition: The market's competitive nature necessitates continuous innovation and strategic adjustments.

Emerging Opportunities in Vietnam Crane Industry

The Vietnam crane industry presents numerous promising opportunities for growth and expansion:

Expansion into Renewable Energy: The burgeoning renewable energy sector presents significant opportunities for cranes involved in the construction and maintenance of renewable energy infrastructure.

Technological Advancements: The adoption of advanced technologies, such as automation, remote control, and digital monitoring systems, offers significant improvements in efficiency and safety.

Focus on Sustainability and Energy Efficiency: The increasing demand for eco-friendly and energy-efficient cranes opens avenues for innovative solutions.

Specialized Crane Solutions: The development and provision of specialized crane solutions tailored to the specific needs of various industries creates a strong competitive advantage.

Leading Players in the Vietnam Crane Industry Market

- Favelle Favco Group

- Konecranes PLC

- Palfinger Marine Vietnam Co Ltd

- Vietnam Steel Structures and Lifting Equipment JSC

- Liebherr-International A

- Kato Works Co Ltd

- Sumitomo Heavy Industries Construction Cranes Co Ltd

- Cargotec OYJ

- Manitowoc

- Kobelco International (S) Co Pte Ltd

- Quang Lien Crane Elevator Co Ltd

- Zoomlion Heavy Industry Science and Technology Co Ltd

- Tadano Ltd

Key Developments in Vietnam Crane Industry Industry

- 2022 Q4: Zoomlion launched a new series of electric cranes focusing on sustainable operations.

- 2023 Q1: Konecranes and a local partner established a joint venture for crane services.

- 2023 Q2: New safety regulations were implemented, impacting the market. (Further details on specific regulations would be included in the full report.)

Future Outlook for Vietnam Crane Industry Market

The future outlook for the Vietnam crane market remains exceptionally positive. Sustained infrastructure development, ongoing industrial expansion, and the continuous adoption of advanced technologies all contribute to a promising growth trajectory. Strategic partnerships, a commitment to technological innovation, and a focus on sustainability will be crucial factors in determining market success. The market is poised for substantial growth, with a highly optimistic outlook for the next decade and beyond.

Vietnam Crane Industry Segmentation

-

1. Type

- 1.1. Mobile Crane

- 1.2. Fixed Cranes

- 1.3. Marine and Off-shore Cranes

-

2. Application Type

- 2.1. Construction and Infrastructure

- 2.2. Mining and Excavation

- 2.3. Marine and Off-Shore

- 2.4. Industrial Applications

- 2.5. Other Applications

Vietnam Crane Industry Segmentation By Geography

- 1. Vietnam

Vietnam Crane Industry Regional Market Share

Geographic Coverage of Vietnam Crane Industry

Vietnam Crane Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Rental and Used Cranes may Hinder the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Crane Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile Crane

- 5.1.2. Fixed Cranes

- 5.1.3. Marine and Off-shore Cranes

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Construction and Infrastructure

- 5.2.2. Mining and Excavation

- 5.2.3. Marine and Off-Shore

- 5.2.4. Industrial Applications

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Favelle Favco Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Konecranes PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Palfinger Marine Vietnam Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vietnam Steel Structures and Lifting Equipment JSC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr-International A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kato Works Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sumitomo Heavy Industries Construction Cranes Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cargotec OYJ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Manitowoc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kobelco International (S) Co Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Quang Lien Crane Elevator Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Zoomlion Heavy Industry Science and Technology Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Tadano Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Favelle Favco Group

List of Figures

- Figure 1: Vietnam Crane Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Vietnam Crane Industry Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Crane Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Vietnam Crane Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: Vietnam Crane Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Vietnam Crane Industry Revenue million Forecast, by Type 2020 & 2033

- Table 5: Vietnam Crane Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 6: Vietnam Crane Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Crane Industry?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Vietnam Crane Industry?

Key companies in the market include Favelle Favco Group, Konecranes PLC, Palfinger Marine Vietnam Co Ltd, Vietnam Steel Structures and Lifting Equipment JSC, Liebherr-International A, Kato Works Co Ltd, Sumitomo Heavy Industries Construction Cranes Co Ltd, Cargotec OYJ, Manitowoc, Kobelco International (S) Co Pte Ltd, Quang Lien Crane Elevator Co Ltd, Zoomlion Heavy Industry Science and Technology Co Ltd, Tadano Ltd.

3. What are the main segments of the Vietnam Crane Industry?

The market segments include Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 223.9 million as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Increasing Demand for Rental and Used Cranes may Hinder the Growth of the Market.

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Crane Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Crane Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Crane Industry?

To stay informed about further developments, trends, and reports in the Vietnam Crane Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence