Key Insights

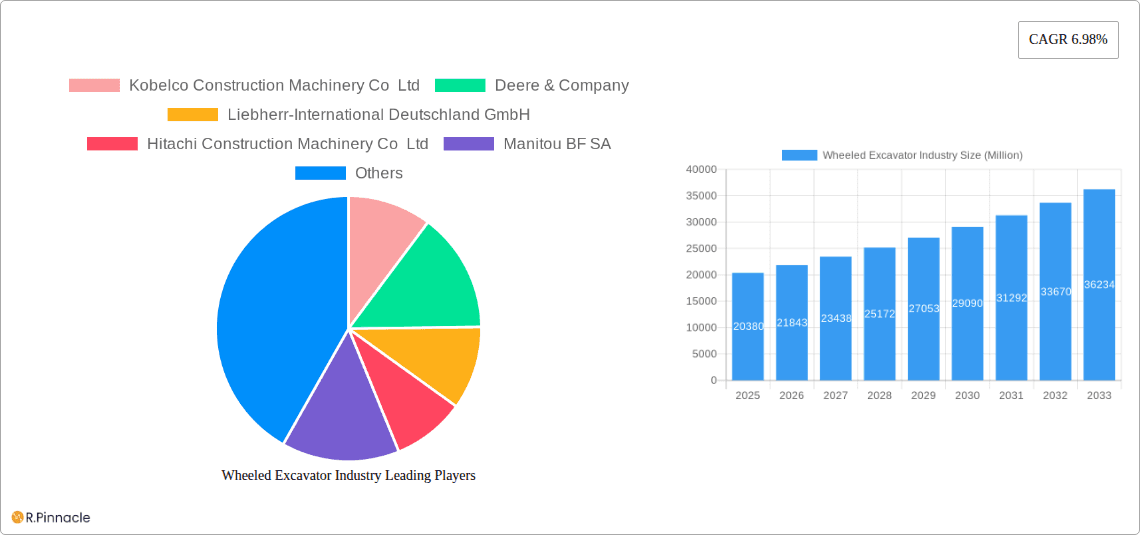

The European wheeled excavator market, valued at €20.38 billion in 2025, is projected to experience robust growth, driven by increasing infrastructure development projects across major economies like Germany, the UK, France, and Italy. The market's Compound Annual Growth Rate (CAGR) of 6.98% from 2025 to 2033 signifies a consistently expanding demand for efficient earthmoving solutions. Key drivers include the rising adoption of electric and hybrid models, spurred by stricter emission regulations and a focus on sustainable construction practices. Furthermore, advancements in technology, such as enhanced automation and telematics, are increasing the appeal of wheeled excavators for improved productivity and operational efficiency. Competition among major players like Kobelco, Deere & Company, Liebherr, Hitachi, and Caterpillar fuels innovation and market expansion. The segmentation by machinery type (excavator, loader) and drive type (hydraulic, electric, hybrid) highlights diverse customer needs and technological trends. While the market faces challenges from fluctuating raw material prices and potential economic downturns, the long-term outlook remains positive due to the ongoing demand for infrastructure upgrades and development across the region.

Wheeled Excavator Industry Market Size (In Billion)

The growth trajectory is expected to be particularly strong in countries with robust construction sectors and government investments in infrastructure modernization. Germany, the UK, and France are projected to remain dominant markets, while smaller European nations are expected to see a surge in adoption of wheeled excavators due to increased focus on local infrastructure improvements. The shift towards sustainable construction will favor the uptake of electric and hybrid models, ultimately leading to increased market penetration of these technologies and influencing the overall market share distribution among different drive types. The competitive landscape, characterized by established players and emerging technological innovators, ensures constant improvements in product features and services, thereby benefiting the end-users. This dynamic interplay of technological advancement, economic factors, and market competition is expected to further propel the growth of the European wheeled excavator market over the forecast period.

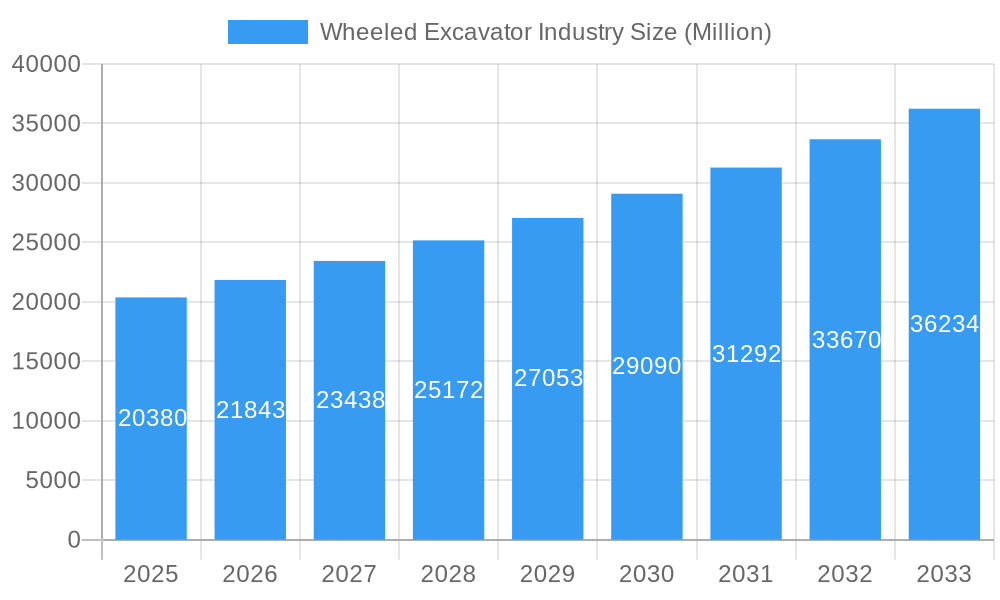

Wheeled Excavator Industry Company Market Share

Wheeled Excavator Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global wheeled excavator industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, competitive landscapes, and future growth opportunities within this dynamic sector. The report projects a market value of xx Million by 2033.

Wheeled Excavator Industry Market Structure & Innovation Trends

The wheeled excavator market exhibits a moderately concentrated structure, with key players such as Kobelco Construction Machinery Co Ltd, Deere & Company, Liebherr-International Deutschland GmbH, Hitachi Construction Machinery Co Ltd, Manitou BF SA, Caterpillar Inc, Doosan Infracore Co Ltd, Volvo Construction Equipment, Komatsu Ltd, CNH Industrial NV, and Yanmar Construction Equipment Co Ltd holding significant market share. Market share fluctuates based on technological advancements and regional demand.

Innovation is driven by stricter emission regulations, the increasing demand for fuel-efficient and environmentally friendly machines, and the growing adoption of automation and digital technologies. Mergers and acquisitions (M&A) play a significant role in shaping the market landscape, with deal values reaching xx Million annually in recent years. Key M&A activities include strategic partnerships focused on technological integration and expansion into new markets. Product substitution is primarily driven by advancements in electric and hybrid drive systems, which present more sustainable and cost-effective alternatives. The primary end-users are construction companies, mining operations, and infrastructure development projects.

Wheeled Excavator Industry Market Dynamics & Trends

The global wheeled excavator market is experiencing a significant upswing, propelled by a surge in infrastructure development projects worldwide. This upward trajectory is further amplified by increasing urbanization and industrialization, particularly in emerging economies, driving a projected Compound Annual Growth Rate (CAGR) of **[Insert XX% here]** over the forecast period of 2025-2033. A pivotal shift is underway with the growing adoption of electric and hybrid models, signaling a strong consumer preference for environmentally sustainable and highly efficient construction equipment. The market penetration of electric excavators, in particular, is forecasted to grow at a CAGR of **[Insert XX% here]**, with an anticipated market share of **[Insert XX% here]** by 2033. The competitive landscape is dynamic, marked by intense rivalry among established manufacturers and the strategic entry of new players, fostering an environment of continuous innovation and a focus on optimized pricing strategies. The market's ongoing evolution is intricately linked to the volatility of raw material costs and the ever-changing landscape of government regulations concerning emissions standards and operational safety.

Dominant Regions & Segments in Wheeled Excavator Industry

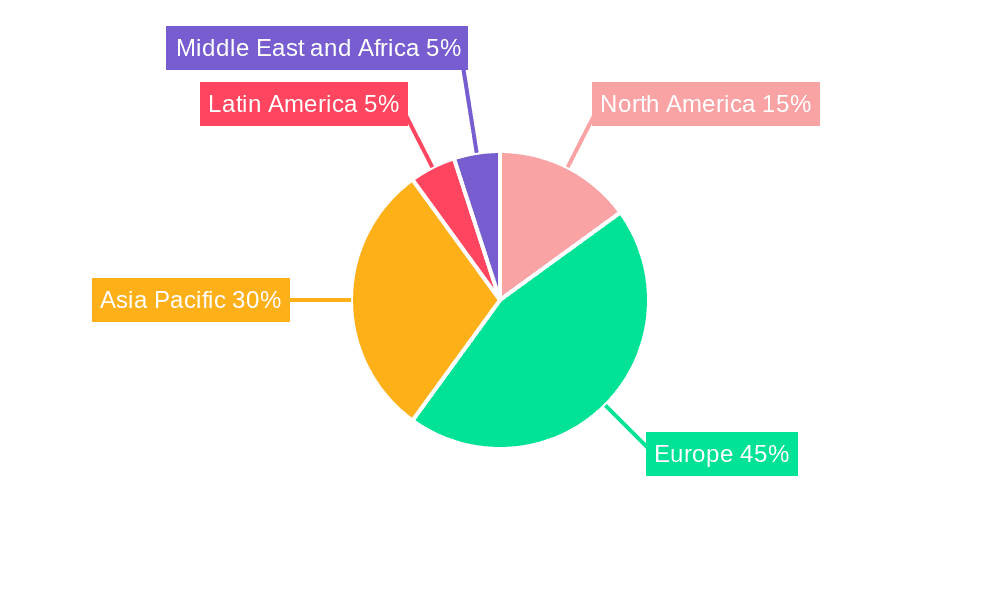

- By Country: Europe stands as the dominant force in the wheeled excavator market, with Germany, the United Kingdom, and France leading the charge, largely attributed to their robust infrastructure development initiatives and mature construction sectors. The broader "Rest of Europe" also contributes substantially to the market's regional strength.

- By Machinery Type: Excavators, owing to their inherent versatility across a wide spectrum of applications, command the largest market share. The loader segment is also witnessing substantial growth, driven by its efficacy in material handling operations.

- By Drive Type: While hydraulic drive systems continue to hold the predominant market share, electric and hybrid drive configurations are rapidly gaining prominence. This surge is primarily fueled by growing environmental consciousness and supportive governmental policies advocating for cleaner energy solutions.

Key contributors to regional market dominance include sustained economic growth, substantial government investments in vital infrastructure projects, and a supportive regulatory framework. Germany's advanced automotive industry and its well-established expertise in sophisticated engineering further solidify its leadership position within this market segment.

Wheeled Excavator Industry Product Innovations

The cutting edge of innovation within the wheeled excavator industry is sharply focused on minimizing environmental impact through reduced emissions and maximizing operational efficiency. The increasing popularity of electric and hybrid variants offers a compelling eco-friendly alternative to conventional hydraulic excavators. Beyond powertrain advancements, product innovation is also driven by the integration of sophisticated automation features, the enhancement of safety systems for operators and job sites, and the deployment of advanced telematics solutions. These technological strides collectively contribute to a significant boost in the overall productivity and cost-effectiveness of wheeled excavators, making them a more attractive proposition for clients across diverse industrial sectors.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the wheeled excavator market across the following key dimensions:

By Machinery Type: Detailed analysis of the Excavator and Loader segments, encompassing their respective market sizes, future growth projections, and prevailing competitive dynamics.

By Drive Type: In-depth examination of the Hydraulic, Electric, and Hybrid segments, with a particular emphasis on technology adoption trends, economic viability, and the environmental footprint of each drive system.

By Country: Granular analysis of key markets including Germany, the United Kingdom, Italy, France, and the broader Rest of Europe, providing region-specific insights informed by economic indicators and ongoing infrastructure development.

Key Drivers of Wheeled Excavator Industry Growth

The wheeled excavator market is experiencing growth due to several factors: Increased government spending on infrastructure projects globally fuels demand. Rapid urbanization and industrialization in developing nations drive construction activities. Technological advancements, such as electric and hybrid models, cater to environmental concerns. Improving economic conditions in several regions boost demand for construction equipment. Favorable government policies and incentives supporting infrastructure projects further drive growth.

Challenges in the Wheeled Excavator Industry Sector

The wheeled excavator industry navigates several critical challenges. Fluctuations in the cost of raw materials present a significant hurdle, directly impacting manufacturing expenses. Disruptions within global supply chains lead to production delays and escalating operational costs. Increasingly stringent emission regulations necessitate substantial investment in technological upgrades to ensure compliance. The fiercely competitive market, characterized by the presence of established giants and nimble new entrants, exerts considerable pressure on pricing and profit margins. Furthermore, periods of economic downturn or instability in key geographical markets can adversely affect overall demand for these essential construction machines.

Emerging Opportunities in Wheeled Excavator Industry

Opportunities lie in developing advanced automation and autonomous systems for increased efficiency. Expansion into new markets, particularly in rapidly developing economies, presents significant potential. Focus on developing more sustainable and environmentally friendly products caters to growing global demand. Exploring strategic partnerships and M&A activities facilitates technological integration and market expansion. Developing niche applications tailored to specific needs and industries offers growth opportunities.

Leading Players in the Wheeled Excavator Industry Market

- Kobelco Construction Machinery Co Ltd

- Deere & Company

- Liebherr-International Deutschland GmbH

- Hitachi Construction Machinery Co Ltd

- Manitou BF SA

- Caterpillar Inc

- Doosan Infracore Co Ltd

- Volvo Construction Equipment

- Komatsu Ltd

- CNH Industrial NV

- Yanmar Construction Equipment Co Ltd

Key Developments in Wheeled Excavator Industry

- September 2023: Sunward Europe unveiled a new 15-ton wheeled excavator at MATEXPO.

- July 2023: Komatsu Europe launched the PC33E-6 electric mini excavator.

- June 2023: Volvo CE launched the EC230 Electric mid-size excavator.

- November 2022: New Holland Construction launched fifteen new excavator models, including two electric ones.

- October 2022: Komatsu unveiled its first battery electric wheel loader.

Future Outlook for Wheeled Excavator Industry Market

The future outlook for the wheeled excavator market remains positive, driven by sustained infrastructure development, increasing urbanization, and the ongoing adoption of electric and hybrid technologies. Strategic investments in research and development, along with the exploration of new markets and applications, will further fuel market growth. The industry is poised for significant expansion, propelled by technological advancements and favorable economic conditions in key regions.

Wheeled Excavator Industry Segmentation

-

1. Machinery Type

- 1.1. Excavator

- 1.2. Loader

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric

- 2.3. Hybrid

Wheeled Excavator Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Wheeled Excavator Industry Regional Market Share

Geographic Coverage of Wheeled Excavator Industry

Wheeled Excavator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing infrastructural development Across the Region

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Excavator Holds the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Excavator

- 5.1.2. Loader

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. North America Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Excavator

- 6.1.2. Loader

- 6.2. Market Analysis, Insights and Forecast - by Drive Type

- 6.2.1. Hydraulic

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. South America Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Excavator

- 7.1.2. Loader

- 7.2. Market Analysis, Insights and Forecast - by Drive Type

- 7.2.1. Hydraulic

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Europe Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Excavator

- 8.1.2. Loader

- 8.2. Market Analysis, Insights and Forecast - by Drive Type

- 8.2.1. Hydraulic

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Middle East & Africa Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Excavator

- 9.1.2. Loader

- 9.2. Market Analysis, Insights and Forecast - by Drive Type

- 9.2.1. Hydraulic

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Asia Pacific Wheeled Excavator Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Excavator

- 10.1.2. Loader

- 10.2. Market Analysis, Insights and Forecast - by Drive Type

- 10.2.1. Hydraulic

- 10.2.2. Electric

- 10.2.3. Hybrid

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kobelco Construction Machinery Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Deere & Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Liebherr-International Deutschland GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Construction Machinery Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Manitou BF SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Caterpillar Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Doosan Infracore Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Volvo Construction Equipment*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Komatsu Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CNH Industrial NV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yanmar Construction Equipment Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Kobelco Construction Machinery Co Ltd

List of Figures

- Figure 1: Global Wheeled Excavator Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 3: North America Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: North America Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 5: North America Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 6: North America Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 9: South America Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 10: South America Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 11: South America Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 12: South America Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 15: Europe Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 16: Europe Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 17: Europe Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 18: Europe Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 21: Middle East & Africa Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 22: Middle East & Africa Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 23: Middle East & Africa Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 24: Middle East & Africa Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Wheeled Excavator Industry Revenue (Million), by Machinery Type 2025 & 2033

- Figure 27: Asia Pacific Wheeled Excavator Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Asia Pacific Wheeled Excavator Industry Revenue (Million), by Drive Type 2025 & 2033

- Figure 29: Asia Pacific Wheeled Excavator Industry Revenue Share (%), by Drive Type 2025 & 2033

- Figure 30: Asia Pacific Wheeled Excavator Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Wheeled Excavator Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: Global Wheeled Excavator Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 5: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 11: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 12: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 17: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 18: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 29: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 30: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Wheeled Excavator Industry Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 38: Global Wheeled Excavator Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 39: Global Wheeled Excavator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Wheeled Excavator Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wheeled Excavator Industry?

The projected CAGR is approximately 6.98%.

2. Which companies are prominent players in the Wheeled Excavator Industry?

Key companies in the market include Kobelco Construction Machinery Co Ltd, Deere & Company, Liebherr-International Deutschland GmbH, Hitachi Construction Machinery Co Ltd, Manitou BF SA, Caterpillar Inc, Doosan Infracore Co Ltd, Volvo Construction Equipment*List Not Exhaustive, Komatsu Ltd, CNH Industrial NV, Yanmar Construction Equipment Co Ltd.

3. What are the main segments of the Wheeled Excavator Industry?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing infrastructural development Across the Region.

6. What are the notable trends driving market growth?

Excavator Holds the Highest Share.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

September 2023: Sunward Europe unveiled a new 15-ton wheeled excavator at the upcoming MATEXPO exhibition (September 6-10) near their European headquarters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wheeled Excavator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wheeled Excavator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wheeled Excavator Industry?

To stay informed about further developments, trends, and reports in the Wheeled Excavator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence