Key Insights

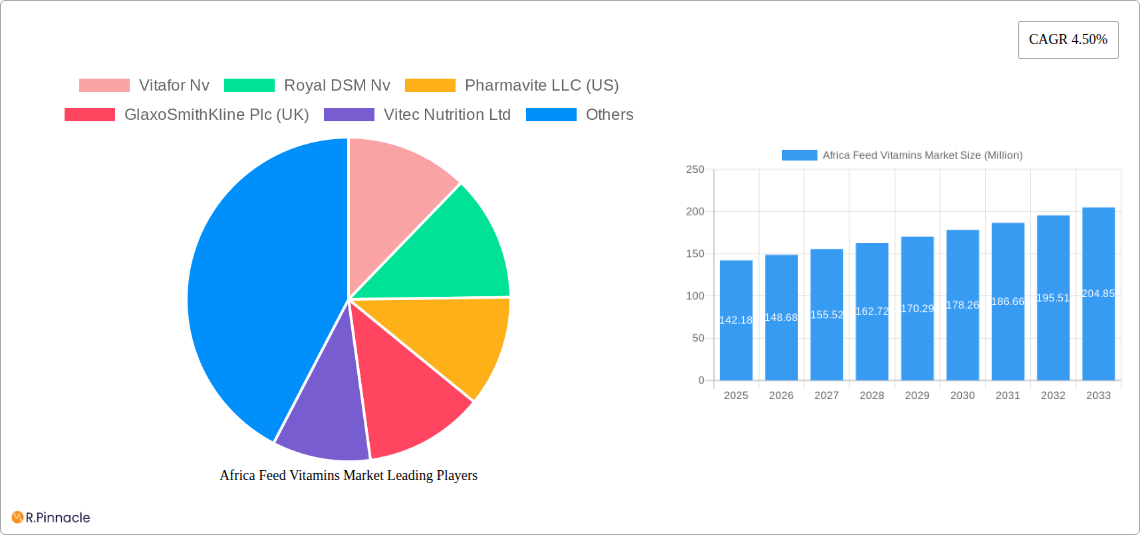

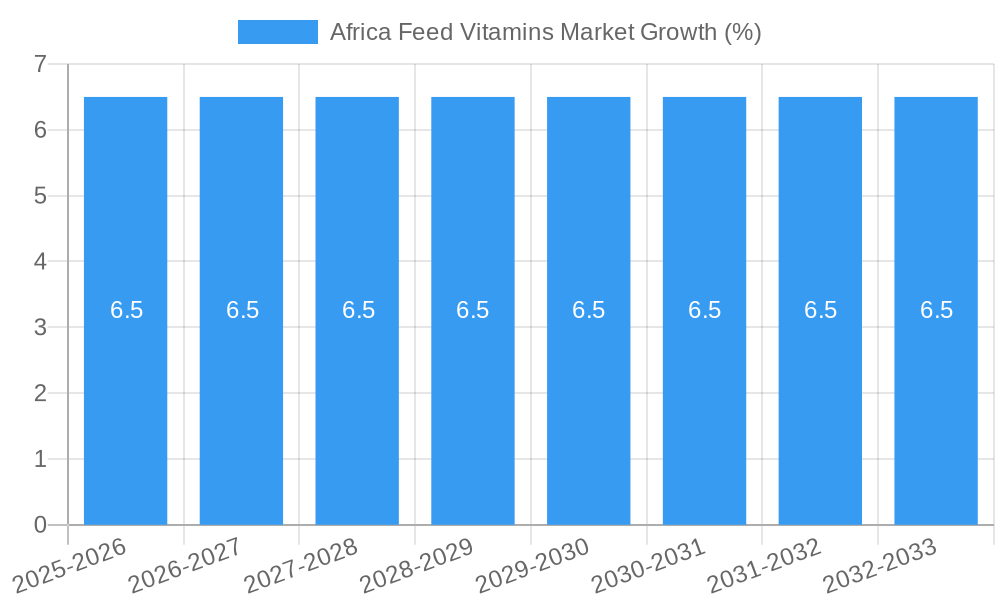

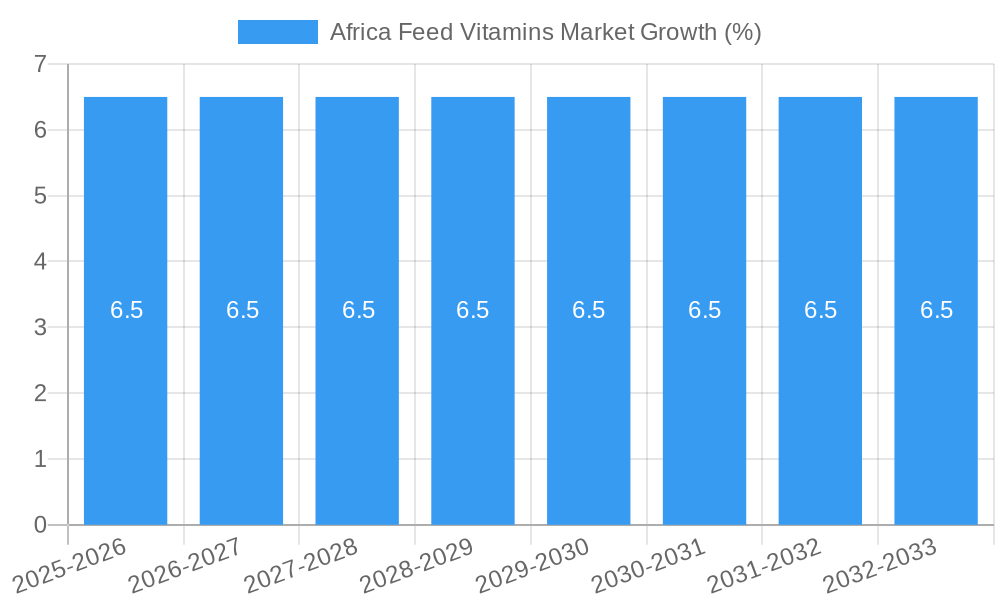

The Africa Feed Vitamins Market, valued at $142.18 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.50% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for animal protein in a rapidly growing African population necessitates efficient and cost-effective animal feed solutions. Feed vitamins play a crucial role in enhancing animal health, productivity, and overall feed conversion ratios, making them indispensable for modern livestock farming. Furthermore, the rising awareness among farmers regarding the benefits of fortified feed and the increasing adoption of improved farming techniques are contributing significantly to market growth. Specific segments within the market, such as ruminant and poultry feed vitamins, are expected to show particularly strong growth due to the prevalence of these animal types in African agriculture. Government initiatives promoting sustainable livestock farming and investments in infrastructure further contribute to this positive outlook. However, challenges such as inconsistent electricity supply, limited access to advanced technologies in certain regions, and fluctuating raw material prices could present some headwinds. Despite these obstacles, the long-term outlook for the Africa Feed Vitamins Market remains optimistic, indicating significant potential for expansion and investment across the forecast period.

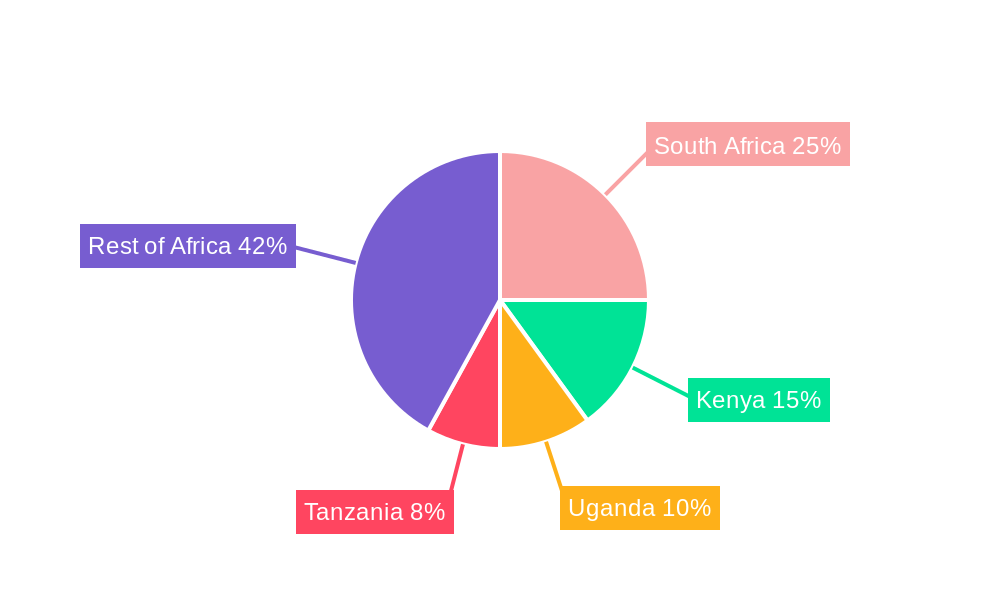

The market's segmentation reveals important dynamics. While the exact proportions for each segment (Type: A, E, B, C, Others; Animal Type: Ruminant, Poultry, Swine, Horse, Others) are not provided, a reasonable estimation based on market trends suggests that ruminant and poultry feed vitamins will constitute the largest shares, given the prevalence of these livestock types in African agriculture. The presence of numerous international and regional players, including Vitafor NV, Royal DSM NV, and Pharmavite LLC, indicates a competitive landscape with diverse product offerings and strategies targeting various market segments and geographical regions. The concentration of companies in this market points to both opportunities for growth and intense competition among established players and new entrants. Furthermore, regional variations in market growth will likely be observed, with countries like South Africa, Kenya, and others experiencing more rapid expansion compared to others, reflecting disparities in infrastructure and economic development across the continent.

Africa Feed Vitamins Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Feed Vitamins Market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, dynamics, dominant segments, and future outlook. The study incorporates detailed segmentation by vitamin type (A, E, B, C, Others) and animal type (Ruminant, Poultry, Swine, Horse, Others), providing granular data for strategic decision-making. Expect detailed analysis of market size (in Millions), CAGR, and competitive landscapes, empowering you to navigate this dynamic market effectively.

Africa Feed Vitamins Market Market Structure & Innovation Trends

This section analyzes the competitive landscape of the Africa Feed Vitamins market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is moderately concentrated, with several key players holding significant market share. However, smaller, specialized companies are also emerging, driven by innovations in vitamin formulations and delivery systems. The regulatory framework varies across African countries, impacting market access and product approvals. Substitutes for feed vitamins are limited, but the market is influenced by factors such as raw material prices and consumer preferences for sustainably produced animal products.

- Market Concentration: xx% controlled by top 5 players in 2025.

- Innovation Drivers: Demand for improved animal health and productivity, focus on sustainable feed solutions.

- M&A Activity: xx number of deals in 2019-2024 with an estimated total value of $xx Million. Major players are engaging in strategic acquisitions to expand their product portfolio and market reach.

- Regulatory Landscape: Varies significantly across African nations, impacting market entry and product registration.

Africa Feed Vitamins Market Market Dynamics & Trends

The Africa Feed Vitamins market is experiencing robust growth driven by several key factors. The increasing demand for animal protein, coupled with rising livestock populations across the continent, fuels the need for effective and efficient animal feed solutions. Technological advancements in feed formulation and vitamin delivery systems are further boosting market expansion. Consumer preferences for high-quality, healthy animal products are pushing for the adoption of advanced vitamin solutions, enhancing the market's appeal. Competitive dynamics are shaped by factors like pricing strategies, product differentiation, and marketing efforts. The market is witnessing a CAGR of xx% during the forecast period (2025-2033), with a market penetration rate of xx% in 2025.

Dominant Regions & Segments in Africa Feed Vitamins Market

The report identifies key regions and segments within the Africa Feed Vitamins market demonstrating exceptional growth. Specific details regarding dominant regions and segments will be provided in the full report. The analysis will consider factors such as economic growth, livestock population, government policies, and infrastructure development.

- Leading Region: [Specific Region will be detailed in the full report] - Key Drivers: [Detailed analysis of economic factors, infrastructure, and livestock populations will be provided]

- Leading Segment (by Type): [Specific Vitamin Type will be detailed in the full report] - Key Drivers: [Detailed analysis of market demand and specific applications will be provided]

- Leading Segment (by Animal Type): [Specific Animal Type will be detailed in the full report] - Key Drivers: [Detailed analysis of livestock population, farming practices, and economic factors will be provided].

Africa Feed Vitamins Market Product Innovations

Recent innovations focus on enhanced bioavailability, targeted delivery systems, and sustainable sourcing of vitamin raw materials. New product formulations are emerging, addressing specific animal health needs and optimizing feed efficiency. The market is witnessing a trend towards premixes and customized vitamin solutions tailored to specific animal species and dietary requirements. These innovations provide competitive advantages by improving animal performance and enhancing the profitability of livestock farming.

Report Scope & Segmentation Analysis

This report segments the Africa Feed Vitamins market by vitamin type (A, E, B, C, Others) and animal type (Ruminant, Poultry, Swine, Horse, Others). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail.

- Vitamin Type Segmentation: [Detailed analysis of each vitamin type market size and growth projections]

- Animal Type Segmentation: [Detailed analysis of each animal type market size and growth projections]

Key Drivers of Africa Feed Vitamins Market Growth

The growth of the Africa Feed Vitamins market is driven by several factors, including:

- Rising demand for animal protein: Growing populations and increasing urbanization contribute to higher meat consumption.

- Increasing livestock populations: Expansion of livestock farming activities across Africa.

- Technological advancements: Innovations in feed formulation and vitamin delivery systems.

- Government initiatives: Support for livestock development and improved animal health.

Challenges in the Africa Feed Vitamins Market Sector

Challenges include:

- Infrastructure limitations: Inadequate transportation and storage facilities in some regions hamper distribution.

- Supply chain disruptions: Variability in raw material availability and pricing.

- Regulatory inconsistencies: Differences in regulations across African countries create complexities.

- Counterfeit products: The presence of counterfeit vitamins in the market poses a challenge.

Emerging Opportunities in Africa Feed Vitamins Market

Opportunities lie in:

- Expansion into new markets: Untapped potential in underserved regions of Africa.

- Development of sustainable solutions: Growing demand for eco-friendly vitamin production methods.

- Technological innovations: Exploration of advanced delivery systems and personalized vitamin solutions.

- Partnerships and collaborations: Joint ventures between international and local companies.

Leading Players in the Africa Feed Vitamins Market Market

- Vitafor Nv

- Royal DSM Nv

- Pharmavite LLC (US)

- GlaxoSmithKline Plc (UK)

- Vitec Nutrition Ltd

- Adisseo France S A S (France)

- Pfizer Inc (US)

- DSM Nutritional Products Ltd (Switzerland)

- Ferrosan Holdings A/S (Denmark)

- Archer Daniels Midland Co (US)

- Zinpro Corporation

- Attrium Innovations Inc (Canada)

- Lonza Group Ltd (Switzerland)

- BASF SE (Germany)

- Bactolac Pharmaceutical Inc (US)

Key Developments in Africa Feed Vitamins Market Industry

- [Specific development 1 with date] - Impact: [Description of impact on market dynamics]

- [Specific development 2 with date] - Impact: [Description of impact on market dynamics]

- [Specific development 3 with date] - Impact: [Description of impact on market dynamics]

- [Continue with further developments as available]

Future Outlook for Africa Feed Vitamins Market Market

The Africa Feed Vitamins market is poised for significant growth, driven by increasing demand, technological advancements, and supportive government policies. Strategic investments in infrastructure, technological innovation, and sustainable production methods will further shape the market's trajectory. The market presents lucrative opportunities for both established players and new entrants, promising a vibrant and expanding future.

Africa Feed Vitamins Market Segmentation

-

1. Type

- 1.1. A

- 1.2. E

- 1.3. B

- 1.4. C

- 1.5. Others

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Horse

- 2.5. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Others

Africa Feed Vitamins Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Others

Africa Feed Vitamins Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products

- 3.3. Market Restrains

- 3.3.1. Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet

- 3.4. Market Trends

- 3.4.1. Increasing Live Stock Production Drives The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. A

- 5.1.2. E

- 5.1.3. B

- 5.1.4. C

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Horse

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. A

- 6.1.2. E

- 6.1.3. B

- 6.1.4. C

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Horse

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Egypt Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. A

- 7.1.2. E

- 7.1.3. B

- 7.1.4. C

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Horse

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Others Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. A

- 8.1.2. E

- 8.1.3. B

- 8.1.4. C

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Horse

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Africa Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Africa Feed Vitamins Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Vitafor Nv

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Royal DSM Nv

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Pharmavite LLC (US)

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 GlaxoSmithKline Plc (UK)

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Vitec Nutrition Ltd

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Adisseo France S A S (France)

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Pfizer Inc (US)

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 DSM Nutritional Products Ltd (Switzerland) II-77

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Ferrosan Holdings A/S (Denmark)

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Archer Daniels Midland Co (US)

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Zinpro Corporatio

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Attrium Innovations Inc (Canada)

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Lonza Group Ltd (Switzerland)

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 BASF SE (Germany)

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Bactolac Pharmaceutical Inc (US)

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.1 Vitafor Nv

List of Figures

- Figure 1: Africa Feed Vitamins Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Feed Vitamins Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Feed Vitamins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Feed Vitamins Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Feed Vitamins Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 4: Africa Feed Vitamins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Africa Feed Vitamins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Feed Vitamins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Feed Vitamins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Feed Vitamins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Feed Vitamins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Feed Vitamins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Feed Vitamins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Feed Vitamins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Feed Vitamins Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Africa Feed Vitamins Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 15: Africa Feed Vitamins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Africa Feed Vitamins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Africa Feed Vitamins Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Africa Feed Vitamins Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 19: Africa Feed Vitamins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Africa Feed Vitamins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Africa Feed Vitamins Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Africa Feed Vitamins Market Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 23: Africa Feed Vitamins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Africa Feed Vitamins Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Feed Vitamins Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Africa Feed Vitamins Market?

Key companies in the market include Vitafor Nv, Royal DSM Nv, Pharmavite LLC (US), GlaxoSmithKline Plc (UK), Vitec Nutrition Ltd, Adisseo France S A S (France), Pfizer Inc (US), DSM Nutritional Products Ltd (Switzerland) II-77, Ferrosan Holdings A/S (Denmark), Archer Daniels Midland Co (US), Zinpro Corporatio, Attrium Innovations Inc (Canada), Lonza Group Ltd (Switzerland), BASF SE (Germany), Bactolac Pharmaceutical Inc (US).

3. What are the main segments of the Africa Feed Vitamins Market?

The market segments include Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 142.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Livestock Population; Area Under Forage Production is Increasing; Increasing Demand for Animal Products.

6. What are the notable trends driving market growth?

Increasing Live Stock Production Drives The Market.

7. Are there any restraints impacting market growth?

Competition Amongst Industries and High Input Prices; Growing Shift Toward Vegan-Based Diet.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Feed Vitamins Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Feed Vitamins Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Feed Vitamins Market?

To stay informed about further developments, trends, and reports in the Africa Feed Vitamins Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence