Key Insights

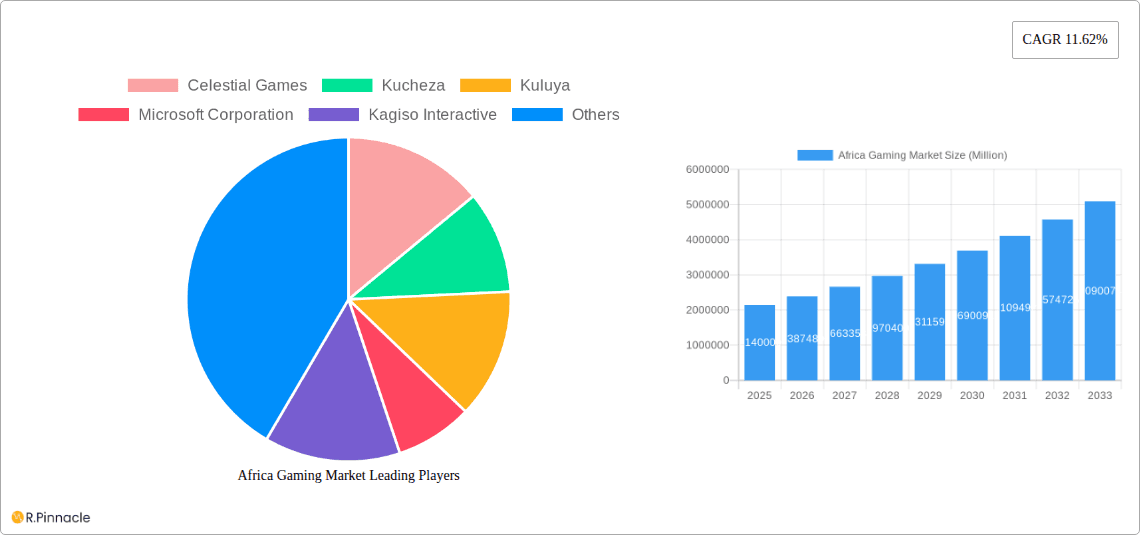

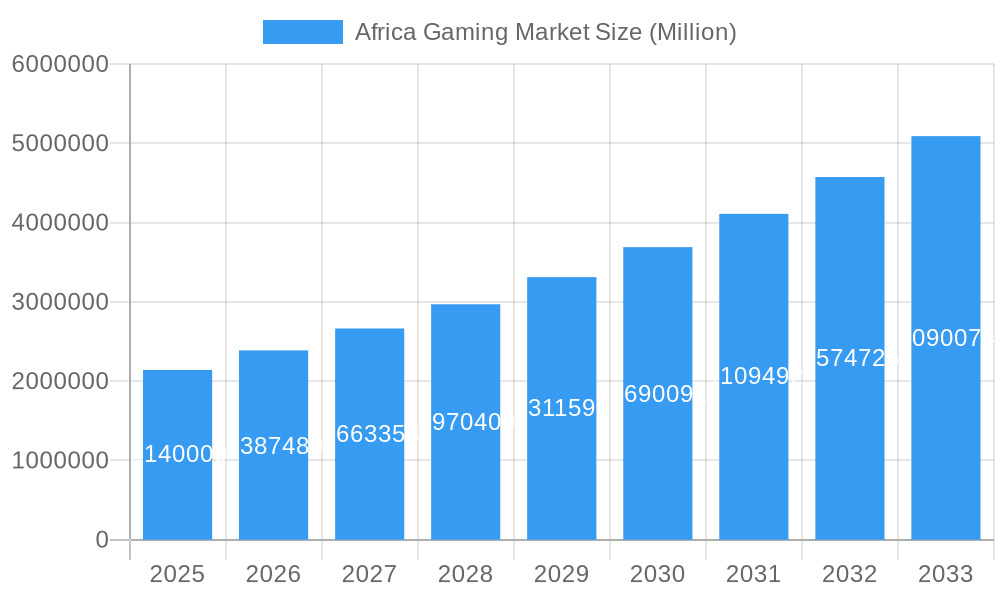

The African gaming market is poised for significant expansion, projected to reach an estimated USD 2.14 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 11.62% through 2033. This burgeoning market is fueled by several powerful drivers, including the increasing penetration of smartphones and affordable internet access across the continent, particularly in key economies like Nigeria, South Africa, and Egypt. The burgeoning youth population, coupled with a growing disposable income, is creating a fertile ground for gaming adoption, with mobile gaming dominating due to its accessibility and affordability. Furthermore, the rise of digital payment solutions and the development of localized content tailored to African cultures are further accelerating market growth. The proliferation of affordable gaming devices and the increasing popularity of e-sports events are also contributing to a more vibrant and engaging gaming ecosystem.

Africa Gaming Market Market Size (In Million)

The market's dynamism is further underscored by evolving trends such as the growing demand for free-to-play (F2P) games, in-app purchases, and subscription-based models. This shift indicates a maturing market where players are willing to invest in their gaming experiences. Cloud gaming is also emerging as a significant trend, promising to democratize access to high-fidelity gaming experiences without requiring expensive hardware. While the market exhibits immense potential, certain restraints, such as limited high-speed internet infrastructure in some regions and prevalent issues of online piracy, pose challenges. However, companies like Microsoft Corporation, Sony Corporation, and a host of innovative local players such as Kucheza and Nyamakop are actively investing in overcoming these obstacles, developing localized platforms, and fostering gaming communities, ensuring a dynamic and competitive landscape for the foreseeable future.

Africa Gaming Market Company Market Share

Africa Gaming Market Report: Comprehensive Analysis and Future Projections (2019-2033)

Unlock the immense potential of the Africa gaming market with this in-depth report. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides actionable insights for industry professionals, investors, and stakeholders. Dive deep into market dynamics, emerging trends in mobile gaming Africa, Africa esports market growth, and cloud gaming Africa adoption, leveraging high-ranking keywords for unparalleled search visibility. Analyze key players like Celestial Games, Kucheza, Kuluya, Microsoft Corporation, Kagiso Interactive, Gamesole, Chopup, Nyamakop, Clockwork Acorn, Sony Corporation, and understand their strategies within the vibrant African landscape. This report is your definitive guide to navigating and capitalizing on the rapidly evolving African gaming industry.

Africa Gaming Market Market Structure & Innovation Trends

The Africa gaming market exhibits a dynamic structure with a growing number of local and international players vying for market share. While historically concentrated, recent years have seen an increase in indie game developers Africa and studio launches, fostering a more competitive environment. Innovation drivers include the rapid adoption of smartphones, the increasing affordability of internet access, and a burgeoning young demographic eager for digital entertainment. Regulatory frameworks are still evolving across the continent, with some nations implementing policies to support the digital economy, while others present challenges for foreign investment. Product substitutes are abundant, ranging from traditional entertainment to other digital services, but the unique appeal of interactive gaming is gaining traction. End-user demographics are predominantly young, tech-savvy individuals with a growing disposable income, particularly in urban centers. Mergers and acquisitions (M&A) activities, while not as prevalent as in mature markets, are on the rise as larger entities seek to establish a foothold and acquire local expertise. For instance, recent acquisitions of smaller studios by regional tech giants signal a consolidation trend. Market share distribution is still fragmented, with mobile gaming dominating, but other platforms are showing significant growth potential. The Africa gaming market size is projected to expand significantly, driven by these structural shifts and innovation.

Africa Gaming Market Market Dynamics & Trends

The Africa gaming market is experiencing an unprecedented surge, propelled by a confluence of powerful market growth drivers and transformative technological disruptions. The most significant catalyst is the widespread proliferation of affordable smartphones and improving mobile internet penetration across the continent. This has democratized access to gaming, making it a mainstream form of entertainment for millions. Consumer preferences are rapidly evolving; there's a discernible shift towards mobile-first experiences, with a strong appetite for accessible, free-to-play titles that offer engaging gameplay and social interaction. Mobile gaming Africa is not just a segment; it's the engine driving much of the market's expansion. Furthermore, the rise of esports in Africa is creating a new competitive landscape, attracting significant attention and investment. This trend is fueled by increased awareness of competitive gaming, the availability of streaming platforms, and the aspirations of a young, energetic population. Technological advancements such as improved network infrastructure, including the rollout of 4G and 5G networks, are crucial in enabling smoother gameplay and supporting data-intensive applications like cloud gaming. This is paving the way for services that offer high-fidelity gaming experiences without the need for expensive hardware. The competitive dynamics are characterized by both fierce competition among local developers and increasing interest from global gaming giants seeking to tap into this untapped market. Strategic partnerships, content localization, and the development of culturally relevant games are becoming critical success factors. The CAGR of the Africa gaming market is robust, reflecting sustained growth. Market penetration is still relatively low compared to global averages, indicating substantial room for future expansion as affordability and accessibility continue to improve. The influx of new technologies and the evolving tastes of the African gamer are shaping a vibrant and rapidly maturing market.

Dominant Regions & Segments in Africa Gaming Market

The Smartphone segment is unequivocally dominant within the Africa gaming market, serving as the primary gateway for the vast majority of players across the continent. This dominance is underpinned by several key drivers, including economic policies that have encouraged the proliferation of affordable mobile devices and a youthful demographic that has embraced mobile technology wholeheartedly. Infrastructure development, particularly the expansion of mobile networks, has been instrumental in facilitating access to online gaming content, even in regions with limited fixed broadband.

- Smartphone: The widespread availability and affordability of smartphones have made them the most accessible gaming platform for a large segment of the African population. This accessibility, coupled with the rise of mobile-first game development and distribution models, has cemented its leading position. The market penetration of smartphones in Africa continues to grow, directly translating into a larger addressable market for mobile games. The diversity of mobile games, from hyper-casual to more complex titles, caters to a broad spectrum of user preferences.

Other segments are also showing promising growth, albeit from a smaller base:

- Browser PC: This segment remains relevant, especially in areas with established internet cafes and for users who prefer PC gaming but have limited access to dedicated gaming consoles. Government initiatives promoting digital literacy and access to technology in educational institutions can also indirectly boost this segment.

- Tablets: While not as ubiquitous as smartphones, tablets offer a larger screen experience for mobile gaming, making them a popular choice for some households and educational settings. Their increasing affordability is contributing to their gradual adoption.

- Gaming Console: The gaming console segment is gradually expanding, driven by increasing disposable incomes in certain urban areas and the growing popularity of major console releases. Major players like Sony and Microsoft are making strategic efforts to penetrate African markets, offering localized pricing and support.

- Downloaded/Box PC: This segment represents traditional PC gaming, which has a dedicated user base, particularly among enthusiasts and in regions with better internet infrastructure that supports large game downloads. The growth here is influenced by the availability of gaming PCs and the adoption of digital distribution platforms.

The dominance of the smartphone segment is a testament to its accessibility and affordability, making it the bedrock of the Africa gaming market. However, the growth trajectories of other segments, particularly gaming consoles, highlight the diversifying landscape and the increasing sophistication of the African gamer.

Africa Gaming Market Product Innovations

Product innovations in the Africa gaming market are increasingly focused on accessibility, localization, and mobile-first experiences. Developers are creating games optimized for lower-end smartphones and variable internet connectivity, ensuring wider reach. Cloud gaming solutions are emerging, leveraging partnerships with telcos to offer high-performance gaming without requiring expensive hardware. The introduction of HTML5 games and platforms catering to emerging markets is also a significant trend, allowing for easy deployment and broad compatibility. These innovations provide competitive advantages by tapping into underserved demographics and addressing specific regional challenges, thereby expanding the market's reach and engagement.

Africa Gaming Market Report & Segmentation Analysis

This report meticulously analyzes the Africa gaming market across its key segments. The projections and market sizes reflect the evolving landscape from 2019 to 2033.

- Browser PC: This segment is projected for moderate growth, driven by internet cafes and educational initiatives. Market size is estimated at xx Million in 2025, with a projected CAGR of xx%. Competitive dynamics involve local internet cafe operators and PC game distributors.

- Smartphone: This segment is the market leader and is expected to experience exponential growth. Estimated market size is xx Million in 2025, with a projected CAGR of xx%. Competitive dynamics are intense, with global publishers and local developers vying for user attention and in-app purchases.

- Tablets: This segment shows steady growth, appealing to users seeking a larger screen for mobile gaming. Estimated market size is xx Million in 2025, with a projected CAGR of xx%. Growth is driven by the increasing affordability of tablets and their use in educational contexts.

- Gaming Console: This segment is poised for significant expansion, driven by rising disposable incomes and increased availability of consoles. Estimated market size is xx Million in 2025, with a projected CAGR of xx%. Competitive dynamics involve major console manufacturers and game publishers.

- Downloaded/Box PC: This segment, representing traditional PC gaming, is expected to see steady growth, particularly with the rise of digital distribution. Estimated market size is xx Million in 2025, with a projected CAGR of xx%. Growth is influenced by PC hardware affordability and internet speeds.

Key Drivers of Africa Gaming Market Growth

The Africa gaming market's growth is propelled by several interconnected factors. The rapid expansion of mobile internet connectivity, driven by telcos investing in 4G and 5G infrastructure, is a primary enabler, making online gaming accessible to a larger populace. The burgeoning youth population, characterized by high digital literacy and a strong affinity for interactive entertainment, forms a substantial consumer base. Economic growth in various African nations, leading to increased disposable income, allows more individuals to invest in gaming hardware and software. Furthermore, government initiatives supporting the digital economy and fostering innovation are creating a more conducive environment for gaming businesses. The increasing popularity of esports and the subsequent rise of professional gaming organizations also contribute significantly by generating excitement and a competitive spirit among the youth.

Challenges in the Africa Gaming Market Sector

Despite its immense growth potential, the Africa gaming market faces significant hurdles. High data costs remain a barrier for many potential gamers, limiting playtime and access to data-intensive games. Insufficient digital payment infrastructure and low credit card penetration in some regions make in-app purchases and game purchases challenging for consumers. The availability of pirated games is also a persistent issue, impacting revenue streams for developers and publishers. Furthermore, a lack of robust intellectual property protection laws in some countries can deter investment and innovation. Lastly, the limited availability of skilled local talent in game development and esports management, while improving, still presents a challenge for the industry's expansion.

Emerging Opportunities in Africa Gaming Market

The Africa gaming market is ripe with emerging opportunities. The continent's vast, young, and increasingly connected population presents a massive untapped consumer base for mobile games. The rise of cloud gaming, supported by improving internet infrastructure, opens avenues for delivering high-quality gaming experiences without the need for expensive hardware. Localization of games to cater to diverse African languages and cultural nuances presents a significant competitive advantage. The burgeoning esports scene is creating opportunities for tournament organizers, content creators, and professional players. Furthermore, the increasing interest from global tech giants in African markets signals potential for strategic partnerships and investment in local game development studios, fostering innovation and creating job opportunities.

Leading Players in the Africa Gaming Market Market

- Celestial Games

- Kucheza

- Kuluya

- Microsoft Corporation

- Kagiso Interactive

- Gamesole

- Chopup

- Nyamakop

- Clockwork Acorn

- Sony Corporation

Key Developments in Africa Gaming Market Industry

- November 2022: rain, South Africa's 4G and 5G data network operator, announced a partnership with NVIDIA to bring high-performance cloud gaming to South Africa with GeForce NOW. This initiative aims to provide millions of South African users with ultra-low latency streaming of PC games from powerful GeForce-powered servers, offering access to over 1400 titles, including premium games like A Plague's Tale: Requiem and Cyberpunk 2077, as well as over one hundred free-to-play titles like Fortnite and Genshin Impact. This development is poised to significantly boost cloud gaming adoption in the region.

- November 2022: Yandex launched Yandex Games in the Middle East and North Africa (MENA) region. This new service acts as a launchpad for game-makers and a catalog of HTML5 games, primarily targeting creators and game developers in the MENA region. It provides an excellent opportunity for monetization and sharing of game projects. The platform boasts over 10,000 games across more than 30 genres, available in 70 languages, including action, puzzles, and racing games. This expansion by Yandex signifies growing interest in the broader African and MENA gaming ecosystems.

Future Outlook for Africa Gaming Market Market

The future outlook for the Africa gaming market is exceptionally bright, characterized by sustained high growth and strategic expansion. Key growth accelerators include the continued decrease in data costs and the further expansion of mobile network coverage, making gaming more accessible than ever. The increasing penetration of smartphones, coupled with a growing middle class, will drive higher spending on in-game purchases and premium gaming experiences. The maturation of the esports ecosystem, with increased investment and professionalization, will further engage a youth demographic seeking competitive and spectator entertainment. Cloud gaming services are expected to gain significant traction, democratizing access to AAA titles. Strategic investments in local game development talent and infrastructure will foster a more robust and innovative African gaming industry, positioning the continent as a significant player in the global gaming landscape.

Africa Gaming Market Segmentation

-

1. Platform

- 1.1. Browser PC

- 1.2. Smartphone

- 1.3. Tablets

- 1.4. Gaming Console

- 1.5. Downloaded/Box PC

Africa Gaming Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Gaming Market Regional Market Share

Geographic Coverage of Africa Gaming Market

Africa Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Young Population; Improvement in Technology and Internet Network Access

- 3.3. Market Restrains

- 3.3.1 Issues such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Improvement in Technology and Internet Network Access

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Gaming Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Browser PC

- 5.1.2. Smartphone

- 5.1.3. Tablets

- 5.1.4. Gaming Console

- 5.1.5. Downloaded/Box PC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Celestial Games

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kucheza

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuluya

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Microsoft Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kagiso Interactive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gamesole

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chopup

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nyamakop

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clockwork Acorn

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Celestial Games

List of Figures

- Figure 1: Africa Gaming Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Gaming Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Africa Gaming Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Africa Gaming Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Africa Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Nigeria Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: South Africa Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Egypt Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Kenya Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Ethiopia Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Morocco Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Ghana Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Algeria Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Tanzania Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ivory Coast Africa Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Gaming Market?

The projected CAGR is approximately 11.62%.

2. Which companies are prominent players in the Africa Gaming Market?

Key companies in the market include Celestial Games, Kucheza, Kuluya, Microsoft Corporation, Kagiso Interactive, Gamesole, Chopup, Nyamakop, Clockwork Acorn, Sony Corporation.

3. What are the main segments of the Africa Gaming Market?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Young Population; Improvement in Technology and Internet Network Access.

6. What are the notable trends driving market growth?

Improvement in Technology and Internet Network Access.

7. Are there any restraints impacting market growth?

Issues such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

November 2022: rain, South Africa's 4G and 5G data network operator, stated the signing of a partnership agreement with NVIDIA to bring high-performance cloud gaming to South Africa with GeForce NOW, NVIDIA's premium cloud gaming service, which seamlessly streams PC games from the world's most potent GeForce-powered servers in the cloud at ultra-low latency. This partnership will allow millions of South African users to get the best gaming experience and access the top gaming titles and a streaming library of over 1400 games like A Plague's Tale: Requiem and Cyberpunk 2077 with over one hundred free-to-play titles like Fortnite and Genshin Impact.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Gaming Market?

To stay informed about further developments, trends, and reports in the Africa Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence