Key Insights

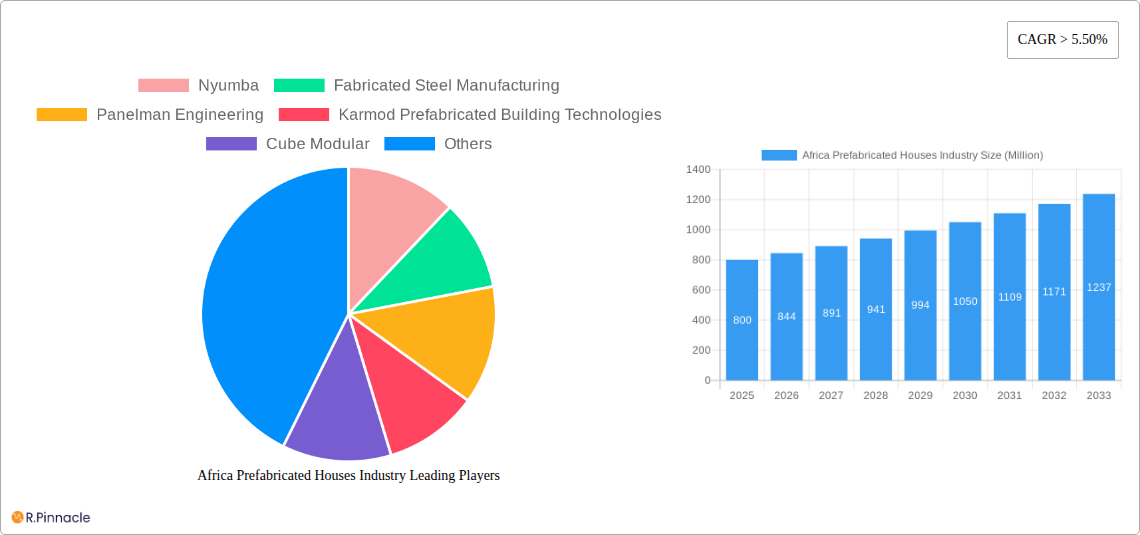

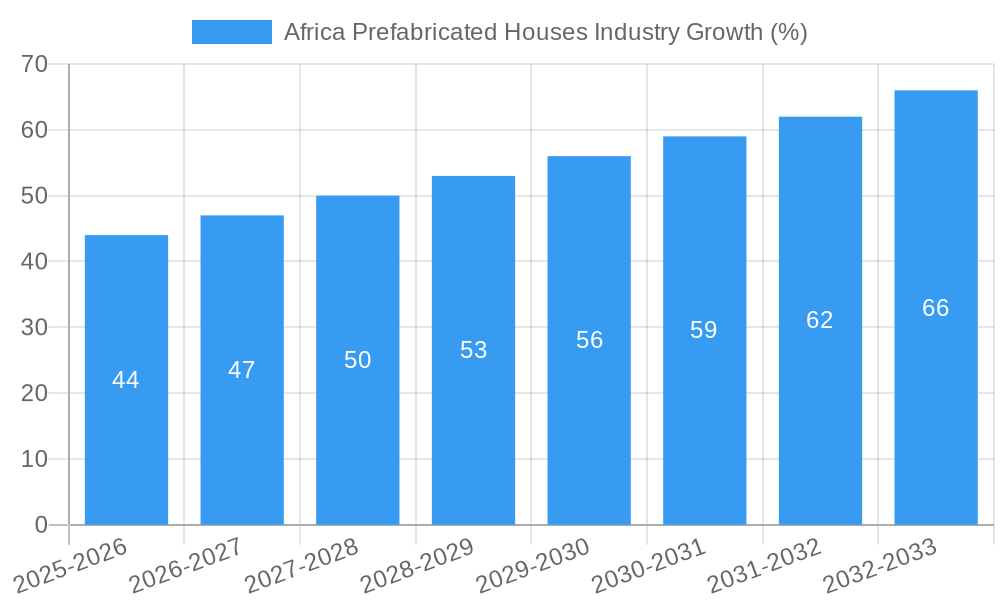

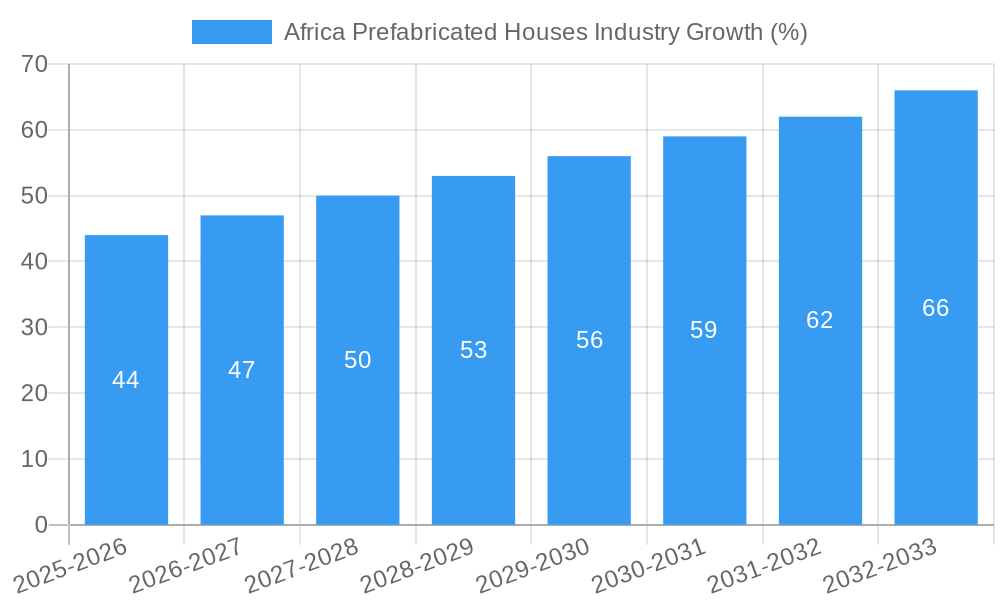

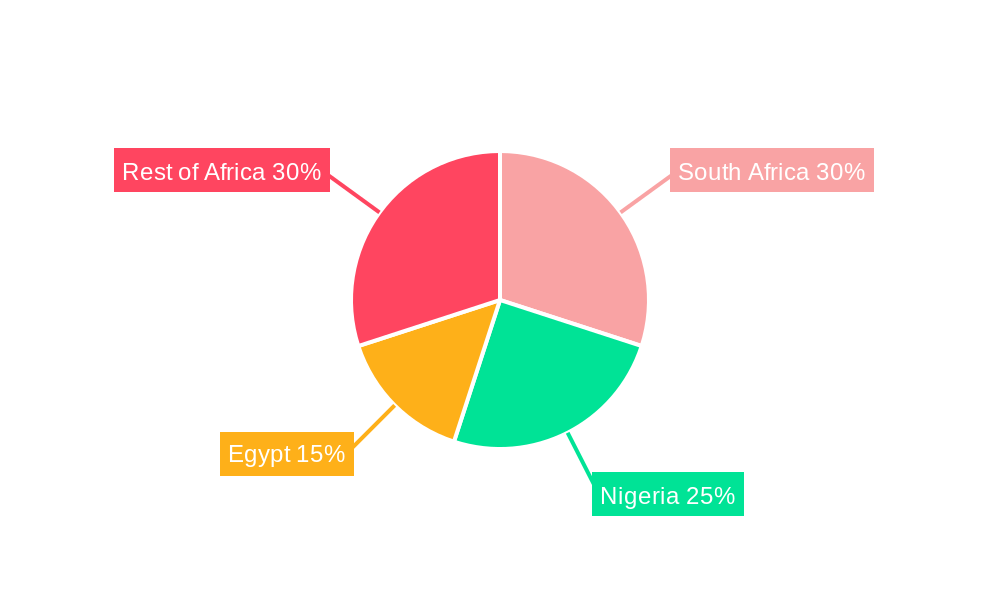

The African prefabricated houses market is experiencing robust growth, driven by factors such as rapid urbanization, increasing population, and the need for affordable and quickly deployable housing solutions. A compound annual growth rate (CAGR) exceeding 5.50% indicates a significant expansion trajectory from 2019 to 2033. The market is segmented by house type (single-family and multi-family) and geographically across key African nations, including Nigeria, Egypt, and South Africa, which represent the largest market shares due to their advanced infrastructure and economic development. While precise market size data for 2025 is unavailable, extrapolating from the provided CAGR and assuming a 2019 market size of approximately $500 million (a reasonable estimation considering similar developing markets), the 2025 market size is estimated to be around $800 million. The industry's growth is further fueled by government initiatives promoting affordable housing and the increasing adoption of sustainable building practices within prefabrication. Key players in the market include Nyumba, Fabricated Steel Manufacturing, and others, contributing to the market's competitiveness through technological innovation and diverse product offerings. However, challenges remain, including inconsistent infrastructure across the region, regulatory hurdles, and the need to address potential skills gaps within the workforce to support ongoing expansion.

The future of the African prefabricated houses market is promising, with continued growth projected through 2033. Demand will be driven by expanding populations in urban centers, a rising middle class seeking improved housing standards, and the inherent advantages of prefabrication—faster construction times, reduced labor costs, and improved quality control. While challenges exist, the increasing awareness of sustainability and the government's push for affordable housing solutions will likely offset these challenges and ensure continued market expansion. This will likely lead to increased investment in the sector, further technological advancements, and the emergence of new market players, especially in less developed regions of Africa. The focus will likely shift towards modular and sustainable designs, incorporating locally sourced materials to promote economic development while reducing environmental impact.

Africa Prefabricated Houses Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning Africa Prefabricated Houses industry, offering invaluable insights for investors, industry professionals, and policymakers. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, key players, and future growth potential. With a projected market size of xx Million by 2033, understanding this sector is crucial for navigating the complexities and opportunities within the African housing market.

Africa Prefabricated Houses Industry Market Structure & Innovation Trends

This section analyzes the competitive landscape of the African prefabricated houses market, encompassing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The industry shows a moderately fragmented structure with key players holding varying market shares. For instance, while precise market share data for each company remains unavailable, Nyumba, Karmod Prefabricated Building Technologies, and Cube Modular are estimated to hold significant positions within their respective niches, with Nyumba potentially leading in the single-family segment. Smaller players, like Kwikspace Modular Buildings Ltd, and M Projects (among many others), cater to more localized demands or specialize in specific types of prefabricated housing.

Innovation is driven by the need for affordable, rapid construction solutions to address the continent’s significant housing shortage. Regulatory frameworks vary across African nations, influencing material standards, construction permits, and overall project timelines. The rise of sustainable and eco-friendly building materials presents a significant product substitution opportunity, leading to a more environmentally conscious industry. Prefabricated houses also directly target the growing urban population and rising middle class as end-users, with affordability and faster construction remaining key factors in their appeal. Mergers and acquisitions (M&A) activity within this sector has been relatively limited thus far, however, future consolidation amongst larger players is anticipated, potentially exceeding $xx Million in deal value within the next decade.

Africa Prefabricated Houses Industry Market Dynamics & Trends

The African prefabricated houses market exhibits robust growth, driven by several key factors. Rapid urbanization, increasing population density, and a persistent housing deficit across numerous African nations present a strong demand for cost-effective and quickly deployable housing solutions. Technological advancements such as 3D printing and improved modular construction techniques are accelerating construction timelines and lowering costs. Consumer preferences are increasingly shifting towards sustainable, energy-efficient, and aesthetically pleasing prefabricated houses. This trend also correlates with government initiatives aimed at promoting sustainable housing. The competitive landscape is characterized by a mix of established international players and local companies, fostering innovation and rivalry within the market, expected to reach a CAGR of xx% during the forecast period (2025-2033). The market penetration rate for prefabricated housing is still relatively low, suggesting significant growth potential as awareness and affordability increase.

Dominant Regions & Segments in Africa Prefabricated Houses Industry

The report identifies Nigeria, Egypt, and South Africa as the leading markets for prefabricated houses in Africa, each contributing significantly to the overall market size. The "Rest of Africa" segment also demonstrates considerable potential, with several countries experiencing rapid urbanization and infrastructural development.

- Nigeria: High population growth, government initiatives focused on affordable housing, and substantial foreign investment propel Nigeria's dominance.

- Egypt: Major infrastructural projects, government policies supporting sustainable development, and a growing middle class enhance market growth.

- South Africa: Established construction industry, relatively advanced infrastructure, and a strong private sector create favorable conditions.

The single-family segment is currently the largest sector in the market due to a higher demand for individual housing units. However, the multi-family segment is anticipated to exhibit faster growth in the future, spurred by the need for high-density housing in rapidly expanding urban areas.

Africa Prefabricated Houses Industry Product Innovations

Recent innovations involve the use of sustainable materials, improved modular designs for quicker assembly, and the integration of smart home technologies. These innovations are driving cost-effectiveness, enhancing efficiency, and meeting the evolving needs and preferences of customers. The market is seeing a growing adoption of sustainable and energy-efficient building materials and techniques which improve the environmental footprint of the prefabricated houses.

Report Scope & Segmentation Analysis

This report segments the African prefabricated houses market by both type (single-family and multi-family) and country (Nigeria, Egypt, South Africa, and Rest of Africa). Growth projections indicate a significant expansion for all segments, with the multi-family segment likely exhibiting higher growth rates over the long term. Market size estimations are provided for each segment, alongside analyses of competitive dynamics and factors influencing growth.

- Single Family: This segment holds the largest current market share but will experience moderate growth.

- Multi Family: This segment shows significant growth potential, driven by urbanization and the need for high-density housing.

- Nigeria: A large market with substantial growth opportunities driven by population growth and government initiatives.

- Egypt: A growing market with a strong focus on infrastructure development.

- South Africa: A mature market with continued growth driven by economic development.

- Rest of Africa: A diverse market with substantial untapped potential across various countries.

Key Drivers of Africa Prefabricated Houses Industry Growth

Several key factors propel the growth of the African prefabricated houses industry. These include rapid urbanization, population growth, government initiatives to address housing shortages (as evidenced by Addis Ababa's 2 million housing plan), and the increasing affordability of prefabricated housing compared to traditional construction methods. Technological advancements leading to faster construction times and improved material efficiency also significantly contribute to the sector's expansion.

Challenges in the Africa Prefabricated Houses Industry Sector

Challenges include inconsistent regulatory frameworks across different African nations, potential supply chain disruptions impacting material availability and cost, and competition from traditional construction methods. Furthermore, access to financing and skilled labor can constrain market growth. The lack of awareness among consumers about the advantages of prefabricated housing can also hinder faster market penetration, leading to slow uptake.

Emerging Opportunities in Africa Prefabricated Houses Industry

Emerging opportunities lie in the development of innovative and sustainable building materials, the integration of smart home technologies, and the expansion into underserved markets across the continent. Government support for affordable housing initiatives is creating opportunities, and new construction technologies, such as 3D printing, offer cost and time-saving possibilities. Increasing focus on sustainable and environmentally friendly prefabricated houses is providing opportunities to cater to this growing segment.

Leading Players in the Africa Prefabricated Houses Industry Market

- Nyumba

- Fabricated Steel Manufacturing

- Panelman Engineering

- Karmod Prefabricated Building Technologies

- Cube Modular

- Concretex

- Kwikspace Modular Buildings Ltd

- M Projects

- House-it Building

- Global Africa Prefabricated Building Solutions Ltd

Key Developments in Africa Prefabricated Houses Industry

- January 2022: Addis Ababa City Administration initiates a project to build 5,000 prefabricated houses, signaling a significant government commitment to address housing challenges and setting the stage for a potential 2 million-unit project over a decade.

- May 2023: NLE, an Amsterdam-based firm, tests a floating prefabricated house model in Cape Verde, exploring innovative solutions for coastal areas and highlighting the industry's drive for cost-effective and adaptable housing solutions.

Future Outlook for Africa Prefabricated Houses Industry Market

The African prefabricated houses market is poised for substantial growth, driven by urbanization, technological advancements, and increasing government support. The industry's future success hinges on addressing existing challenges, fostering innovation, and ensuring that prefabricated housing becomes an increasingly accessible and desirable option for the continent's expanding population. The continuous integration of sustainable and innovative materials and designs offers a strong pathway to sustainable growth.

Africa Prefabricated Houses Industry Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

Africa Prefabricated Houses Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Prefabricated Houses Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Shift Towards Prefab Housing due to High Pricing in Egypt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Prefabricated Houses Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nyumba

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fabricated Steel Manufacturing

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Panelman Engineering

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Karmod Prefabricated Building Technologies

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cube Modular

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Concretex

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Kwikspace Modular Buildings Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 M Projects**List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 House-it Building

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Global Africa Prefabricated Building Solutions Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nyumba

List of Figures

- Figure 1: Africa Prefabricated Houses Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Prefabricated Houses Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Prefabricated Houses Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Africa Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Africa Prefabricated Houses Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Africa Prefabricated Houses Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa Prefabricated Houses Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Prefabricated Houses Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Africa Prefabricated Houses Industry?

Key companies in the market include Nyumba, Fabricated Steel Manufacturing, Panelman Engineering, Karmod Prefabricated Building Technologies, Cube Modular, Concretex, Kwikspace Modular Buildings Ltd, M Projects**List Not Exhaustive, House-it Building, Global Africa Prefabricated Building Solutions Ltd.

3. What are the main segments of the Africa Prefabricated Houses Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Shift Towards Prefab Housing due to High Pricing in Egypt.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

May 2023: A new prefab housing structure is under development by Amsterdam-based architecture firm NLE. They installed a model in Africa's Cape Verde to understand its viability's various aspects as floating houses. The idea is to reduce the overall cost emanating from land prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Prefabricated Houses Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Prefabricated Houses Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Prefabricated Houses Industry?

To stay informed about further developments, trends, and reports in the Africa Prefabricated Houses Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence