Key Insights

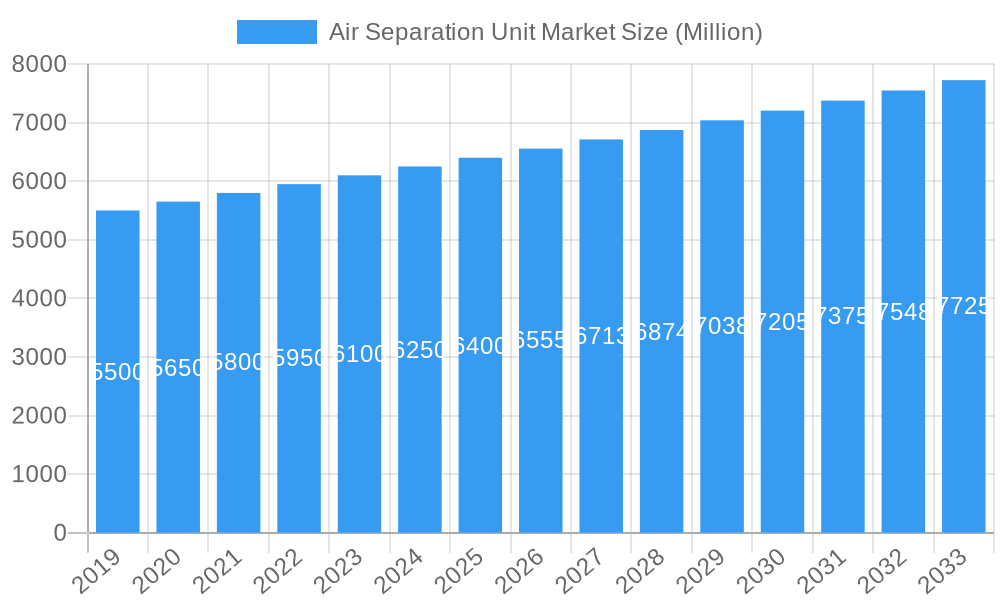

The global Air Separation Unit (ASU) market is poised for robust expansion, projected to reach an estimated USD 6.4 billion in 2025 with a compelling Compound Annual Growth Rate (CAGR) of 4.3% through 2033. This steady growth is primarily fueled by the escalating demand for industrial gases like nitrogen, oxygen, and argon across a multitude of sectors. The burgeoning chemical industry, with its increasing reliance on these gases for synthesis and processing, stands as a significant demand driver. Similarly, the oil and gas sector's continuous need for oxygen in refining and gasification processes, coupled with the iron and steel industry's indispensable use of oxygen and nitrogen for melting and refining, are substantial growth engines. Furthermore, advancements in ASU technologies, including more energy-efficient cryogenic distillation processes and the development of innovative non-cryogenic solutions, are enhancing operational efficiency and cost-effectiveness, thereby stimulating market adoption.

Air Separation Unit Market Market Size (In Billion)

The market's trajectory is also influenced by evolving industrial landscapes and technological innovations. Increasing investments in infrastructure development and manufacturing facilities worldwide, particularly in emerging economies, are creating new avenues for ASU deployment. The growing emphasis on stringent environmental regulations is also a subtle driver, as ASUs play a crucial role in various emission control processes and in the production of gases used in environmental remediation. While the market exhibits strong growth potential, certain restraints warrant consideration. High initial capital investment for ASU installation and maintenance can be a barrier for smaller enterprises. Additionally, the logistical challenges associated with transporting and installing large-scale ASU units in remote locations can also impact market penetration. Nevertheless, the persistent demand for industrial gases and ongoing technological improvements are expected to outweigh these challenges, ensuring a dynamic and expanding market for air separation units.

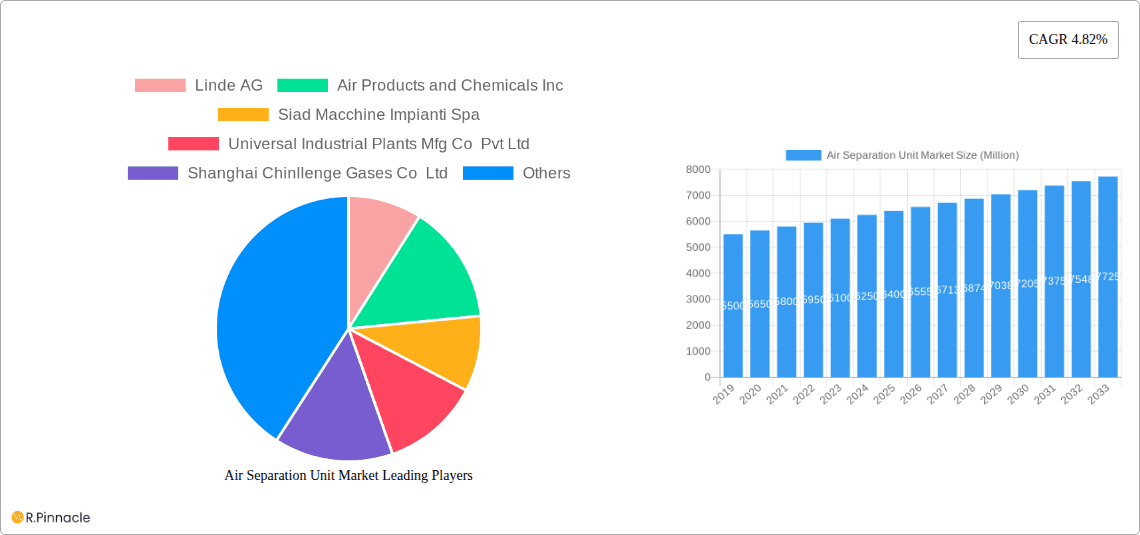

Air Separation Unit Market Company Market Share

Air Separation Unit Market: Comprehensive Analysis & Future Projections (2019-2033)

This in-depth report provides a critical analysis of the global Air Separation Unit (ASU) market, offering actionable insights for industry stakeholders. Leveraging an extensive study period from 2019 to 2033, with a base year of 2025, this report delivers a granular understanding of market dynamics, dominant segments, key players, and future growth trajectories. We delve into the intricate workings of ASUs, from cryogenic and non-cryogenic distillation processes to the production of essential gases like nitrogen, oxygen, and argon, serving diverse end-user industries including chemical, oil and gas, and iron and steel. With forecasted market values reaching into the billions, this report is an indispensable resource for strategic decision-making, investment planning, and competitive positioning in the rapidly evolving ASU landscape.

Air Separation Unit Market Market Structure & Innovation Trends

The Air Separation Unit (ASU) market exhibits a moderately concentrated structure, with a few dominant players like Linde AG, Air Products and Chemicals Inc., and Air Liquide SA holding significant market share. This concentration is driven by high capital expenditure requirements, complex technological expertise, and economies of scale inherent in ASU manufacturing and operation. Innovation within the market is primarily fueled by the relentless pursuit of enhanced energy efficiency, reduced operational costs, and the development of smaller, modular ASUs catering to decentralized industrial needs. Key innovation drivers include advancements in cryogenic distillation technology, improved membrane separation techniques for non-cryogenic processes, and the integration of digital solutions for remote monitoring and predictive maintenance. Regulatory frameworks, particularly concerning environmental emissions and safety standards, play a crucial role in shaping technological advancements and market entry barriers. Product substitutes, such as on-site gas generators for lower purity requirements, exist but are largely outperformed by ASUs for high-purity and large-volume gas demands. End-user demographics are increasingly influenced by the expansion of heavy industries in emerging economies and the growing demand for ultra-high purity gases in sectors like semiconductors. Merger and acquisition (M&A) activities, while not overtly prevalent, are strategically utilized by major players to expand geographical reach, acquire new technologies, and consolidate market dominance. For instance, the ongoing consolidation within the industrial gases sector often involves strategic acquisitions of smaller ASU manufacturers or technology providers to bolster competitive offerings.

Air Separation Unit Market Market Dynamics & Trends

The Air Separation Unit (ASU) market is poised for substantial growth, driven by a confluence of robust economic expansion, burgeoning industrialization, and technological advancements. The Compound Annual Growth Rate (CAGR) is projected to be robust throughout the forecast period, indicating a healthy expansion trajectory. Market penetration of ASUs is expected to deepen across various industrial sectors due to their indispensable role in providing essential industrial gases. Key growth drivers include the escalating demand for oxygen in healthcare and steel production, nitrogen in the chemical and electronics industries, and argon in welding and metallurgy. The oil and gas industry, in particular, is a significant consumer, utilizing these gases for enhanced oil recovery, purging, and inerting processes. Furthermore, the chemical industry's expanding production capacities and the need for high-purity gases in complex chemical reactions are fueling ASU demand.

Technological disruptions are continuously reshaping the market. Innovations in cryogenic distillation are focusing on optimizing energy consumption through advanced heat exchanger designs and more efficient compression systems. Simultaneously, non-cryogenic distillation technologies, such as pressure swing adsorption (PSA) and membrane separation, are gaining traction for applications requiring lower purity gases or for smaller-scale, decentralized operations, offering cost-effectiveness and operational flexibility. Consumer preferences are increasingly leaning towards sustainable and energy-efficient solutions, compelling ASU manufacturers to invest in greener technologies. The competitive dynamics are characterized by intense rivalry among established global players and emerging regional manufacturers. Companies are differentiating themselves through product innovation, customization capabilities, and comprehensive after-sales services. The trend towards digitalization and Industry 4.0 is also influencing the market, with an increasing adoption of smart ASUs equipped with advanced analytics for performance optimization and predictive maintenance. The global economic climate, industrial output, and government policies related to industrial development and environmental regulations will continue to shape the overall trajectory of the ASU market. The rising global industrial production, particularly in developing nations, is directly translating into increased demand for industrial gases, thereby propelling the ASU market forward.

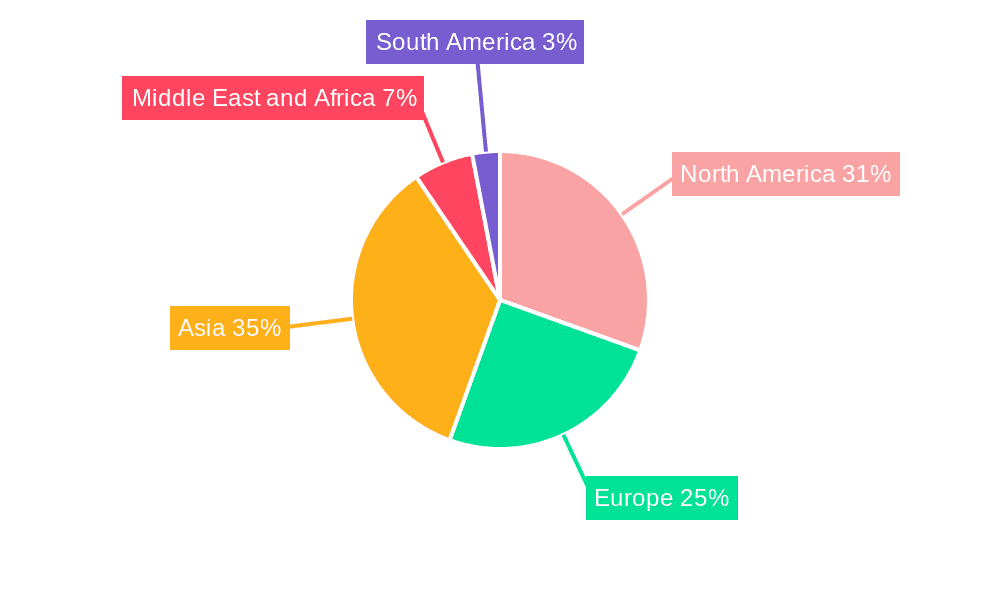

Dominant Regions & Segments in Air Separation Unit Market

The Asia Pacific region is emerging as the dominant force in the global Air Separation Unit (ASU) market, driven by rapid industrialization, substantial infrastructure development, and a growing manufacturing base. Countries like China and India are leading this growth, fueled by significant investments in sectors such as iron and steel, chemicals, and oil and gas. These industries are the primary consumers of ASUs, demanding large volumes of nitrogen, oxygen, and argon for their diverse operational needs.

- Key Drivers in Asia Pacific:

- Rapid Industrialization: Expansion of manufacturing hubs and heavy industries across the region.

- Infrastructure Development: Government initiatives focused on building robust industrial infrastructure, including petrochemical complexes and steel plants.

- Growing Demand for High-Purity Gases: The burgeoning semiconductor and electronics industries in countries like South Korea and Taiwan are driving demand for ultra-high purity gases produced by advanced ASUs.

- Favorable Government Policies: Supportive policies promoting domestic manufacturing and industrial growth indirectly boost ASU demand.

Within the Process segment, Cryogenic Distillation remains the dominant technology due to its capability to produce large volumes of high-purity gases, essential for major industrial applications. However, Non-cryogenic Distillation technologies are steadily gaining market share, particularly in niche applications and for smaller industrial needs, offering flexibility and lower capital expenditure.

The Gas segment is led by Nitrogen and Oxygen, which are fundamental to a wide array of industrial processes. Nitrogen is crucial for inerting, purging, and cryogenic applications, while oxygen is vital for combustion, medical uses, and the iron and steel industry. Argon also holds significant importance, particularly in welding and specialized industrial processes.

In terms of End Users, the Chemical Industry and the Oil and Gas Industry are paramount, consuming substantial quantities of industrial gases for various processes, including synthesis, refining, and extraction. The Iron and Steel Industry is another major consumer, relying heavily on oxygen for steelmaking. The increasing demand for industrial gases across these sectors directly translates into increased demand for ASUs, solidifying their dominance in the market. The robust growth in steel production in emerging economies, coupled with the expansion of refining capacities in the oil and gas sector, further accentuates the importance of these end-user segments.

Air Separation Unit Market Product Innovations

Product innovations in the Air Separation Unit (ASU) market are primarily focused on enhancing energy efficiency, reducing operational costs, and improving reliability. Manufacturers are developing advanced cryogenic distillation systems with optimized heat exchangers and more efficient compressors to minimize energy consumption, a significant operating expense. The development of modular and smaller-scale ASUs is catering to decentralized industrial needs and emerging markets. Furthermore, the integration of advanced control systems and digital solutions is enabling real-time performance monitoring, predictive maintenance, and remote diagnostics, leading to increased uptime and operational flexibility. These innovations not only provide a competitive advantage but also align with the growing industry trend towards sustainability and operational excellence, directly addressing the market's demand for cost-effective and environmentally conscious solutions.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Air Separation Unit (ASU) market, segmented across key parameters to provide granular insights. The segmentation includes:

- Process: This section meticulously analyzes the market share and growth projections for Cryogenic Distillation and Non-cryogenic Distillation technologies. Cryogenic distillation is expected to maintain its dominance due to its high-purity output and large-scale capabilities, while non-cryogenic methods will see steady growth in niche applications.

- Gas: The report delves into the market dynamics for Nitrogen, Oxygen, Argon, and Other Gases. Nitrogen and Oxygen are projected to hold the largest market shares, driven by their widespread industrial applications, with Argon also showing strong growth in specialized sectors.

- End User: This segmentation categorizes the market by major consuming industries, including the Chemical Industry, Oil and Gas Industry, Iron and Steel Industry, and Other End Users. The chemical and oil & gas sectors are anticipated to be key growth drivers, with the iron & steel industry remaining a significant consumer.

Each segment is analyzed for its market size, growth potential, and competitive landscape, providing a holistic view of the ASU market's intricate structure and future prospects.

Key Drivers of Air Separation Unit Market Growth

The Air Separation Unit (ASU) market is propelled by several significant growth drivers. The escalating demand for industrial gases across burgeoning sectors like healthcare, electronics, and metallurgy is a primary catalyst. The expansion of the oil and gas industry, particularly in exploration and production activities, necessitates a consistent supply of gases for various operations. Furthermore, the global increase in steel production, especially in developing economies, directly translates into higher oxygen demand, a core output of ASUs. Technological advancements focused on energy efficiency and cost reduction in ASU operations are making them more attractive to industrial consumers. Government initiatives promoting industrial development and investment in infrastructure also play a crucial role in driving market growth.

Challenges in the Air Separation Unit Market Sector

Despite robust growth prospects, the Air Separation Unit (ASU) market faces several challenges. The high capital expenditure required for constructing large-scale ASUs acts as a significant barrier to entry for new players and can slow down expansion for smaller companies. Fluctuations in raw material prices, particularly for metals used in ASU construction, can impact manufacturing costs and profitability. Stringent environmental regulations regarding emissions and noise pollution necessitate continuous investment in cleaner and more efficient technologies, adding to operational expenses. Supply chain disruptions, as witnessed in recent global events, can lead to delays in project execution and impact the availability of critical components. Finally, intense competition among established players and the emergence of alternative gas supply solutions for specific applications pose ongoing challenges to market share.

Emerging Opportunities in Air Separation Unit Market

The Air Separation Unit (ASU) market is ripe with emerging opportunities. The increasing demand for ultra-high purity gases in rapidly growing sectors like semiconductors and advanced electronics presents a significant avenue for growth. The development of smaller, modular ASUs catering to decentralized industrial needs and remote locations offers new market potential. Furthermore, advancements in hydrogen production and carbon capture technologies, where ASUs play a crucial role in gas separation, are opening up new frontiers. The growing emphasis on sustainable industrial practices is driving opportunities for ASUs that offer improved energy efficiency and reduced environmental impact. Expansion into emerging economies with developing industrial bases also presents substantial untapped market potential for ASU deployment.

Leading Players in the Air Separation Unit Market Market

- Linde AG

- Air Products and Chemicals Inc.

- Siad Macchine Impianti Spa

- Universal Industrial Plants Mfg Co Pvt Ltd

- Shanghai Chinllenge Gases Co Ltd

- Air Liquide SA

- Messer Group GmbH

- Sichuan Air Separation Plant Group

- Taiyo Nippon Sanso Corporation

- Bhoruka Gases Limited

Key Developments in Air Separation Unit Market Industry

- May 2022: Air Products San Fu, a subsidiary of Air Products and Chemicals Inc., brought two new air separation units on stream. The project is part of a long-term agreement to provide ultra-high purity industrial gases to one of Asia's largest semiconductor manufacturers. Air Products San Fu may invest approximately USD 400 million to build, own, and operate large air separation units to provide ultra-high purity oxygen, argon, nitrogen, and hydrogen in Tainan Science Park, southern Taiwan.

- May 2022: PKN Orlen announced plans to invest in an ASU for oxygen and nitrogen production at the Plock refinery in Poland. The ASU will be built by the German company Linde GmbH. The project investment is estimated to cost around USD 187 million (EUR 164 million) and is expected to be completed by early 2025. The plant will produce 38,500 cubic meters of oxygen and 75,000 cubic meters of nitrogen per hour.

Future Outlook for Air Separation Unit Market Market

The future outlook for the Air Separation Unit (ASU) market is exceptionally promising, with sustained growth projected across all segments. The increasing global industrial output, coupled with a growing focus on advanced manufacturing and technological innovation, will continue to be primary growth accelerators. The rising demand for specialized industrial gases in burgeoning sectors like electronics and renewable energy, alongside the continued expansion of traditional industries like chemicals and steel, will ensure robust ASU deployment. Furthermore, advancements in ASU technology, leading to higher energy efficiency and reduced environmental footprints, will align with global sustainability initiatives, creating new market opportunities. Strategic investments in emerging economies and the continuous pursuit of process optimization by leading players will further solidify the market's upward trajectory. The potential for integration with emerging technologies like green hydrogen production also presents a significant long-term growth avenue.

Air Separation Unit Market Segmentation

-

1. Process

- 1.1. Cryogenic Distillation

- 1.2. Non-cryogenic Distillation

-

2. Gas

- 2.1. Nitrogen

- 2.2. Oxygen

- 2.3. Argon

- 2.4. Other Gases

-

3. End User

- 3.1. Chemical Industry

- 3.2. Oil and Gas Industry

- 3.3. Iron and Steel Industry

- 3.4. Other End Users

Air Separation Unit Market Segmentation By Geography

-

1. North America

- 1.1. United States of America

- 1.2. Canada

- 1.3. Rest of the North America

-

2. Asia

- 2.1. China

- 2.2. India

- 2.3. South Korea

- 2.4. Japan

- 2.5. Rest of the Asia

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. Italy

- 3.4. France

- 3.5. Rest of the Europe

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. South Africa

- 4.4. Rest of the Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of the South America

Air Separation Unit Market Regional Market Share

Geographic Coverage of Air Separation Unit Market

Air Separation Unit Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Industrial Gases4.; Growth in Steel and Process Industries

- 3.3. Market Restrains

- 3.3.1. 4.; The Huge Cost to Supply High-Purity Industrial Gases

- 3.4. Market Trends

- 3.4.1. Iron and Steel End-user Segment to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Separation Unit Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Cryogenic Distillation

- 5.1.2. Non-cryogenic Distillation

- 5.2. Market Analysis, Insights and Forecast - by Gas

- 5.2.1. Nitrogen

- 5.2.2. Oxygen

- 5.2.3. Argon

- 5.2.4. Other Gases

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Chemical Industry

- 5.3.2. Oil and Gas Industry

- 5.3.3. Iron and Steel Industry

- 5.3.4. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia

- 5.4.3. Europe

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. North America Air Separation Unit Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Cryogenic Distillation

- 6.1.2. Non-cryogenic Distillation

- 6.2. Market Analysis, Insights and Forecast - by Gas

- 6.2.1. Nitrogen

- 6.2.2. Oxygen

- 6.2.3. Argon

- 6.2.4. Other Gases

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Chemical Industry

- 6.3.2. Oil and Gas Industry

- 6.3.3. Iron and Steel Industry

- 6.3.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. Asia Air Separation Unit Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Cryogenic Distillation

- 7.1.2. Non-cryogenic Distillation

- 7.2. Market Analysis, Insights and Forecast - by Gas

- 7.2.1. Nitrogen

- 7.2.2. Oxygen

- 7.2.3. Argon

- 7.2.4. Other Gases

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Chemical Industry

- 7.3.2. Oil and Gas Industry

- 7.3.3. Iron and Steel Industry

- 7.3.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. Europe Air Separation Unit Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Cryogenic Distillation

- 8.1.2. Non-cryogenic Distillation

- 8.2. Market Analysis, Insights and Forecast - by Gas

- 8.2.1. Nitrogen

- 8.2.2. Oxygen

- 8.2.3. Argon

- 8.2.4. Other Gases

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Chemical Industry

- 8.3.2. Oil and Gas Industry

- 8.3.3. Iron and Steel Industry

- 8.3.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. Middle East and Africa Air Separation Unit Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Cryogenic Distillation

- 9.1.2. Non-cryogenic Distillation

- 9.2. Market Analysis, Insights and Forecast - by Gas

- 9.2.1. Nitrogen

- 9.2.2. Oxygen

- 9.2.3. Argon

- 9.2.4. Other Gases

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Chemical Industry

- 9.3.2. Oil and Gas Industry

- 9.3.3. Iron and Steel Industry

- 9.3.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. South America Air Separation Unit Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process

- 10.1.1. Cryogenic Distillation

- 10.1.2. Non-cryogenic Distillation

- 10.2. Market Analysis, Insights and Forecast - by Gas

- 10.2.1. Nitrogen

- 10.2.2. Oxygen

- 10.2.3. Argon

- 10.2.4. Other Gases

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Chemical Industry

- 10.3.2. Oil and Gas Industry

- 10.3.3. Iron and Steel Industry

- 10.3.4. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Linde AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Air Products and Chemicals Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siad Macchine Impianti Spa

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Universal Industrial Plants Mfg Co Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Chinllenge Gases Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Air Liquide SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Messer Group GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sichuan Air Separation Plant Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Taiyo Nippon Sanso Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bhoruka Gases Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Linde AG

List of Figures

- Figure 1: Global Air Separation Unit Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Air Separation Unit Market Revenue (undefined), by Process 2025 & 2033

- Figure 3: North America Air Separation Unit Market Revenue Share (%), by Process 2025 & 2033

- Figure 4: North America Air Separation Unit Market Revenue (undefined), by Gas 2025 & 2033

- Figure 5: North America Air Separation Unit Market Revenue Share (%), by Gas 2025 & 2033

- Figure 6: North America Air Separation Unit Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Air Separation Unit Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Air Separation Unit Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Air Separation Unit Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Air Separation Unit Market Revenue (undefined), by Process 2025 & 2033

- Figure 11: Asia Air Separation Unit Market Revenue Share (%), by Process 2025 & 2033

- Figure 12: Asia Air Separation Unit Market Revenue (undefined), by Gas 2025 & 2033

- Figure 13: Asia Air Separation Unit Market Revenue Share (%), by Gas 2025 & 2033

- Figure 14: Asia Air Separation Unit Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Asia Air Separation Unit Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Asia Air Separation Unit Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Asia Air Separation Unit Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Air Separation Unit Market Revenue (undefined), by Process 2025 & 2033

- Figure 19: Europe Air Separation Unit Market Revenue Share (%), by Process 2025 & 2033

- Figure 20: Europe Air Separation Unit Market Revenue (undefined), by Gas 2025 & 2033

- Figure 21: Europe Air Separation Unit Market Revenue Share (%), by Gas 2025 & 2033

- Figure 22: Europe Air Separation Unit Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Europe Air Separation Unit Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe Air Separation Unit Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Air Separation Unit Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Air Separation Unit Market Revenue (undefined), by Process 2025 & 2033

- Figure 27: Middle East and Africa Air Separation Unit Market Revenue Share (%), by Process 2025 & 2033

- Figure 28: Middle East and Africa Air Separation Unit Market Revenue (undefined), by Gas 2025 & 2033

- Figure 29: Middle East and Africa Air Separation Unit Market Revenue Share (%), by Gas 2025 & 2033

- Figure 30: Middle East and Africa Air Separation Unit Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Middle East and Africa Air Separation Unit Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Air Separation Unit Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Air Separation Unit Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Air Separation Unit Market Revenue (undefined), by Process 2025 & 2033

- Figure 35: South America Air Separation Unit Market Revenue Share (%), by Process 2025 & 2033

- Figure 36: South America Air Separation Unit Market Revenue (undefined), by Gas 2025 & 2033

- Figure 37: South America Air Separation Unit Market Revenue Share (%), by Gas 2025 & 2033

- Figure 38: South America Air Separation Unit Market Revenue (undefined), by End User 2025 & 2033

- Figure 39: South America Air Separation Unit Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Air Separation Unit Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Air Separation Unit Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Separation Unit Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 2: Global Air Separation Unit Market Revenue undefined Forecast, by Gas 2020 & 2033

- Table 3: Global Air Separation Unit Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Air Separation Unit Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Air Separation Unit Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 6: Global Air Separation Unit Market Revenue undefined Forecast, by Gas 2020 & 2033

- Table 7: Global Air Separation Unit Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Air Separation Unit Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States of America Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of the North America Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Air Separation Unit Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 13: Global Air Separation Unit Market Revenue undefined Forecast, by Gas 2020 & 2033

- Table 14: Global Air Separation Unit Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Air Separation Unit Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: China Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: India Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: South Korea Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Japan Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of the Asia Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Air Separation Unit Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 22: Global Air Separation Unit Market Revenue undefined Forecast, by Gas 2020 & 2033

- Table 23: Global Air Separation Unit Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 24: Global Air Separation Unit Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Italy Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: France Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of the Europe Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Air Separation Unit Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 31: Global Air Separation Unit Market Revenue undefined Forecast, by Gas 2020 & 2033

- Table 32: Global Air Separation Unit Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 33: Global Air Separation Unit Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of the Middle East and Africa Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Air Separation Unit Market Revenue undefined Forecast, by Process 2020 & 2033

- Table 39: Global Air Separation Unit Market Revenue undefined Forecast, by Gas 2020 & 2033

- Table 40: Global Air Separation Unit Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 41: Global Air Separation Unit Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Brazil Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Argentina Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of the South America Air Separation Unit Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Separation Unit Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Air Separation Unit Market?

Key companies in the market include Linde AG, Air Products and Chemicals Inc, Siad Macchine Impianti Spa, Universal Industrial Plants Mfg Co Pvt Ltd, Shanghai Chinllenge Gases Co Ltd, Air Liquide SA, Messer Group GmbH, Sichuan Air Separation Plant Group, Taiyo Nippon Sanso Corporation, Bhoruka Gases Limited.

3. What are the main segments of the Air Separation Unit Market?

The market segments include Process, Gas, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Industrial Gases4.; Growth in Steel and Process Industries.

6. What are the notable trends driving market growth?

Iron and Steel End-user Segment to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; The Huge Cost to Supply High-Purity Industrial Gases.

8. Can you provide examples of recent developments in the market?

May 2022: Air Products San Fu, a subsidiary of Air Products and Chemicals Inc., brought two new air separation units on stream. The project is part of a long-term agreement to provide ultra-high purity industrial gases to one of Asia's largest semiconductor manufacturers. Air Products San Fu may invest approximately USD 400 million to build, own, and operate large air separation units to provide ultra-high purity oxygen, argon, nitrogen, and hydrogen in Tainan Science Park, southern Taiwan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Separation Unit Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Separation Unit Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Separation Unit Market?

To stay informed about further developments, trends, and reports in the Air Separation Unit Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence