Key Insights

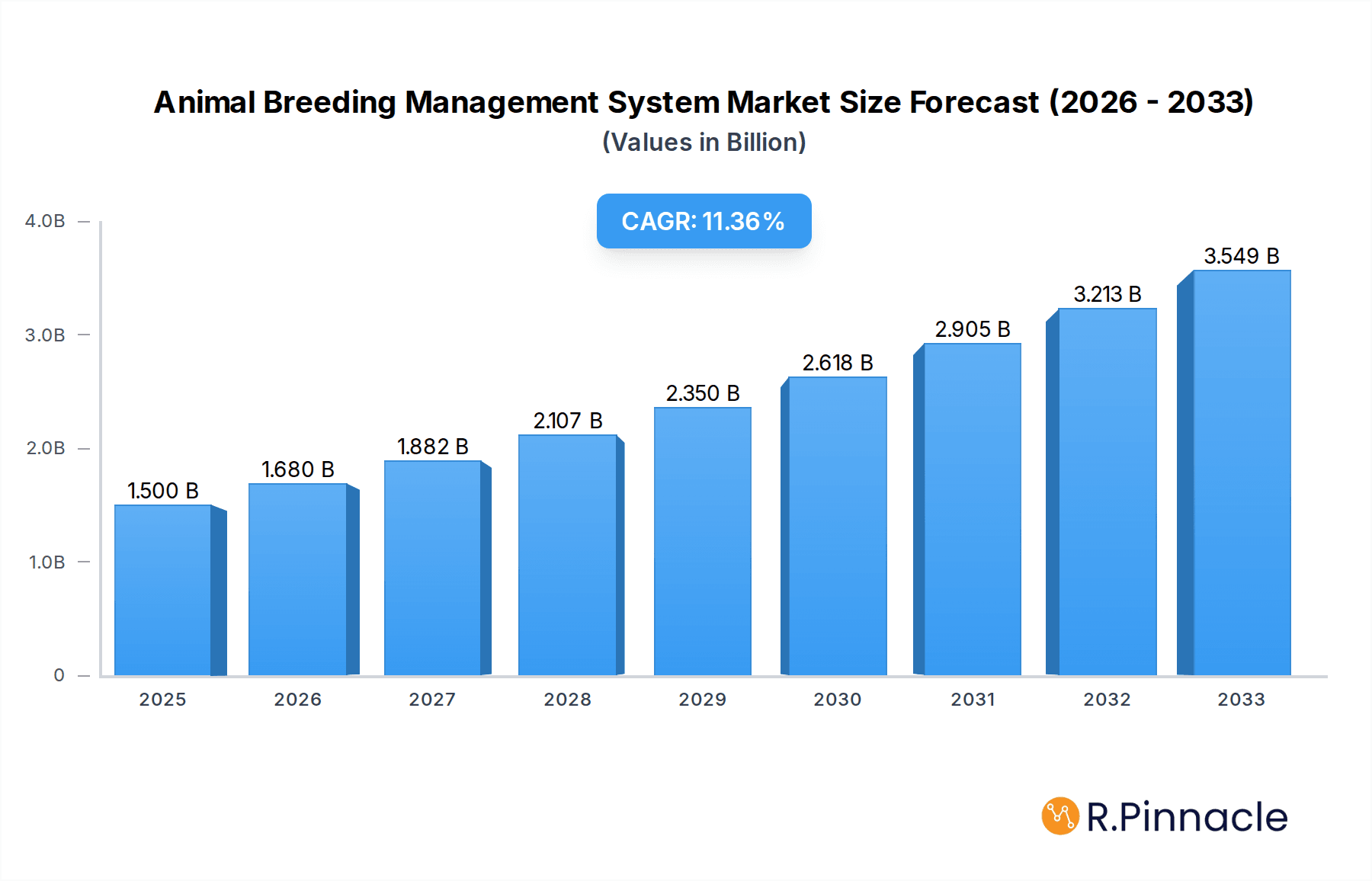

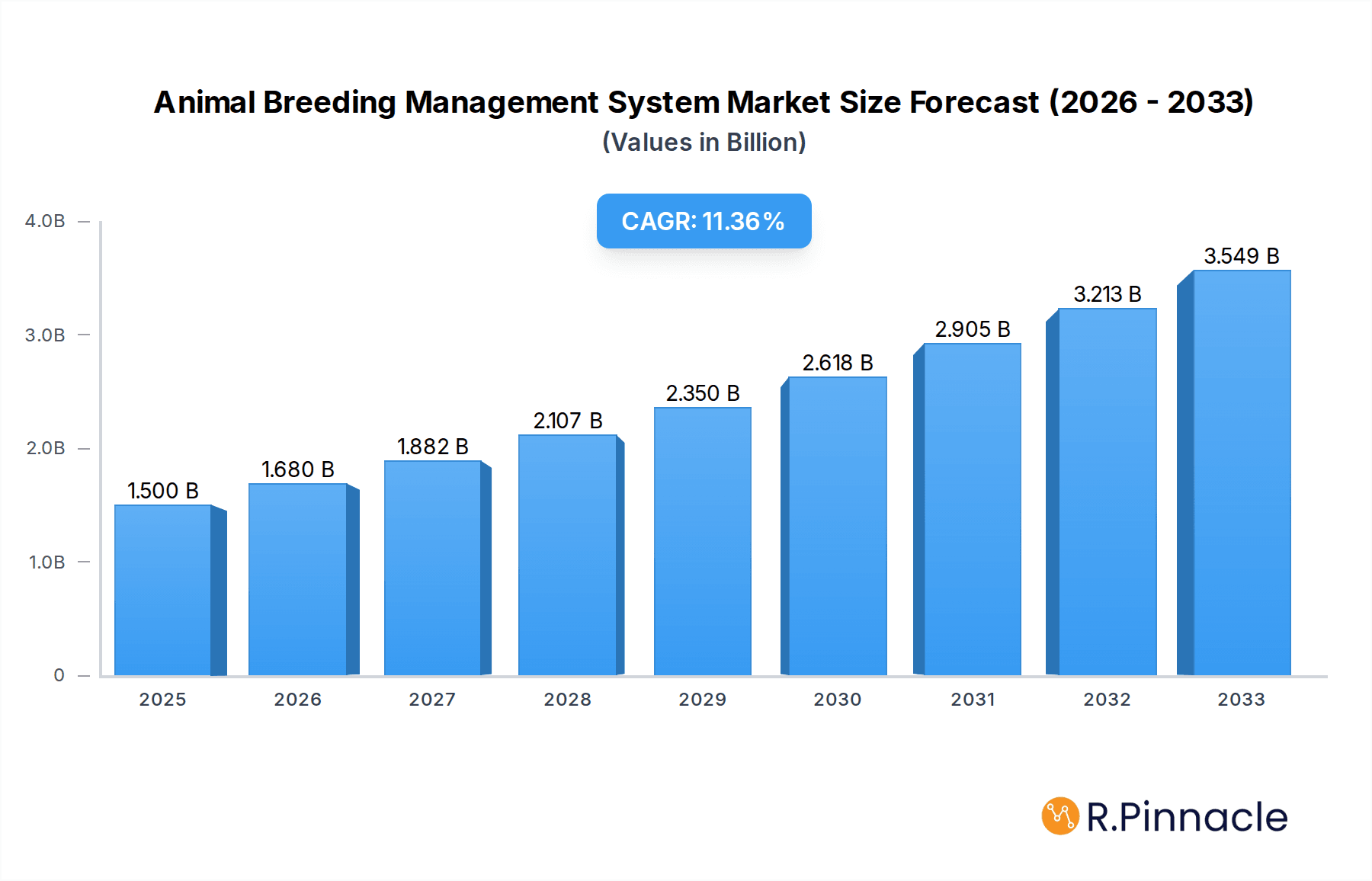

The global Animal Breeding Management System market is poised for significant expansion, projected to reach USD 1.5 billion in 2025 and achieve a robust Compound Annual Growth Rate (CAGR) of 12% through 2033. This impressive growth trajectory is fueled by a confluence of factors, primarily the increasing demand for efficient and data-driven livestock management solutions to enhance productivity and genetic improvement in the poultry sector. Key drivers include the growing global population and the subsequent rise in demand for animal protein, necessitating optimized breeding practices for higher yields. Advancements in technology, such as AI, IoT, and cloud computing, are enabling more sophisticated breeding management systems that offer real-time monitoring, predictive analytics, and automated decision-making, thereby improving animal welfare and farm profitability. The market is also experiencing a surge in adoption due to the need for better disease management and traceability within the supply chain.

Animal Breeding Management System Market Size (In Billion)

The market is segmented across various poultry applications, including Chicken, Duck, Geese, and Quail, with Chicken applications dominating due to the sheer scale of global poultry production. Furthermore, the increasing preference for cloud-based solutions over on-premise systems, driven by their scalability, accessibility, and cost-effectiveness, is a significant trend shaping the market landscape. While the market exhibits strong growth potential, certain restraints, such as the high initial investment cost for advanced systems and the need for skilled labor to operate them, could pose challenges. However, the continuous innovation in software and hardware, coupled with growing awareness among farmers about the benefits of integrated breeding management systems, is expected to mitigate these restraints, paving the way for sustained market development.

Animal Breeding Management System Company Market Share

Animal Breeding Management System Market Report: Driving Efficiency and Profitability in Modern Agriculture

This comprehensive report provides an in-depth analysis of the global Animal Breeding Management System market, offering critical insights for industry stakeholders, from farm managers to technology providers. Covering the historical period from 2019 to 2024 and forecasting growth through 2033, this study leverages advanced analytics to pinpoint market trends, key players, and emerging opportunities. Our analysis focuses on delivering actionable intelligence, equipping you with the data needed to navigate this dynamic sector and optimize breeding programs for enhanced productivity and profitability. The report examines critical aspects including market concentration, innovation trends, regional dominance, product advancements, and future growth trajectories.

Animal Breeding Management System Market Structure & Innovation Trends

The Animal Breeding Management System market exhibits a moderately concentrated structure, with key players actively investing in research and development to enhance system functionalities and integrate advanced technologies such as artificial intelligence and machine learning for predictive analytics. Innovation drivers are primarily focused on improving animal welfare, optimizing genetic selection, enhancing disease management, and streamlining operational workflows for poultry, duck, geese, and quail farms. Regulatory frameworks, particularly concerning animal health and biosecurity, are also shaping market strategies, encouraging the adoption of robust management systems. While direct product substitutes are limited, advancements in traditional record-keeping methods and manual management pose a competitive challenge. End-user demographics are diverse, ranging from small-scale independent farms to large integrated agricultural corporations. Mergers and acquisition activities are strategically driven by companies seeking to expand their product portfolios, geographical reach, and technological capabilities. For instance, strategic acquisitions in the past have aimed to consolidate market share and integrate innovative software solutions, with deal values estimated to be in the range of billions, further fueling market consolidation. This dynamic landscape underscores the importance of continuous innovation and strategic partnerships for sustained growth.

Animal Breeding Management System Market Dynamics & Trends

The Animal Breeding Management System market is experiencing robust growth, propelled by several key dynamics and emerging trends that are reshaping agricultural practices worldwide. A significant growth driver is the escalating global demand for animal protein, necessitating increased efficiency and productivity in livestock and poultry farming. This demand, projected to grow by billions in the coming decade, directly translates into a higher adoption rate for sophisticated breeding management systems that optimize genetic selection, monitor herd health, and improve reproductive success. Technological disruptions are at the forefront of this market evolution. The integration of IoT sensors, cloud computing, and AI-powered analytics is revolutionizing data collection and analysis. These technologies enable real-time monitoring of animal behavior, health parameters, and environmental conditions, allowing for proactive interventions and personalized breeding strategies. For instance, predictive models for disease outbreaks or optimal breeding cycles are becoming increasingly prevalent, helping to mitigate losses and enhance farm profitability.

Consumer preferences are also playing a pivotal role. There is a growing emphasis on animal welfare, traceability, and sustainable farming practices. Consumers are increasingly seeking assurances about the origin and ethical treatment of the animals from which their food is derived. Animal Breeding Management Systems that can provide detailed records, ensure compliance with welfare standards, and offer transparent traceability are gaining significant traction. This shift in consumer sentiment is forcing producers to adopt more advanced management techniques.

The competitive dynamics within the market are characterized by intense innovation and strategic collaborations. Companies are striving to differentiate themselves by offering integrated solutions that encompass breeding, health, nutrition, and financial management. Market penetration is steadily increasing, particularly in developed regions, as farms recognize the return on investment from adopting these advanced systems. The total addressable market is expected to reach billions in the coming years, with a projected Compound Annual Growth Rate (CAGR) of xx%, driven by technological advancements and the continuous need for enhanced farm efficiency and output. The ongoing development of specialized modules for different animal types, such as chickens, ducks, geese, and quails, further broadens the market's appeal and reach, catering to the specific needs of diverse agricultural operations. The shift towards cloud-based solutions is also a major trend, offering greater scalability, accessibility, and cost-effectiveness for farms of all sizes.

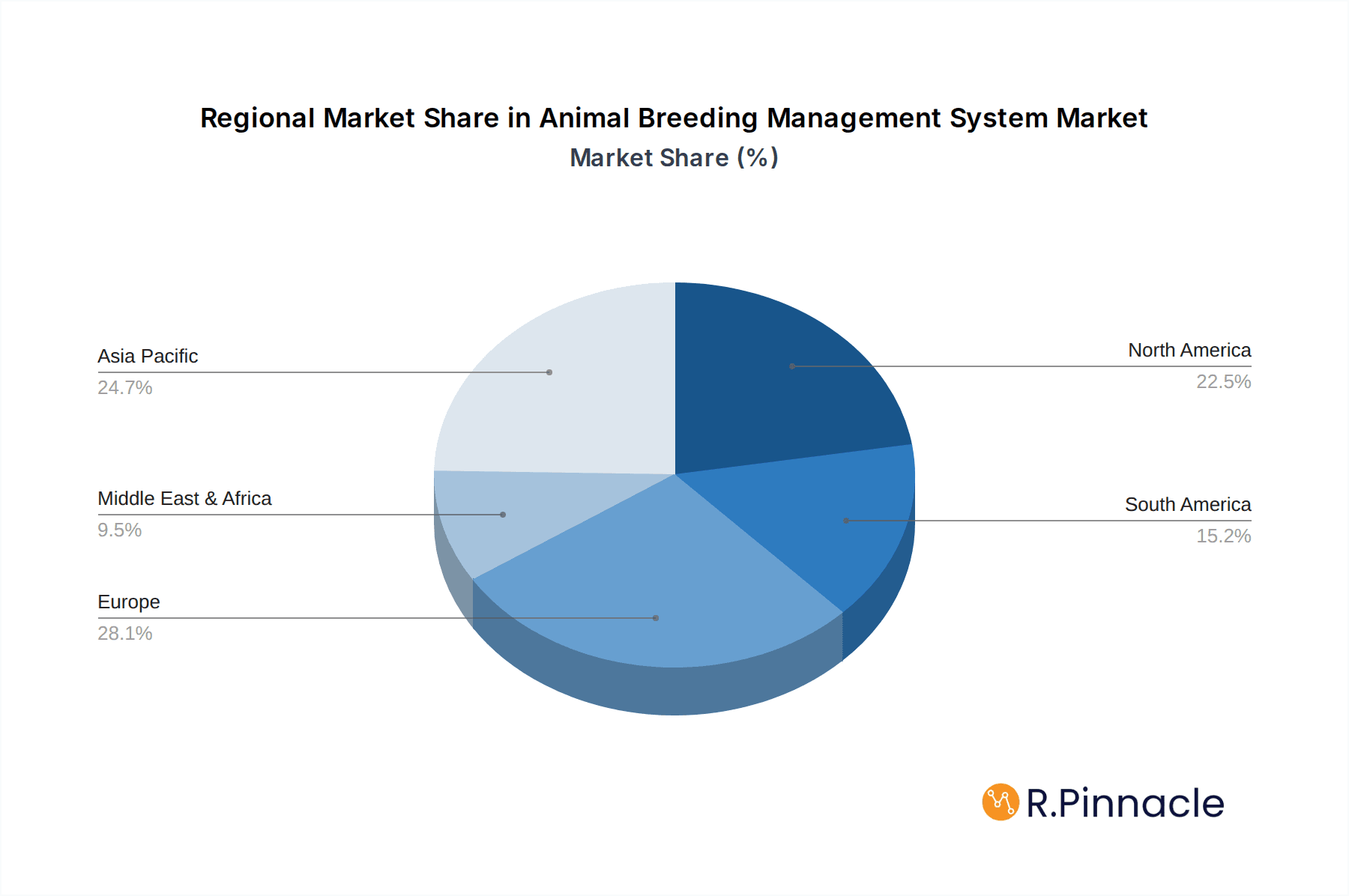

Dominant Regions & Segments in Animal Breeding Management System

The Chicken segment, within the broader Animal Breeding Management System market, currently stands as the dominant force, demonstrating exceptional growth and widespread adoption across the globe. This dominance is attributable to several key drivers, including the sheer scale of global chicken production, which consistently ranks as a primary source of animal protein, and the inherent biological characteristics of poultry that lend themselves well to structured breeding management. The economic policies enacted in major agricultural economies, such as the United States, China, and Brazil, often prioritize and support advancements in poultry farming, including the adoption of technology that enhances efficiency and output. Furthermore, the infrastructure development in these regions, encompassing advanced feed mills, processing plants, and robust supply chains, creates a fertile ground for the implementation of sophisticated Animal Breeding Management Systems.

- Key Drivers of Chicken Segment Dominance:

- Global Protein Demand: Chicken is the most consumed meat globally, driving demand for high-efficiency breeding.

- Technological Integration: Poultry farming has been an early adopter of automation and data-driven management.

- Economic Policies: Government subsidies and support for the poultry industry in key producing nations.

- Infrastructure: Well-established infrastructure supporting large-scale poultry operations.

- Scalability: The inherent ability of poultry operations to scale rapidly makes optimized breeding crucial.

Beyond the dominant Chicken application, other segments like Duck, Geese, and Quail are exhibiting steady growth. While their market share is smaller, specialized management systems are being developed to cater to their unique breeding cycles and health requirements. The Cloud Based deployment type is rapidly gaining prominence, surpassing On-premise solutions in many markets. This shift is driven by the flexibility, scalability, and accessibility offered by cloud platforms. Cloud-based systems enable real-time data access from any location, facilitate easier software updates and maintenance, and often come with more predictable subscription-based pricing models. This trend is particularly beneficial for smaller farms that may not have the IT infrastructure or expertise to manage on-premise solutions. The global market size for cloud-based animal breeding management systems is projected to reach billions by 2033, reflecting a significant transition in how farms manage their operations. This widespread adoption is a testament to the evolving technological landscape and the increasing need for agile and cost-effective solutions in modern agriculture.

Animal Breeding Management System Product Innovations

The Animal Breeding Management System market is witnessing continuous product innovation driven by the need for enhanced efficiency, precision, and data-driven decision-making. Key developments include the integration of AI and machine learning for predictive analytics, enabling early detection of diseases and optimization of breeding cycles. Advanced sensors and IoT devices are providing real-time data on animal health, behavior, and environmental conditions, which are seamlessly integrated into management platforms. These innovations offer competitive advantages by improving genetic selection accuracy, reducing mortality rates, and optimizing resource utilization. The focus is on developing user-friendly interfaces and mobile accessibility, making these sophisticated systems accessible to a wider range of farm managers. Market fit is being enhanced through specialized modules catering to the unique needs of different animal types and farm sizes.

Report Scope & Segmentation Analysis

This report provides a granular segmentation of the Animal Breeding Management System market, covering key application areas and deployment types. The application segments include Chicken, Duck, Geese, Quail, and Other livestock. The deployment types analyzed are On-premise and Cloud Based solutions.

Each segment is analyzed for its current market size, projected growth, and competitive dynamics. The Chicken segment is expected to maintain its leading position due to high global demand. The Cloud Based deployment type is projected to experience the highest growth rate, driven by its scalability and accessibility. Growth projections for each segment indicate a significant overall market expansion, with cloud-based solutions for chicken breeding anticipated to represent a substantial portion of the market value.

Key Drivers of Animal Breeding Management System Growth

The growth of the Animal Breeding Management System market is propelled by a confluence of technological advancements, economic imperatives, and evolving regulatory landscapes. Technologically, the integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is revolutionizing farm management. These technologies enable precise data collection on animal health, behavior, and genetics, leading to optimized breeding programs and improved productivity. Economically, the increasing global demand for animal protein, coupled with rising feed costs and the need for greater operational efficiency, incentivizes farmers to invest in solutions that enhance output and reduce waste. Regulatory factors, such as stricter biosecurity measures and animal welfare standards, also drive adoption as systems help farms comply with these requirements and maintain traceability. For example, the implementation of advanced genetic selection algorithms can significantly improve flock health and reproductive rates, leading to billions in increased revenue for large-scale operations.

Challenges in the Animal Breeding Management System Sector

The Animal Breeding Management System sector faces several challenges that can impede its growth trajectory. High initial investment costs for sophisticated software and hardware can be a significant barrier for small to medium-sized enterprises. The need for specialized technical expertise to operate and maintain these systems can also pose a challenge, particularly in regions with a shortage of skilled agricultural technicians. Furthermore, fragmented markets and diverse farming practices across different geographical locations require adaptable and customizable solutions, which can be complex to develop and implement. Cybersecurity concerns related to cloud-based systems and the protection of sensitive farm data are also paramount. Finally, resistance to change and a lack of awareness regarding the benefits of modern breeding management systems among some traditional farmers can slow down adoption rates, even with proven ROI.

Emerging Opportunities in Animal Breeding Management System

Significant emerging opportunities exist within the Animal Breeding Management System market, driven by advancements in technology and evolving agricultural practices. The increasing focus on precision agriculture presents a substantial opportunity for systems that can leverage big data analytics to provide hyper-personalized breeding strategies for individual animals or small groups. The growing demand for sustainable and ethical farming practices opens doors for systems that can track and report on animal welfare metrics, carbon footprint, and resource efficiency, appealing to a growing segment of conscious consumers and corporate social responsibility initiatives. Furthermore, the expansion of the market into developing economies, where agricultural modernization is a priority, offers a vast untapped potential. The development of integrated platforms that combine breeding management with other farm operations, such as feed management, health monitoring, and financial planning, presents a significant opportunity for cross-selling and creating comprehensive farm management solutions.

Leading Players in the Animal Breeding Management System Market

- Tulasi Technologies

- Navfarm

- BigFarmNet

- Texha

- eMazel

- VAI

- AbuErdan

- PoultryPlan

- Munters Company

- Livine

- PoultryCare

- SmartBird

- Unitas

- Farmbrite

Key Developments in Animal Breeding Management System Industry

- 2024 January: Launch of AI-powered predictive analytics module for disease outbreak forecasting, enhancing biosecurity measures and reducing potential losses by billions.

- 2023 December: Strategic partnership formed between Navfarm and a leading IoT sensor manufacturer to integrate real-time environmental monitoring with breeding management software.

- 2023 October: BigFarmNet introduces advanced genetic selection tools that improve breeding efficiency by an estimated xx%, impacting billions in livestock value.

- 2023 July: Texha expands its cloud-based offerings with enhanced mobile application features, improving accessibility for on-farm management.

- 2023 April: eMazel secures significant funding to accelerate R&D in blockchain integration for enhanced traceability in animal breeding.

- 2022 November: VAI launches a new comprehensive module for duck breeding management, catering to a niche but growing market segment.

- 2022 August: AbuErdan announces a xx% increase in its customer base due to the growing demand for integrated farm management solutions.

- 2022 May: PoultryPlan releases an updated version of its software with improved data visualization capabilities, enabling easier interpretation of complex breeding data.

- 2022 February: Munters Company focuses on energy-efficient climate control solutions integrated with breeding management systems, impacting operational costs by billions.

- 2021 December: Livine enhances its data security protocols for cloud-based solutions, addressing growing industry concerns around data privacy.

- 2021 September: PoultryCare introduces automated reporting features for regulatory compliance, simplifying audits for farms.

- 2021 June: SmartBird releases an advanced algorithm for optimizing egg production cycles, projected to increase output by billions annually.

- 2021 March: Unitas expands its market presence into Southeast Asia, targeting the growing poultry industry in the region.

- 2020 November: Farmbrite acquires a smaller competitor, strengthening its market position and expanding its product portfolio by billions.

Future Outlook for Animal Breeding Management System Market

The future outlook for the Animal Breeding Management System market is exceptionally bright, driven by continuous technological innovation and the increasing necessity for sustainable and efficient agricultural practices. The adoption of AI and machine learning will continue to deepen, leading to more sophisticated predictive analytics for breeding, health, and disease management, potentially saving billions in operational losses. The trend towards cloud-based solutions will accelerate, offering greater flexibility and scalability to farms of all sizes. We anticipate further integration of these systems with other aspects of the farm value chain, creating end-to-end digital farming ecosystems. Emerging markets are expected to witness significant growth as governments and private sectors invest in modernizing agriculture. Strategic collaborations and potential mergers and acquisitions will continue to shape the competitive landscape, leading to more comprehensive and integrated offerings. The market is poised for substantial growth, reaching billions in value, driven by the insatiable demand for animal protein and the unwavering pursuit of enhanced farm productivity and profitability.

Animal Breeding Management System Segmentation

-

1. Application

- 1.1. Chicken

- 1.2. Duck

- 1.3. Geese

- 1.4. Quail

- 1.5. Other

-

2. Types

- 2.1. On-premise

- 2.2. Cloud Based

Animal Breeding Management System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Animal Breeding Management System Regional Market Share

Geographic Coverage of Animal Breeding Management System

Animal Breeding Management System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Breeding Management System Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Chicken

- 5.1.2. Duck

- 5.1.3. Geese

- 5.1.4. Quail

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. On-premise

- 5.2.2. Cloud Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Animal Breeding Management System Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Chicken

- 6.1.2. Duck

- 6.1.3. Geese

- 6.1.4. Quail

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. On-premise

- 6.2.2. Cloud Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Animal Breeding Management System Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Chicken

- 7.1.2. Duck

- 7.1.3. Geese

- 7.1.4. Quail

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. On-premise

- 7.2.2. Cloud Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Animal Breeding Management System Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Chicken

- 8.1.2. Duck

- 8.1.3. Geese

- 8.1.4. Quail

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. On-premise

- 8.2.2. Cloud Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Animal Breeding Management System Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Chicken

- 9.1.2. Duck

- 9.1.3. Geese

- 9.1.4. Quail

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. On-premise

- 9.2.2. Cloud Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Animal Breeding Management System Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Chicken

- 10.1.2. Duck

- 10.1.3. Geese

- 10.1.4. Quail

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. On-premise

- 10.2.2. Cloud Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tulasi Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Navfarm

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BigFarmNet

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Texha

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 eMazel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VAI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AbuErdan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PoultryPlan

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Munters Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Livine

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PoultryCare

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SmartBird

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Unitas

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Farmbrite

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Tulasi Technologies

List of Figures

- Figure 1: Global Animal Breeding Management System Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Animal Breeding Management System Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Animal Breeding Management System Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Animal Breeding Management System Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Animal Breeding Management System Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Animal Breeding Management System Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Animal Breeding Management System Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Animal Breeding Management System Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Animal Breeding Management System Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Animal Breeding Management System Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Animal Breeding Management System Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Animal Breeding Management System Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Animal Breeding Management System Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Animal Breeding Management System Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Animal Breeding Management System Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Animal Breeding Management System Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Animal Breeding Management System Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Animal Breeding Management System Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Animal Breeding Management System Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Animal Breeding Management System Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Animal Breeding Management System Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Animal Breeding Management System Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Animal Breeding Management System Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Animal Breeding Management System Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Animal Breeding Management System Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Animal Breeding Management System Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Animal Breeding Management System Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Animal Breeding Management System Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Animal Breeding Management System Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Animal Breeding Management System Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Animal Breeding Management System Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Breeding Management System Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Animal Breeding Management System Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Animal Breeding Management System Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Animal Breeding Management System Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Animal Breeding Management System Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Animal Breeding Management System Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Animal Breeding Management System Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Animal Breeding Management System Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Animal Breeding Management System Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Animal Breeding Management System Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Animal Breeding Management System Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Animal Breeding Management System Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Animal Breeding Management System Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Animal Breeding Management System Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Animal Breeding Management System Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Animal Breeding Management System Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Animal Breeding Management System Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Animal Breeding Management System Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Animal Breeding Management System Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Breeding Management System?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Animal Breeding Management System?

Key companies in the market include Tulasi Technologies, Navfarm, BigFarmNet, Texha, eMazel, VAI, AbuErdan, PoultryPlan, Munters Company, Livine, PoultryCare, SmartBird, Unitas, Farmbrite.

3. What are the main segments of the Animal Breeding Management System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Breeding Management System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Breeding Management System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Breeding Management System?

To stay informed about further developments, trends, and reports in the Animal Breeding Management System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence