Key Insights

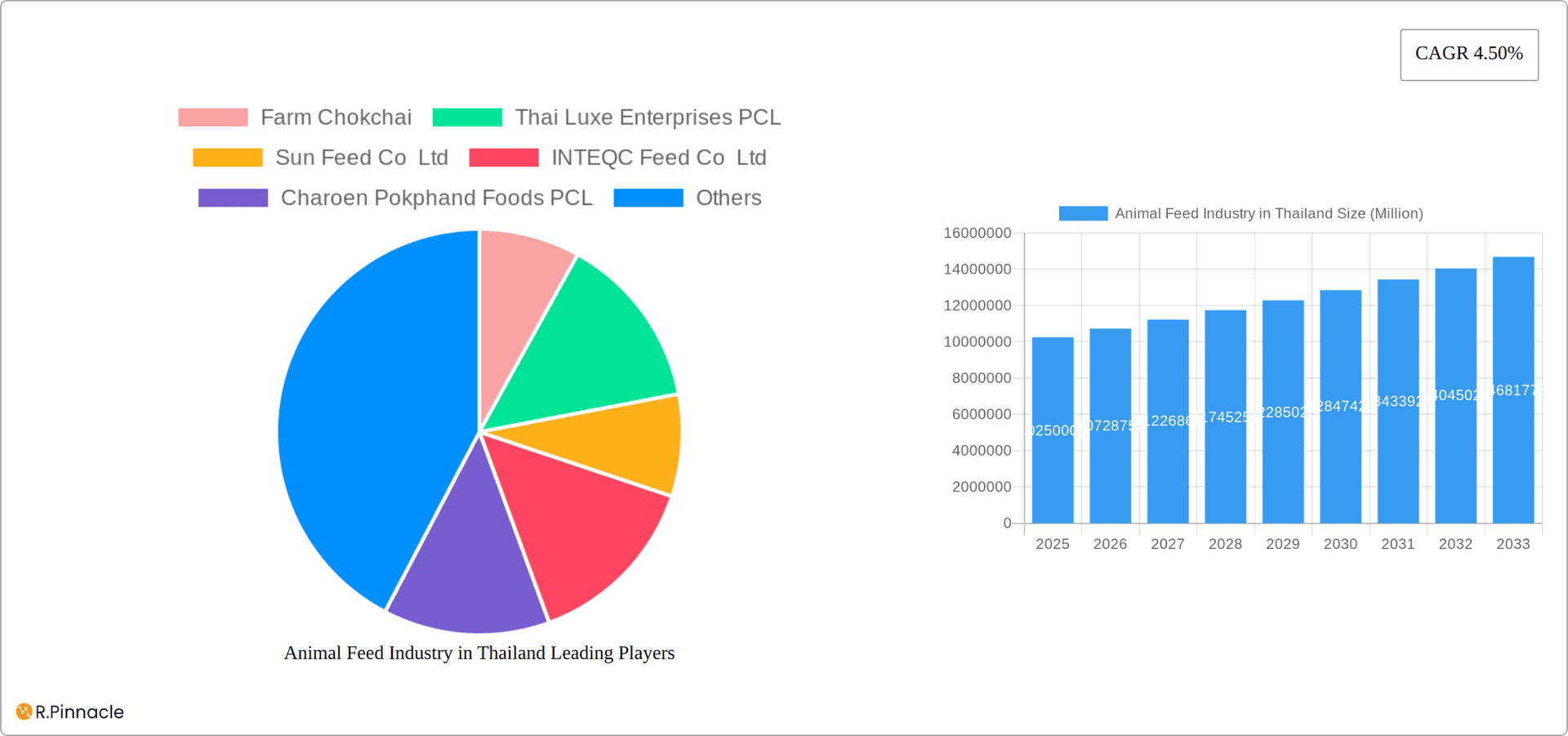

The Thai animal feed market, valued at 10.25 million USD in 2025, is projected to experience steady growth, driven by a robust livestock and aquaculture sector. A compound annual growth rate (CAGR) of 4.50% from 2025 to 2033 indicates a promising outlook. Key drivers include rising domestic meat consumption, increasing demand for high-quality animal protein, and government initiatives promoting sustainable agricultural practices. Growth is further fueled by the diversification of animal feed ingredients, with a notable increase in the use of cereals, cakes and meals, and specialized supplements tailored to optimize animal health and productivity. While precise figures for each segment are unavailable, it's reasonable to assume that ruminant feed (cattle, buffalo) currently holds the largest market share, followed by poultry and swine, with aquaculture and other animal types contributing a smaller, though growing, percentage. Major players like Charoen Pokphand Foods PCL and Betagro Public Company Limited dominate the market, benefiting from established distribution networks and strong brand recognition. However, the market also features a number of smaller, regional companies competing intensely on price and product differentiation.

Animal Feed Industry in Thailand Market Size (In Million)

Challenges facing the industry include fluctuations in raw material prices (especially grains), increasing environmental concerns related to animal waste management, and the potential impact of future disease outbreaks. To mitigate these risks, companies are investing in research and development to create more sustainable and efficient feed formulations, exploring alternative protein sources, and improving farm management practices. The forecast period (2025-2033) anticipates continued market expansion, although the exact growth trajectory will depend on various economic and environmental factors. The increased focus on food safety and animal welfare regulations also presents both opportunities and challenges for the industry. Companies that can adapt and innovate in these areas will be best positioned for long-term success.

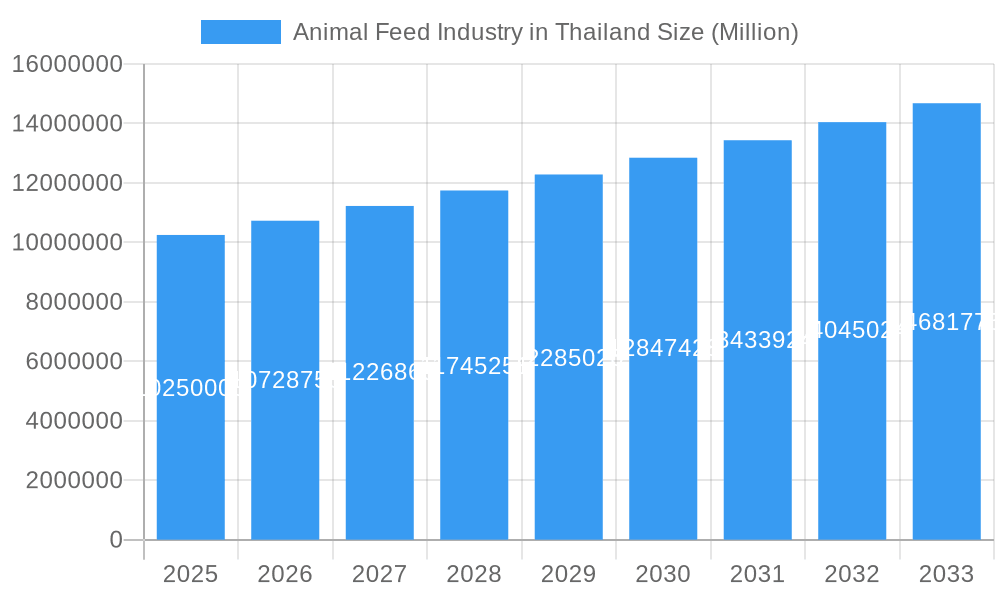

Animal Feed Industry in Thailand Company Market Share

Animal Feed Industry in Thailand: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Animal Feed Industry in Thailand, covering market structure, dynamics, key players, and future outlook from 2019 to 2033. Leveraging extensive data and expert insights, this report is an invaluable resource for industry professionals, investors, and stakeholders seeking to understand and navigate this dynamic market. The report utilizes a base year of 2025 and forecasts market trends until 2033, incorporating historical data from 2019-2024. Expect detailed analysis across key segments, including ruminants, poultry, swine, aquaculture, and other animal types, with ingredient breakdowns of cereals, cakes & meals, by-products, and supplements. Discover valuable insights into market share, M&A activities, and emerging trends shaping the future of Thailand's animal feed sector. The report projects a market size of xx Million in 2025, with a CAGR of xx% from 2025 to 2033.

Animal Feed Industry in Thailand Market Structure & Innovation Trends

Thailand's animal feed market presents a dynamic landscape characterized by a blend of large multinational corporations and established domestic players. While market concentration is moderate, several key players, such as Charoen Pokphand Foods PCL and Betagro Public Company Limited, hold substantial market share, collectively commanding an estimated [Insert Precise Percentage]% in 2025. This competitive environment fuels innovation, driven primarily by the escalating demand for sustainable and highly efficient feed solutions. This demand is further amplified by increasingly stringent government regulations prioritizing animal welfare and environmental sustainability. The industry's operations are significantly shaped by a robust regulatory framework encompassing stringent feed quality standards and comprehensive environmental regulations. The emergence of alternative protein sources as product substitutes presents both compelling opportunities and significant challenges for existing players. The mergers and acquisitions (M&A) landscape reflects a clear trend toward consolidation, exemplified by recent transactions such as Cargill's acquisition of a feed mill in 2022, which demonstrably enhanced production capacity and broadened market reach. The estimated cumulative value of M&A deals within the sector from 2019 to 2024 reached [Insert Precise Value] Million.

- Market Concentration: Moderate, with the top 5 players holding [Insert Precise Percentage]% market share (2025).

- Innovation Drivers: Sustainability, efficiency improvements, and strict regulatory compliance.

- Regulatory Frameworks: Stringent feed quality and comprehensive environmental standards are key considerations.

- Product Substitutes: The growing interest in and adoption of alternative protein sources is reshaping the market.

- M&A Activity: A noticeable trend toward consolidation is evident, with significant deal values recorded.

Animal Feed Industry in Thailand Market Dynamics & Trends

The Thai animal feed market exhibits robust growth, driven by factors such as rising domestic consumption of animal protein, increasing livestock production, and government support for the agricultural sector. Technological advancements in feed formulation and processing contribute to efficiency gains. Consumer preferences for healthier and more sustainably produced animal products influence the demand for specific feed ingredients and production methods. Competitive dynamics are shaped by price competition, product differentiation, and brand loyalty. The market is expected to witness significant growth in the coming years, with a projected CAGR of xx% during the forecast period (2025-2033). Market penetration of premium feed products with enhanced nutritional value and sustainability features is steadily increasing, driven by higher consumer spending and awareness.

Dominant Regions & Segments in Animal Feed Industry in Thailand

The central and eastern regions of Thailand dominate the animal feed market due to high livestock density and proximity to major processing facilities. Within animal types, poultry feed holds the largest market share, followed by swine and aquaculture. The dominance is primarily driven by strong consumer demand for poultry products and the efficiency of poultry farming.

Key Drivers:

- Poultry: High consumer demand, efficient farming practices, and government support.

- Swine: Growing domestic consumption and rising export demand.

- Aquaculture: Expanding aquaculture industry and increasing seafood consumption.

Ingredient Dominance:

- Cereals: Maize and rice by-products are the most widely used due to cost-effectiveness and availability.

- Cakes and Meals: Soybean meal is a significant protein source, while other oilseed meals play a supportive role.

- By-products: Utilization of by-products from agricultural processing minimizes waste and cost.

- Supplements: Vitamins, minerals, and amino acids are added to ensure optimal animal health and productivity.

Animal Feed Industry in Thailand Product Innovations

Recent product innovations within the Thai animal feed industry are significantly focused on enhancing feed efficiency, bolstering animal health, and minimizing environmental impact. Key developments include functional feed additives designed to promote robust gut health and enhance disease resistance. The incorporation of sustainable and locally sourced ingredients is also gaining traction. Technological advancements, such as precision feeding technologies and sophisticated data analytics, are playing a crucial role in optimizing feed formulation and minimizing waste. These innovations directly address the rising consumer demand for safe, healthy, and sustainably produced animal products, reflecting a broader shift towards responsible and ethical consumption patterns.

Report Scope & Segmentation Analysis

This comprehensive report offers a detailed segmentation analysis of the Thai animal feed market, categorized by animal type (ruminants, poultry, swine, aquaculture, and other animal types) and feed ingredients (cereals, cakes and meals, by-products, and supplements). The report meticulously analyzes each segment's projected growth, precise market size, and intricate competitive dynamics. For example, the poultry feed segment is anticipated to exhibit substantial growth, fueled by increasing domestic consumption. Similarly, the aquaculture segment is driven by the expansion of the shrimp farming industry. The market for feed supplements is poised for significant growth, driven by the heightened focus on optimizing animal health and productivity.

Key Drivers of Animal Feed Industry in Thailand Growth

Several key factors are driving the growth of the Thai animal feed industry. These include rising domestic consumption of animal protein, driven by population growth and increasing disposable incomes. Technological advancements in feed production and processing lead to improved efficiency and cost reduction. Government policies supporting the livestock and aquaculture sectors, along with the development of improved infrastructure, are fostering industry expansion.

Challenges in the Animal Feed Industry in Thailand Sector

The Thai animal feed industry faces a multitude of challenges. Fluctuations in raw material prices pose a significant threat to production costs and overall profitability. Intense competition from other regional markets necessitates maintaining cost competitiveness and unwavering product quality. Ensuring feed safety and quality through rigorous regulatory compliance adds complexity and operational overhead. Furthermore, supply chain disruptions stemming from global events can significantly impact feed availability and potentially disrupt production schedules.

Emerging Opportunities in Animal Feed Industry in Thailand

The growth of the organic and sustainable food market presents opportunities for animal feed producers to develop and market specialized products that meet consumer demands for eco-friendly and ethically sourced animal products. Technological advancements, such as precision feeding and data analytics, can be leveraged to enhance efficiency and profitability. The development of innovative feed formulations that improve animal health and productivity will be crucial for sustaining competitiveness. Expansion into new export markets will create further opportunities for growth.

Leading Players in the Animal Feed Industry in Thailand Market

- Farm Chokchai

- Thai Luxe Enterprises PCL

- Sun Feed Co Ltd

- INTEQC Feed Co Ltd

- Charoen Pokphand Foods PCL

- Laemthong Corporation Group

- S P M FEED MILL COMPANY LIMITED

- Alltech Inc

- Cargill Inc

- Betagro Public Company Limited

- Thai Union Group Public Company Limited

Key Developments in Animal Feed Industry in Thailand Industry

- September 2022: Cargill acquired a feed mill in Prachinburi, expanding its poultry and swine feed production capacity by 72,000 metric tons annually.

- September 2022: Charoen Pokphand Foods' Pakthongchai feed mill achieved carbon-neutral certification, setting a benchmark for sustainability.

- January 2022: Royal DSM and CPF partnered to measure and improve the environmental footprint of animal protein production.

Future Outlook for Animal Feed Industry in Thailand Market

The Thai animal feed market is projected to experience continued growth, propelled by sustained domestic demand for animal protein, ongoing technological innovation, and supportive government policies. Strategic investments in sustainable and highly efficient feed production, coupled with strategic expansion into new markets and product diversification, will be pivotal for success in this fiercely competitive landscape. The increasing emphasis on sustainability and robust traceability will undoubtedly be defining factors in shaping future market trends and consumer preferences.

Animal Feed Industry in Thailand Segmentation

-

1. Animal Type

- 1.1. Ruminants

- 1.2. Poultry

- 1.3. Swine

- 1.4. Aquaculture

- 1.5. Other Animal Types

-

2. Ingredient

- 2.1. Cereals

- 2.2. Cakes and Meals

- 2.3. By-products

- 2.4. Supplements

Animal Feed Industry in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Animal Feed Industry in Thailand Regional Market Share

Geographic Coverage of Animal Feed Industry in Thailand

Animal Feed Industry in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Preferences for the Animal Sourced Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Ruminants

- 5.1.2. Poultry

- 5.1.3. Swine

- 5.1.4. Aquaculture

- 5.1.5. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereals

- 5.2.2. Cakes and Meals

- 5.2.3. By-products

- 5.2.4. Supplements

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. North America Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 6.1.1. Ruminants

- 6.1.2. Poultry

- 6.1.3. Swine

- 6.1.4. Aquaculture

- 6.1.5. Other Animal Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredient

- 6.2.1. Cereals

- 6.2.2. Cakes and Meals

- 6.2.3. By-products

- 6.2.4. Supplements

- 6.1. Market Analysis, Insights and Forecast - by Animal Type

- 7. South America Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 7.1.1. Ruminants

- 7.1.2. Poultry

- 7.1.3. Swine

- 7.1.4. Aquaculture

- 7.1.5. Other Animal Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredient

- 7.2.1. Cereals

- 7.2.2. Cakes and Meals

- 7.2.3. By-products

- 7.2.4. Supplements

- 7.1. Market Analysis, Insights and Forecast - by Animal Type

- 8. Europe Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 8.1.1. Ruminants

- 8.1.2. Poultry

- 8.1.3. Swine

- 8.1.4. Aquaculture

- 8.1.5. Other Animal Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredient

- 8.2.1. Cereals

- 8.2.2. Cakes and Meals

- 8.2.3. By-products

- 8.2.4. Supplements

- 8.1. Market Analysis, Insights and Forecast - by Animal Type

- 9. Middle East & Africa Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 9.1.1. Ruminants

- 9.1.2. Poultry

- 9.1.3. Swine

- 9.1.4. Aquaculture

- 9.1.5. Other Animal Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredient

- 9.2.1. Cereals

- 9.2.2. Cakes and Meals

- 9.2.3. By-products

- 9.2.4. Supplements

- 9.1. Market Analysis, Insights and Forecast - by Animal Type

- 10. Asia Pacific Animal Feed Industry in Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 10.1.1. Ruminants

- 10.1.2. Poultry

- 10.1.3. Swine

- 10.1.4. Aquaculture

- 10.1.5. Other Animal Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredient

- 10.2.1. Cereals

- 10.2.2. Cakes and Meals

- 10.2.3. By-products

- 10.2.4. Supplements

- 10.1. Market Analysis, Insights and Forecast - by Animal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Farm Chokchai

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thai Luxe Enterprises PCL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sun Feed Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 INTEQC Feed Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Charoen Pokphand Foods PCL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Laemthong Corporation Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 S P M FEED MILL COMPANY LIMITED

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alltech Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cargill Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Betagro Public Company Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thai Union Group Public Company Limite

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Farm Chokchai

List of Figures

- Figure 1: Global Animal Feed Industry in Thailand Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 3: North America Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 4: North America Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 5: North America Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 6: North America Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 9: South America Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: South America Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 11: South America Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 12: South America Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Europe Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 17: Europe Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 18: Europe Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 21: Middle East & Africa Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 22: Middle East & Africa Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 23: Middle East & Africa Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 24: Middle East & Africa Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Animal Feed Industry in Thailand Revenue (Million), by Animal Type 2025 & 2033

- Figure 27: Asia Pacific Animal Feed Industry in Thailand Revenue Share (%), by Animal Type 2025 & 2033

- Figure 28: Asia Pacific Animal Feed Industry in Thailand Revenue (Million), by Ingredient 2025 & 2033

- Figure 29: Asia Pacific Animal Feed Industry in Thailand Revenue Share (%), by Ingredient 2025 & 2033

- Figure 30: Asia Pacific Animal Feed Industry in Thailand Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Animal Feed Industry in Thailand Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 2: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 3: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 5: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 6: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 11: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 12: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 17: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 18: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 29: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 30: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 38: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Ingredient 2020 & 2033

- Table 39: Global Animal Feed Industry in Thailand Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Animal Feed Industry in Thailand Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Feed Industry in Thailand?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Animal Feed Industry in Thailand?

Key companies in the market include Farm Chokchai, Thai Luxe Enterprises PCL, Sun Feed Co Ltd, INTEQC Feed Co Ltd, Charoen Pokphand Foods PCL, Laemthong Corporation Group, S P M FEED MILL COMPANY LIMITED, Alltech Inc, Cargill Inc, Betagro Public Company Limited, Thai Union Group Public Company Limite.

3. What are the main segments of the Animal Feed Industry in Thailand?

The market segments include Animal Type, Ingredient.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Preferences for the Animal Sourced Food.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Cargill acquired a feed mill in Prachinburi province in Thailand to expand its capabilities for its animal feed and nutrition business. Through the acquisition, the plant will now produce poultry and swine feed for Cargill's customers based in Thailand. The company planned production in a year at its new plant which produces 72,000 Metric Ton per year for swine and poultry customers in the Eastern and Northeastern areas of Thailand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Feed Industry in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Feed Industry in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Feed Industry in Thailand?

To stay informed about further developments, trends, and reports in the Animal Feed Industry in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence